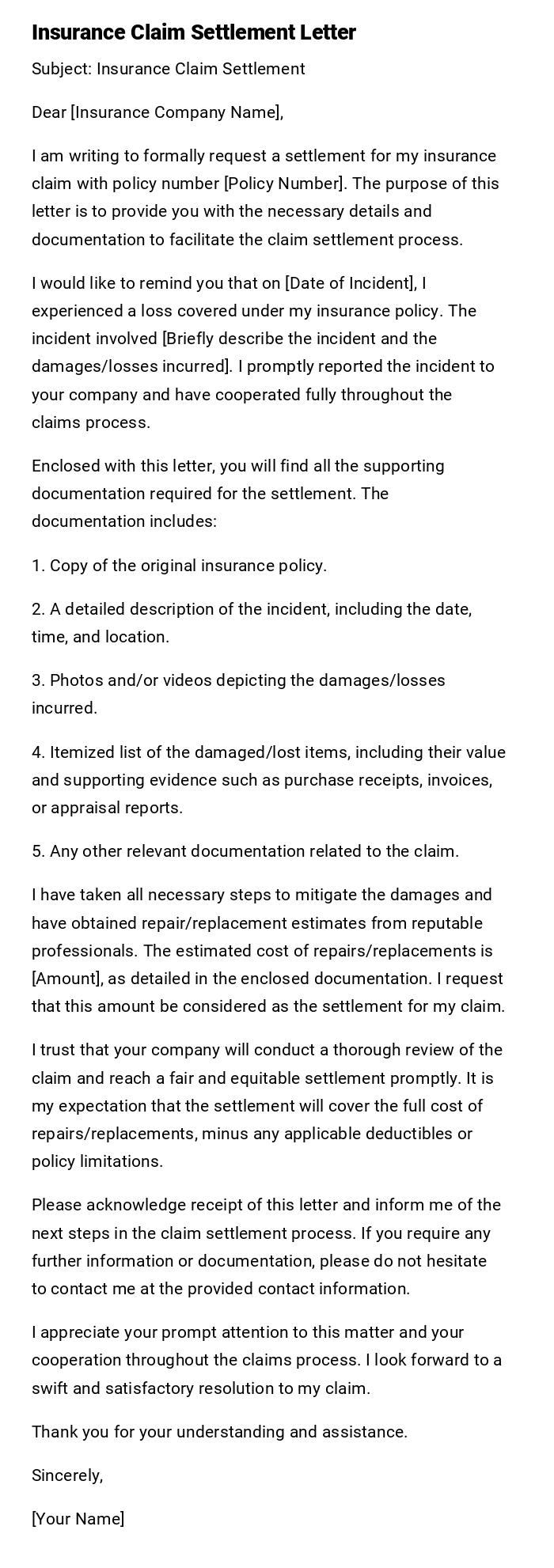

Insurance Claim Settlement Letter

Subject: Insurance Claim Settlement

Dear [Insurance Company Name],

I am writing to formally request a settlement for my insurance claim with policy number [Policy Number]. The purpose of this letter is to provide you with the necessary details and documentation to facilitate the claim settlement process.

I would like to remind you that on [Date of Incident], I experienced a loss covered under my insurance policy. The incident involved [Briefly describe the incident and the damages/losses incurred]. I promptly reported the incident to your company and have cooperated fully throughout the claims process.

Enclosed with this letter, you will find all the supporting documentation required for the settlement. The documentation includes:

1. Copy of the original insurance policy.

2. A detailed description of the incident, including the date, time, and location.

3. Photos and/or videos depicting the damages/losses incurred.

4. Itemized list of the damaged/lost items, including their value and supporting evidence such as purchase receipts, invoices, or appraisal reports.

5. Any other relevant documentation related to the claim.

I have taken all necessary steps to mitigate the damages and have obtained repair/replacement estimates from reputable professionals. The estimated cost of repairs/replacements is [Amount], as detailed in the enclosed documentation. I request that this amount be considered as the settlement for my claim.

I trust that your company will conduct a thorough review of the claim and reach a fair and equitable settlement promptly. It is my expectation that the settlement will cover the full cost of repairs/replacements, minus any applicable deductibles or policy limitations.

Please acknowledge receipt of this letter and inform me of the next steps in the claim settlement process. If you require any further information or documentation, please do not hesitate to contact me at the provided contact information.

I appreciate your prompt attention to this matter and your cooperation throughout the claims process. I look forward to a swift and satisfactory resolution to my claim.

Thank you for your understanding and assistance.

Sincerely,

[Your Name]

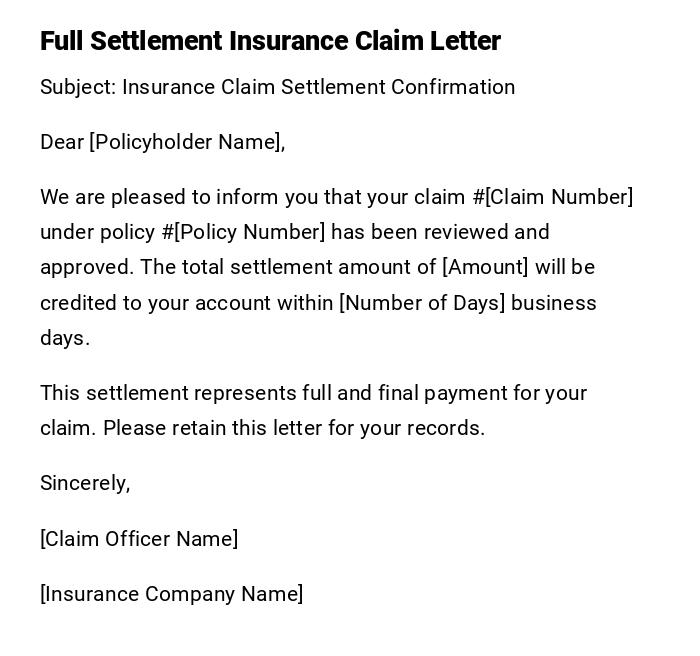

Insurance Claim Settlement Letter – Full Settlement Confirmation

Subject: Insurance Claim Settlement Confirmation

Dear [Policyholder Name],

We are pleased to inform you that your claim #[Claim Number] under policy #[Policy Number] has been reviewed and approved. The total settlement amount of [Amount] will be credited to your account within [Number of Days] business days.

This settlement represents full and final payment for your claim. Please retain this letter for your records.

Sincerely,

[Claim Officer Name]

[Insurance Company Name]

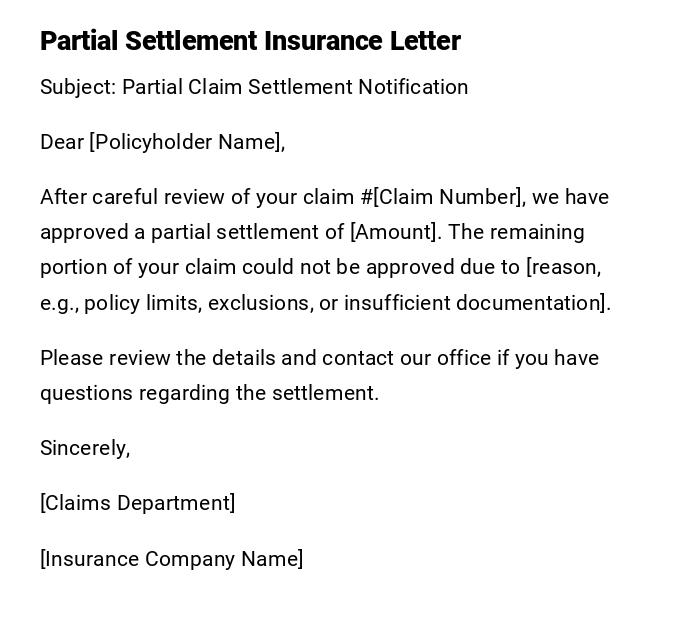

Partial Insurance Claim Settlement Letter

Subject: Partial Claim Settlement Notification

Dear [Policyholder Name],

After careful review of your claim #[Claim Number], we have approved a partial settlement of [Amount]. The remaining portion of your claim could not be approved due to [reason, e.g., policy limits, exclusions, or insufficient documentation].

Please review the details and contact our office if you have questions regarding the settlement.

Sincerely,

[Claims Department]

[Insurance Company Name]

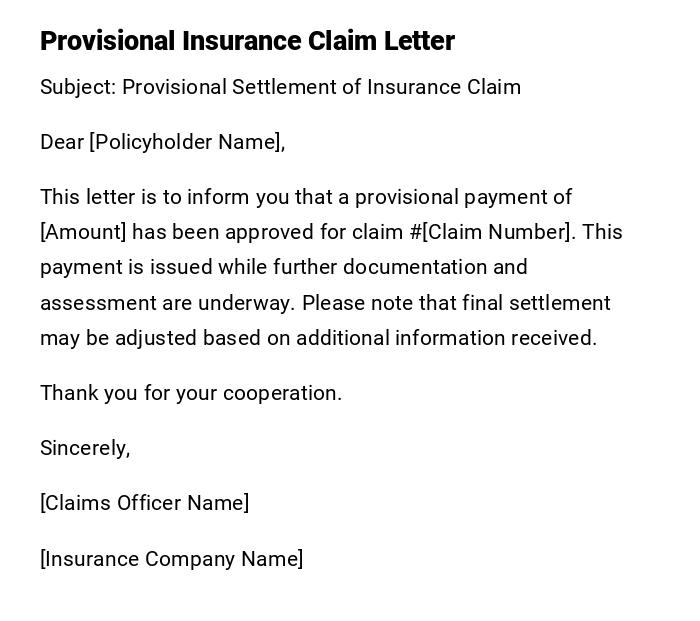

Provisional Insurance Claim Settlement Letter

Subject: Provisional Settlement of Insurance Claim

Dear [Policyholder Name],

This letter is to inform you that a provisional payment of [Amount] has been approved for claim #[Claim Number]. This payment is issued while further documentation and assessment are underway. Please note that final settlement may be adjusted based on additional information received.

Thank you for your cooperation.

Sincerely,

[Claims Officer Name]

[Insurance Company Name]

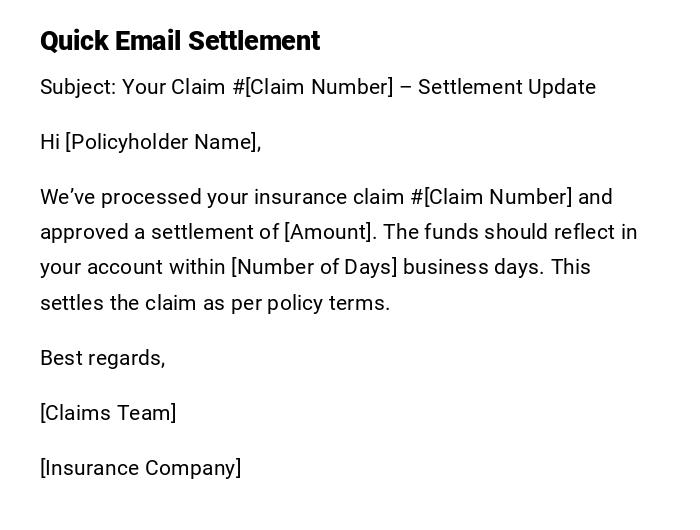

Insurance Claim Settlement Letter – Quick Digital Email

Subject: Your Claim #[Claim Number] – Settlement Update

Hi [Policyholder Name],

We’ve processed your insurance claim #[Claim Number] and approved a settlement of [Amount]. The funds should reflect in your account within [Number of Days] business days. This settles the claim as per policy terms.

Best regards,

[Claims Team]

[Insurance Company]

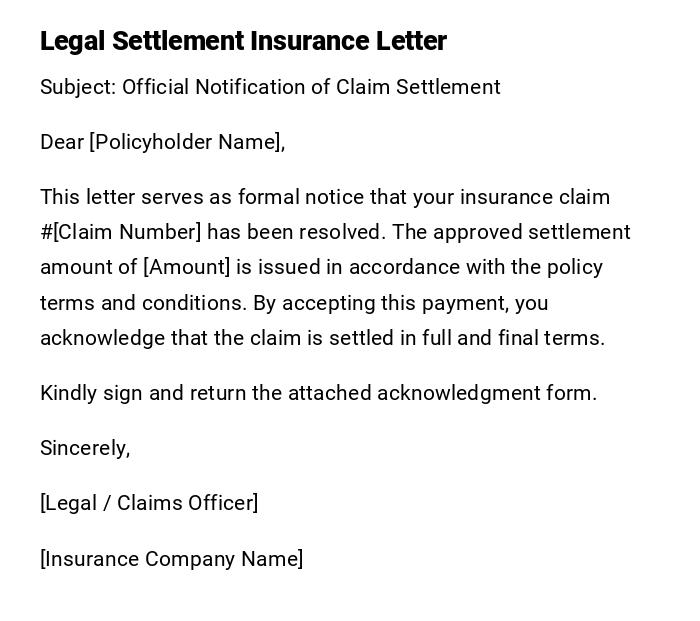

Insurance Claim Settlement Letter – Legal / Official Scenario

Subject: Official Notification of Claim Settlement

Dear [Policyholder Name],

This letter serves as formal notice that your insurance claim #[Claim Number] has been resolved. The approved settlement amount of [Amount] is issued in accordance with the policy terms and conditions. By accepting this payment, you acknowledge that the claim is settled in full and final terms.

Kindly sign and return the attached acknowledgment form.

Sincerely,

[Legal / Claims Officer]

[Insurance Company Name]

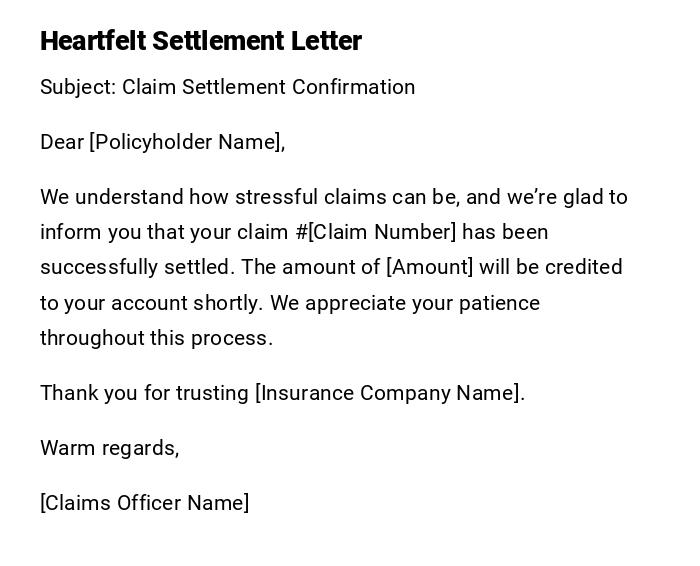

Insurance Claim Settlement Letter – Heartfelt / Customer-Friendly Tone

Subject: Claim Settlement Confirmation

Dear [Policyholder Name],

We understand how stressful claims can be, and we’re glad to inform you that your claim #[Claim Number] has been successfully settled. The amount of [Amount] will be credited to your account shortly. We appreciate your patience throughout this process.

Thank you for trusting [Insurance Company Name].

Warm regards,

[Claims Officer Name]

What / Why an Insurance Claim Settlement Letter is Needed

- Confirms the settlement of an insurance claim.

- Provides official record of payment and resolution.

- Protects both the insurer and policyholder legally.

- Communicates clearly about the amount and terms of settlement.

Who Should Send the Insurance Claim Settlement Letter

- Insurance company’s claims officer or claims department.

- Legal or compliance officer if the claim involves a formal or disputed settlement.

- Customer service representative in customer-friendly communications.

Whom Should Receive the Letter

- Policyholders who filed a claim.

- Authorized representatives or claimants in case of third-party settlements.

- Legal representatives if the claim resolution involves legal documentation.

When to Send an Insurance Claim Settlement Letter

- After approval of a full or partial insurance claim.

- When issuing provisional payments while assessment is ongoing.

- Following resolution of disputes or adjustments to claims.

- Upon completion of all documentation required for settlement.

How to Write and Send the Insurance Claim Settlement Letter

- Clearly state claim number, policy number, and settlement amount.

- Indicate whether the settlement is full, partial, or provisional.

- Use professional, friendly, or digital email tone depending on context.

- Attach acknowledgment forms if required for legal purposes.

- Send via mail for official letters or email for quick digital communication.

Requirements and Prerequisites Before Sending

- Complete assessment of the claim.

- Verification of policy terms and limits.

- Documentation of any deductions, adjustments, or exclusions.

- Approval from claims or legal department for official settlement letters.

Formatting Guidelines for Insurance Claim Settlement Letters

- Length: One to two pages maximum.

- Tone: Professional, formal, or customer-friendly depending on context.

- Structure: Subject, greeting, body, closing, signature.

- Attachments: Acknowledgment forms, claim summaries, or receipts.

- Email or printed format depending on recipient preference.

After Sending / Follow-up Actions

- Confirm receipt of the letter by the policyholder.

- Track transfer of settlement amount.

- Store the letter and acknowledgment for internal records.

- Respond promptly to queries or disputes arising post-settlement.

Tricks and Tips for Effective Insurance Claim Settlement Letters

- Be concise yet detailed: include claim numbers and amounts.

- Maintain a neutral and professional tone for legal cases.

- Use friendly, reassuring language for customer-facing letters.

- Clearly differentiate between full, partial, or provisional settlements.

- Include contact information for follow-up questions.

Common Mistakes to Avoid

- Failing to specify whether the settlement is full, partial, or provisional.

- Omitting claim or policy numbers.

- Sending letters without proper internal approvals.

- Using confusing or overly legalistic language for customer communications.

- Not including acknowledgment instructions when required.

Elements and Structure of an Insurance Claim Settlement Letter

- Subject line specifying claim settlement.

- Salutation addressing the policyholder.

- Body: Claim details, settlement amount, type (full/partial/provisional), and terms.

- Closing: Professional or friendly sign-off.

- Attachments: Acknowledgment forms, receipts, or claim summaries.

- Contact details for queries or follow-up.

FAQ About Insurance Claim Settlement Letters

-

Q: Can I request a settlement in parts?

A: Yes, insurers may issue partial or provisional payments. -

Q: How long does it take to receive settlement funds?

A: Usually within a few business days after the letter is sent, depending on policy terms. -

Q: Do I need to sign any document to confirm settlement?

A: Often, an acknowledgment form is required to confirm receipt. -

Q: Can settlement letters be emailed?

A: Yes, for quick communication; official/legal letters may require printed copies.

Compare and Contrast With Other Insurance Letters

- Unlike claim acknowledgment letters, settlement letters confirm payment.

- Unlike denial letters, they communicate positive outcomes.

- Unlike provisional notices, they indicate the final status of the claim.

- Similar to remittance letters but focused on insurance claims specifically.

Download Word Doc

Download Word Doc

Download PDF

Download PDF