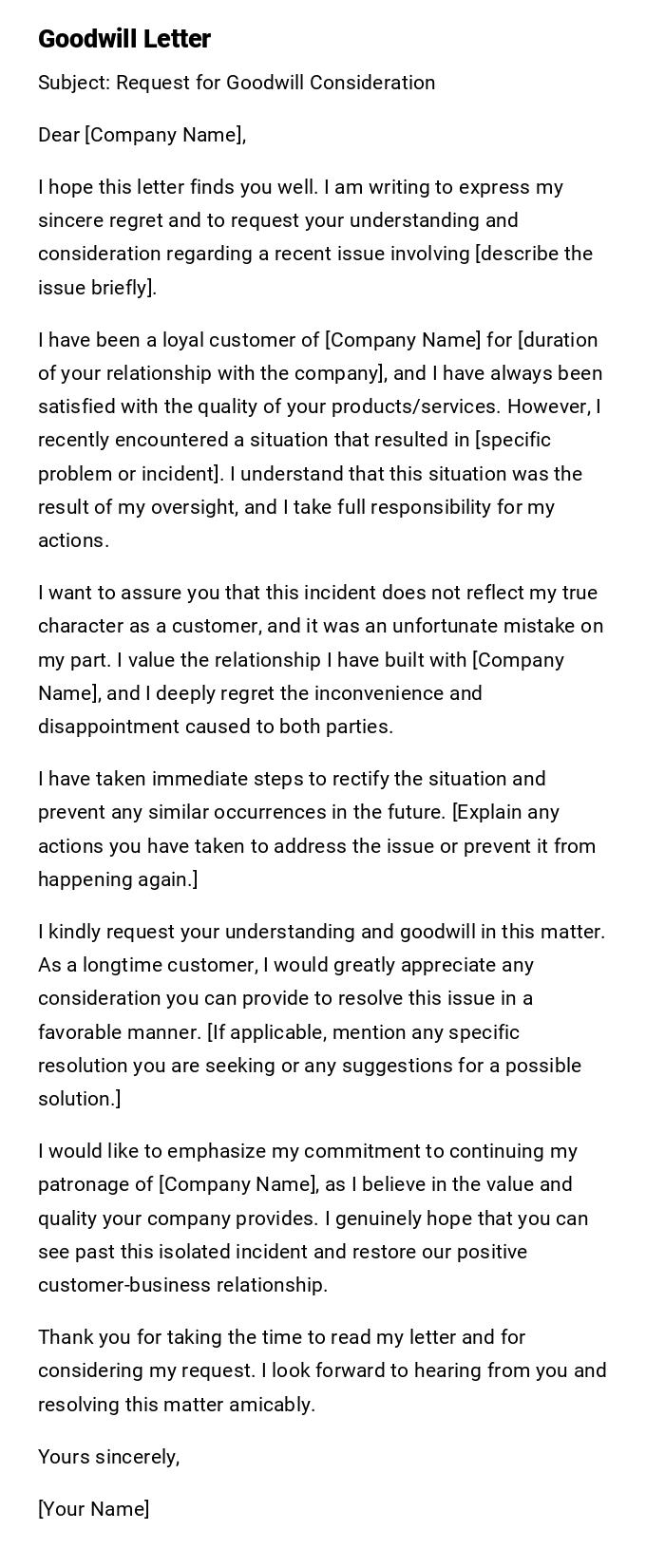

Goodwill Letter

Subject: Request for Goodwill Consideration

Dear [Company Name],

I hope this letter finds you well. I am writing to express my sincere regret and to request your understanding and consideration regarding a recent issue involving [describe the issue briefly].

I have been a loyal customer of [Company Name] for [duration of your relationship with the company], and I have always been satisfied with the quality of your products/services. However, I recently encountered a situation that resulted in [specific problem or incident]. I understand that this situation was the result of my oversight, and I take full responsibility for my actions.

I want to assure you that this incident does not reflect my true character as a customer, and it was an unfortunate mistake on my part. I value the relationship I have built with [Company Name], and I deeply regret the inconvenience and disappointment caused to both parties.

I have taken immediate steps to rectify the situation and prevent any similar occurrences in the future. [Explain any actions you have taken to address the issue or prevent it from happening again.]

I kindly request your understanding and goodwill in this matter. As a longtime customer, I would greatly appreciate any consideration you can provide to resolve this issue in a favorable manner. [If applicable, mention any specific resolution you are seeking or any suggestions for a possible solution.]

I would like to emphasize my commitment to continuing my patronage of [Company Name], as I believe in the value and quality your company provides. I genuinely hope that you can see past this isolated incident and restore our positive customer-business relationship.

Thank you for taking the time to read my letter and for considering my request. I look forward to hearing from you and resolving this matter amicably.

Yours sincerely,

[Your Name]

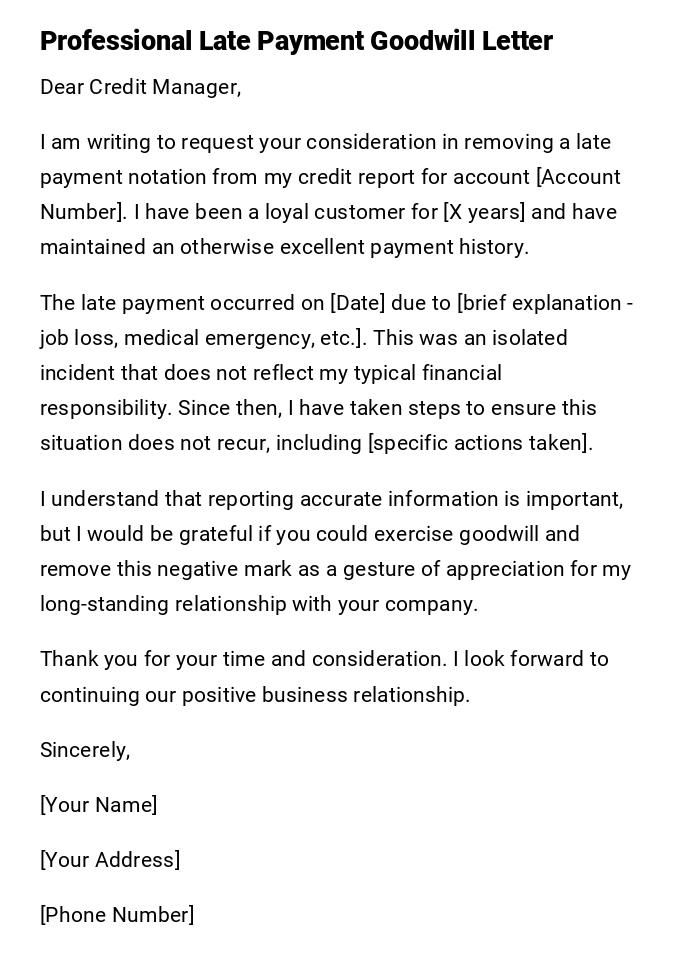

Late Payment Removal - Professional

Dear Credit Manager,

I am writing to request your consideration in removing a late payment notation from my credit report for account [Account Number]. I have been a loyal customer for [X years] and have maintained an otherwise excellent payment history.

The late payment occurred on [Date] due to [brief explanation - job loss, medical emergency, etc.]. This was an isolated incident that does not reflect my typical financial responsibility. Since then, I have taken steps to ensure this situation does not recur, including [specific actions taken].

I understand that reporting accurate information is important, but I would be grateful if you could exercise goodwill and remove this negative mark as a gesture of appreciation for my long-standing relationship with your company.

Thank you for your time and consideration. I look forward to continuing our positive business relationship.

Sincerely,

[Your Name]

[Your Address]

[Phone Number]

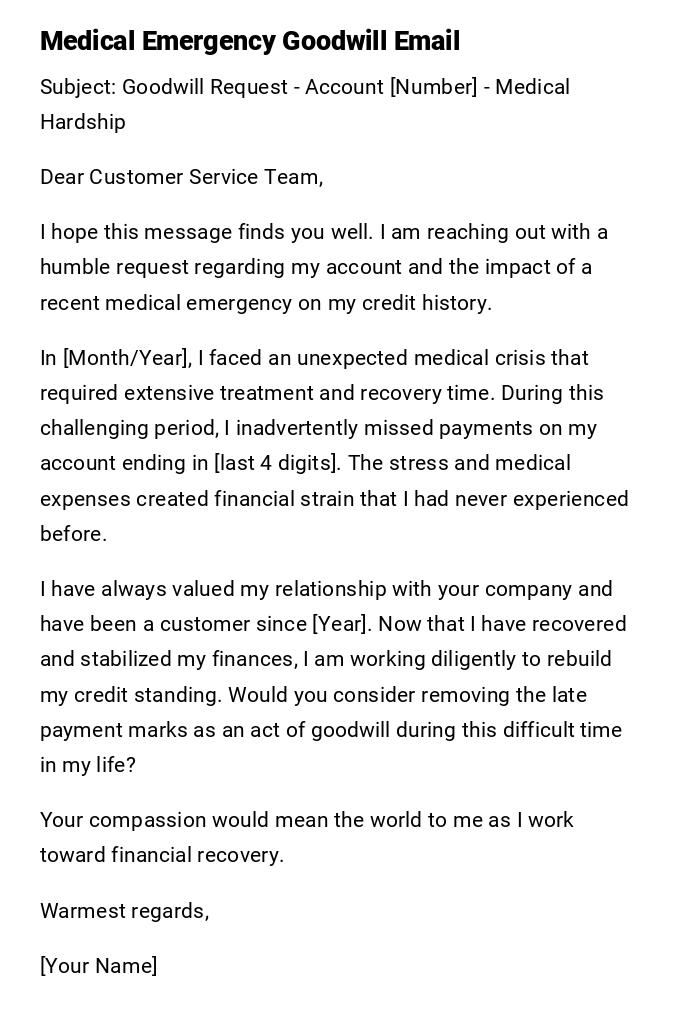

Medical Emergency Goodwill - Heartfelt

Subject: Goodwill Request - Account [Number] - Medical Hardship

Dear Customer Service Team,

I hope this message finds you well. I am reaching out with a humble request regarding my account and the impact of a recent medical emergency on my credit history.

In [Month/Year], I faced an unexpected medical crisis that required extensive treatment and recovery time. During this challenging period, I inadvertently missed payments on my account ending in [last 4 digits]. The stress and medical expenses created financial strain that I had never experienced before.

I have always valued my relationship with your company and have been a customer since [Year]. Now that I have recovered and stabilized my finances, I am working diligently to rebuild my credit standing. Would you consider removing the late payment marks as an act of goodwill during this difficult time in my life?

Your compassion would mean the world to me as I work toward financial recovery.

Warmest regards,

[Your Name]

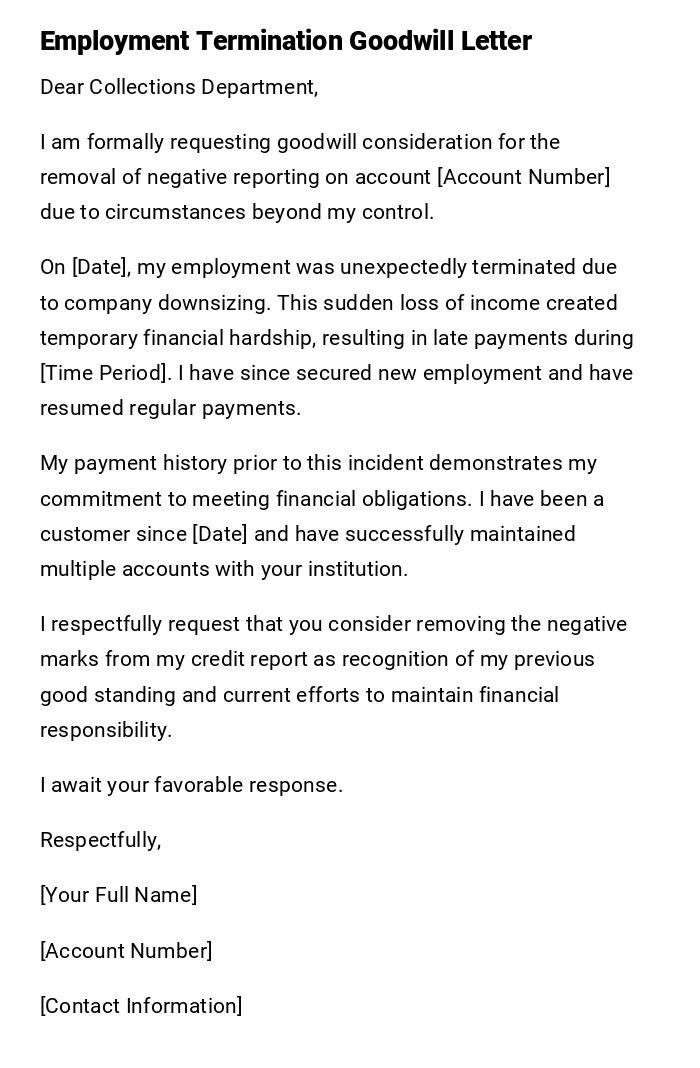

Job Loss Goodwill - Formal

Dear Collections Department,

I am formally requesting goodwill consideration for the removal of negative reporting on account [Account Number] due to circumstances beyond my control.

On [Date], my employment was unexpectedly terminated due to company downsizing. This sudden loss of income created temporary financial hardship, resulting in late payments during [Time Period]. I have since secured new employment and have resumed regular payments.

My payment history prior to this incident demonstrates my commitment to meeting financial obligations. I have been a customer since [Date] and have successfully maintained multiple accounts with your institution.

I respectfully request that you consider removing the negative marks from my credit report as recognition of my previous good standing and current efforts to maintain financial responsibility.

I await your favorable response.

Respectfully,

[Your Full Name]

[Account Number]

[Contact Information]

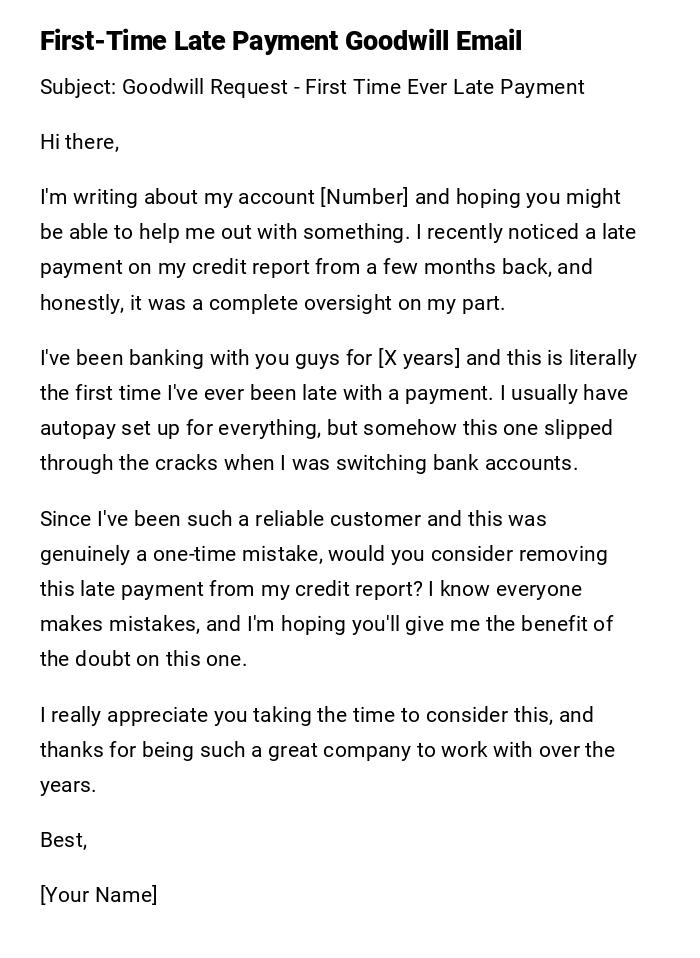

First-Time Offense - Casual

Subject: Goodwill Request - First Time Ever Late Payment

Hi there,

I'm writing about my account [Number] and hoping you might be able to help me out with something. I recently noticed a late payment on my credit report from a few months back, and honestly, it was a complete oversight on my part.

I've been banking with you guys for [X years] and this is literally the first time I've ever been late with a payment. I usually have autopay set up for everything, but somehow this one slipped through the cracks when I was switching bank accounts.

Since I've been such a reliable customer and this was genuinely a one-time mistake, would you consider removing this late payment from my credit report? I know everyone makes mistakes, and I'm hoping you'll give me the benefit of the doubt on this one.

I really appreciate you taking the time to consider this, and thanks for being such a great company to work with over the years.

Best,

[Your Name]

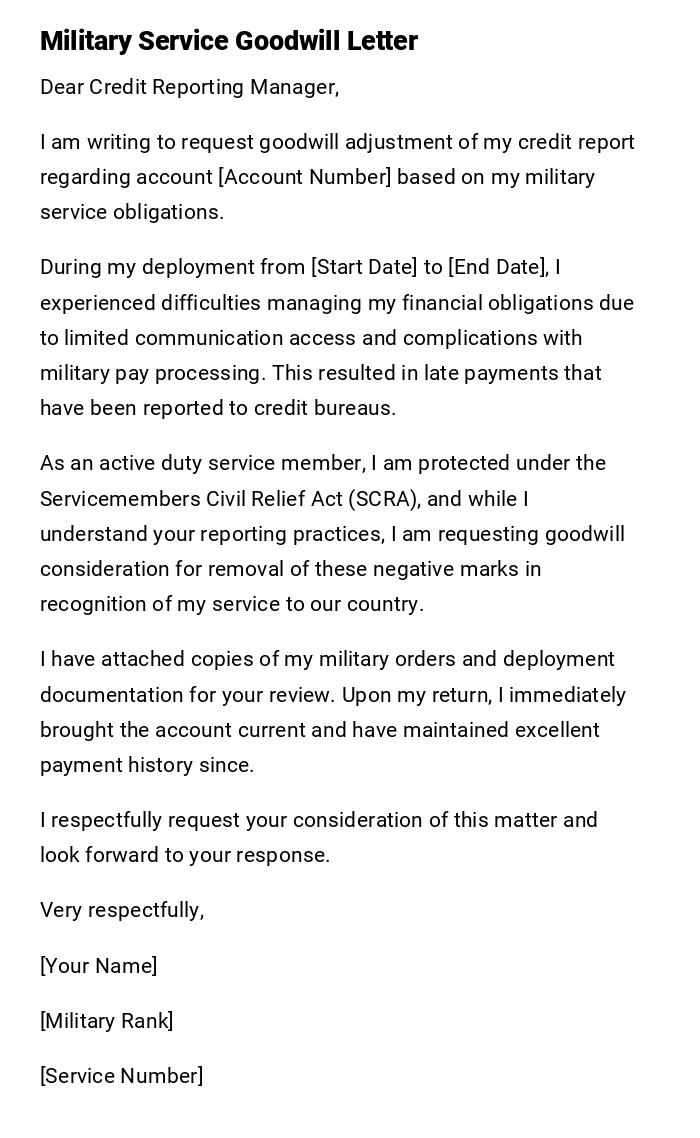

Military Deployment Goodwill - Official

Dear Credit Reporting Manager,

I am writing to request goodwill adjustment of my credit report regarding account [Account Number] based on my military service obligations.

During my deployment from [Start Date] to [End Date], I experienced difficulties managing my financial obligations due to limited communication access and complications with military pay processing. This resulted in late payments that have been reported to credit bureaus.

As an active duty service member, I am protected under the Servicemembers Civil Relief Act (SCRA), and while I understand your reporting practices, I am requesting goodwill consideration for removal of these negative marks in recognition of my service to our country.

I have attached copies of my military orders and deployment documentation for your review. Upon my return, I immediately brought the account current and have maintained excellent payment history since.

I respectfully request your consideration of this matter and look forward to your response.

Very respectfully,

[Your Name]

[Military Rank]

[Service Number]

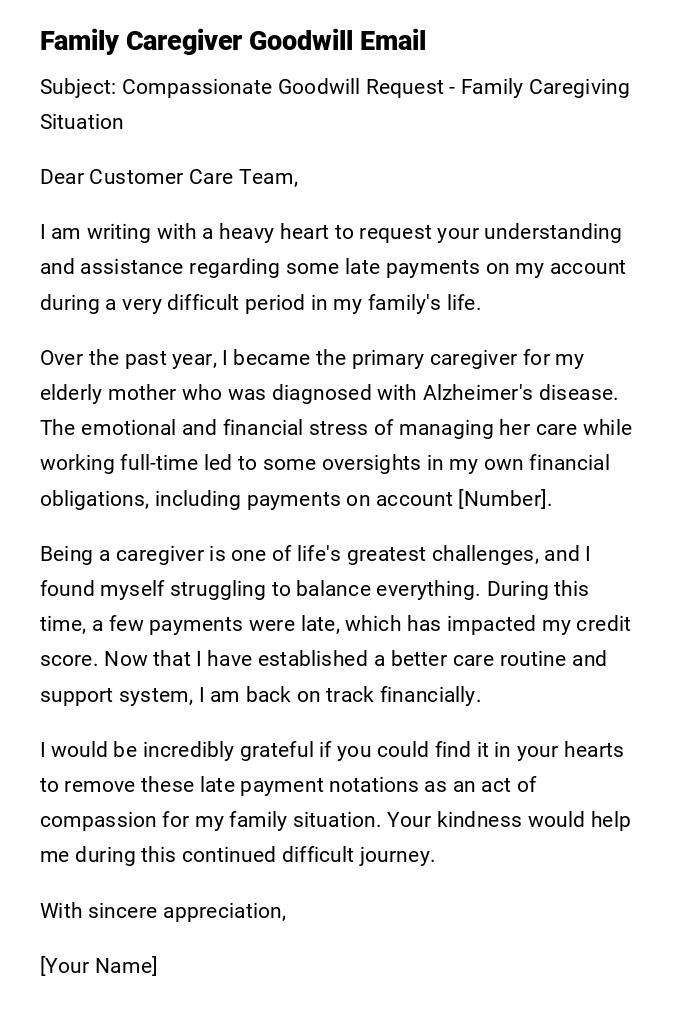

Elderly Parent Care - Heartfelt

Subject: Compassionate Goodwill Request - Family Caregiving Situation

Dear Customer Care Team,

I am writing with a heavy heart to request your understanding and assistance regarding some late payments on my account during a very difficult period in my family's life.

Over the past year, I became the primary caregiver for my elderly mother who was diagnosed with Alzheimer's disease. The emotional and financial stress of managing her care while working full-time led to some oversights in my own financial obligations, including payments on account [Number].

Being a caregiver is one of life's greatest challenges, and I found myself struggling to balance everything. During this time, a few payments were late, which has impacted my credit score. Now that I have established a better care routine and support system, I am back on track financially.

I would be incredibly grateful if you could find it in your hearts to remove these late payment notations as an act of compassion for my family situation. Your kindness would help me during this continued difficult journey.

With sincere appreciation,

[Your Name]

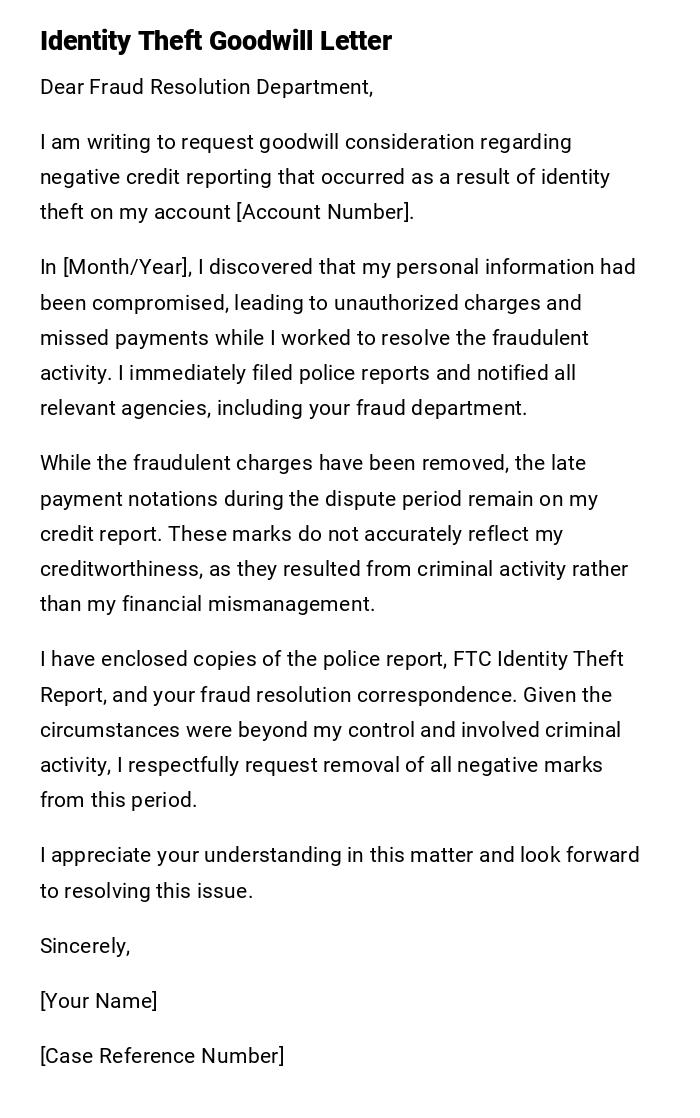

Identity Theft Recovery - Serious

Dear Fraud Resolution Department,

I am writing to request goodwill consideration regarding negative credit reporting that occurred as a result of identity theft on my account [Account Number].

In [Month/Year], I discovered that my personal information had been compromised, leading to unauthorized charges and missed payments while I worked to resolve the fraudulent activity. I immediately filed police reports and notified all relevant agencies, including your fraud department.

While the fraudulent charges have been removed, the late payment notations during the dispute period remain on my credit report. These marks do not accurately reflect my creditworthiness, as they resulted from criminal activity rather than my financial mismanagement.

I have enclosed copies of the police report, FTC Identity Theft Report, and your fraud resolution correspondence. Given the circumstances were beyond my control and involved criminal activity, I respectfully request removal of all negative marks from this period.

I appreciate your understanding in this matter and look forward to resolving this issue.

Sincerely,

[Your Name]

[Case Reference Number]

Divorce Settlement Goodwill - Professional

Dear Customer Relations Manager,

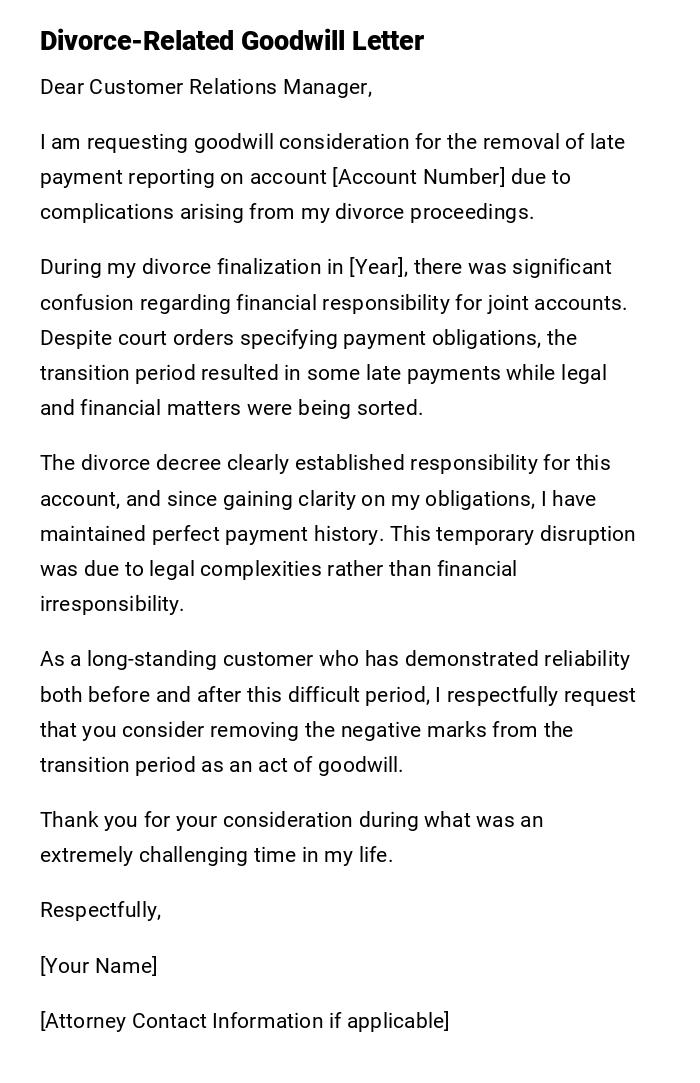

I am requesting goodwill consideration for the removal of late payment reporting on account [Account Number] due to complications arising from my divorce proceedings.

During my divorce finalization in [Year], there was significant confusion regarding financial responsibility for joint accounts. Despite court orders specifying payment obligations, the transition period resulted in some late payments while legal and financial matters were being sorted.

The divorce decree clearly established responsibility for this account, and since gaining clarity on my obligations, I have maintained perfect payment history. This temporary disruption was due to legal complexities rather than financial irresponsibility.

As a long-standing customer who has demonstrated reliability both before and after this difficult period, I respectfully request that you consider removing the negative marks from the transition period as an act of goodwill.

Thank you for your consideration during what was an extremely challenging time in my life.

Respectfully,

[Your Name]

[Attorney Contact Information if applicable]

What is a Goodwill Letter and Why Do You Need One

A goodwill letter is a formal request to a creditor asking them to remove negative information from your credit report as a gesture of goodwill. Unlike dispute letters that challenge the accuracy of information, goodwill letters acknowledge that the negative mark is accurate but request removal based on circumstances, customer loyalty, or demonstrated improvement.

- Primary purpose: Remove legitimate negative marks through creditor compassion

- Key difference: Admits responsibility while requesting mercy

- Success basis: Relies on relationship building and emotional appeal

- Credit repair tool: Helps improve credit scores by removing valid but harmful information

- Relationship preservation: Maintains positive ongoing business relationships with creditors

When to Send a Goodwill Letter

Goodwill letters are appropriate in specific situations where you have legitimate reasons for requesting removal of accurate negative information:

- After establishing positive payment history following a period of late payments

- When facing first-time late payments with an otherwise perfect record

- During life hardships such as medical emergencies, job loss, or family crises

- Following identity theft recovery where disputes have been resolved

- After military deployment or service-related payment difficulties

- Before major financial decisions like mortgage applications or refinancing

- When divorce or legal issues temporarily disrupted financial obligations

- After demonstrating financial rehabilitation following bankruptcy or settlement

Who Should Send Goodwill Letters

The sender of a goodwill letter must be the person whose name appears on the account and credit report:

- Primary account holders have the strongest position for requests

- Authorized users may write letters but with limited success potential

- Joint account holders should both sign the letter when possible

- Deceased person's estate representative with proper legal documentation

- Legal guardians for disabled individuals with court appointment papers

- Attorneys representing clients (though personal letters often work better)

- Credit repair companies generally have lower success rates than personal appeals

To Whom Should Goodwill Letters Be Addressed

Proper addressing significantly impacts success rates:

- Customer service managers often have deletion authority

- Executive customer relations departments handle escalated requests

- Credit reporting managers specialize in credit bureau communications

- Loss mitigation departments understand hardship situations

- Fraud departments for identity theft-related issues

- Collections managers for charged-off accounts

- CEO or executive offices for final appeals (use sparingly)

- Specific contact names when available (research on LinkedIn or company websites)

Requirements and Prerequisites Before Sending

Ensure you meet these conditions before writing your goodwill letter:

- Account must be current with no outstanding balances or recent late payments

- Verify negative marks exist by obtaining current credit reports from all three bureaus

- Gather supporting documentation such as medical records, termination letters, or military orders

- Research creditor policies regarding goodwill deletions and contact information

- Establish timeline of events leading to negative marks

- Document customer history including length of relationship and overall payment record

- Prepare multiple versions for different creditors if multiple negative marks exist

- Set realistic expectations as success rates vary widely by creditor

How to Write and Send Effective Goodwill Letters

The writing and sending process requires strategic planning:

- Start with creditor research to find appropriate contacts and policies

- Choose the right tone based on your situation (professional for business matters, heartfelt for personal hardships)

- Structure logically with clear introduction, explanation, request, and closing

- Include specific details such as account numbers, dates, and circumstances

- Attach supporting documentation but don't overwhelm with unnecessary papers

- Send via certified mail for important letters requiring proof of delivery

- Email for faster response but follow up with hard copies when necessary

- Keep detailed records of all communications and responses

- Be patient as responses can take 30-60 days

Letter Formatting Guidelines and Best Practices

Proper formatting enhances credibility and readability:

- Length: Keep letters to one page when possible, maximum two pages

- Tone: Match the severity of your situation (formal for legal issues, compassionate for medical)

- Structure: Professional business letter format with proper headers and closings

- Language: Clear, concise, and respectful without being overly emotional

- Font: Standard business fonts like Times New Roman or Arial, 12-point size

- Spacing: Single-spaced with double spacing between paragraphs

- Sending method: Certified mail for important requests, regular mail for routine requests

- Follow-up timeline: Wait 30-45 days before sending follow-up communications

- Record keeping: Maintain copies of all correspondence and delivery confirmations

After Sending Your Goodwill Letter

Post-sending activities are crucial for success:

- Monitor your mail for responses from creditors

- Check credit reports monthly for changes or deletions

- Document all responses including rejection letters for potential appeals

- Send thank you notes when deletions are granted

- Maintain payment history to preserve your improved standing

- Follow up appropriately if no response after 45-60 days

- Consider phone calls to customer service to check on letter status

- Prepare appeals for denials with additional documentation or different approach

- Update contact information if you move during the process

Advantages and Disadvantages of Goodwill Letters

Understanding both sides helps set appropriate expectations:

Advantages:

- Cost-effective method compared to professional credit repair

- Preserves relationships with creditors you want to keep

- Can improve credit scores significantly with successful deletions

- Faster than disputes when successful

- No legal complications unlike formal dispute processes

Disadvantages:

- Low success rates varying from 10-30% depending on creditor

- Time-consuming process with no guaranteed results

- May draw attention to accounts creditors might have forgotten

- Requires patience as responses take weeks or months

- Success depends heavily on individual creditor policies and staff discretion

Common Mistakes to Avoid

Prevent these errors that reduce success chances:

- Don't lie or exaggerate circumstances - creditors can verify information

- Avoid generic templates that sound impersonal and mass-produced

- Don't send multiple letters to the same creditor in short timeframes

- Never admit to strategic defaults or intentional non-payment

- Don't threaten legal action in goodwill letters - this changes the tone completely

- Avoid demanding language - remember you're asking for a favor

- Don't ignore current obligations while requesting past forgiveness

- Never send handwritten letters for professional requests

- Don't include irrelevant information that distracts from your main request

Essential Letter Elements and Structure

Every effective goodwill letter should include these components:

- Professional header with your contact information and date

- Proper recipient addressing to specific person/department when possible

- Clear subject line identifying the purpose and account

- Opening acknowledgment of your responsibility for the negative mark

- Detailed explanation of circumstances leading to the problem

- Evidence of improvement showing current financial stability

- Specific request for deletion of negative reporting

- Appreciation statement acknowledging their consideration

- Professional closing with signature and printed name

- Account identification including full account number and dates of negative marks

Tips and Best Practices for Success

Maximize your chances with these proven strategies:

- Research creditor policies - some have formal goodwill programs

- Time your request strategically after establishing 6-12 months of perfect payments

- Personalize each letter for different creditors and situations

- Use specific examples of your loyalty and positive history

- Be honest but strategic about hardship circumstances

- Include minimal documentation - just enough to support your case

- Follow up professionally if no response after reasonable timeframe

- Consider escalation path from customer service to management to executives

- Maintain realistic expectations - not all creditors participate in goodwill deletions

- Combine with other strategies like pay-for-delete negotiations when appropriate

Comparison with Alternative Credit Repair Methods

Understand how goodwill letters compare to other options:

Goodwill vs. Dispute Letters:

- Disputes challenge accuracy; goodwill admits accuracy but requests mercy

- Disputes have legal backing; goodwill relies on customer relations

- Success rates vary widely between methods depending on situation

Goodwill vs. Pay-for-Delete:

- Pay-for-delete involves payment negotiation; goodwill requests free removal

- Pay-for-delete works with collections; goodwill works with original creditors

- Both preserve creditor relationships better than aggressive disputes

Goodwill vs. Professional Credit Repair:

- DIY goodwill letters cost only postage; professional services charge monthly fees

- Professionals may have insider contacts; personal letters often feel more authentic

- Success rates vary based on individual circumstances rather than method chosen

Frequently Asked Questions About Goodwill Letters

How long does it take to get a response? Most creditors respond within 30-60 days, though some may take up to 90 days.

What if my goodwill letter is denied? You can try again in 6-12 months with improved payment history or different approach.

Should I send letters to all three credit bureaus? No, send letters to the original creditor who reports to the bureaus, not the bureaus themselves.

Can I send goodwill letters for charge-offs or collections? Yes, but success rates are generally lower for severely delinquent accounts.

Do goodwill deletions affect my credit score immediately? Credit scores typically update within 30-45 days after negative marks are removed.

Is there a limit to how many goodwill letters I can send? While no legal limit exists, excessive letters may harm your credibility with creditors.

Download Word Doc

Download Word Doc

Download PDF

Download PDF