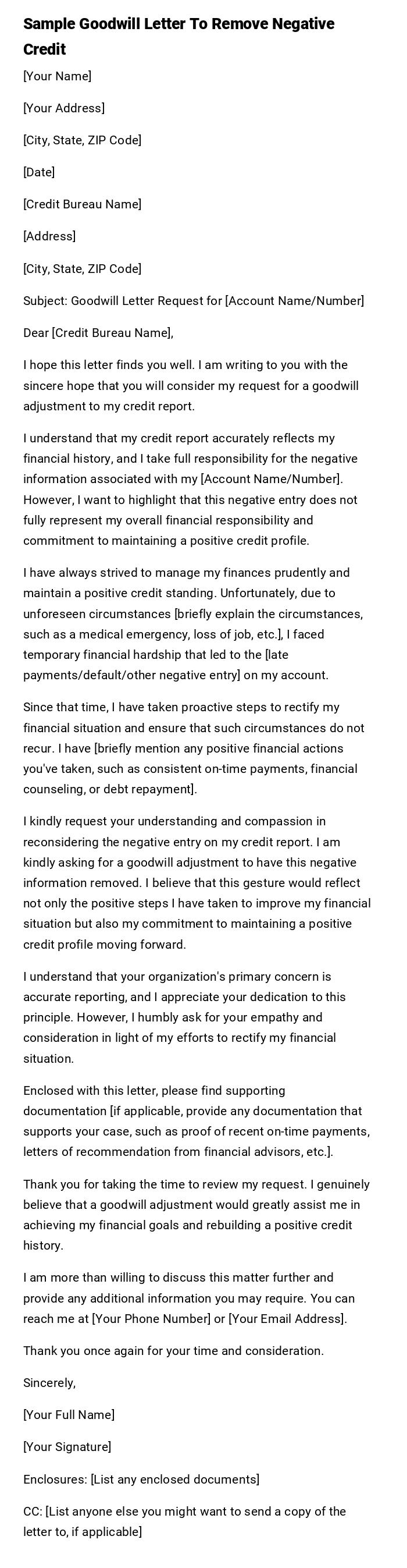

Sample Goodwill Letter To Remove Negative Credit

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Credit Bureau Name]

[Address]

[City, State, ZIP Code]

Subject: Goodwill Letter Request for [Account Name/Number]

Dear [Credit Bureau Name],

I hope this letter finds you well. I am writing to you with the sincere hope that you will consider my request for a goodwill adjustment to my credit report.

I understand that my credit report accurately reflects my financial history, and I take full responsibility for the negative information associated with my [Account Name/Number]. However, I want to highlight that this negative entry does not fully represent my overall financial responsibility and commitment to maintaining a positive credit profile.

I have always strived to manage my finances prudently and maintain a positive credit standing. Unfortunately, due to unforeseen circumstances [briefly explain the circumstances, such as a medical emergency, loss of job, etc.], I faced temporary financial hardship that led to the [late payments/default/other negative entry] on my account.

Since that time, I have taken proactive steps to rectify my financial situation and ensure that such circumstances do not recur. I have [briefly mention any positive financial actions you've taken, such as consistent on-time payments, financial counseling, or debt repayment].

I kindly request your understanding and compassion in reconsidering the negative entry on my credit report. I am kindly asking for a goodwill adjustment to have this negative information removed. I believe that this gesture would reflect not only the positive steps I have taken to improve my financial situation but also my commitment to maintaining a positive credit profile moving forward.

I understand that your organization's primary concern is accurate reporting, and I appreciate your dedication to this principle. However, I humbly ask for your empathy and consideration in light of my efforts to rectify my financial situation.

Enclosed with this letter, please find supporting documentation [if applicable, provide any documentation that supports your case, such as proof of recent on-time payments, letters of recommendation from financial advisors, etc.].

Thank you for taking the time to review my request. I genuinely believe that a goodwill adjustment would greatly assist me in achieving my financial goals and rebuilding a positive credit history.

I am more than willing to discuss this matter further and provide any additional information you may require. You can reach me at [Your Phone Number] or [Your Email Address].

Thank you once again for your time and consideration.

Sincerely,

[Your Full Name]

[Your Signature]

Enclosures: [List any enclosed documents]

CC: [List anyone else you might want to send a copy of the letter to, if applicable]

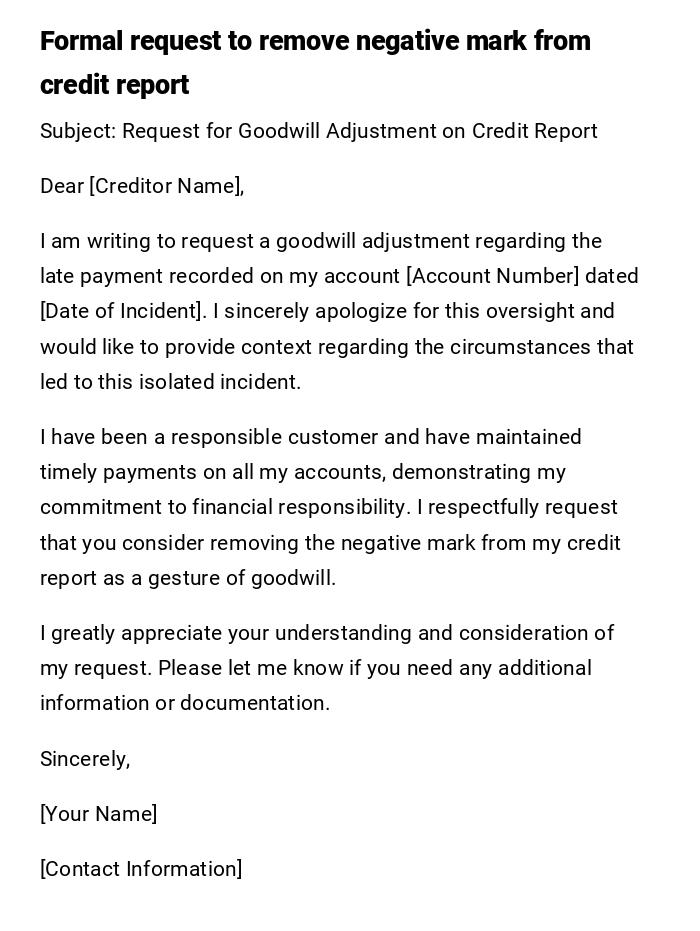

Professional Goodwill Letter to Remove Negative Credit

Subject: Request for Goodwill Adjustment on Credit Report

Dear [Creditor Name],

I am writing to request a goodwill adjustment regarding the late payment recorded on my account [Account Number] dated [Date of Incident]. I sincerely apologize for this oversight and would like to provide context regarding the circumstances that led to this isolated incident.

I have been a responsible customer and have maintained timely payments on all my accounts, demonstrating my commitment to financial responsibility. I respectfully request that you consider removing the negative mark from my credit report as a gesture of goodwill.

I greatly appreciate your understanding and consideration of my request. Please let me know if you need any additional information or documentation.

Sincerely,

[Your Name]

[Contact Information]

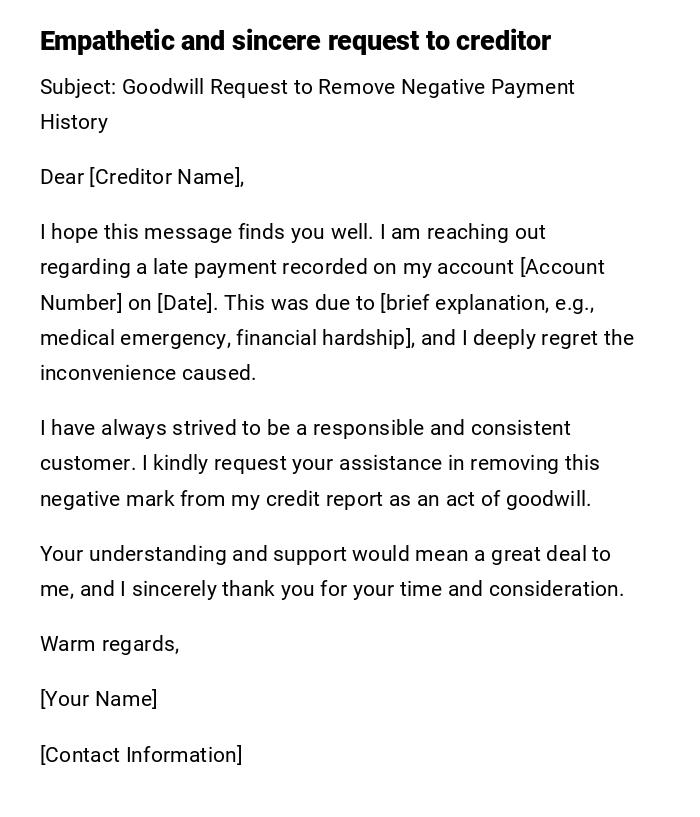

Heartfelt Goodwill Letter for Credit Repair

Subject: Goodwill Request to Remove Negative Payment History

Dear [Creditor Name],

I hope this message finds you well. I am reaching out regarding a late payment recorded on my account [Account Number] on [Date]. This was due to [brief explanation, e.g., medical emergency, financial hardship], and I deeply regret the inconvenience caused.

I have always strived to be a responsible and consistent customer. I kindly request your assistance in removing this negative mark from my credit report as an act of goodwill.

Your understanding and support would mean a great deal to me, and I sincerely thank you for your time and consideration.

Warm regards,

[Your Name]

[Contact Information]

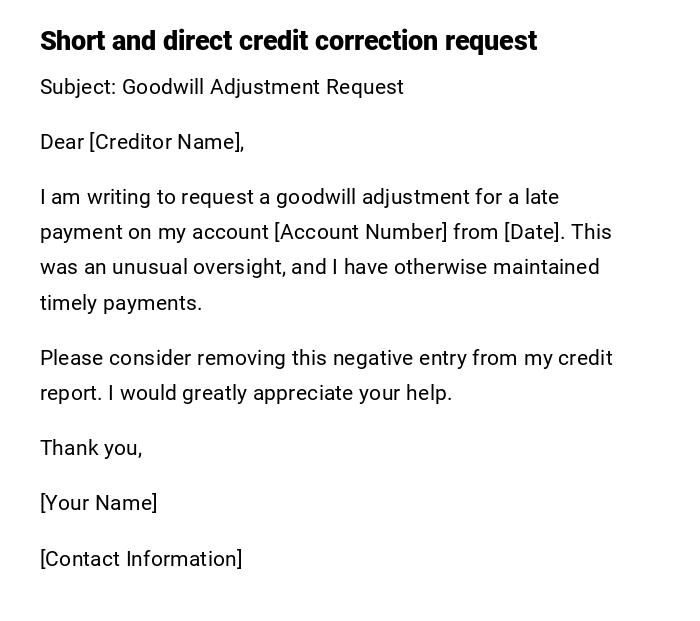

Quick and Simple Goodwill Letter

Subject: Goodwill Adjustment Request

Dear [Creditor Name],

I am writing to request a goodwill adjustment for a late payment on my account [Account Number] from [Date]. This was an unusual oversight, and I have otherwise maintained timely payments.

Please consider removing this negative entry from my credit report. I would greatly appreciate your help.

Thank you,

[Your Name]

[Contact Information]

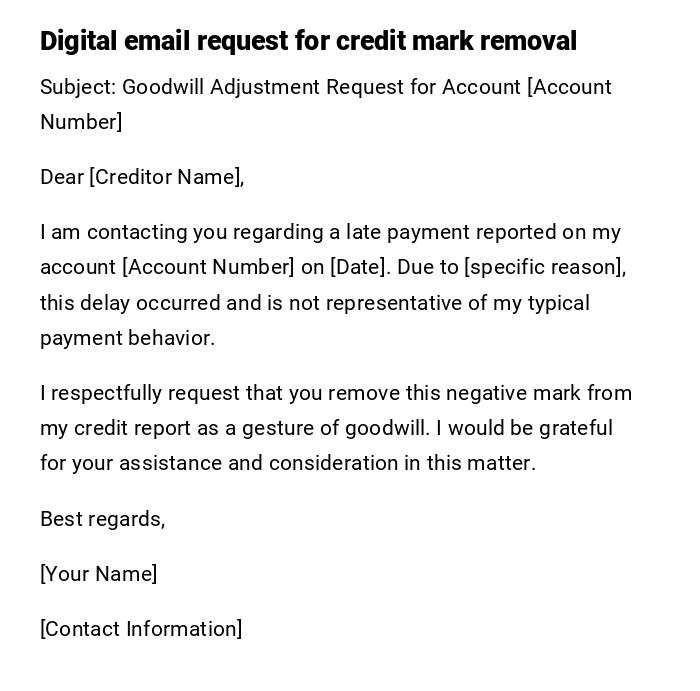

Formal Email Request for Credit Report Correction

Subject: Goodwill Adjustment Request for Account [Account Number]

Dear [Creditor Name],

I am contacting you regarding a late payment reported on my account [Account Number] on [Date]. Due to [specific reason], this delay occurred and is not representative of my typical payment behavior.

I respectfully request that you remove this negative mark from my credit report as a gesture of goodwill. I would be grateful for your assistance and consideration in this matter.

Best regards,

[Your Name]

[Contact Information]

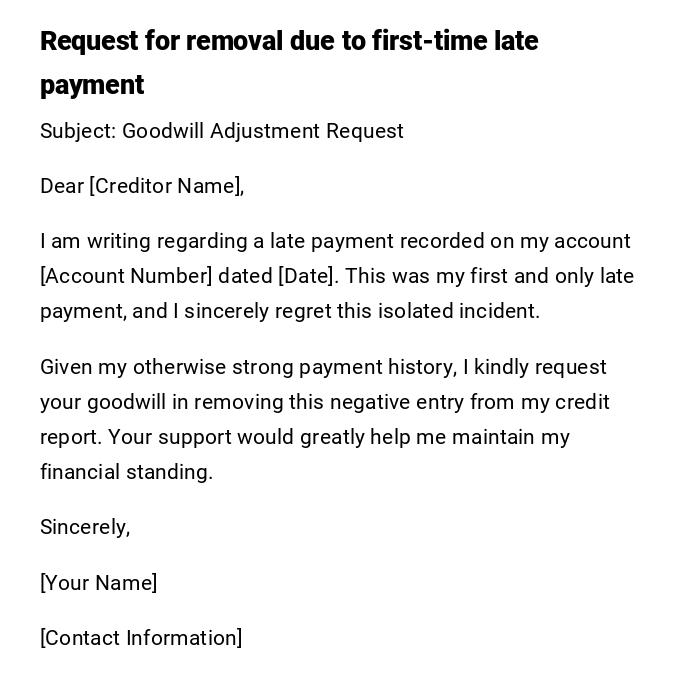

Preliminary Goodwill Letter for First-Time Offense

Subject: Goodwill Adjustment Request

Dear [Creditor Name],

I am writing regarding a late payment recorded on my account [Account Number] dated [Date]. This was my first and only late payment, and I sincerely regret this isolated incident.

Given my otherwise strong payment history, I kindly request your goodwill in removing this negative entry from my credit report. Your support would greatly help me maintain my financial standing.

Sincerely,

[Your Name]

[Contact Information]

What / Why Section

Why Send a Goodwill Letter to Remove Negative Credit

A goodwill letter is a formal request to a creditor asking them to remove a negative mark from a credit report, typically due to an isolated mistake or unforeseen circumstance.

Purpose:

- Restore credit score affected by a negative entry.

- Maintain eligibility for future loans or credit.

- Demonstrate accountability and responsibility to the creditor.

- Resolve issues amicably without legal action.

Who Should Send This Letter

Eligible Senders

- The account holder who experienced the negative mark.

- Authorized representatives or legal guardians in special cases.

- Financial advisors sending on behalf of a client with consent.

Whom to Address the Letter To

Recipients

- Creditor or lending institution reporting the negative entry.

- Collections department or credit reporting liaison.

- Customer service department of the financial institution.

- Credit bureau, if the creditor requires direct submission.

When to Send a Goodwill Letter

Timing Considerations

- After an isolated late payment or minor account error.

- Following a period of consistent on-time payments.

- Soon after the incident to maximize goodwill chances.

- Prior to applying for a major loan or mortgage.

How to Write and Send a Goodwill Letter

Steps to Draft and Send

- Gather account information and identify the negative mark.

- Explain the situation clearly and concisely.

- Highlight your positive payment history and reliability.

- Request removal politely and sincerely.

- Send via certified mail or email as per creditor preference.

- Keep a copy for records and future reference.

Requirements and Prerequisites

Preparation Checklist

- Account number and specific dates of negative entries.

- Documentation supporting your explanation (e.g., medical bills, payment records).

- Proof of consistent positive payment history.

- Clear and polite language outlining the request.

Formatting Guidelines

Best Practices

- Length: 1 page maximum, concise and focused.

- Tone: professional, sincere, and respectful.

- Include account details, specific incident dates, and request for removal.

- Preferred modes: email for convenience, printed letter for formal submissions.

- Use a clear subject line indicating the purpose.

After Sending / Follow-Up Actions

Next Steps

- Allow 2–4 weeks for the creditor to respond.

- Follow up with a polite reminder if no response is received.

- Keep documentation of correspondence.

- Confirm that the negative entry has been removed from your credit report.

Pros and Cons

Advantages

- May improve credit score and eligibility for loans.

- Demonstrates responsibility and accountability to creditors.

- Avoids legal or formal dispute processes.

Disadvantages

- No guarantee that the creditor will grant the request.

- May require multiple attempts or additional follow-up.

- Overly aggressive or emotional letters may reduce effectiveness.

Tricks and Tips for Effective Goodwill Letters

Tips

- Keep the letter polite, concise, and factual.

- Emphasize long-term positive history with the creditor.

- Avoid blaming the creditor; focus on circumstances and resolution.

- Attach supporting documentation when possible.

- Send during weekdays for faster attention.

Mistakes to Avoid

Common Pitfalls

- Being confrontational or rude.

- Failing to explain the reason for the negative entry.

- Omitting account or incident details.

- Not following up or keeping records of correspondence.

Elements and Structure

Essential Components

- Subject line: Clear and specific to the request.

- Salutation addressing the creditor or department.

- Brief explanation of the incident leading to the negative mark.

- Acknowledgment of responsibility or explanation of circumstances.

- Request for goodwill removal of the negative entry.

- Closing remarks expressing appreciation.

- Signature and contact information.

- Attachments or supporting evidence if relevant.

Does It Require Attestation or Authorization?

Authorization Considerations

- Usually does not require notarization, but official letters may benefit from certified mailing.

- Some creditors may require approval from a manager or credit department.

- Attach documents verifying circumstances if requested to strengthen the request.

Download Word Doc

Download Word Doc

Download PDF

Download PDF