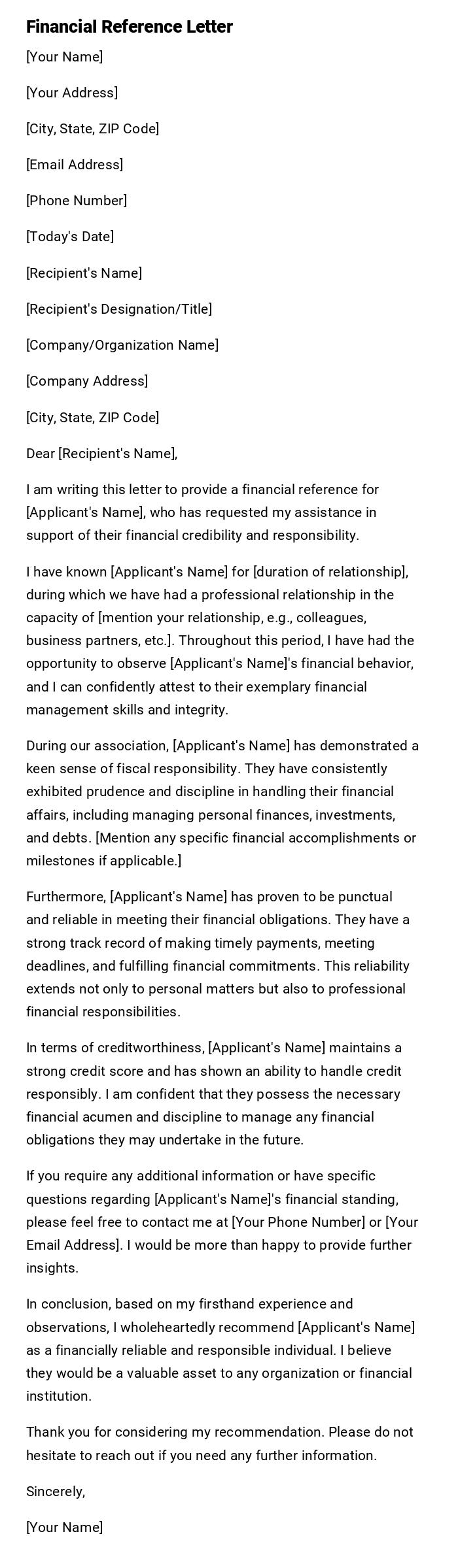

Financial Reference Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Today's Date]

[Recipient's Name]

[Recipient's Designation/Title]

[Company/Organization Name]

[Company Address]

[City, State, ZIP Code]

Dear [Recipient's Name],

I am writing this letter to provide a financial reference for [Applicant's Name], who has requested my assistance in support of their financial credibility and responsibility.

I have known [Applicant's Name] for [duration of relationship], during which we have had a professional relationship in the capacity of [mention your relationship, e.g., colleagues, business partners, etc.]. Throughout this period, I have had the opportunity to observe [Applicant's Name]'s financial behavior, and I can confidently attest to their exemplary financial management skills and integrity.

During our association, [Applicant's Name] has demonstrated a keen sense of fiscal responsibility. They have consistently exhibited prudence and discipline in handling their financial affairs, including managing personal finances, investments, and debts. [Mention any specific financial accomplishments or milestones if applicable.]

Furthermore, [Applicant's Name] has proven to be punctual and reliable in meeting their financial obligations. They have a strong track record of making timely payments, meeting deadlines, and fulfilling financial commitments. This reliability extends not only to personal matters but also to professional financial responsibilities.

In terms of creditworthiness, [Applicant's Name] maintains a strong credit score and has shown an ability to handle credit responsibly. I am confident that they possess the necessary financial acumen and discipline to manage any financial obligations they may undertake in the future.

If you require any additional information or have specific questions regarding [Applicant's Name]'s financial standing, please feel free to contact me at [Your Phone Number] or [Your Email Address]. I would be more than happy to provide further insights.

In conclusion, based on my firsthand experience and observations, I wholeheartedly recommend [Applicant's Name] as a financially reliable and responsible individual. I believe they would be a valuable asset to any organization or financial institution.

Thank you for considering my recommendation. Please do not hesitate to reach out if you need any further information.

Sincerely,

[Your Name]

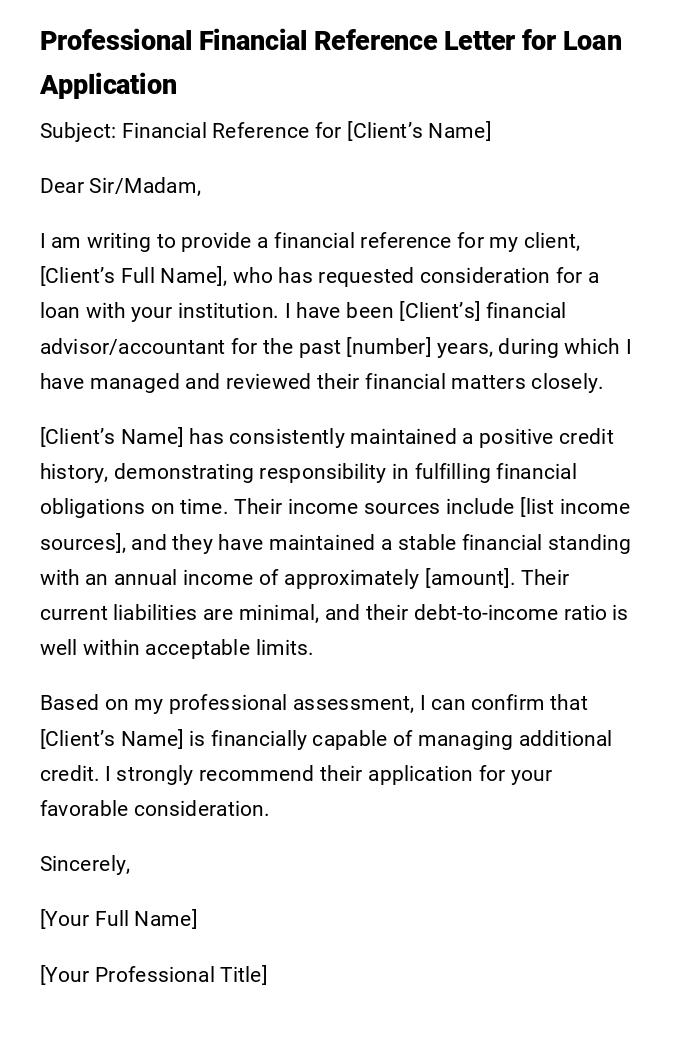

Professional Financial Reference Letter for Loan Application

Subject: Financial Reference for [Client’s Name]

Dear Sir/Madam,

I am writing to provide a financial reference for my client, [Client’s Full Name], who has requested consideration for a loan with your institution. I have been [Client’s] financial advisor/accountant for the past [number] years, during which I have managed and reviewed their financial matters closely.

[Client’s Name] has consistently maintained a positive credit history, demonstrating responsibility in fulfilling financial obligations on time. Their income sources include [list income sources], and they have maintained a stable financial standing with an annual income of approximately [amount]. Their current liabilities are minimal, and their debt-to-income ratio is well within acceptable limits.

Based on my professional assessment, I can confirm that [Client’s Name] is financially capable of managing additional credit. I strongly recommend their application for your favorable consideration.

Sincerely,

[Your Full Name]

[Your Professional Title]

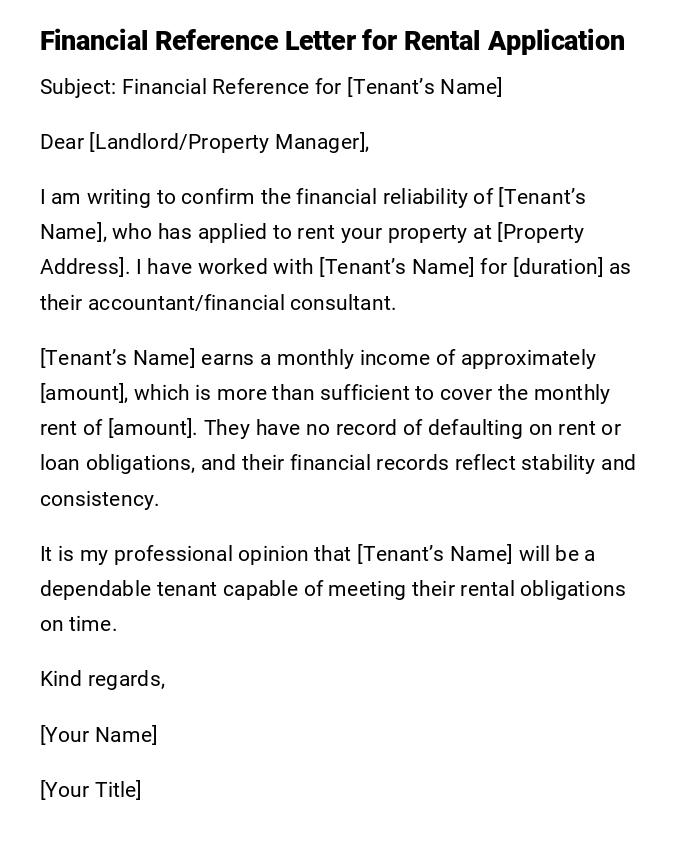

Financial Reference Letter for Rental Application

Subject: Financial Reference for [Tenant’s Name]

Dear [Landlord/Property Manager],

I am writing to confirm the financial reliability of [Tenant’s Name], who has applied to rent your property at [Property Address]. I have worked with [Tenant’s Name] for [duration] as their accountant/financial consultant.

[Tenant’s Name] earns a monthly income of approximately [amount], which is more than sufficient to cover the monthly rent of [amount]. They have no record of defaulting on rent or loan obligations, and their financial records reflect stability and consistency.

It is my professional opinion that [Tenant’s Name] will be a dependable tenant capable of meeting their rental obligations on time.

Kind regards,

[Your Name]

[Your Title]

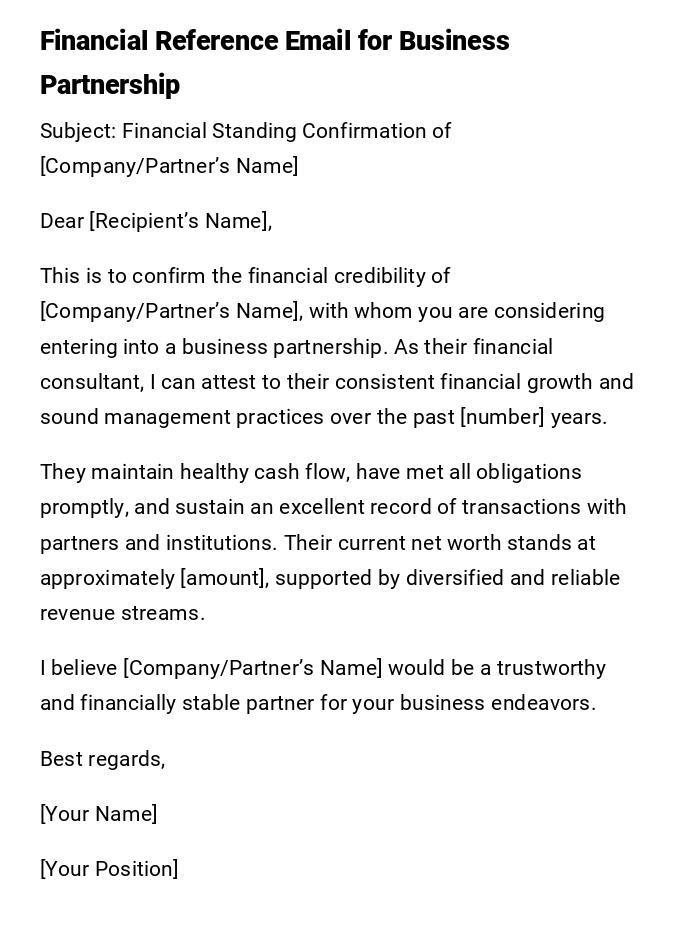

Financial Reference Email for Business Partnership

Subject: Financial Standing Confirmation of [Company/Partner’s Name]

Dear [Recipient’s Name],

This is to confirm the financial credibility of [Company/Partner’s Name], with whom you are considering entering into a business partnership. As their financial consultant, I can attest to their consistent financial growth and sound management practices over the past [number] years.

They maintain healthy cash flow, have met all obligations promptly, and sustain an excellent record of transactions with partners and institutions. Their current net worth stands at approximately [amount], supported by diversified and reliable revenue streams.

I believe [Company/Partner’s Name] would be a trustworthy and financially stable partner for your business endeavors.

Best regards,

[Your Name]

[Your Position]

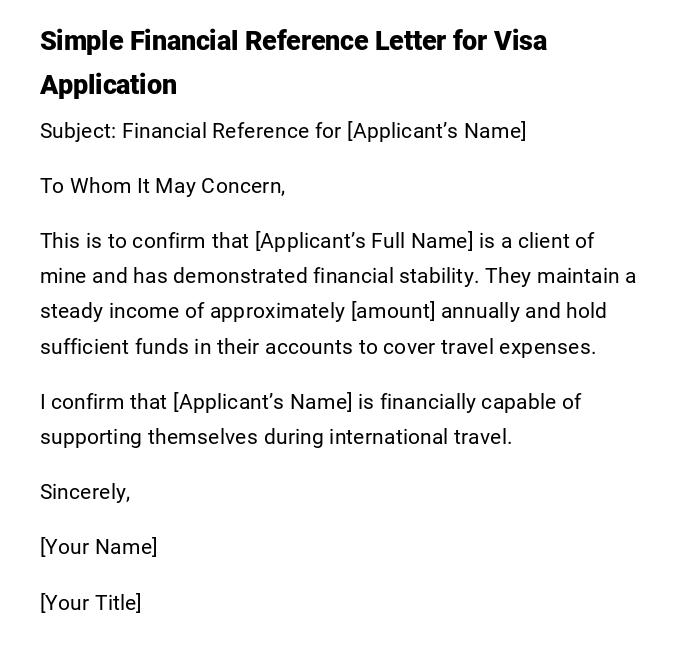

Simple Financial Reference Letter for Visa Application

Subject: Financial Reference for [Applicant’s Name]

To Whom It May Concern,

This is to confirm that [Applicant’s Full Name] is a client of mine and has demonstrated financial stability. They maintain a steady income of approximately [amount] annually and hold sufficient funds in their accounts to cover travel expenses.

I confirm that [Applicant’s Name] is financially capable of supporting themselves during international travel.

Sincerely,

[Your Name]

[Your Title]

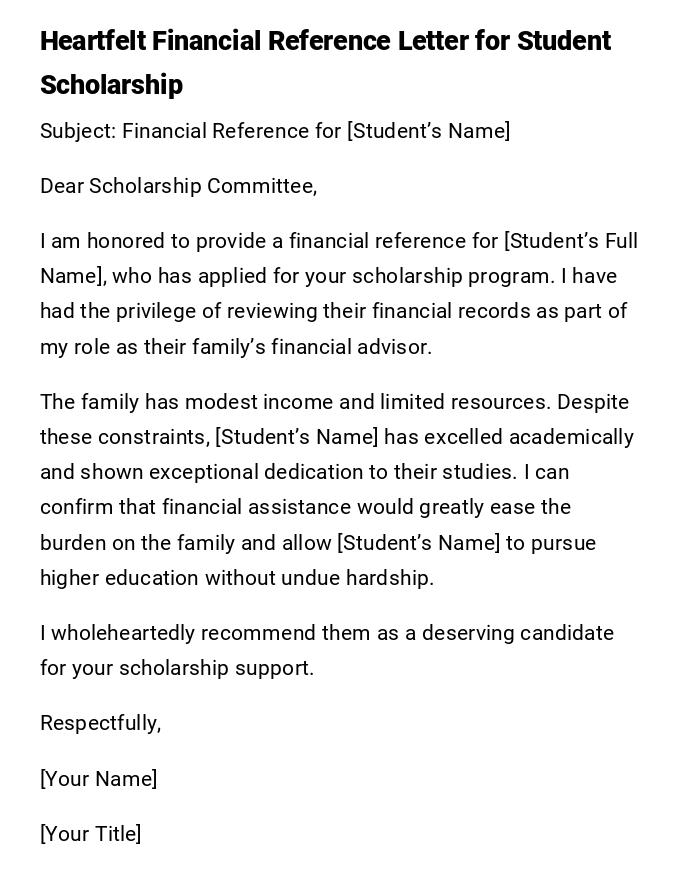

Heartfelt Financial Reference Letter for Student Scholarship

Subject: Financial Reference for [Student’s Name]

Dear Scholarship Committee,

I am honored to provide a financial reference for [Student’s Full Name], who has applied for your scholarship program. I have had the privilege of reviewing their financial records as part of my role as their family’s financial advisor.

The family has modest income and limited resources. Despite these constraints, [Student’s Name] has excelled academically and shown exceptional dedication to their studies. I can confirm that financial assistance would greatly ease the burden on the family and allow [Student’s Name] to pursue higher education without undue hardship.

I wholeheartedly recommend them as a deserving candidate for your scholarship support.

Respectfully,

[Your Name]

[Your Title]

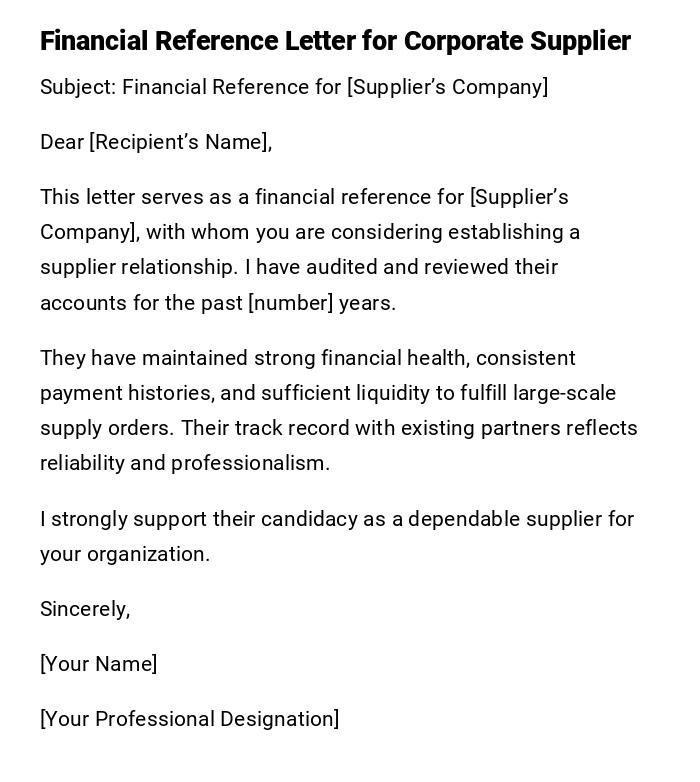

Financial Reference Letter for Corporate Supplier

Subject: Financial Reference for [Supplier’s Company]

Dear [Recipient’s Name],

This letter serves as a financial reference for [Supplier’s Company], with whom you are considering establishing a supplier relationship. I have audited and reviewed their accounts for the past [number] years.

They have maintained strong financial health, consistent payment histories, and sufficient liquidity to fulfill large-scale supply orders. Their track record with existing partners reflects reliability and professionalism.

I strongly support their candidacy as a dependable supplier for your organization.

Sincerely,

[Your Name]

[Your Professional Designation]

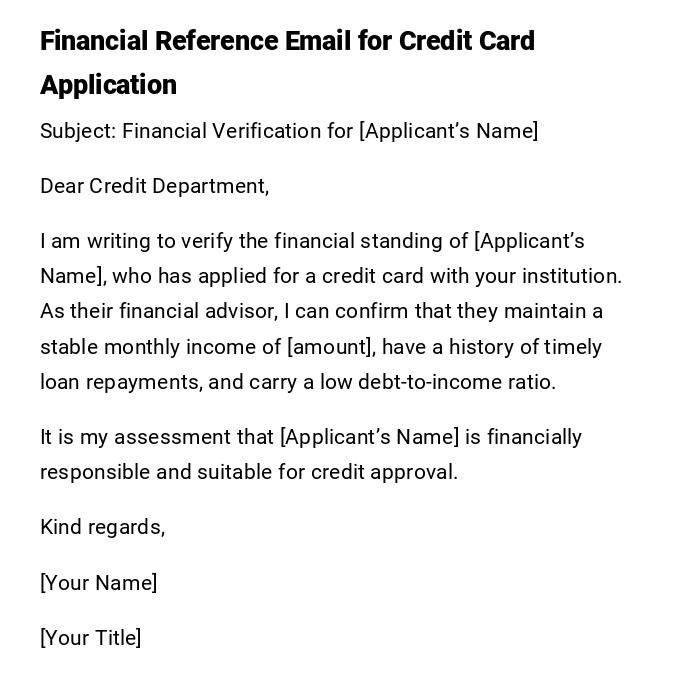

Financial Reference Email for Credit Card Application

Subject: Financial Verification for [Applicant’s Name]

Dear Credit Department,

I am writing to verify the financial standing of [Applicant’s Name], who has applied for a credit card with your institution. As their financial advisor, I can confirm that they maintain a stable monthly income of [amount], have a history of timely loan repayments, and carry a low debt-to-income ratio.

It is my assessment that [Applicant’s Name] is financially responsible and suitable for credit approval.

Kind regards,

[Your Name]

[Your Title]

Financial Reference Letter for Personal Character Support

Subject: Financial Character Reference for [Individual’s Name]

Dear [Recipient’s Name],

I am pleased to provide a financial character reference for [Individual’s Name]. I have known them for [duration] in my capacity as their financial consultant and have always observed them to be diligent and responsible with their finances.

They have consistently honored their obligations, avoided unnecessary debts, and demonstrated wise financial planning. Their record reflects not only financial stability but also integrity in handling commitments.

I recommend them with confidence for any financial engagements or considerations.

Sincerely,

[Your Name]

[Your Title]

What is a financial reference letter and why is it needed?

A financial reference letter is a document written by a financial professional, employer, or institution that confirms an individual’s or organization’s financial stability.

It is often required for purposes such as loan applications, rental agreements, visas, scholarships, or business partnerships.

The letter helps the recipient assess trustworthiness and financial reliability before entering into agreements.

Who should write a financial reference letter?

- Accountants, auditors, or financial advisors familiar with the client’s financial history.

- Employers or HR departments confirming income and financial reliability.

- Banks or financial institutions where the applicant maintains accounts.

- In some cases, landlords or business partners who have had direct financial dealings with the person or company.

To whom should a financial reference letter be addressed?

- Banks or lenders when applying for loans or credit cards.

- Landlords or property managers when applying for rentals.

- Visa officers or immigration authorities for travel or residency applications.

- Scholarship committees for educational financial support.

- Business partners or suppliers in cases of new contracts or ventures.

Common situations when a financial reference letter is required

- Applying for personal or business loans.

- Renting an apartment or commercial property.

- Submitting documentation for visa or travel permits.

- Applying for scholarships or educational financial aid.

- Engaging in new business partnerships or supplier agreements.

- Applying for new credit facilities such as credit cards.

How to write and send a financial reference letter

- Begin with a clear subject line and greeting.

- Identify the person or company being referred to and their financial situation.

- Provide specific but concise financial details (income, debt history, repayment record).

- Maintain a professional and formal tone unless otherwise required.

- Close with a confident recommendation.

- Send via the method requested (printed letter, email, or official message).

- Ensure confidentiality by not disclosing unnecessary sensitive information.

Requirements and prerequisites before writing

- Obtain consent from the person whose financial details you are disclosing.

- Verify all figures and statements with official records.

- Ensure the purpose of the letter is clear (loan, rental, scholarship, etc.).

- Confirm the recipient’s requirements for formatting and level of detail.

- Have updated and accurate financial documents available for reference.

Formatting guidelines for financial reference letters

- Length: usually one page, concise but detailed enough.

- Tone: professional, formal, and factual.

- Content: income details, debt history, repayment ability, and financial behavior.

- Style: clear paragraphs with no exaggeration or unnecessary detail.

- Mode: letter for formal purposes, email for business or casual contexts.

- Etiquette: respect confidentiality and only disclose relevant details.

What to do after sending the letter

- Confirm that the recipient has received the letter.

- Be available for follow-up verification calls or emails.

- Keep a copy of the letter for your records.

- If required, provide additional supporting documents such as account statements or tax returns.

- Monitor the outcome to ensure the letter served its purpose (loan approval, rental acceptance, etc.).

Advantages and disadvantages of sending a financial reference letter

Pros:

- Builds credibility for the applicant.

- Provides assurance to the recipient.

- Increases chances of approval for loans, rentals, or partnerships.

Cons:

- May disclose sensitive financial details.

- Requires accuracy and responsibility, otherwise it could backfire.

- Can sometimes be misinterpreted if not written clearly.

Mistakes to avoid when writing a financial reference letter

- Being vague and not including enough financial details.

- Exaggerating financial strength or providing misleading information.

- Sharing sensitive or irrelevant details that compromise privacy.

- Using casual or unprofessional language.

- Forgetting to proofread and correct grammar or spelling errors.

Key elements and structure of a financial reference letter

- Subject line or purpose statement.

- Greeting (formal address).

- Introduction explaining your relationship to the applicant.

- Clear details of the applicant’s financial status.

- Mention of repayment history or financial responsibility.

- Closing statement with recommendation.

- Professional sign-off with your name and title.

Tips and best practices for writing a strong financial reference letter

- Keep the letter professional and concise.

- Use specific numbers and timelines where possible.

- Match the tone to the recipient (bank, landlord, visa officer, etc.).

- Always obtain written consent from the applicant.

- Avoid personal opinions—stick to verifiable facts.

- Double-check financial figures before submission.

Download Word Doc

Download Word Doc

Download PDF

Download PDF