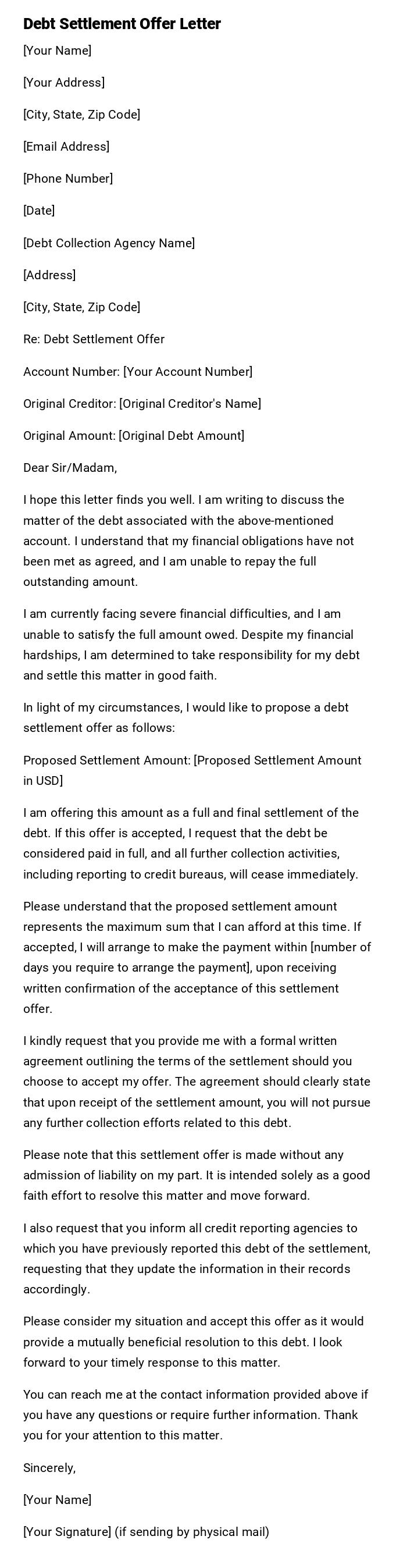

Debt Settlement Offer Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Debt Collection Agency Name]

[Address]

[City, State, Zip Code]

Re: Debt Settlement Offer

Account Number: [Your Account Number]

Original Creditor: [Original Creditor's Name]

Original Amount: [Original Debt Amount]

Dear Sir/Madam,

I hope this letter finds you well. I am writing to discuss the matter of the debt associated with the above-mentioned account. I understand that my financial obligations have not been met as agreed, and I am unable to repay the full outstanding amount.

I am currently facing severe financial difficulties, and I am unable to satisfy the full amount owed. Despite my financial hardships, I am determined to take responsibility for my debt and settle this matter in good faith.

In light of my circumstances, I would like to propose a debt settlement offer as follows:

Proposed Settlement Amount: [Proposed Settlement Amount in USD]

I am offering this amount as a full and final settlement of the debt. If this offer is accepted, I request that the debt be considered paid in full, and all further collection activities, including reporting to credit bureaus, will cease immediately.

Please understand that the proposed settlement amount represents the maximum sum that I can afford at this time. If accepted, I will arrange to make the payment within [number of days you require to arrange the payment], upon receiving written confirmation of the acceptance of this settlement offer.

I kindly request that you provide me with a formal written agreement outlining the terms of the settlement should you choose to accept my offer. The agreement should clearly state that upon receipt of the settlement amount, you will not pursue any further collection efforts related to this debt.

Please note that this settlement offer is made without any admission of liability on my part. It is intended solely as a good faith effort to resolve this matter and move forward.

I also request that you inform all credit reporting agencies to which you have previously reported this debt of the settlement, requesting that they update the information in their records accordingly.

Please consider my situation and accept this offer as it would provide a mutually beneficial resolution to this debt. I look forward to your timely response to this matter.

You can reach me at the contact information provided above if you have any questions or require further information. Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Your Signature] (if sending by physical mail)

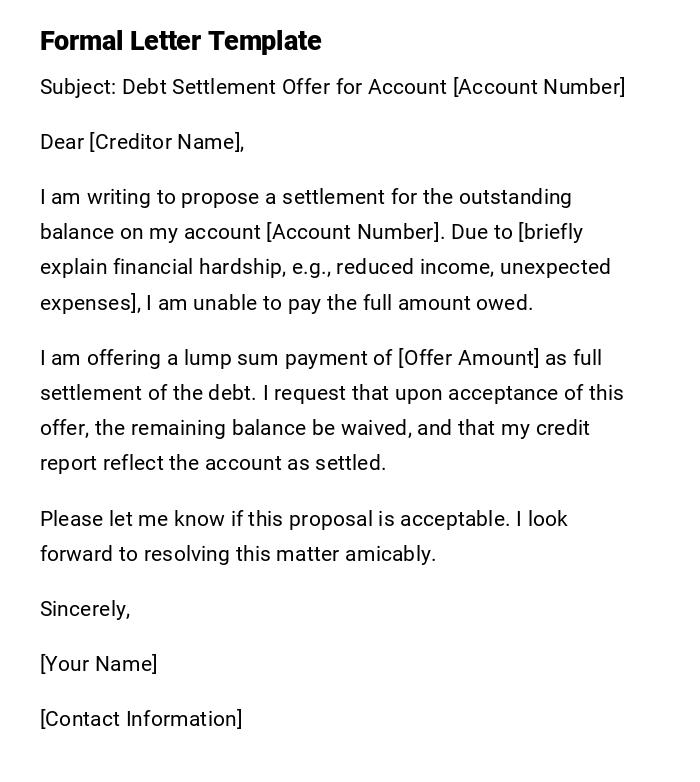

Formal Debt Settlement Offer Letter

Subject: Debt Settlement Offer for Account [Account Number]

Dear [Creditor Name],

I am writing to propose a settlement for the outstanding balance on my account [Account Number]. Due to [briefly explain financial hardship, e.g., reduced income, unexpected expenses], I am unable to pay the full amount owed.

I am offering a lump sum payment of [Offer Amount] as full settlement of the debt. I request that upon acceptance of this offer, the remaining balance be waived, and that my credit report reflect the account as settled.

Please let me know if this proposal is acceptable. I look forward to resolving this matter amicably.

Sincerely,

[Your Name]

[Contact Information]

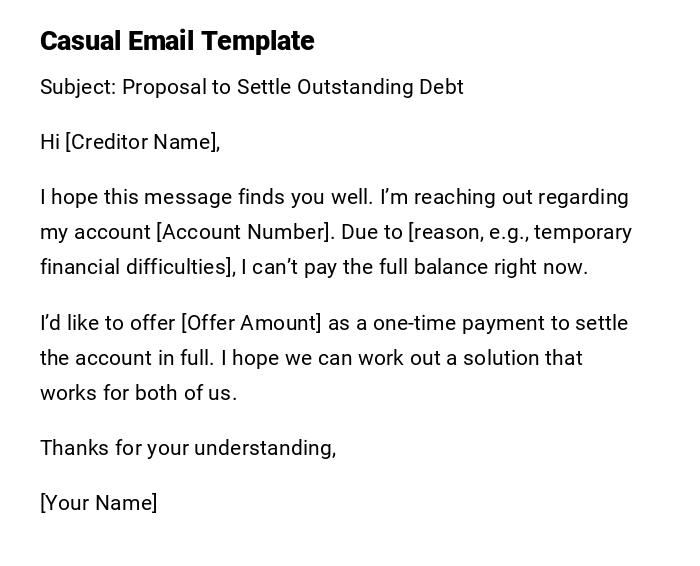

Casual / Friendly Debt Settlement Email

Subject: Proposal to Settle Outstanding Debt

Hi [Creditor Name],

I hope this message finds you well. I’m reaching out regarding my account [Account Number]. Due to [reason, e.g., temporary financial difficulties], I can’t pay the full balance right now.

I’d like to offer [Offer Amount] as a one-time payment to settle the account in full. I hope we can work out a solution that works for both of us.

Thanks for your understanding,

[Your Name]

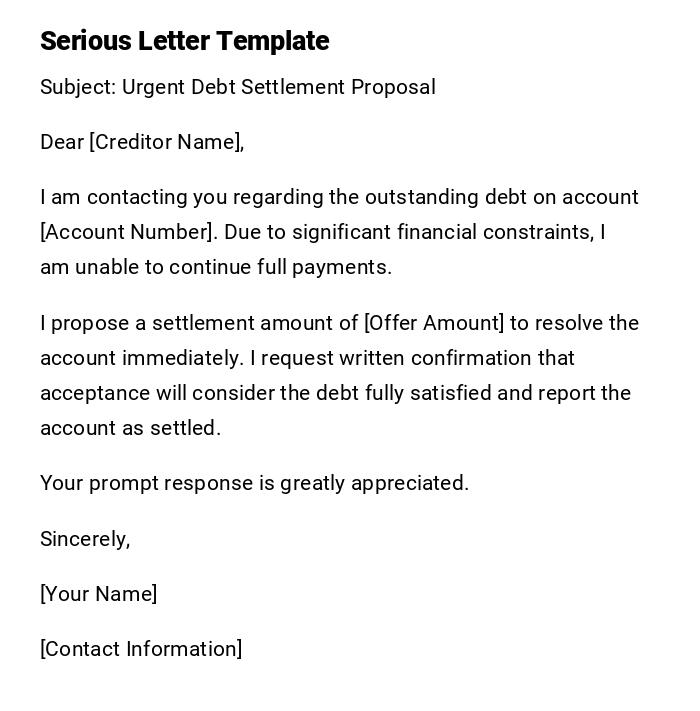

Urgent / Serious Debt Settlement Letter

Subject: Urgent Debt Settlement Proposal

Dear [Creditor Name],

I am contacting you regarding the outstanding debt on account [Account Number]. Due to significant financial constraints, I am unable to continue full payments.

I propose a settlement amount of [Offer Amount] to resolve the account immediately. I request written confirmation that acceptance will consider the debt fully satisfied and report the account as settled.

Your prompt response is greatly appreciated.

Sincerely,

[Your Name]

[Contact Information]

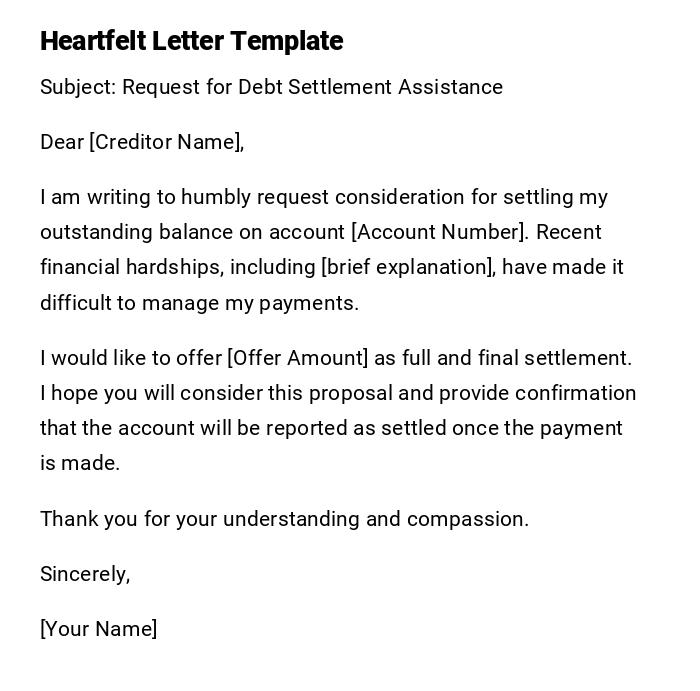

Heartfelt Debt Settlement Request Letter

Subject: Request for Debt Settlement Assistance

Dear [Creditor Name],

I am writing to humbly request consideration for settling my outstanding balance on account [Account Number]. Recent financial hardships, including [brief explanation], have made it difficult to manage my payments.

I would like to offer [Offer Amount] as full and final settlement. I hope you will consider this proposal and provide confirmation that the account will be reported as settled once the payment is made.

Thank you for your understanding and compassion.

Sincerely,

[Your Name]

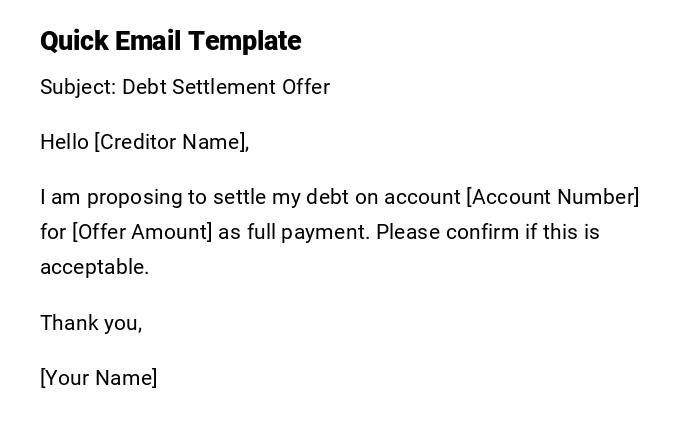

Quick and Simple Debt Settlement Email

Subject: Debt Settlement Offer

Hello [Creditor Name],

I am proposing to settle my debt on account [Account Number] for [Offer Amount] as full payment. Please confirm if this is acceptable.

Thank you,

[Your Name]

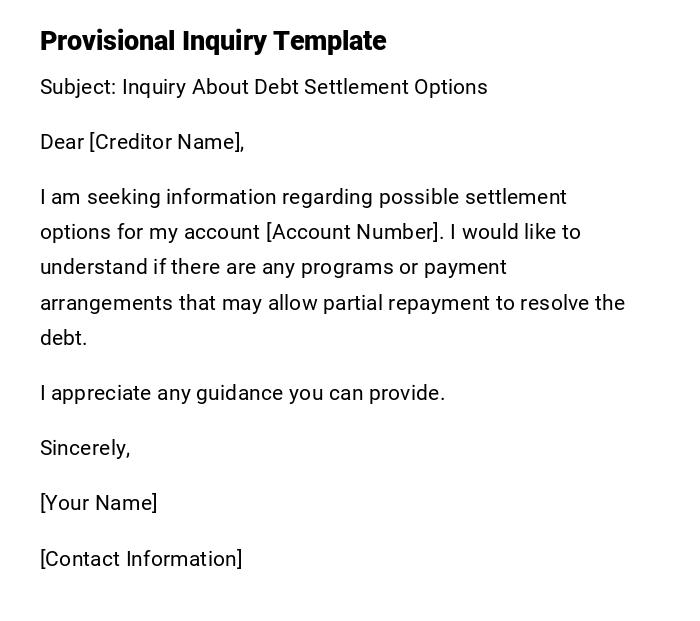

Provisional / Inquiry Debt Settlement Letter

Subject: Inquiry About Debt Settlement Options

Dear [Creditor Name],

I am seeking information regarding possible settlement options for my account [Account Number]. I would like to understand if there are any programs or payment arrangements that may allow partial repayment to resolve the debt.

I appreciate any guidance you can provide.

Sincerely,

[Your Name]

[Contact Information]

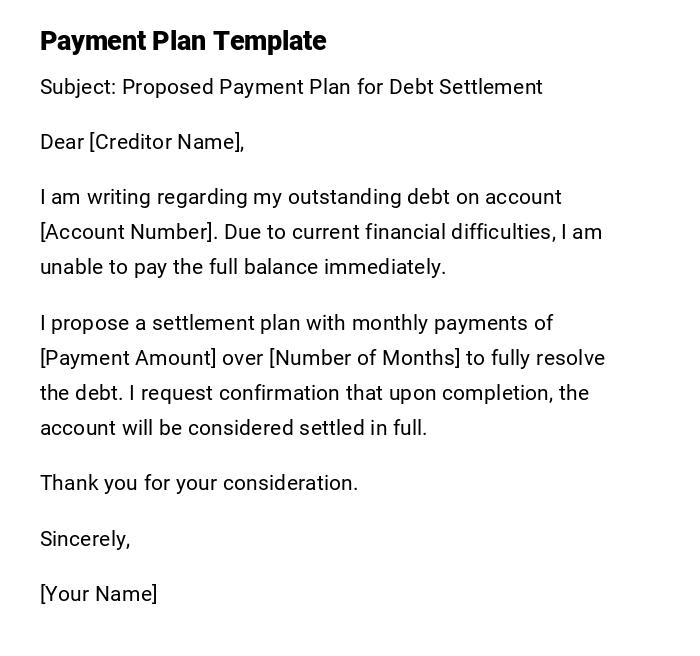

Debt Settlement Letter with Payment Plan Proposal

Subject: Proposed Payment Plan for Debt Settlement

Dear [Creditor Name],

I am writing regarding my outstanding debt on account [Account Number]. Due to current financial difficulties, I am unable to pay the full balance immediately.

I propose a settlement plan with monthly payments of [Payment Amount] over [Number of Months] to fully resolve the debt. I request confirmation that upon completion, the account will be considered settled in full.

Thank you for your consideration.

Sincerely,

[Your Name]

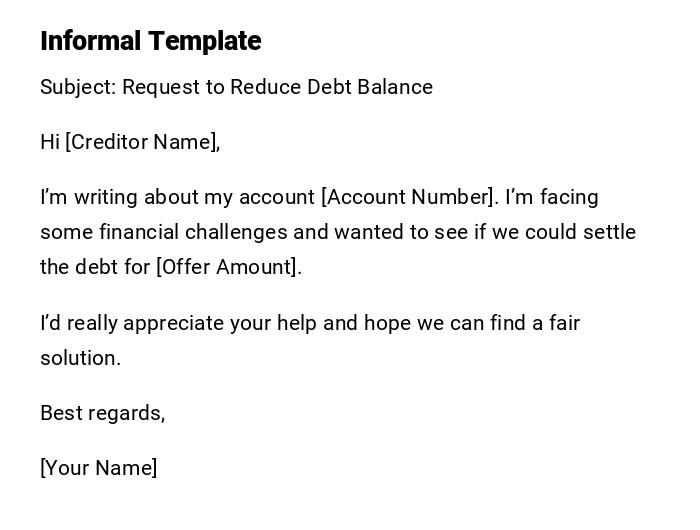

Informal / Friendly Debt Reduction Letter

Subject: Request to Reduce Debt Balance

Hi [Creditor Name],

I’m writing about my account [Account Number]. I’m facing some financial challenges and wanted to see if we could settle the debt for [Offer Amount].

I’d really appreciate your help and hope we can find a fair solution.

Best regards,

[Your Name]

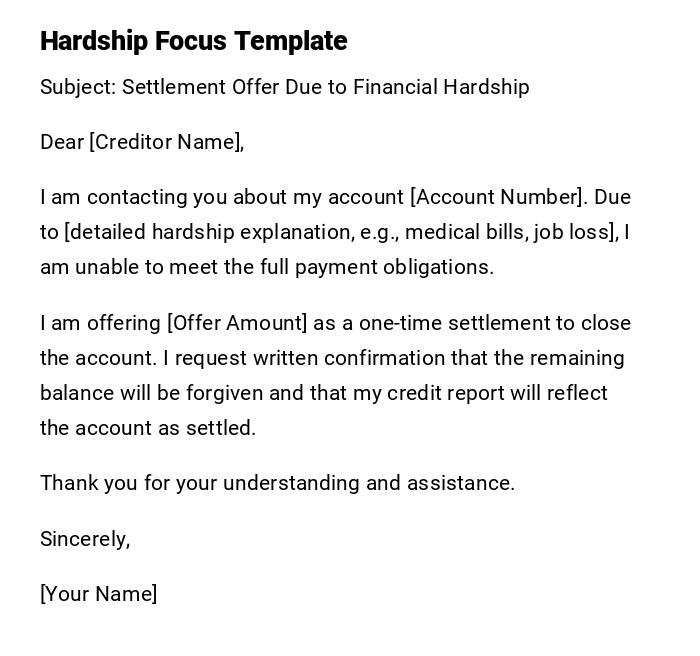

Debt Settlement Letter Highlighting Hardship

Subject: Settlement Offer Due to Financial Hardship

Dear [Creditor Name],

I am contacting you about my account [Account Number]. Due to [detailed hardship explanation, e.g., medical bills, job loss], I am unable to meet the full payment obligations.

I am offering [Offer Amount] as a one-time settlement to close the account. I request written confirmation that the remaining balance will be forgiven and that my credit report will reflect the account as settled.

Thank you for your understanding and assistance.

Sincerely,

[Your Name]

What / Why: Purpose of a Debt Settlement Offer Letter

A Debt Settlement Offer Letter is a written proposal from a debtor to a creditor suggesting a reduced payment to resolve an outstanding debt.

Its purpose is to negotiate a manageable settlement, often due to financial hardship, and provide formal documentation of the offer.

This letter helps avoid prolonged collection procedures and can lead to a mutually agreeable resolution.

Who Should Send a Debt Settlement Offer Letter

- Individuals with outstanding debts they are unable to pay in full.

- Consumers facing financial hardship, such as job loss, medical expenses, or unexpected costs.

- Debtors wishing to proactively communicate and negotiate with creditors.

- Representatives or legal advisors acting on behalf of the debtor.

Whom the Letter Should Be Addressed To

- Creditors or debt collection agencies managing the account.

- Banks or financial institutions to which payments are owed.

- Loan servicing companies handling the debt.

- Any authorized contact for debt resolution within the organization.

When to Send a Debt Settlement Offer Letter

- When unable to pay the full outstanding debt.

- Upon receiving collection notices or warnings.

- During negotiations to avoid legal action or credit reporting issues.

- When seeking formal documentation of a proposed settlement.

How to Write and Send a Debt Settlement Offer Letter

- State the account information and current outstanding balance.

- Explain the financial hardship or reason for offering a reduced payment.

- Propose a specific settlement amount or payment plan.

- Request written confirmation of the settlement and account status.

- Maintain a professional, respectful, and clear tone.

- Send via certified mail or email to ensure documentation and receipt.

Requirements and Prerequisites Before Sending the Letter

- Accurate account and balance information.

- Documentation of financial hardship if required.

- Understanding of what settlement amount is feasible.

- Contact details for the creditor or debt collection agency.

- Written record of all correspondence for future reference.

Formatting a Debt Settlement Offer Letter

- Length: 150–300 words for clarity.

- Tone: formal, respectful, and professional; can be slightly informal for friendly creditors.

- Structure: subject line, greeting, introduction, hardship explanation, settlement proposal, closing.

- Wording: concise, factual, and polite.

- Mode: certified mail, email, or fax depending on creditor preference.

- Etiquette: avoid aggressive language; express willingness to resolve debt.

After Sending / Follow-up Actions

- Confirm receipt through certified mail return or email acknowledgment.

- Follow up after 1–2 weeks if no response is received.

- Keep copies of the letter and any responses for records.

- Only proceed with payment after receiving written confirmation of settlement terms.

Tricks and Tips for Successful Debt Settlement Letters

- Offer a lump sum if possible; creditors may prefer immediate payment.

- Be honest about financial hardship; provide documentation if requested.

- Keep the tone respectful and non-confrontational.

- Specify that the remaining balance should be forgiven upon acceptance.

- Follow up politely but persistently if no initial response is received.

Common Mistakes to Avoid

- Offering vague or unclear amounts without specifying terms.

- Using threatening or aggressive language.

- Ignoring proper documentation or formal communication channels.

- Paying before receiving written agreement.

- Failing to maintain a record of correspondence.

Elements and Structure of a Debt Settlement Offer Letter

- Subject line clearly stating the purpose (e.g., "Debt Settlement Offer").

- Salutation addressing the creditor or agency.

- Introduction stating account number and outstanding balance.

- Explanation of financial hardship or reason for reduced payment.

- Specific settlement offer (lump sum or payment plan).

- Request for written confirmation and terms of agreement.

- Closing with appreciation and contact information.

- Optional attachments: financial statements, hardship documents, or prior correspondence.

Compare and Contrast Debt Settlement Letters with Other Debt Communications

- Unlike simple payment reminders, settlement letters propose negotiation and resolution.

- Compared to legal notices, these letters are proactive and cooperative.

- Unlike informal calls, written letters provide a formal record.

- Serve as a foundation for mutual agreement, unlike unilateral payment attempts.

Download Word Doc

Download Word Doc

Download PDF

Download PDF