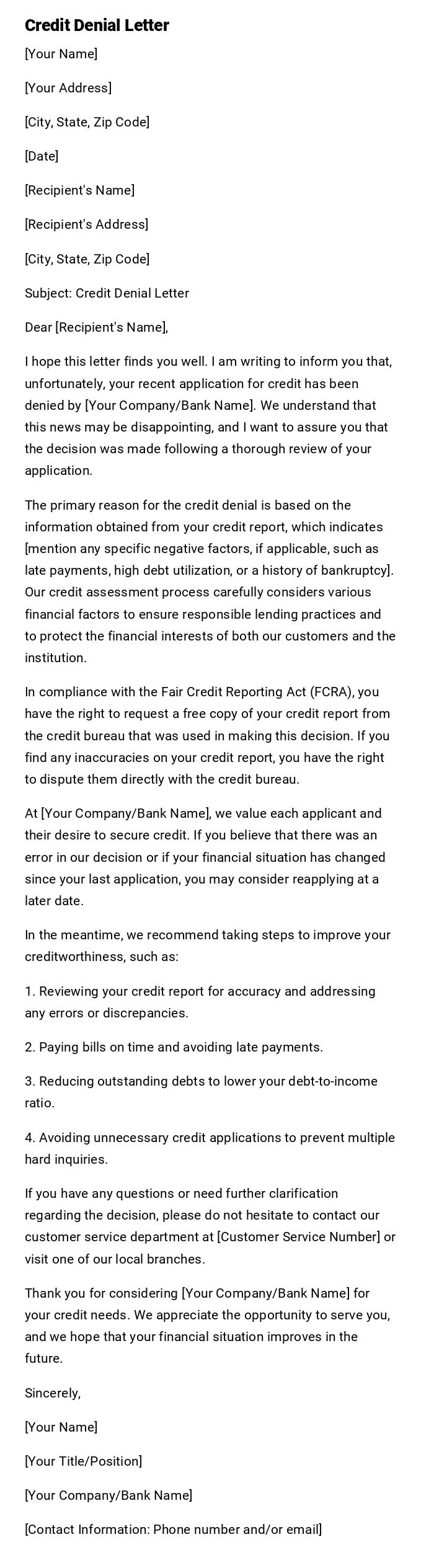

Credit Denial Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, Zip Code]

Subject: Credit Denial Letter

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to inform you that, unfortunately, your recent application for credit has been denied by [Your Company/Bank Name]. We understand that this news may be disappointing, and I want to assure you that the decision was made following a thorough review of your application.

The primary reason for the credit denial is based on the information obtained from your credit report, which indicates [mention any specific negative factors, if applicable, such as late payments, high debt utilization, or a history of bankruptcy]. Our credit assessment process carefully considers various financial factors to ensure responsible lending practices and to protect the financial interests of both our customers and the institution.

In compliance with the Fair Credit Reporting Act (FCRA), you have the right to request a free copy of your credit report from the credit bureau that was used in making this decision. If you find any inaccuracies on your credit report, you have the right to dispute them directly with the credit bureau.

At [Your Company/Bank Name], we value each applicant and their desire to secure credit. If you believe that there was an error in our decision or if your financial situation has changed since your last application, you may consider reapplying at a later date.

In the meantime, we recommend taking steps to improve your creditworthiness, such as:

1. Reviewing your credit report for accuracy and addressing any errors or discrepancies.

2. Paying bills on time and avoiding late payments.

3. Reducing outstanding debts to lower your debt-to-income ratio.

4. Avoiding unnecessary credit applications to prevent multiple hard inquiries.

If you have any questions or need further clarification regarding the decision, please do not hesitate to contact our customer service department at [Customer Service Number] or visit one of our local branches.

Thank you for considering [Your Company/Bank Name] for your credit needs. We appreciate the opportunity to serve you, and we hope that your financial situation improves in the future.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Company/Bank Name]

[Contact Information: Phone number and/or email]

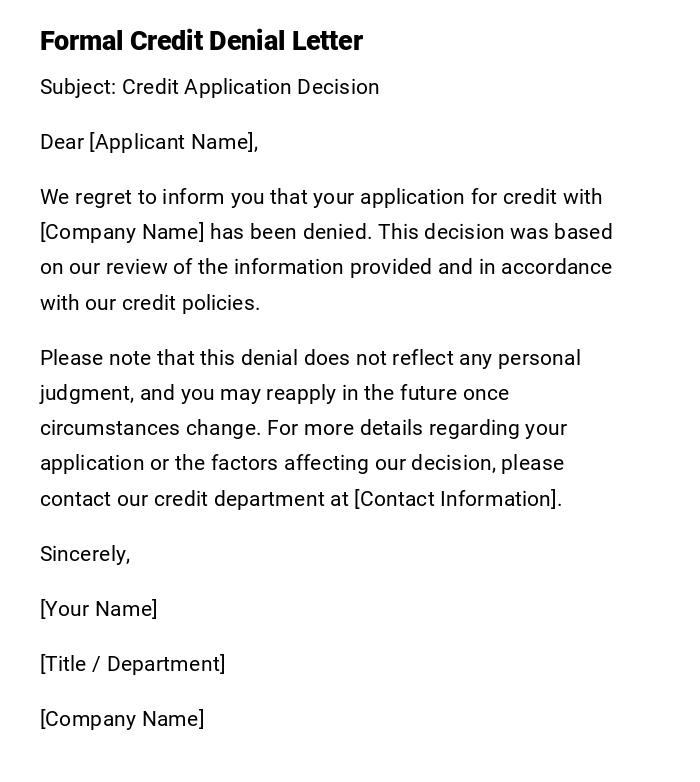

Credit Denial Letter – Formal Professional

Subject: Credit Application Decision

Dear [Applicant Name],

We regret to inform you that your application for credit with [Company Name] has been denied. This decision was based on our review of the information provided and in accordance with our credit policies.

Please note that this denial does not reflect any personal judgment, and you may reapply in the future once circumstances change. For more details regarding your application or the factors affecting our decision, please contact our credit department at [Contact Information].

Sincerely,

[Your Name]

[Title / Department]

[Company Name]

Credit Denial Email – Quick Notification

Subject: Credit Application Update

Hi [Applicant Name],

We wanted to inform you that your credit application with [Company Name] has not been approved at this time. If you would like more information about this decision, please contact our team.

Thank you for your understanding.

Best regards,

[Your Name]

[Title / Department]

Credit Denial Letter – Heartfelt / Empathetic

Subject: Notification of Credit Application Status

Dear [Applicant Name],

After careful review of your recent credit application, we regret to inform you that we are unable to extend credit to you at this time. We understand that this news may be disappointing, and we encourage you to review your credit profile and consider reapplying in the future.

We appreciate your interest in [Company Name] and thank you for your application.

Warm regards,

[Your Name]

[Title / Department]

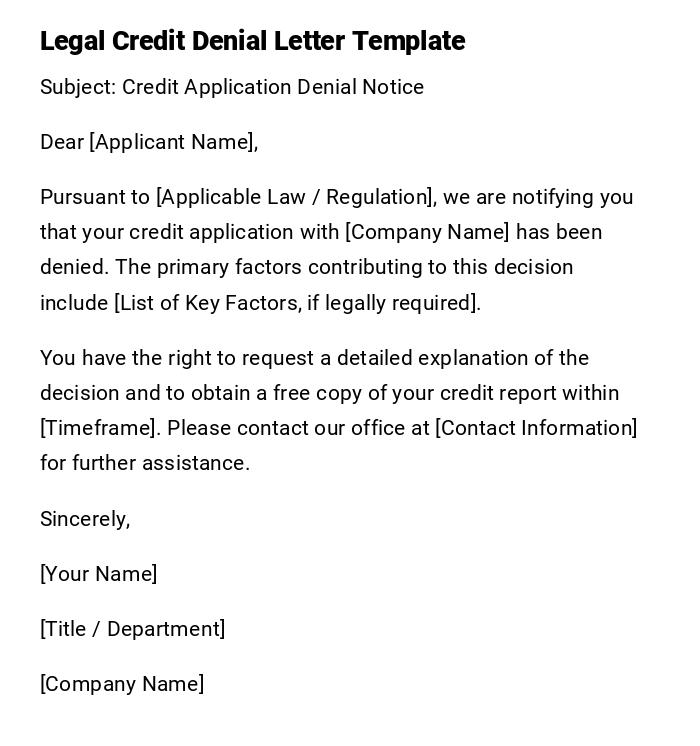

Credit Denial Letter – Legal / Regulatory Compliance

Subject: Credit Application Denial Notice

Dear [Applicant Name],

Pursuant to [Applicable Law / Regulation], we are notifying you that your credit application with [Company Name] has been denied. The primary factors contributing to this decision include [List of Key Factors, if legally required].

You have the right to request a detailed explanation of the decision and to obtain a free copy of your credit report within [Timeframe]. Please contact our office at [Contact Information] for further assistance.

Sincerely,

[Your Name]

[Title / Department]

[Company Name]

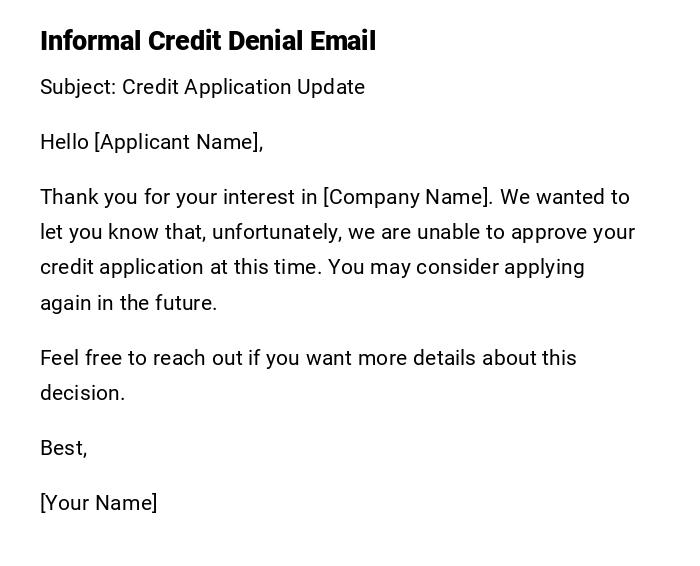

Credit Denial Letter – Informal / Friendly Email

Subject: Credit Application Update

Hello [Applicant Name],

Thank you for your interest in [Company Name]. We wanted to let you know that, unfortunately, we are unable to approve your credit application at this time. You may consider applying again in the future.

Feel free to reach out if you want more details about this decision.

Best,

[Your Name]

What is a Credit Denial Letter and why it is necessary

- A Credit Denial Letter is a formal communication informing an applicant that their request for credit has been declined.

- Purpose: Provides official notice and ensures compliance with financial regulations.

- Importance: Protects the lender legally and maintains transparency with applicants.

- Helps applicants understand the status of their credit application and next steps.

Who should send a Credit Denial Letter

- Typically sent by banks, financial institutions, credit card companies, or lending agencies.

- Issued by personnel in credit, loan, or customer service departments.

- Should be an official representative authorized to communicate credit decisions.

Whom should receive a Credit Denial Letter

- The primary recipient is the individual or entity that applied for credit.

- In some cases, co-applicants or guarantors may also need to be informed.

- Must be directed to the contact information provided in the application.

When is a Credit Denial Letter applicable

- After evaluation of a credit, loan, or financing application.

- When creditworthiness or eligibility criteria are not met.

- If documentation is incomplete, inconsistent, or fails verification.

- Whenever regulatory or company policy requires formal notification.

How to write and send a Credit Denial Letter

- Review the applicant’s credit application and supporting documents.

- Determine key reasons for denial while adhering to legal and privacy standards.

- Choose tone: formal for regulatory compliance, empathetic for customer relations, or quick for emails.

- Include instructions for requesting further details or reapplying.

- Send via email for quick notification or printed letter for official/legal documentation.

How much detail should be included in a Credit Denial Letter

- State that the application was denied.

- Include legal or regulatory requirements if applicable (e.g., Fair Credit Reporting Act).

- Optional: list general factors affecting the decision (without disclosing sensitive third-party info).

- Provide contact info for inquiries or reapplication procedures.

Requirements and prerequisites before sending a Credit Denial Letter

- Confirm the final decision on the application.

- Ensure compliance with relevant credit reporting and privacy laws.

- Verify that all internal approvals for denial are complete.

- Prepare any documentation required for legal compliance.

Formatting and style considerations

- Length: concise, typically one page or email.

- Tone: professional, clear, and neutral; empathetic for sensitive cases.

- Wording: avoid ambiguous or accusatory language.

- Style: formal letter for legal purposes, email for standard communication.

- Etiquette: express appreciation for the applicant’s interest and provide guidance for next steps.

After sending a Credit Denial Letter

- Confirm delivery and receipt of the letter.

- Maintain records for regulatory compliance and internal auditing.

- Be prepared to answer applicant inquiries or provide additional documentation.

- Allow a process for appeal or reapplication if applicable.

Pros and Cons of sending a Credit Denial Letter

Pros:

- Ensures legal compliance and protects the lender from disputes.

- Provides transparency to applicants about their credit status.

- Maintains professional and ethical communication standards.

Cons:

- May result in customer dissatisfaction or lost business.

- Requires careful wording to avoid potential legal challenges.

- Needs follow-up for any disputes or questions from applicants.

Tricks and Tips for effective Credit Denial Letters

- Be clear and concise while maintaining a professional tone.

- Include instructions for requesting more information or reapplying.

- Avoid overly detailed explanations that could expose the lender to risk.

- Use templates to ensure consistency across multiple communications.

- Ensure letters meet regulatory compliance requirements.

Common mistakes to avoid

- Providing incomplete or ambiguous denial reasons.

- Using casual or informal language in a formal credit denial.

- Failing to comply with legal and regulatory notification requirements.

- Not maintaining records of sent letters.

- Ignoring follow-up inquiries from applicants.

Elements and Structure of a Credit Denial Letter

- Subject line clearly stating credit denial.

- Salutation addressing the applicant.

- Introduction informing the applicant of the decision.

- Optional: explanation of general reasons for denial (without violating privacy laws).

- Reference to regulatory compliance or rights of the applicant.

- Contact information for inquiries or further steps.

- Closing with appreciation for interest in the company.

- Signature of authorized personnel.

- Attachments (if required), e.g., regulatory forms.

Does a Credit Denial Letter require attestation or authorization

- Yes, should be issued by authorized personnel in the credit or lending department.

- For legal compliance, may require official letterhead or signature.

- Some institutions include additional attestation for formal or regulatory purposes.

Download Word Doc

Download Word Doc

Download PDF

Download PDF