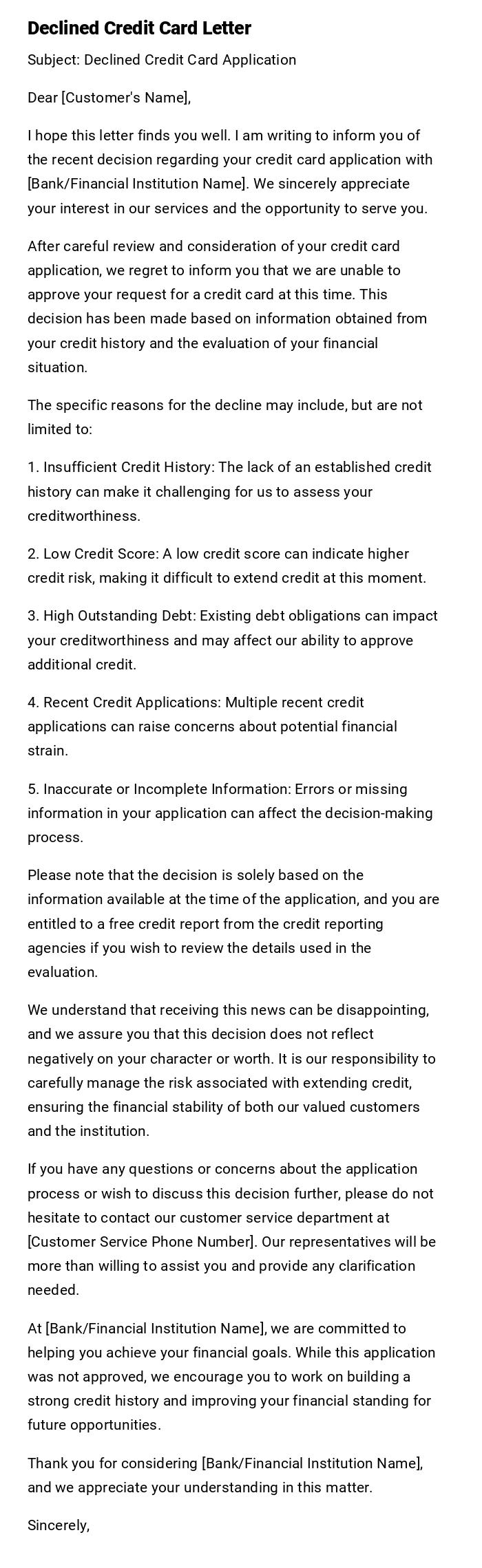

Declined Credit Card Letter

Subject: Declined Credit Card Application

Dear [Customer's Name],

I hope this letter finds you well. I am writing to inform you of the recent decision regarding your credit card application with [Bank/Financial Institution Name]. We sincerely appreciate your interest in our services and the opportunity to serve you.

After careful review and consideration of your credit card application, we regret to inform you that we are unable to approve your request for a credit card at this time. This decision has been made based on information obtained from your credit history and the evaluation of your financial situation.

The specific reasons for the decline may include, but are not limited to:

1. Insufficient Credit History: The lack of an established credit history can make it challenging for us to assess your creditworthiness.

2. Low Credit Score: A low credit score can indicate higher credit risk, making it difficult to extend credit at this moment.

3. High Outstanding Debt: Existing debt obligations can impact your creditworthiness and may affect our ability to approve additional credit.

4. Recent Credit Applications: Multiple recent credit applications can raise concerns about potential financial strain.

5. Inaccurate or Incomplete Information: Errors or missing information in your application can affect the decision-making process.

Please note that the decision is solely based on the information available at the time of the application, and you are entitled to a free credit report from the credit reporting agencies if you wish to review the details used in the evaluation.

We understand that receiving this news can be disappointing, and we assure you that this decision does not reflect negatively on your character or worth. It is our responsibility to carefully manage the risk associated with extending credit, ensuring the financial stability of both our valued customers and the institution.

If you have any questions or concerns about the application process or wish to discuss this decision further, please do not hesitate to contact our customer service department at [Customer Service Phone Number]. Our representatives will be more than willing to assist you and provide any clarification needed.

At [Bank/Financial Institution Name], we are committed to helping you achieve your financial goals. While this application was not approved, we encourage you to work on building a strong credit history and improving your financial standing for future opportunities.

Thank you for considering [Bank/Financial Institution Name], and we appreciate your understanding in this matter.

Sincerely,

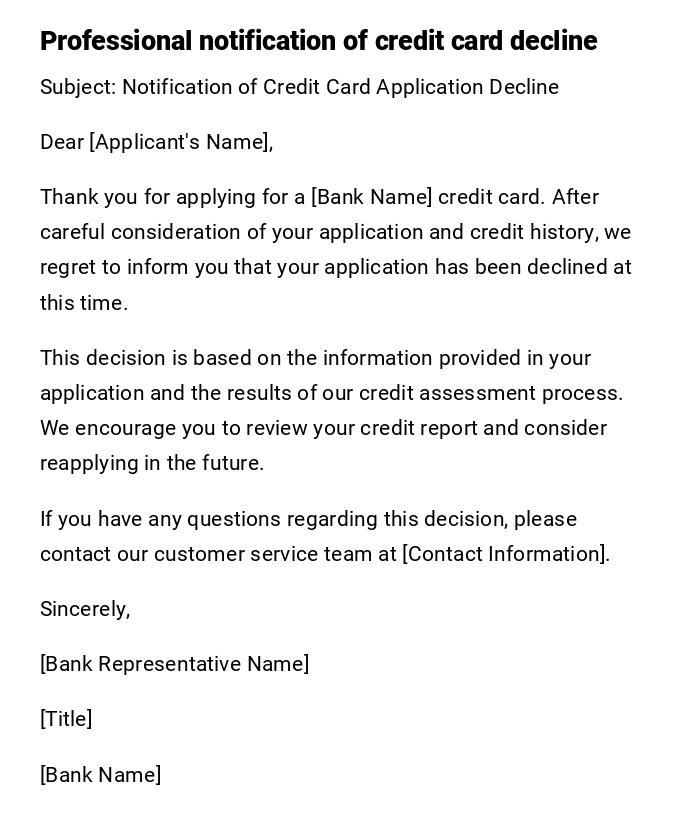

Formal Declined Credit Card Letter

Subject: Notification of Credit Card Application Decline

Dear [Applicant's Name],

Thank you for applying for a [Bank Name] credit card. After careful consideration of your application and credit history, we regret to inform you that your application has been declined at this time.

This decision is based on the information provided in your application and the results of our credit assessment process. We encourage you to review your credit report and consider reapplying in the future.

If you have any questions regarding this decision, please contact our customer service team at [Contact Information].

Sincerely,

[Bank Representative Name]

[Title]

[Bank Name]

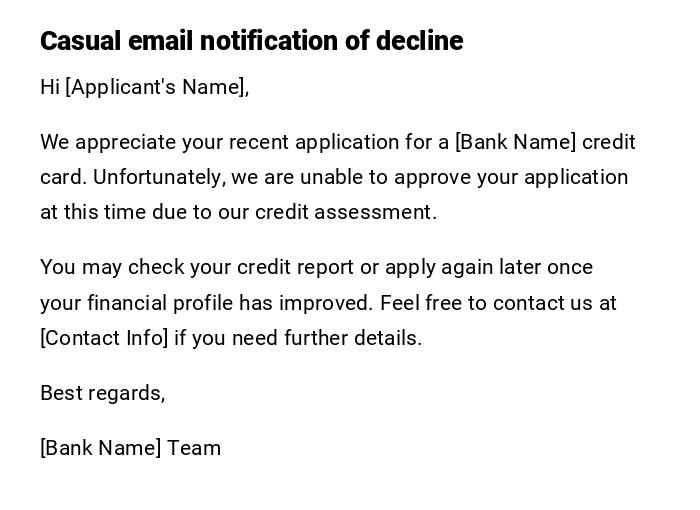

Informal Declined Credit Card Email

Hi [Applicant's Name],

We appreciate your recent application for a [Bank Name] credit card. Unfortunately, we are unable to approve your application at this time due to our credit assessment.

You may check your credit report or apply again later once your financial profile has improved. Feel free to contact us at [Contact Info] if you need further details.

Best regards,

[Bank Name] Team

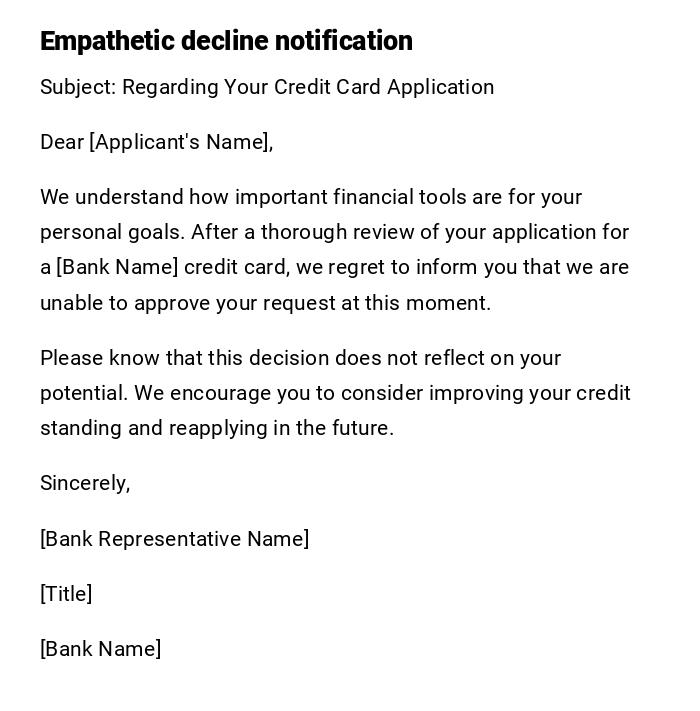

Heartfelt Declined Credit Card Letter

Subject: Regarding Your Credit Card Application

Dear [Applicant's Name],

We understand how important financial tools are for your personal goals. After a thorough review of your application for a [Bank Name] credit card, we regret to inform you that we are unable to approve your request at this moment.

Please know that this decision does not reflect on your potential. We encourage you to consider improving your credit standing and reapplying in the future.

Sincerely,

[Bank Representative Name]

[Title]

[Bank Name]

Provisional Declined Credit Card Letter

Subject: Provisional Response to Your Credit Card Application

Dear [Applicant's Name],

Thank you for your interest in our [Bank Name] credit card. At this stage, your application has been provisionally declined pending additional verification or updated information.

You are welcome to provide any supplementary documentation or financial details that may influence reconsideration. Contact our team at [Contact Information] for guidance.

Sincerely,

[Bank Representative Name]

[Title]

[Bank Name]

Quick and Simple Declined Credit Card Notification

Subject: Credit Card Application Status

Dear [Applicant's Name],

We regret to inform you that your application for a [Bank Name] credit card has been declined. Please contact us for any further clarification.

Best regards,

[Bank Name] Customer Service

What a Declined Credit Card Letter Is and Why It Matters

A Declined Credit Card Letter is a formal or informal communication sent to notify an applicant that their credit card application has not been approved.

Purpose:

- Provides transparency and official notification.

- Explains, to some extent, the reason for decline.

- Guides the applicant on possible next steps.

Who Should Send a Declined Credit Card Letter

- Issuing bank or financial institution.

- Credit card department or customer service representatives.

- Authorized bank officials responsible for account applications.

Whom a Declined Credit Card Letter Should Be Addressed To

- Individual applicants who applied for the credit card.

- Co-applicants or secondary applicants if applicable.

- Authorized representatives of the applicant in case of business accounts.

When a Declined Credit Card Letter Is Sent

- After the completion of credit assessment and verification.

- When the applicant does not meet eligibility criteria.

- Following review of credit history, income, or other risk factors.

How to Write and Send a Declined Credit Card Letter

- Start with a clear subject line (e.g., Credit Card Application Status).

- Address the applicant respectfully by name.

- Mention the card applied for and the decision.

- Provide a brief, professional explanation (without overly detailed reasons that breach privacy).

- Suggest potential next steps if applicable.

- Include contact information for queries.

- Send via postal mail or secure email, depending on company policy.

Formatting Guidelines for Declined Credit Card Letters

- Tone: Professional, neutral, or empathetic.

- Length: One page or less; concise and clear.

- Structure: Subject line, salutation, decision statement, optional explanation, contact info, closing.

- Mode: Official letter or email depending on application channel.

- Etiquette: Avoid negative or judgmental language; maintain clarity.

Requirements and Prerequisites Before Sending

- Completed credit card application review and decision.

- Verification of applicant's information.

- Confirmation of the reason for decline aligned with regulations and policies.

- Internal approval for sending the communication.

Elements and Structure of a Declined Credit Card Letter

- Subject line stating purpose of letter.

- Salutation addressing applicant.

- Clear statement of application decline.

- Reason or explanation, brief and compliant with regulations.

- Guidance for next steps or contact for queries.

- Closing and authorized signature.

- Optional attachments like informational brochures or links.

Common Mistakes to Avoid in Declined Credit Card Letters

- Using harsh or judgmental language.

- Providing overly detailed reasons that violate privacy regulations.

- Forgetting contact information for follow-up.

- Sending the letter without proper internal authorization.

Tips and Best Practices for Declined Credit Card Letters

- Keep tone neutral or empathetic.

- Provide actionable advice (e.g., check credit report, reapply later).

- Ensure letter complies with legal and banking regulations.

- Personalize with applicant's name for a professional touch.

- Use clear formatting for readability.

After Sending a Declined Credit Card Letter

- Monitor applicant responses and queries.

- Be prepared to provide clarification if legally allowed.

- Maintain records of sent communications for regulatory compliance.

- Avoid unsolicited repeated communications; respect applicant privacy.

FAQ About Declined Credit Card Letters

Q: Can I appeal the decision?

A: Many banks allow applicants to reapply or provide additional information for reconsideration.

Q: Will the letter explain the full reason for decline?

A: Typically, only brief, compliant explanations are provided due to privacy regulations.

Q: Is a declined letter legally required?

A: In many jurisdictions, financial institutions must notify applicants of adverse credit decisions.

Download Word Doc

Download Word Doc

Download PDF

Download PDF