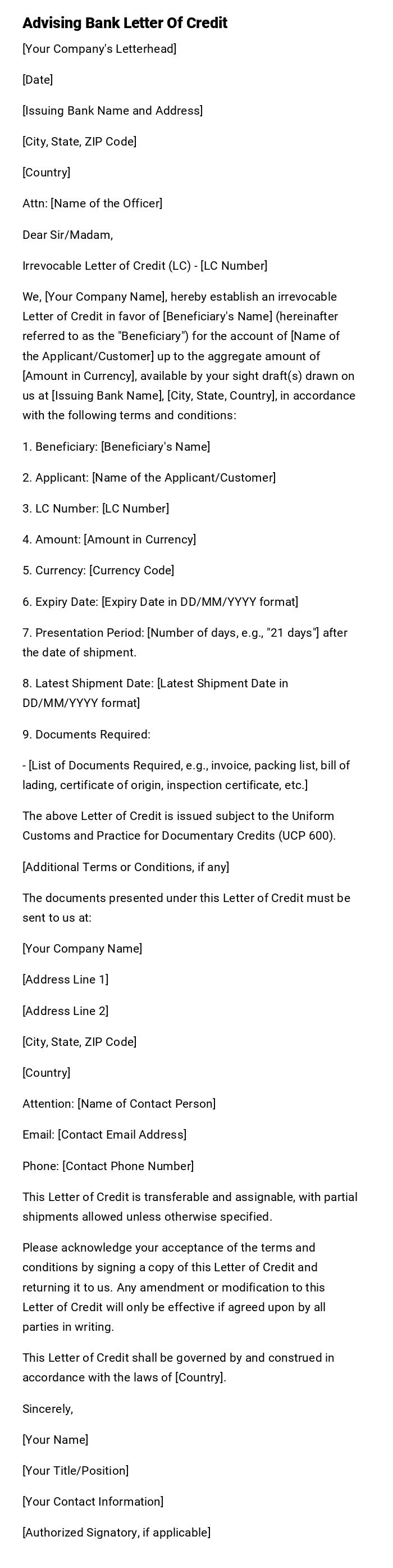

Advising Bank Letter Of Credit

[Your Company's Letterhead]

[Date]

[Issuing Bank Name and Address]

[City, State, ZIP Code]

[Country]

Attn: [Name of the Officer]

Dear Sir/Madam,

Irrevocable Letter of Credit (LC) - [LC Number]

We, [Your Company Name], hereby establish an irrevocable Letter of Credit in favor of [Beneficiary's Name] (hereinafter referred to as the "Beneficiary") for the account of [Name of the Applicant/Customer] up to the aggregate amount of [Amount in Currency], available by your sight draft(s) drawn on us at [Issuing Bank Name], [City, State, Country], in accordance with the following terms and conditions:

1. Beneficiary: [Beneficiary's Name]

2. Applicant: [Name of the Applicant/Customer]

3. LC Number: [LC Number]

4. Amount: [Amount in Currency]

5. Currency: [Currency Code]

6. Expiry Date: [Expiry Date in DD/MM/YYYY format]

7. Presentation Period: [Number of days, e.g., "21 days"] after the date of shipment.

8. Latest Shipment Date: [Latest Shipment Date in DD/MM/YYYY format]

9. Documents Required:

- [List of Documents Required, e.g., invoice, packing list, bill of lading, certificate of origin, inspection certificate, etc.]

The above Letter of Credit is issued subject to the Uniform Customs and Practice for Documentary Credits (UCP 600).

[Additional Terms or Conditions, if any]

The documents presented under this Letter of Credit must be sent to us at:

[Your Company Name]

[Address Line 1]

[Address Line 2]

[City, State, ZIP Code]

[Country]

Attention: [Name of Contact Person]

Email: [Contact Email Address]

Phone: [Contact Phone Number]

This Letter of Credit is transferable and assignable, with partial shipments allowed unless otherwise specified.

Please acknowledge your acceptance of the terms and conditions by signing a copy of this Letter of Credit and returning it to us. Any amendment or modification to this Letter of Credit will only be effective if agreed upon by all parties in writing.

This Letter of Credit shall be governed by and construed in accordance with the laws of [Country].

Sincerely,

[Your Name]

[Your Title/Position]

[Your Contact Information]

[Authorized Signatory, if applicable]

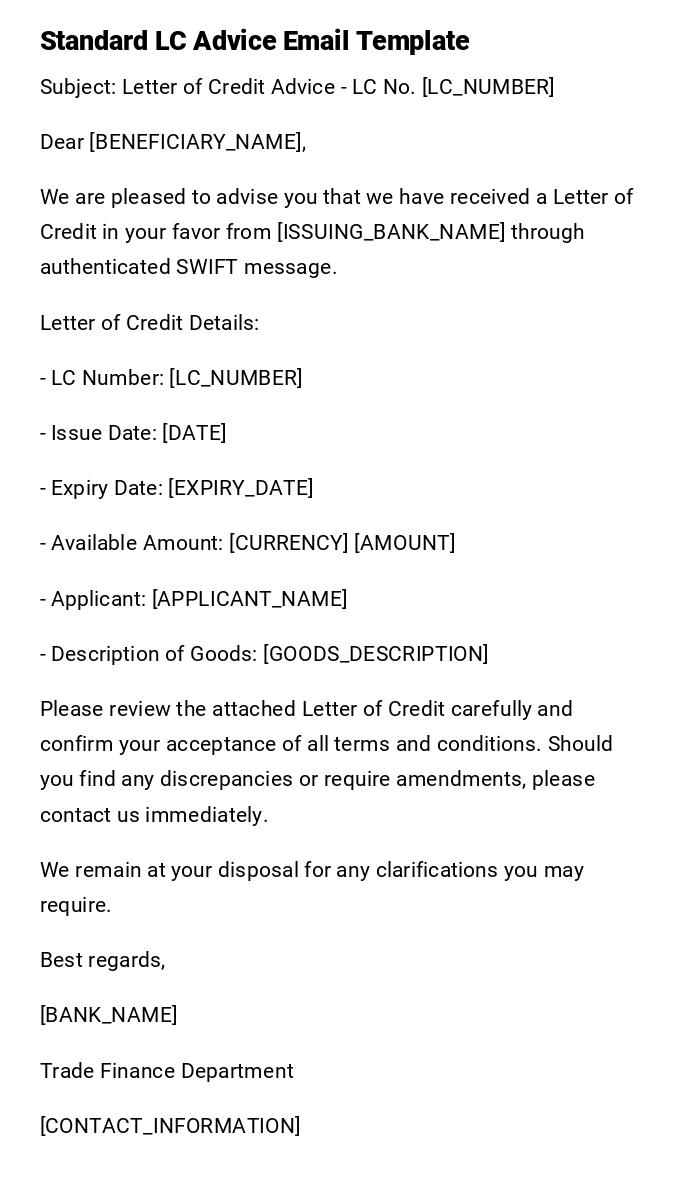

Letter of Credit Advice Notification

Subject: Letter of Credit Advice - LC No. [LC_NUMBER]

Dear [BENEFICIARY_NAME],

We are pleased to advise you that we have received a Letter of Credit in your favor from [ISSUING_BANK_NAME] through authenticated SWIFT message.

Letter of Credit Details:

- LC Number: [LC_NUMBER]

- Issue Date: [DATE]

- Expiry Date: [EXPIRY_DATE]

- Available Amount: [CURRENCY] [AMOUNT]

- Applicant: [APPLICANT_NAME]

- Description of Goods: [GOODS_DESCRIPTION]

Please review the attached Letter of Credit carefully and confirm your acceptance of all terms and conditions. Should you find any discrepancies or require amendments, please contact us immediately.

We remain at your disposal for any clarifications you may require.

Best regards,

[BANK_NAME]

Trade Finance Department

[CONTACT_INFORMATION]

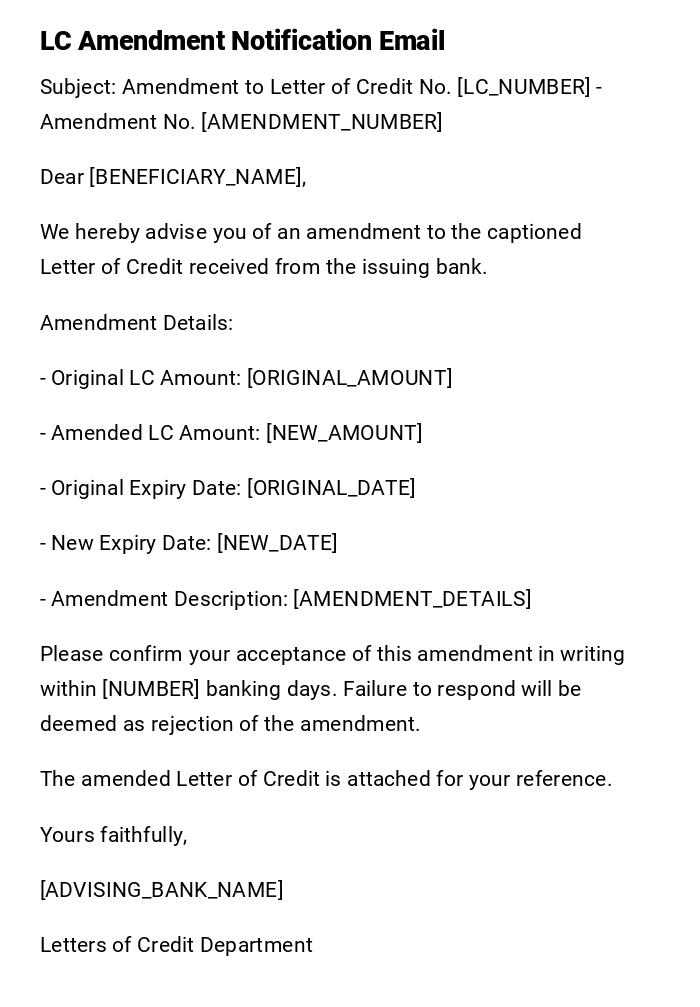

Letter of Credit Amendment Advice

Subject: Amendment to Letter of Credit No. [LC_NUMBER] - Amendment No. [AMENDMENT_NUMBER]

Dear [BENEFICIARY_NAME],

We hereby advise you of an amendment to the captioned Letter of Credit received from the issuing bank.

Amendment Details:

- Original LC Amount: [ORIGINAL_AMOUNT]

- Amended LC Amount: [NEW_AMOUNT]

- Original Expiry Date: [ORIGINAL_DATE]

- New Expiry Date: [NEW_DATE]

- Amendment Description: [AMENDMENT_DETAILS]

Please confirm your acceptance of this amendment in writing within [NUMBER] banking days. Failure to respond will be deemed as rejection of the amendment.

The amended Letter of Credit is attached for your reference.

Yours faithfully,

[ADVISING_BANK_NAME]

Letters of Credit Department

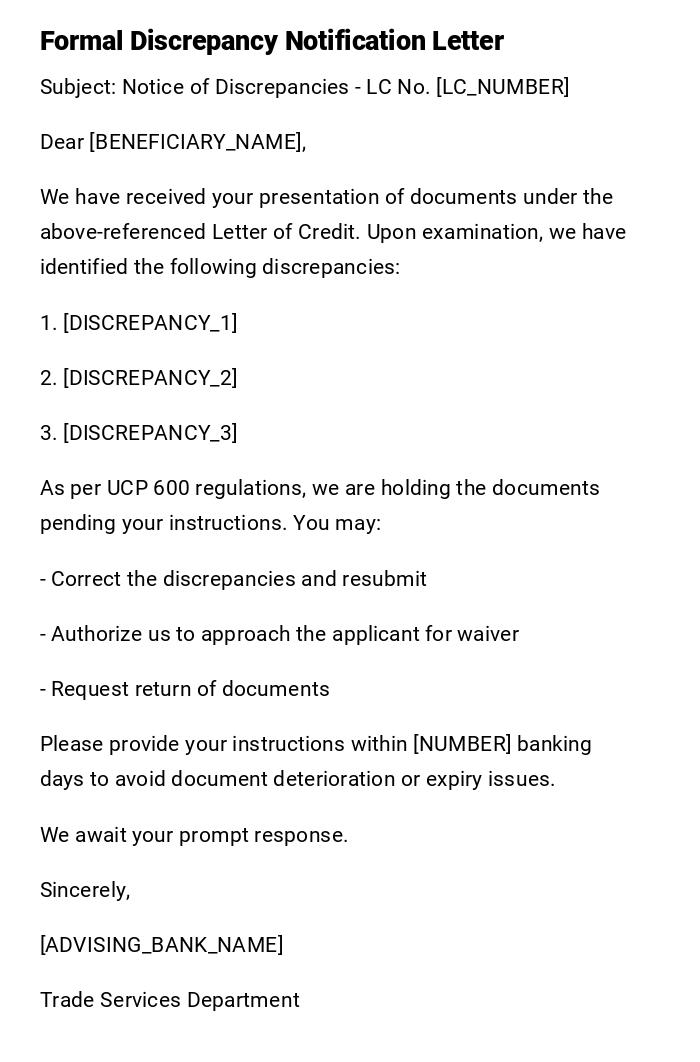

Letter of Credit Discrepancy Notice

Subject: Notice of Discrepancies - LC No. [LC_NUMBER]

Dear [BENEFICIARY_NAME],

We have received your presentation of documents under the above-referenced Letter of Credit. Upon examination, we have identified the following discrepancies:

1. [DISCREPANCY_1]

2. [DISCREPANCY_2]

3. [DISCREPANCY_3]

As per UCP 600 regulations, we are holding the documents pending your instructions. You may:

- Correct the discrepancies and resubmit

- Authorize us to approach the applicant for waiver

- Request return of documents

Please provide your instructions within [NUMBER] banking days to avoid document deterioration or expiry issues.

We await your prompt response.

Sincerely,

[ADVISING_BANK_NAME]

Trade Services Department

Letter of Credit Expiry Warning

Subject: URGENT - Letter of Credit Expiry Notice - LC No. [LC_NUMBER]

Dear [BENEFICIARY_NAME],

This serves as an urgent reminder that the above-referenced Letter of Credit is approaching expiry.

Critical Information:

- Current Date: [CURRENT_DATE]

- LC Expiry Date: [EXPIRY_DATE]

- Days Remaining: [DAYS_LEFT]

- Outstanding Amount: [AMOUNT]

If you intend to utilize this Letter of Credit, immediate action is required. Please ensure all compliant documents are presented before the expiry date and time.

Should you require an extension, please contact the applicant immediately to arrange for an amendment.

Time is of the essence. Please treat this matter with utmost urgency.

Best regards,

[BANK_NAME]

Trade Finance Operations

Letter of Credit Cancellation Notice

Subject: Cancellation of Letter of Credit No. [LC_NUMBER]

Dear [BENEFICIARY_NAME],

We regret to inform you that we have received instructions from the issuing bank to cancel the above-referenced Letter of Credit effective immediately.

Cancellation Details:

- Reason for Cancellation: [REASON]

- Effective Date: [CANCELLATION_DATE]

- Final Status: CANCELLED - NO FURTHER DRAWINGS PERMITTED

Any documents presented after this cancellation will not be honored. If you have shipments in transit or preparations underway, please contact the applicant directly to discuss alternative arrangements.

We apologize for any inconvenience this may cause and remain available to assist with future trade finance requirements.

Yours truly,

[ADVISING_BANK_NAME]

International Trade Department

Letter of Credit Confirmation Declination

Subject: Declination to Add Confirmation - LC No. [LC_NUMBER]

Dear [BENEFICIARY_NAME],

Thank you for your request to add our confirmation to the Letter of Credit referenced above.

After careful consideration of our credit policies and current exposure limits, we regret to inform you that we are unable to add our confirmation to this Letter of Credit at this time.

However, we remain your advising bank and will continue to handle all advice functions, document examinations, and payment processing upon receipt of funds from the issuing bank.

We appreciate your understanding and look forward to serving your future trade finance needs.

Kind regards,

[BANK_NAME]

Credit Risk Department

Letter of Credit Payment Advice

Subject: Payment Processed - LC No. [LC_NUMBER]

Dear [BENEFICIARY_NAME],

We are delighted to inform you that payment under the above-referenced Letter of Credit has been successfully processed!

Payment Details:

- Payment Amount: [CURRENCY] [AMOUNT]

- Payment Date: [PAYMENT_DATE]

- Value Date: [VALUE_DATE]

- Our Charges: [CHARGES]

- Net Amount Credited: [NET_AMOUNT]

The funds have been credited to your account [ACCOUNT_NUMBER] with us. A detailed credit advice will follow separately.

Thank you for choosing our trade finance services. We look forward to supporting your continued business growth.

Warm regards,

[BANK_NAME]

Trade Finance Team

Letter of Credit Document Examination Request

Subject: Document Examination Required - LC No. [LC_NUMBER]

Dear Trade Operations Team,

We have received a document presentation under the captioned Letter of Credit and require your urgent examination.

Presentation Details:

- Date Received: [RECEIVE_DATE]

- Number of Documents: [DOC_COUNT]

- Presentation Amount: [AMOUNT]

- Latest Shipment Date: [SHIPMENT_DATE]

Please examine all documents for compliance with LC terms and advise of any discrepancies within the standard timeframe.

The beneficiary is expecting quick turnaround, so please prioritize this examination.

Thanks for your prompt attention.

[SENDER_NAME]

Customer Relationship Manager

What is an Advising Bank Letter of Credit and Why is it Needed

An Advising Bank Letter of Credit is a formal communication issued by an advising bank to notify a beneficiary about the establishment, amendment, or other important developments regarding a Letter of Credit. The advising bank acts as an intermediary between the issuing bank and the beneficiary, ensuring secure and authenticated transmission of LC-related information.

These letters serve several critical purposes:

- Provide official notification to beneficiaries about LC establishment

- Communicate amendments or changes to existing LCs

- Report discrepancies in document presentations

- Notify about payment processing or cancellations

- Maintain documented communication trail for compliance

- Ensure all parties stay informed about LC status changes

Who Should Send Advising Bank Letters of Credit

The responsibility for sending these letters typically falls to specific departments and personnel within financial institutions:

- Trade Finance Department managers and officers

- Letters of Credit specialists and analysts

- International Trade Services teams

- Customer Relationship Managers handling trade clients

- Operations staff processing LC transactions

- Compliance officers ensuring regulatory adherence

- Senior trade finance executives for high-value transactions

The sender should always be an authorized bank representative with proper signing authority and expertise in international trade finance regulations.

Who Receives Advising Bank Letters of Credit

These communications are directed to various recipients depending on the specific situation:

- Primary beneficiaries named in the Letter of Credit

- Exporters and suppliers expecting LC payments

- Trading companies and international businesses

- Manufacturing firms with export operations

- Freight forwarders handling shipment documentation

- Legal representatives acting on behalf of beneficiaries

- Other correspondent banks in the LC transaction chain

- Internal bank departments requiring notification

When to Send Advising Bank Letters of Credit

Several specific events and scenarios trigger the need for these communications:

- Initial LC establishment - When a new Letter of Credit is received and needs to be advised

- Amendment notifications - Any changes to LC terms, amounts, or conditions

- Document presentation - Upon receipt of shipping and commercial documents

- Discrepancy identification - When documents don't comply with LC terms

- Payment processing - Confirmation of successful payment execution

- LC expiry warnings - Reminders about approaching expiration dates

- Cancellation notices - When LCs are terminated before utilization

- Confirmation requests - When beneficiaries seek additional bank guarantees

- Status inquiries - Response to beneficiary questions about LC progress

Requirements and Prerequisites Before Sending

Before issuing any advising bank letter, several conditions must be met:

- Authenticated SWIFT message receipt from the issuing bank

- Proper LC authentication using standard banking codes and signatures

- Complete beneficiary identification and contact information verification

- Internal credit approval for confirmation requests when applicable

- Compliance with UCP 600 regulations and local banking laws

- Risk assessment completion for the issuing bank and country

- System entry of LC details into the bank's trade finance platform

- Document security protocols for sensitive financial information

- Authorization from designated signatories within the advising bank

How to Write and Send Advising Bank Letters

The process involves several systematic steps to ensure accuracy and compliance:

Planning Phase:

- Review LC terms thoroughly for completeness

- Identify the appropriate communication type needed

- Determine urgency level and timeline requirements

- Verify all recipient contact information

Writing Process:

- Use standardized bank letterhead and formatting

- Include all relevant LC reference numbers and dates

- State the purpose clearly in the subject line

- Provide complete transaction details

- Use professional but clear language

- Include specific action items or deadlines

Review and Approval:

- Conduct dual control review by another officer

- Verify all numerical amounts and dates

- Confirm compliance with internal procedures

- Obtain necessary approvals based on transaction size

Delivery Methods:

- Electronic transmission via secure banking networks

- SWIFT messaging for international communications

- Encrypted email for routine notifications

- Registered mail for formal legal documents

Elements and Structure Required in Letters

Every advising bank letter must contain specific structural elements:

Header Information:

- Bank letterhead with full contact details

- Date and reference numbers

- Recipient name and address

- Clear subject line with LC number

Body Content:

- Professional greeting appropriate to relationship

- Clear statement of purpose

- Complete LC transaction details

- Specific terms and conditions

- Action items or required responses

- Timeline for beneficiary response

Closing Components:

- Professional closing remarks

- Bank name and department

- Authorized signatory information

- Contact details for follow-up questions

Attachments and Enclosures:

- Original LC copy when required

- Amendment details and documentation

- Supporting documents as applicable

- Return instructions when necessary

Formatting Guidelines and Best Practices

Professional formatting ensures clarity and maintains banking standards:

Length and Style:

- Keep letters concise but comprehensive

- Use formal business tone for official communications

- Employ clear, jargon-free language when possible

- Maintain consistent formatting throughout

Technical Specifications:

- Standard business letter format

- Professional font selection (Times New Roman, Arial)

- Appropriate margins and spacing

- Sequential numbering for multiple points

Tone Considerations:

- Formal tone for legal and compliance matters

- Professional yet approachable for routine communications

- Urgent tone for time-sensitive matters

- Diplomatic language for problem notifications

Delivery Preferences:

- Electronic delivery for speed and efficiency

- Registered mail for legal documentation

- Secure messaging for confidential information

- Multiple channels for critical notifications

Follow-up Actions After Sending

Several important steps must be taken after dispatching advising bank letters:

Immediate Actions:

- Confirm receipt by beneficiary when required

- File copies in appropriate transaction records

- Update internal tracking systems

- Schedule follow-up reminders for time-sensitive matters

Ongoing Monitoring:

- Track beneficiary response timelines

- Monitor LC expiry dates and deadlines

- Watch for incoming document presentations

- Coordinate with issuing bank communications

Documentation Requirements:

- Maintain complete communication trail

- Record all beneficiary acknowledgments

- Document any requested amendments or changes

- Preserve audit trail for regulatory compliance

Escalation Procedures:

- Alert senior management for non-responses to critical letters

- Coordinate with legal department for dispute situations

- Engage relationship managers for customer service issues

- Involve compliance officers for regulatory concerns

Common Mistakes to Avoid

Understanding frequent errors helps prevent costly complications:

Documentation Errors:

- Incorrect LC numbers or reference details

- Inaccurate beneficiary information

- Missing critical terms or conditions

- Failure to include required attachments

Communication Issues:

- Unclear or ambiguous language

- Inadequate explanation of required actions

- Missing deadline information

- Inappropriate tone for the situation

Process Failures:

- Insufficient internal review before sending

- Failure to obtain proper approvals

- Inadequate follow-up on time-sensitive matters

- Poor record keeping and filing

Compliance Oversights:

- Non-adherence to UCP 600 regulations

- Failure to follow internal bank procedures

- Inadequate authentication of source documents

- Missing regulatory disclosures when required

Advantages and Disadvantages of Different Communication Types

Electronic Communications:

- Pros: Speed, cost-effectiveness, easy tracking, environmental benefits

- Cons: Security concerns, technical failures, less formal appearance

Traditional Mail:

- Pros: Legal validity, formal presentation, permanent record

- Cons: Slow delivery, higher costs, risk of loss

SWIFT Messaging:

- Pros: High security, international standards, bank authentication

- Cons: Technical complexity, system dependency, limited formatting

Phone Communications:

- Pros: Immediate clarification, personal touch, quick problem resolution

- Cons: No permanent record, potential misunderstandings, time zone challenges

Professional Tips and Best Practices

Experienced trade finance professionals recommend these strategies:

Efficiency Tips:

- Develop standardized templates for common situations

- Use automated systems for routine notifications

- Maintain updated beneficiary contact databases

- Establish clear internal escalation procedures

Quality Assurance:

- Implement dual control review processes

- Create checklists for different letter types

- Regular training on UCP 600 updates

- Periodic audit of communication procedures

Customer Service Excellence:

- Respond promptly to beneficiary inquiries

- Provide clear explanations of complex terms

- Offer proactive updates on transaction status

- Maintain professional relationships with all parties

Risk Management:

- Verify all communications through multiple channels

- Maintain comprehensive audit trails

- Regular review of authentication procedures

- Stay updated on international banking regulations

Download Word Doc

Download Word Doc

Download PDF

Download PDF