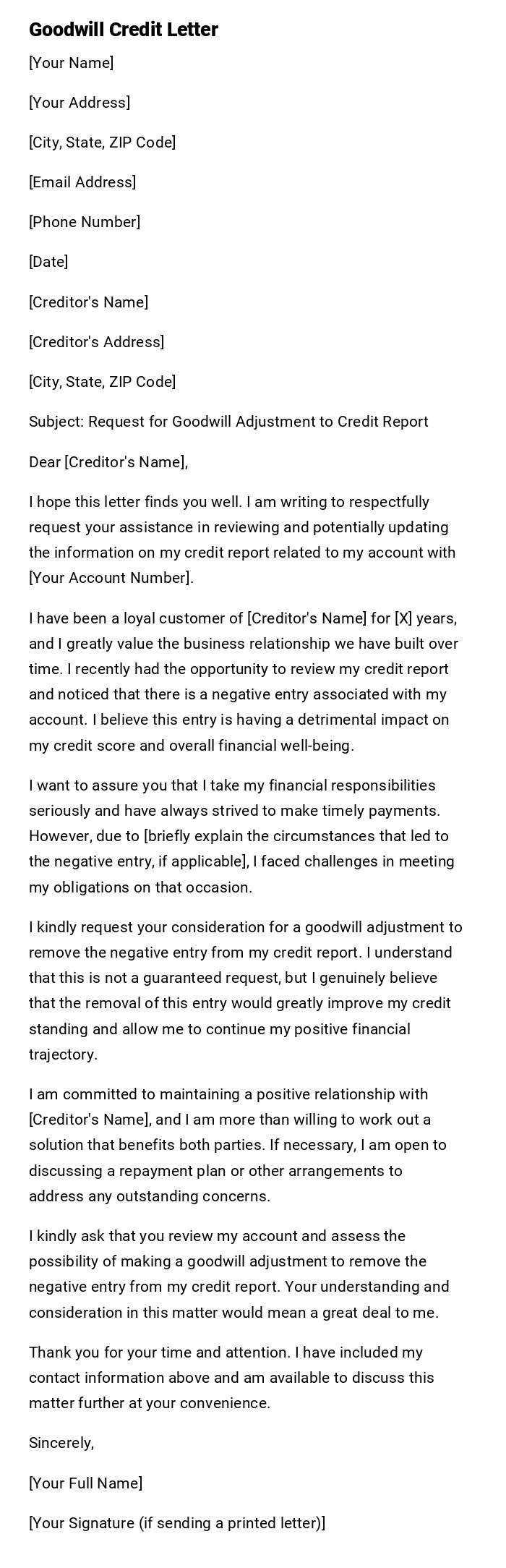

Goodwill Credit Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Creditor's Name]

[Creditor's Address]

[City, State, ZIP Code]

Subject: Request for Goodwill Adjustment to Credit Report

Dear [Creditor's Name],

I hope this letter finds you well. I am writing to respectfully request your assistance in reviewing and potentially updating the information on my credit report related to my account with [Your Account Number].

I have been a loyal customer of [Creditor's Name] for [X] years, and I greatly value the business relationship we have built over time. I recently had the opportunity to review my credit report and noticed that there is a negative entry associated with my account. I believe this entry is having a detrimental impact on my credit score and overall financial well-being.

I want to assure you that I take my financial responsibilities seriously and have always strived to make timely payments. However, due to [briefly explain the circumstances that led to the negative entry, if applicable], I faced challenges in meeting my obligations on that occasion.

I kindly request your consideration for a goodwill adjustment to remove the negative entry from my credit report. I understand that this is not a guaranteed request, but I genuinely believe that the removal of this entry would greatly improve my credit standing and allow me to continue my positive financial trajectory.

I am committed to maintaining a positive relationship with [Creditor's Name], and I am more than willing to work out a solution that benefits both parties. If necessary, I am open to discussing a repayment plan or other arrangements to address any outstanding concerns.

I kindly ask that you review my account and assess the possibility of making a goodwill adjustment to remove the negative entry from my credit report. Your understanding and consideration in this matter would mean a great deal to me.

Thank you for your time and attention. I have included my contact information above and am available to discuss this matter further at your convenience.

Sincerely,

[Your Full Name]

[Your Signature (if sending a printed letter)]

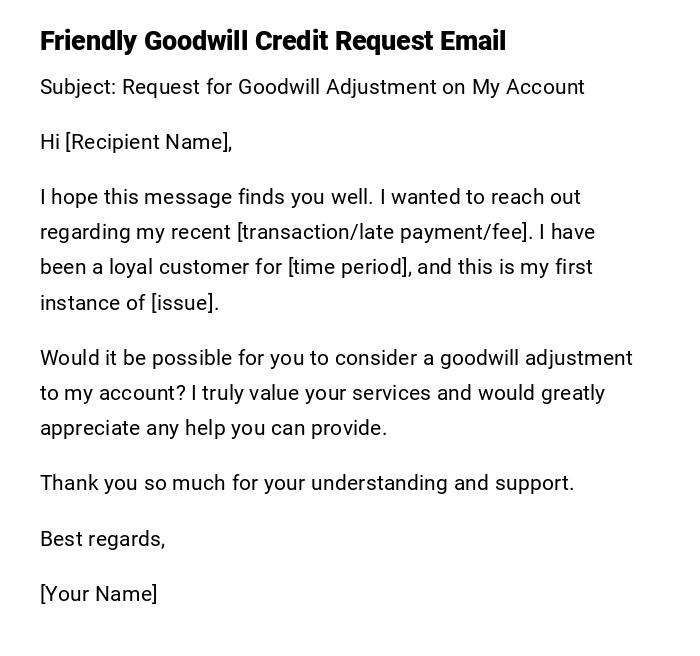

Friendly Goodwill Credit Request Email

Subject: Request for Goodwill Adjustment on My Account

Hi [Recipient Name],

I hope this message finds you well. I wanted to reach out regarding my recent [transaction/late payment/fee]. I have been a loyal customer for [time period], and this is my first instance of [issue].

Would it be possible for you to consider a goodwill adjustment to my account? I truly value your services and would greatly appreciate any help you can provide.

Thank you so much for your understanding and support.

Best regards,

[Your Name]

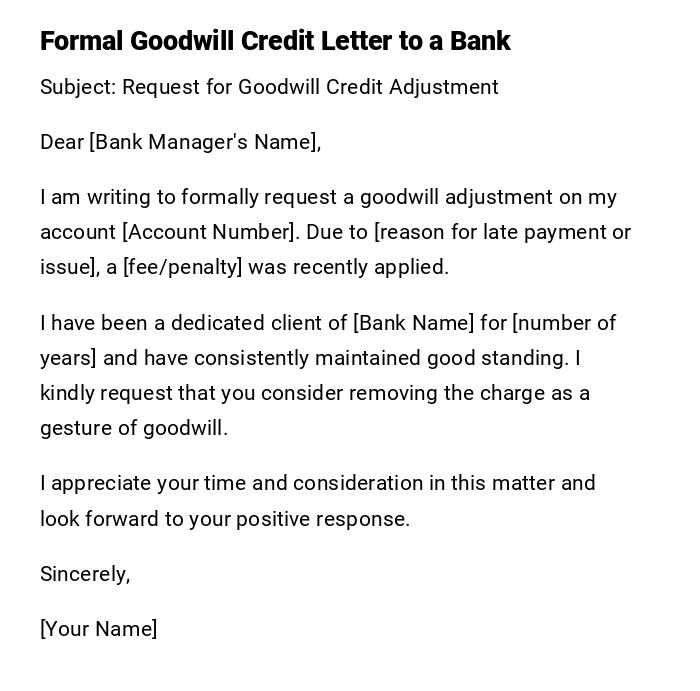

Formal Goodwill Credit Letter to a Bank

Subject: Request for Goodwill Credit Adjustment

Dear [Bank Manager's Name],

I am writing to formally request a goodwill adjustment on my account [Account Number]. Due to [reason for late payment or issue], a [fee/penalty] was recently applied.

I have been a dedicated client of [Bank Name] for [number of years] and have consistently maintained good standing. I kindly request that you consider removing the charge as a gesture of goodwill.

I appreciate your time and consideration in this matter and look forward to your positive response.

Sincerely,

[Your Name]

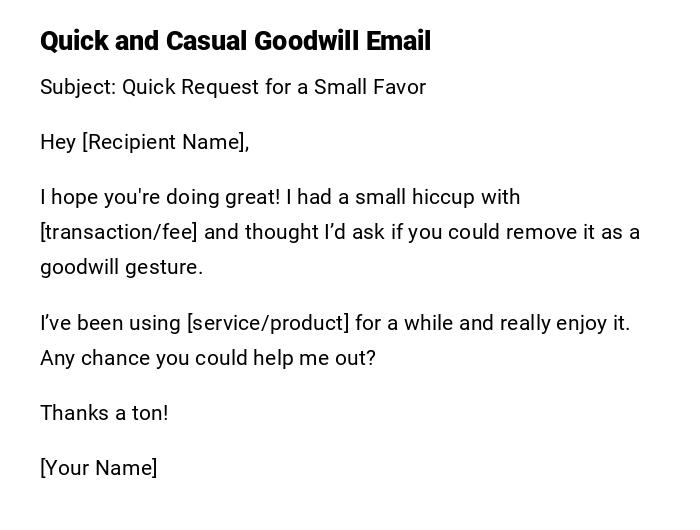

Quick and Casual Goodwill Email

Subject: Quick Request for a Small Favor

Hey [Recipient Name],

I hope you're doing great! I had a small hiccup with [transaction/fee] and thought I’d ask if you could remove it as a goodwill gesture.

I’ve been using [service/product] for a while and really enjoy it. Any chance you could help me out?

Thanks a ton!

[Your Name]

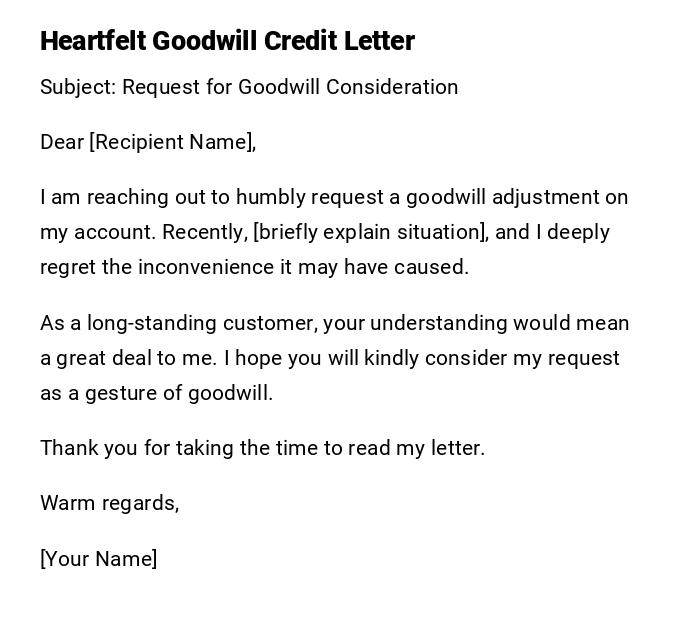

Heartfelt Goodwill Credit Letter

Subject: Request for Goodwill Consideration

Dear [Recipient Name],

I am reaching out to humbly request a goodwill adjustment on my account. Recently, [briefly explain situation], and I deeply regret the inconvenience it may have caused.

As a long-standing customer, your understanding would mean a great deal to me. I hope you will kindly consider my request as a gesture of goodwill.

Thank you for taking the time to read my letter.

Warm regards,

[Your Name]

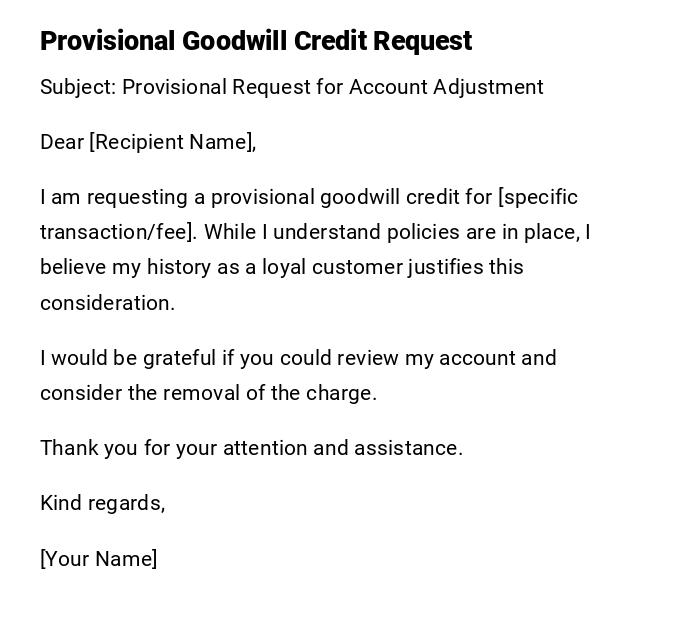

Provisional Goodwill Credit Request

Subject: Provisional Request for Account Adjustment

Dear [Recipient Name],

I am requesting a provisional goodwill credit for [specific transaction/fee]. While I understand policies are in place, I believe my history as a loyal customer justifies this consideration.

I would be grateful if you could review my account and consider the removal of the charge.

Thank you for your attention and assistance.

Kind regards,

[Your Name]

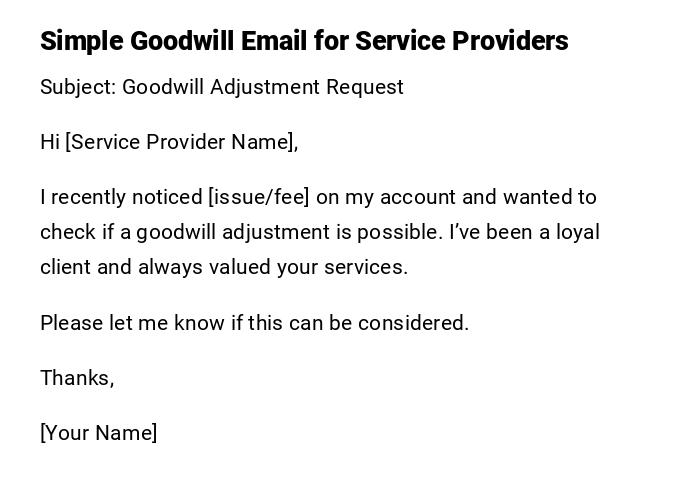

Simple Goodwill Email for Service Providers

Subject: Goodwill Adjustment Request

Hi [Service Provider Name],

I recently noticed [issue/fee] on my account and wanted to check if a goodwill adjustment is possible. I’ve been a loyal client and always valued your services.

Please let me know if this can be considered.

Thanks,

[Your Name]

What / Why is a Goodwill Credit Letter

A Goodwill Credit Letter is a formal or informal request made by a customer to a service provider, bank, or business asking for the removal or reduction of a fee, penalty, or charge as a gesture of goodwill.

Purpose:

- Rectify small mistakes or unusual situations.

- Maintain positive customer relations.

- Request leniency for first-time or rare issues.

- Reinforce long-term loyalty with the service provider.

Who Should Send a Goodwill Credit Letter

- Individuals who have been loyal customers or clients.

- Businesses requesting adjustments on behalf of clients.

- Anyone affected by a fee, penalty, or charge they believe is unfair or unusual.

- People seeking a resolution without escalating disputes.

Whom Should Receive This Letter

- Customer service representatives.

- Account managers at banks or financial institutions.

- Billing departments of service providers.

- Supervisors or managers authorized to approve account adjustments.

When Should You Send a Goodwill Credit Letter

- After an unintentional late payment.

- When a fee or charge appears incorrectly.

- Following a service disruption or error.

- When trying to prevent negative impacts on credit history.

- During first-time issues for loyal customers.

How to Write and Send a Goodwill Credit Letter

- Identify the specific charge or fee you want adjusted.

- Keep the tone polite and respectful; avoid anger or threats.

- Explain the situation clearly and concisely.

- Mention your history or loyalty with the company.

- Specify your request clearly, e.g., removal of fee or credit applied.

- Choose the mode: email for speed, letter for formality.

- Proofread before sending.

Formatting Guidelines for a Goodwill Credit Letter

- Length: 3–5 paragraphs.

- Tone: polite, professional, or friendly depending on context.

- Style: formal for banks; casual or simple for service providers.

- Mode: email preferred for fast response; printed letters for formal requests.

- Wording: clear, concise, no emotional exaggeration.

- Etiquette: thank the recipient, avoid demanding language.

Requirements and Prerequisites

- Know your account number or transaction details.

- Review your payment history.

- Gather evidence of loyalty or good conduct (e.g., long-term client, no prior issues).

- Be aware of company policies on fees and adjustments.

- Have a clear goal: what exactly you want removed or adjusted.

FAQ About Goodwill Credit Letters

-

Q: Can I request a goodwill credit multiple times?

A: Generally, it’s best as a rare, respectful request. Frequent requests may reduce credibility. -

Q: Will they always approve it?

A: No, approval is discretionary; companies may refuse based on policy. -

Q: Can I call instead of writing?

A: Yes, but a written request provides documentation. -

Q: How long does it take to respond?

A: Typically 1–2 weeks for formal letters; emails may respond faster.

After Sending / Follow-up

- Track your request and response time.

- Send a polite follow-up if no response within the expected period.

- Keep records of all communication.

- If approved, confirm the adjustment has been applied.

- If denied, consider alternative options (appeal, negotiate, or accept).

Tricks and Tips for a Successful Goodwill Credit Letter

- Mention your loyalty and history briefly but prominently.

- Be concise and focus on facts.

- Use a polite tone, even when frustrated.

- Avoid threatening or demanding language.

- Follow up with gratitude regardless of outcome.

- Include all relevant account or transaction details upfront.

Common Mistakes to Avoid

- Being rude or aggressive.

- Leaving out key account or transaction information.

- Over-explaining or rambling.

- Requesting too many favors at once.

- Failing to proofread or check accuracy.

Elements and Structure of a Goodwill Credit Letter

- Subject Line / Heading: Clearly states purpose.

- Greeting: Personalize if possible.

- Introduction: Brief context or situation.

- Body: Explain issue, history, and reason for goodwill request.

- Request: Clearly state what you want (fee removal, credit).

- Closing: Polite ending and thanks.

- Signature: Include name and contact details.

- Attachments: Optional proofs or supporting documents.

Pros and Cons of Sending a Goodwill Credit Letter

Pros:

- May remove unwanted fees or penalties.

- Strengthens customer-company relationship.

- Provides a documented request for future reference.

Cons:

- No guarantee of approval.

- Can appear overly dependent on favors if overused.

- May require follow-up and time investment.

Compare and Contrast with Other Requests

-

Goodwill Credit Letter vs. Complaint Letter:

- Goodwill letter focuses on leniency and understanding.

- Complaint letter focuses on rectifying a problem or poor service.

-

Goodwill Letter vs. Refund Request:

- Refund request demands compensation.

- Goodwill letter politely asks for discretionary leniency.

-

Goodwill Letter vs. Collection Dispute:

- Goodwill focuses on relationship and trust.

- Collection disputes are formal legal or billing challenges.

Download Word Doc

Download Word Doc

Download PDF

Download PDF