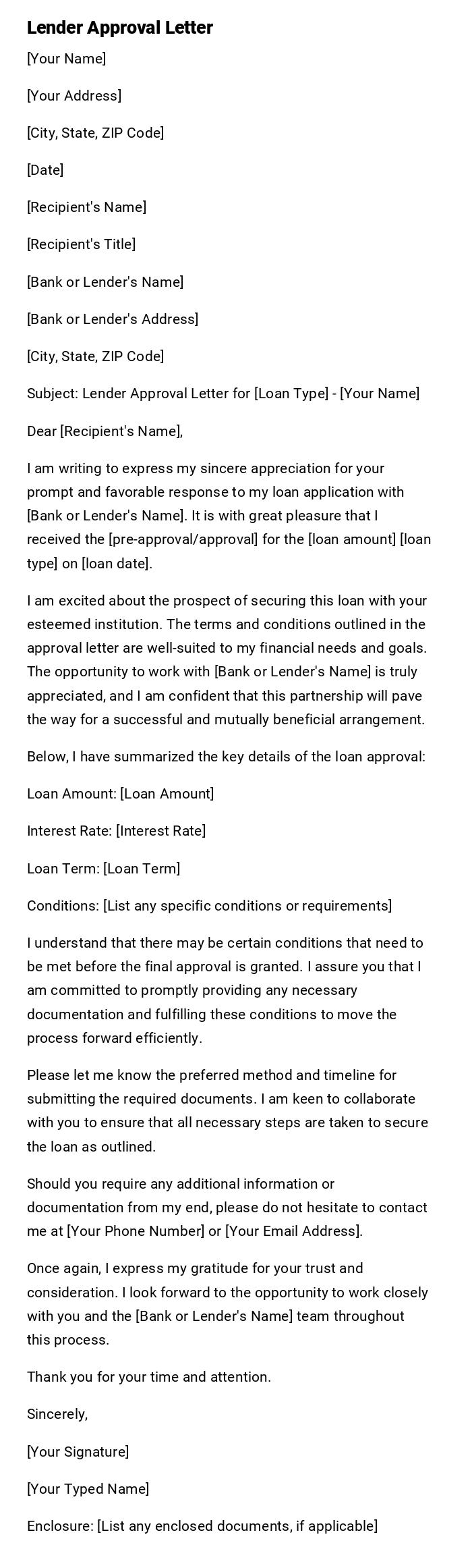

Lender Approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Recipient's Name]

[Recipient's Title]

[Bank or Lender's Name]

[Bank or Lender's Address]

[City, State, ZIP Code]

Subject: Lender Approval Letter for [Loan Type] - [Your Name]

Dear [Recipient's Name],

I am writing to express my sincere appreciation for your prompt and favorable response to my loan application with [Bank or Lender's Name]. It is with great pleasure that I received the [pre-approval/approval] for the [loan amount] [loan type] on [loan date].

I am excited about the prospect of securing this loan with your esteemed institution. The terms and conditions outlined in the approval letter are well-suited to my financial needs and goals. The opportunity to work with [Bank or Lender's Name] is truly appreciated, and I am confident that this partnership will pave the way for a successful and mutually beneficial arrangement.

Below, I have summarized the key details of the loan approval:

Loan Amount: [Loan Amount]

Interest Rate: [Interest Rate]

Loan Term: [Loan Term]

Conditions: [List any specific conditions or requirements]

I understand that there may be certain conditions that need to be met before the final approval is granted. I assure you that I am committed to promptly providing any necessary documentation and fulfilling these conditions to move the process forward efficiently.

Please let me know the preferred method and timeline for submitting the required documents. I am keen to collaborate with you to ensure that all necessary steps are taken to secure the loan as outlined.

Should you require any additional information or documentation from my end, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

Once again, I express my gratitude for your trust and consideration. I look forward to the opportunity to work closely with you and the [Bank or Lender's Name] team throughout this process.

Thank you for your time and attention.

Sincerely,

[Your Signature]

[Your Typed Name]

Enclosure: [List any enclosed documents, if applicable]

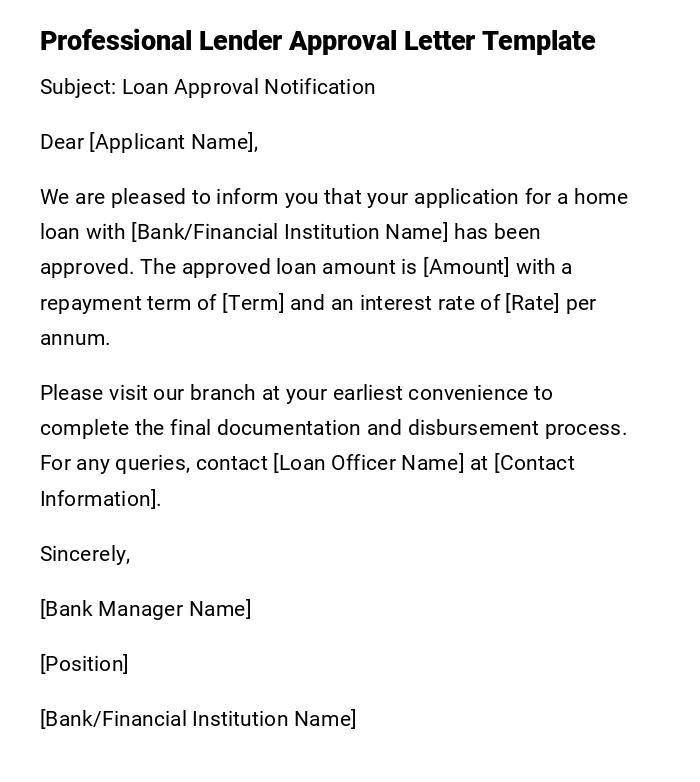

Formal Lender Approval Letter for Home Loan

Subject: Loan Approval Notification

Dear [Applicant Name],

We are pleased to inform you that your application for a home loan with [Bank/Financial Institution Name] has been approved. The approved loan amount is [Amount] with a repayment term of [Term] and an interest rate of [Rate] per annum.

Please visit our branch at your earliest convenience to complete the final documentation and disbursement process. For any queries, contact [Loan Officer Name] at [Contact Information].

Sincerely,

[Bank Manager Name]

[Position]

[Bank/Financial Institution Name]

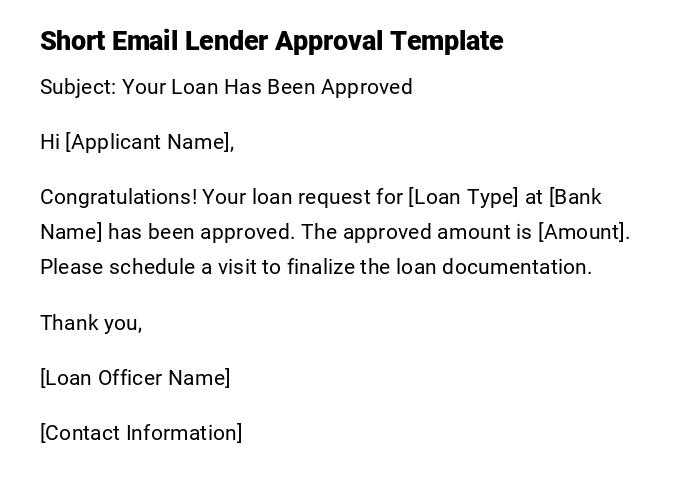

Quick Email Lender Approval Notification

Subject: Your Loan Has Been Approved

Hi [Applicant Name],

Congratulations! Your loan request for [Loan Type] at [Bank Name] has been approved. The approved amount is [Amount]. Please schedule a visit to finalize the loan documentation.

Thank you,

[Loan Officer Name]

[Contact Information]

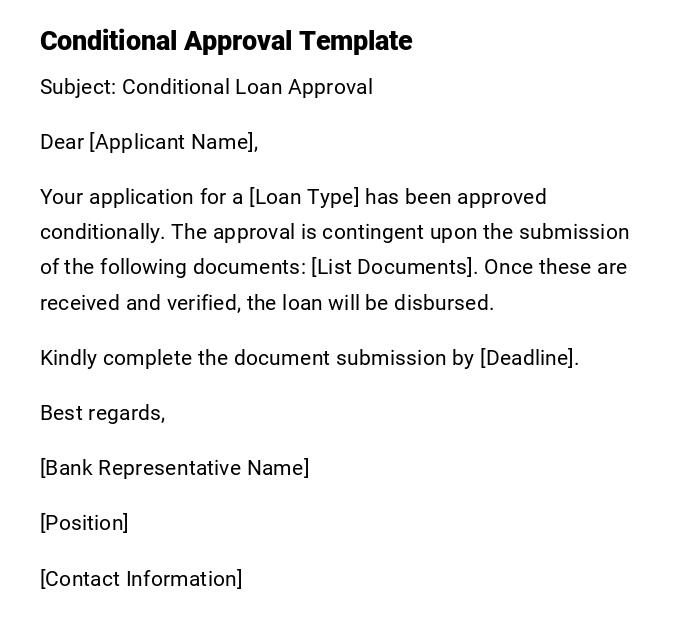

Conditional Lender Approval Letter

Subject: Conditional Loan Approval

Dear [Applicant Name],

Your application for a [Loan Type] has been approved conditionally. The approval is contingent upon the submission of the following documents: [List Documents]. Once these are received and verified, the loan will be disbursed.

Kindly complete the document submission by [Deadline].

Best regards,

[Bank Representative Name]

[Position]

[Contact Information]

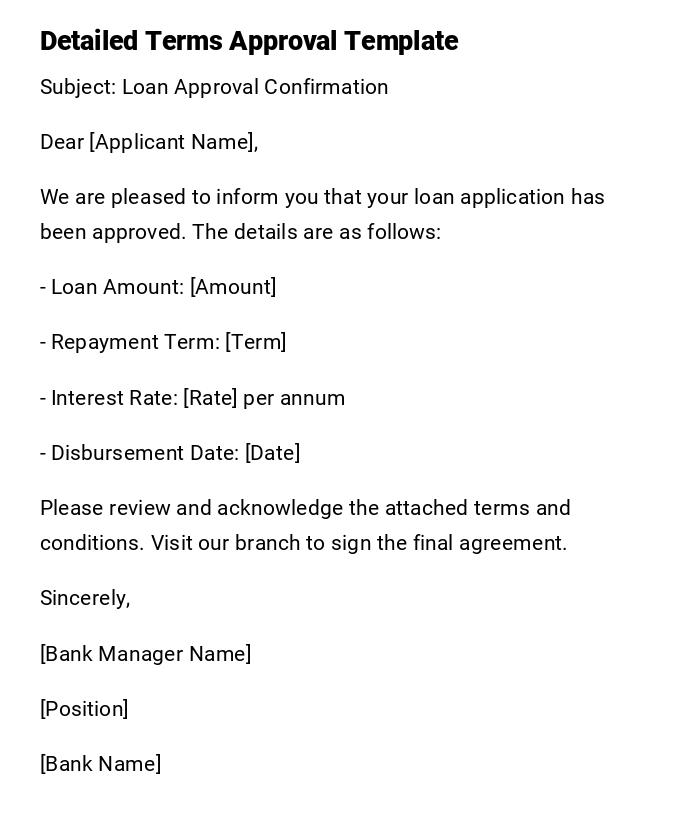

Formal Lender Approval Letter with Terms and Conditions

Subject: Loan Approval Confirmation

Dear [Applicant Name],

We are pleased to inform you that your loan application has been approved. The details are as follows:

- Loan Amount: [Amount]

- Repayment Term: [Term]

- Interest Rate: [Rate] per annum

- Disbursement Date: [Date]

Please review and acknowledge the attached terms and conditions. Visit our branch to sign the final agreement.

Sincerely,

[Bank Manager Name]

[Position]

[Bank Name]

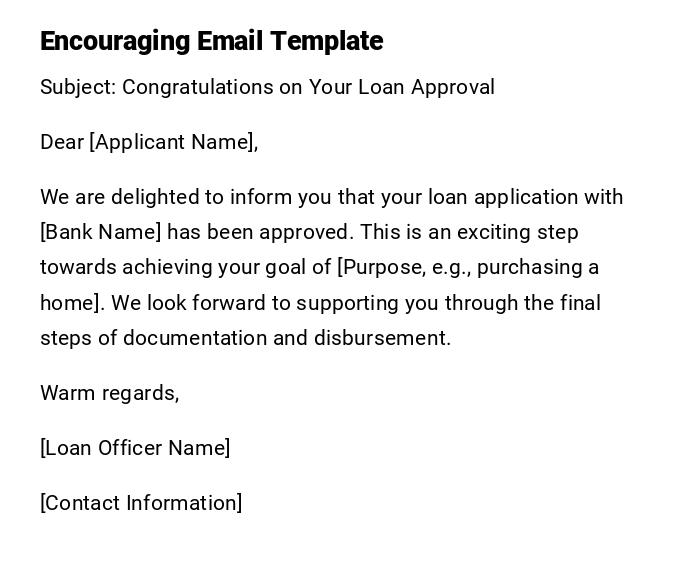

Heartfelt and Encouraging Lender Approval Email

Subject: Congratulations on Your Loan Approval

Dear [Applicant Name],

We are delighted to inform you that your loan application with [Bank Name] has been approved. This is an exciting step towards achieving your goal of [Purpose, e.g., purchasing a home]. We look forward to supporting you through the final steps of documentation and disbursement.

Warm regards,

[Loan Officer Name]

[Contact Information]

What / Why: Purpose of a Lender Approval Letter

- To officially communicate that a loan application has been approved.

- Provides the borrower with loan details, conditions, and next steps.

- Serves as an official record for both the lender and borrower.

Who Should Send a Lender Approval Letter

- Loan officer or credit officer responsible for the application.

- Bank manager or authorized representative for formal approval letters.

- Lender’s administrative department for official correspondence.

Whom the Letter Should Be Addressed To

- The applicant or borrower whose loan has been approved.

- Optional cc to co-applicants or guarantors if applicable.

- HR or legal department internally for record-keeping.

When to Send a Lender Approval Letter

- After completing the evaluation and credit check process.

- When all internal approvals have been obtained.

- Immediately after conditional or full approval to facilitate documentation.

How to Write and Send a Lender Approval Letter

- Include applicant details, loan amount, interest rate, and repayment terms.

- Mention any conditions or documents required if it is conditional approval.

- Use a formal or professional tone; emails can be used for quicker communication.

- Ensure clarity and correctness to avoid misinterpretation.

Requirements and Prerequisites Before Sending

- Complete loan evaluation and internal approval.

- Verify applicant information, documents, and creditworthiness.

- Prepare loan terms, repayment schedule, and disbursement instructions.

- Ensure compliance with internal and legal standards.

Formatting Guidelines

- Length: one to two pages for detailed letters; single-paragraph emails for quick notifications.

- Tone: formal, professional, and clear; optional encouraging tone for emails.

- Structure: subject, greeting, approval statement, loan details, next steps, closing.

- Mode: printed letter for official records, email for faster communication.

After Sending / Follow-up

- Schedule appointment for document signing and disbursement.

- Confirm receipt and acknowledgment by the borrower.

- Maintain copy for lender’s internal records.

- Follow up on any conditional requirements promptly.

Common Mistakes to Avoid

- Omitting loan terms or repayment details.

- Using vague language about approval conditions.

- Sending approval before final verification or internal consent.

- Failing to mention required documents for conditional approvals.

Elements and Structure of a Lender Approval Letter

- Subject line indicating loan approval.

- Greeting addressing the applicant.

- Statement of approval with loan details (amount, term, interest rate).

- Conditional clauses if any.

- Instructions for next steps and documentation.

- Closing with bank representative signature.

- Contact information for queries.

Tricks and Tips for Writing Effective Lender Approval Letters

- Keep the letter clear and concise.

- Include exact figures and dates to avoid confusion.

- Use professional but approachable tone for customer satisfaction.

- Highlight any conditions clearly to prevent delays.

- Consider digital signatures for faster approval processing.

Pros and Cons of Sending a Lender Approval Letter

Pros:

- Provides official confirmation of loan approval.

- Clarifies terms and conditions for the borrower.

- Builds trust and professional relationship.

Cons:

- Errors or omissions can lead to disputes.

- Premature approval communication may cause misunderstandings.

Compare and Contrast with Similar Letters

- Differs from loan pre-approval letters, which are conditional and not final.

- Similar to mortgage or personal loan approval letters in structure.

- Approval letters are formal and legally significant, unlike casual verbal notifications.

Does it Require Attestation or Authorization?

- Usually requires signature of authorized bank officer.

- May require official bank letterhead or digital verification for formal records.

- No external notary is generally needed unless specified by law or policy.

Download Word Doc

Download Word Doc

Download PDF

Download PDF