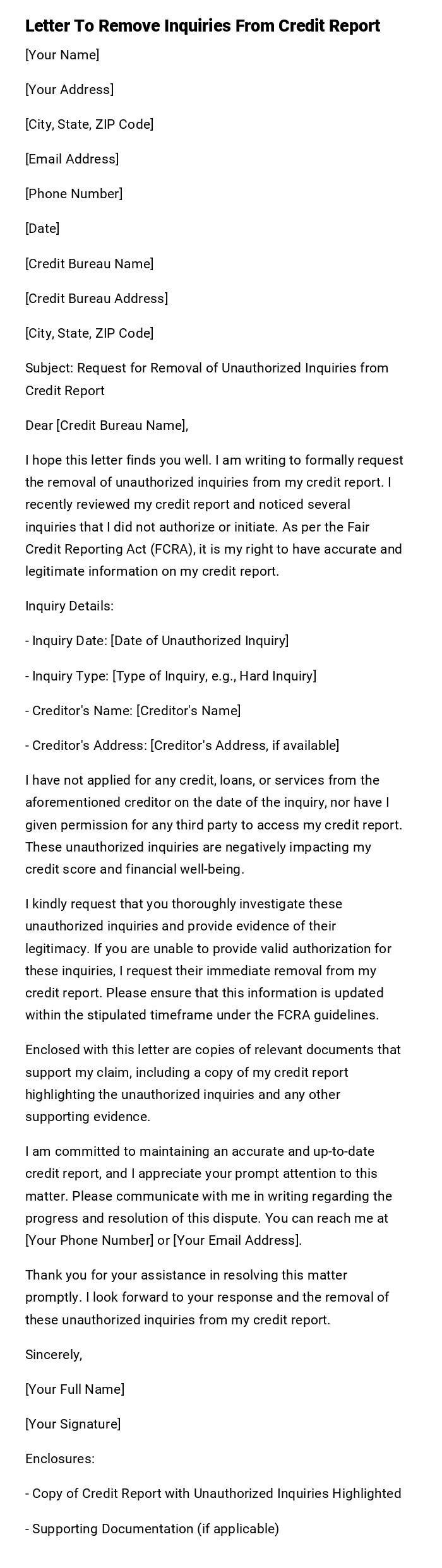

Letter To Remove Inquiries From Credit Report

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

[City, State, ZIP Code]

Subject: Request for Removal of Unauthorized Inquiries from Credit Report

Dear [Credit Bureau Name],

I hope this letter finds you well. I am writing to formally request the removal of unauthorized inquiries from my credit report. I recently reviewed my credit report and noticed several inquiries that I did not authorize or initiate. As per the Fair Credit Reporting Act (FCRA), it is my right to have accurate and legitimate information on my credit report.

Inquiry Details:

- Inquiry Date: [Date of Unauthorized Inquiry]

- Inquiry Type: [Type of Inquiry, e.g., Hard Inquiry]

- Creditor's Name: [Creditor's Name]

- Creditor's Address: [Creditor's Address, if available]

I have not applied for any credit, loans, or services from the aforementioned creditor on the date of the inquiry, nor have I given permission for any third party to access my credit report. These unauthorized inquiries are negatively impacting my credit score and financial well-being.

I kindly request that you thoroughly investigate these unauthorized inquiries and provide evidence of their legitimacy. If you are unable to provide valid authorization for these inquiries, I request their immediate removal from my credit report. Please ensure that this information is updated within the stipulated timeframe under the FCRA guidelines.

Enclosed with this letter are copies of relevant documents that support my claim, including a copy of my credit report highlighting the unauthorized inquiries and any other supporting evidence.

I am committed to maintaining an accurate and up-to-date credit report, and I appreciate your prompt attention to this matter. Please communicate with me in writing regarding the progress and resolution of this dispute. You can reach me at [Your Phone Number] or [Your Email Address].

Thank you for your assistance in resolving this matter promptly. I look forward to your response and the removal of these unauthorized inquiries from my credit report.

Sincerely,

[Your Full Name]

[Your Signature]

Enclosures:

- Copy of Credit Report with Unauthorized Inquiries Highlighted

- Supporting Documentation (if applicable)

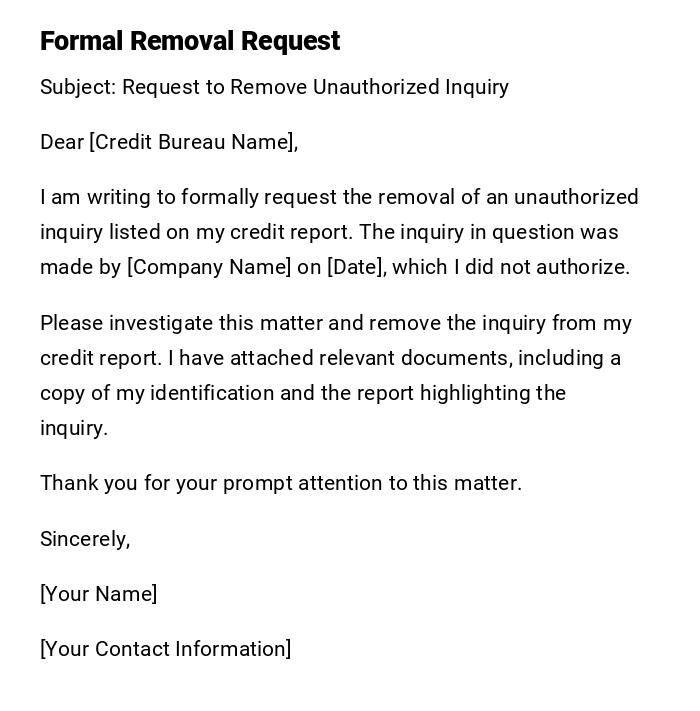

Formal Letter to Remove Unauthorized Inquiry

Subject: Request to Remove Unauthorized Inquiry

Dear [Credit Bureau Name],

I am writing to formally request the removal of an unauthorized inquiry listed on my credit report. The inquiry in question was made by [Company Name] on [Date], which I did not authorize.

Please investigate this matter and remove the inquiry from my credit report. I have attached relevant documents, including a copy of my identification and the report highlighting the inquiry.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Contact Information]

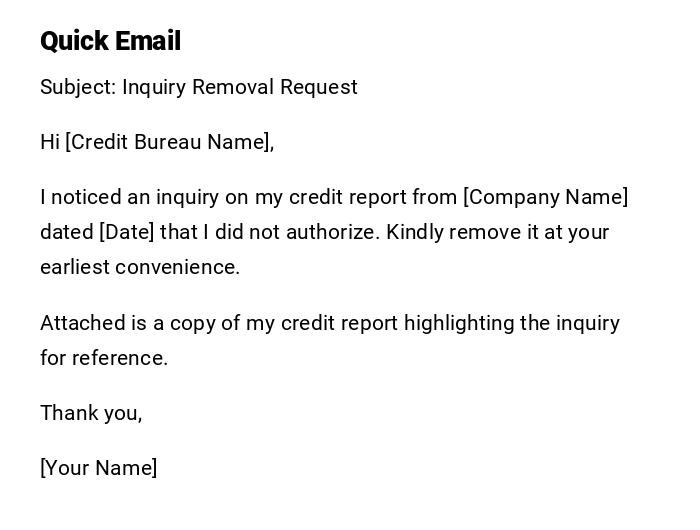

Quick Email Request to Remove Inquiries

Subject: Inquiry Removal Request

Hi [Credit Bureau Name],

I noticed an inquiry on my credit report from [Company Name] dated [Date] that I did not authorize. Kindly remove it at your earliest convenience.

Attached is a copy of my credit report highlighting the inquiry for reference.

Thank you,

[Your Name]

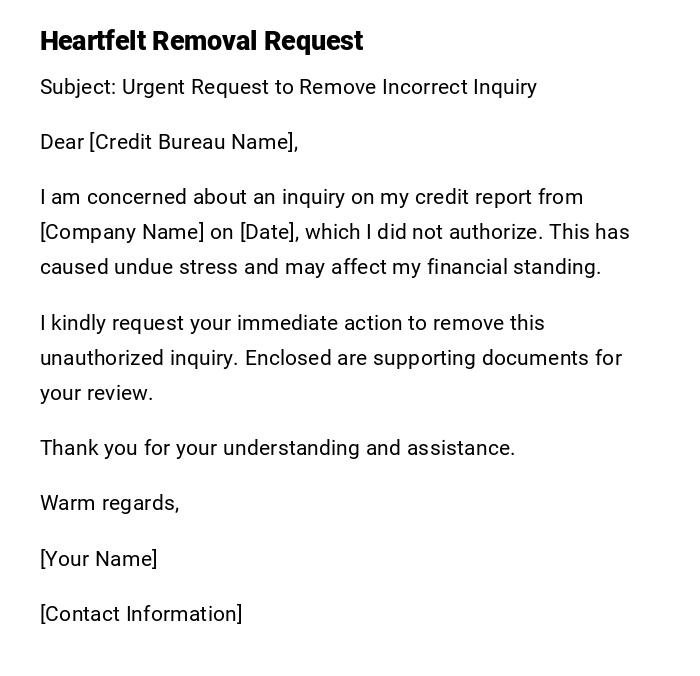

Heartfelt Letter Requesting Inquiry Removal

Subject: Urgent Request to Remove Incorrect Inquiry

Dear [Credit Bureau Name],

I am concerned about an inquiry on my credit report from [Company Name] on [Date], which I did not authorize. This has caused undue stress and may affect my financial standing.

I kindly request your immediate action to remove this unauthorized inquiry. Enclosed are supporting documents for your review.

Thank you for your understanding and assistance.

Warm regards,

[Your Name]

[Contact Information]

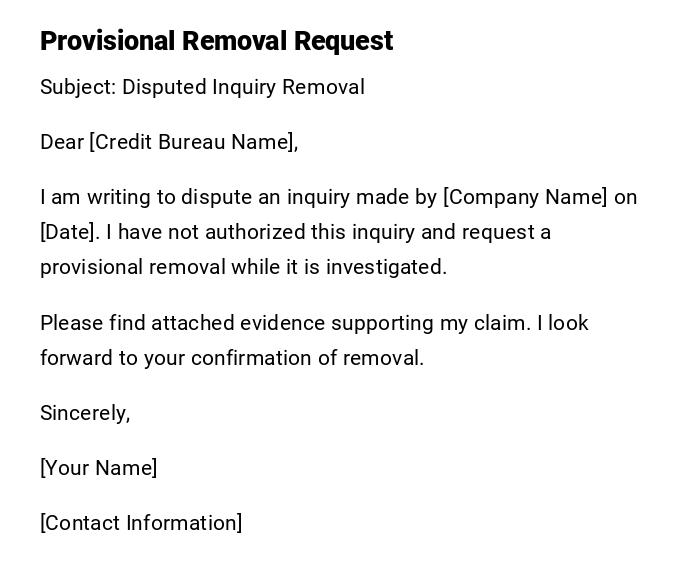

Provisional Letter to Remove Disputed Inquiry

Subject: Disputed Inquiry Removal

Dear [Credit Bureau Name],

I am writing to dispute an inquiry made by [Company Name] on [Date]. I have not authorized this inquiry and request a provisional removal while it is investigated.

Please find attached evidence supporting my claim. I look forward to your confirmation of removal.

Sincerely,

[Your Name]

[Contact Information]

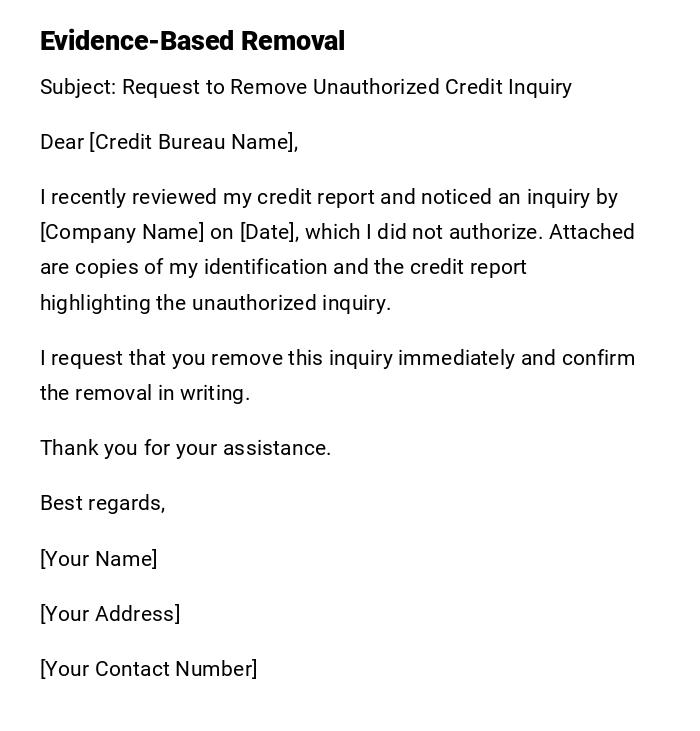

Formal Letter With Evidence for Inquiry Removal

Subject: Request to Remove Unauthorized Credit Inquiry

Dear [Credit Bureau Name],

I recently reviewed my credit report and noticed an inquiry by [Company Name] on [Date], which I did not authorize. Attached are copies of my identification and the credit report highlighting the unauthorized inquiry.

I request that you remove this inquiry immediately and confirm the removal in writing.

Thank you for your assistance.

Best regards,

[Your Name]

[Your Address]

[Your Contact Number]

What is a Letter to Remove Inquiries From Credit Report and Why You Need It

A letter to remove inquiries from a credit report is a formal request sent to credit bureaus to eliminate unauthorized or incorrect credit inquiries.

Purpose:

- Protect your credit score from inaccurate or unauthorized inquiries.

- Ensure your credit report accurately reflects your financial activity.

- Resolve potential disputes that could affect loan or credit approvals.

Who Should Send a Letter to Remove Inquiries

- Individuals whose credit reports contain unauthorized or incorrect inquiries.

- Anyone who identifies errors in their credit history that may affect financial credibility.

- Consumers who need to proactively maintain accurate credit information.

Whom Should the Letter Be Addressed To

- Major credit bureaus such as Experian, Equifax, and TransUnion.

- Financial institutions or lenders listed as making the inquiry if required.

- Compliance or customer service departments that handle credit disputes.

When Should You Send a Letter to Remove Credit Inquiries

- Immediately after noticing unauthorized inquiries on your credit report.

- During credit disputes or if an inquiry negatively impacts credit applications.

- As part of routine credit report checks to maintain accuracy.

How to Write and Send a Letter to Remove Inquiries

- Clearly identify the unauthorized inquiry with company name and date.

- State that you did not authorize the inquiry.

- Attach supporting documentation (ID, copy of credit report).

- Request removal and a written confirmation.

- Send via certified mail for printed letters or secure email if accepted digitally.

Requirements and Prerequisites Before Sending

- A recent copy of your credit report.

- Identification documents to verify your identity.

- Clear evidence of the unauthorized inquiry (highlighted report).

- Contact information for follow-up and correspondence.

Formatting Guidelines for a Credit Inquiry Removal Letter

- Length: One page is sufficient for printed letters; concise email format is acceptable.

- Tone: Formal, polite, and professional.

- Wording: Clear and factual; avoid emotional exaggeration.

- Attachments: Include copies of identification and report with highlighted inquiries.

- Mode: Certified mail for official correspondence; email if bureau allows digital submissions.

Common Mistakes to Avoid When Writing

- Omitting crucial details such as inquiry date or company name.

- Sending without supporting documents.

- Using aggressive or threatening language.

- Sending multiple duplicate letters without waiting for response.

Elements and Structure of the Letter

- Subject line indicating inquiry removal request.

- Greeting to the appropriate credit bureau or department.

- Identification of the unauthorized inquiry.

- Statement of non-authorization.

- Request for removal and confirmation.

- Attachments list (ID, credit report).

- Closing and signature with contact information.

After Sending / Follow-up

- Keep copies of the letter and attachments for records.

- Confirm receipt with the credit bureau.

- Follow up after a reasonable time (typically 30 days).

- Respond to any requests for additional information promptly.

Tricks and Tips for Faster Processing

- Send via certified mail to ensure delivery confirmation.

- Clearly highlight unauthorized inquiries in attachments.

- Maintain polite and concise language to avoid delays.

- Include a specific request for written confirmation of removal.

- Keep all communications organized in one file for reference.

Compare and Contrast: Letter vs. Online Dispute

- Letters provide a formal, documented request with attachments.

- Online dispute forms may be faster but sometimes less detailed.

- Letters can include detailed explanations and evidence, increasing chances of removal.

- Both methods can be used together for efficiency and proof of correspondence.

Download Word Doc

Download Word Doc

Download PDF

Download PDF