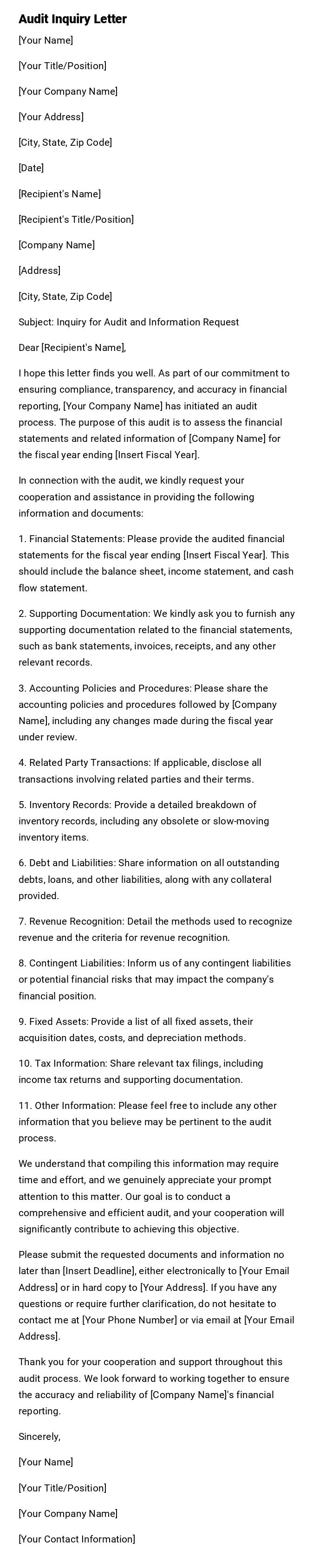

Audit Inquiry Letter

[Your Name]

[Your Title/Position]

[Your Company Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Recipient's Name]

[Recipient's Title/Position]

[Company Name]

[Address]

[City, State, Zip Code]

Subject: Inquiry for Audit and Information Request

Dear [Recipient's Name],

I hope this letter finds you well. As part of our commitment to ensuring compliance, transparency, and accuracy in financial reporting, [Your Company Name] has initiated an audit process. The purpose of this audit is to assess the financial statements and related information of [Company Name] for the fiscal year ending [Insert Fiscal Year].

In connection with the audit, we kindly request your cooperation and assistance in providing the following information and documents:

1. Financial Statements: Please provide the audited financial statements for the fiscal year ending [Insert Fiscal Year]. This should include the balance sheet, income statement, and cash flow statement.

2. Supporting Documentation: We kindly ask you to furnish any supporting documentation related to the financial statements, such as bank statements, invoices, receipts, and any other relevant records.

3. Accounting Policies and Procedures: Please share the accounting policies and procedures followed by [Company Name], including any changes made during the fiscal year under review.

4. Related Party Transactions: If applicable, disclose all transactions involving related parties and their terms.

5. Inventory Records: Provide a detailed breakdown of inventory records, including any obsolete or slow-moving inventory items.

6. Debt and Liabilities: Share information on all outstanding debts, loans, and other liabilities, along with any collateral provided.

7. Revenue Recognition: Detail the methods used to recognize revenue and the criteria for revenue recognition.

8. Contingent Liabilities: Inform us of any contingent liabilities or potential financial risks that may impact the company's financial position.

9. Fixed Assets: Provide a list of all fixed assets, their acquisition dates, costs, and depreciation methods.

10. Tax Information: Share relevant tax filings, including income tax returns and supporting documentation.

11. Other Information: Please feel free to include any other information that you believe may be pertinent to the audit process.

We understand that compiling this information may require time and effort, and we genuinely appreciate your prompt attention to this matter. Our goal is to conduct a comprehensive and efficient audit, and your cooperation will significantly contribute to achieving this objective.

Please submit the requested documents and information no later than [Insert Deadline], either electronically to [Your Email Address] or in hard copy to [Your Address]. If you have any questions or require further clarification, do not hesitate to contact me at [Your Phone Number] or via email at [Your Email Address].

Thank you for your cooperation and support throughout this audit process. We look forward to working together to ensure the accuracy and reliability of [Company Name]'s financial reporting.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Company Name]

[Your Contact Information]

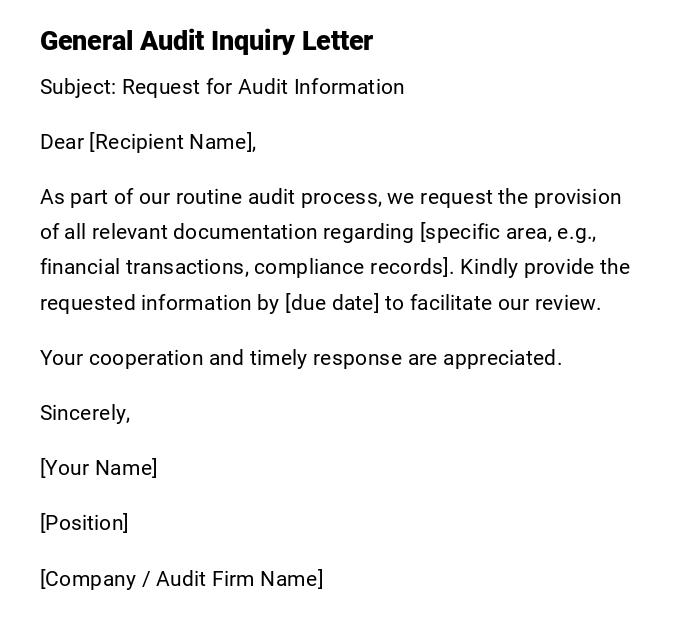

General Audit Inquiry Letter

Subject: Request for Audit Information

Dear [Recipient Name],

As part of our routine audit process, we request the provision of all relevant documentation regarding [specific area, e.g., financial transactions, compliance records]. Kindly provide the requested information by [due date] to facilitate our review.

Your cooperation and timely response are appreciated.

Sincerely,

[Your Name]

[Position]

[Company / Audit Firm Name]

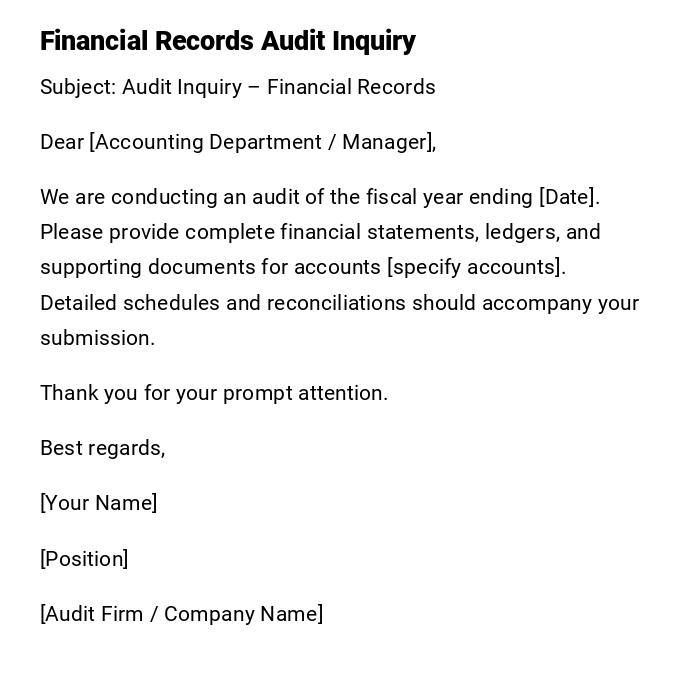

Financial Records Audit Inquiry

Subject: Audit Inquiry – Financial Records

Dear [Accounting Department / Manager],

We are conducting an audit of the fiscal year ending [Date]. Please provide complete financial statements, ledgers, and supporting documents for accounts [specify accounts]. Detailed schedules and reconciliations should accompany your submission.

Thank you for your prompt attention.

Best regards,

[Your Name]

[Position]

[Audit Firm / Company Name]

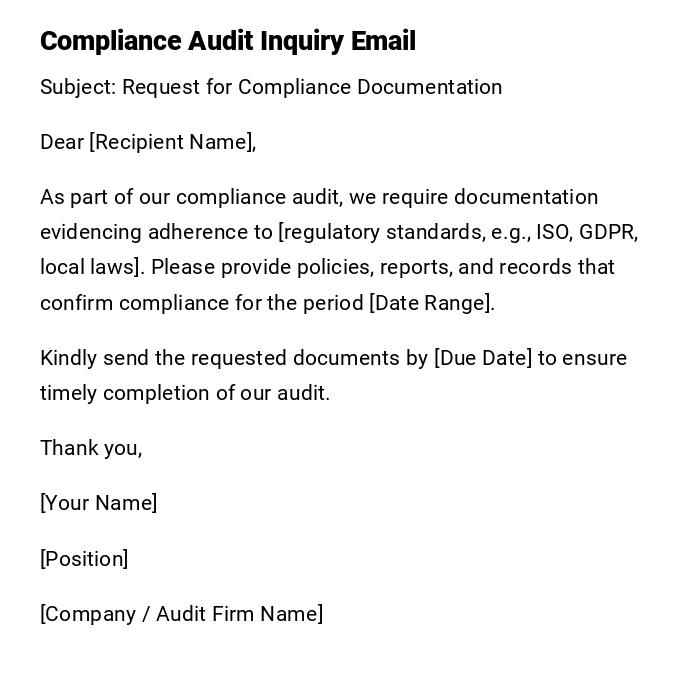

Compliance Audit Inquiry Email

Subject: Request for Compliance Documentation

Dear [Recipient Name],

As part of our compliance audit, we require documentation evidencing adherence to [regulatory standards, e.g., ISO, GDPR, local laws]. Please provide policies, reports, and records that confirm compliance for the period [Date Range].

Kindly send the requested documents by [Due Date] to ensure timely completion of our audit.

Thank you,

[Your Name]

[Position]

[Company / Audit Firm Name]

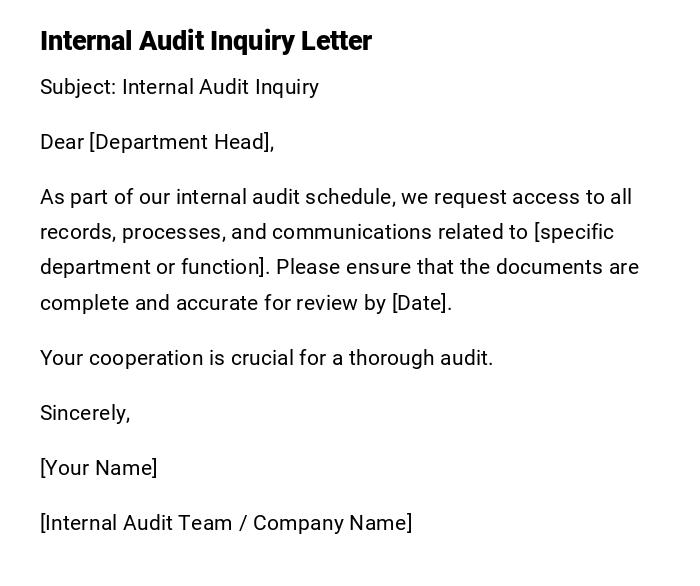

Internal Audit Inquiry Letter

Subject: Internal Audit Inquiry

Dear [Department Head],

As part of our internal audit schedule, we request access to all records, processes, and communications related to [specific department or function]. Please ensure that the documents are complete and accurate for review by [Date].

Your cooperation is crucial for a thorough audit.

Sincerely,

[Your Name]

[Internal Audit Team / Company Name]

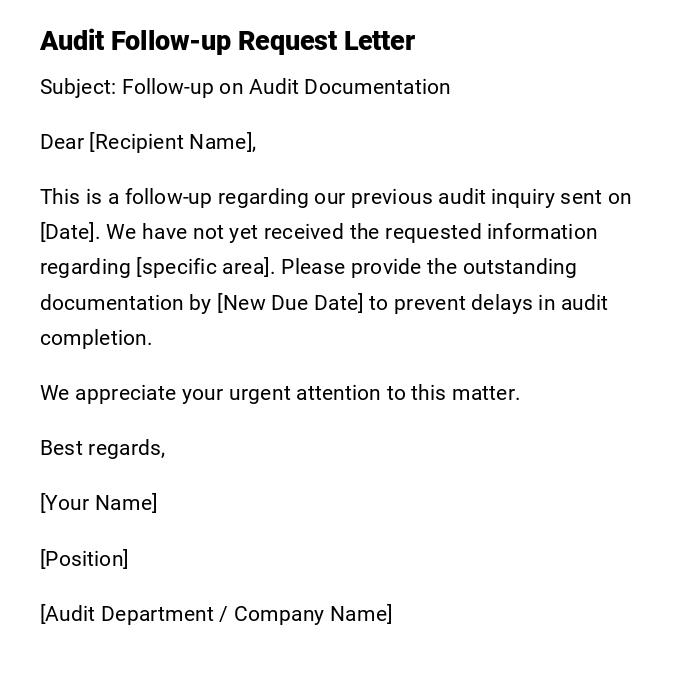

Audit Follow-up Request Letter

Subject: Follow-up on Audit Documentation

Dear [Recipient Name],

This is a follow-up regarding our previous audit inquiry sent on [Date]. We have not yet received the requested information regarding [specific area]. Please provide the outstanding documentation by [New Due Date] to prevent delays in audit completion.

We appreciate your urgent attention to this matter.

Best regards,

[Your Name]

[Position]

[Audit Department / Company Name]

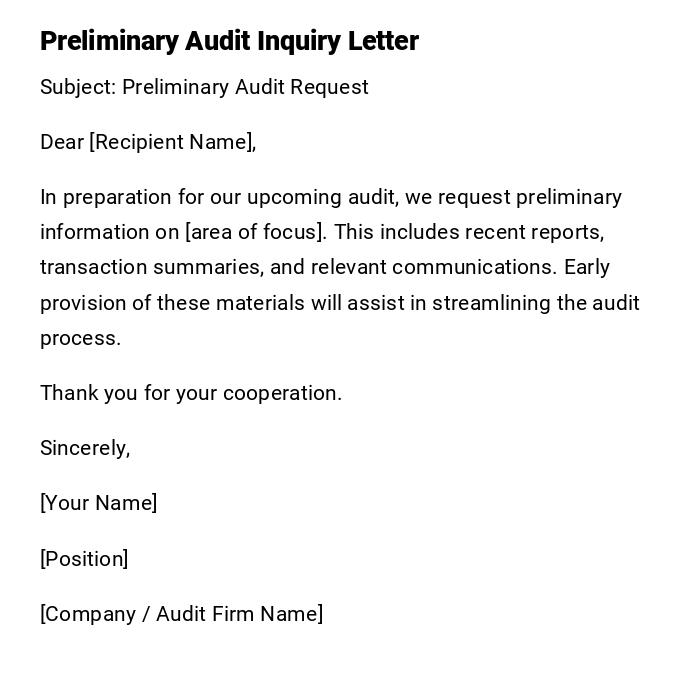

Preliminary Audit Inquiry Letter

Subject: Preliminary Audit Request

Dear [Recipient Name],

In preparation for our upcoming audit, we request preliminary information on [area of focus]. This includes recent reports, transaction summaries, and relevant communications. Early provision of these materials will assist in streamlining the audit process.

Thank you for your cooperation.

Sincerely,

[Your Name]

[Position]

[Company / Audit Firm Name]

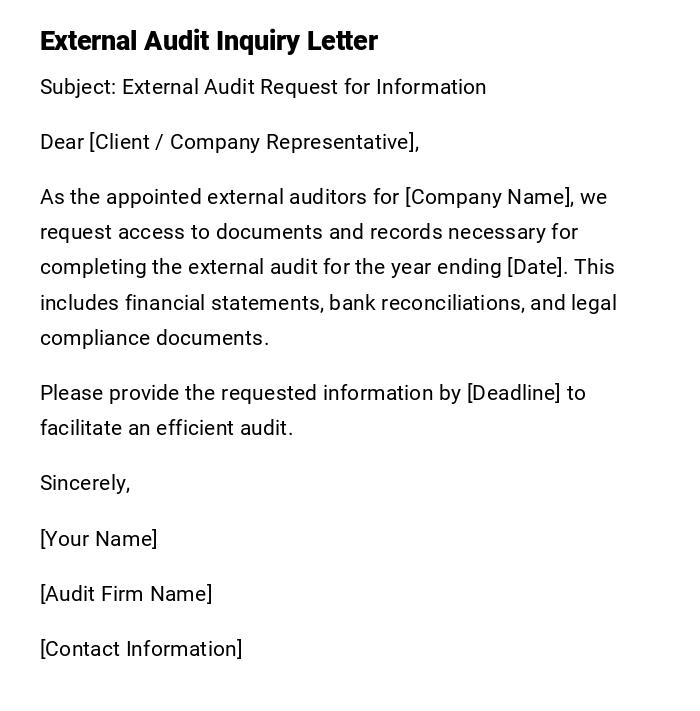

External Audit Inquiry Letter

Subject: External Audit Request for Information

Dear [Client / Company Representative],

As the appointed external auditors for [Company Name], we request access to documents and records necessary for completing the external audit for the year ending [Date]. This includes financial statements, bank reconciliations, and legal compliance documents.

Please provide the requested information by [Deadline] to facilitate an efficient audit.

Sincerely,

[Your Name]

[Audit Firm Name]

[Contact Information]

What an Audit Inquiry Letter Is and Why It Is Needed

- A formal request sent to obtain information required for conducting an audit.

- Purpose: Ensures transparency, completeness, and accuracy in financial or operational records.

- Supports decision-making, compliance, and accountability within an organization.

Who Should Send an Audit Inquiry Letter

- Internal auditors within a company or organization.

- External auditors or audit firms appointed for independent review.

- Regulatory authorities requesting records for compliance audits.

Whom an Audit Inquiry Letter Should Be Addressed To

- Department heads responsible for the records being audited.

- Accounting or finance teams for financial audits.

- Compliance officers or relevant operational staff.

When to Send an Audit Inquiry Letter

- Prior to scheduled audits to prepare documentation.

- During the audit process to clarify or request missing information.

- For follow-up purposes if previous requests were incomplete or delayed.

How to Prepare and Send an Audit Inquiry Letter

- Identify the scope and purpose of the audit.

- List all required documents, records, and reports.

- Draft a clear and concise letter specifying deadlines and contact points.

- Send via formal channels: email, postal mail, or internal memos.

- Track receipt and maintain records for accountability.

Requirements and Prerequisites Before Sending an Audit Inquiry Letter

- Knowledge of the audit scope and objectives.

- Clear identification of recipients responsible for providing information.

- Documentation checklist specifying required reports, dates, and formats.

- Approval from audit manager or relevant authority to send the inquiry.

Elements and Structure of an Audit Inquiry Letter

- Subject line clearly stating the audit request.

- Salutation addressing the responsible party.

- Clear description of the requested information.

- Deadline for submission and contact details for queries.

- Closing with formal signature and position.

Formatting and Tone for Audit Inquiry Letters

- Tone: Professional, serious, and clear.

- Length: Concise but complete; usually one page.

- Mode: Email or printed letter depending on recipient preference.

- Etiquette: Polite but firm regarding deadlines and requirements.

Common Mistakes in Audit Inquiry Letters

- Vague or incomplete description of requested documents.

- Incorrect recipient or missing cc to relevant stakeholders.

- Unclear deadlines leading to delays.

- Failure to track responses or follow up.

After Sending an Audit Inquiry Letter

- Confirm receipt by the recipient.

- Follow up on outstanding or incomplete submissions.

- Maintain a log of received documents for audit tracking.

- Communicate any issues or discrepancies to audit management promptly.

Pros and Cons of Using Audit Inquiry Letters

Pros:

- Ensures structured and documented requests.

- Facilitates compliance and audit efficiency.

- Provides accountability and a record of communication.

Cons:

- May cause delays if recipients do not respond promptly.

- Can be perceived as formal or rigid if tone is too harsh.

- Requires careful tracking to prevent missed submissions.

Tricks and Tips for Effective Audit Inquiry Letters

- Use a standardized template for consistency.

- Specify exact documents, dates, and formats to prevent ambiguity.

- Include a follow-up schedule in the initial letter.

- Keep the tone professional but cooperative to encourage timely responses.

Compare and Contrast Audit Inquiry Letters With Informal Requests

- Audit Inquiry Letters: formal, documented, and deadline-driven.

- Informal Requests: verbal or casual emails, may lack accountability.

- Formal letters ensure traceability and compliance, whereas informal requests may result in incomplete information or disputes.

Frequently Asked Questions About Audit Inquiry Letters

-

Q: Can an audit inquiry letter be sent via email?

A: Yes, email is acceptable if it maintains a professional format. -

Q: What if the recipient fails to respond?

A: Follow up with reminders, escalate to management if necessary. -

Q: Are attachments required?

A: Yes, include checklists or templates to clarify requested information. -

Q: Can the letter request confidential documents?

A: Yes, but ensure proper authorization and secure transmission methods.

Does an Audit Inquiry Letter Require Authorization

- Yes, letters must be authorized by the audit manager or relevant authority.

- External audits require formal engagement letters and permission from company leadership.

- Ensures the request is legitimate and protects both auditors and recipients.

Download Word Doc

Download Word Doc

Download PDF

Download PDF