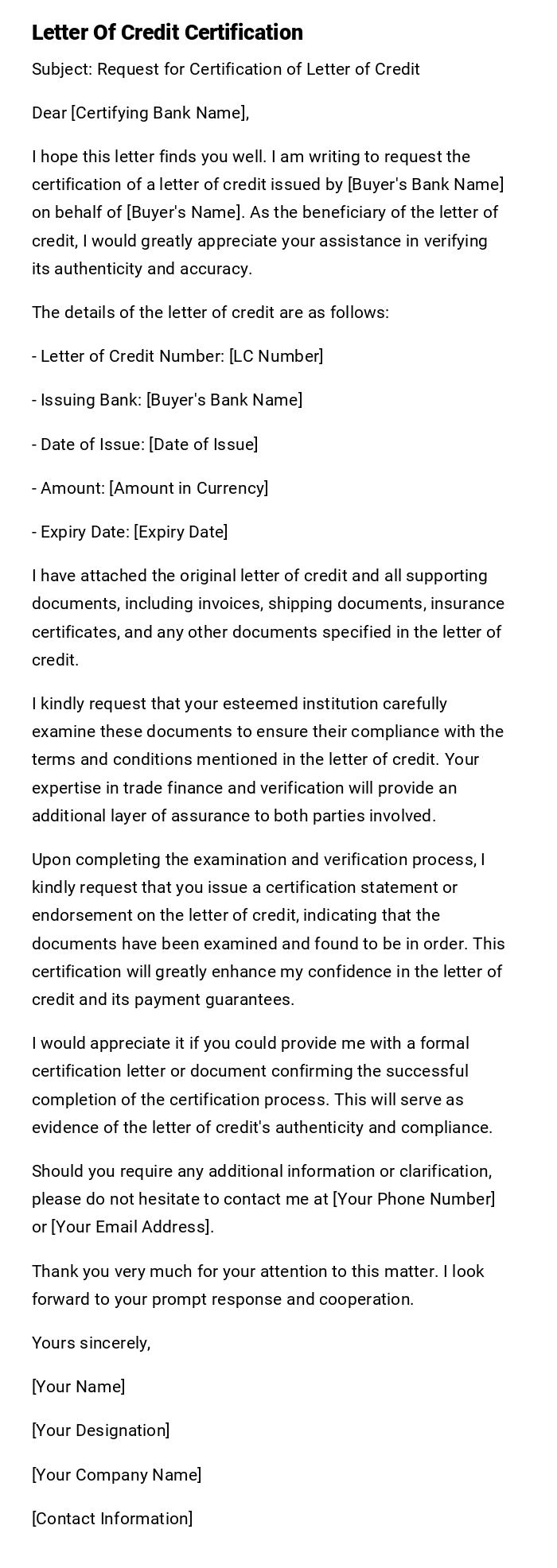

Letter Of Credit Certification

Subject: Request for Certification of Letter of Credit

Dear [Certifying Bank Name],

I hope this letter finds you well. I am writing to request the certification of a letter of credit issued by [Buyer's Bank Name] on behalf of [Buyer's Name]. As the beneficiary of the letter of credit, I would greatly appreciate your assistance in verifying its authenticity and accuracy.

The details of the letter of credit are as follows:

- Letter of Credit Number: [LC Number]

- Issuing Bank: [Buyer's Bank Name]

- Date of Issue: [Date of Issue]

- Amount: [Amount in Currency]

- Expiry Date: [Expiry Date]

I have attached the original letter of credit and all supporting documents, including invoices, shipping documents, insurance certificates, and any other documents specified in the letter of credit.

I kindly request that your esteemed institution carefully examine these documents to ensure their compliance with the terms and conditions mentioned in the letter of credit. Your expertise in trade finance and verification will provide an additional layer of assurance to both parties involved.

Upon completing the examination and verification process, I kindly request that you issue a certification statement or endorsement on the letter of credit, indicating that the documents have been examined and found to be in order. This certification will greatly enhance my confidence in the letter of credit and its payment guarantees.

I would appreciate it if you could provide me with a formal certification letter or document confirming the successful completion of the certification process. This will serve as evidence of the letter of credit's authenticity and compliance.

Should you require any additional information or clarification, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

Thank you very much for your attention to this matter. I look forward to your prompt response and cooperation.

Yours sincerely,

[Your Name]

[Your Designation]

[Your Company Name]

[Contact Information]

A letter of credit (LC) certification refers to the process of verifying the authenticity and accuracy of a letter of credit issued by a financial institution. When a seller (beneficiary) receives a letter of credit from a buyer's bank (issuing bank), they may choose to have it certified by another bank or financial institution to ensure its validity and credibility.

The certification process involves the following steps:

-

Submission of Documents: The seller presents the original letter of credit along with all supporting documents to the certifying bank. These documents typically include invoices, shipping documents, insurance certificates, and any other documents specified in the letter of credit.

-

Examination of Documents: The certifying bank carefully examines the letter of credit and accompanying documents to ensure that they comply with the terms and conditions mentioned in the letter of credit. They verify the accuracy of the information, completeness of the documents, and adherence to any applicable international trade regulations.

-

Certification: If the certifying bank is satisfied with the authenticity and compliance of the documents, they provide a certification statement or endorsement on the letter of credit. This certification signifies that the documents have been examined, found in order, and comply with the terms of the letter of credit.

-

Notification: The certifying bank then notifies the seller about the certification, usually through a certification letter or a similar document. This notification confirms that the letter of credit has been successfully verified and certified by the bank.

The certification of a letter of credit adds an additional layer of assurance for the seller by ensuring that the issuing bank's obligations will be fulfilled. It gives confidence to the seller that they will receive payment as specified in the letter of credit, subject to the terms and conditions mentioned therein.

It's important to note that the process and requirements for letter of credit certification may vary based on the specific procedures followed by different banks or financial institutions.

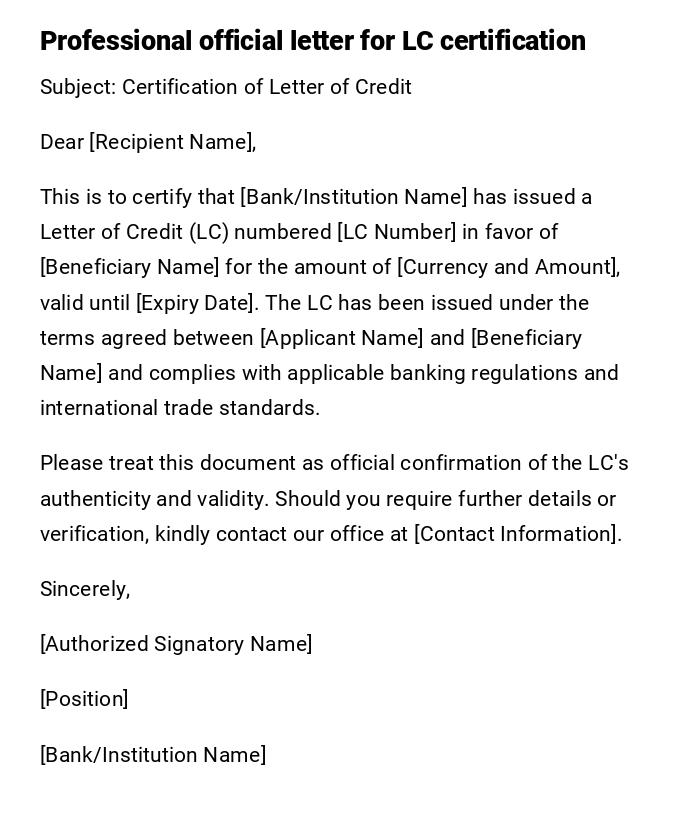

Formal Letter of Credit Certification

Subject: Certification of Letter of Credit

Dear [Recipient Name],

This is to certify that [Bank/Institution Name] has issued a Letter of Credit (LC) numbered [LC Number] in favor of [Beneficiary Name] for the amount of [Currency and Amount], valid until [Expiry Date]. The LC has been issued under the terms agreed between [Applicant Name] and [Beneficiary Name] and complies with applicable banking regulations and international trade standards.

Please treat this document as official confirmation of the LC's authenticity and validity. Should you require further details or verification, kindly contact our office at [Contact Information].

Sincerely,

[Authorized Signatory Name]

[Position]

[Bank/Institution Name]

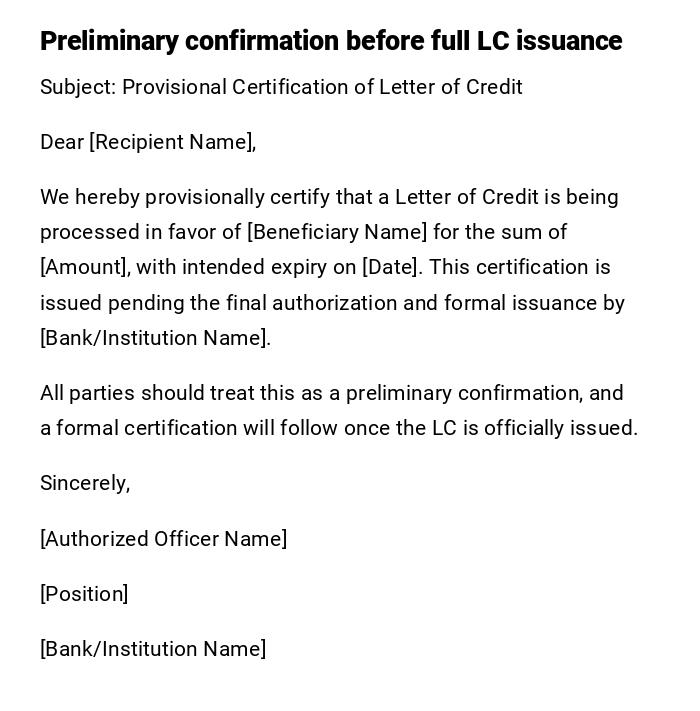

Provisional Letter of Credit Certification

Subject: Provisional Certification of Letter of Credit

Dear [Recipient Name],

We hereby provisionally certify that a Letter of Credit is being processed in favor of [Beneficiary Name] for the sum of [Amount], with intended expiry on [Date]. This certification is issued pending the final authorization and formal issuance by [Bank/Institution Name].

All parties should treat this as a preliminary confirmation, and a formal certification will follow once the LC is officially issued.

Sincerely,

[Authorized Officer Name]

[Position]

[Bank/Institution Name]

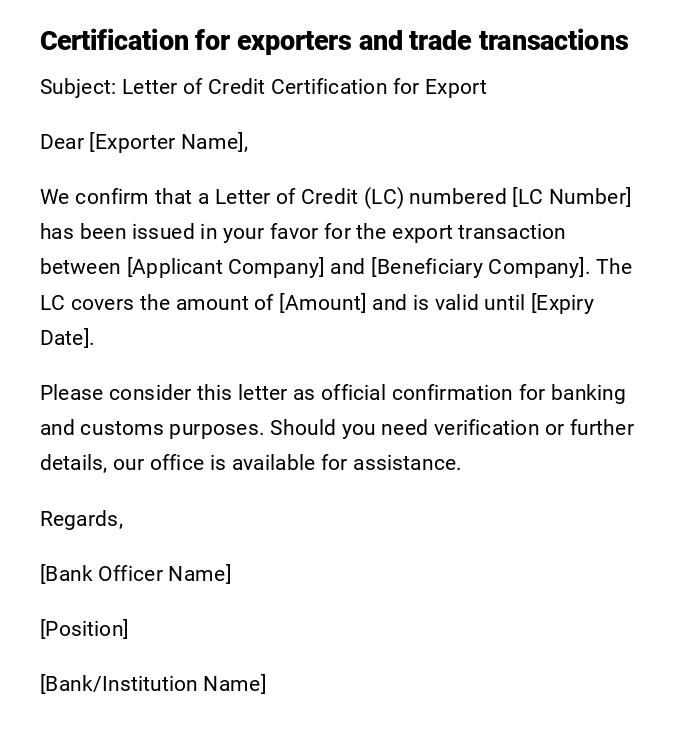

Letter of Credit Certification for Export Transactions

Subject: Letter of Credit Certification for Export

Dear [Exporter Name],

We confirm that a Letter of Credit (LC) numbered [LC Number] has been issued in your favor for the export transaction between [Applicant Company] and [Beneficiary Company]. The LC covers the amount of [Amount] and is valid until [Expiry Date].

Please consider this letter as official confirmation for banking and customs purposes. Should you need verification or further details, our office is available for assistance.

Regards,

[Bank Officer Name]

[Position]

[Bank/Institution Name]

Certification Letter for Irrevocable Letter of Credit

Subject: Certification of Irrevocable Letter of Credit

Dear [Recipient Name],

This letter certifies that an irrevocable Letter of Credit, LC number [LC Number], has been issued by [Bank Name] in favor of [Beneficiary Name] for [Amount], valid until [Expiry Date]. The LC terms cannot be amended or canceled without prior consent of all parties involved.

This certification may be used for banking, insurance, or customs purposes as required. For any queries regarding the LC, please contact our office.

Sincerely,

[Authorized Signatory Name]

[Position]

[Bank/Institution Name]

Letter of Credit Certification for Import Transactions

Subject: Certification of Letter of Credit for Import

Dear [Importer Name],

We certify that a Letter of Credit (LC) numbered [LC Number] has been issued in your favor to facilitate the import of goods from [Exporter Company]. The LC covers [Amount] and remains valid until [Expiry Date].

This certification confirms that all banking formalities have been completed and the LC is enforceable under international trade regulations. Please contact us for any verification or further documentation.

Sincerely,

[Bank Officer Name]

[Position]

[Bank/Institution Name]

Digital Letter of Credit Certification Email

Subject: Electronic Certification of Letter of Credit

Dear [Recipient Name],

This email serves as confirmation that a Letter of Credit numbered [LC Number] has been issued in favor of [Beneficiary Name] for the amount of [Amount], effective [Date]. All terms and conditions have been verified, and the LC is valid until [Expiry Date].

Please retain this electronic certification for your records. For verification or inquiries, contact our office at [Email/Phone].

Best regards,

[Authorized Signatory Name]

[Position]

[Bank/Institution Name]

Urgent Letter of Credit Certification

Subject: Urgent Certification of Letter of Credit

Dear [Recipient Name],

We hereby urgently certify that Letter of Credit [LC Number] has been issued in favor of [Beneficiary Name] for [Amount]. The LC is valid until [Expiry Date] and can be used immediately for the intended transaction.

Kindly acknowledge receipt of this certification and contact our office for any required verification or documents to expedite the process.

Sincerely,

[Bank Officer Name]

[Position]

[Bank/Institution Name]

Formal Confirmation of Letter of Credit Certification

Subject: Confirmation of Letter of Credit Certification

Dear [Recipient Name],

This letter confirms that Letter of Credit [LC Number] has been issued by [Bank Name] in favor of [Beneficiary Name] in the amount of [Amount]. The LC is valid until [Expiry Date] and complies with all relevant banking and trade regulations.

This confirmation can be used for submission to customs, insurance, and regulatory authorities as required. Please contact our office for any clarifications or additional documentation.

Regards,

[Authorized Signatory Name]

[Position]

[Bank/Institution Name]

What is a Letter of Credit Certification and Why it is Needed

A Letter of Credit (LC) certification is an official document that verifies the issuance and validity of a Letter of Credit.

- Confirms authenticity and details of LC for beneficiary and financial institutions

- Ensures compliance with international trade and banking standards

- Facilitates secure import/export transactions

- Provides legal and financial assurance to all parties involved

Who Should Issue a Letter of Credit Certification

- Banks and financial institutions issuing the LC

- Authorized officers or signatories within the bank

- Corporate treasury departments for internal confirmation

- Trade finance departments for export/import operations

Whom the Letter of Credit Certification is Addressed To

- Beneficiaries of the LC (exporters, suppliers)

- Applicants of the LC (importers, buyers)

- Customs authorities or insurance companies requiring verification

- Regulatory or financial auditors when documentation is needed

When to Send a Letter of Credit Certification

- Immediately after LC issuance

- For urgent trade transactions requiring proof of LC

- During import/export documentation submission

- For provisional or preliminary confirmation before full LC issuance

How to Write and Send a Letter of Credit Certification

- Verify LC details: number, amount, validity, parties involved

- Use a professional, formal tone suitable for banking documentation

- Include all necessary information: LC number, date, expiry, beneficiary, amount

- Send via official letterhead for printed letters or secured email for digital communication

- Ensure signature and authorization of bank officer or institution

Formatting Guidelines for Letter of Credit Certification

- Length: 150–300 words

- Tone: Professional, formal, serious

- Structure: Subject, salutation, confirmation statement, LC details, contact information, closing

- Attach supporting documents if needed

- Include official stamp or signature for authenticity

Requirements and Prerequisites Before Issuing

- Confirmation of LC issuance and banking compliance

- Verification of all transaction parties and amounts

- Authorization from bank or financial institution

- Supporting trade documents, if applicable

- Internal approval for provisional or urgent certification

After Sending / Follow-Up Actions

- Confirm receipt by beneficiary and applicant

- Retain copies for bank records and audits

- Provide additional documents upon request

- Monitor LC validity and advise parties if amendments occur

Pros and Cons of Sending a Letter of Credit Certification

Pros:

- Provides proof of LC for all parties

- Facilitates smooth trade transactions

- Enhances trust between importer, exporter, and banks

Cons:

- Requires precise verification to avoid errors

- Delays or inaccuracies can impact trade timelines

- May need formal authorization and compliance checks

Common Mistakes to Avoid in Letter of Credit Certification

- Omitting LC number or critical details

- Using informal or unclear language

- Failing to confirm signature or authority of the issuer

- Sending without verifying dates, amounts, or beneficiary names

- Not retaining copies for bank records

Elements and Structure of a Letter of Credit Certification

- Subject line indicating LC certification

- Recipient's name and designation

- Clear statement confirming LC issuance

- LC number, amount, date, expiry, and beneficiary details

- Contact information for verification

- Authorized signature and bank stamp

- Optional attachment of related trade documents

Tricks and Tips for Effective Letter of Credit Certification

- Always double-check all LC details before certification

- Use official letterhead or secured digital platform

- Include clear contact points for verification

- Specify if the LC is irrevocable or provisional

- Keep records for internal and audit purposes

Does a Letter of Credit Certification Require Attestation or Authorization?

- Yes, requires signature of authorized bank officer or financial institution

- May require corporate seal or official stamp

- Internal approval ensures compliance with trade and banking regulations

- Digital certifications should be sent from secure, verified channels

Download Word Doc

Download Word Doc

Download PDF

Download PDF