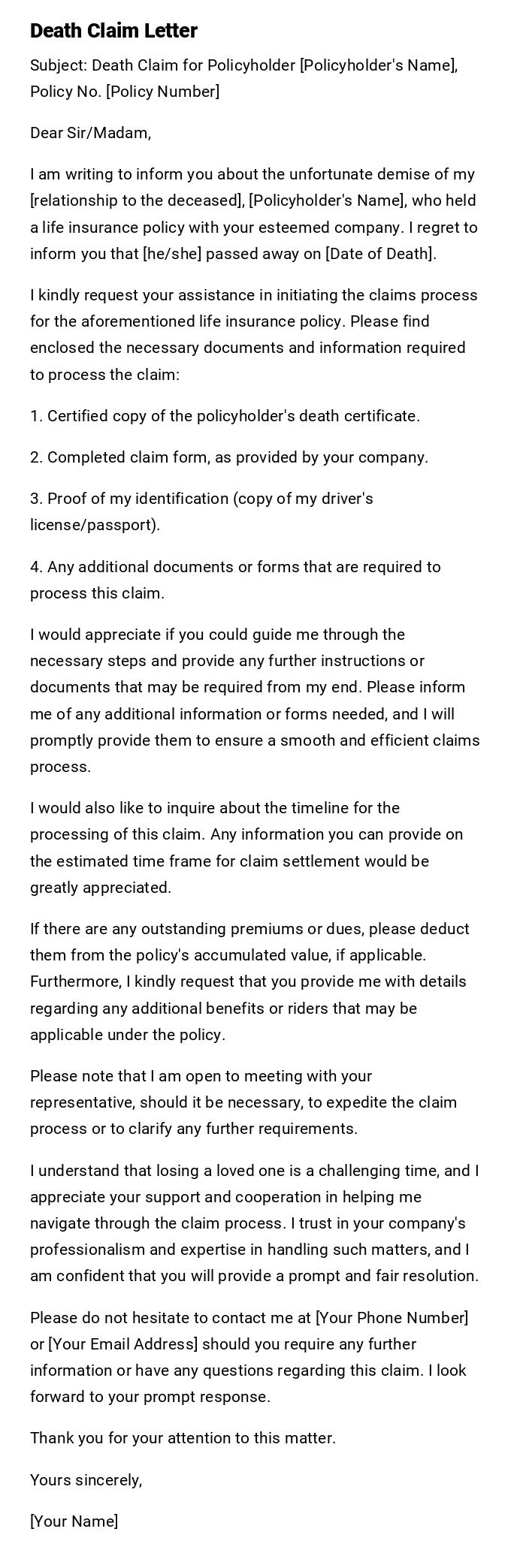

Death Claim Letter

Subject: Death Claim for Policyholder [Policyholder's Name], Policy No. [Policy Number]

Dear Sir/Madam,

I am writing to inform you about the unfortunate demise of my [relationship to the deceased], [Policyholder's Name], who held a life insurance policy with your esteemed company. I regret to inform you that [he/she] passed away on [Date of Death].

I kindly request your assistance in initiating the claims process for the aforementioned life insurance policy. Please find enclosed the necessary documents and information required to process the claim:

1. Certified copy of the policyholder's death certificate.

2. Completed claim form, as provided by your company.

3. Proof of my identification (copy of my driver's license/passport).

4. Any additional documents or forms that are required to process this claim.

I would appreciate if you could guide me through the necessary steps and provide any further instructions or documents that may be required from my end. Please inform me of any additional information or forms needed, and I will promptly provide them to ensure a smooth and efficient claims process.

I would also like to inquire about the timeline for the processing of this claim. Any information you can provide on the estimated time frame for claim settlement would be greatly appreciated.

If there are any outstanding premiums or dues, please deduct them from the policy's accumulated value, if applicable. Furthermore, I kindly request that you provide me with details regarding any additional benefits or riders that may be applicable under the policy.

Please note that I am open to meeting with your representative, should it be necessary, to expedite the claim process or to clarify any further requirements.

I understand that losing a loved one is a challenging time, and I appreciate your support and cooperation in helping me navigate through the claim process. I trust in your company's professionalism and expertise in handling such matters, and I am confident that you will provide a prompt and fair resolution.

Please do not hesitate to contact me at [Your Phone Number] or [Your Email Address] should you require any further information or have any questions regarding this claim. I look forward to your prompt response.

Thank you for your attention to this matter.

Yours sincerely,

[Your Name]

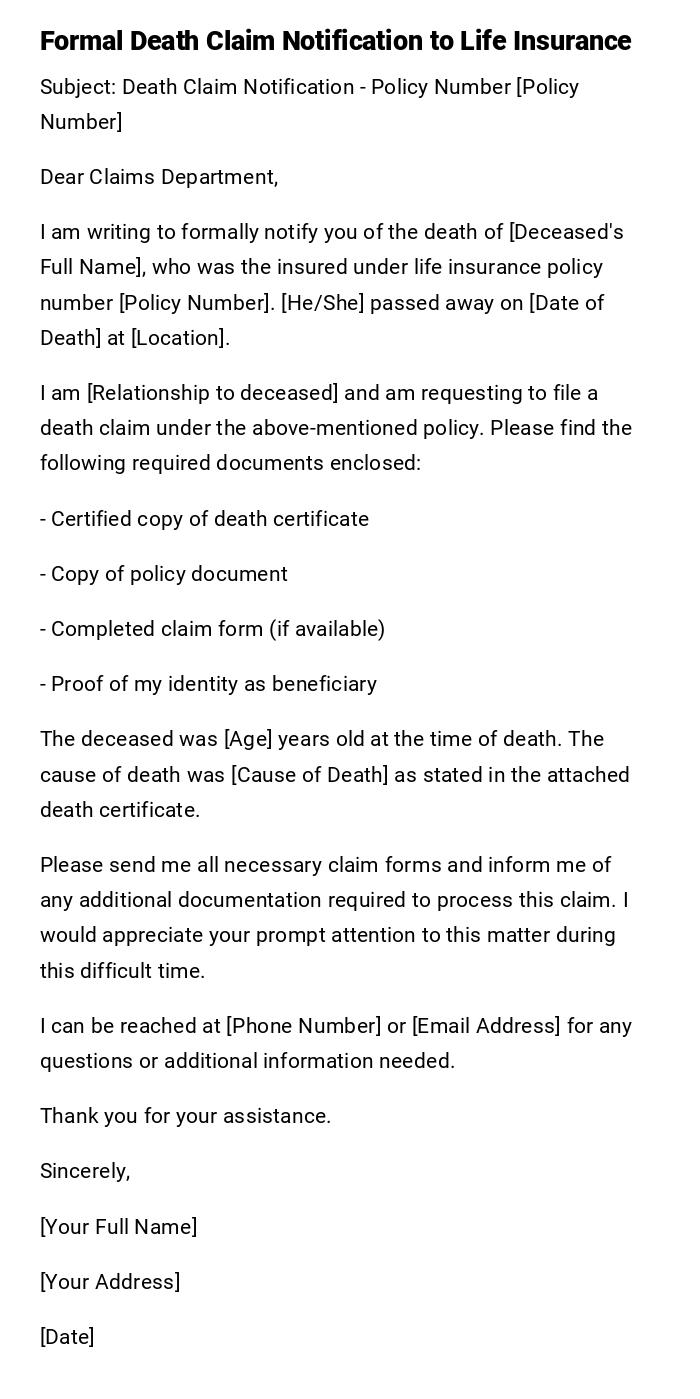

Death Claim Letter to Life Insurance Company

Subject: Death Claim Notification - Policy Number [Policy Number]

Dear Claims Department,

I am writing to formally notify you of the death of [Deceased's Full Name], who was the insured under life insurance policy number [Policy Number]. [He/She] passed away on [Date of Death] at [Location].

I am [Relationship to deceased] and am requesting to file a death claim under the above-mentioned policy. Please find the following required documents enclosed:

- Certified copy of death certificate

- Copy of policy document

- Completed claim form (if available)

- Proof of my identity as beneficiary

The deceased was [Age] years old at the time of death. The cause of death was [Cause of Death] as stated in the attached death certificate.

Please send me all necessary claim forms and inform me of any additional documentation required to process this claim. I would appreciate your prompt attention to this matter during this difficult time.

I can be reached at [Phone Number] or [Email Address] for any questions or additional information needed.

Thank you for your assistance.

Sincerely,

[Your Full Name]

[Your Address]

[Date]

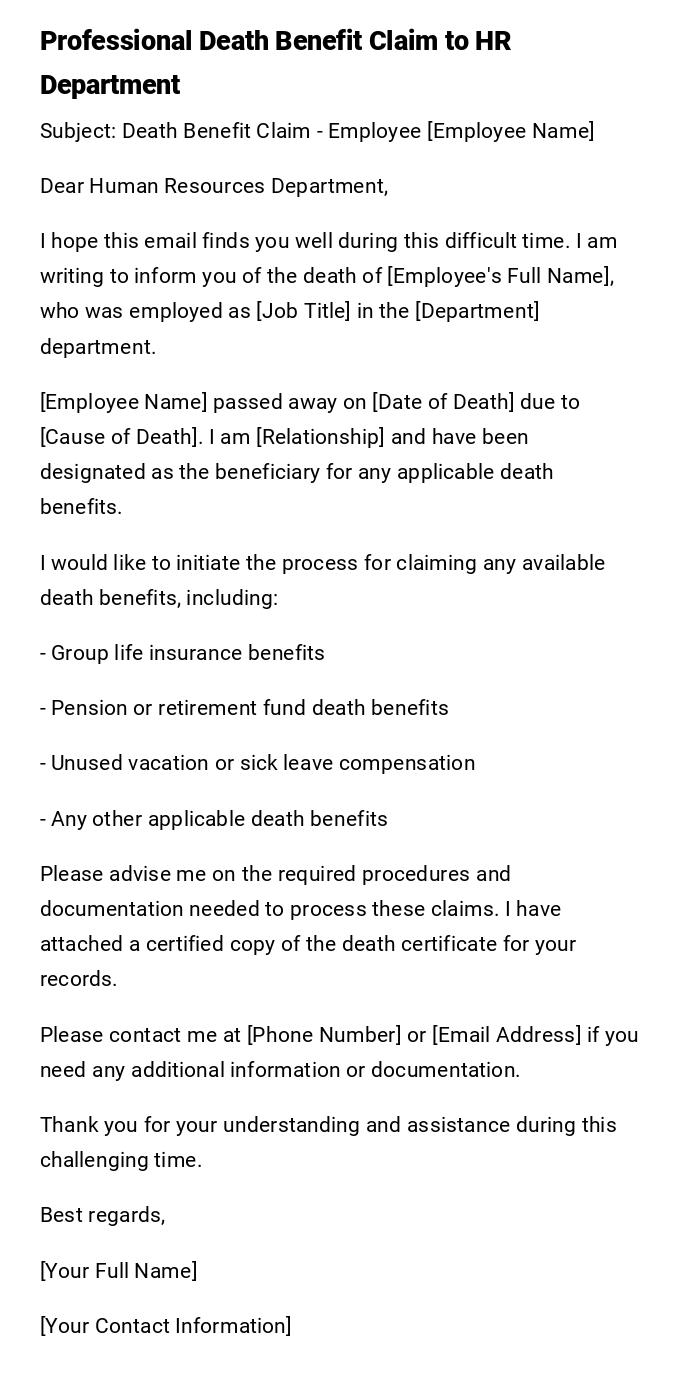

Death Claim Email to Employer for Benefits

Subject: Death Benefit Claim - Employee [Employee Name]

Dear Human Resources Department,

I hope this email finds you well during this difficult time. I am writing to inform you of the death of [Employee's Full Name], who was employed as [Job Title] in the [Department] department.

[Employee Name] passed away on [Date of Death] due to [Cause of Death]. I am [Relationship] and have been designated as the beneficiary for any applicable death benefits.

I would like to initiate the process for claiming any available death benefits, including:

- Group life insurance benefits

- Pension or retirement fund death benefits

- Unused vacation or sick leave compensation

- Any other applicable death benefits

Please advise me on the required procedures and documentation needed to process these claims. I have attached a certified copy of the death certificate for your records.

Please contact me at [Phone Number] or [Email Address] if you need any additional information or documentation.

Thank you for your understanding and assistance during this challenging time.

Best regards,

[Your Full Name]

[Your Contact Information]

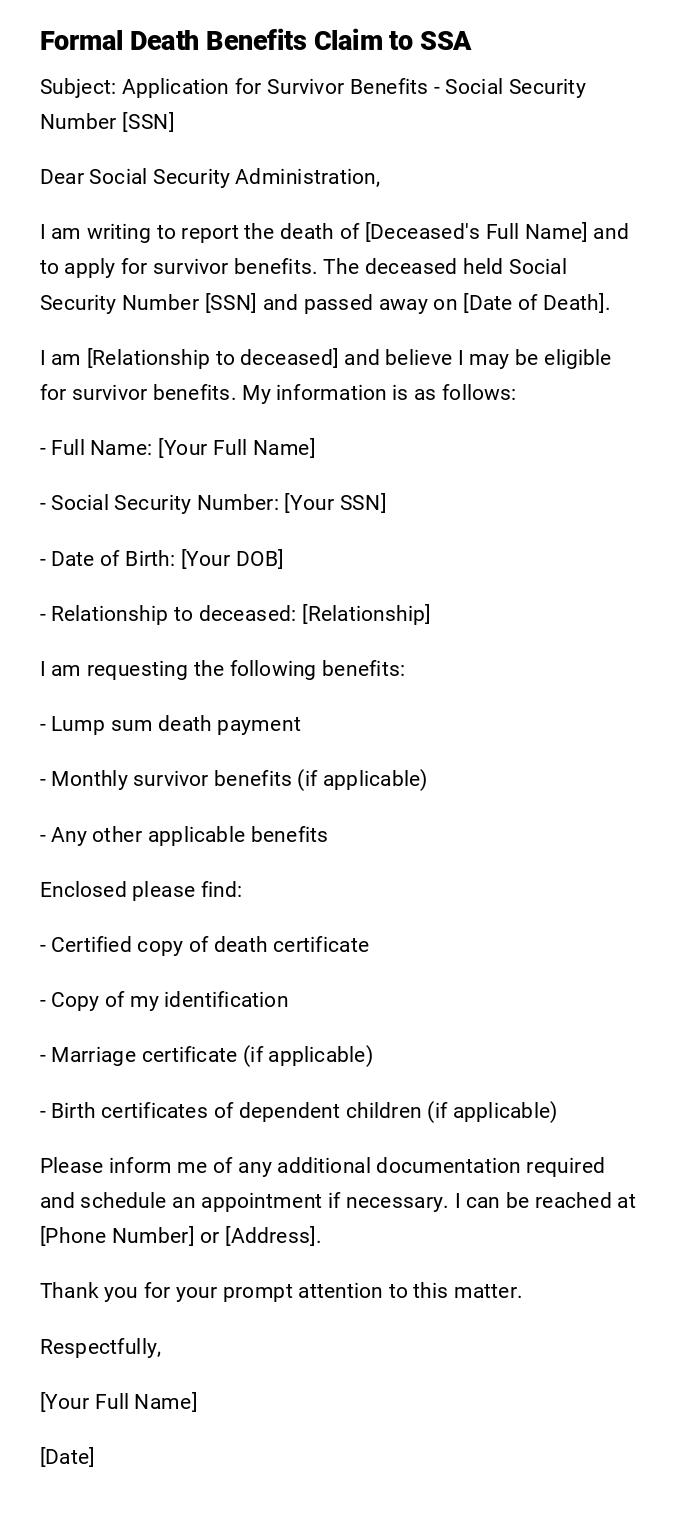

Death Claim Letter to Social Security Administration

Subject: Application for Survivor Benefits - Social Security Number [SSN]

Dear Social Security Administration,

I am writing to report the death of [Deceased's Full Name] and to apply for survivor benefits. The deceased held Social Security Number [SSN] and passed away on [Date of Death].

I am [Relationship to deceased] and believe I may be eligible for survivor benefits. My information is as follows:

- Full Name: [Your Full Name]

- Social Security Number: [Your SSN]

- Date of Birth: [Your DOB]

- Relationship to deceased: [Relationship]

I am requesting the following benefits:

- Lump sum death payment

- Monthly survivor benefits (if applicable)

- Any other applicable benefits

Enclosed please find:

- Certified copy of death certificate

- Copy of my identification

- Marriage certificate (if applicable)

- Birth certificates of dependent children (if applicable)

Please inform me of any additional documentation required and schedule an appointment if necessary. I can be reached at [Phone Number] or [Address].

Thank you for your prompt attention to this matter.

Respectfully,

[Your Full Name]

[Date]

Death Claim Message to Bank for Account Access

Subject: Death Notification and Account Access Request

Dear Customer Service Manager,

I hope you understand the sensitivity of this message. I am writing to inform you of the death of [Deceased's Full Name], who held account number [Account Number] with your institution.

[He/She] passed away on [Date of Death], and I am [Relationship] serving as [Executor/Administrator] of [his/her] estate. I need to understand the process for accessing the account and claiming any funds.

I have the following documentation available:

- Death certificate

- Letters of administration/testamentary

- Proof of my identity

- Copy of will (if applicable)

Please advise me on your institution's procedures for handling deceased account holders' assets and what additional documentation may be required.

This has been an incredibly difficult time for our family, and I would greatly appreciate your guidance and support through this process.

Please contact me at [Phone Number] or [Email Address] at your earliest convenience.

Thank you for your understanding and assistance.

Warm regards,

[Your Full Name]

Death Claim Letter to Pension Fund

Subject: Death Benefit Claim - Pension Plan Member [Member Number]

Dear Pension Fund Administrator,

I am writing to notify you of the death of [Deceased's Full Name], who was a member of your pension plan under member number [Member Number].

[He/She] passed away on [Date of Death] at [Location]. I am [Relationship] and am writing to claim any death benefits available under the pension plan.

According to my understanding of the plan terms, I may be entitled to:

- Death benefit payment

- Survivor pension benefits

- Return of contributions (if applicable)

Please find enclosed:

- Certified death certificate

- Marriage certificate (if applicable)

- Birth certificate (for age verification)

- Completed beneficiary forms

I would appreciate receiving information about the benefit calculation, payment schedule, and any additional requirements for processing this claim.

Please contact me at [Phone Number] or [Email Address] if you require any additional information or documentation.

Thank you for your prompt attention to this important matter.

Sincerely,

[Your Full Name]

[Your Address]

[Date]

Death Claim Email to Credit Card Company

Subject: Death Notification - Account Holder [Account Number]

Dear Customer Service,

I am writing to inform you that [Deceased's Full Name], the primary account holder for credit card account [Account Number], passed away on [Date of Death].

I am [Relationship] and am handling [his/her] estate matters. I understand there may be credit protection insurance or death benefits associated with this account that could help settle the outstanding balance.

Current account details:

- Account Number: [Account Number]

- Outstanding Balance: [Amount if known]

- Date of Death: [Date]

Please advise me on:

- Any available death benefits or insurance coverage

- Procedures for settling the account

- Required documentation

- Timeline for resolution

I have attached a copy of the death certificate and can provide additional documentation as needed.

Please contact me at [Phone Number] or [Email Address] to discuss next steps.

Thank you for your assistance during this difficult time.

Best regards,

[Your Full Name]

Death Claim Letter to Veterans Affairs

Subject: Application for Veteran Death Benefits - Service Number [Service Number]

Dear Department of Veterans Affairs,

I am writing to apply for death benefits for [Deceased's Full Name], a veteran who served in [Branch of Service] from [Start Date] to [End Date]. [He/She] passed away on [Date of Death].

Veteran Information:

- Service Number: [Service Number]

- Social Security Number: [SSN]

- Date of Birth: [DOB]

- Date of Death: [Death Date]

- Place of Death: [Location]

I am [Relationship] and am applying for the following benefits:

- Burial allowance

- Dependency and Indemnity Compensation (DIC)

- Accrued benefits

- Plot allowance (if applicable)

Enclosed documentation:

- Death certificate

- DD-214 (discharge papers)

- Marriage certificate (if applicable)

- Medical records related to service-connected conditions

Please process this application and inform me of any additional requirements. I can be reached at [Phone Number] or [Address].

Thank you for honoring our veteran's service and supporting the surviving family.

Respectfully submitted,

[Your Full Name]

[Date]

What is a Death Claim Letter and Why is it Necessary

A death claim letter is a formal written notification sent to various organizations and institutions to report someone's death and initiate the process of claiming benefits, assets, or settling accounts. These letters serve multiple critical purposes: they legally notify entities of the death, request access to benefits or funds, provide official documentation of the death, and establish the sender's authority to act on behalf of the deceased or their estate. The letter is essential because it triggers the formal claims process and ensures that all entitled benefits are identified and properly claimed during an already difficult time.

Who Should Send Death Claim Letters

Death claim letters should typically be sent by the deceased's immediate family members, designated beneficiaries, estate executors or administrators, legal representatives or attorneys, or trusted family friends with proper authorization. The sender must have legal standing to make the claim and access to necessary documentation. Spouses often handle most claims, but adult children, parents, or siblings may also be appropriate senders depending on the circumstances and relationship to the deceased.

When Death Claim Letters Are Required

These letters become necessary immediately following several triggering events:

- Death of a family member or beneficiary

- Discovery of unclaimed benefits or policies

- Probate proceedings requiring asset identification

- Insurance policy maturation due to death

- Employment termination due to death

- Military service member death

- When estate settlement requires benefit claims

- Discovery of forgotten accounts or policies

- Court appointment as executor or administrator

- When creditors need to be notified of death benefits available to settle debts

Requirements and Prerequisites Before Sending

Before writing and sending death claim letters, ensure you have obtained certified copies of the death certificate, gathered all relevant policy numbers and account information, confirmed your legal authority to act (letters testamentary, letters of administration), collected identification documents for yourself and the deceased, located important documents like wills, insurance policies, and employment records. You should also verify beneficiary designations, understand the institution's specific claim procedures, and prepare copies of marriage certificates, birth certificates, or other relationship-proving documents as needed.

How to Write and Send Death Claim Letters

The process involves several systematic steps:

- Research each organization's specific claim procedures and required forms

- Gather all necessary supporting documentation before writing

- Use formal business letter format for official claims

- Include all relevant identifying information (policy numbers, account numbers, SSN)

- Clearly state your relationship to the deceased and your authority to make the claim

- Be specific about what benefits or access you're requesting

- Attach copies (never originals) of required documents

- Send via certified mail with return receipt for important claims

- Keep detailed records of all correspondence

- Follow up if you don't receive acknowledgment within reasonable timeframes

Formatting Guidelines and Best Practices

Death claim letters should be concise yet comprehensive, typically 1-2 pages long. Use professional, respectful tone throughout while being direct about your needs. Include complete contact information and preferred communication methods. Organize information logically with clear subject lines for emails or reference lines for letters. Always proofread for accuracy, especially regarding dates, numbers, and names. Use certified mail for original submissions and keep copies of everything. Consider using letterhead if representing an estate officially, and ensure all attachments are clearly labeled and referenced in the letter body.

Common Mistakes to Avoid

Frequent errors include sending letters without proper documentation, failing to include sufficient identifying information, using informal tone for official claims, not keeping copies of correspondence, missing deadline requirements, sending to wrong departments or addresses, providing inconsistent information across multiple claims, forgetting to sign letters, using outdated contact information, and failing to follow up appropriately. Also avoid emotional language in formal claims, don't assume organizations will coordinate with each other, and never send original documents unless specifically required.

After Sending - Follow-up Requirements

Most death claim letters require active follow-up to ensure processing. Expect acknowledgment within 1-2 weeks, and follow up if you don't receive it. Many institutions will send additional forms or request more documentation. Keep track of deadlines for returning completed forms or additional information. Some claims require periodic updates or annual certifications. Be prepared for phone interviews or in-person appointments. Maintain organized files of all correspondence and decisions. Monitor payment processing and address any discrepancies promptly. Some benefits may require ongoing communication or annual eligibility verification.

Essential Elements and Structure

Every death claim letter must include specific structural elements: clear subject line or reference line, formal greeting, statement of the death with date and basic details, your relationship to deceased and authority to make the claim, specific benefits or access being requested, list of enclosed documentation, your complete contact information, professional closing, and your signature. Additional elements may include policy numbers, account numbers, the deceased's identifying information, cause of death (when relevant), and specific deadlines or time-sensitive issues that need attention.

Download Word Doc

Download Word Doc

Download PDF

Download PDF