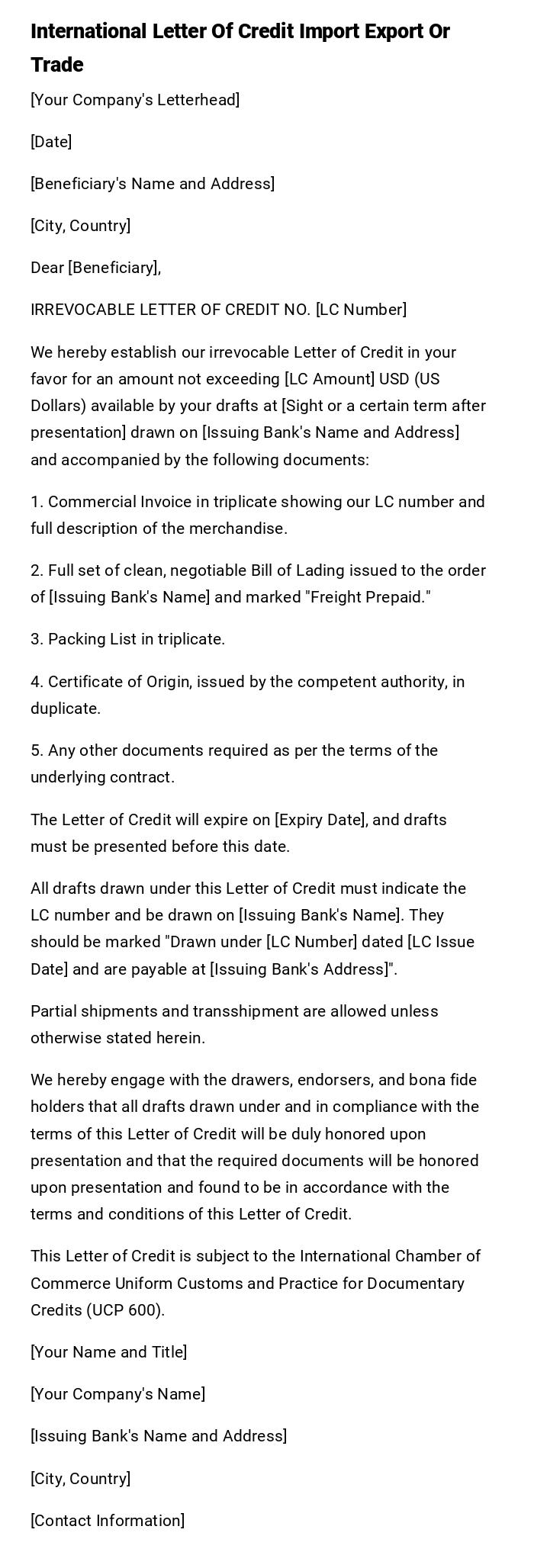

International Letter Of Credit Import Export Or Trade

[Your Company's Letterhead]

[Date]

[Beneficiary's Name and Address]

[City, Country]

Dear [Beneficiary],

IRREVOCABLE LETTER OF CREDIT NO. [LC Number]

We hereby establish our irrevocable Letter of Credit in your favor for an amount not exceeding [LC Amount] USD (US Dollars) available by your drafts at [Sight or a certain term after presentation] drawn on [Issuing Bank's Name and Address] and accompanied by the following documents:

1. Commercial Invoice in triplicate showing our LC number and full description of the merchandise.

2. Full set of clean, negotiable Bill of Lading issued to the order of [Issuing Bank's Name] and marked "Freight Prepaid."

3. Packing List in triplicate.

4. Certificate of Origin, issued by the competent authority, in duplicate.

5. Any other documents required as per the terms of the underlying contract.

The Letter of Credit will expire on [Expiry Date], and drafts must be presented before this date.

All drafts drawn under this Letter of Credit must indicate the LC number and be drawn on [Issuing Bank's Name]. They should be marked "Drawn under [LC Number] dated [LC Issue Date] and are payable at [Issuing Bank's Address]".

Partial shipments and transshipment are allowed unless otherwise stated herein.

We hereby engage with the drawers, endorsers, and bona fide holders that all drafts drawn under and in compliance with the terms of this Letter of Credit will be duly honored upon presentation and that the required documents will be honored upon presentation and found to be in accordance with the terms and conditions of this Letter of Credit.

This Letter of Credit is subject to the International Chamber of Commerce Uniform Customs and Practice for Documentary Credits (UCP 600).

[Your Name and Title]

[Your Company's Name]

[Issuing Bank's Name and Address]

[City, Country]

[Contact Information]

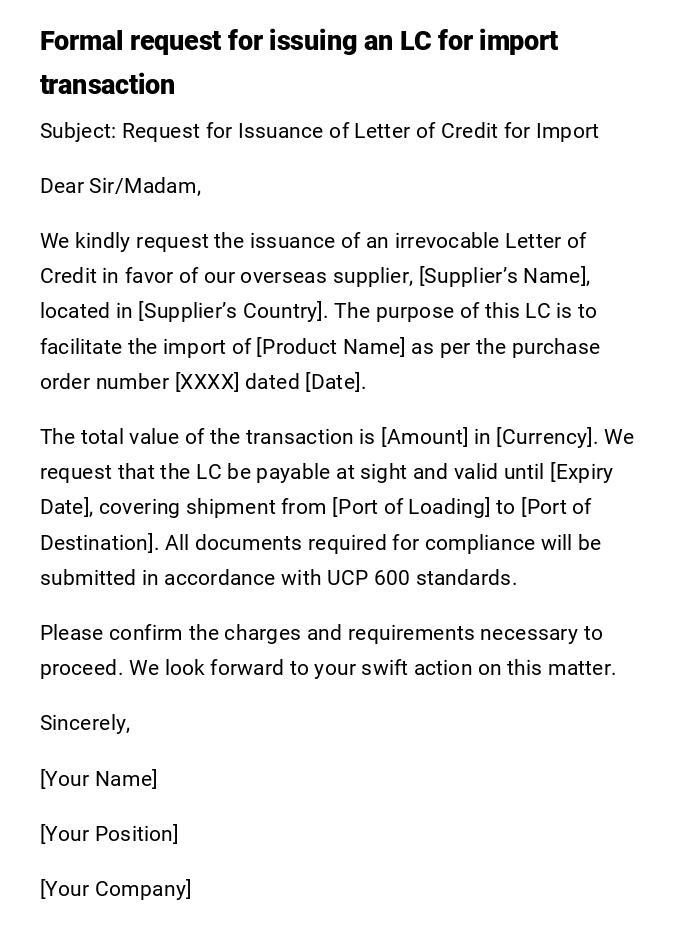

Formal Letter of Credit Request for Import Transaction

Subject: Request for Issuance of Letter of Credit for Import

Dear Sir/Madam,

We kindly request the issuance of an irrevocable Letter of Credit in favor of our overseas supplier, [Supplier’s Name], located in [Supplier’s Country]. The purpose of this LC is to facilitate the import of [Product Name] as per the purchase order number [XXXX] dated [Date].

The total value of the transaction is [Amount] in [Currency]. We request that the LC be payable at sight and valid until [Expiry Date], covering shipment from [Port of Loading] to [Port of Destination]. All documents required for compliance will be submitted in accordance with UCP 600 standards.

Please confirm the charges and requirements necessary to proceed. We look forward to your swift action on this matter.

Sincerely,

[Your Name]

[Your Position]

[Your Company]

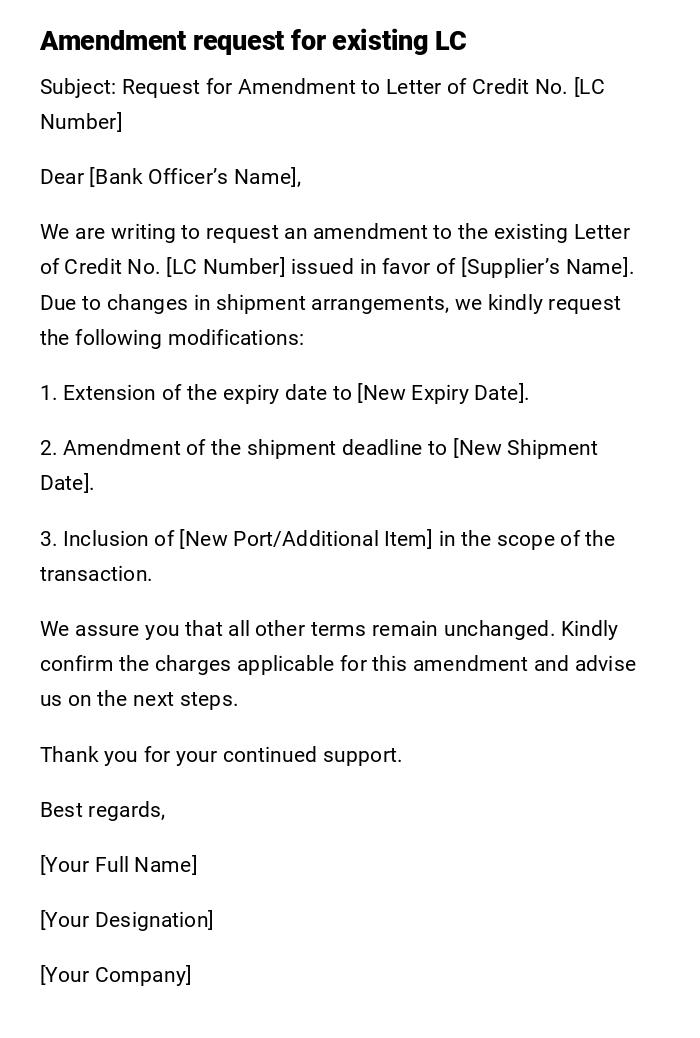

Letter of Credit Amendment Request (Professional Tone)

Subject: Request for Amendment to Letter of Credit No. [LC Number]

Dear [Bank Officer’s Name],

We are writing to request an amendment to the existing Letter of Credit No. [LC Number] issued in favor of [Supplier’s Name]. Due to changes in shipment arrangements, we kindly request the following modifications:

1. Extension of the expiry date to [New Expiry Date].

2. Amendment of the shipment deadline to [New Shipment Date].

3. Inclusion of [New Port/Additional Item] in the scope of the transaction.

We assure you that all other terms remain unchanged. Kindly confirm the charges applicable for this amendment and advise us on the next steps.

Thank you for your continued support.

Best regards,

[Your Full Name]

[Your Designation]

[Your Company]

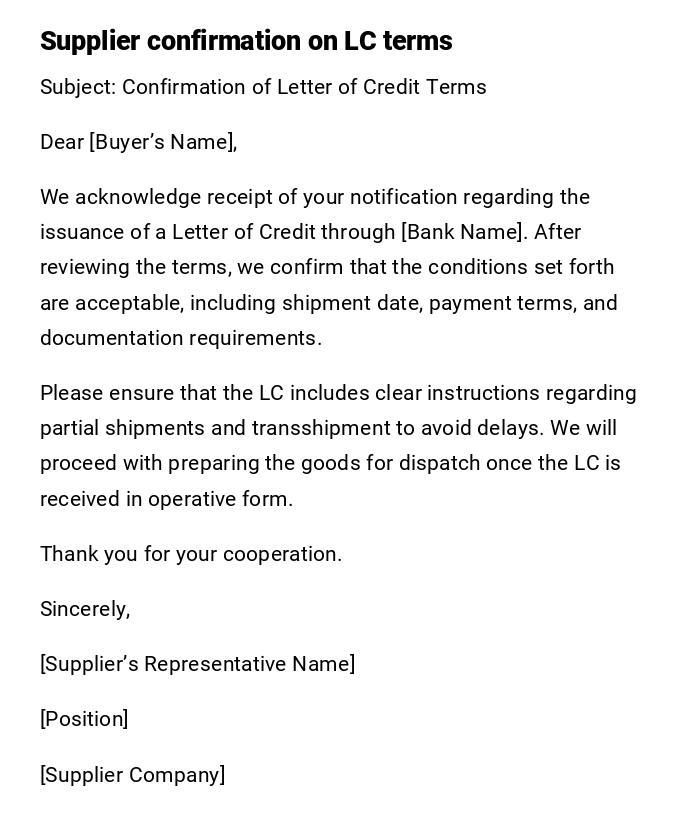

Supplier Confirmation Letter Regarding LC Terms (Serious Tone)

Subject: Confirmation of Letter of Credit Terms

Dear [Buyer’s Name],

We acknowledge receipt of your notification regarding the issuance of a Letter of Credit through [Bank Name]. After reviewing the terms, we confirm that the conditions set forth are acceptable, including shipment date, payment terms, and documentation requirements.

Please ensure that the LC includes clear instructions regarding partial shipments and transshipment to avoid delays. We will proceed with preparing the goods for dispatch once the LC is received in operative form.

Thank you for your cooperation.

Sincerely,

[Supplier’s Representative Name]

[Position]

[Supplier Company]

Preliminary LC Request Email for Trade Negotiations

Subject: Preliminary Request for Letter of Credit Arrangement

Dear [Bank Officer’s Name],

We are in the process of finalizing a trade agreement with [Overseas Supplier] for the import of [Goods/Materials]. Before concluding the contract, we would like to inquire about the procedures, costs, and timelines involved in arranging a Letter of Credit through your institution.

Please provide us with the requirements for initiating such a facility, including margin deposits, credit assessment, and related charges. This will assist us in negotiating with our supplier on more concrete terms.

Your early response will be highly appreciated.

Best regards,

[Your Name]

[Your Position]

[Your Company]

Letter of Credit Discrepancy Notice (Official Tone)

Subject: Notice of Discrepancy in Letter of Credit Documents

Dear [Supplier’s Name],

We regret to inform you that upon examination of the documents presented under Letter of Credit No. [LC Number], certain discrepancies have been identified. Specifically:

1. The invoice value does not match the LC amount.

2. The shipment date exceeded the latest permissible date.

3. The Bill of Lading lacks required endorsements.

Due to these discrepancies, our bank has placed the documents on hold. Kindly rectify the issues or provide clarification at the earliest to avoid delays in payment release.

We appreciate your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Position]

[Your Company]

LC Settlement Confirmation Letter (Formal and Neutral)

Subject: Confirmation of LC Settlement

Dear [Supplier’s Name],

We are pleased to confirm that payment under Letter of Credit No. [LC Number] has been duly settled by our bank on [Date]. The documents were found compliant, and the amount of [Currency/Amount] has been credited to your account as per the agreed terms.

We thank you for your cooperation throughout this transaction and look forward to future business opportunities together.

Best regards,

[Your Name]

[Your Position]

[Your Company]

Casual Message to Supplier About Upcoming LC

Subject: Update on Letter of Credit Process

Hi [Supplier’s Name],

Just a quick note to let you know that we’ve already initiated the process with our bank for the Letter of Credit covering the order of [Product]. The bank has all the documents they need, and the LC should be operative in a few days.

I’ll update you once it’s confirmed. Thanks for your patience, and looking forward to smooth shipping.

Best,

[Your Name]

Letter Requesting Bank to Negotiate LC Documents

Subject: Request for Negotiation of Documents Under LC

Dear [Bank Officer’s Name],

We request your assistance in negotiating the documents presented under Letter of Credit No. [LC Number] issued by [Issuing Bank]. The documents were presented by [Beneficiary Name] and appear to be in compliance with the LC terms.

Kindly process the negotiation and credit our account at the earliest possible time. Please advise us if any charges or additional steps are required.

Thank you for your continued support.

Sincerely,

[Your Name]

[Your Position]

[Your Company]

What is an International Letter of Credit and Why Do You Need It?

An international letter of credit (LC) is a financial instrument issued by a bank guaranteeing payment to an exporter once specific conditions are met. It acts as a safety net in global trade, ensuring that both buyers and sellers reduce their risk. Importers use it to assure suppliers of secure payment, while exporters rely on it to protect against non-payment.

Who Should Send an International LC Letter?

These letters are typically sent by the importer (buyer) or their bank to initiate, amend, or settle the LC. In some cases, the exporter (seller) may draft a letter requesting clarification, confirmation, or amendment. Banks, as intermediaries, may also issue official notices to both parties.

When Are LC Letters Required in Trade?

LC letters are triggered in scenarios such as:

- When initiating a new trade agreement requiring secure payment.

- When amending LC terms like shipment dates or values.

- When discrepancies in documents are discovered.

- When confirming settlement of payment under LC.

- During pre-negotiation phases to clarify procedures and costs.

Formatting Guidelines for LC Letters

- Length: Keep it concise but detailed (1–2 pages).

- Tone: Use a formal, professional tone unless writing casual updates.

- Style: Stick to clear, precise, and factual language.

- Mode: Banks prefer official printed letters, while suppliers often accept email.

- Etiquette: Always reference LC numbers, amounts, and dates clearly.

Requirements and Prerequisites Before Writing an LC Letter

Before drafting an LC-related letter:

- Ensure you have the LC number, supplier details, and transaction value.

- Confirm UCP 600 compliance for documentation.

- Have copies of invoices, bills of lading, and contracts ready.

- Review the purchase agreement for accuracy.

- Verify shipment schedules and deadlines.

Common Mistakes in LC Letters to Avoid

- Forgetting to include the LC reference number.

- Using vague language that can cause misinterpretation.

- Not double-checking transaction details (amounts, dates, ports).

- Ignoring discrepancies instead of addressing them.

- Mixing informal tone in official banking correspondence.

Elements and Structure of a Proper LC Letter

An effective LC letter should include:

- Subject line stating the purpose.

- Reference to LC number and date.

- Clear description of requested action (issue, amend, confirm).

- Supporting details like amounts, ports, and shipment dates.

- A closing statement thanking the recipient or requesting confirmation.

Follow-up After Sending an LC Letter

After sending the letter:

- Confirm receipt with the bank or supplier.

- Track whether the LC is amended, issued, or settled.

- Keep copies of all correspondence for audit and compliance.

- If discrepancies exist, ensure they are corrected quickly.

- Maintain communication until the transaction is fully completed.

Pros and Cons of Using Letters of Credit in Trade

Pros:

- Reduces payment risk for exporters.

- Builds trust between trading partners.

- Provides legal and financial protection.

Cons:

- High bank fees and charges.

- Time-consuming document checks.

- Complex procedures leading to possible delays.

Tricks and Tips for Writing Effective LC Letters

- Always use precise terminology aligned with UCP 600 standards.

- Double-check all financial figures before sending.

- Reference all relevant purchase orders.

- Use a professional but cooperative tone with banks.

- Keep a template library for faster drafting of common letters.

Download Word Doc

Download Word Doc

Download PDF

Download PDF