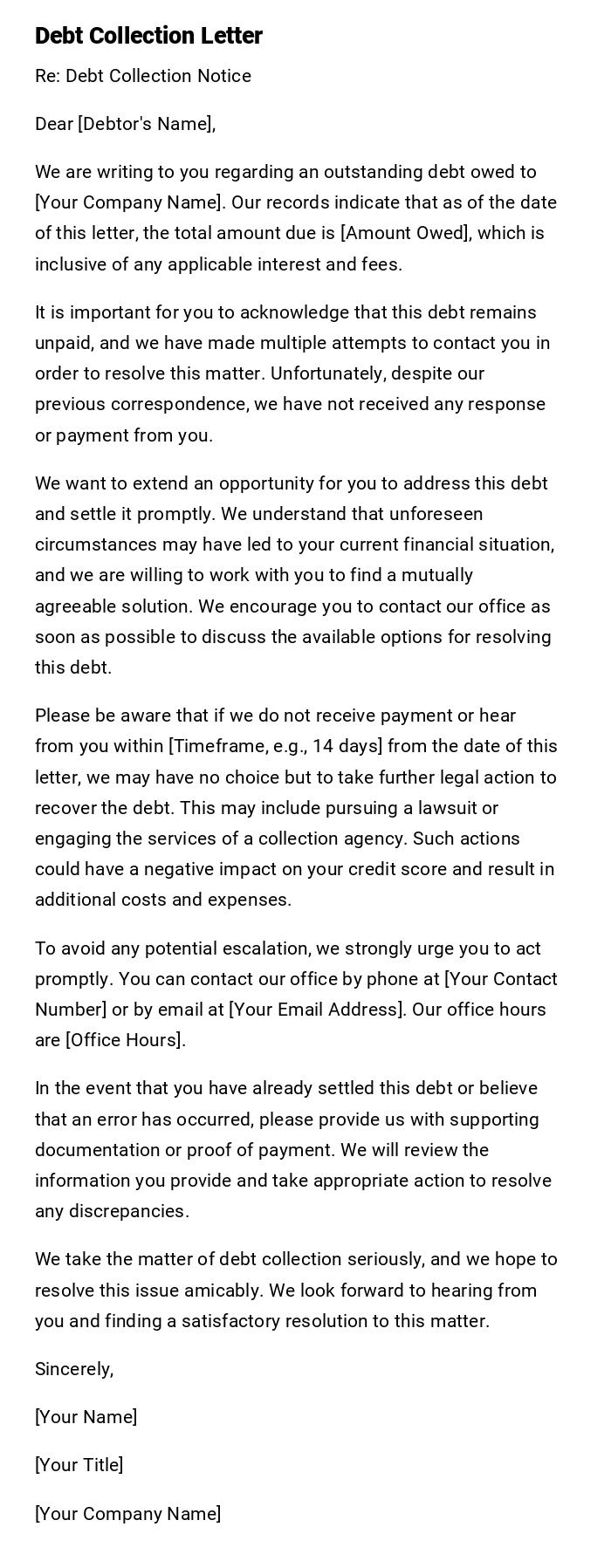

Debt Collection Letter

Re: Debt Collection Notice

Dear [Debtor's Name],

We are writing to you regarding an outstanding debt owed to [Your Company Name]. Our records indicate that as of the date of this letter, the total amount due is [Amount Owed], which is inclusive of any applicable interest and fees.

It is important for you to acknowledge that this debt remains unpaid, and we have made multiple attempts to contact you in order to resolve this matter. Unfortunately, despite our previous correspondence, we have not received any response or payment from you.

We want to extend an opportunity for you to address this debt and settle it promptly. We understand that unforeseen circumstances may have led to your current financial situation, and we are willing to work with you to find a mutually agreeable solution. We encourage you to contact our office as soon as possible to discuss the available options for resolving this debt.

Please be aware that if we do not receive payment or hear from you within [Timeframe, e.g., 14 days] from the date of this letter, we may have no choice but to take further legal action to recover the debt. This may include pursuing a lawsuit or engaging the services of a collection agency. Such actions could have a negative impact on your credit score and result in additional costs and expenses.

To avoid any potential escalation, we strongly urge you to act promptly. You can contact our office by phone at [Your Contact Number] or by email at [Your Email Address]. Our office hours are [Office Hours].

In the event that you have already settled this debt or believe that an error has occurred, please provide us with supporting documentation or proof of payment. We will review the information you provide and take appropriate action to resolve any discrepancies.

We take the matter of debt collection seriously, and we hope to resolve this issue amicably. We look forward to hearing from you and finding a satisfactory resolution to this matter.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

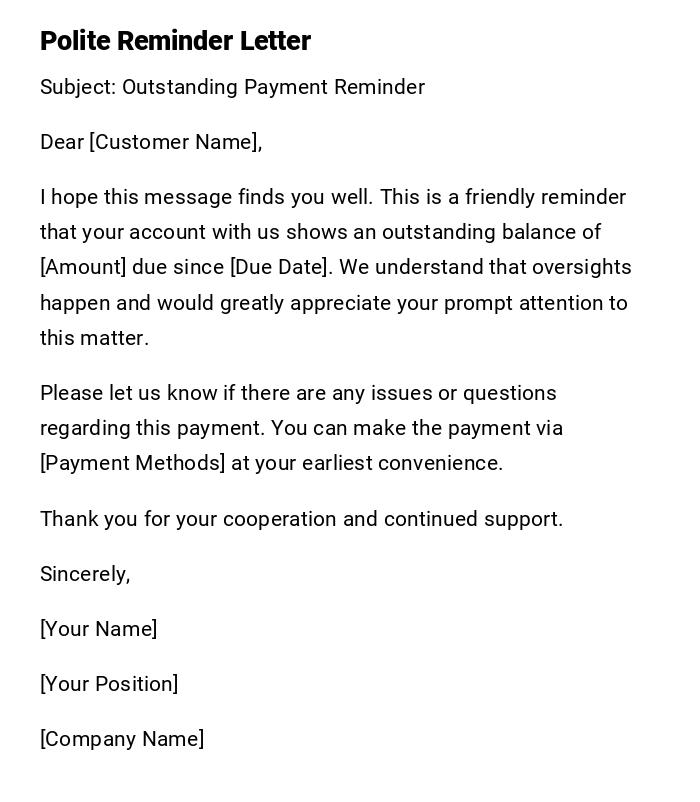

Polite Reminder Debt Collection Letter

Subject: Outstanding Payment Reminder

Dear [Customer Name],

I hope this message finds you well. This is a friendly reminder that your account with us shows an outstanding balance of [Amount] due since [Due Date]. We understand that oversights happen and would greatly appreciate your prompt attention to this matter.

Please let us know if there are any issues or questions regarding this payment. You can make the payment via [Payment Methods] at your earliest convenience.

Thank you for your cooperation and continued support.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

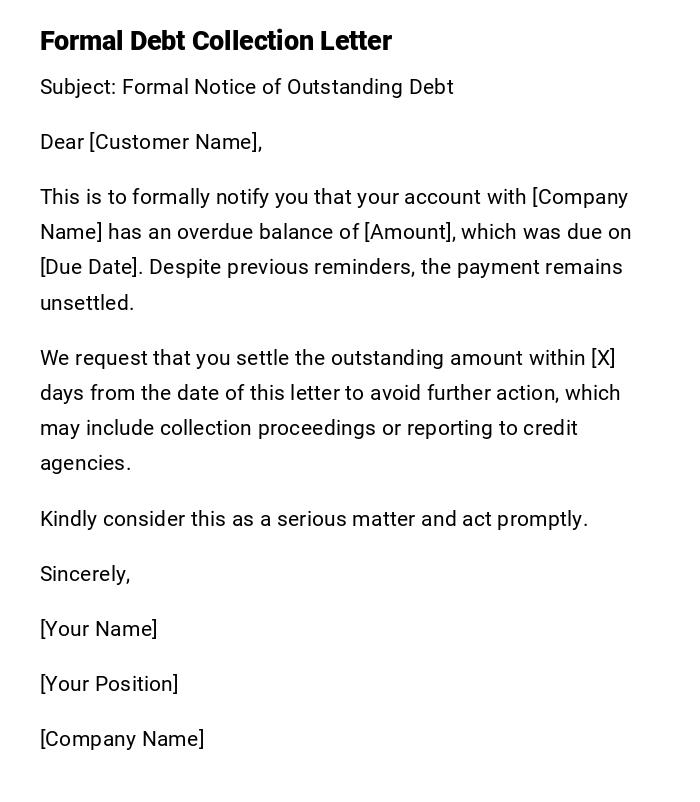

Formal Debt Collection Letter

Subject: Formal Notice of Outstanding Debt

Dear [Customer Name],

This is to formally notify you that your account with [Company Name] has an overdue balance of [Amount], which was due on [Due Date]. Despite previous reminders, the payment remains unsettled.

We request that you settle the outstanding amount within [X] days from the date of this letter to avoid further action, which may include collection proceedings or reporting to credit agencies.

Kindly consider this as a serious matter and act promptly.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

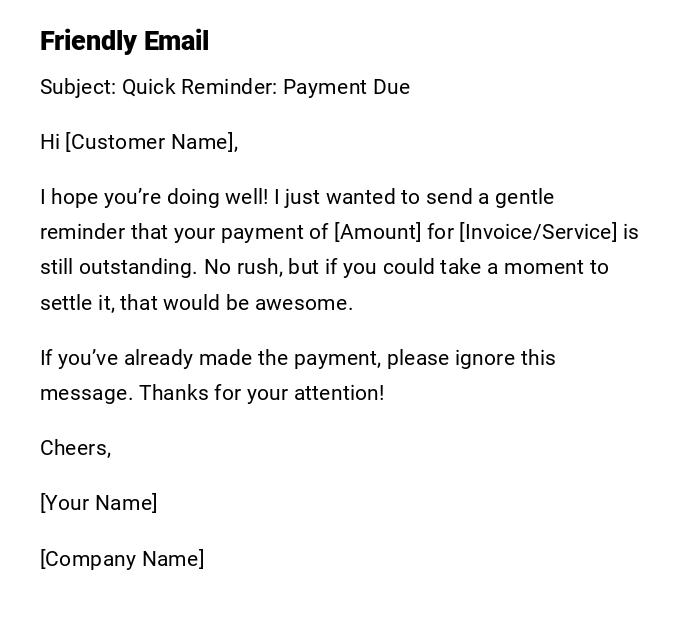

Friendly Debt Collection Email

Subject: Quick Reminder: Payment Due

Hi [Customer Name],

I hope you’re doing well! I just wanted to send a gentle reminder that your payment of [Amount] for [Invoice/Service] is still outstanding. No rush, but if you could take a moment to settle it, that would be awesome.

If you’ve already made the payment, please ignore this message. Thanks for your attention!

Cheers,

[Your Name]

[Company Name]

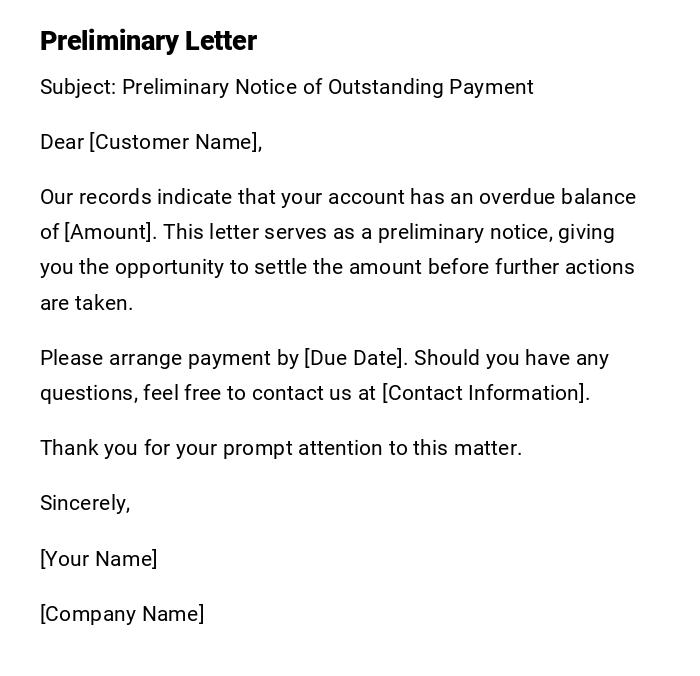

Preliminary Debt Collection Letter

Subject: Preliminary Notice of Outstanding Payment

Dear [Customer Name],

Our records indicate that your account has an overdue balance of [Amount]. This letter serves as a preliminary notice, giving you the opportunity to settle the amount before further actions are taken.

Please arrange payment by [Due Date]. Should you have any questions, feel free to contact us at [Contact Information].

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Company Name]

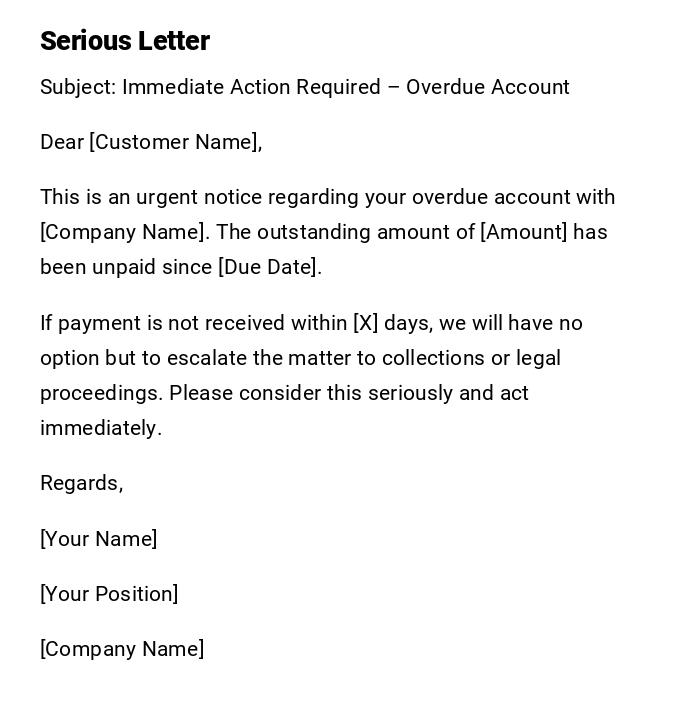

Serious Debt Collection Letter

Subject: Immediate Action Required – Overdue Account

Dear [Customer Name],

This is an urgent notice regarding your overdue account with [Company Name]. The outstanding amount of [Amount] has been unpaid since [Due Date].

If payment is not received within [X] days, we will have no option but to escalate the matter to collections or legal proceedings. Please consider this seriously and act immediately.

Regards,

[Your Name]

[Your Position]

[Company Name]

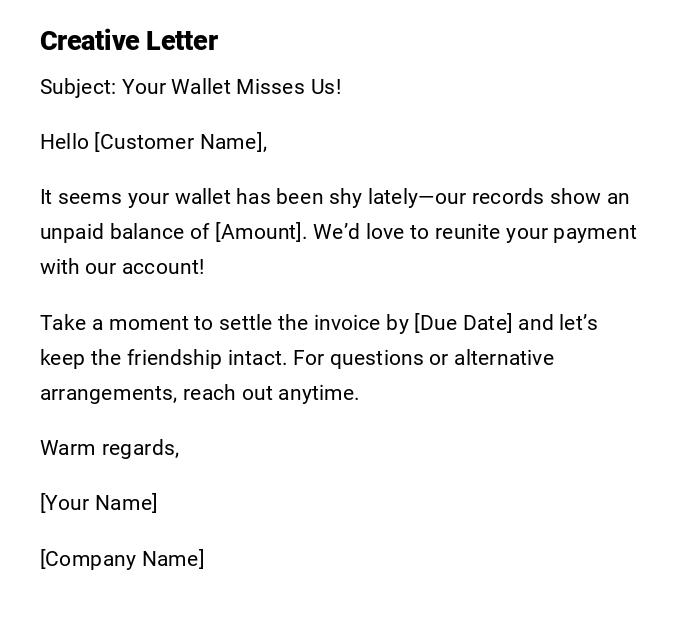

Creative Debt Collection Letter

Subject: Your Wallet Misses Us!

Hello [Customer Name],

It seems your wallet has been shy lately—our records show an unpaid balance of [Amount]. We’d love to reunite your payment with our account!

Take a moment to settle the invoice by [Due Date] and let’s keep the friendship intact. For questions or alternative arrangements, reach out anytime.

Warm regards,

[Your Name]

[Company Name]

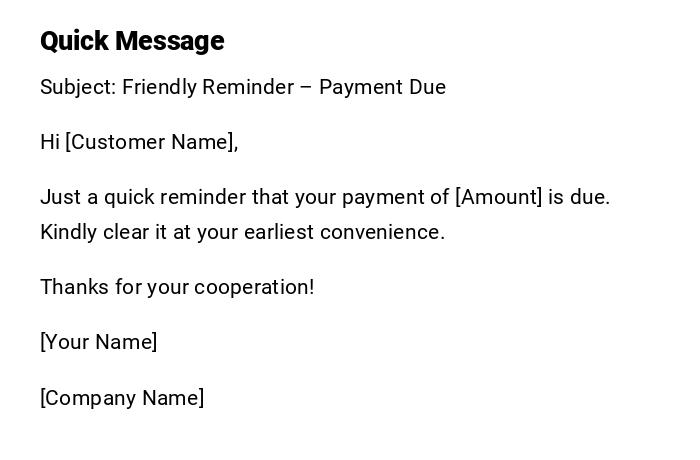

Quick Reminder Debt Collection Message

Subject: Friendly Reminder – Payment Due

Hi [Customer Name],

Just a quick reminder that your payment of [Amount] is due. Kindly clear it at your earliest convenience.

Thanks for your cooperation!

[Your Name]

[Company Name]

What is a Debt Collection Letter and Why It Is Used

A debt collection letter is a formal or informal communication sent to a debtor to request payment of an outstanding amount.

It serves multiple purposes:

- Notifying the debtor of overdue payments.

- Maintaining a professional record of communication.

- Encouraging prompt resolution without resorting to legal action.

- Preserving business relationships by providing reminders in a courteous manner.

Who Should Send a Debt Collection Letter

Debt collection letters are typically sent by:

- The company or individual owed the money.

- Authorized representatives, such as accountants or finance managers.

- Professional debt collection agencies in formal or legal scenarios.

The sender should have proper authorization and access to accurate account information.

Whom the Letter Should Be Addressed To

Debt collection letters should be directed to:

- The person or business legally responsible for the debt.

- Co-signers or guarantors if applicable.

- In cases of joint accounts, all parties involved may be addressed.

Ensure the recipient’s contact details are accurate to prevent delivery issues.

When to Send a Debt Collection Letter

Debt collection letters are triggered by:

- Missed invoice payments.

- Overdue credit card or loan balances.

- Failure to pay for goods or services received.

- As a preliminary step before legal action.

- After initial verbal or email reminders have gone unanswered.

How to Write and Send a Debt Collection Letter

Key steps include:

- Review the account and verify the outstanding amount.

- Choose the tone: friendly, formal, serious, or creative.

- Include clear details: amount, due date, and payment options.

- Specify consequences of non-payment if appropriate.

- Send via preferred mode: mail for formal letters, email for casual reminders.

- Keep a copy for records.

How Many Debt Collection Letters Should Be Sent

- Typically, start with 1–2 friendly reminders.

- If ignored, escalate to formal letters or notices.

- Serious or final notices can follow after 2–3 prior communications.

- Avoid excessive repetition to prevent harassment claims.

Formatting a Debt Collection Letter

Consider:

- Length: concise but informative, ideally 150–300 words.

- Tone: match the stage (friendly, formal, or serious).

- Style: structured with subject line, greeting, body, and closing.

- Mode: letter for official documentation, email for quick reminders.

- Wording: clear, polite, and non-threatening to maintain professionalism.

Requirements and Prerequisites Before Sending

- Verify the outstanding amount and payment history.

- Gather all invoices, contracts, or proof of agreement.

- Confirm the recipient’s correct contact information.

- Ensure authorization to send the letter is in place.

- Determine the preferred communication method (email, post, etc.).

After Sending and Follow-up Actions

- Keep a copy for your records.

- Monitor for payment within the stated deadline.

- Send follow-up reminders if no response is received.

- Escalate to formal collections or legal action if payment is still outstanding.

- Maintain a professional tone throughout all follow-up communications.

Tricks and Tips for Effective Debt Collection Letters

- Use polite but firm language to encourage payment.

- Include multiple payment methods for convenience.

- Reference prior communications to reinforce seriousness.

- Offer flexible arrangements if necessary to maintain goodwill.

- Personalize messages to improve response rates.

Common Mistakes to Avoid

- Sending letters without verifying the amount owed.

- Using threatening or aggressive language.

- Ignoring proper authorization to send the letter.

- Failing to track sent letters and responses.

- Repeating the same message excessively.

Elements and Structure of a Debt Collection Letter

Include the following:

- Subject Line: Clearly states the purpose.

- Greeting: Address the recipient politely.

- Opening Paragraph: Introduce the matter and amount owed.

- Details: Specify due date, invoice number, and payment methods.

- Action Request: Clearly state what the recipient should do.

- Closing: Professional sign-off with contact information.

- Attachments: Copies of invoices or agreements if necessary.

Pros and Cons of Sending a Debt Collection Letter

Pros:

- Encourages payment without legal action.

- Maintains a formal record for accounting or legal purposes.

- Can preserve professional relationships with clear communication.

Cons:

- May strain relationships if the tone is perceived as harsh.

- Requires careful monitoring and follow-up.

- Ineffective if recipient ignores the letter or is unreachable.

Compare and Contrast with Other Methods

Debt collection letters vs:

- Phone Calls: Letters provide written proof; calls are immediate but informal.

- Emails: Faster than letters, may be overlooked; less formal.

- Legal Notices: More serious; letters are less confrontational and cheaper.

- Debt Collection Agencies: Agencies may be more effective but add cost; letters allow personal control.

Download Word Doc

Download Word Doc

Download PDF

Download PDF