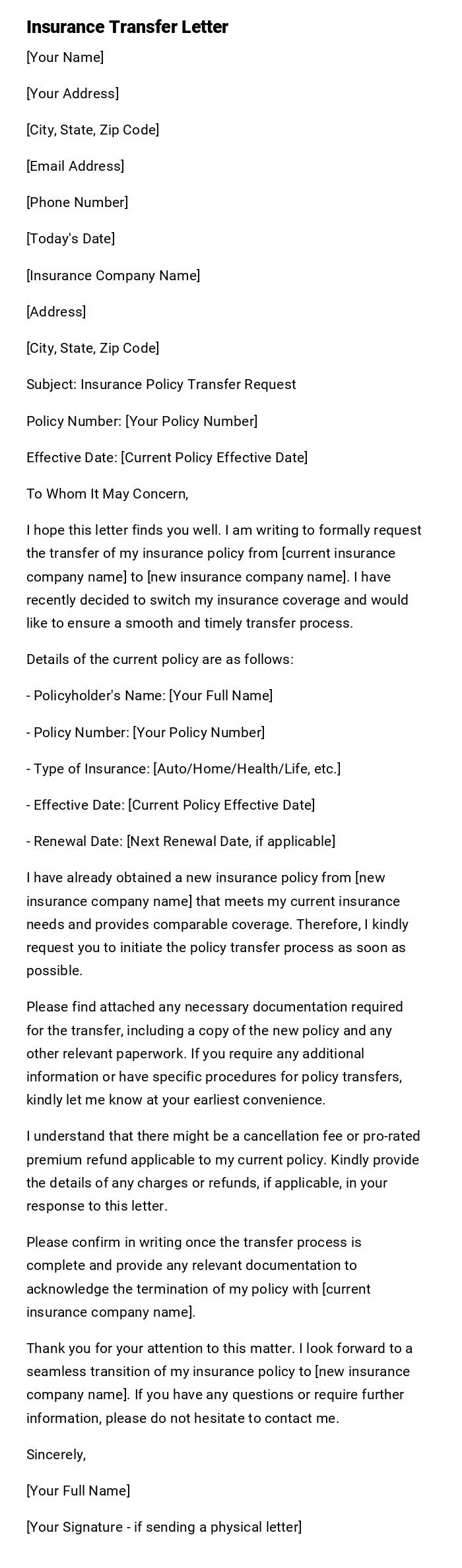

Insurance Transfer Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Today's Date]

[Insurance Company Name]

[Address]

[City, State, Zip Code]

Subject: Insurance Policy Transfer Request

Policy Number: [Your Policy Number]

Effective Date: [Current Policy Effective Date]

To Whom It May Concern,

I hope this letter finds you well. I am writing to formally request the transfer of my insurance policy from [current insurance company name] to [new insurance company name]. I have recently decided to switch my insurance coverage and would like to ensure a smooth and timely transfer process.

Details of the current policy are as follows:

- Policyholder's Name: [Your Full Name]

- Policy Number: [Your Policy Number]

- Type of Insurance: [Auto/Home/Health/Life, etc.]

- Effective Date: [Current Policy Effective Date]

- Renewal Date: [Next Renewal Date, if applicable]

I have already obtained a new insurance policy from [new insurance company name] that meets my current insurance needs and provides comparable coverage. Therefore, I kindly request you to initiate the policy transfer process as soon as possible.

Please find attached any necessary documentation required for the transfer, including a copy of the new policy and any other relevant paperwork. If you require any additional information or have specific procedures for policy transfers, kindly let me know at your earliest convenience.

I understand that there might be a cancellation fee or pro-rated premium refund applicable to my current policy. Kindly provide the details of any charges or refunds, if applicable, in your response to this letter.

Please confirm in writing once the transfer process is complete and provide any relevant documentation to acknowledge the termination of my policy with [current insurance company name].

Thank you for your attention to this matter. I look forward to a seamless transition of my insurance policy to [new insurance company name]. If you have any questions or require further information, please do not hesitate to contact me.

Sincerely,

[Your Full Name]

[Your Signature - if sending a physical letter]

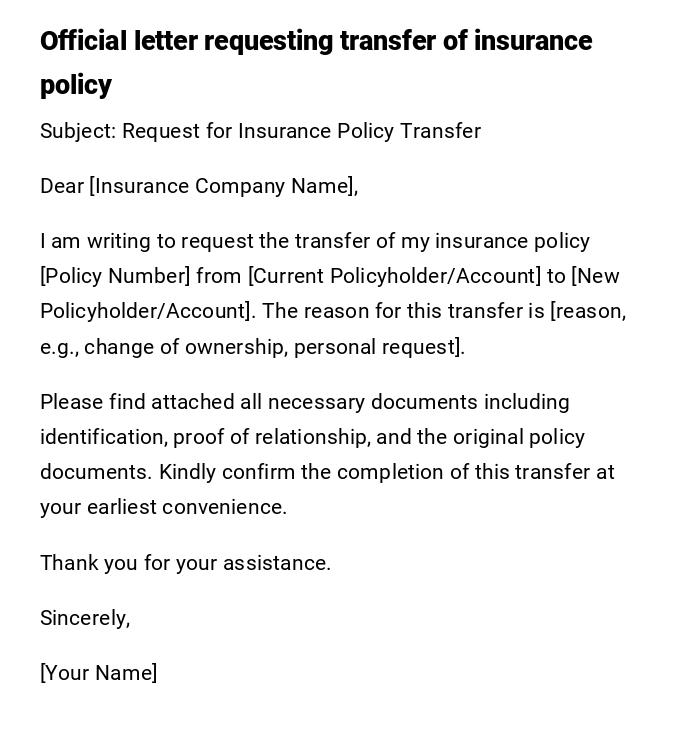

Formal Insurance Transfer Letter

Subject: Request for Insurance Policy Transfer

Dear [Insurance Company Name],

I am writing to request the transfer of my insurance policy [Policy Number] from [Current Policyholder/Account] to [New Policyholder/Account]. The reason for this transfer is [reason, e.g., change of ownership, personal request].

Please find attached all necessary documents including identification, proof of relationship, and the original policy documents. Kindly confirm the completion of this transfer at your earliest convenience.

Thank you for your assistance.

Sincerely,

[Your Name]

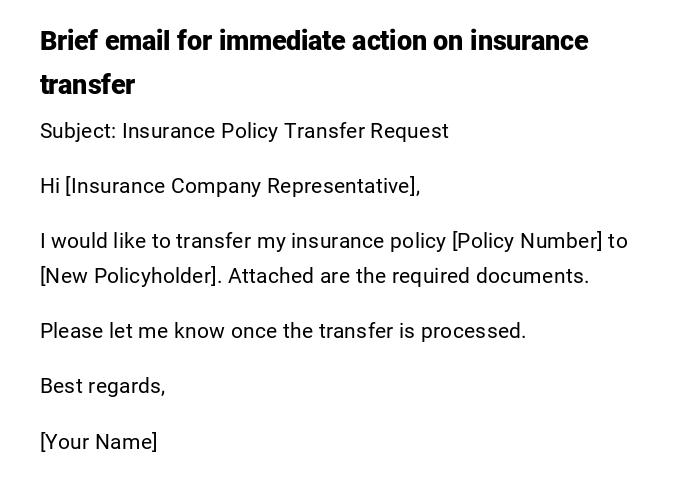

Quick Email for Insurance Transfer

Subject: Insurance Policy Transfer Request

Hi [Insurance Company Representative],

I would like to transfer my insurance policy [Policy Number] to [New Policyholder]. Attached are the required documents.

Please let me know once the transfer is processed.

Best regards,

[Your Name]

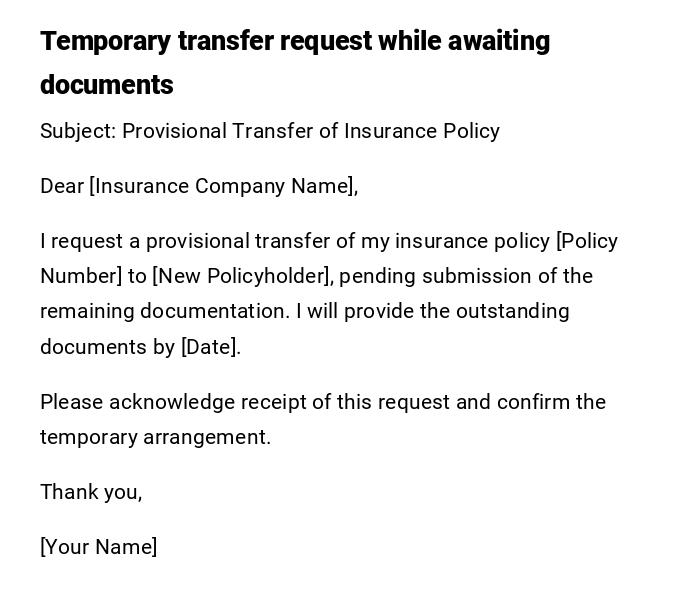

Provisional Insurance Transfer Letter

Subject: Provisional Transfer of Insurance Policy

Dear [Insurance Company Name],

I request a provisional transfer of my insurance policy [Policy Number] to [New Policyholder], pending submission of the remaining documentation. I will provide the outstanding documents by [Date].

Please acknowledge receipt of this request and confirm the temporary arrangement.

Thank you,

[Your Name]

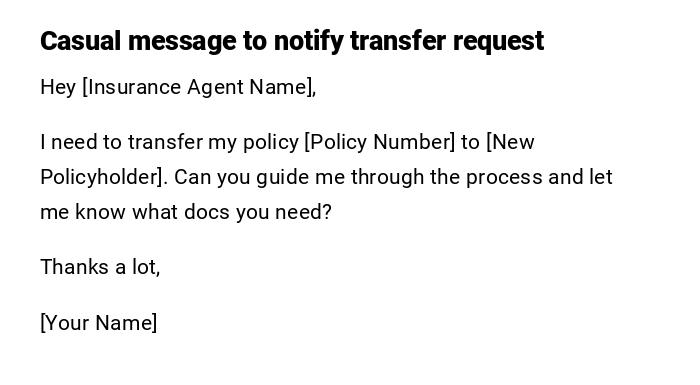

Informal Insurance Transfer Message

Hey [Insurance Agent Name],

I need to transfer my policy [Policy Number] to [New Policyholder]. Can you guide me through the process and let me know what docs you need?

Thanks a lot,

[Your Name]

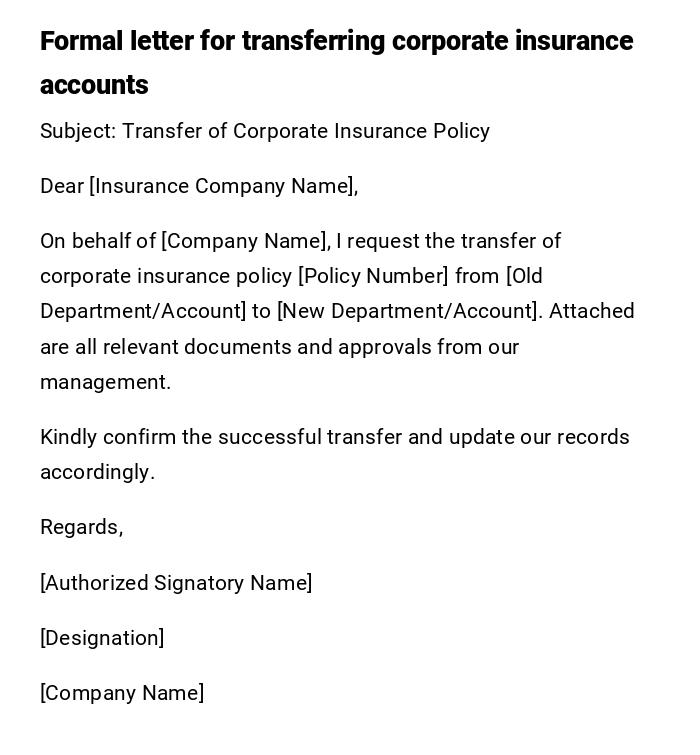

Official Corporate Insurance Transfer Letter

Subject: Transfer of Corporate Insurance Policy

Dear [Insurance Company Name],

On behalf of [Company Name], I request the transfer of corporate insurance policy [Policy Number] from [Old Department/Account] to [New Department/Account]. Attached are all relevant documents and approvals from our management.

Kindly confirm the successful transfer and update our records accordingly.

Regards,

[Authorized Signatory Name]

[Designation]

[Company Name]

What an Insurance Transfer Letter Is and Why It Is Needed

An Insurance Transfer Letter is a formal request to transfer ownership or responsibility of an insurance policy from one party to another.

Purpose:

- Change of ownership or beneficiary.

- Organizational or personal account updates.

- Compliance with legal or contractual requirements.

- To ensure smooth continuity of coverage under the correct holder.

Who Should Send an Insurance Transfer Letter

- Policyholders seeking to transfer their own insurance policies.

- Authorized representatives on behalf of corporate or organizational policyholders.

- Beneficiaries requesting transfer of benefits.

Whom the Insurance Transfer Letter Should Be Addressed To

- Insurance company customer service or policy management department.

- Designated insurance agents or brokers handling the policy.

- For corporate policies: insurance account managers or corporate liaison officers.

When to Use an Insurance Transfer Letter

- When changing the beneficiary of a life or health insurance policy.

- During corporate restructuring affecting policy ownership.

- After buying or selling a business with associated insurance coverage.

- Following legal or personal events necessitating policy reassignment.

How to Write and Send an Insurance Transfer Letter

- Begin with a clear subject line indicating the purpose.

- Include policy number and details of both current and new holders.

- Explain the reason for transfer.

- Attach supporting documents (ID, legal approvals, etc.).

- Send via certified mail, email, or through the insurer's portal.

- Request confirmation of receipt and completion.

Requirements and Prerequisites Before Sending the Letter

- Complete policy details including numbers and holder information.

- Identification documents of both current and new policyholders.

- Legal documentation, if required (e.g., corporate resolutions, death certificate).

- Authorization letters for third-party requests.

Formatting Guidelines for Insurance Transfer Letters

- Length: concise but comprehensive (1–2 pages maximum).

- Tone: professional and formal.

- Style: clear, precise, and direct.

- Mode: email, physical letter, or insurer’s online submission portal.

- Include subject, salutation, main content, and closing signature.

After Sending an Insurance Transfer Letter

- Follow up with the insurer to confirm receipt.

- Verify that the policy transfer has been processed correctly.

- Maintain copies of all submitted documents and correspondence.

- Ensure the new policyholder receives all relevant information.

Tricks and Tips for Efficient Insurance Transfers

- Include all necessary documents in the first submission to avoid delays.

- Clearly highlight the policy number and new holder details.

- Use formal headings and bullet points to improve readability.

- Request acknowledgment and estimated processing time from the insurer.

Common Mistakes to Avoid in Insurance Transfer Letters

- Providing incomplete or incorrect policy information.

- Failing to attach required identification or legal documents.

- Using informal language in official communications.

- Not requesting confirmation of the transfer completion.

Elements and Structure of an Insurance Transfer Letter

- Subject line indicating purpose.

- Salutation addressing the correct department or person.

- Introduction stating intent to transfer.

- Detailed policy information.

- Reason for transfer.

- List of attached documents.

- Closing with signature and contact information.

Compare and Contrast Insurance Transfer Letters with Other Methods

- Written Letter vs. Online Portal: Letters are formal and can include explanations; portals are faster but may not allow detailed explanations.

- Letters vs. Phone Requests: Letters provide documentation and legal standing; phone requests are informal and may require follow-up.

- Similarities: Both communicate intent to transfer and require verification.

- Differences: Letters ensure a traceable record; other methods may be more immediate but less formal.

Download Word Doc

Download Word Doc

Download PDF

Download PDF