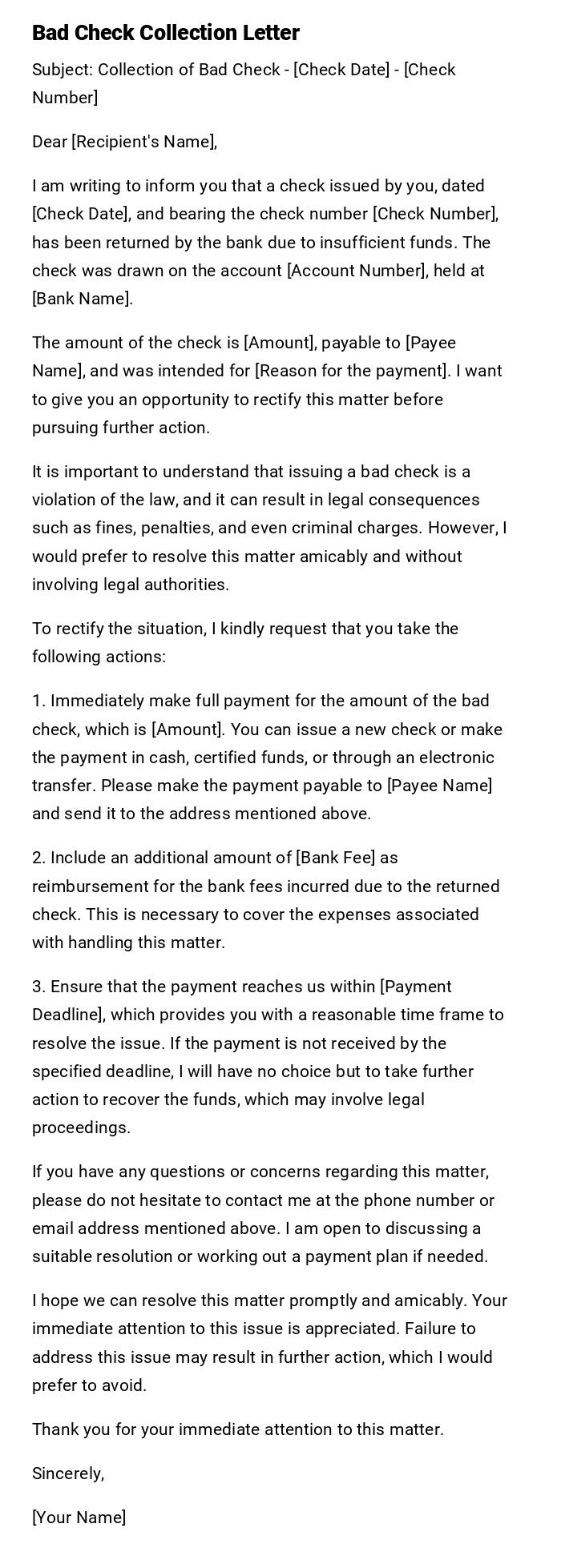

Bad Check Collection Letter

Subject: Collection of Bad Check - [Check Date] - [Check Number]

Dear [Recipient's Name],

I am writing to inform you that a check issued by you, dated [Check Date], and bearing the check number [Check Number], has been returned by the bank due to insufficient funds. The check was drawn on the account [Account Number], held at [Bank Name].

The amount of the check is [Amount], payable to [Payee Name], and was intended for [Reason for the payment]. I want to give you an opportunity to rectify this matter before pursuing further action.

It is important to understand that issuing a bad check is a violation of the law, and it can result in legal consequences such as fines, penalties, and even criminal charges. However, I would prefer to resolve this matter amicably and without involving legal authorities.

To rectify the situation, I kindly request that you take the following actions:

1. Immediately make full payment for the amount of the bad check, which is [Amount]. You can issue a new check or make the payment in cash, certified funds, or through an electronic transfer. Please make the payment payable to [Payee Name] and send it to the address mentioned above.

2. Include an additional amount of [Bank Fee] as reimbursement for the bank fees incurred due to the returned check. This is necessary to cover the expenses associated with handling this matter.

3. Ensure that the payment reaches us within [Payment Deadline], which provides you with a reasonable time frame to resolve the issue. If the payment is not received by the specified deadline, I will have no choice but to take further action to recover the funds, which may involve legal proceedings.

If you have any questions or concerns regarding this matter, please do not hesitate to contact me at the phone number or email address mentioned above. I am open to discussing a suitable resolution or working out a payment plan if needed.

I hope we can resolve this matter promptly and amicably. Your immediate attention to this issue is appreciated. Failure to address this issue may result in further action, which I would prefer to avoid.

Thank you for your immediate attention to this matter.

Sincerely,

[Your Name]

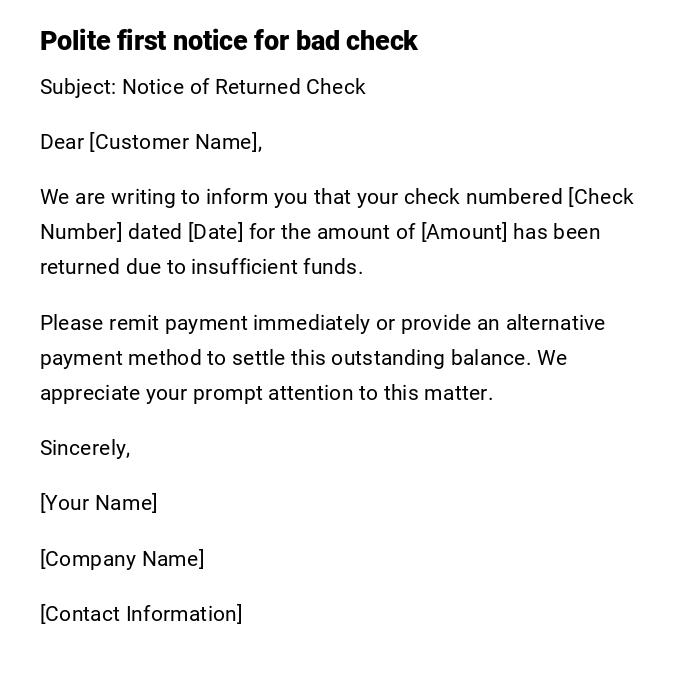

Initial Bad Check Collection Letter

Subject: Notice of Returned Check

Dear [Customer Name],

We are writing to inform you that your check numbered [Check Number] dated [Date] for the amount of [Amount] has been returned due to insufficient funds.

Please remit payment immediately or provide an alternative payment method to settle this outstanding balance. We appreciate your prompt attention to this matter.

Sincerely,

[Your Name]

[Company Name]

[Contact Information]

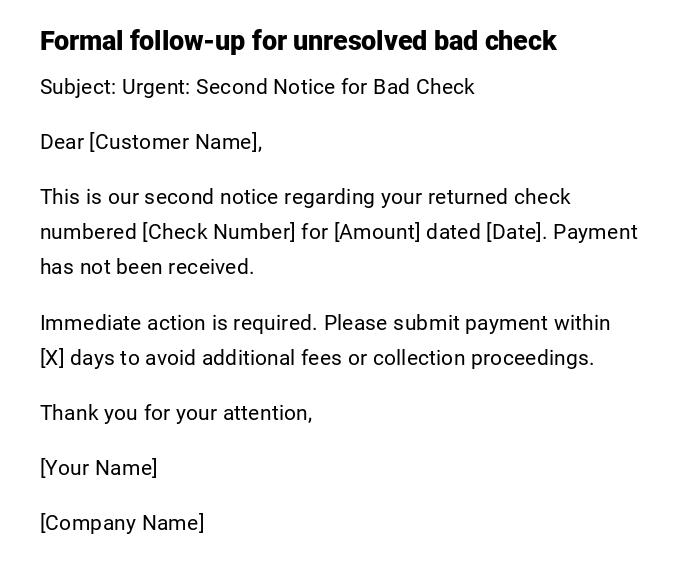

Second Notice Bad Check Collection Letter

Subject: Urgent: Second Notice for Bad Check

Dear [Customer Name],

This is our second notice regarding your returned check numbered [Check Number] for [Amount] dated [Date]. Payment has not been received.

Immediate action is required. Please submit payment within [X] days to avoid additional fees or collection proceedings.

Thank you for your attention,

[Your Name]

[Company Name]

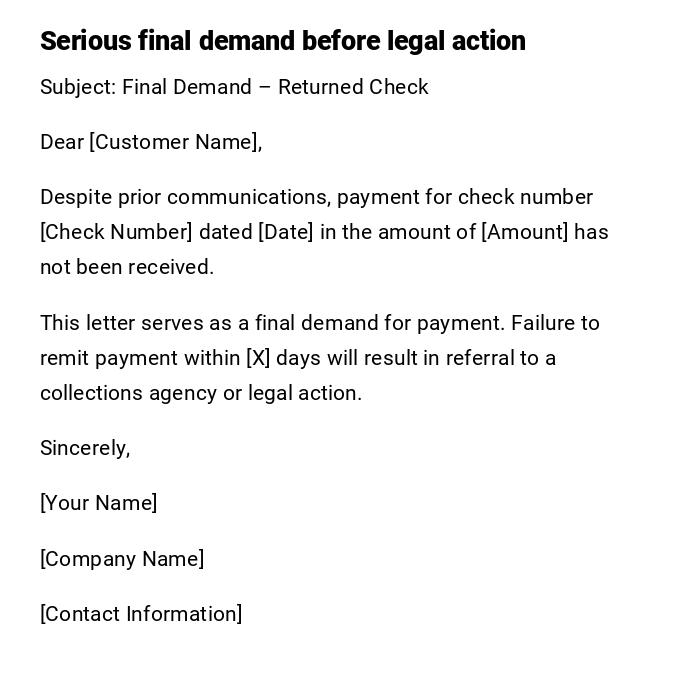

Final Demand Bad Check Letter

Subject: Final Demand – Returned Check

Dear [Customer Name],

Despite prior communications, payment for check number [Check Number] dated [Date] in the amount of [Amount] has not been received.

This letter serves as a final demand for payment. Failure to remit payment within [X] days will result in referral to a collections agency or legal action.

Sincerely,

[Your Name]

[Company Name]

[Contact Information]

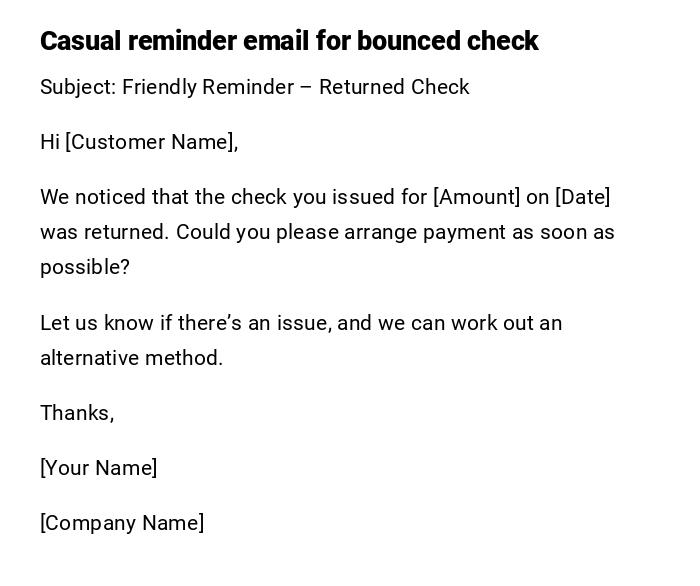

Informal Bad Check Reminder Email

Subject: Friendly Reminder – Returned Check

Hi [Customer Name],

We noticed that the check you issued for [Amount] on [Date] was returned. Could you please arrange payment as soon as possible?

Let us know if there’s an issue, and we can work out an alternative method.

Thanks,

[Your Name]

[Company Name]

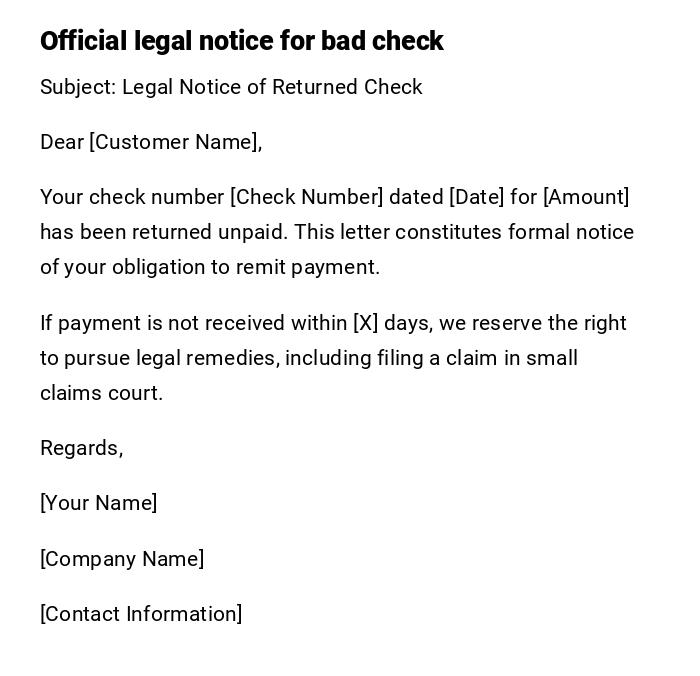

Legal Notice for Bad Check

Subject: Legal Notice of Returned Check

Dear [Customer Name],

Your check number [Check Number] dated [Date] for [Amount] has been returned unpaid. This letter constitutes formal notice of your obligation to remit payment.

If payment is not received within [X] days, we reserve the right to pursue legal remedies, including filing a claim in small claims court.

Regards,

[Your Name]

[Company Name]

[Contact Information]

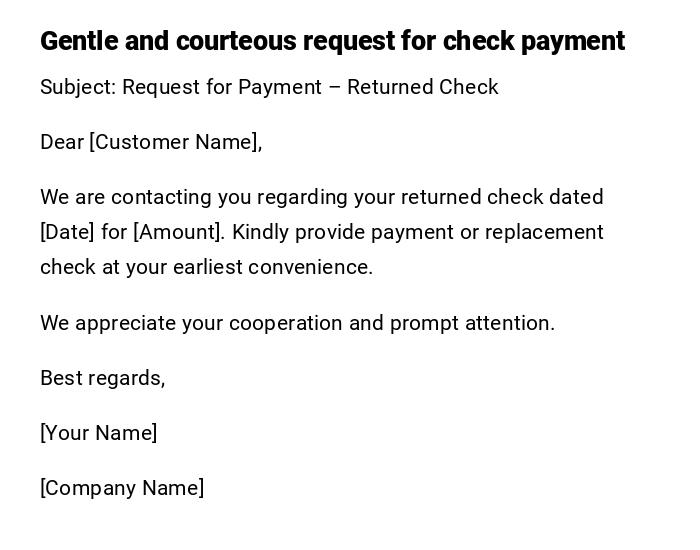

Polite Payment Request Letter

Subject: Request for Payment – Returned Check

Dear [Customer Name],

We are contacting you regarding your returned check dated [Date] for [Amount]. Kindly provide payment or replacement check at your earliest convenience.

We appreciate your cooperation and prompt attention.

Best regards,

[Your Name]

[Company Name]

What a Bad Check Collection Letter Is and Why You Need It

A bad check collection letter is a formal notice sent to a customer whose check has been returned due to insufficient funds. Purpose:

- Notify the customer of the unpaid amount.

- Request immediate payment.

- Document the collection attempt for legal or accounting purposes.

- Prevent further financial loss to the business.

Who Should Send a Bad Check Collection Letter

- Business owners or managers.

- Accounts receivable departments.

- Authorized financial personnel handling customer payments.

Whom the Bad Check Collection Letter Should Be Addressed To

- Individual or entity that issued the returned check.

- Responsible parties authorized to make payments in case of a business account.

- Legal representatives if prior communication has failed.

When to Send a Bad Check Collection Letter

- Immediately after a check is returned by the bank.

- As a follow-up if the initial payment request was ignored.

- Before taking legal or collection action.

How to Write a Bad Check Collection Letter

- State the returned check details clearly (number, date, amount).

- Indicate prior attempts to collect payment if applicable.

- Provide a clear deadline for payment.

- Mention potential consequences for non-payment.

- Keep the tone professional, escalating formality with subsequent notices.

Requirements and Prerequisites Before Sending a Bad Check Letter

- Confirm check has actually bounced with your bank.

- Record all prior communications and attempts to collect payment.

- Verify customer contact information.

- Determine legal requirements or fees associated with collections.

Formatting Guidelines for Bad Check Collection Letters

- Tone: Professional and polite initially; firm and serious in follow-ups.

- Length: One page, concise and precise.

- Structure: Subject, greeting, reference to returned check, payment request, deadline, consequences, closing.

- Mode: Printed letter or email depending on communication channel.

- Wording: Clear, factual, non-inflammatory.

After Sending a Bad Check Collection Letter

- Confirm receipt by customer if possible.

- Track payment status and deadlines.

- Escalate to legal action or collections if ignored.

- Document all correspondence for future reference.

Common Mistakes to Avoid in Bad Check Collection Letters

- Using aggressive or threatening language prematurely.

- Failing to provide necessary check details.

- Ignoring local laws regarding notice and fees.

- Sending multiple letters without escalating appropriately.

- Forgetting to document all communications.

Elements and Structure of a Bad Check Collection Letter

- Subject line clearly indicating purpose.

- Salutation to customer or responsible party.

- Details of returned check (number, date, amount).

- Request for immediate payment or alternative.

- Deadline for payment.

- Mention of consequences for non-payment.

- Professional closing and signature.

Tricks and Tips for Effective Bad Check Collection

- Start polite and escalate firmness gradually.

- Include all necessary details for clarity.

- Keep copies of all correspondence.

- Offer alternative payment methods to facilitate compliance.

- Use certified mail or email read receipt for proof of notice.

FAQ About Bad Check Collection Letters

- Do I need to send a letter if the check bounced? Yes, to document the attempt and formally request payment.

- Can I demand additional fees? Check local laws for NSF fees and collection charges.

- What if the customer ignores the letter? Escalate to legal action or collection agency.

- Is an email acceptable? Yes, but certified mail may provide better proof of notice.

- Should I keep records of all letters? Absolutely, for legal protection and accounting purposes.

Download Word Doc

Download Word Doc

Download PDF

Download PDF