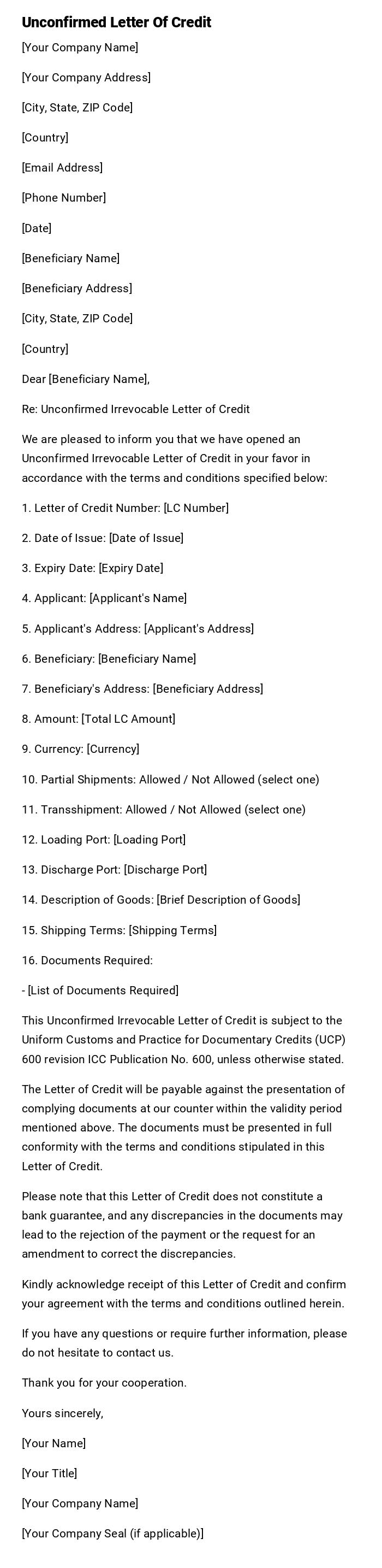

Unconfirmed Letter Of Credit

[Your Company Name]

[Your Company Address]

[City, State, ZIP Code]

[Country]

[Email Address]

[Phone Number]

[Date]

[Beneficiary Name]

[Beneficiary Address]

[City, State, ZIP Code]

[Country]

Dear [Beneficiary Name],

Re: Unconfirmed Irrevocable Letter of Credit

We are pleased to inform you that we have opened an Unconfirmed Irrevocable Letter of Credit in your favor in accordance with the terms and conditions specified below:

1. Letter of Credit Number: [LC Number]

2. Date of Issue: [Date of Issue]

3. Expiry Date: [Expiry Date]

4. Applicant: [Applicant's Name]

5. Applicant's Address: [Applicant's Address]

6. Beneficiary: [Beneficiary Name]

7. Beneficiary's Address: [Beneficiary Address]

8. Amount: [Total LC Amount]

9. Currency: [Currency]

10. Partial Shipments: Allowed / Not Allowed (select one)

11. Transshipment: Allowed / Not Allowed (select one)

12. Loading Port: [Loading Port]

13. Discharge Port: [Discharge Port]

14. Description of Goods: [Brief Description of Goods]

15. Shipping Terms: [Shipping Terms]

16. Documents Required:

- [List of Documents Required]

This Unconfirmed Irrevocable Letter of Credit is subject to the Uniform Customs and Practice for Documentary Credits (UCP) 600 revision ICC Publication No. 600, unless otherwise stated.

The Letter of Credit will be payable against the presentation of complying documents at our counter within the validity period mentioned above. The documents must be presented in full conformity with the terms and conditions stipulated in this Letter of Credit.

Please note that this Letter of Credit does not constitute a bank guarantee, and any discrepancies in the documents may lead to the rejection of the payment or the request for an amendment to correct the discrepancies.

Kindly acknowledge receipt of this Letter of Credit and confirm your agreement with the terms and conditions outlined herein.

If you have any questions or require further information, please do not hesitate to contact us.

Thank you for your cooperation.

Yours sincerely,

[Your Name]

[Your Title]

[Your Company Name]

[Your Company Seal (if applicable)]

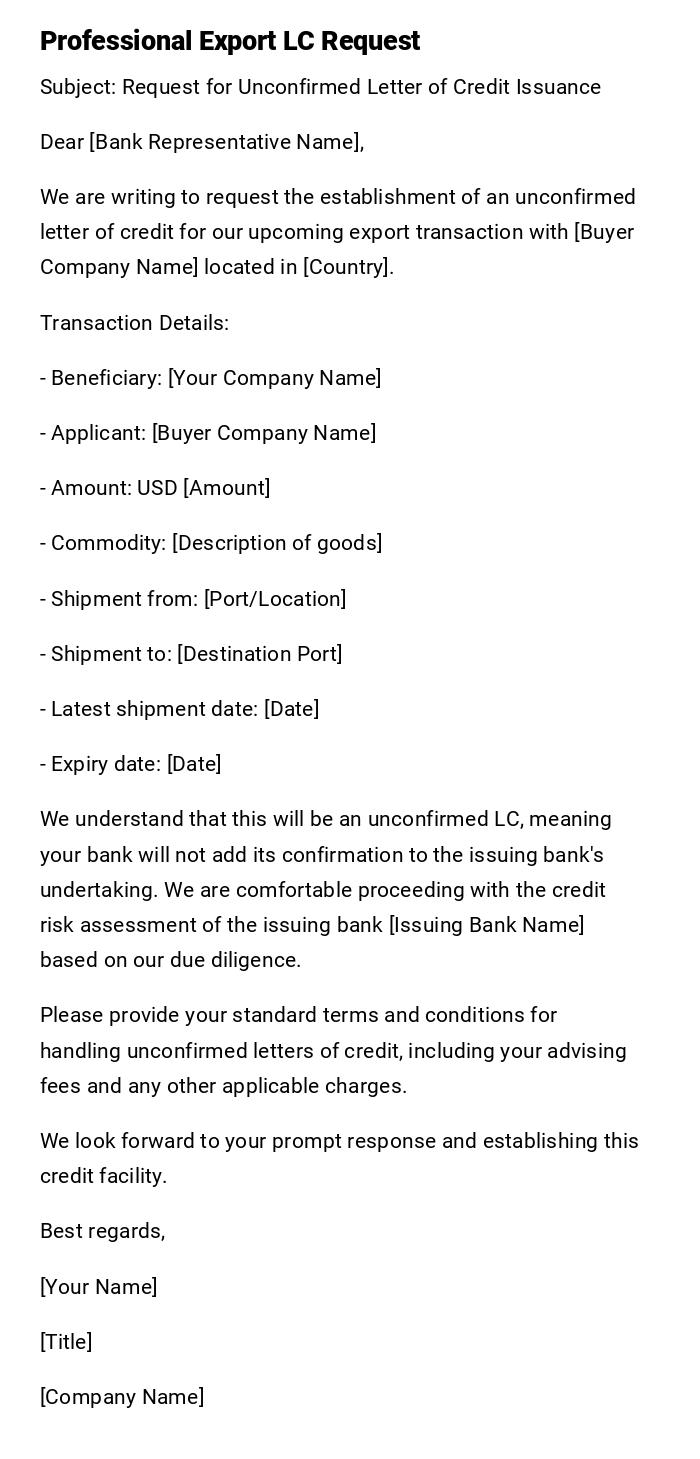

Request for Unconfirmed Letter of Credit - Export Transaction

Subject: Request for Unconfirmed Letter of Credit Issuance

Dear [Bank Representative Name],

We are writing to request the establishment of an unconfirmed letter of credit for our upcoming export transaction with [Buyer Company Name] located in [Country].

Transaction Details:

- Beneficiary: [Your Company Name]

- Applicant: [Buyer Company Name]

- Amount: USD [Amount]

- Commodity: [Description of goods]

- Shipment from: [Port/Location]

- Shipment to: [Destination Port]

- Latest shipment date: [Date]

- Expiry date: [Date]

We understand that this will be an unconfirmed LC, meaning your bank will not add its confirmation to the issuing bank's undertaking. We are comfortable proceeding with the credit risk assessment of the issuing bank [Issuing Bank Name] based on our due diligence.

Please provide your standard terms and conditions for handling unconfirmed letters of credit, including your advising fees and any other applicable charges.

We look forward to your prompt response and establishing this credit facility.

Best regards,

[Your Name]

[Title]

[Company Name]

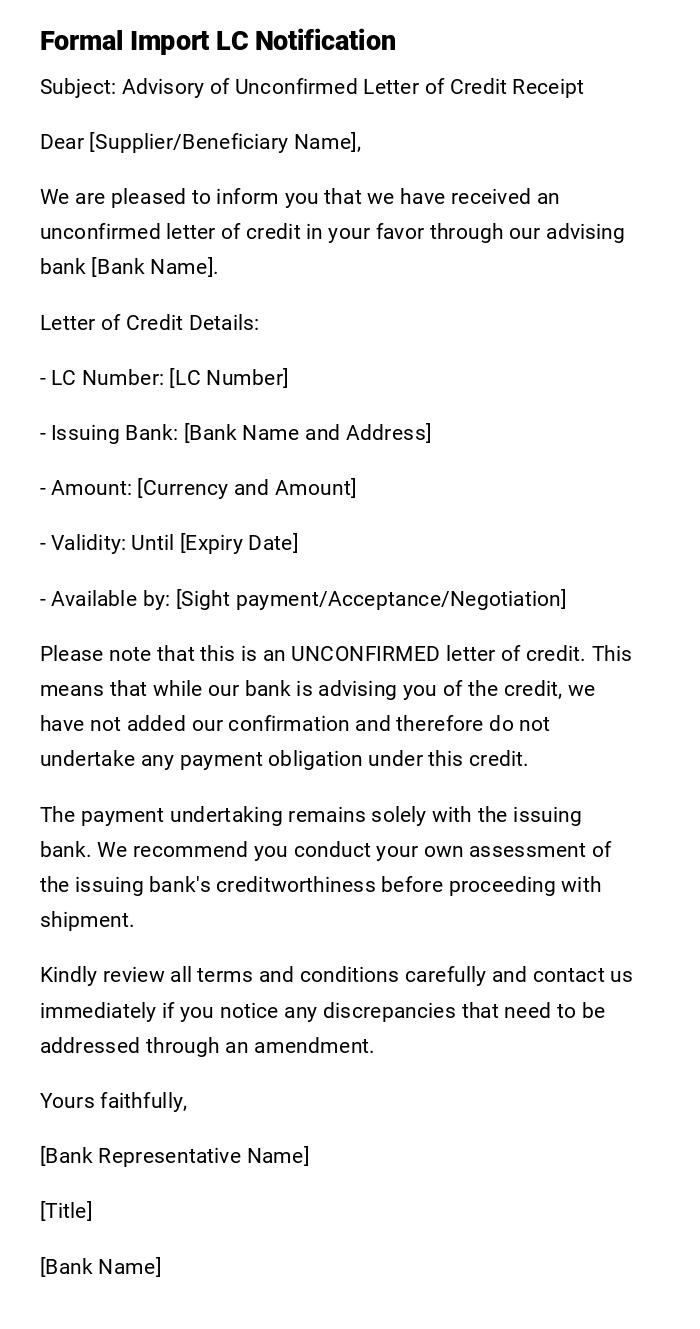

Import Transaction LC Advisory

Subject: Advisory of Unconfirmed Letter of Credit Receipt

Dear [Supplier/Beneficiary Name],

We are pleased to inform you that we have received an unconfirmed letter of credit in your favor through our advising bank [Bank Name].

Letter of Credit Details:

- LC Number: [LC Number]

- Issuing Bank: [Bank Name and Address]

- Amount: [Currency and Amount]

- Validity: Until [Expiry Date]

- Available by: [Sight payment/Acceptance/Negotiation]

Please note that this is an UNCONFIRMED letter of credit. This means that while our bank is advising you of the credit, we have not added our confirmation and therefore do not undertake any payment obligation under this credit.

The payment undertaking remains solely with the issuing bank. We recommend you conduct your own assessment of the issuing bank's creditworthiness before proceeding with shipment.

Kindly review all terms and conditions carefully and contact us immediately if you notice any discrepancies that need to be addressed through an amendment.

Yours faithfully,

[Bank Representative Name]

[Title]

[Bank Name]

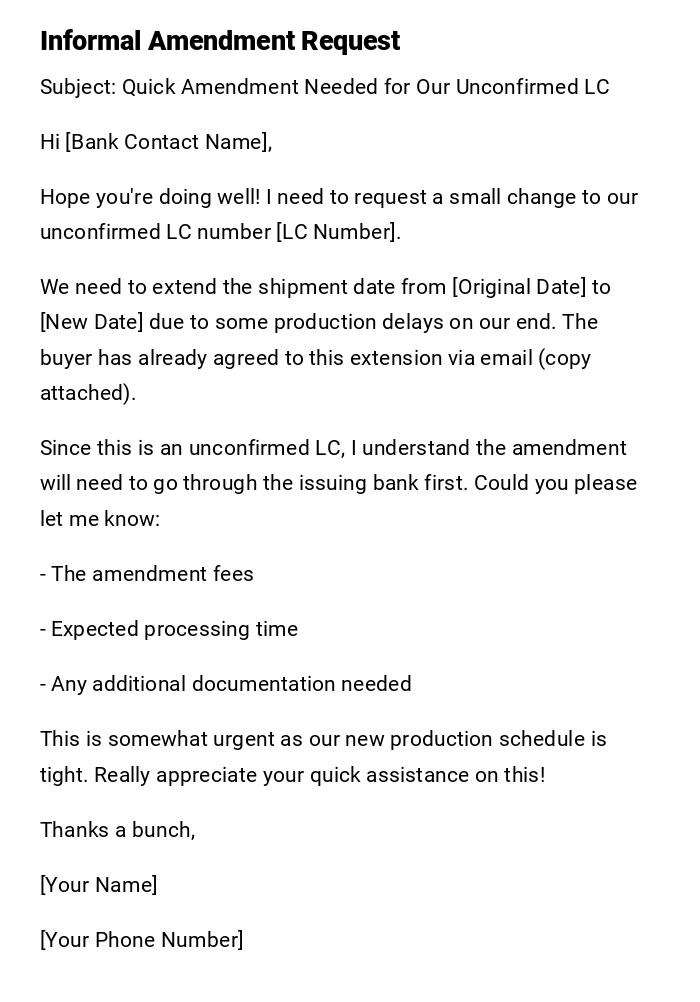

LC Amendment Request - Casual Tone

Subject: Quick Amendment Needed for Our Unconfirmed LC

Hi [Bank Contact Name],

Hope you're doing well! I need to request a small change to our unconfirmed LC number [LC Number].

We need to extend the shipment date from [Original Date] to [New Date] due to some production delays on our end. The buyer has already agreed to this extension via email (copy attached).

Since this is an unconfirmed LC, I understand the amendment will need to go through the issuing bank first. Could you please let me know:

- The amendment fees

- Expected processing time

- Any additional documentation needed

This is somewhat urgent as our new production schedule is tight. Really appreciate your quick assistance on this!

Thanks a bunch,

[Your Name]

[Your Phone Number]

Credit Risk Assessment Request

Subject: Urgent - Credit Assessment Required for Unconfirmed LC

Dear Risk Management Team,

We have received an unconfirmed letter of credit from [Issuing Bank Name] for USD [Amount]. Given the unconfirmed nature of this credit, we need to conduct a thorough credit risk assessment before advising our client.

Issuing Bank Details:

- Name: [Bank Name]

- Country: [Country]

- SWIFT Code: [Code]

- Established: [Year]

Please provide your assessment on:

- Current credit rating and any recent changes

- Political and country risk factors

- Recommended exposure limits

- Any adverse news or sanctions considerations

The beneficiary is pressuring for immediate advice of the credit. However, given recent market volatility in [Region/Country], I believe a careful risk assessment is warranted before we proceed.

Please treat this as priority and revert by [Date].

Regards,

[Your Name]

Trade Finance Department

Payment Claim Under Unconfirmed LC

Subject: Presentation of Documents for Payment - LC No. [Number]

Dear Sirs,

We hereby present documents for payment under the captioned unconfirmed letter of credit in our favor.

Documents presented:

1. Commercial Invoice No. [Number] dated [Date]

2. Full set of Clean On Board Bills of Lading dated [Date]

3. Packing List dated [Date]

4. Certificate of Origin dated [Date]

5. Insurance Policy/Certificate No. [Number]

We confirm that all documents have been prepared strictly in accordance with the terms and conditions of the letter of credit and applicable UCP 600 rules.

As this is an unconfirmed letter of credit, we understand that payment is subject to reimbursement from the issuing bank [Bank Name]. We request you to forward these documents to the issuing bank immediately for their honor.

Please confirm receipt of documents and advise the expected payment date upon issuing bank's acceptance.

We remain at your disposal for any clarifications.

Very truly yours,

[Authorized Signatory Name]

[Company Name]

Discrepancy Notice

Subject: Notice of Discrepancies - LC No. [Number]

Dear [Beneficiary Name],

We have examined the documents you presented under the above-referenced unconfirmed letter of credit. Unfortunately, we have identified the following discrepancies that prevent us from processing your claim:

1. Commercial Invoice dated [Date] shows amount USD [Amount], while LC stipulates maximum USD [Amount]

2. Bill of Lading shows shipment date as [Date], which is after the LC's latest shipment date of [Date]

3. Certificate of Origin missing required signature and company stamp

As the advising bank for this unconfirmed LC, we are obligated to refuse the documents containing these discrepancies. The documents are held at your disposal pending your instructions.

You may either:

- Correct the discrepancies and re-present complying documents before LC expiry

- Request the applicant to authorize acceptance despite discrepancies

- Request an LC amendment to cover the discrepancies

Please note that the issuing bank has not yet been contacted regarding these documents due to the apparent discrepancies.

Time is of essence as the LC expires on [Date].

Best regards,

[Bank Officer Name]

Documentary Credits Department

LC Expiry Warning

Subject: URGENT - Unconfirmed LC Expiring Soon

Dear [Beneficiary Name],

This is to urgently remind you that the unconfirmed letter of credit in your favor is expiring in [Number] days.

LC Details:

- Number: [LC Number]

- Expiry Date: [Date]

- Outstanding Amount: [Currency Amount]

As of today, we have not received any documents for negotiation/payment under this credit. Please note that:

- All documents must be presented before the expiry date

- Any documents received after expiry will be processed on a collection basis only

- The issuing bank's undertaking ceases upon expiry

If you are experiencing difficulties in meeting the LC terms, we strongly recommend requesting an amendment to extend the validity period immediately.

Given the unconfirmed nature of this LC, any extension will require the issuing bank's agreement and may involve additional costs.

Please confirm your shipping status and expected document presentation date urgently.

Yours truly,

[Trade Finance Officer]

[Contact Details]

What is an Unconfirmed Letter of Credit and Why is it Used

An unconfirmed letter of credit is a trade finance instrument where the advising bank does not add its own payment undertaking to that of the issuing bank. The advising bank merely transmits the LC to the beneficiary without guaranteeing payment, leaving the sole payment obligation with the original issuing bank. This arrangement is commonly used when:

- The issuing bank has strong creditworthiness and international recognition

- The beneficiary is comfortable with the credit risk of the issuing bank

- Cost reduction is a priority as confirmation fees are avoided

- The transaction involves established trade relationships

- Political and country risks are minimal

Who Should Use Unconfirmed Letters of Credit

Exporters/Beneficiaries should consider unconfirmed LCs when:

- Working with highly rated international banks

- Having previous successful experience with the issuing bank

- Operating in low-risk jurisdictions

- Prioritizing cost savings over additional security

- Maintaining established business relationships

Importers/Applicants benefit from unconfirmed LCs by:

- Reducing overall transaction costs

- Faster LC establishment process

- Simplified documentation requirements

- Lower bank charges and fees

When to Request or Accept Unconfirmed Letters of Credit

Triggering scenarios include:

- First-time transactions with cost-conscious approach

- Repeat business with trusted issuing banks

- High-volume, low-margin trade transactions

- Shipments to countries with stable banking systems

- Time-sensitive deals requiring quick LC setup

- Transactions where confirmation adds excessive cost

- Dealings with top-tier international banks

- Regional trade within established economic zones

Requirements and Prerequisites Before Proceeding

Essential preparations include:

- Credit assessment of the issuing bank

- Country risk evaluation

- Review of bank ratings from agencies like Moody's, S&P

- Legal framework analysis of issuing bank's jurisdiction

- Insurance coverage evaluation

- Internal credit approval processes

- Compliance with local banking regulations

- Documentation of risk acceptance decisions

- Establishment of exposure limits

- Review of UCP 600 rules and local banking practices

How to Process Unconfirmed Letters of Credit

The step-by-step process involves:

- Initial LC receipt and authenticity verification

- Preliminary examination of terms and conditions

- Credit risk assessment of issuing bank

- Communication with beneficiary about unconfirmed status

- Document examination upon presentation

- Forwarding complying documents to issuing bank

- Monitoring issuing bank's response and payment

- Handling any discrepancies or rejections

- Final settlement and closure procedures

Key considerations during processing:

- Strict adherence to documentary credit rules

- Clear communication about unconfirmed nature

- Proper risk disclosure to all parties

- Timely handling to avoid expiry issues

Formatting and Communication Standards

Professional formatting requirements:

- Clear subject lines indicating LC numbers

- Formal business letter structure

- Complete contact information

- Proper legal entity names and addresses

- Specific reference to terms and conditions

- Professional tone matching the business relationship

Optimal length and style:

- Business letters: 1-2 pages maximum

- Email communications: Concise but complete

- Technical details in bullet points or tables

- Clear action items and deadlines

- Professional yet accessible language

- Appropriate urgency indicators when needed

Common Mistakes to Avoid

Critical errors include:

- Failing to disclose unconfirmed status clearly

- Inadequate credit risk assessment

- Poor communication about additional risks

- Ignoring country and political risk factors

- Delayed document processing

- Insufficient documentation of decisions

- Overlooking expiry dates and deadlines

- Inadequate insurance coverage

- Poor record keeping for audit purposes

- Mixing confirmed and unconfirmed procedures

After Sending - Follow-up Procedures

Essential follow-up actions:

- Confirmation of receipt by intended recipient

- Status monitoring throughout LC validity period

- Regular communication with issuing bank

- Document tracking and status updates

- Amendment processing when required

- Discrepancy resolution coordination

- Payment monitoring and collection follow-up

- Final documentation and record closure

- Relationship maintenance for future transactions

- Performance analysis and process improvement

Pros and Cons Analysis

Advantages of unconfirmed LCs:

- Reduced costs compared to confirmed credits

- Faster establishment and processing

- Simplified documentation requirements

- Direct relationship with issuing bank

- Lower overall transaction fees

- Greater flexibility in terms negotiation

Disadvantages and risks:

- Higher credit risk exposure

- No additional bank guarantee

- Potential country and political risks

- Limited recourse in case of non-payment

- Dependency on single institution

- Possible longer payment collection periods

- Higher due diligence requirements

Compare and Contrast with Similar Instruments

Unconfirmed LC vs Confirmed LC:

- Confirmed LCs provide additional bank guarantee

- Higher costs but lower risk in confirmed credits

- Faster processing with unconfirmed LCs

- Different risk distribution between parties

Alternatives to consider:

- Standby letters of credit for different risk coverage

- Documentary collections for lower-cost options

- Open account trading for established relationships

- Trade credit insurance as risk mitigation

- Bank guarantees for performance assurance

- Factoring services for immediate cash flow

Essential Elements and Structure Requirements

Mandatory components include:

- Clear identification as unconfirmed LC

- Complete issuing bank details and credentials

- Precise transaction amount and currency

- Detailed commodity description

- Shipping terms and deadlines

- Required documentation checklist

- Expiry date and presentation period

- Payment terms and conditions

- Applicable rules reference (typically UCP 600)

- Special conditions and restrictions

- Contact information for all parties

- Amendment procedures and authorization

Download Word Doc

Download Word Doc

Download PDF

Download PDF