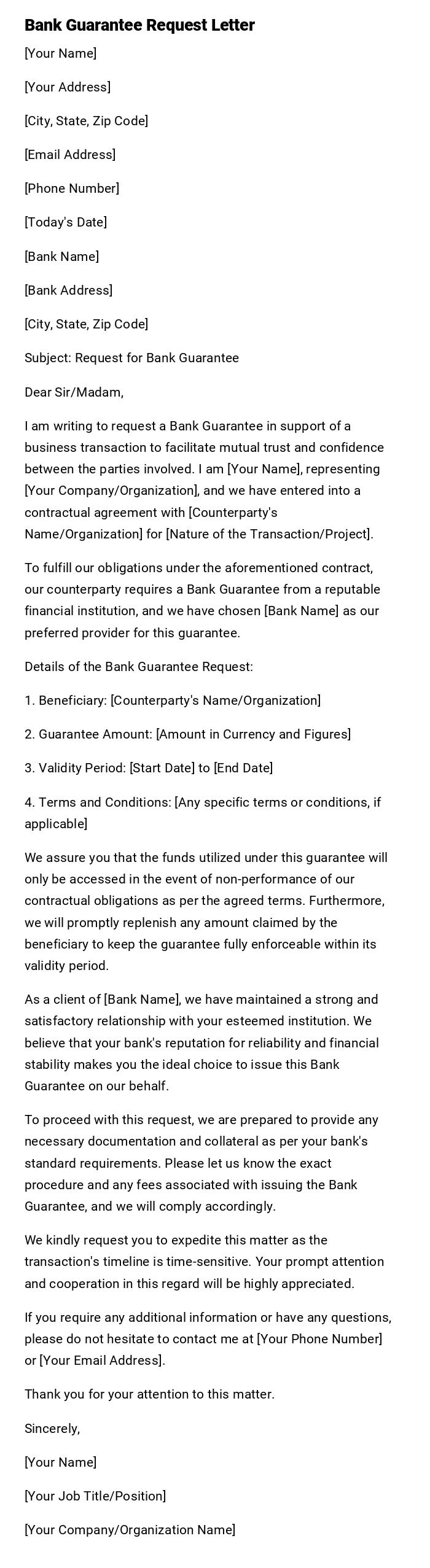

Bank Guarantee Request Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Today's Date]

[Bank Name]

[Bank Address]

[City, State, Zip Code]

Subject: Request for Bank Guarantee

Dear Sir/Madam,

I am writing to request a Bank Guarantee in support of a business transaction to facilitate mutual trust and confidence between the parties involved. I am [Your Name], representing [Your Company/Organization], and we have entered into a contractual agreement with [Counterparty's Name/Organization] for [Nature of the Transaction/Project].

To fulfill our obligations under the aforementioned contract, our counterparty requires a Bank Guarantee from a reputable financial institution, and we have chosen [Bank Name] as our preferred provider for this guarantee.

Details of the Bank Guarantee Request:

1. Beneficiary: [Counterparty's Name/Organization]

2. Guarantee Amount: [Amount in Currency and Figures]

3. Validity Period: [Start Date] to [End Date]

4. Terms and Conditions: [Any specific terms or conditions, if applicable]

We assure you that the funds utilized under this guarantee will only be accessed in the event of non-performance of our contractual obligations as per the agreed terms. Furthermore, we will promptly replenish any amount claimed by the beneficiary to keep the guarantee fully enforceable within its validity period.

As a client of [Bank Name], we have maintained a strong and satisfactory relationship with your esteemed institution. We believe that your bank's reputation for reliability and financial stability makes you the ideal choice to issue this Bank Guarantee on our behalf.

To proceed with this request, we are prepared to provide any necessary documentation and collateral as per your bank's standard requirements. Please let us know the exact procedure and any fees associated with issuing the Bank Guarantee, and we will comply accordingly.

We kindly request you to expedite this matter as the transaction's timeline is time-sensitive. Your prompt attention and cooperation in this regard will be highly appreciated.

If you require any additional information or have any questions, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address].

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Your Job Title/Position]

[Your Company/Organization Name]

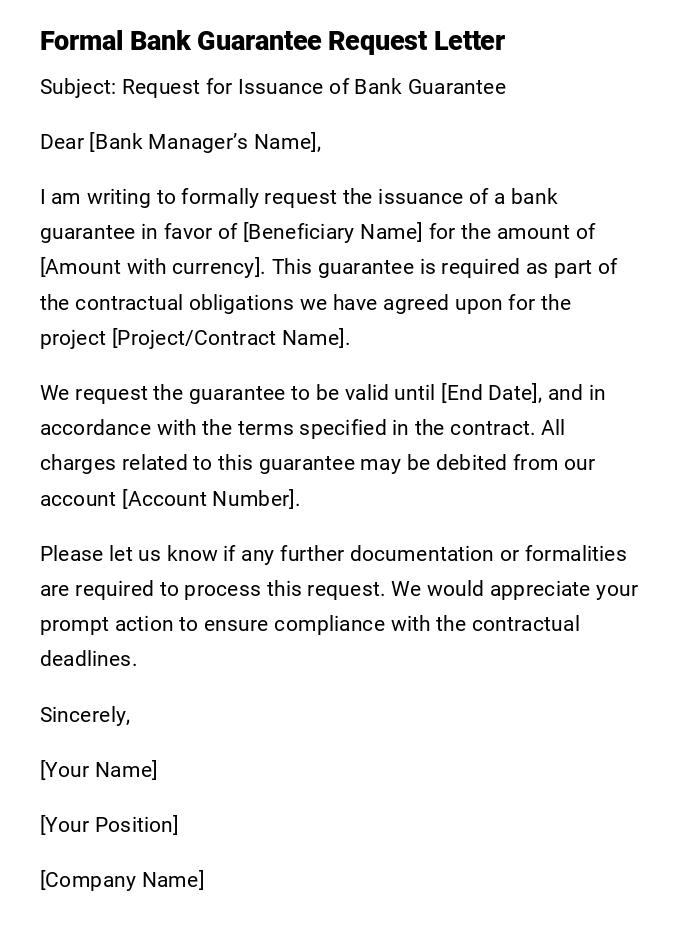

Formal Bank Guarantee Request Letter

Subject: Request for Issuance of Bank Guarantee

Dear [Bank Manager’s Name],

I am writing to formally request the issuance of a bank guarantee in favor of [Beneficiary Name] for the amount of [Amount with currency]. This guarantee is required as part of the contractual obligations we have agreed upon for the project [Project/Contract Name].

We request the guarantee to be valid until [End Date], and in accordance with the terms specified in the contract. All charges related to this guarantee may be debited from our account [Account Number].

Please let us know if any further documentation or formalities are required to process this request. We would appreciate your prompt action to ensure compliance with the contractual deadlines.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

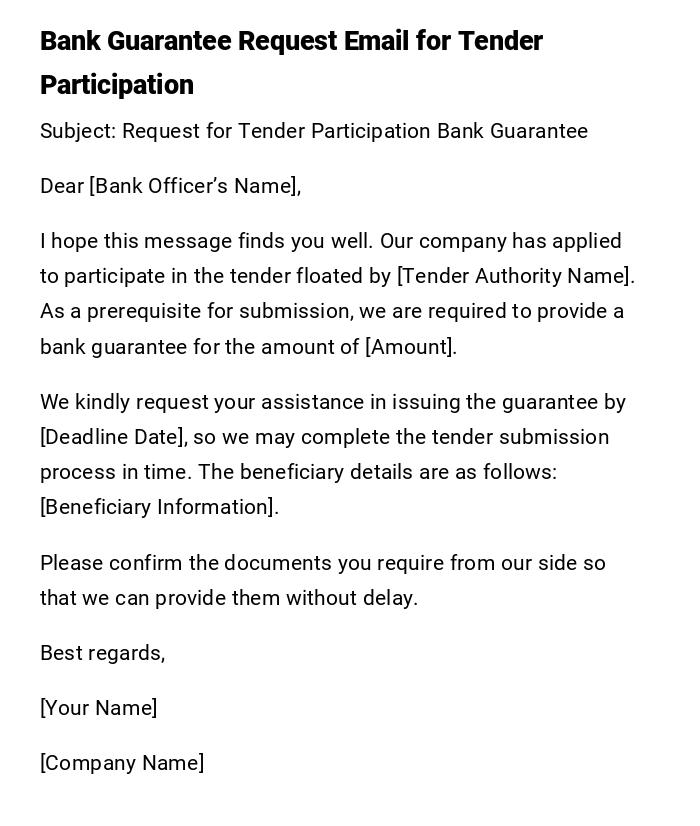

Bank Guarantee Request Email for Tender Participation

Subject: Request for Tender Participation Bank Guarantee

Dear [Bank Officer’s Name],

I hope this message finds you well. Our company has applied to participate in the tender floated by [Tender Authority Name]. As a prerequisite for submission, we are required to provide a bank guarantee for the amount of [Amount].

We kindly request your assistance in issuing the guarantee by [Deadline Date], so we may complete the tender submission process in time. The beneficiary details are as follows: [Beneficiary Information].

Please confirm the documents you require from our side so that we can provide them without delay.

Best regards,

[Your Name]

[Company Name]

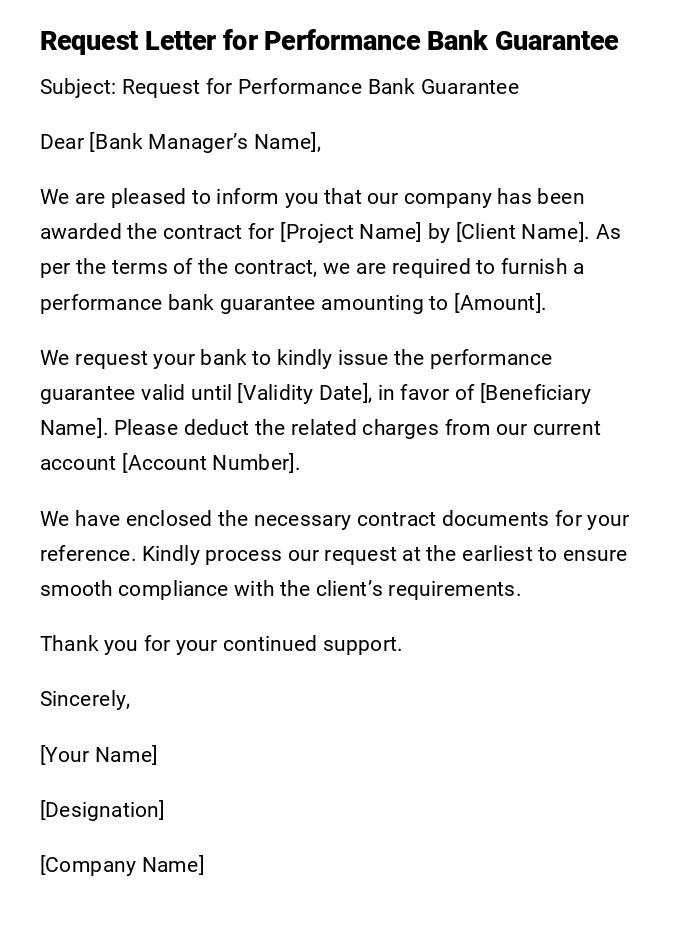

Request Letter for Performance Bank Guarantee

Subject: Request for Performance Bank Guarantee

Dear [Bank Manager’s Name],

We are pleased to inform you that our company has been awarded the contract for [Project Name] by [Client Name]. As per the terms of the contract, we are required to furnish a performance bank guarantee amounting to [Amount].

We request your bank to kindly issue the performance guarantee valid until [Validity Date], in favor of [Beneficiary Name]. Please deduct the related charges from our current account [Account Number].

We have enclosed the necessary contract documents for your reference. Kindly process our request at the earliest to ensure smooth compliance with the client’s requirements.

Thank you for your continued support.

Sincerely,

[Your Name]

[Designation]

[Company Name]

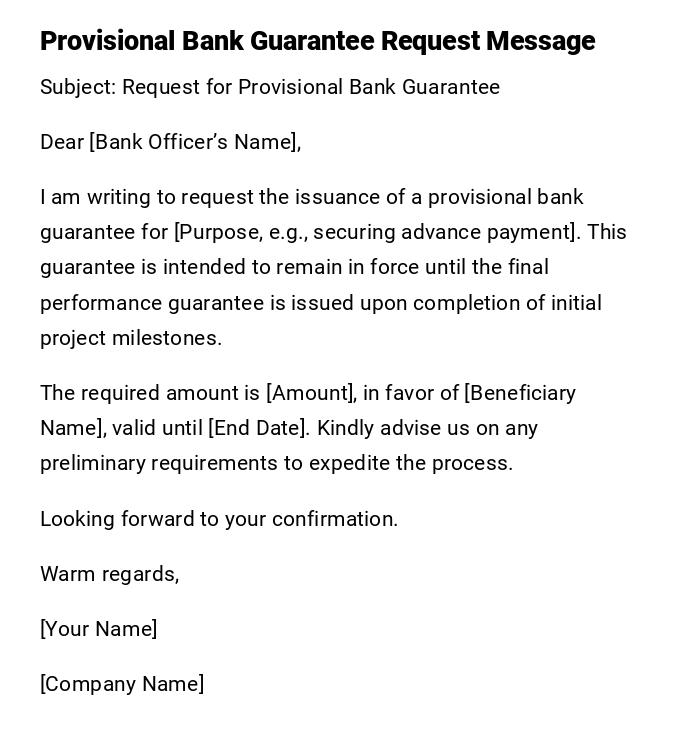

Provisional Bank Guarantee Request Message

Subject: Request for Provisional Bank Guarantee

Dear [Bank Officer’s Name],

I am writing to request the issuance of a provisional bank guarantee for [Purpose, e.g., securing advance payment]. This guarantee is intended to remain in force until the final performance guarantee is issued upon completion of initial project milestones.

The required amount is [Amount], in favor of [Beneficiary Name], valid until [End Date]. Kindly advise us on any preliminary requirements to expedite the process.

Looking forward to your confirmation.

Warm regards,

[Your Name]

[Company Name]

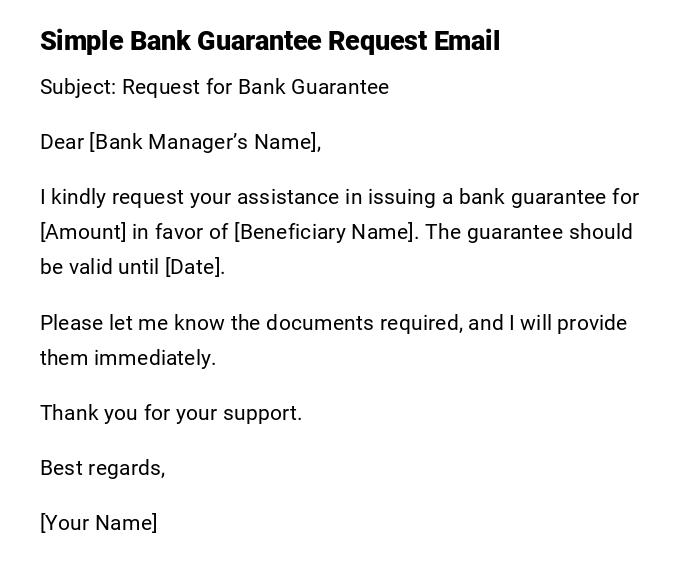

Simple Bank Guarantee Request Email

Subject: Request for Bank Guarantee

Dear [Bank Manager’s Name],

I kindly request your assistance in issuing a bank guarantee for [Amount] in favor of [Beneficiary Name]. The guarantee should be valid until [Date].

Please let me know the documents required, and I will provide them immediately.

Thank you for your support.

Best regards,

[Your Name]

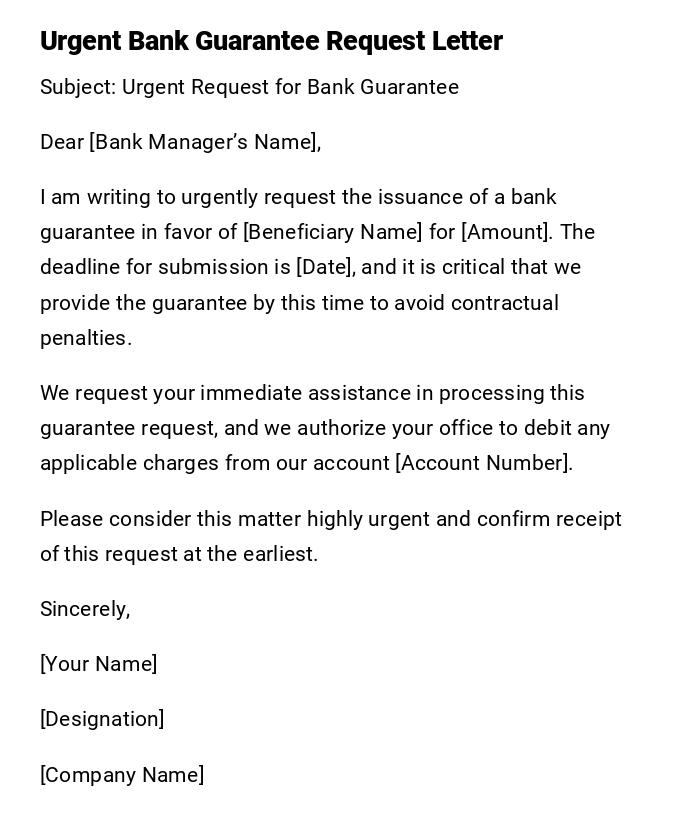

Urgent Bank Guarantee Request Letter

Subject: Urgent Request for Bank Guarantee

Dear [Bank Manager’s Name],

I am writing to urgently request the issuance of a bank guarantee in favor of [Beneficiary Name] for [Amount]. The deadline for submission is [Date], and it is critical that we provide the guarantee by this time to avoid contractual penalties.

We request your immediate assistance in processing this guarantee request, and we authorize your office to debit any applicable charges from our account [Account Number].

Please consider this matter highly urgent and confirm receipt of this request at the earliest.

Sincerely,

[Your Name]

[Designation]

[Company Name]

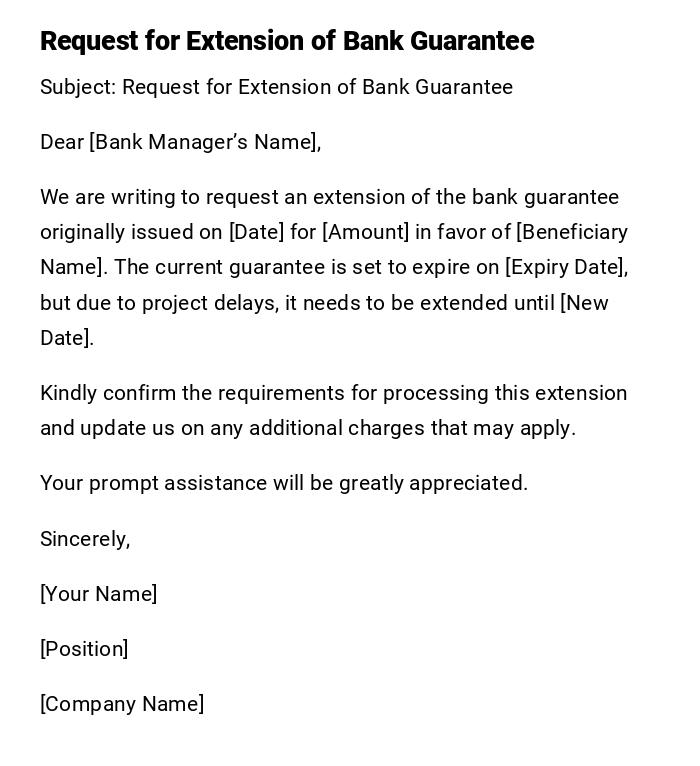

Request for Extension of Bank Guarantee

Subject: Request for Extension of Bank Guarantee

Dear [Bank Manager’s Name],

We are writing to request an extension of the bank guarantee originally issued on [Date] for [Amount] in favor of [Beneficiary Name]. The current guarantee is set to expire on [Expiry Date], but due to project delays, it needs to be extended until [New Date].

Kindly confirm the requirements for processing this extension and update us on any additional charges that may apply.

Your prompt assistance will be greatly appreciated.

Sincerely,

[Your Name]

[Position]

[Company Name]

Creative Bank Guarantee Request Email (Light Tone)

Subject: A Small Favor – Request for Bank Guarantee

Dear [Bank Officer’s Name],

I trust you are doing well. We’ve landed an exciting project with [Client Name], but as always, the paperwork trail is chasing us! One key item on the list is a bank guarantee worth [Amount] in favor of [Beneficiary Name].

Could you kindly help us sort this out before [Deadline Date]? We’d be grateful if you could let us know the steps and documents needed. Consider this a team effort—your support means we can hit the ground running.

Warm thanks,

[Your Name]

[Company Name]

Official Bank Guarantee Request Letter for Advance Payment

Subject: Request for Advance Payment Bank Guarantee

Dear [Bank Manager’s Name],

We are writing to request an advance payment bank guarantee as per the terms of our agreement with [Client Name]. The guarantee amounting to [Amount] must be issued in favor of [Beneficiary Name] and should remain valid until [Date].

This guarantee is required to secure the advance payment of [Amount] being released by our client. We request your bank to kindly issue this guarantee at the earliest convenience and debit any applicable charges from our account [Account Number].

Thank you for your cooperation.

Sincerely,

[Your Name]

[Position]

[Company Name]

What is a Bank Guarantee Request Letter and Why is it Needed?

A bank guarantee request letter is a formal communication sent to a bank to ask for the issuance of a guarantee on behalf of a client. It assures a third party (the beneficiary) that the bank will cover financial obligations if the client fails to fulfill them. The purpose is to build trust in business deals, secure tenders, safeguard advance payments, and comply with contract requirements.

Who Should Send a Bank Guarantee Request Letter?

- Business owners requesting support for contracts or tenders.

- Contractors needing to furnish performance or advance guarantees.

- Exporters or importers dealing in international trade.

- Companies participating in government projects.

- Finance departments acting on behalf of their organizations.

To Whom Should a Bank Guarantee Request Letter Be Addressed?

- The branch manager of the company’s bank.

- A relationship officer or corporate banking representative.

- In some cases, the letter may be addressed to the head of credit or trade finance department.

- For urgent matters, it may be directed to senior bank officials who can authorize quick processing.

Common Scenarios When a Bank Guarantee Request Letter is Needed

- Participation in tenders or bids.

- Award of a new project contract.

- Securing advance payments from clients.

- Providing performance guarantees for project completion.

- Extending existing guarantees due to project delays.

- Replacing provisional guarantees with permanent ones.

- Emergency compliance with sudden client or regulatory requirements.

Process of Writing and Sending a Bank Guarantee Request Letter

- Start with a clear subject line mentioning the guarantee.

- Greet the bank official politely.

- State the amount, purpose, and beneficiary.

- Provide validity dates and account details.

- Mention attached documents (contracts, tender notices, etc.).

- Authorize charges to be debited.

- Close with a polite request for quick action.

- Send via email or printed letter, depending on urgency.

Requirements and Prerequisites Before Sending a Bank Guarantee Request

- Valid contract or tender notice requiring the guarantee.

- Availability of sufficient balance or sanctioned credit line.

- Board resolution (for companies, if needed).

- Correct beneficiary details and format of guarantee.

- Supporting documents such as invoices or agreements.

- Internal approval from company management.

Formatting Guidelines for Bank Guarantee Request Letters

- Keep the tone professional and respectful.

- Length: 1–2 pages maximum.

- Be specific about the amount, dates, and beneficiary.

- Use simple and clear wording; avoid jargon.

- Use "Letter" for formal, printed requests and "Email" for quick communications.

- Attach relevant documents instead of embedding too much detail in the text.

What to Do After Sending a Bank Guarantee Request Letter

- Follow up with the bank to confirm receipt.

- Ask for an estimated timeline for issuance.

- Track deductions or charges applied to your account.

- Share issued guarantee details with the beneficiary.

- Keep copies of correspondence for audit and record-keeping.

Pros and Cons of Sending a Bank Guarantee Request Letter

Pros:

- Builds trust with clients and partners.

- Ensures compliance with tender and project requirements.

- Helps secure advance payments and business opportunities.

Cons:

- Requires financial backing or collateral.

- Involves bank fees and service charges.

- May increase liability if not properly managed.

Common Mistakes to Avoid in Bank Guarantee Request Letters

- Forgetting to specify validity dates.

- Providing incorrect beneficiary details.

- Not attaching required documents.

- Using vague wording instead of precise terms.

- Sending the request too close to the deadline.

Elements and Structure of a Bank Guarantee Request Letter

- Subject line mentioning the guarantee.

- Greeting to the bank official.

- Purpose of the guarantee.

- Amount and beneficiary details.

- Validity dates and account information.

- Authorization for charges.

- Closing remarks with request for confirmation.

- Attachments (contracts, invoices, resolutions).

Does a Bank Guarantee Request Require Attestation or Authorization?

Yes, in many cases:

- Companies may require a board resolution authorizing the request.

- The guarantee format often requires signatures of authorized signatories.

- Some banks request company stamps and official authorization documents.

- For international trade guarantees, notary attestation or embassy verification may be required.

Tips and Best Practices for Writing a Bank Guarantee Request Letter

- Always start early—don’t wait until the last minute.

- Double-check beneficiary details before submission.

- Keep your language formal and respectful.

- Maintain a standard template for your organization.

- Build a strong relationship with your bank for smoother processing.

Comparing Bank Guarantee Request Letters with Other Documents

- Bank Guarantee Request Letter vs. Loan Application Letter: The former secures obligations, while the latter seeks funds.

- Bank Guarantee vs. Letter of Credit: A guarantee is a backup promise, while a letter of credit directly facilitates payment.

- Bank Guarantee Request vs. Insurance Bond Request: Both provide security, but one is financial (via bank), the other is insurance-based.

Download Word Doc

Download Word Doc

Download PDF

Download PDF