Tax Notification Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, Zip Code]

Re: Tax Notification Letter

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to bring to your attention an important matter regarding your tax obligations for the tax year [Tax Year]. It has come to our attention that there might be discrepancies or outstanding issues in your tax filings, which require immediate attention.

The purpose of this notification is to inform you of the specific areas of concern and to request your prompt action in resolving any outstanding tax matters. We understand that dealing with taxes can be complex, and we are here to assist you in resolving any issues and ensuring compliance with tax laws and regulations.

Please find below the key issues we have identified:

1. Late or Unfiled Tax Returns: It appears that you have not filed your tax return for [Tax Year] or have filed it after the due date. Timely filing of tax returns is crucial to avoid penalties and interest charges.

2. Underreported Income: Based on the information provided by your employers, financial institutions, and other sources, there seems to be a discrepancy in the reported income on your tax return. It is essential to ensure that all sources of income are accurately reported.

3. Deduction and Credit Discrepancies: Certain deductions or tax credits claimed on your tax return require further review and verification. Please ensure that you have the necessary documentation to support these claims.

To address these concerns, we recommend the following actions:

1. File Any Outstanding Tax Returns: If you have not yet filed your tax return(s) for [Tax Year], please do so immediately. If you require additional time to gather the necessary information, please contact us as soon as possible to request an extension.

2. Review and Correct Tax Return(s): If you believe there are errors on your tax return(s), please review them carefully and file an amended return for the respective tax year(s). This will help rectify any discrepancies and update the relevant tax information.

3. Gather Supporting Documentation: Ensure that you have all the relevant documentation, such as receipts, invoices, and records, to support the income, deductions, and credits claimed on your tax return(s).

4. Reach Out to Our Office: If you have any questions or require assistance in resolving these matters, please contact our office at [Contact Number] or visit us in person at [Office Address]. Our team of tax professionals will be more than willing to guide you through the process and provide any necessary guidance.

Please be aware that failure to address these concerns promptly may result in penalties, interest charges, or further enforcement actions, such as audits or assessments.

We understand that tax matters can be overwhelming, and we are committed to working with you to achieve a resolution. It is essential to act promptly to avoid any adverse consequences.

Thank you for your attention to this matter. We look forward to your prompt response and cooperation in resolving these tax issues.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Tax Professional Firm (if applicable)]

Formal Tax Notification Letter

Subject: Notification of Tax Assessment – [Tax Year]

Dear [Taxpayer Name],

This letter serves to notify you of the tax assessment for the year [Tax Year] related to your tax identification number [TIN]. According to our records, the total tax liability is [Amount], due by [Due Date].

Please review the attached assessment notice and ensure payment is made on or before the due date. Failure to comply may result in penalties or interest charges.

If you have any questions regarding this assessment, contact our office at [Contact Information] for assistance.

Sincerely,

[Authorized Officer Name]

[Title]

[Tax Authority / Department Name]

Preliminary / Provisional Tax Notification Letter

Subject: Preliminary Tax Notification – [Tax Year]

Dear [Taxpayer Name],

We are issuing this preliminary notice to inform you of the estimated tax liability for the year [Tax Year] under your tax identification number [TIN]. The estimated total is [Amount].

This notice is provisional and subject to review. You are encouraged to submit any supporting documentation or corrections within [X days] from the date of this letter.

Thank you for your prompt attention.

Sincerely,

[Authorized Officer Name]

[Title]

[Tax Authority]

Friendly Reminder Tax Notification Email

Subject: Reminder: Tax Payment Due for [Tax Year]

Hi [Taxpayer Name],

Just a friendly reminder that your tax payment for [Tax Year] is due by [Due Date]. The amount due is [Amount].

Please make sure to complete your payment on time to avoid any penalties. For questions or assistance, contact us at [Contact Information].

Best regards,

[Tax Department Name]

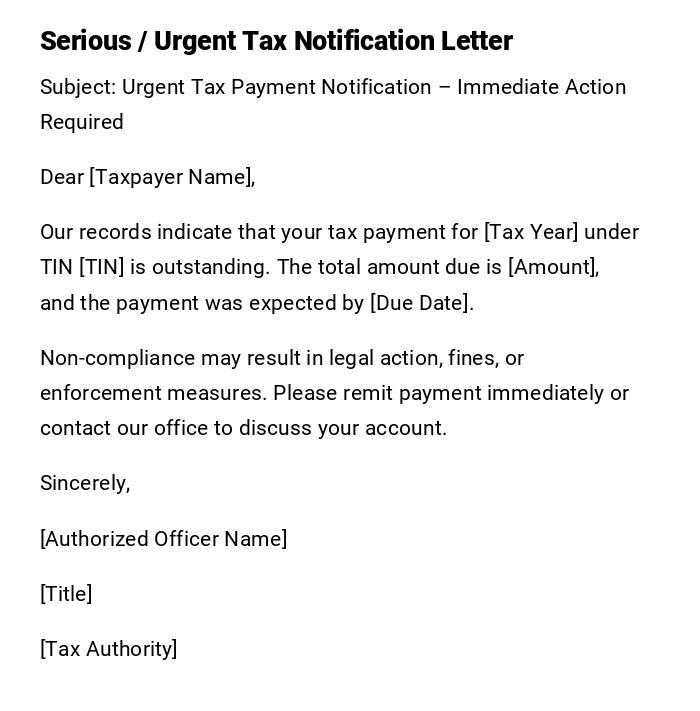

Serious / Urgent Tax Notification Letter

Subject: Urgent Tax Payment Notification – Immediate Action Required

Dear [Taxpayer Name],

Our records indicate that your tax payment for [Tax Year] under TIN [TIN] is outstanding. The total amount due is [Amount], and the payment was expected by [Due Date].

Non-compliance may result in legal action, fines, or enforcement measures. Please remit payment immediately or contact our office to discuss your account.

Sincerely,

[Authorized Officer Name]

[Title]

[Tax Authority]

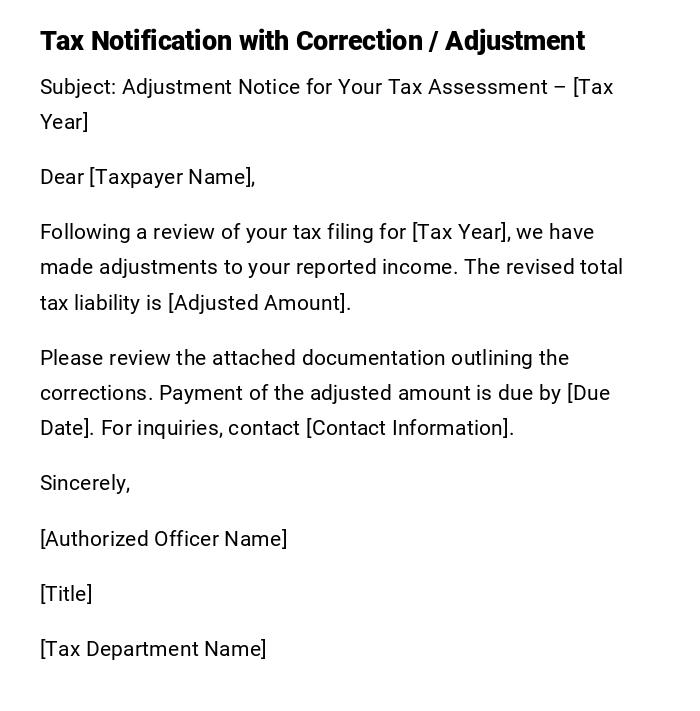

Tax Notification with Correction / Adjustment

Subject: Adjustment Notice for Your Tax Assessment – [Tax Year]

Dear [Taxpayer Name],

Following a review of your tax filing for [Tax Year], we have made adjustments to your reported income. The revised total tax liability is [Adjusted Amount].

Please review the attached documentation outlining the corrections. Payment of the adjusted amount is due by [Due Date]. For inquiries, contact [Contact Information].

Sincerely,

[Authorized Officer Name]

[Title]

[Tax Department Name]

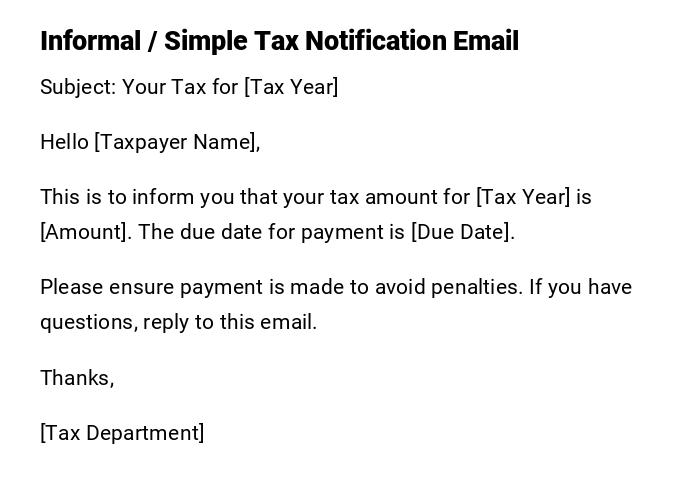

Informal / Simple Tax Notification Email

Subject: Your Tax for [Tax Year]

Hello [Taxpayer Name],

This is to inform you that your tax amount for [Tax Year] is [Amount]. The due date for payment is [Due Date].

Please ensure payment is made to avoid penalties. If you have questions, reply to this email.

Thanks,

[Tax Department]

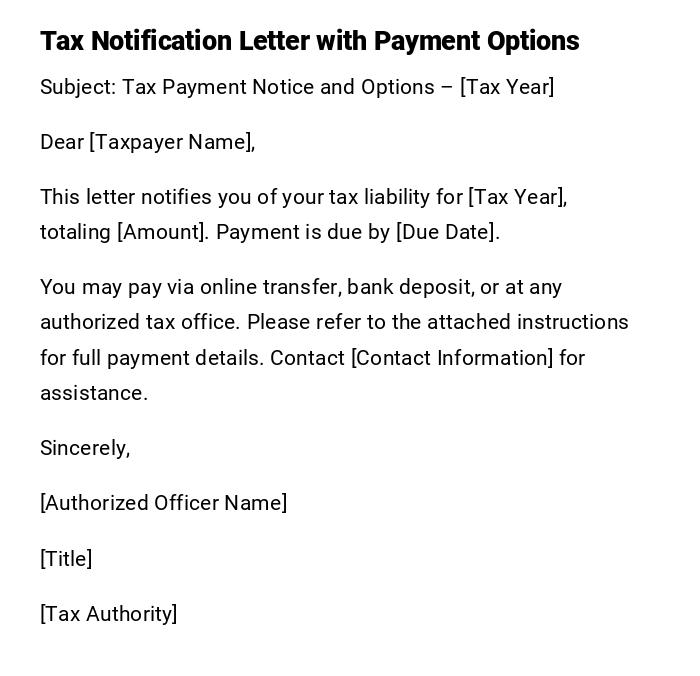

Tax Notification Letter with Payment Options

Subject: Tax Payment Notice and Options – [Tax Year]

Dear [Taxpayer Name],

This letter notifies you of your tax liability for [Tax Year], totaling [Amount]. Payment is due by [Due Date].

You may pay via online transfer, bank deposit, or at any authorized tax office. Please refer to the attached instructions for full payment details. Contact [Contact Information] for assistance.

Sincerely,

[Authorized Officer Name]

[Title]

[Tax Authority]

Tax Notification Letter for Late Payment

Subject: Overdue Tax Notification – [Tax Year]

Dear [Taxpayer Name],

Our records indicate that payment for your [Tax Year] taxes, amounting to [Amount], has not been received by the due date [Due Date].

Immediate payment is required to avoid additional penalties and interest. Please contact [Contact Information] if you have already made the payment or require assistance.

Sincerely,

[Authorized Officer Name]

[Title]

[Tax Department Name]

What / Why is a Tax Notification Letter

- A tax notification letter is an official communication from a tax authority informing a taxpayer about their tax liabilities, adjustments, or due payments.

- Purpose: Ensure taxpayers are aware of obligations, deadlines, and any changes to assessments.

- It serves as a formal record and a prompt for timely payment or response.

Who Should Send a Tax Notification Letter

- Tax authorities or government tax departments.

- Authorized officers within tax offices.

- The sender must have official capacity to issue legal or financial notifications.

Whom Should the Tax Notification Letter Be Addressed To

- Individual taxpayers or businesses registered with the tax authority.

- Legal representatives or accountants authorized to act on behalf of the taxpayer.

- In cases of deceased estates, the executor or legal guardian.

When to Send a Tax Notification Letter

- At the beginning of a new tax year to remind of upcoming obligations.

- After assessment of tax returns or audits.

- When payment deadlines approach or are missed.

- To communicate corrections or adjustments to previously reported information.

How to Write and Send a Tax Notification Letter

- Clearly state the tax year and taxpayer identification number (TIN).

- Specify the amount due, payment methods, and due dates.

- Use formal and professional tone, except for casual reminders via email.

- Include attachments such as assessment forms or instructions for payment.

- Send via certified mail, email, or official online portals to ensure delivery and record.

Requirements and Prerequisites Before Sending

- Accurate calculation of tax liability.

- Verification of taxpayer’s information and contact details.

- Relevant supporting documentation (audit results, assessment reports, previous payments).

- Review and authorization by the responsible officer or department.

Formatting Guidelines for Tax Notification Letters

- Length: Usually one page, detailed if adjustments are included.

- Tone: Formal, professional, or official; friendly for reminders.

- Structure: subject line, greeting, notification details, payment instructions, closing.

- Include clear references to assessment numbers, TIN, and payment methods.

After Sending / Follow-up Actions

- Confirm receipt via mail, email, or acknowledgment through an online portal.

- Monitor payment compliance.

- Issue reminders or escalate in case of overdue payments.

- Maintain official records for audits and compliance verification.

Pros and Cons of Sending Tax Notification Letters

Pros:

- Ensures taxpayers are informed and compliant.

- Creates official documentation for record-keeping.

- Reduces disputes and promotes timely payments.

Cons:

- May incur administrative costs.

- Overly frequent reminders can cause confusion.

- Errors in the notification can lead to disputes or appeals.

Compare and Contrast with Other Notifications

- Compared to phone calls, letters provide a permanent record.

- Email notifications allow faster delivery but may lack formal documentation.

- Alternative reminders include SMS or online portal alerts; letters are legally recognized.

Tricks and Tips for Effective Tax Notification Letters

- Include clear deadlines and instructions for payment.

- Attach supporting documents for transparency.

- Provide multiple contact options for queries.

- Use standardized formats for consistency.

- Include a reference number to track responses or payments.

Common Mistakes to Avoid

- Sending inaccurate amounts or wrong TINs.

- Omitting due dates or payment instructions.

- Using unclear or ambiguous language.

- Failing to attach necessary supporting documentation.

- Ignoring follow-up procedures for overdue payments.

Elements and Structure of a Tax Notification Letter

- Subject line: Clearly indicates tax year and purpose.

- Greeting: Personalized or formal to the taxpayer.

- Notification details: Tax amount, due date, assessment reference.

- Payment instructions: Methods and account details.

- Attachments: Supporting documents, forms, instructions.

- Closing: Polite, professional, and legally appropriate.

- Signature: Authorized officer and department details.

Does it Require Attestation or Authorization

- Official signature of a tax officer is required.

- Departmental or supervisor approval may be needed for adjustments or corrections.

- Sending via certified mail or official portal ensures legal acknowledgment.

Download Word Doc

Download Word Doc

Download PDF

Download PDF