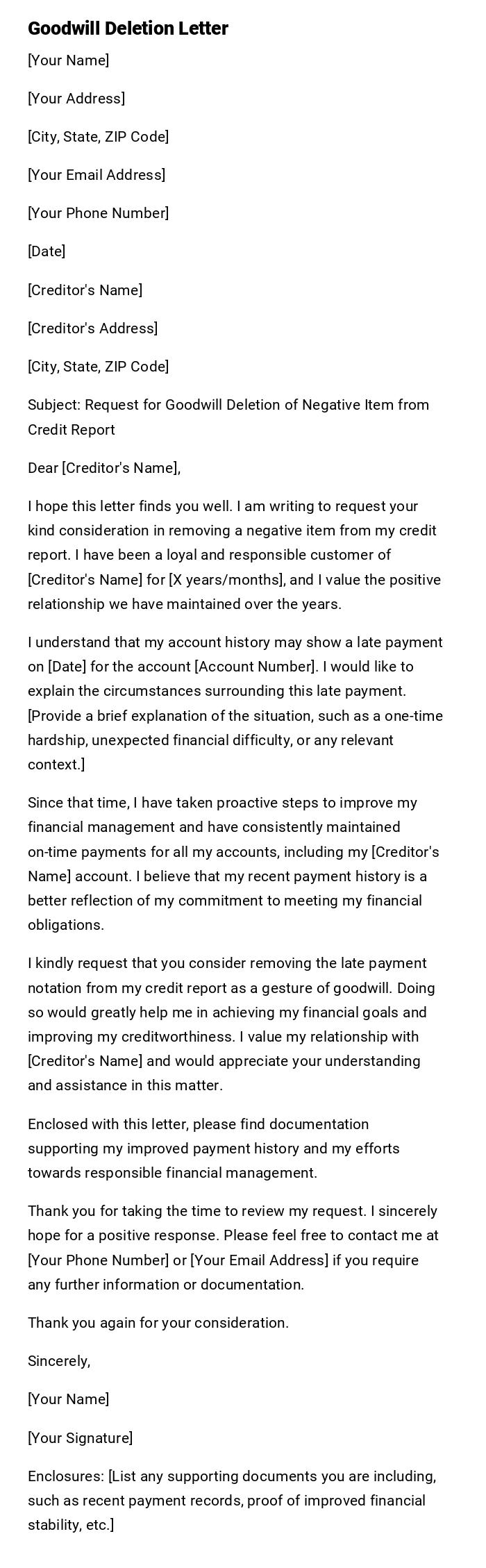

Goodwill Deletion Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Creditor's Name]

[Creditor's Address]

[City, State, ZIP Code]

Subject: Request for Goodwill Deletion of Negative Item from Credit Report

Dear [Creditor's Name],

I hope this letter finds you well. I am writing to request your kind consideration in removing a negative item from my credit report. I have been a loyal and responsible customer of [Creditor's Name] for [X years/months], and I value the positive relationship we have maintained over the years.

I understand that my account history may show a late payment on [Date] for the account [Account Number]. I would like to explain the circumstances surrounding this late payment. [Provide a brief explanation of the situation, such as a one-time hardship, unexpected financial difficulty, or any relevant context.]

Since that time, I have taken proactive steps to improve my financial management and have consistently maintained on-time payments for all my accounts, including my [Creditor's Name] account. I believe that my recent payment history is a better reflection of my commitment to meeting my financial obligations.

I kindly request that you consider removing the late payment notation from my credit report as a gesture of goodwill. Doing so would greatly help me in achieving my financial goals and improving my creditworthiness. I value my relationship with [Creditor's Name] and would appreciate your understanding and assistance in this matter.

Enclosed with this letter, please find documentation supporting my improved payment history and my efforts towards responsible financial management.

Thank you for taking the time to review my request. I sincerely hope for a positive response. Please feel free to contact me at [Your Phone Number] or [Your Email Address] if you require any further information or documentation.

Thank you again for your consideration.

Sincerely,

[Your Name]

[Your Signature]

Enclosures: [List any supporting documents you are including, such as recent payment records, proof of improved financial stability, etc.]

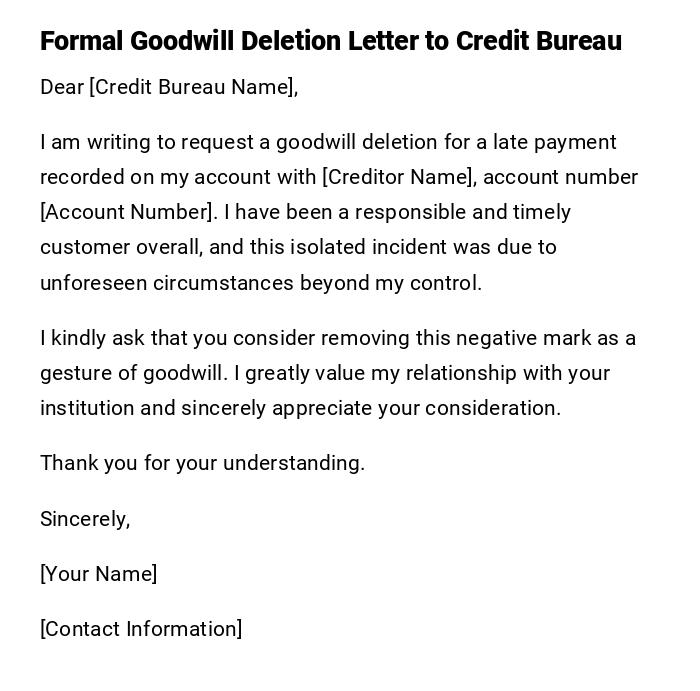

Formal Goodwill Deletion Letter to Credit Bureau

Dear [Credit Bureau Name],

I am writing to request a goodwill deletion for a late payment recorded on my account with [Creditor Name], account number [Account Number]. I have been a responsible and timely customer overall, and this isolated incident was due to unforeseen circumstances beyond my control.

I kindly ask that you consider removing this negative mark as a gesture of goodwill. I greatly value my relationship with your institution and sincerely appreciate your consideration.

Thank you for your understanding.

Sincerely,

[Your Name]

[Contact Information]

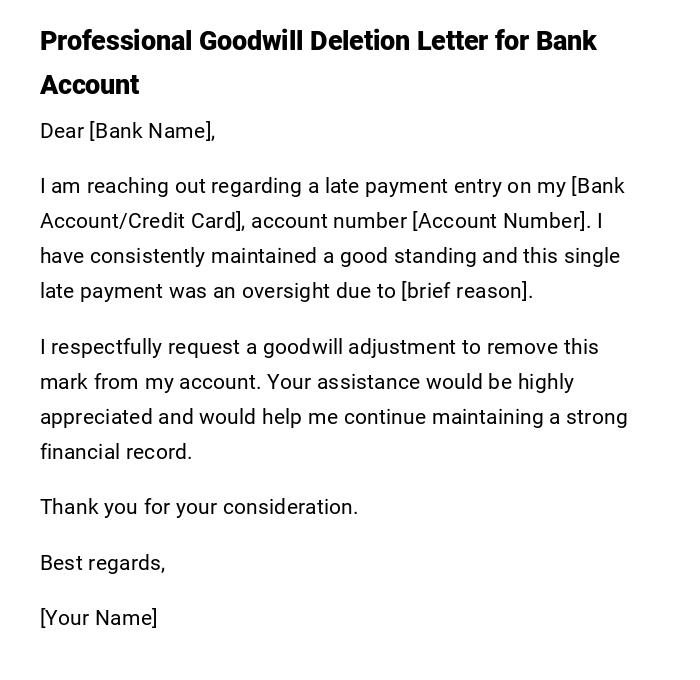

Professional Goodwill Deletion Letter for Bank Account

Dear [Bank Name],

I am reaching out regarding a late payment entry on my [Bank Account/Credit Card], account number [Account Number]. I have consistently maintained a good standing and this single late payment was an oversight due to [brief reason].

I respectfully request a goodwill adjustment to remove this mark from my account. Your assistance would be highly appreciated and would help me continue maintaining a strong financial record.

Thank you for your consideration.

Best regards,

[Your Name]

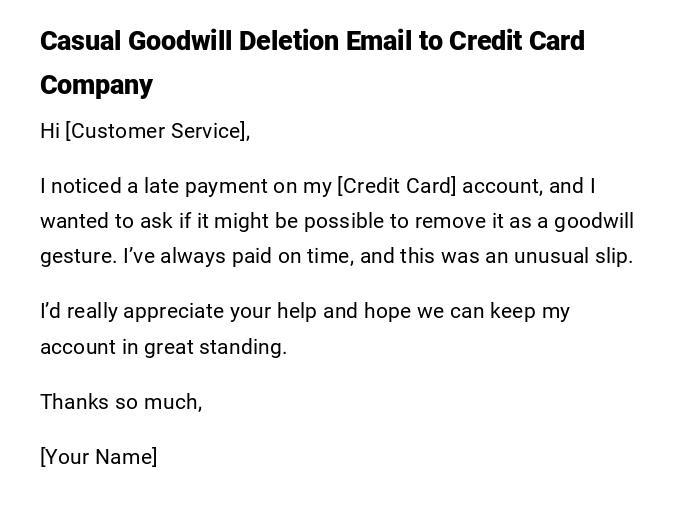

Casual Goodwill Deletion Email to Credit Card Company

Hi [Customer Service],

I noticed a late payment on my [Credit Card] account, and I wanted to ask if it might be possible to remove it as a goodwill gesture. I’ve always paid on time, and this was an unusual slip.

I’d really appreciate your help and hope we can keep my account in great standing.

Thanks so much,

[Your Name]

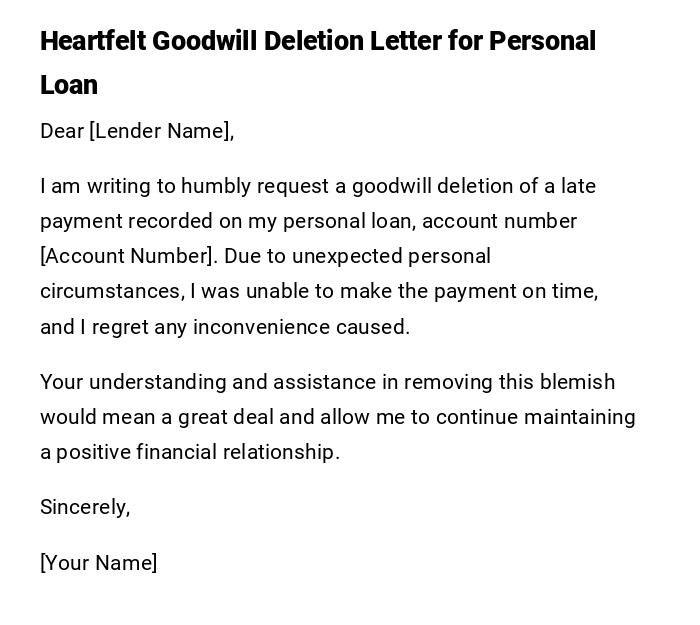

Heartfelt Goodwill Deletion Letter for Personal Loan

Dear [Lender Name],

I am writing to humbly request a goodwill deletion of a late payment recorded on my personal loan, account number [Account Number]. Due to unexpected personal circumstances, I was unable to make the payment on time, and I regret any inconvenience caused.

Your understanding and assistance in removing this blemish would mean a great deal and allow me to continue maintaining a positive financial relationship.

Sincerely,

[Your Name]

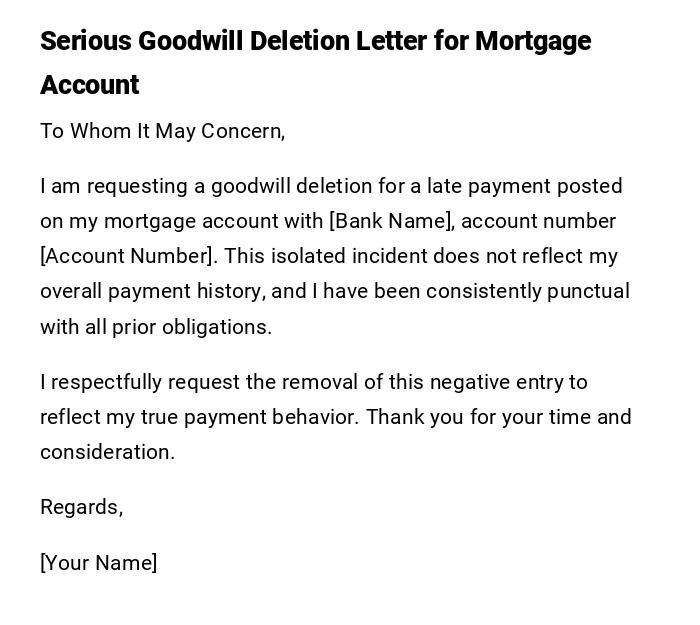

Serious Goodwill Deletion Letter for Mortgage Account

To Whom It May Concern,

I am requesting a goodwill deletion for a late payment posted on my mortgage account with [Bank Name], account number [Account Number]. This isolated incident does not reflect my overall payment history, and I have been consistently punctual with all prior obligations.

I respectfully request the removal of this negative entry to reflect my true payment behavior. Thank you for your time and consideration.

Regards,

[Your Name]

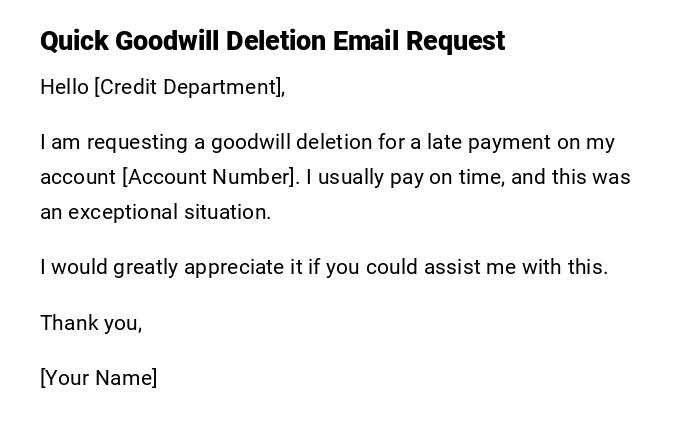

Quick Goodwill Deletion Email Request

Hello [Credit Department],

I am requesting a goodwill deletion for a late payment on my account [Account Number]. I usually pay on time, and this was an exceptional situation.

I would greatly appreciate it if you could assist me with this.

Thank you,

[Your Name]

What / Why of a Goodwill Deletion Letter

- A goodwill deletion letter is a request to remove a negative account entry, such as a late payment, from a credit report as a gesture of goodwill.

- Purpose: To maintain or improve credit score, reflect accurate payment behavior, and sustain a positive relationship with financial institutions.

- Often used after demonstrating generally responsible account management.

Who Should Send a Goodwill Deletion Letter

- Individuals with an otherwise good payment history seeking correction of isolated late payments.

- Account holders with credit card, mortgage, personal loan, or other financial accounts.

- Customers looking to maintain or improve their credit profile.

Whom Should a Goodwill Deletion Letter Be Addressed To

- Credit card companies or bank customer service departments.

- Mortgage lenders or personal loan providers.

- Credit bureaus or reporting agencies in some cases.

- Financial institutions responsible for maintaining your account history.

When to Send a Goodwill Deletion Letter

- After a late payment or negative mark has been recorded.

- When you have demonstrated consistent on-time payments in general.

- As soon as possible after the incident, to maximize the chance of favorable consideration.

Requirements and Prerequisites Before Sending

- Accurate account details: account numbers, dates, and specific negative entries.

- Documentation of good payment history if available.

- Reason for the late payment or incident (optional but recommended).

- Clear, polite, and professional tone.

How to Write and Send a Goodwill Deletion Letter

- Start with a polite greeting and specify the account and negative entry.

- Acknowledge the late payment briefly, expressing regret or explanation.

- Highlight your consistent positive payment history.

- Request a goodwill deletion politely, emphasizing continued relationship and reliability.

- Send via email for faster response or traditional mail for formal cases.

Formatting Guidelines for Goodwill Deletion Letters

- Length: 1–2 paragraphs for emails, 2–3 for formal letters.

- Tone: Polite, professional, and serious.

- Mode: Email or postal letter depending on the institution.

- Etiquette: Be concise, include all necessary account details, and remain respectful.

After Sending / Follow-up Actions

- Allow reasonable time for the credit institution to respond (usually 2–4 weeks).

- Follow up politely if no response is received.

- Keep copies of the letter and any correspondence for your records.

- Check credit report to confirm deletion if granted.

Tricks and Tips for a Successful Goodwill Deletion Request

- Emphasize your strong payment history and reliability.

- Keep the explanation brief; focus on goodwill and future intent.

- Be polite and professional to increase chances of a positive response.

- Include specific account details to avoid confusion or delays.

Common Mistakes to Avoid

- Using a rude or demanding tone.

- Providing excessive personal information or lengthy explanations.

- Omitting account details or dates.

- Waiting too long to request a goodwill deletion.

Elements and Structure of a Goodwill Deletion Letter

- Opening: Polite greeting and account identification.

- Body: Acknowledge late payment, provide context, highlight positive history.

- Request: Politely ask for goodwill deletion.

- Closing: Express gratitude and willingness to continue positive relationship.

- Optional Attachments: Payment history statements or supporting documentation.

FAQ About Goodwill Deletion Letters

-

Q: Can a goodwill deletion guarantee removal of negative entries?

A: No, it is at the discretion of the financial institution. -

Q: Should I mention the reason for the late payment?

A: A brief and polite explanation can improve the chances of approval. -

Q: How long does it take to get a response?

A: Typically 2–4 weeks, depending on the institution. -

Q: Is it better to send an email or a mailed letter?

A: Emails are faster; mailed letters may carry more formality and impact.

Download Word Doc

Download Word Doc

Download PDF

Download PDF