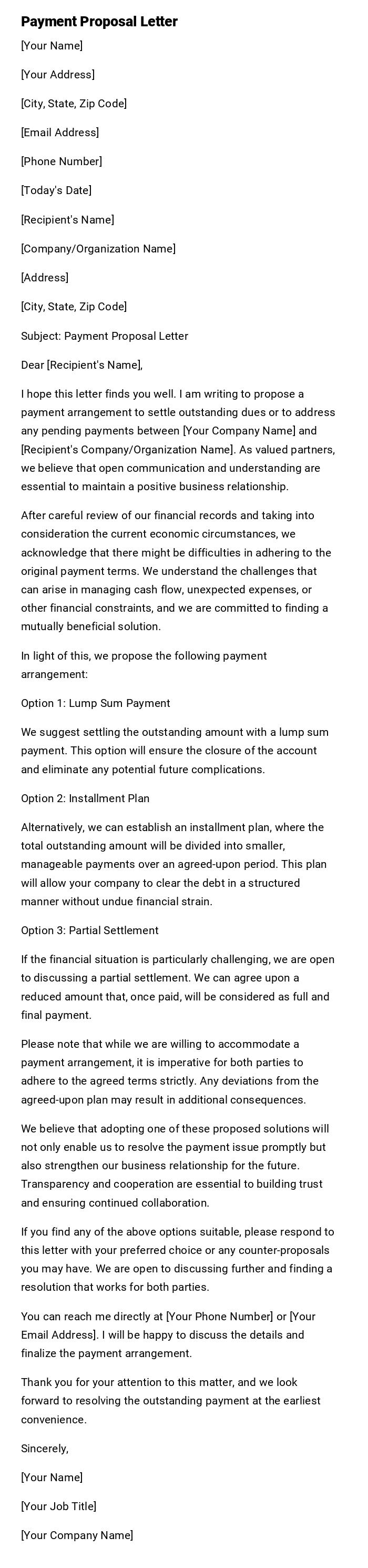

Payment Proposal Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Today's Date]

[Recipient's Name]

[Company/Organization Name]

[Address]

[City, State, Zip Code]

Subject: Payment Proposal Letter

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to propose a payment arrangement to settle outstanding dues or to address any pending payments between [Your Company Name] and [Recipient's Company/Organization Name]. As valued partners, we believe that open communication and understanding are essential to maintain a positive business relationship.

After careful review of our financial records and taking into consideration the current economic circumstances, we acknowledge that there might be difficulties in adhering to the original payment terms. We understand the challenges that can arise in managing cash flow, unexpected expenses, or other financial constraints, and we are committed to finding a mutually beneficial solution.

In light of this, we propose the following payment arrangement:

Option 1: Lump Sum Payment

We suggest settling the outstanding amount with a lump sum payment. This option will ensure the closure of the account and eliminate any potential future complications.

Option 2: Installment Plan

Alternatively, we can establish an installment plan, where the total outstanding amount will be divided into smaller, manageable payments over an agreed-upon period. This plan will allow your company to clear the debt in a structured manner without undue financial strain.

Option 3: Partial Settlement

If the financial situation is particularly challenging, we are open to discussing a partial settlement. We can agree upon a reduced amount that, once paid, will be considered as full and final payment.

Please note that while we are willing to accommodate a payment arrangement, it is imperative for both parties to adhere to the agreed terms strictly. Any deviations from the agreed-upon plan may result in additional consequences.

We believe that adopting one of these proposed solutions will not only enable us to resolve the payment issue promptly but also strengthen our business relationship for the future. Transparency and cooperation are essential to building trust and ensuring continued collaboration.

If you find any of the above options suitable, please respond to this letter with your preferred choice or any counter-proposals you may have. We are open to discussing further and finding a resolution that works for both parties.

You can reach me directly at [Your Phone Number] or [Your Email Address]. I will be happy to discuss the details and finalize the payment arrangement.

Thank you for your attention to this matter, and we look forward to resolving the outstanding payment at the earliest convenience.

Sincerely,

[Your Name]

[Your Job Title]

[Your Company Name]

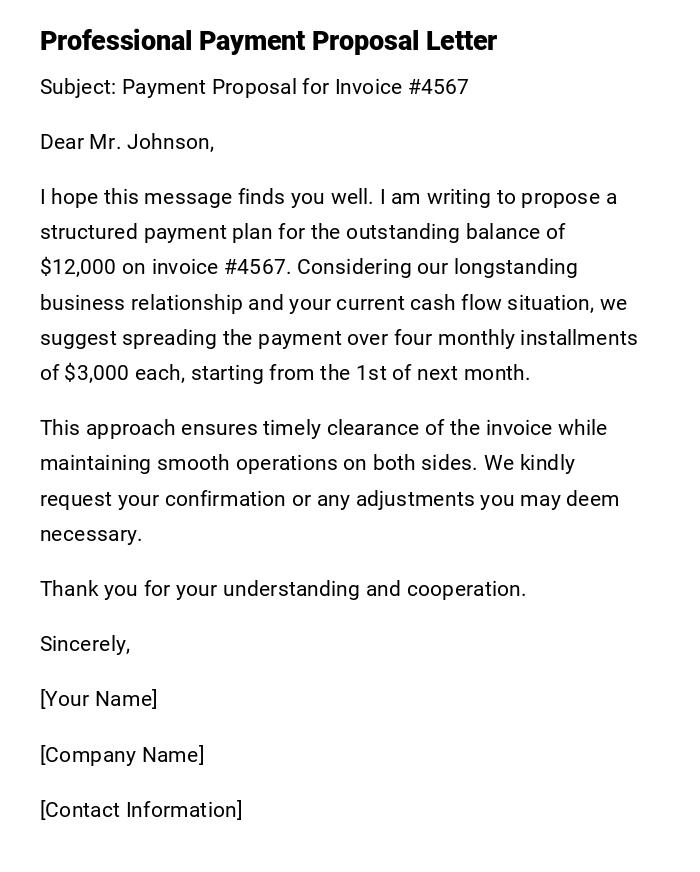

Professional Payment Proposal Letter

Subject: Payment Proposal for Invoice #4567

Dear Mr. Johnson,

I hope this message finds you well. I am writing to propose a structured payment plan for the outstanding balance of $12,000 on invoice #4567. Considering our longstanding business relationship and your current cash flow situation, we suggest spreading the payment over four monthly installments of $3,000 each, starting from the 1st of next month.

This approach ensures timely clearance of the invoice while maintaining smooth operations on both sides. We kindly request your confirmation or any adjustments you may deem necessary.

Thank you for your understanding and cooperation.

Sincerely,

[Your Name]

[Company Name]

[Contact Information]

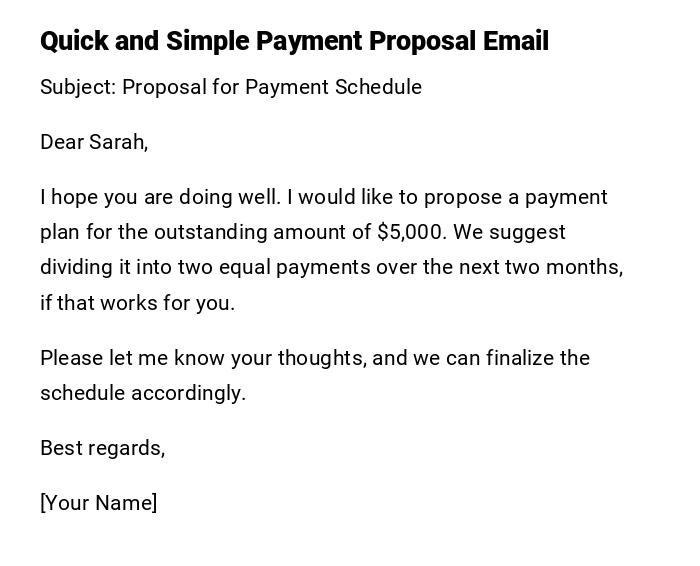

Quick and Simple Payment Proposal Email

Subject: Proposal for Payment Schedule

Dear Sarah,

I hope you are doing well. I would like to propose a payment plan for the outstanding amount of $5,000. We suggest dividing it into two equal payments over the next two months, if that works for you.

Please let me know your thoughts, and we can finalize the schedule accordingly.

Best regards,

[Your Name]

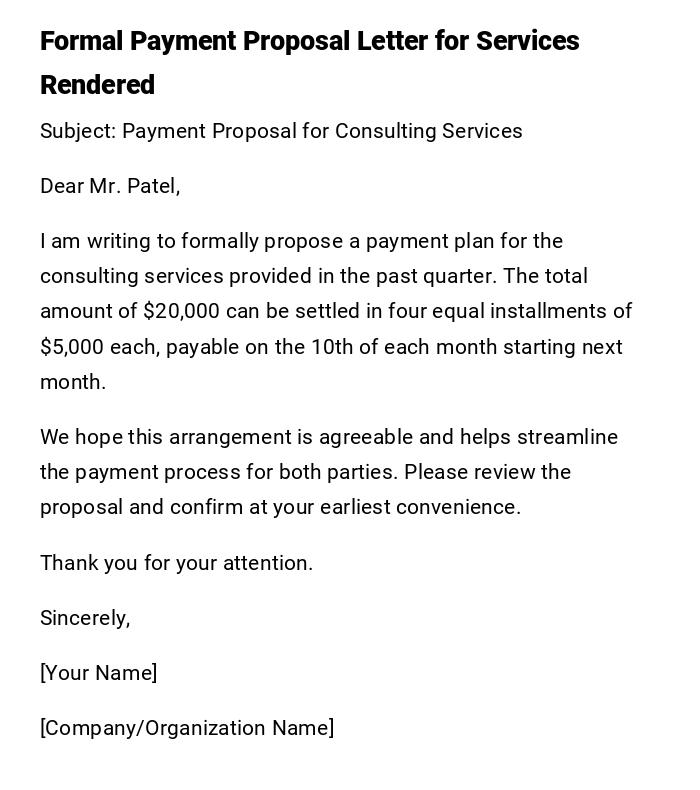

Formal Payment Proposal Letter for Services Rendered

Subject: Payment Proposal for Consulting Services

Dear Mr. Patel,

I am writing to formally propose a payment plan for the consulting services provided in the past quarter. The total amount of $20,000 can be settled in four equal installments of $5,000 each, payable on the 10th of each month starting next month.

We hope this arrangement is agreeable and helps streamline the payment process for both parties. Please review the proposal and confirm at your earliest convenience.

Thank you for your attention.

Sincerely,

[Your Name]

[Company/Organization Name]

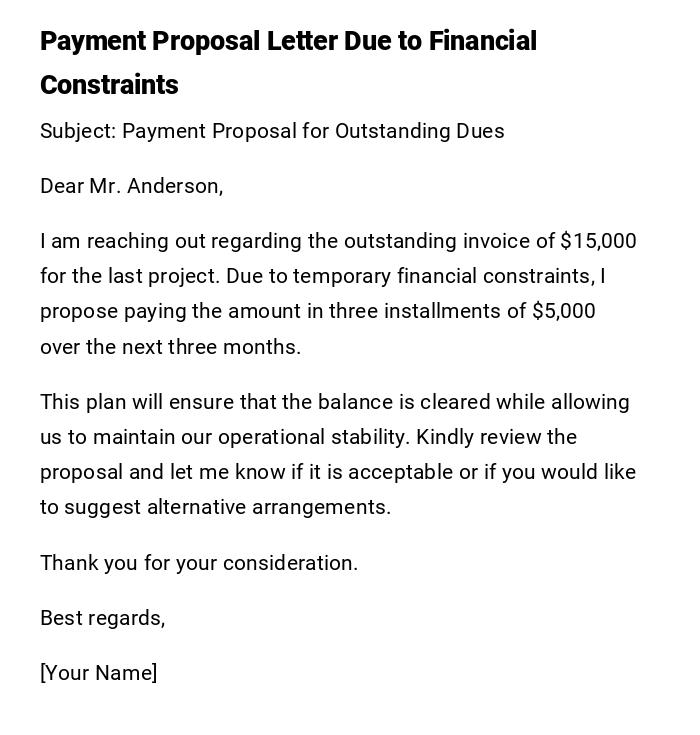

Payment Proposal Letter Due to Financial Constraints

Subject: Payment Proposal for Outstanding Dues

Dear Mr. Anderson,

I am reaching out regarding the outstanding invoice of $15,000 for the last project. Due to temporary financial constraints, I propose paying the amount in three installments of $5,000 over the next three months.

This plan will ensure that the balance is cleared while allowing us to maintain our operational stability. Kindly review the proposal and let me know if it is acceptable or if you would like to suggest alternative arrangements.

Thank you for your consideration.

Best regards,

[Your Name]

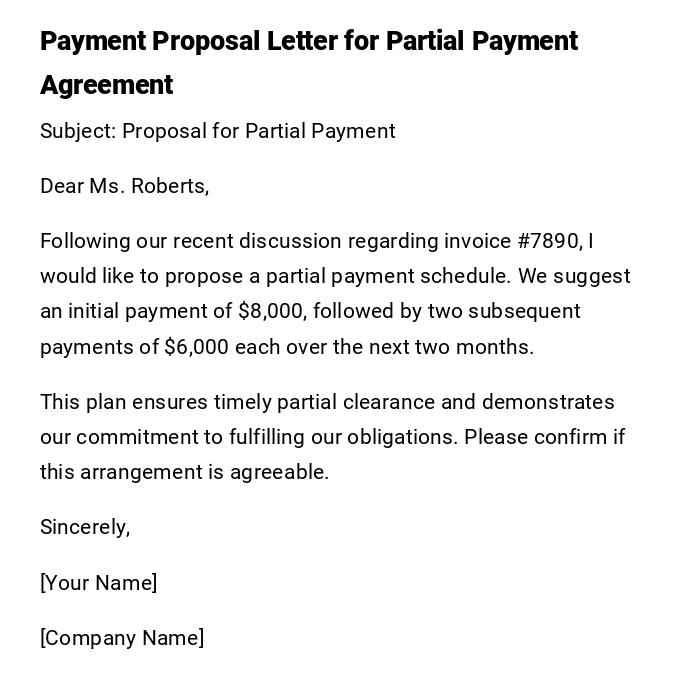

Payment Proposal Letter for Partial Payment Agreement

Subject: Proposal for Partial Payment

Dear Ms. Roberts,

Following our recent discussion regarding invoice #7890, I would like to propose a partial payment schedule. We suggest an initial payment of $8,000, followed by two subsequent payments of $6,000 each over the next two months.

This plan ensures timely partial clearance and demonstrates our commitment to fulfilling our obligations. Please confirm if this arrangement is agreeable.

Sincerely,

[Your Name]

[Company Name]

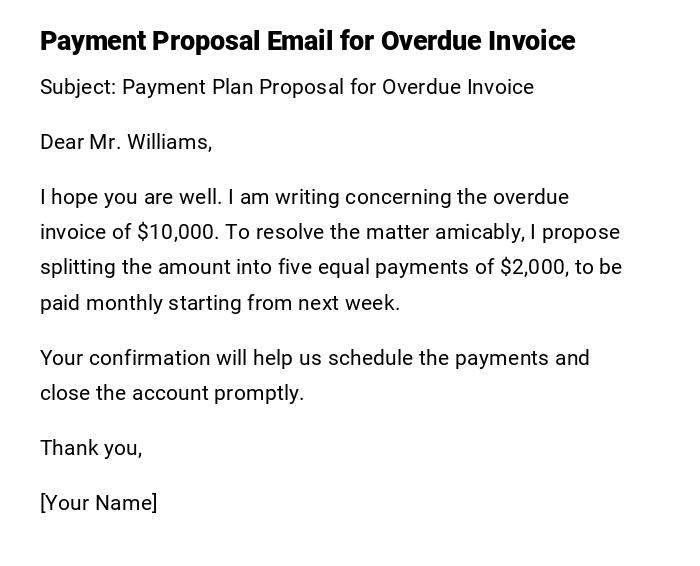

Payment Proposal Email for Overdue Invoice

Subject: Payment Plan Proposal for Overdue Invoice

Dear Mr. Williams,

I hope you are well. I am writing concerning the overdue invoice of $10,000. To resolve the matter amicably, I propose splitting the amount into five equal payments of $2,000, to be paid monthly starting from next week.

Your confirmation will help us schedule the payments and close the account promptly.

Thank you,

[Your Name]

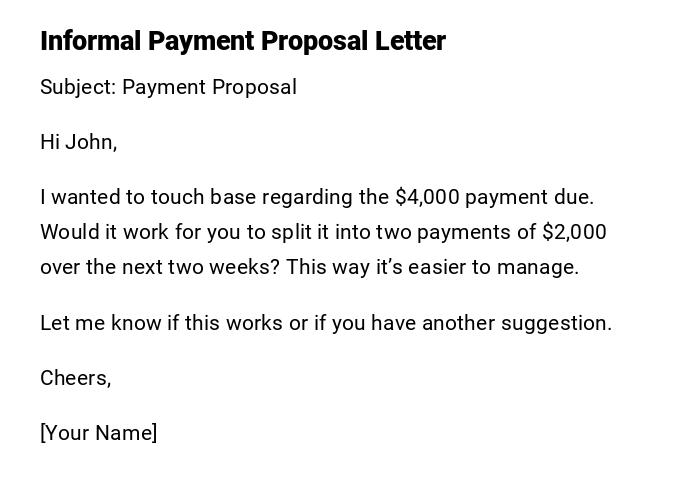

Informal Payment Proposal Letter

Subject: Payment Proposal

Hi John,

I wanted to touch base regarding the $4,000 payment due. Would it work for you to split it into two payments of $2,000 over the next two weeks? This way it’s easier to manage.

Let me know if this works or if you have another suggestion.

Cheers,

[Your Name]

Payment Proposal Letter for Contracted Work

Subject: Proposal for Payment Schedule – Contracted Work

Dear Mr. Lee,

I am writing in reference to the contract completed on September 30th. The total payment of $25,000 can be divided into five equal installments of $5,000 each, payable on the 15th of each month, starting October 15th.

We believe this schedule ensures fairness and timely settlement for both parties. Kindly confirm your acceptance or suggest any modifications.

Thank you for your cooperation.

Sincerely,

[Your Name]

[Company Name]

What is a Payment Proposal Letter and Why It Is Important

A payment proposal letter is a formal request sent to a client, vendor, or partner to suggest a structured plan for paying outstanding dues.

It is important because it:

- Maintains professional communication regarding debts.

- Demonstrates commitment to fulfilling financial obligations.

- Helps prevent disputes and misunderstandings.

- Allows both parties to agree on a manageable payment plan.

Who Should Send a Payment Proposal Letter

- The debtor or client who owes money.

- A business representative responsible for financial arrangements.

- Contractors or freelancers requesting installment plans.

- Companies negotiating with vendors or suppliers for delayed or partial payments.

Whom Should the Payment Proposal Letter Be Addressed To

- The creditor, supplier, or service provider owed the payment.

- Accounts payable department in case of companies.

- Individual business owners or project managers depending on the agreement.

- For informal proposals, it can be addressed directly to the contact person handling finances.

When to Write a Payment Proposal Letter

- When you are unable to pay the full amount at once.

- After an invoice becomes overdue.

- To negotiate partial payments or installments.

- When proposing early payment discounts or alternate arrangements.

- Before legal escalation to maintain amicable relations.

How to Write and Send a Payment Proposal Letter

Steps to write an effective letter:

- Begin with a clear subject line.

- Address the recipient professionally.

- State the total outstanding amount and reason for proposal.

- Suggest a detailed payment schedule or partial amounts.

- Provide dates and amounts for each installment.

- Request confirmation or feedback.

- Close politely with contact information.

Modes of sending:

- Email for quick responses.

- Printed letter for formal or official records.

- PDF attachment if supporting documents are needed.

Elements and Structure of a Payment Proposal Letter

A professional payment proposal letter should include:

- Subject line: Clearly stating the purpose.

- Greeting: Address the recipient formally.

- Introduction: Mention invoice or obligation.

- Payment proposal details: Include amounts, dates, and frequency.

- Reasoning: Optional explanation for requesting a plan.

- Attachments: Any relevant invoices or supporting documents.

- Closing: Polite request for confirmation.

- Contact information: Phone number and email.

Mistakes to Avoid in Payment Proposal Letters

- Being vague about amounts or dates.

- Using an overly casual or demanding tone.

- Failing to attach necessary supporting documents.

- Proposing unrealistic or unfair payment terms.

- Not following up after sending the letter.

Tips for Writing a Successful Payment Proposal Letter

- Be clear, concise, and polite.

- Suggest a realistic and mutually acceptable plan.

- Include all relevant details like invoice numbers and total amounts.

- Offer flexibility for negotiation if possible.

- Use professional formatting and check for grammar.

After Sending the Payment Proposal Letter: Follow-up Steps

- Confirm receipt of the letter via email or phone.

- Be prepared to negotiate or adjust the plan.

- Maintain records of all communications.

- Schedule payment reminders according to the agreed plan.

- Ensure compliance to maintain professional relationships.

Advantages and Disadvantages of Sending a Payment Proposal Letter

Pros:

- Builds trust with creditors.

- Prevents legal disputes.

- Provides a structured plan for payment.

Cons:

- May be perceived as inability to pay if not worded carefully.

- Requires careful planning to avoid default.

- Needs follow-up to ensure agreement is honored.

Requirements and Prerequisites Before Writing a Payment Proposal Letter

- Accurate details of outstanding invoices or dues.

- Current financial information to propose realistic installments.

- Contact details of the recipient or financial department.

- Supporting documents like prior invoices, contracts, or agreements.

Formatting Guidelines for a Payment Proposal Letter

- Keep it one page if possible.

- Use professional and polite language.

- Number installments clearly with amounts and dates.

- Include subject line and reference numbers.

- Maintain formal letter structure for print or PDF versions.

Download Word Doc

Download Word Doc

Download PDF

Download PDF