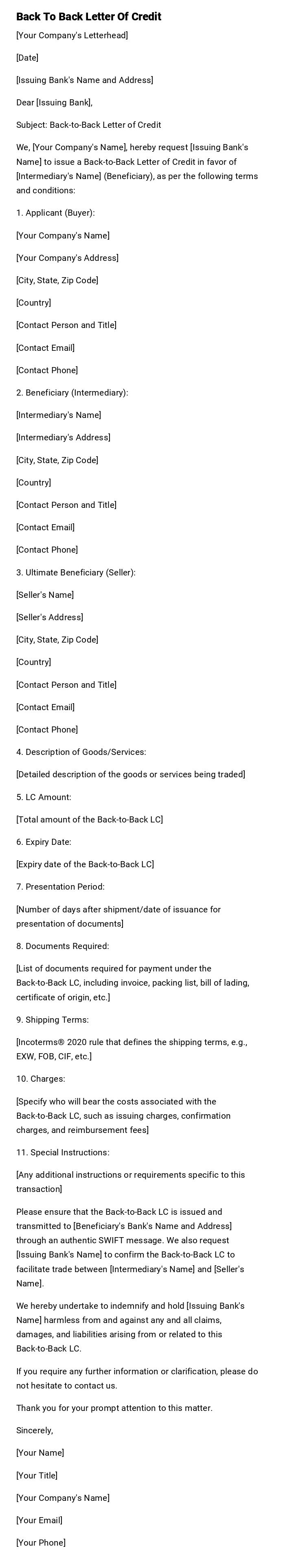

Back To Back Letter Of Credit

[Your Company's Letterhead]

[Date]

[Issuing Bank's Name and Address]

Dear [Issuing Bank],

Subject: Back-to-Back Letter of Credit

We, [Your Company's Name], hereby request [Issuing Bank's Name] to issue a Back-to-Back Letter of Credit in favor of [Intermediary's Name] (Beneficiary), as per the following terms and conditions:

1. Applicant (Buyer):

[Your Company's Name]

[Your Company's Address]

[City, State, Zip Code]

[Country]

[Contact Person and Title]

[Contact Email]

[Contact Phone]

2. Beneficiary (Intermediary):

[Intermediary's Name]

[Intermediary's Address]

[City, State, Zip Code]

[Country]

[Contact Person and Title]

[Contact Email]

[Contact Phone]

3. Ultimate Beneficiary (Seller):

[Seller's Name]

[Seller's Address]

[City, State, Zip Code]

[Country]

[Contact Person and Title]

[Contact Email]

[Contact Phone]

4. Description of Goods/Services:

[Detailed description of the goods or services being traded]

5. LC Amount:

[Total amount of the Back-to-Back LC]

6. Expiry Date:

[Expiry date of the Back-to-Back LC]

7. Presentation Period:

[Number of days after shipment/date of issuance for presentation of documents]

8. Documents Required:

[List of documents required for payment under the Back-to-Back LC, including invoice, packing list, bill of lading, certificate of origin, etc.]

9. Shipping Terms:

[Incoterms® 2020 rule that defines the shipping terms, e.g., EXW, FOB, CIF, etc.]

10. Charges:

[Specify who will bear the costs associated with the Back-to-Back LC, such as issuing charges, confirmation charges, and reimbursement fees]

11. Special Instructions:

[Any additional instructions or requirements specific to this transaction]

Please ensure that the Back-to-Back LC is issued and transmitted to [Beneficiary's Bank's Name and Address] through an authentic SWIFT message. We also request [Issuing Bank's Name] to confirm the Back-to-Back LC to facilitate trade between [Intermediary's Name] and [Seller's Name].

We hereby undertake to indemnify and hold [Issuing Bank's Name] harmless from and against any and all claims, damages, and liabilities arising from or related to this Back-to-Back LC.

If you require any further information or clarification, please do not hesitate to contact us.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

[Your Title]

[Your Company's Name]

[Your Email]

[Your Phone]

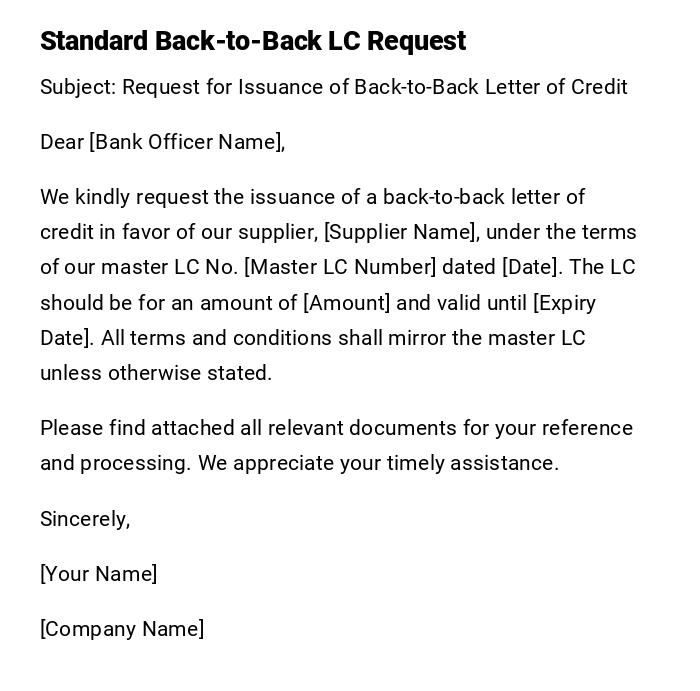

Standard Back-to-Back Letter of Credit Request

Subject: Request for Issuance of Back-to-Back Letter of Credit

Dear [Bank Officer Name],

We kindly request the issuance of a back-to-back letter of credit in favor of our supplier, [Supplier Name], under the terms of our master LC No. [Master LC Number] dated [Date]. The LC should be for an amount of [Amount] and valid until [Expiry Date]. All terms and conditions shall mirror the master LC unless otherwise stated.

Please find attached all relevant documents for your reference and processing. We appreciate your timely assistance.

Sincerely,

[Your Name]

[Company Name]

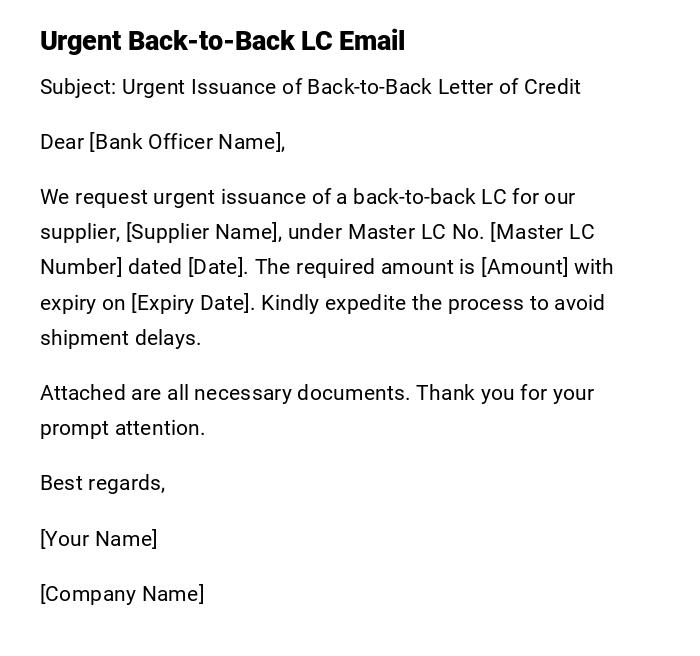

Urgent Back-to-Back Letter of Credit Email

Subject: Urgent Issuance of Back-to-Back Letter of Credit

Dear [Bank Officer Name],

We request urgent issuance of a back-to-back LC for our supplier, [Supplier Name], under Master LC No. [Master LC Number] dated [Date]. The required amount is [Amount] with expiry on [Expiry Date]. Kindly expedite the process to avoid shipment delays.

Attached are all necessary documents. Thank you for your prompt attention.

Best regards,

[Your Name]

[Company Name]

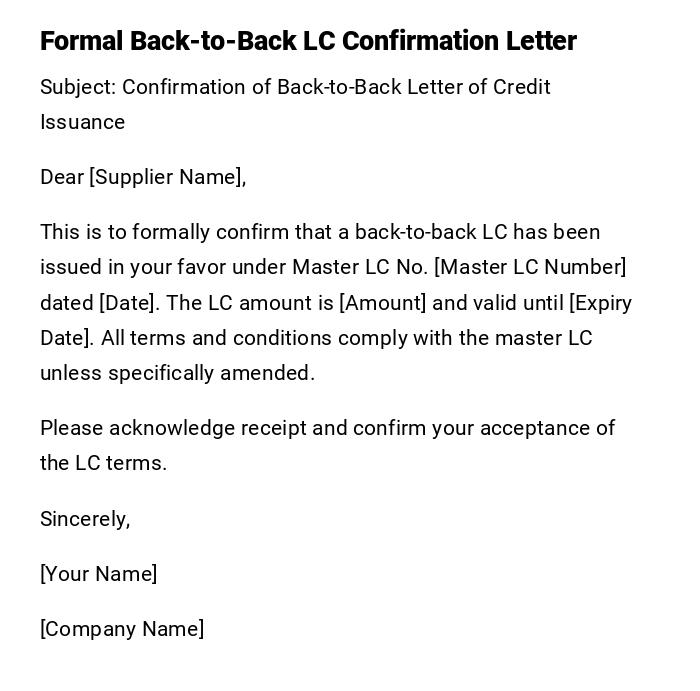

Formal Back-to-Back LC Confirmation Letter

Subject: Confirmation of Back-to-Back Letter of Credit Issuance

Dear [Supplier Name],

This is to formally confirm that a back-to-back LC has been issued in your favor under Master LC No. [Master LC Number] dated [Date]. The LC amount is [Amount] and valid until [Expiry Date]. All terms and conditions comply with the master LC unless specifically amended.

Please acknowledge receipt and confirm your acceptance of the LC terms.

Sincerely,

[Your Name]

[Company Name]

Back-to-Back Letter of Credit Amendment Request

Subject: Amendment Request for Back-to-Back Letter of Credit

Dear [Bank Officer Name],

We request the following amendments to the back-to-back LC No. [LC Number] issued under Master LC No. [Master LC Number]:

1. Extend expiry date to [New Expiry Date]

2. Revise shipment terms as per attached updated contract

Please process the amendment at your earliest convenience and confirm once done.

Thank you for your support.

Best regards,

[Your Name]

[Company Name]

Provisional Back-to-Back Letter of Credit Notification

Subject: Provisional Back-to-Back LC Notification

Dear [Supplier Name],

We wish to inform you that a provisional back-to-back LC has been arranged in your favor under Master LC No. [Master LC Number] dated [Date]. The provisional amount is [Amount] pending final verification and approval from our bank.

Kindly review the provisional terms and provide acknowledgment.

Sincerely,

[Your Name]

[Company Name]

What is a Back-to-Back Letter of Credit and Why It Is Used

- A secondary LC issued based on an existing master LC

- Enables a buyer to finance payments to a supplier using the security of the original LC

- Commonly used in trading scenarios involving intermediaries

- Ensures payment security and smooth international transactions

Who Should Send a Back-to-Back Letter of Credit

- Importers or trading companies acting as intermediaries

- Exporters requesting a secondary LC to fulfill orders

- Bank officers responsible for LC processing and approval

Whom Should a Back-to-Back LC Be Addressed To

- Supplier or exporter receiving the secondary LC

- Issuing bank handling the back-to-back LC

- Beneficiaries outlined in the master LC

When to Use a Back-to-Back Letter of Credit

- When an intermediary purchases goods on behalf of another party

- When the master LC cannot be assigned directly to the supplier

- During international trade requiring secure financing for suppliers

- For partial shipments or phased deliveries requiring separate LCs

How to Apply for a Back-to-Back Letter of Credit

- Review terms of the master LC

- Identify the supplier and required LC amount

- Draft a formal request to the issuing bank

- Attach supporting documents: invoice, purchase order, and master LC copy

- Ensure compliance with bank regulations and international trade laws

- Submit the request and follow up for issuance

Formatting Guidelines for Back-to-Back Letters of Credit

- Tone: Professional and formal

- Include: Master LC reference, amount, beneficiary, expiry date, and terms

- Attach supporting documents

- Signature: Authorized company representative

- Mode: Preferably official letter, but email acceptable for internal processing

Requirements and Prerequisites Before Issuing a Back-to-Back LC

- Copy of the master LC

- Agreement or contract with the supplier

- Approved credit limit with the issuing bank

- Compliance checks (KYC, regulatory approvals)

- Payment terms clearly defined

After Sending a Back-to-Back Letter of Credit

- Obtain confirmation from the bank of LC issuance

- Notify the supplier and request acknowledgment

- Monitor shipment and document compliance for payment

- Keep record of all communications for auditing and future reference

Common Mistakes to Avoid in Back-to-Back LC

- Failing to reference the master LC correctly

- Omitting critical terms like amount, expiry date, or beneficiary

- Ignoring bank compliance and documentation requirements

- Sending provisional LC without proper confirmation

Elements and Structure of a Back-to-Back Letter of Credit

- Subject line indicating LC type

- Salutation to the bank or beneficiary

- Reference to master LC and terms

- Amount and currency

- Expiry date and validity period

- Shipment terms and documents required

- Closing statement and signature

Tips for Efficient Back-to-Back LC Processing

- Verify master LC terms carefully

- Maintain clear communication with supplier and bank

- Use professional and precise language

- Ensure all required documents are attached

- Follow up consistently to avoid delays

FAQ About Back-to-Back Letters of Credit

-

Q: Can the secondary LC differ from the master LC?

A: Minor amendments are possible, but generally, terms should mirror the master LC. -

Q: Who bears the risk in a back-to-back LC?

A: The intermediary relies on the master LC for security; the supplier depends on the secondary LC. -

Q: Are banks required to issue a back-to-back LC?

A: Issuance is subject to the bank’s approval, credit checks, and compliance with regulations.

Download Word Doc

Download Word Doc

Download PDF

Download PDF