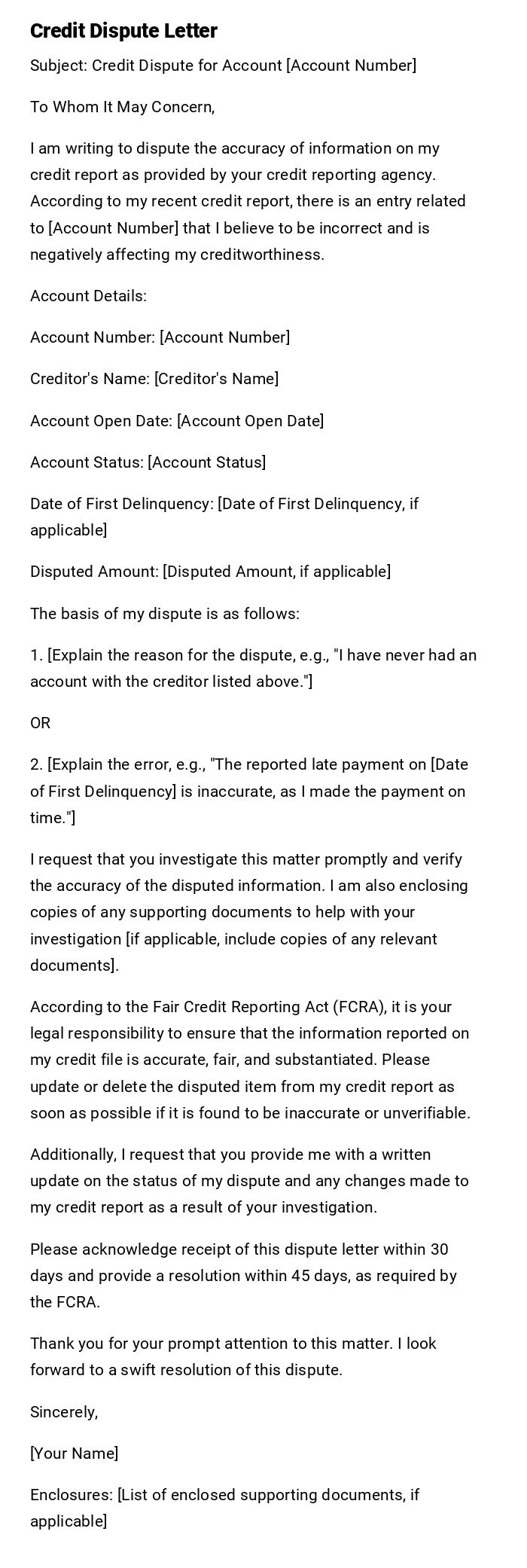

Credit Dispute Letter

Subject: Credit Dispute for Account [Account Number]

To Whom It May Concern,

I am writing to dispute the accuracy of information on my credit report as provided by your credit reporting agency. According to my recent credit report, there is an entry related to [Account Number] that I believe to be incorrect and is negatively affecting my creditworthiness.

Account Details:

Account Number: [Account Number]

Creditor's Name: [Creditor's Name]

Account Open Date: [Account Open Date]

Account Status: [Account Status]

Date of First Delinquency: [Date of First Delinquency, if applicable]

Disputed Amount: [Disputed Amount, if applicable]

The basis of my dispute is as follows:

1. [Explain the reason for the dispute, e.g., "I have never had an account with the creditor listed above."]

OR

2. [Explain the error, e.g., "The reported late payment on [Date of First Delinquency] is inaccurate, as I made the payment on time."]

I request that you investigate this matter promptly and verify the accuracy of the disputed information. I am also enclosing copies of any supporting documents to help with your investigation [if applicable, include copies of any relevant documents].

According to the Fair Credit Reporting Act (FCRA), it is your legal responsibility to ensure that the information reported on my credit file is accurate, fair, and substantiated. Please update or delete the disputed item from my credit report as soon as possible if it is found to be inaccurate or unverifiable.

Additionally, I request that you provide me with a written update on the status of my dispute and any changes made to my credit report as a result of your investigation.

Please acknowledge receipt of this dispute letter within 30 days and provide a resolution within 45 days, as required by the FCRA.

Thank you for your prompt attention to this matter. I look forward to a swift resolution of this dispute.

Sincerely,

[Your Name]

Enclosures: [List of enclosed supporting documents, if applicable]

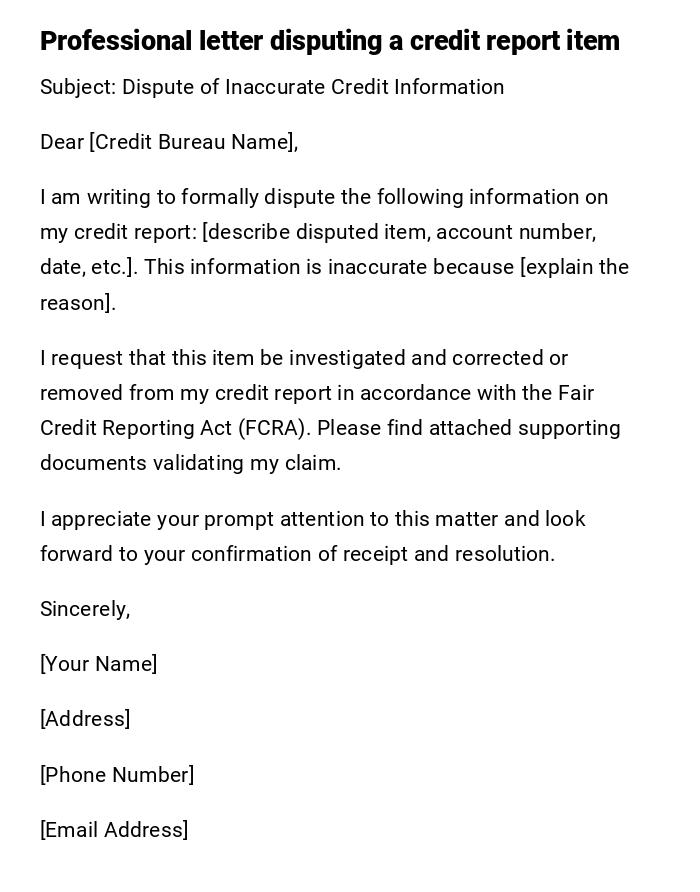

Formal Credit Dispute Letter to Credit Bureau

Subject: Dispute of Inaccurate Credit Information

Dear [Credit Bureau Name],

I am writing to formally dispute the following information on my credit report: [describe disputed item, account number, date, etc.]. This information is inaccurate because [explain the reason].

I request that this item be investigated and corrected or removed from my credit report in accordance with the Fair Credit Reporting Act (FCRA). Please find attached supporting documents validating my claim.

I appreciate your prompt attention to this matter and look forward to your confirmation of receipt and resolution.

Sincerely,

[Your Name]

[Address]

[Phone Number]

[Email Address]

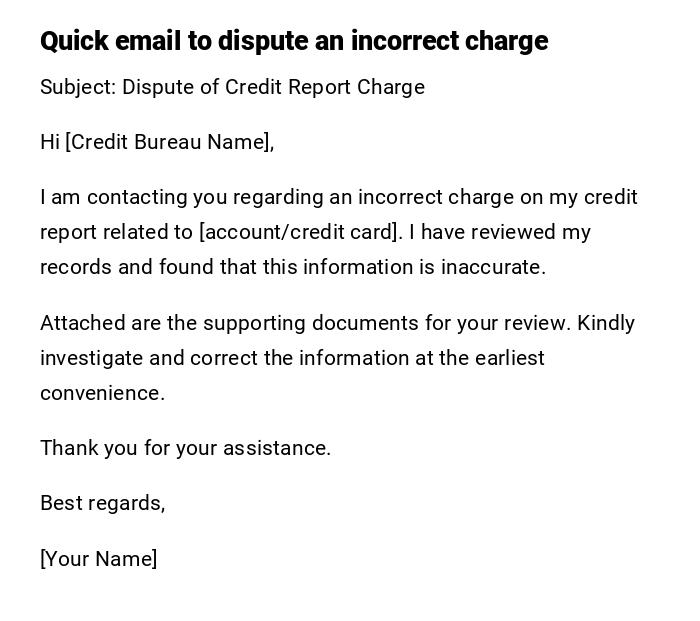

Credit Dispute Email for Billing Error

Subject: Dispute of Credit Report Charge

Hi [Credit Bureau Name],

I am contacting you regarding an incorrect charge on my credit report related to [account/credit card]. I have reviewed my records and found that this information is inaccurate.

Attached are the supporting documents for your review. Kindly investigate and correct the information at the earliest convenience.

Thank you for your assistance.

Best regards,

[Your Name]

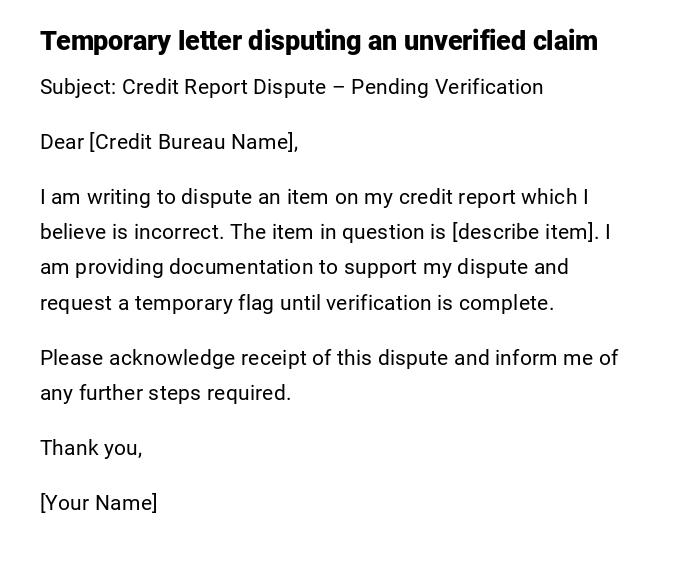

Provisional Credit Dispute Letter for Pending Verification

Subject: Credit Report Dispute – Pending Verification

Dear [Credit Bureau Name],

I am writing to dispute an item on my credit report which I believe is incorrect. The item in question is [describe item]. I am providing documentation to support my dispute and request a temporary flag until verification is complete.

Please acknowledge receipt of this dispute and inform me of any further steps required.

Thank you,

[Your Name]

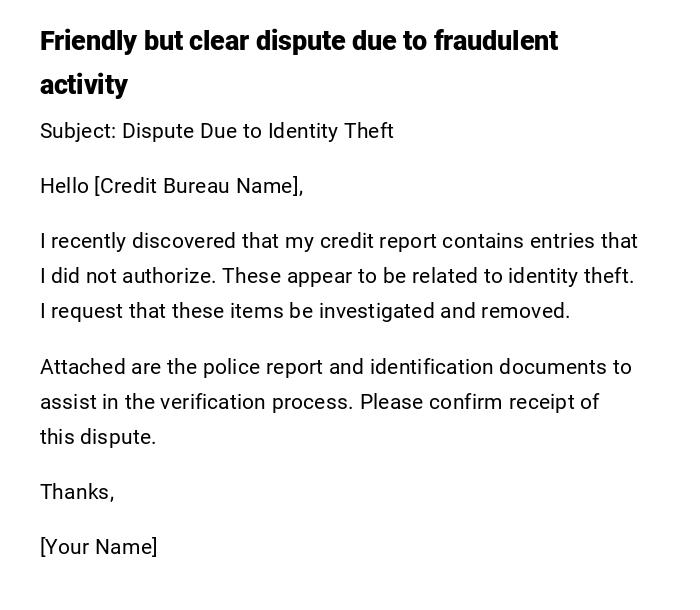

Informal Credit Dispute Letter for Identity Theft

Subject: Dispute Due to Identity Theft

Hello [Credit Bureau Name],

I recently discovered that my credit report contains entries that I did not authorize. These appear to be related to identity theft. I request that these items be investigated and removed.

Attached are the police report and identification documents to assist in the verification process. Please confirm receipt of this dispute.

Thanks,

[Your Name]

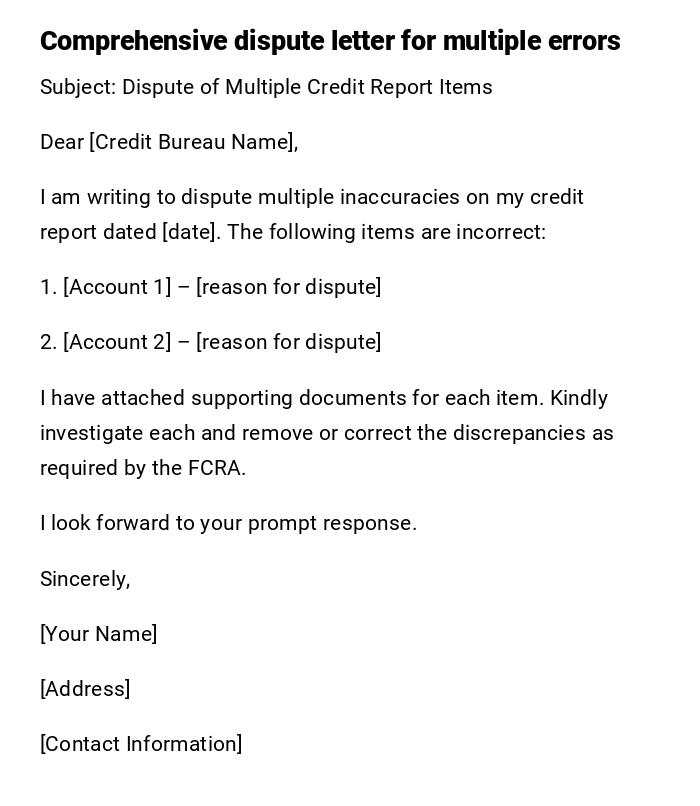

Detailed Dispute Letter for Account Error

Subject: Dispute of Multiple Credit Report Items

Dear [Credit Bureau Name],

I am writing to dispute multiple inaccuracies on my credit report dated [date]. The following items are incorrect:

1. [Account 1] – [reason for dispute]

2. [Account 2] – [reason for dispute]

I have attached supporting documents for each item. Kindly investigate each and remove or correct the discrepancies as required by the FCRA.

I look forward to your prompt response.

Sincerely,

[Your Name]

[Address]

[Contact Information]

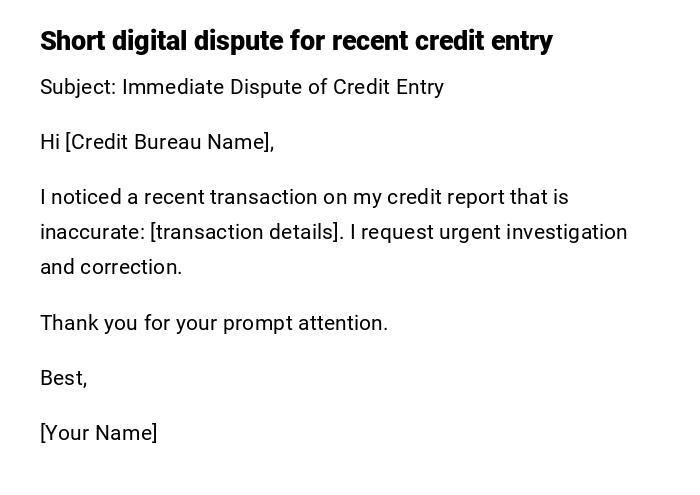

Quick Text/Email Dispute for Recent Transaction

Subject: Immediate Dispute of Credit Entry

Hi [Credit Bureau Name],

I noticed a recent transaction on my credit report that is inaccurate: [transaction details]. I request urgent investigation and correction.

Thank you for your prompt attention.

Best,

[Your Name]

What is a Credit Dispute Letter and Why You Might Need One

- A formal written communication to a credit bureau or lender challenging inaccurate, outdated, or fraudulent information on a credit report.

- Purpose: Correct errors, protect credit score, and ensure financial records are accurate.

- Provides documented proof of dispute and triggers investigation procedures by law.

Who Should Send a Credit Dispute Letter

- Consumers who notice inaccuracies in their credit reports.

- Individuals impacted by identity theft, billing errors, or reporting mistakes.

- Anyone seeking to maintain or improve their creditworthiness through accurate reporting.

Whom Should a Credit Dispute Letter Be Addressed To

- Major credit reporting agencies: Experian, Equifax, TransUnion.

- Specific lenders or collection agencies reporting inaccurate information.

- Credit bureaus’ designated dispute departments.

When Should You Send a Credit Dispute Letter

- Upon identifying inaccurate or fraudulent items on a credit report.

- After receiving a report containing unexpected negative entries.

- When disputing outdated accounts, incorrect balances, or identity theft-related entries.

How to Write and Submit a Credit Dispute Letter

- Gather supporting documents (statements, receipts, police reports if applicable).

- Clearly identify the disputed item(s) and explain why they are incorrect.

- Specify the resolution requested (removal, correction, verification).

- Send via certified mail or secure email to ensure traceable delivery.

- Keep copies of all correspondence for your records.

Elements and Structure of a Credit Dispute Letter

- Subject Line: Clearly indicate “Credit Report Dispute.”

- Greeting: Address the appropriate department or representative.

- Identification of Disputed Items: Include account numbers, dates, and specific details.

- Explanation: Provide reasons and evidence supporting the dispute.

- Attachments: Include documentation for verification.

- Request for Action: State the desired outcome.

- Closing and Signature: Polite and professional sign-off with contact details.

Requirements and Prerequisites Before Sending

- Obtain the latest credit report to identify discrepancies.

- Collect supporting documentation proving inaccuracies.

- Review dispute procedures of the relevant credit bureau.

- Ensure personal details and contact information are up-to-date.

Formatting and Style Guidelines

- Tone: Professional, factual, and courteous.

- Length: Keep concise; focus on clarity and evidence.

- Style: Formal for printed letters, clear and structured for emails.

- Mode: Certified mail for physical letters, secure portals or email for digital submission.

After Sending a Credit Dispute Letter: Follow-Up Steps

- Await acknowledgement from the credit bureau (usually within 30 days as per law).

- Check for updates and corrections in subsequent credit reports.

- Respond to any additional requests for information promptly.

- Maintain a log of all correspondence and supporting documents.

Common Mistakes to Avoid When Disputing Credit Reports

- Failing to provide sufficient documentation.

- Being vague about the disputed items.

- Sending the dispute to the wrong bureau or department.

- Missing deadlines for investigation responses.

- Using an aggressive or unprofessional tone.

Tips and Best Practices for Successful Credit Disputes

- Keep copies of all letters, emails, and attachments.

- Be specific about errors and clearly request action.

- Use certified mail or read receipts for confirmation.

- Monitor credit reports regularly to prevent future errors.

- Follow up if no response is received within the statutory time frame.

FAQ About Credit Dispute Letters

- Q: How long does it take to resolve a dispute?

A: Typically within 30–45 days from receipt, per the FCRA. - Q: Can I dispute multiple items in one letter?

A: Yes, but ensure each item is clearly identified and supported. - Q: Do I need proof for every disputed item?

A: Strong supporting evidence increases the likelihood of a successful dispute. - Q: Is email acceptable for disputes?

A: Yes, if submitted through the bureau’s secure portal; certified mail is preferred for legal tracking.

Download Word Doc

Download Word Doc

Download PDF

Download PDF