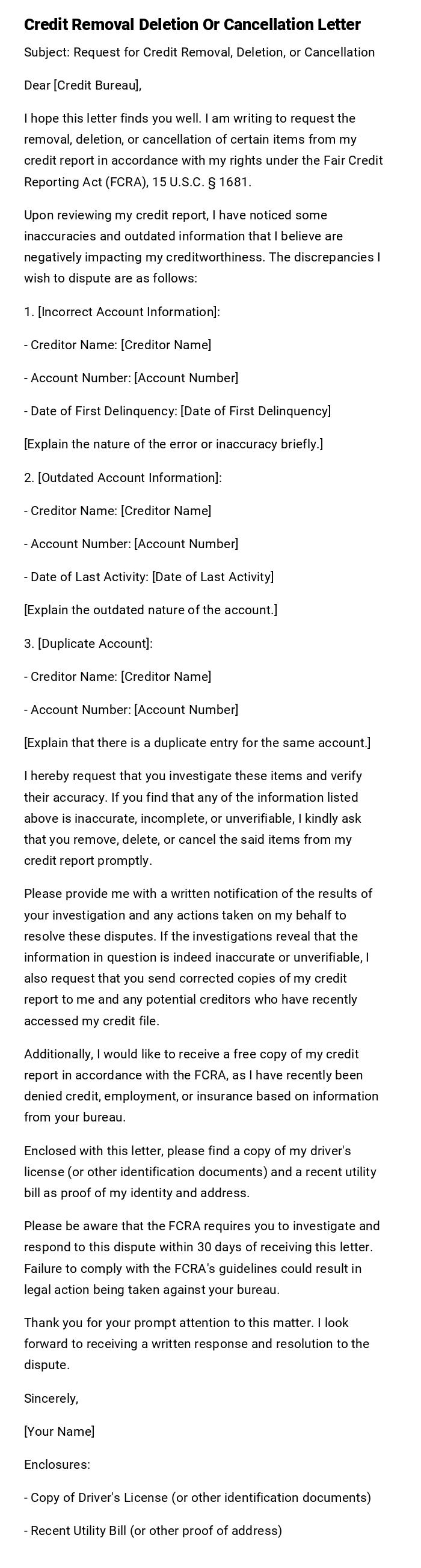

Credit Removal Deletion Or Cancellation Letter

Subject: Request for Credit Removal, Deletion, or Cancellation

Dear [Credit Bureau],

I hope this letter finds you well. I am writing to request the removal, deletion, or cancellation of certain items from my credit report in accordance with my rights under the Fair Credit Reporting Act (FCRA), 15 U.S.C. § 1681.

Upon reviewing my credit report, I have noticed some inaccuracies and outdated information that I believe are negatively impacting my creditworthiness. The discrepancies I wish to dispute are as follows:

1. [Incorrect Account Information]:

- Creditor Name: [Creditor Name]

- Account Number: [Account Number]

- Date of First Delinquency: [Date of First Delinquency]

[Explain the nature of the error or inaccuracy briefly.]

2. [Outdated Account Information]:

- Creditor Name: [Creditor Name]

- Account Number: [Account Number]

- Date of Last Activity: [Date of Last Activity]

[Explain the outdated nature of the account.]

3. [Duplicate Account]:

- Creditor Name: [Creditor Name]

- Account Number: [Account Number]

[Explain that there is a duplicate entry for the same account.]

I hereby request that you investigate these items and verify their accuracy. If you find that any of the information listed above is inaccurate, incomplete, or unverifiable, I kindly ask that you remove, delete, or cancel the said items from my credit report promptly.

Please provide me with a written notification of the results of your investigation and any actions taken on my behalf to resolve these disputes. If the investigations reveal that the information in question is indeed inaccurate or unverifiable, I also request that you send corrected copies of my credit report to me and any potential creditors who have recently accessed my credit file.

Additionally, I would like to receive a free copy of my credit report in accordance with the FCRA, as I have recently been denied credit, employment, or insurance based on information from your bureau.

Enclosed with this letter, please find a copy of my driver's license (or other identification documents) and a recent utility bill as proof of my identity and address.

Please be aware that the FCRA requires you to investigate and respond to this dispute within 30 days of receiving this letter. Failure to comply with the FCRA's guidelines could result in legal action being taken against your bureau.

Thank you for your prompt attention to this matter. I look forward to receiving a written response and resolution to the dispute.

Sincerely,

[Your Name]

Enclosures:

- Copy of Driver's License (or other identification documents)

- Recent Utility Bill (or other proof of address)

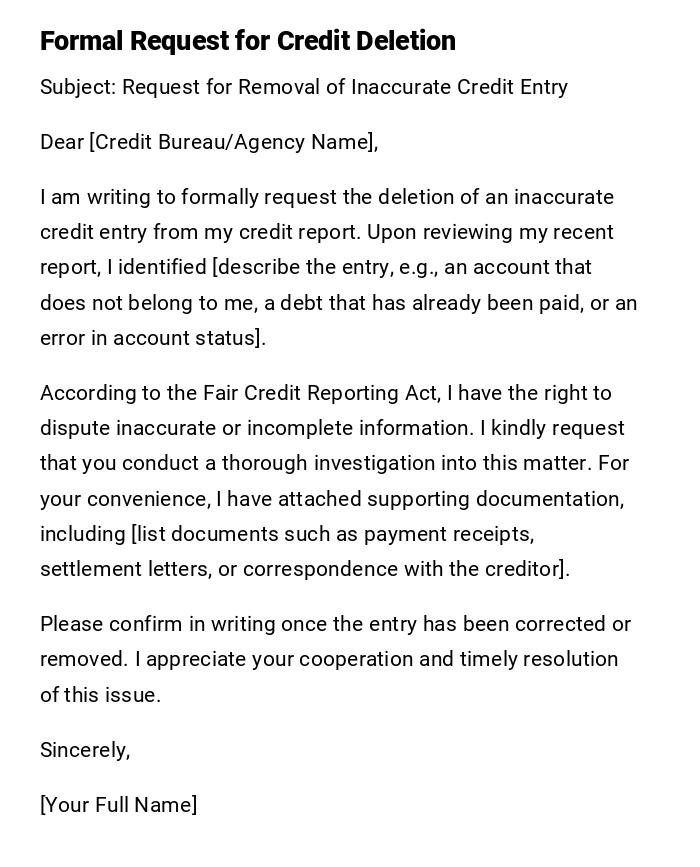

Formal Letter to Request Credit Deletion

Subject: Request for Removal of Inaccurate Credit Entry

Dear [Credit Bureau/Agency Name],

I am writing to formally request the deletion of an inaccurate credit entry from my credit report. Upon reviewing my recent report, I identified [describe the entry, e.g., an account that does not belong to me, a debt that has already been paid, or an error in account status].

According to the Fair Credit Reporting Act, I have the right to dispute inaccurate or incomplete information. I kindly request that you conduct a thorough investigation into this matter. For your convenience, I have attached supporting documentation, including [list documents such as payment receipts, settlement letters, or correspondence with the creditor].

Please confirm in writing once the entry has been corrected or removed. I appreciate your cooperation and timely resolution of this issue.

Sincerely,

[Your Full Name]

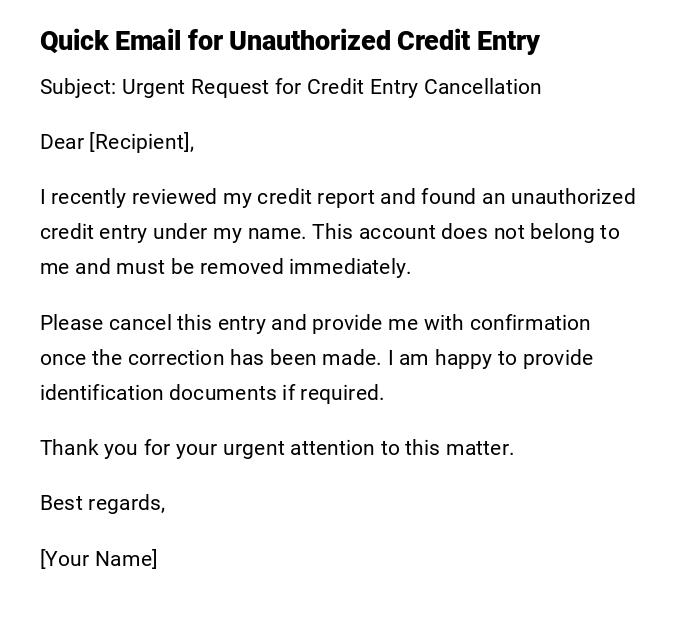

Simple Email to Cancel Unauthorized Credit Entry

Subject: Urgent Request for Credit Entry Cancellation

Dear [Recipient],

I recently reviewed my credit report and found an unauthorized credit entry under my name. This account does not belong to me and must be removed immediately.

Please cancel this entry and provide me with confirmation once the correction has been made. I am happy to provide identification documents if required.

Thank you for your urgent attention to this matter.

Best regards,

[Your Name]

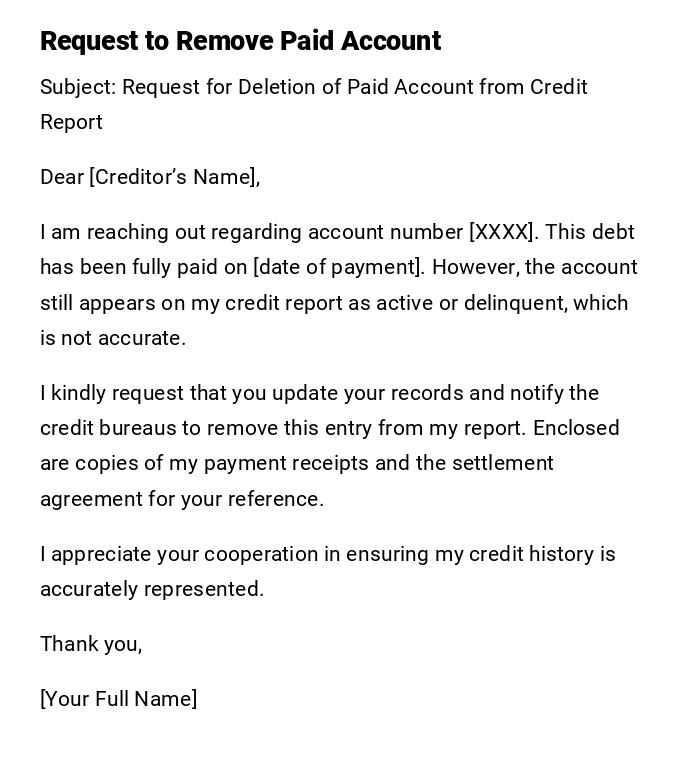

Letter to Creditor for Paid Account Deletion

Subject: Request for Deletion of Paid Account from Credit Report

Dear [Creditor’s Name],

I am reaching out regarding account number [XXXX]. This debt has been fully paid on [date of payment]. However, the account still appears on my credit report as active or delinquent, which is not accurate.

I kindly request that you update your records and notify the credit bureaus to remove this entry from my report. Enclosed are copies of my payment receipts and the settlement agreement for your reference.

I appreciate your cooperation in ensuring my credit history is accurately represented.

Thank you,

[Your Full Name]

Friendly Message for Goodwill Deletion

Subject: Goodwill Request for Credit Report Update

Dear [Creditor/Agency Name],

I hope this message finds you well. I am writing to request a goodwill adjustment regarding account [XXXX]. While I did experience late payments in the past due to [brief explanation, e.g., medical emergency, job loss], I have since resolved the debt and maintained consistent payments.

I kindly ask if you could remove the negative entry from my credit report as a gesture of goodwill. This adjustment would greatly assist me in rebuilding my financial stability and moving forward positively.

Thank you very much for your understanding and consideration.

Warm regards,

[Your Name]

Official Dispute Letter to Credit Bureau

Subject: Dispute of Incorrect Credit Information

Dear [Equifax/Experian/TransUnion],

I am writing to dispute inaccurate information in my credit file. The account in question is [account name/number]. This account is incorrectly listed as delinquent, though I have records that show otherwise.

I request that you investigate this matter and remove the incorrect entry. Enclosed are copies of the documents supporting my claim, including [list documents].

Please inform me of the outcome of your investigation and send me an updated copy of my credit report reflecting the correction.

Thank you for your time and assistance.

Sincerely,

[Your Full Name]

Cancellation Request for Closed Account

Subject: Removal of Closed Account from Credit Report

Dear [Recipient],

I recently closed my account with your institution, account number [XXXX]. However, the account still appears on my credit report in an unfavorable manner.

I request that you update your records to reflect the account’s closed status and remove it from any negative listings. I have included my closing statement as proof.

Thank you for updating this promptly.

Sincerely,

[Your Name]

Polite Request for Duplicate Entry Deletion

Subject: Duplicate Credit Entry Removal Request

Dear [Credit Agency],

I noticed that the same account appears twice on my credit report under different listings. This duplication negatively affects my credit score.

Please review the entries and remove the duplicate one. For your review, I’ve attached a copy of my credit report highlighting the issue.

Thank you for your swift action.

Best regards,

[Your Full Name]

Serious Letter for Identity Theft Credit Cancellation

Subject: Urgent Removal of Fraudulent Credit Entries

Dear [Credit Bureau/Agency Name],

I am a victim of identity theft, and several unauthorized accounts have appeared on my credit report. I did not open these accounts, nor have I authorized anyone to act on my behalf.

I request immediate cancellation and deletion of these fraudulent entries. Enclosed are copies of my police report, FTC Identity Theft Report, and government-issued ID.

Please confirm once the fraudulent accounts have been removed and send me an updated copy of my credit report.

Thank you for your urgent attention to this matter.

Respectfully,

[Your Full Name]

Message Requesting Credit Deletion Confirmation

Subject: Request for Confirmation of Credit Deletion

Dear [Recipient],

I recently submitted a request to have a credit entry removed from my report. Could you please confirm whether the deletion has been processed?

Kindly provide me with written confirmation or a copy of the updated report once the correction is complete.

Thank you for your assistance.

Best regards,

[Your Full Name]

What is a credit removal, deletion, or cancellation letter and why do you need it?

A credit removal, deletion, or cancellation letter is a formal request sent to a credit bureau, creditor, or financial institution to correct, update, or eliminate inaccurate, duplicate, fraudulent, or outdated entries in your credit report.

You need this letter to protect your credit score, ensure fairness in lending decisions, and maintain a clean financial history. Without such letters, inaccurate information can stay on your record for years and negatively affect loan approvals, job applications, or even rental agreements.

Who should send a credit removal or cancellation letter?

- Individuals disputing inaccurate or fraudulent entries on their credit reports.

- Victims of identity theft needing unauthorized accounts deleted.

- Borrowers who have paid or settled debts but the record still appears as delinquent.

- Consumers seeking goodwill adjustments from creditors for past late payments.

- Attorneys, financial advisors, or authorized representatives writing on behalf of their clients.

To whom should the credit deletion letter be addressed?

- Major credit bureaus (Equifax, Experian, TransUnion).

- Original creditors (banks, credit card companies, loan providers).

- Collection agencies that may still report outdated or paid accounts.

- Fraud departments in case of identity theft.

- Customer service or credit reporting divisions of financial institutions.

When do you need to send a credit deletion letter?

- When you discover inaccurate or duplicate entries on your credit report.

- After fully repaying or settling a debt that still shows as active.

- When closing an account but it continues to reflect negatively.

- After becoming a victim of identity theft.

- When requesting a goodwill deletion for late payments due to exceptional circumstances.

- While preparing for major financial steps such as applying for a mortgage, car loan, or job requiring a background check.

How do you write and send an effective credit removal letter?

- Review your credit report thoroughly and identify inaccuracies.

- Collect evidence such as payment receipts, settlement letters, or identity theft reports.

- Clearly state the account in dispute, why it is incorrect, and what correction you expect.

- Keep your tone formal, polite, and concise.

- Attach relevant documentation as proof.

- Send the letter via certified mail or secure email for tracking.

- Follow up within 30 days if you don’t receive confirmation.

Requirements and prerequisites before sending a credit deletion request

- Obtain the latest copy of your credit report.

- Highlight and document the exact errors or entries.

- Collect supporting evidence (proof of payment, identity theft reports, police complaints).

- Verify the address or email of the correct credit bureau/agency.

- Draft the letter with clear identification details (name, SSN/ID, address).

- Make copies of all documents for your records.

Formatting guidelines for a credit removal letter

- Keep it 1–2 pages long.

- Use a professional and respectful tone.

- Begin with subject and account details immediately.

- Avoid emotional or unnecessary details.

- Send in written letter format for formal cases, or email for quick requests.

- Always include evidence as attachments or enclosures.

Common mistakes to avoid when writing a credit deletion letter

- Failing to provide account details or reference numbers.

- Not attaching supporting documentation.

- Using aggressive or hostile language.

- Sending to the wrong department or agency.

- Forgetting to keep a copy for your own records.

- Assuming one letter will solve the issue without follow-up.

Pros and cons of sending a credit removal letter

Pros:

- Protects and improves your credit score.

- Provides a written record of your dispute.

- Helps correct mistakes quickly.

- May remove harmful or fraudulent accounts entirely.

Cons:

- The process can take time (30+ days for investigation).

- Not all creditors agree to goodwill deletions.

- Requires effort to gather documents and follow up.

- Some disputes may be denied if insufficient proof is provided.

Tricks and tips for making your letter more effective

- Always be polite and respectful, even if frustrated.

- Reference relevant consumer protection laws (e.g., FCRA).

- Use certified mail for proof of delivery.

- Keep a dispute log with dates, agencies contacted, and responses.

- If denied, resend with additional documents or escalate to a higher authority.

After sending your credit deletion letter: what next?

- Wait 30 days for the credit bureau to complete its investigation.

- Check your credit report again after the deadline.

- If the entry is removed, request an updated copy of your report.

- If denied, ask for a written explanation and appeal with stronger evidence.

- Continue monitoring your credit regularly for new or recurring errors.

Download Word Doc

Download Word Doc

Download PDF

Download PDF