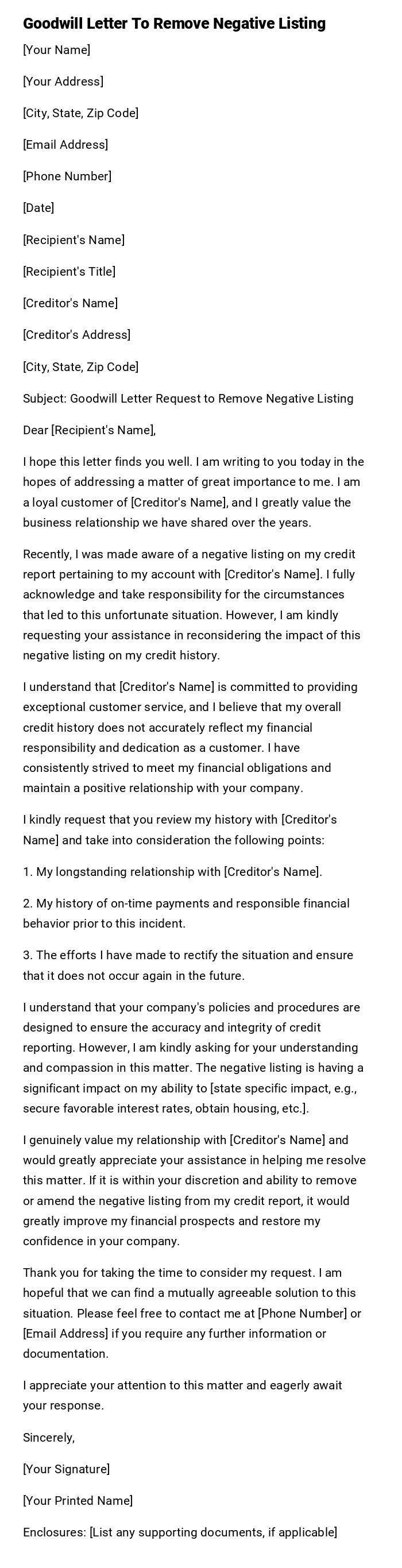

Goodwill Letter To Remove Negative Listing

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Creditor's Name]

[Creditor's Address]

[City, State, Zip Code]

Subject: Goodwill Letter Request to Remove Negative Listing

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to you today in the hopes of addressing a matter of great importance to me. I am a loyal customer of [Creditor's Name], and I greatly value the business relationship we have shared over the years.

Recently, I was made aware of a negative listing on my credit report pertaining to my account with [Creditor's Name]. I fully acknowledge and take responsibility for the circumstances that led to this unfortunate situation. However, I am kindly requesting your assistance in reconsidering the impact of this negative listing on my credit history.

I understand that [Creditor's Name] is committed to providing exceptional customer service, and I believe that my overall credit history does not accurately reflect my financial responsibility and dedication as a customer. I have consistently strived to meet my financial obligations and maintain a positive relationship with your company.

I kindly request that you review my history with [Creditor's Name] and take into consideration the following points:

1. My longstanding relationship with [Creditor's Name].

2. My history of on-time payments and responsible financial behavior prior to this incident.

3. The efforts I have made to rectify the situation and ensure that it does not occur again in the future.

I understand that your company's policies and procedures are designed to ensure the accuracy and integrity of credit reporting. However, I am kindly asking for your understanding and compassion in this matter. The negative listing is having a significant impact on my ability to [state specific impact, e.g., secure favorable interest rates, obtain housing, etc.].

I genuinely value my relationship with [Creditor's Name] and would greatly appreciate your assistance in helping me resolve this matter. If it is within your discretion and ability to remove or amend the negative listing from my credit report, it would greatly improve my financial prospects and restore my confidence in your company.

Thank you for taking the time to consider my request. I am hopeful that we can find a mutually agreeable solution to this situation. Please feel free to contact me at [Phone Number] or [Email Address] if you require any further information or documentation.

I appreciate your attention to this matter and eagerly await your response.

Sincerely,

[Your Signature]

[Your Printed Name]

Enclosures: [List any supporting documents, if applicable]

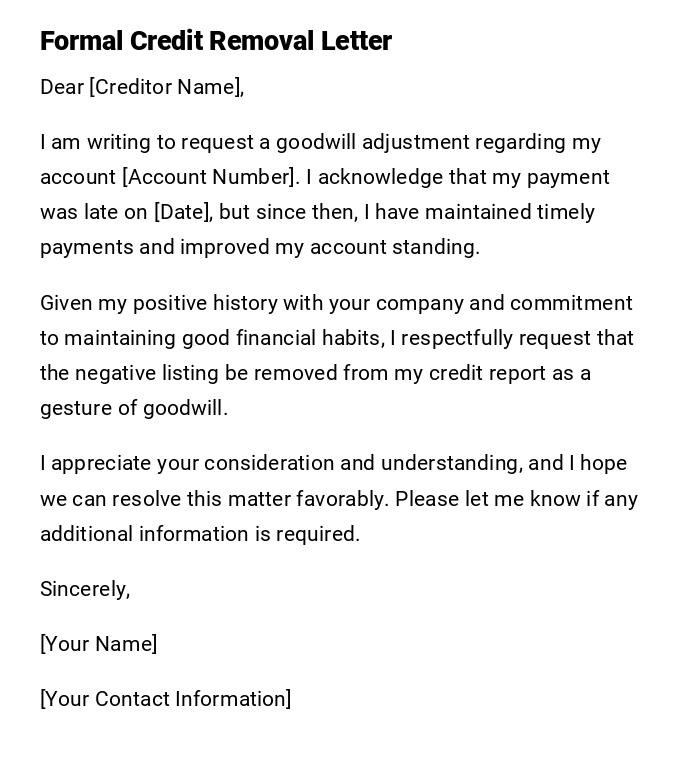

Formal Goodwill Letter to Remove Negative Credit Listing

Dear [Creditor Name],

I am writing to request a goodwill adjustment regarding my account [Account Number]. I acknowledge that my payment was late on [Date], but since then, I have maintained timely payments and improved my account standing.

Given my positive history with your company and commitment to maintaining good financial habits, I respectfully request that the negative listing be removed from my credit report as a gesture of goodwill.

I appreciate your consideration and understanding, and I hope we can resolve this matter favorably. Please let me know if any additional information is required.

Sincerely,

[Your Name]

[Your Contact Information]

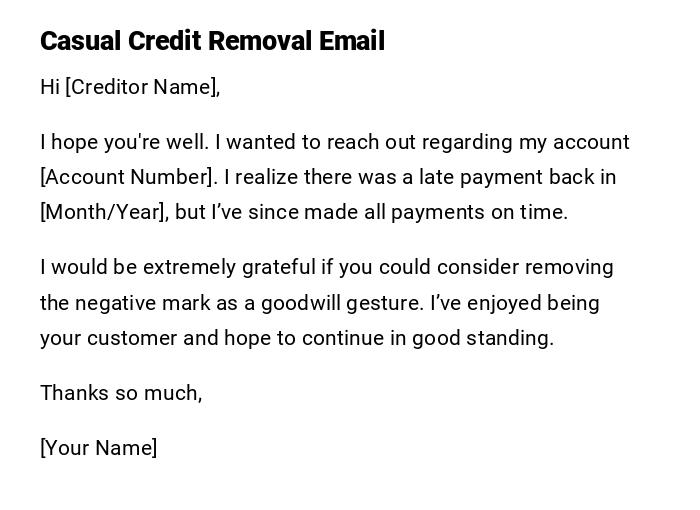

Casual Goodwill Email to Remove Minor Negative Listing

Hi [Creditor Name],

I hope you're well. I wanted to reach out regarding my account [Account Number]. I realize there was a late payment back in [Month/Year], but I’ve since made all payments on time.

I would be extremely grateful if you could consider removing the negative mark as a goodwill gesture. I’ve enjoyed being your customer and hope to continue in good standing.

Thanks so much,

[Your Name]

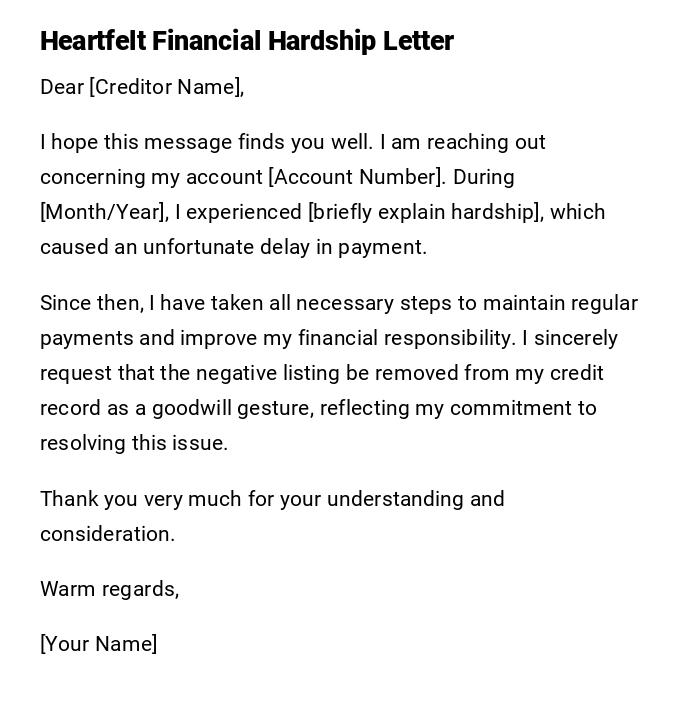

Heartfelt Goodwill Letter After Financial Hardship

Dear [Creditor Name],

I hope this message finds you well. I am reaching out concerning my account [Account Number]. During [Month/Year], I experienced [briefly explain hardship], which caused an unfortunate delay in payment.

Since then, I have taken all necessary steps to maintain regular payments and improve my financial responsibility. I sincerely request that the negative listing be removed from my credit record as a goodwill gesture, reflecting my commitment to resolving this issue.

Thank you very much for your understanding and consideration.

Warm regards,

[Your Name]

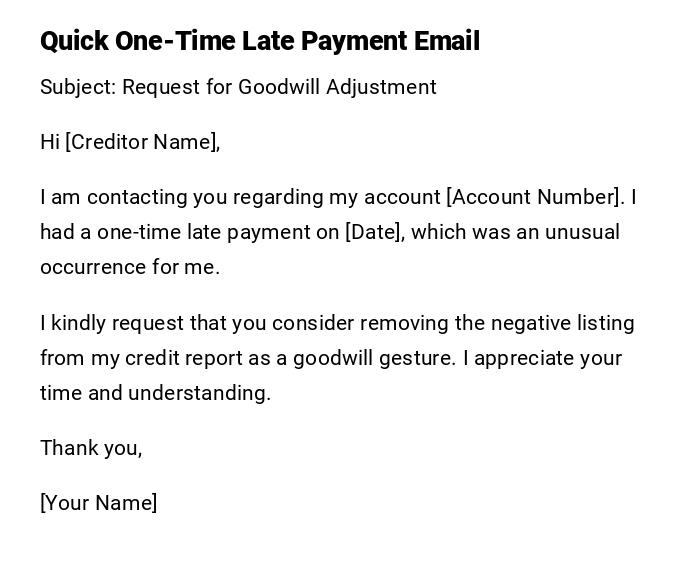

Quick Goodwill Email for One-Time Late Payment

Subject: Request for Goodwill Adjustment

Hi [Creditor Name],

I am contacting you regarding my account [Account Number]. I had a one-time late payment on [Date], which was an unusual occurrence for me.

I kindly request that you consider removing the negative listing from my credit report as a goodwill gesture. I appreciate your time and understanding.

Thank you,

[Your Name]

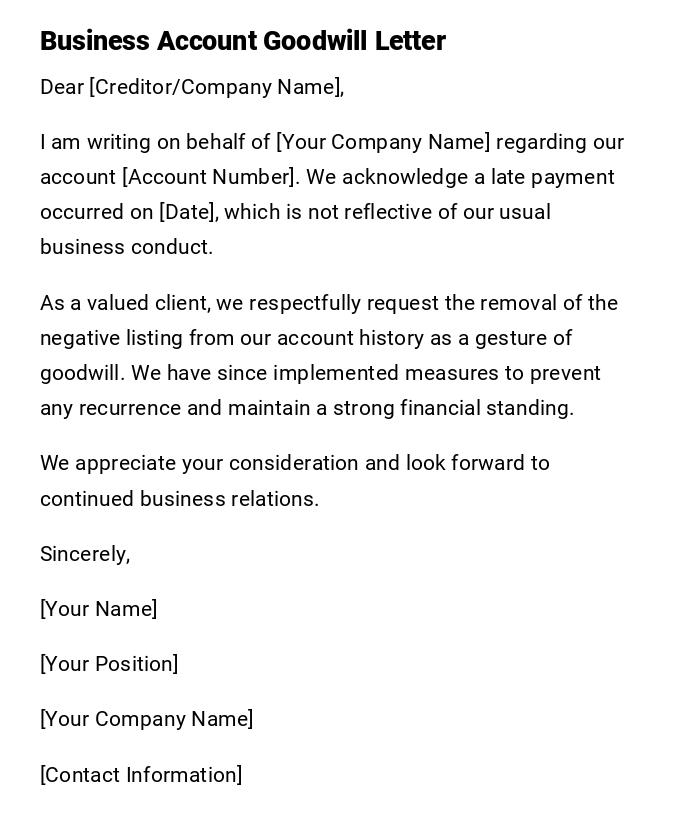

Professional Goodwill Letter for Business Account

Dear [Creditor/Company Name],

I am writing on behalf of [Your Company Name] regarding our account [Account Number]. We acknowledge a late payment occurred on [Date], which is not reflective of our usual business conduct.

As a valued client, we respectfully request the removal of the negative listing from our account history as a gesture of goodwill. We have since implemented measures to prevent any recurrence and maintain a strong financial standing.

We appreciate your consideration and look forward to continued business relations.

Sincerely,

[Your Name]

[Your Position]

[Your Company Name]

[Contact Information]

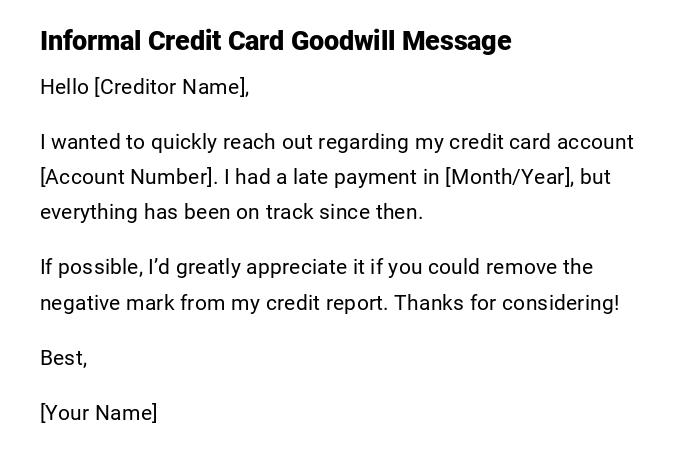

Informal Goodwill Message for Credit Card Late Payment

Hello [Creditor Name],

I wanted to quickly reach out regarding my credit card account [Account Number]. I had a late payment in [Month/Year], but everything has been on track since then.

If possible, I’d greatly appreciate it if you could remove the negative mark from my credit report. Thanks for considering!

Best,

[Your Name]

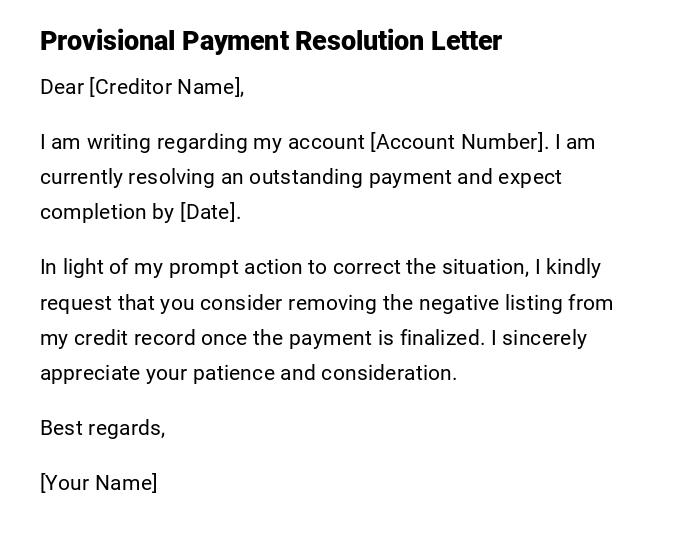

Provisional Goodwill Letter Pending Payment Resolution

Dear [Creditor Name],

I am writing regarding my account [Account Number]. I am currently resolving an outstanding payment and expect completion by [Date].

In light of my prompt action to correct the situation, I kindly request that you consider removing the negative listing from my credit record once the payment is finalized. I sincerely appreciate your patience and consideration.

Best regards,

[Your Name]

What is a Goodwill Letter to Remove Negative Listing and Why You Might Need It

- A goodwill letter is a written request to a creditor asking for removal of a negative mark from your credit report.

- It is used when a late payment, minor default, or other negative listing does not reflect your usual payment behavior.

- The purpose is to restore your credit standing and demonstrate responsible financial conduct.

- Often applied as a courtesy request rather than a legal right, relying on the creditor's discretion.

Who Should Send a Goodwill Letter

- Individuals who have a generally positive payment history but have one or few negative listings.

- Business owners with minor lapses in financial accounts or invoices.

- People seeking to improve creditworthiness for loans, mortgages, or rentals.

- Those who experienced temporary hardship resulting in delayed payments.

Whom the Goodwill Letter Should Be Addressed To

- Credit card issuers or banks holding the negative account.

- Mortgage lenders or finance companies reporting the negative listing.

- Utility companies or service providers if the negative mark impacts credit reporting.

- Any creditor capable of reporting or removing the negative listing on your credit profile.

When to Send a Goodwill Letter

- After a one-time late payment that is an anomaly in your credit history.

- Following temporary financial hardship or unexpected personal circumstances.

- After resolving or paying off the account in question.

- When planning major financial applications like mortgages or loans, and you want to preempt credit issues.

How to Write and Send a Goodwill Letter

- Begin with a polite and professional greeting.

- Explain the circumstances surrounding the negative listing briefly and honestly.

- Highlight your otherwise good payment history or responsible behavior.

- Request removal of the negative listing as a goodwill gesture.

- Close with appreciation and contact information.

- Choose the mode: printed letter for formal requests, email/message for faster communication.

Requirements and Prerequisites Before Writing

- Know your account details: account number, dates of missed payments, and the negative entry.

- Understand the creditor's policies regarding goodwill adjustments.

- Evidence of consistent payment behavior after the incident.

- Documentation of financial hardship if applicable (optional but helpful).

- Clear reason and polite tone for requesting removal.

Formatting Guidelines for Goodwill Letters

- Length: 1 page for printed letters, 150–250 words for emails.

- Tone: Polite, professional, and courteous; may be heartfelt in hardship cases.

- Structure: Opening explaining the reason, body detailing circumstances and good history, closing requesting goodwill adjustment.

- Mode: Printed letters for formal credit requests, emails/messages for digital communication.

- Etiquette: Avoid blaming the creditor; focus on personal responsibility and request respectfully.

After Sending / Follow-up Actions

- Wait at least 2–3 weeks for a response before following up.

- Send a polite follow-up email or call if no response is received.

- Keep records of all communications for future reference.

- Confirm if the negative listing was removed after a positive response.

Pros and Cons of Sending a Goodwill Letter

Pros:

- Potentially restores creditworthiness and improves credit score.

- Demonstrates responsibility and proactiveness.

- Often a simple, low-cost method for credit repair.

Cons:

- No guarantee of success; the creditor may refuse.

- May require repeated attempts or persistence.

- Over-reliance on goodwill letters can delay exploring other credit repair options.

Tricks and Tips for Effective Goodwill Letters

- Keep the letter concise and focused on positive behavior.

- Highlight history of timely payments except for the incident.

- Be honest and transparent about reasons for the negative listing.

- Use polite language and express appreciation for consideration.

- Include supporting documents if applicable (receipts, payment history).

Common Mistakes to Avoid

- Writing a confrontational or blaming letter.

- Being vague about the incident or not providing account details.

- Making unrealistic demands or expecting guaranteed removal.

- Ignoring proper formatting, grammar, or tone.

- Sending letters without confirming the correct recipient or contact details.

Elements and Structure of a Goodwill Letter

- Introduction: State purpose and account details.

- Explanation: Briefly describe circumstances of the negative listing.

- Positive History: Highlight otherwise good payment behavior.

- Request: Politely ask for removal as a goodwill gesture.

- Closing: Thank the creditor and provide contact information.

- Optional Attachments: Payment proof, financial hardship documents, or account statements.

Does It Require Attestation or Authorization?

- Typically, goodwill letters do not require formal attestation.

- Creditor discretion governs approval; no legal obligation exists to honor the request.

- Ensuring honesty and a professional tone is critical for credibility.

How Many Goodwill Letters Might Be Needed

- Often, a single letter is sufficient per negative listing.

- Multiple letters may be sent to different departments if no response is received.

- Prioritize quality, clarity, and evidence over quantity; a strong, well-written letter is more effective than repeated requests.

Compare and Contrast Goodwill Letters with Other Credit Repair Methods

- Goodwill Letter vs Formal Dispute: Letters rely on creditor discretion, disputes challenge reporting accuracy.

- Goodwill Letter vs Credit Counseling: Letters are direct and specific; counseling may provide broader long-term support.

- Alternatives: Negotiation for payment plan adjustments or settling accounts may also result in removal but are not guaranteed as goodwill gestures.

Download Word Doc

Download Word Doc

Download PDF

Download PDF