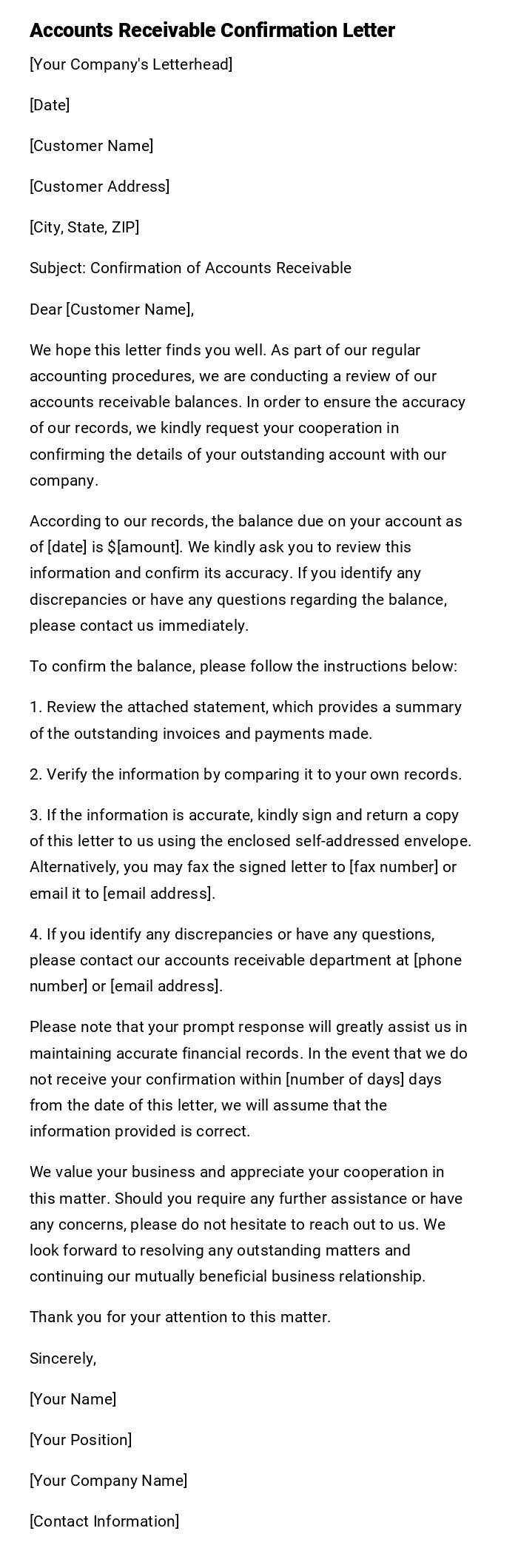

Accounts Receivable Confirmation Letter

[Your Company's Letterhead]

[Date]

[Customer Name]

[Customer Address]

[City, State, ZIP]

Subject: Confirmation of Accounts Receivable

Dear [Customer Name],

We hope this letter finds you well. As part of our regular accounting procedures, we are conducting a review of our accounts receivable balances. In order to ensure the accuracy of our records, we kindly request your cooperation in confirming the details of your outstanding account with our company.

According to our records, the balance due on your account as of [date] is $[amount]. We kindly ask you to review this information and confirm its accuracy. If you identify any discrepancies or have any questions regarding the balance, please contact us immediately.

To confirm the balance, please follow the instructions below:

1. Review the attached statement, which provides a summary of the outstanding invoices and payments made.

2. Verify the information by comparing it to your own records.

3. If the information is accurate, kindly sign and return a copy of this letter to us using the enclosed self-addressed envelope. Alternatively, you may fax the signed letter to [fax number] or email it to [email address].

4. If you identify any discrepancies or have any questions, please contact our accounts receivable department at [phone number] or [email address].

Please note that your prompt response will greatly assist us in maintaining accurate financial records. In the event that we do not receive your confirmation within [number of days] days from the date of this letter, we will assume that the information provided is correct.

We value your business and appreciate your cooperation in this matter. Should you require any further assistance or have any concerns, please do not hesitate to reach out to us. We look forward to resolving any outstanding matters and continuing our mutually beneficial business relationship.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Your Position]

[Your Company Name]

[Contact Information]

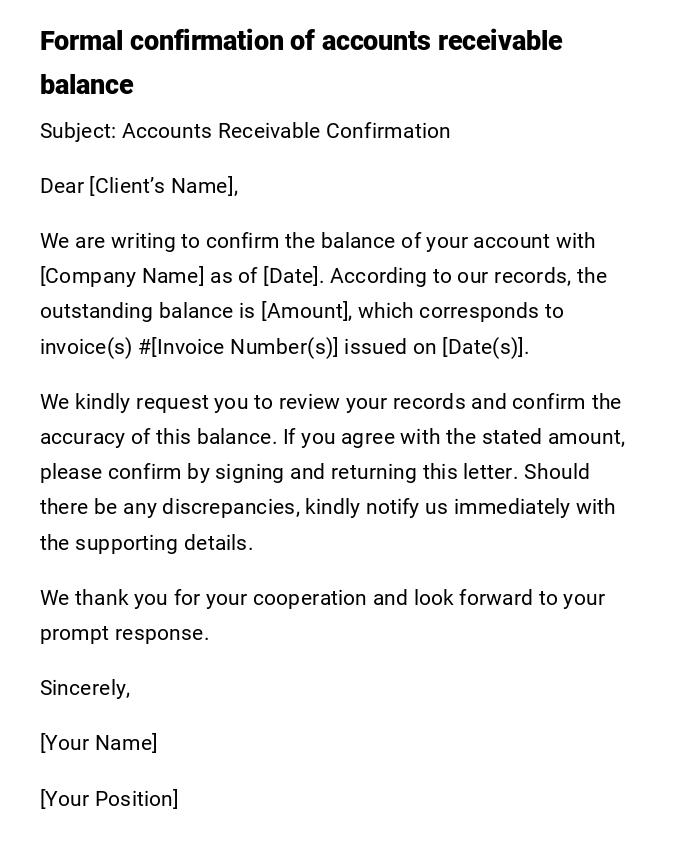

Formal Accounts Receivable Confirmation Letter

Subject: Accounts Receivable Confirmation

Dear [Client’s Name],

We are writing to confirm the balance of your account with [Company Name] as of [Date]. According to our records, the outstanding balance is [Amount], which corresponds to invoice(s) #[Invoice Number(s)] issued on [Date(s)].

We kindly request you to review your records and confirm the accuracy of this balance. If you agree with the stated amount, please confirm by signing and returning this letter. Should there be any discrepancies, kindly notify us immediately with the supporting details.

We thank you for your cooperation and look forward to your prompt response.

Sincerely,

[Your Name]

[Your Position]

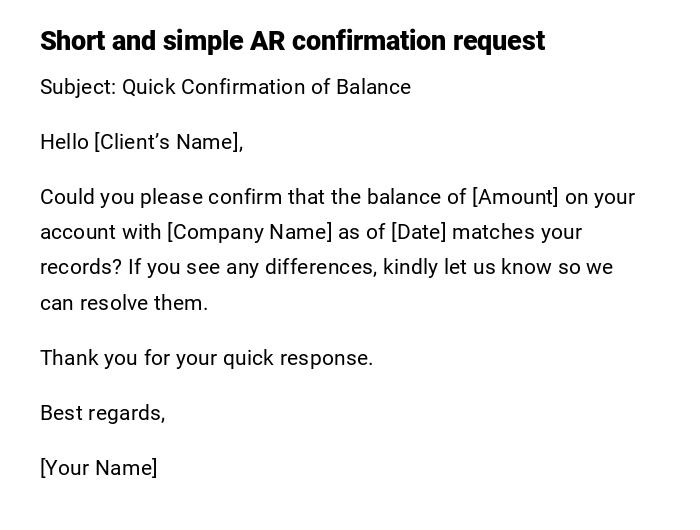

Quick Accounts Receivable Confirmation Email

Subject: Quick Confirmation of Balance

Hello [Client’s Name],

Could you please confirm that the balance of [Amount] on your account with [Company Name] as of [Date] matches your records? If you see any differences, kindly let us know so we can resolve them.

Thank you for your quick response.

Best regards,

[Your Name]

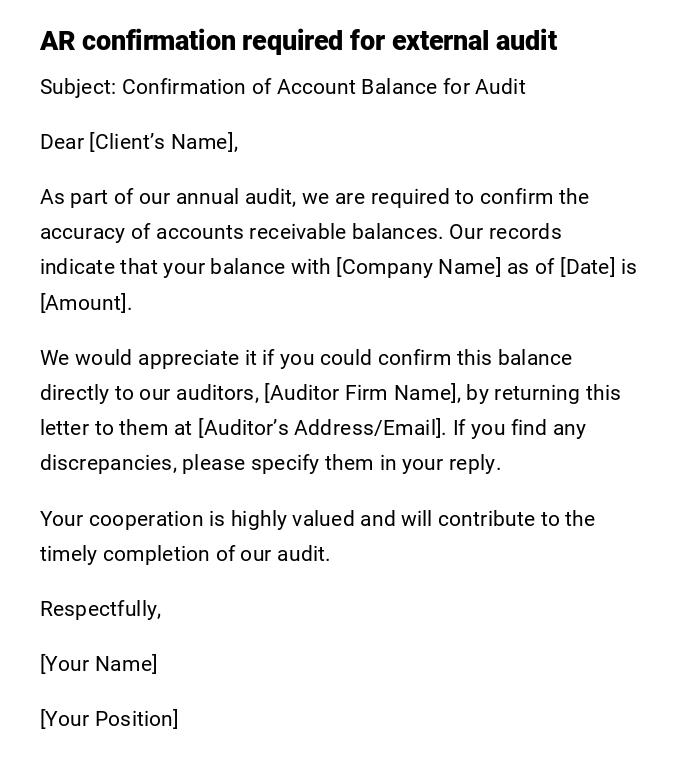

Accounts Receivable Confirmation Letter for Audit Purposes

Subject: Confirmation of Account Balance for Audit

Dear [Client’s Name],

As part of our annual audit, we are required to confirm the accuracy of accounts receivable balances. Our records indicate that your balance with [Company Name] as of [Date] is [Amount].

We would appreciate it if you could confirm this balance directly to our auditors, [Auditor Firm Name], by returning this letter to them at [Auditor’s Address/Email]. If you find any discrepancies, please specify them in your reply.

Your cooperation is highly valued and will contribute to the timely completion of our audit.

Respectfully,

[Your Name]

[Your Position]

Friendly Accounts Receivable Confirmation Email

Subject: Friendly Balance Check

Hi [Client’s First Name],

Hope all is going well! I just wanted to quickly check in and confirm that your account balance with us as of [Date] is [Amount]. Please let me know if everything matches up on your side.

Thanks a lot for your cooperation, and as always, we appreciate your business.

Warm regards,

[Your Name]

Accounts Receivable Confirmation Letter with Discrepancy Option

Subject: Accounts Receivable Balance Verification

Dear [Client’s Name],

We are contacting you to confirm the balance on your account with [Company Name]. As of [Date], the outstanding balance is [Amount], related to invoices #[Invoice Numbers].

Please review your records and confirm whether this balance is accurate. If you find any discrepancies, kindly provide us with the details so that we can reconcile our accounts promptly.

We appreciate your timely response and continued partnership.

Sincerely,

[Your Name]

Accounts Receivable Confirmation Letter for Overdue Account

Subject: Confirmation of Overdue Balance

Dear [Client’s Name],

According to our records, your account shows an outstanding overdue balance of [Amount] as of [Date]. The balance relates to invoice #[Invoice Number], which was due on [Due Date].

We request that you confirm the accuracy of this balance and advise us on the expected date of payment. If you believe this balance is incorrect, please provide supporting documents so we may review.

Thank you for your immediate attention to this matter.

Sincerely,

[Your Name]

Accounts Receivable Confirmation Message for Partial Payment Dispute

Subject: Confirmation of Adjusted Balance

Dear [Client’s Name],

Our records indicate that partial payments have been received against your invoices, and the current outstanding balance is [Amount] as of [Date]. We kindly request that you confirm this adjusted balance based on your own records.

If there are any differences, please notify us with the payment details so that we may reconcile accordingly.

Thank you for your cooperation.

Best regards,

[Your Name]

Accounts Receivable Confirmation Letter for Large Corporate Clients

Subject: Formal Confirmation of Account Balance

Dear [Client’s Finance Department/Name],

As part of our financial reconciliation, we are seeking confirmation of your account balance with [Company Name]. According to our records, your balance as of [Date] is [Amount], comprising the following invoices:

- Invoice #[Number] dated [Date] – [Amount]

- Invoice #[Number] dated [Date] – [Amount]

- Total Outstanding – [Amount]

Please review your internal records and confirm whether the above information matches your accounts. If not, kindly provide the adjustments for reconciliation.

We appreciate your timely confirmation and thank you for your continued business relationship.

Sincerely,

[Your Name]

[Your Position]

What is an accounts receivable confirmation letter and why do you need it?

An accounts receivable confirmation letter is a document sent by a business to a customer asking them to verify the balance they owe.

It helps ensure accuracy in financial records, supports audits, and resolves potential discrepancies early.

This letter is crucial for maintaining trust, avoiding disputes, and ensuring smooth cash flow.

Who should send an accounts receivable confirmation letter?

- Companies verifying balances with customers

- Finance or accounting departments during reconciliation

- Auditors requesting independent confirmation

- Businesses conducting year-end financial reporting

- Vendors clarifying overdue or disputed balances

Whom should the letter be addressed to?

- Customers with outstanding balances

- Corporate finance or accounts payable departments

- Individual clients in case of personal services

- External auditors (if required for direct confirmation)

- Distributors, retailers, or partners handling payments

When do you need to send an accounts receivable confirmation letter?

- At the end of a financial period for reconciliation

- During an audit to verify outstanding balances

- When there are overdue payments requiring confirmation

- Before closing year-end financial statements

- To resolve discrepancies identified in ledgers

How to write and send an accounts receivable confirmation letter

- Start with a clear subject line.

- State the outstanding balance as per your records.

- Provide invoice references, dates, and amounts.

- Request confirmation or correction from the recipient.

- Maintain a professional and polite tone.

- Send by email for quick response, or by letter for formal audits.

Formatting guidelines for an AR confirmation letter

- Length: 1–2 pages maximum.

- Tone: Professional and courteous.

- Details: Must include dates, invoice numbers, and amounts.

- Mode: Printed letters for audits, emails for regular checks.

- Attachments: Include statements or summaries for clarity.

Common mistakes to avoid

- Sending without invoice details

- Using vague wording like "some balance" instead of exact numbers

- Sounding accusatory or aggressive

- Not providing space for recipient to dispute errors

- Forgetting to include a deadline for response

Pros and cons of sending AR confirmation letters

Pros:

- Verifies accuracy of financial records

- Helps auditors finalize reports quickly

- Prevents disputes later on

- Improves communication with customers

Cons:

- Time-consuming if balances are numerous

- May irritate clients if sent too often

- Requires tracking responses and follow-ups

Tricks and tips for effective AR confirmation letters

- Always include invoice breakdowns for clarity

- Set a response deadline to ensure timely replies

- Keep the tone polite, not demanding

- Use templates to save time and maintain consistency

- Follow up with a phone call if the letter is not acknowledged

Elements and structure of an AR confirmation letter

- Subject line or heading

- Greeting with client’s name or department

- Statement of outstanding balance

- Reference to invoice numbers and dates

- Request for confirmation or corrections

- Closing with thanks and contact details

After sending an AR confirmation letter: what next?

- Track responses and confirmations

- Record any discrepancies and reconcile accounts

- Follow up with unresponsive clients

- Escalate unresolved issues to management or auditors

- File the confirmations for audit and compliance records

Download Word Doc

Download Word Doc

Download PDF

Download PDF