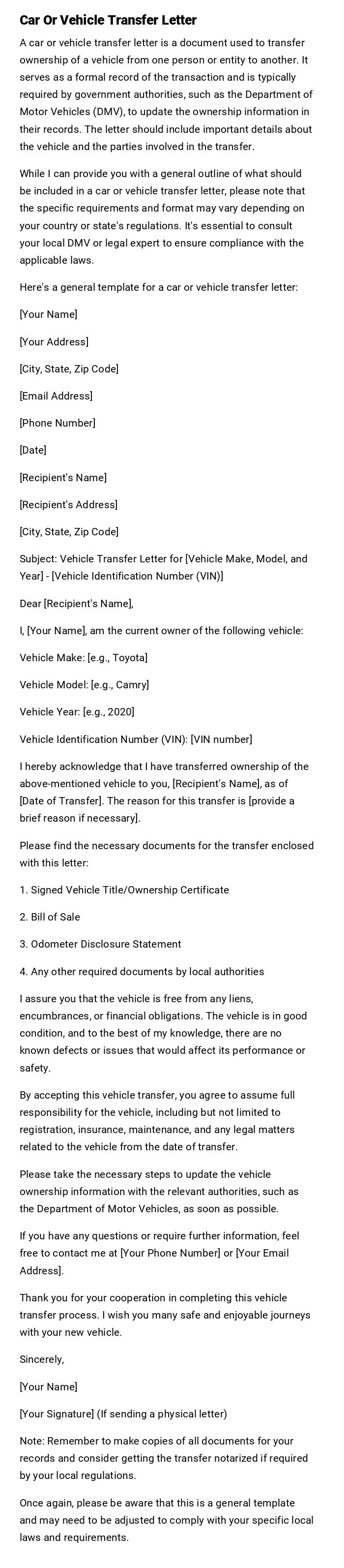

Car Or Vehicle Transfer Letter

A car or vehicle transfer letter is a document used to transfer ownership of a vehicle from one person or entity to another. It serves as a formal record of the transaction and is typically required by government authorities, such as the Department of Motor Vehicles (DMV), to update the ownership information in their records. The letter should include important details about the vehicle and the parties involved in the transfer.

While I can provide you with a general outline of what should be included in a car or vehicle transfer letter, please note that the specific requirements and format may vary depending on your country or state's regulations. It's essential to consult your local DMV or legal expert to ensure compliance with the applicable laws.

Here's a general template for a car or vehicle transfer letter:

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, Zip Code]

Subject: Vehicle Transfer Letter for [Vehicle Make, Model, and Year] - [Vehicle Identification Number (VIN)]

Dear [Recipient's Name],

I, [Your Name], am the current owner of the following vehicle:

Vehicle Make: [e.g., Toyota]

Vehicle Model: [e.g., Camry]

Vehicle Year: [e.g., 2020]

Vehicle Identification Number (VIN): [VIN number]

I hereby acknowledge that I have transferred ownership of the above-mentioned vehicle to you, [Recipient's Name], as of [Date of Transfer]. The reason for this transfer is [provide a brief reason if necessary].

Please find the necessary documents for the transfer enclosed with this letter:

1. Signed Vehicle Title/Ownership Certificate

2. Bill of Sale

3. Odometer Disclosure Statement

4. Any other required documents by local authorities

I assure you that the vehicle is free from any liens, encumbrances, or financial obligations. The vehicle is in good condition, and to the best of my knowledge, there are no known defects or issues that would affect its performance or safety.

By accepting this vehicle transfer, you agree to assume full responsibility for the vehicle, including but not limited to registration, insurance, maintenance, and any legal matters related to the vehicle from the date of transfer.

Please take the necessary steps to update the vehicle ownership information with the relevant authorities, such as the Department of Motor Vehicles, as soon as possible.

If you have any questions or require further information, feel free to contact me at [Your Phone Number] or [Your Email Address].

Thank you for your cooperation in completing this vehicle transfer process. I wish you many safe and enjoyable journeys with your new vehicle.

Sincerely,

[Your Name]

[Your Signature] (If sending a physical letter)

Note: Remember to make copies of all documents for your records and consider getting the transfer notarized if required by your local regulations.

Once again, please be aware that this is a general template and may need to be adjusted to comply with your specific local laws and requirements.

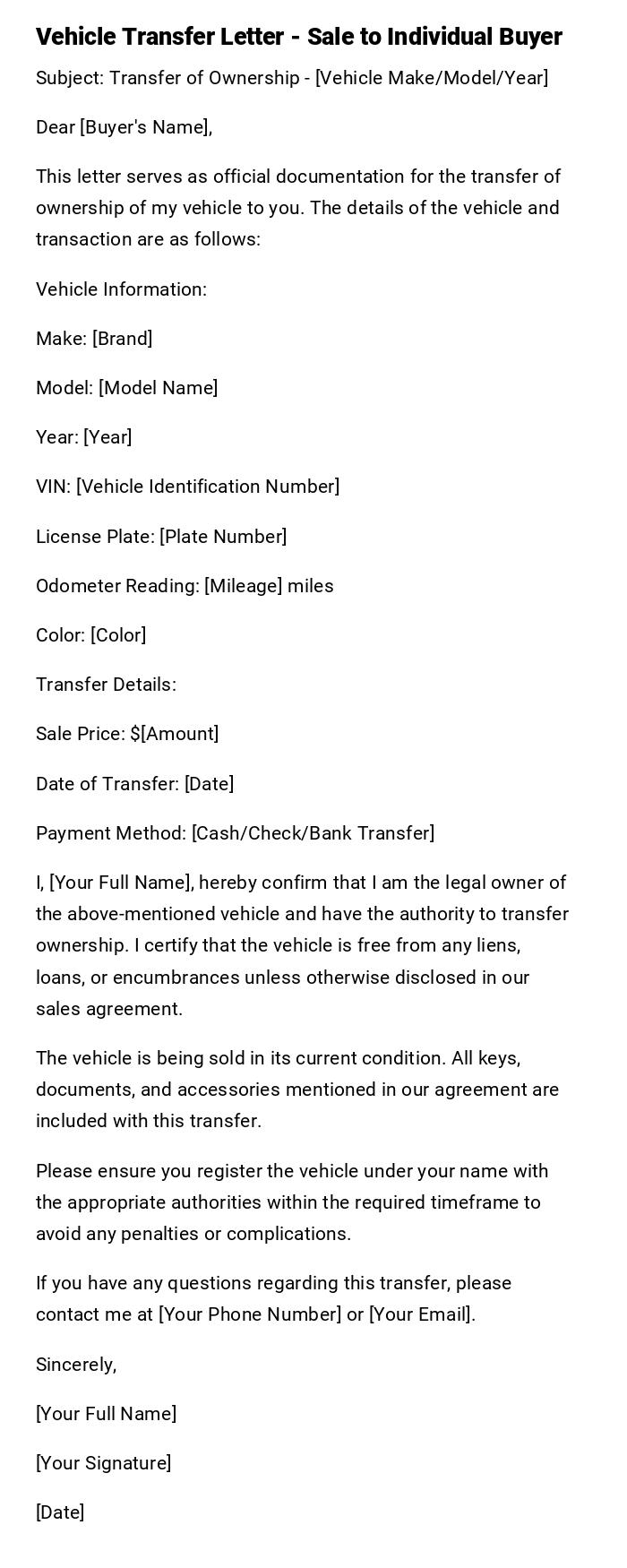

Vehicle Transfer Letter - Sale to Individual Buyer

Subject: Transfer of Ownership - [Vehicle Make/Model/Year]

Dear [Buyer's Name],

This letter serves as official documentation for the transfer of ownership of my vehicle to you. The details of the vehicle and transaction are as follows:

Vehicle Information:

Make: [Brand]

Model: [Model Name]

Year: [Year]

VIN: [Vehicle Identification Number]

License Plate: [Plate Number]

Odometer Reading: [Mileage] miles

Color: [Color]

Transfer Details:

Sale Price: $[Amount]

Date of Transfer: [Date]

Payment Method: [Cash/Check/Bank Transfer]

I, [Your Full Name], hereby confirm that I am the legal owner of the above-mentioned vehicle and have the authority to transfer ownership. I certify that the vehicle is free from any liens, loans, or encumbrances unless otherwise disclosed in our sales agreement.

The vehicle is being sold in its current condition. All keys, documents, and accessories mentioned in our agreement are included with this transfer.

Please ensure you register the vehicle under your name with the appropriate authorities within the required timeframe to avoid any penalties or complications.

If you have any questions regarding this transfer, please contact me at [Your Phone Number] or [Your Email].

Sincerely,

[Your Full Name]

[Your Signature]

[Date]

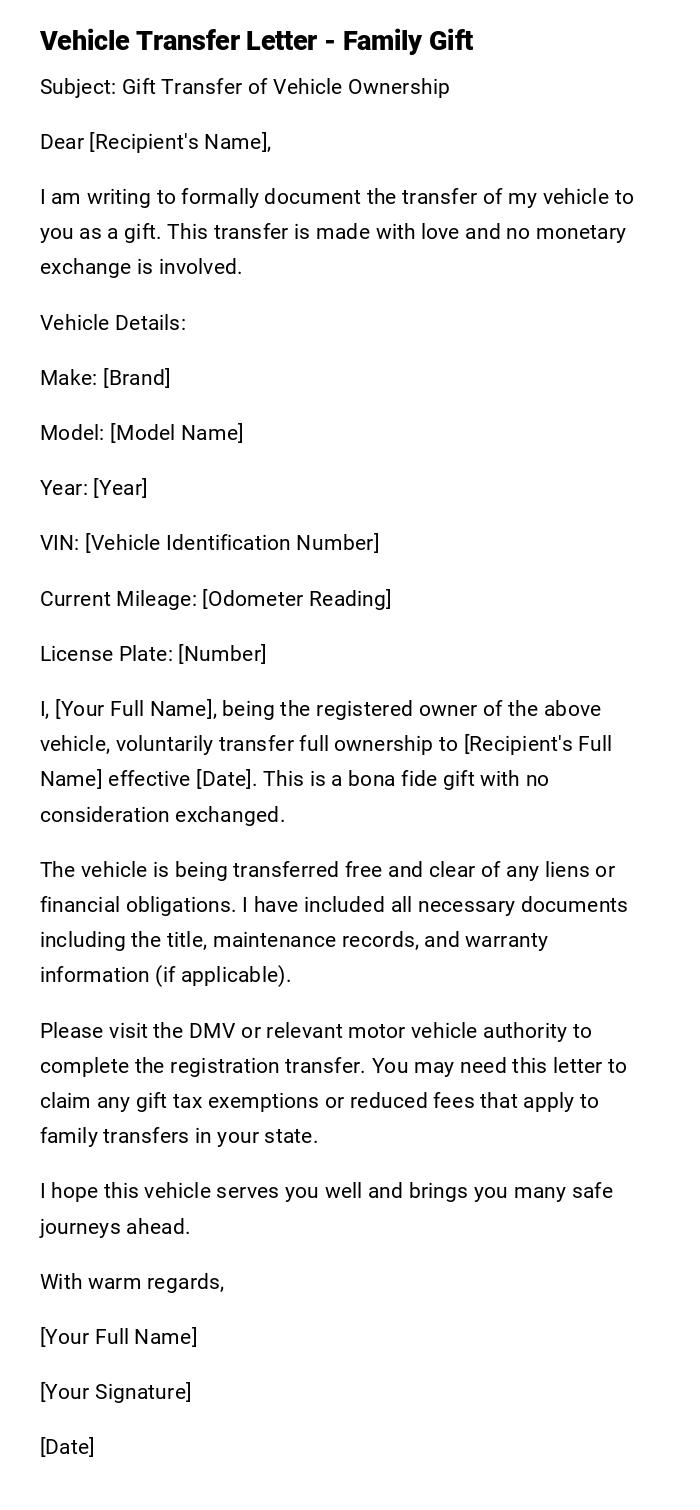

Vehicle Transfer Letter - Family Gift

Subject: Gift Transfer of Vehicle Ownership

Dear [Recipient's Name],

I am writing to formally document the transfer of my vehicle to you as a gift. This transfer is made with love and no monetary exchange is involved.

Vehicle Details:

Make: [Brand]

Model: [Model Name]

Year: [Year]

VIN: [Vehicle Identification Number]

Current Mileage: [Odometer Reading]

License Plate: [Number]

I, [Your Full Name], being the registered owner of the above vehicle, voluntarily transfer full ownership to [Recipient's Full Name] effective [Date]. This is a bona fide gift with no consideration exchanged.

The vehicle is being transferred free and clear of any liens or financial obligations. I have included all necessary documents including the title, maintenance records, and warranty information (if applicable).

Please visit the DMV or relevant motor vehicle authority to complete the registration transfer. You may need this letter to claim any gift tax exemptions or reduced fees that apply to family transfers in your state.

I hope this vehicle serves you well and brings you many safe journeys ahead.

With warm regards,

[Your Full Name]

[Your Signature]

[Date]

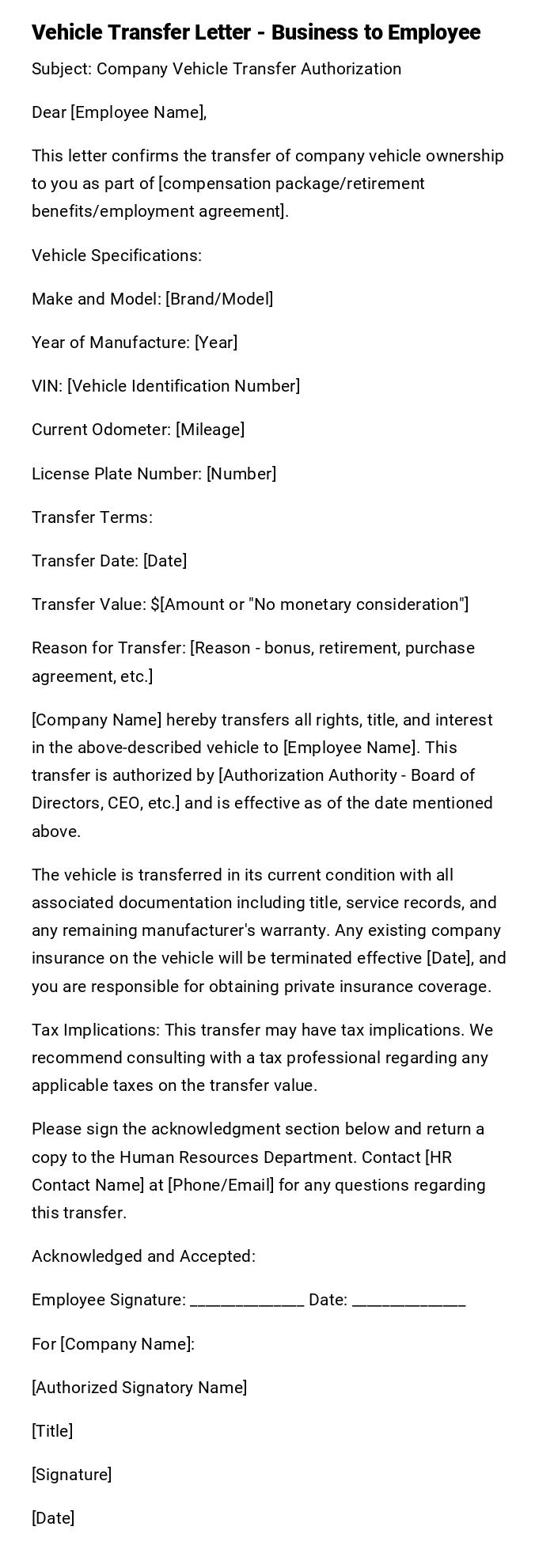

Vehicle Transfer Letter - Business to Employee

Subject: Company Vehicle Transfer Authorization

Dear [Employee Name],

This letter confirms the transfer of company vehicle ownership to you as part of [compensation package/retirement benefits/employment agreement].

Vehicle Specifications:

Make and Model: [Brand/Model]

Year of Manufacture: [Year]

VIN: [Vehicle Identification Number]

Current Odometer: [Mileage]

License Plate Number: [Number]

Transfer Terms:

Transfer Date: [Date]

Transfer Value: $[Amount or "No monetary consideration"]

Reason for Transfer: [Reason - bonus, retirement, purchase agreement, etc.]

[Company Name] hereby transfers all rights, title, and interest in the above-described vehicle to [Employee Name]. This transfer is authorized by [Authorization Authority - Board of Directors, CEO, etc.] and is effective as of the date mentioned above.

The vehicle is transferred in its current condition with all associated documentation including title, service records, and any remaining manufacturer's warranty. Any existing company insurance on the vehicle will be terminated effective [Date], and you are responsible for obtaining private insurance coverage.

Tax Implications: This transfer may have tax implications. We recommend consulting with a tax professional regarding any applicable taxes on the transfer value.

Please sign the acknowledgment section below and return a copy to the Human Resources Department. Contact [HR Contact Name] at [Phone/Email] for any questions regarding this transfer.

Acknowledged and Accepted:

Employee Signature: _______________ Date: _______________

For [Company Name]:

[Authorized Signatory Name]

[Title]

[Signature]

[Date]

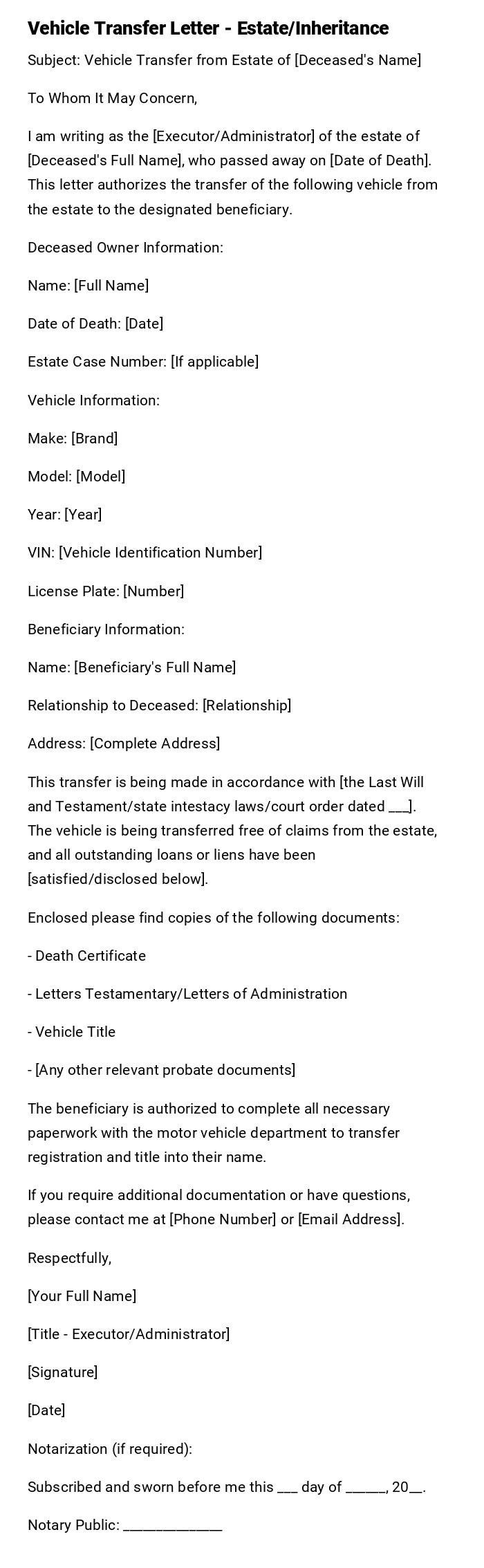

Vehicle Transfer Letter - Estate/Inheritance

Subject: Vehicle Transfer from Estate of [Deceased's Name]

To Whom It May Concern,

I am writing as the [Executor/Administrator] of the estate of [Deceased's Full Name], who passed away on [Date of Death]. This letter authorizes the transfer of the following vehicle from the estate to the designated beneficiary.

Deceased Owner Information:

Name: [Full Name]

Date of Death: [Date]

Estate Case Number: [If applicable]

Vehicle Information:

Make: [Brand]

Model: [Model]

Year: [Year]

VIN: [Vehicle Identification Number]

License Plate: [Number]

Beneficiary Information:

Name: [Beneficiary's Full Name]

Relationship to Deceased: [Relationship]

Address: [Complete Address]

This transfer is being made in accordance with [the Last Will and Testament/state intestacy laws/court order dated ___]. The vehicle is being transferred free of claims from the estate, and all outstanding loans or liens have been [satisfied/disclosed below].

Enclosed please find copies of the following documents:

- Death Certificate

- Letters Testamentary/Letters of Administration

- Vehicle Title

- [Any other relevant probate documents]

The beneficiary is authorized to complete all necessary paperwork with the motor vehicle department to transfer registration and title into their name.

If you require additional documentation or have questions, please contact me at [Phone Number] or [Email Address].

Respectfully,

[Your Full Name]

[Title - Executor/Administrator]

[Signature]

[Date]

Notarization (if required):

Subscribed and sworn before me this ___ day of ______, 20__.

Notary Public: _______________

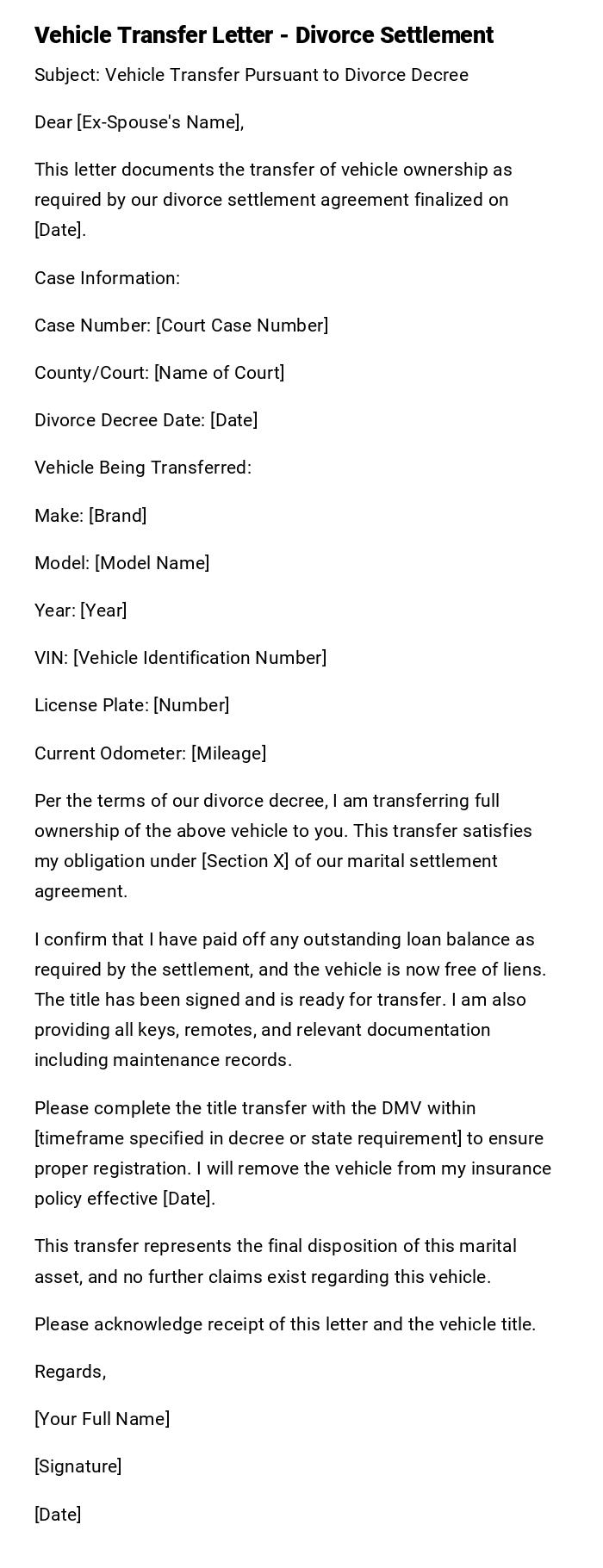

Vehicle Transfer Letter - Divorce Settlement

Subject: Vehicle Transfer Pursuant to Divorce Decree

Dear [Ex-Spouse's Name],

This letter documents the transfer of vehicle ownership as required by our divorce settlement agreement finalized on [Date].

Case Information:

Case Number: [Court Case Number]

County/Court: [Name of Court]

Divorce Decree Date: [Date]

Vehicle Being Transferred:

Make: [Brand]

Model: [Model Name]

Year: [Year]

VIN: [Vehicle Identification Number]

License Plate: [Number]

Current Odometer: [Mileage]

Per the terms of our divorce decree, I am transferring full ownership of the above vehicle to you. This transfer satisfies my obligation under [Section X] of our marital settlement agreement.

I confirm that I have paid off any outstanding loan balance as required by the settlement, and the vehicle is now free of liens. The title has been signed and is ready for transfer. I am also providing all keys, remotes, and relevant documentation including maintenance records.

Please complete the title transfer with the DMV within [timeframe specified in decree or state requirement] to ensure proper registration. I will remove the vehicle from my insurance policy effective [Date].

This transfer represents the final disposition of this marital asset, and no further claims exist regarding this vehicle.

Please acknowledge receipt of this letter and the vehicle title.

Regards,

[Your Full Name]

[Signature]

[Date]

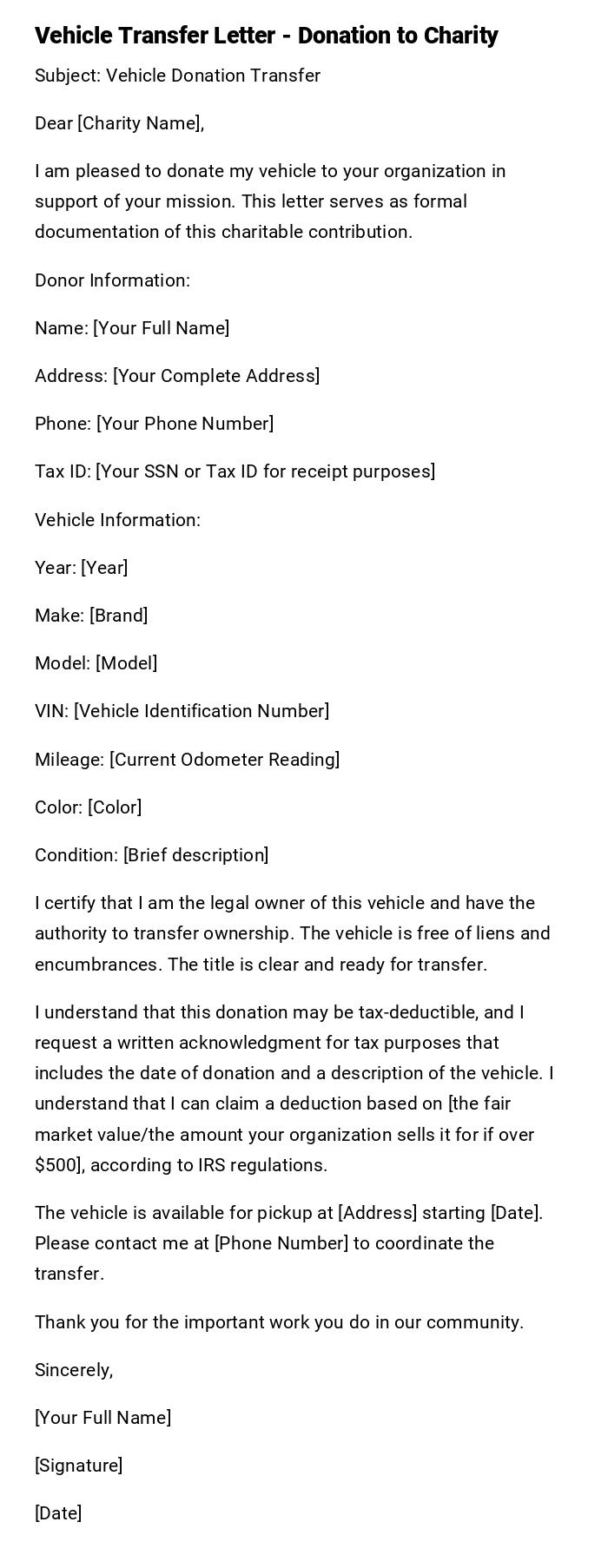

Vehicle Transfer Letter - Donation to Charity

Subject: Vehicle Donation Transfer

Dear [Charity Name],

I am pleased to donate my vehicle to your organization in support of your mission. This letter serves as formal documentation of this charitable contribution.

Donor Information:

Name: [Your Full Name]

Address: [Your Complete Address]

Phone: [Your Phone Number]

Tax ID: [Your SSN or Tax ID for receipt purposes]

Vehicle Information:

Year: [Year]

Make: [Brand]

Model: [Model]

VIN: [Vehicle Identification Number]

Mileage: [Current Odometer Reading]

Color: [Color]

Condition: [Brief description]

I certify that I am the legal owner of this vehicle and have the authority to transfer ownership. The vehicle is free of liens and encumbrances. The title is clear and ready for transfer.

I understand that this donation may be tax-deductible, and I request a written acknowledgment for tax purposes that includes the date of donation and a description of the vehicle. I understand that I can claim a deduction based on [the fair market value/the amount your organization sells it for if over $500], according to IRS regulations.

The vehicle is available for pickup at [Address] starting [Date]. Please contact me at [Phone Number] to coordinate the transfer.

Thank you for the important work you do in our community.

Sincerely,

[Your Full Name]

[Signature]

[Date]

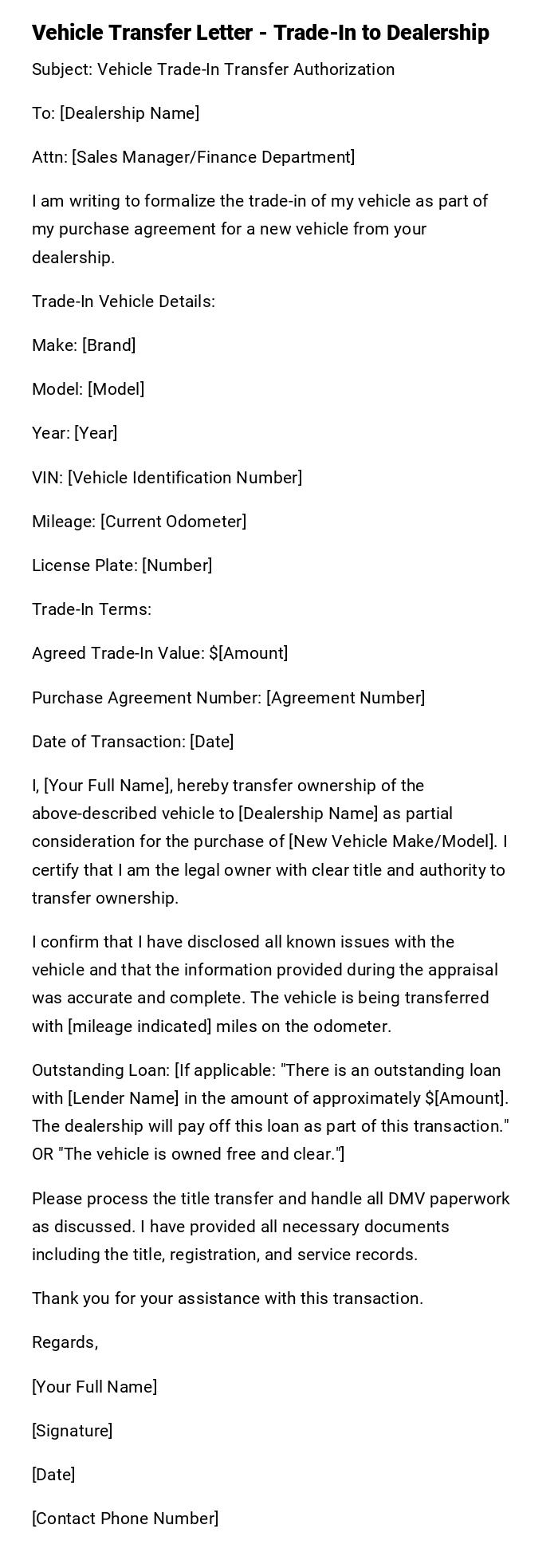

Vehicle Transfer Letter - Trade-In to Dealership

Subject: Vehicle Trade-In Transfer Authorization

To: [Dealership Name]

Attn: [Sales Manager/Finance Department]

I am writing to formalize the trade-in of my vehicle as part of my purchase agreement for a new vehicle from your dealership.

Trade-In Vehicle Details:

Make: [Brand]

Model: [Model]

Year: [Year]

VIN: [Vehicle Identification Number]

Mileage: [Current Odometer]

License Plate: [Number]

Trade-In Terms:

Agreed Trade-In Value: $[Amount]

Purchase Agreement Number: [Agreement Number]

Date of Transaction: [Date]

I, [Your Full Name], hereby transfer ownership of the above-described vehicle to [Dealership Name] as partial consideration for the purchase of [New Vehicle Make/Model]. I certify that I am the legal owner with clear title and authority to transfer ownership.

I confirm that I have disclosed all known issues with the vehicle and that the information provided during the appraisal was accurate and complete. The vehicle is being transferred with [mileage indicated] miles on the odometer.

Outstanding Loan: [If applicable: "There is an outstanding loan with [Lender Name] in the amount of approximately $[Amount]. The dealership will pay off this loan as part of this transaction." OR "The vehicle is owned free and clear."]

Please process the title transfer and handle all DMV paperwork as discussed. I have provided all necessary documents including the title, registration, and service records.

Thank you for your assistance with this transaction.

Regards,

[Your Full Name]

[Signature]

[Date]

[Contact Phone Number]

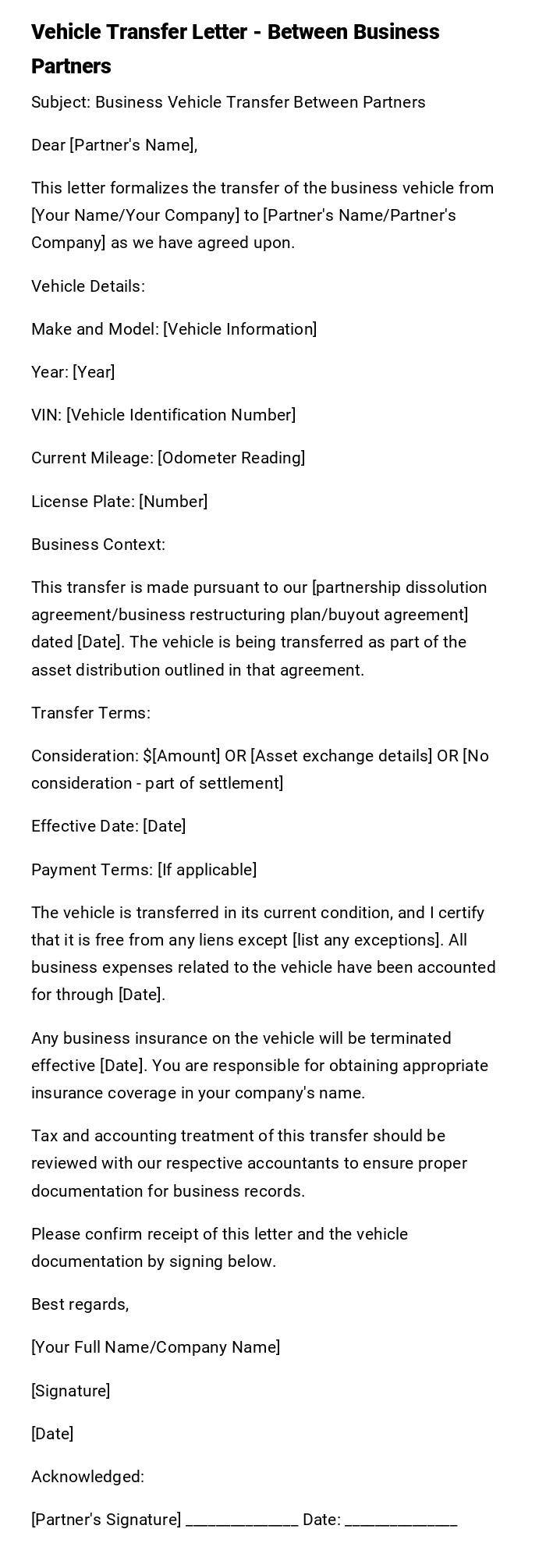

Vehicle Transfer Letter - Between Business Partners

Subject: Business Vehicle Transfer Between Partners

Dear [Partner's Name],

This letter formalizes the transfer of the business vehicle from [Your Name/Your Company] to [Partner's Name/Partner's Company] as we have agreed upon.

Vehicle Details:

Make and Model: [Vehicle Information]

Year: [Year]

VIN: [Vehicle Identification Number]

Current Mileage: [Odometer Reading]

License Plate: [Number]

Business Context:

This transfer is made pursuant to our [partnership dissolution agreement/business restructuring plan/buyout agreement] dated [Date]. The vehicle is being transferred as part of the asset distribution outlined in that agreement.

Transfer Terms:

Consideration: $[Amount] OR [Asset exchange details] OR [No consideration - part of settlement]

Effective Date: [Date]

Payment Terms: [If applicable]

The vehicle is transferred in its current condition, and I certify that it is free from any liens except [list any exceptions]. All business expenses related to the vehicle have been accounted for through [Date].

Any business insurance on the vehicle will be terminated effective [Date]. You are responsible for obtaining appropriate insurance coverage in your company's name.

Tax and accounting treatment of this transfer should be reviewed with our respective accountants to ensure proper documentation for business records.

Please confirm receipt of this letter and the vehicle documentation by signing below.

Best regards,

[Your Full Name/Company Name]

[Signature]

[Date]

Acknowledged:

[Partner's Signature] _______________ Date: _______________

What is a Car or Vehicle Transfer Letter and Why Do You Need It

A car or vehicle transfer letter is a formal written document that records and authorizes the transfer of vehicle ownership from one party to another. This letter serves as both a notification and a legal record of the transaction, providing detailed information about the vehicle, the parties involved, and the terms of the transfer.

Why you need this letter:

- Legal documentation: Creates an official paper trail proving the transfer occurred on a specific date with specific terms

- Liability protection: Protects the seller from liability for tickets, accidents, or other incidents that occur after the transfer date

- Tax purposes: Provides documentation for tax deductions (donations), capital gains/losses (sales), or gift tax exemptions (family transfers)

- DMV requirements: Many motor vehicle departments require or strongly recommend written documentation for title transfers

- Dispute prevention: Prevents future disagreements about transfer terms, vehicle condition, or payment details

- Third-party verification: Allows banks, insurance companies, and government agencies to verify the legitimate transfer of ownership

Who Should Send a Car or Vehicle Transfer Letter

Sellers in private sales: Any individual selling their personal vehicle to another private party should provide a transfer letter to document the transaction and protect themselves from future liability.

Gift givers: Family members or friends giving a vehicle as a gift need to document the transfer, especially since many states offer reduced fees or tax exemptions for intrafamily transfers.

Estate executors or administrators: Personal representatives of a deceased person's estate must provide transfer letters when distributing vehicles to heirs or beneficiaries according to the will or intestacy laws.

Business entities: Companies transferring vehicles to employees (as compensation or benefits), selling fleet vehicles, or transferring assets between divisions require formal documentation for accounting and tax purposes.

Divorcing spouses: Either party may need to provide a transfer letter as required by the divorce decree to document compliance with the property settlement.

Donors: Individuals donating vehicles to charitable organizations should provide transfer documentation to facilitate the charity's receipt and to support tax deduction claims.

Dealerships and businesses: While dealerships have standardized processes, they still provide transfer documentation when accepting trade-ins or selling vehicles to ensure clear record-keeping.

Elements and Structure That Must Be Included in the Transfer Letter

Vehicle identification information:

- Complete vehicle make, model, and year

- Vehicle Identification Number (VIN) - critical for unique identification

- License plate number

- Current odometer reading

- Vehicle color and any distinguishing features

Parties involved:

- Full legal name of the current owner/transferor

- Full legal name of the new owner/recipient

- Complete addresses for both parties

- Contact information (phone numbers and email addresses)

Transfer details:

- Specific date of transfer/effective date

- Sale price or gift designation

- Payment method and terms

- Reason for transfer (sale, gift, inheritance, etc.)

Legal certifications:

- Statement of legal ownership and authority to transfer

- Disclosure of liens, loans, or encumbrances

- Condition statement or "as-is" declaration

Documentation references:

- Reference to accompanying documents (title, bill of sale, etc.)

- Court case numbers (for divorce or estate transfers)

- Business agreement references (for corporate transfers)

Signatures and dates:

- Signature of transferor

- Date of signature

- Witness or notary signatures if required

- Acknowledgment section for recipient (optional but recommended)

Attachments:

- Copy of vehicle title

- Maintenance and service records

- Warranty documents if transferable

- Lien release documents if applicable

- Supporting legal documents (death certificates, court orders, etc.)

When Do You Need to Write a Vehicle Transfer Letter

Private vehicle sales: Whenever you sell your car to another individual, whether to a friend, family member, or stranger through classified ads or online platforms.

Gifting to family or friends: When giving a vehicle as a birthday present, graduation gift, college transportation, or helping out a family member in need.

Estate settlement: After someone passes away and their vehicle needs to be transferred to heirs, beneficiaries, or sold as part of estate liquidation.

Divorce proceedings: When the divorce decree requires one spouse to transfer their vehicle to the other as part of property division.

Business transactions: When a company sells a fleet vehicle, transfers a car to an employee as compensation, or restructures assets between divisions or partners.

Charitable donations: When donating a vehicle to a nonprofit organization for tax deduction purposes or to support a cause.

Trade-ins: When trading your old vehicle to a dealership as partial payment for a new or used vehicle purchase.

Partnership dissolution: When business partners split up and need to divide company vehicles between them.

Loan payoff and transfer: When you finish paying off a vehicle loan and the lender needs documentation before releasing the title for transfer to a new owner.

Relocation or emigration: When moving abroad and transferring your vehicle to someone staying in the country.

Requirements and Prerequisites Before Writing the Transfer Letter

Verify clear title ownership: Confirm that you are listed as the registered owner on the vehicle title and have the legal right to transfer ownership. If there's a co-owner, you'll need their consent and signature.

Resolve outstanding liens: Contact your lender to pay off any remaining loan balance and obtain a lien release document. The vehicle cannot be transferred with an active lien unless the buyer agrees to assume the loan.

Gather vehicle documentation: Collect the original title certificate, registration documents, maintenance records, warranty information, and any inspection certificates required by your state.

Complete vehicle inspection if required: Some states require emissions testing or safety inspections before transfer. Check your local DMV requirements.

Determine accurate vehicle value: For sales, research fair market value using resources like Kelley Blue Book or NADA guides. For gifts or donations, you may need a professional appraisal for tax purposes.

Check state-specific requirements: Research your state's DMV requirements for title transfers, including required forms, fees, and documentation. Some states have specific bill of sale requirements.

Obtain odometer disclosure: Federal law requires an odometer disclosure statement for most vehicle transfers. This may be on the title itself or a separate form.

Verify buyer's identity: For private sales, confirm the buyer's identity through valid driver's license or government-issued ID to protect yourself from fraud.

Remove personal belongings: Thoroughly check the vehicle for personal items, toll transponders, parking passes, and garage door openers before transfer.

Cancel or transfer insurance: Contact your insurance company to cancel coverage on the vehicle effective on the transfer date, or if keeping it, ensure the new owner obtains their own insurance first.

How to Write and Send a Vehicle Transfer Letter Properly

Start with accurate information gathering: Before writing, collect all vehicle details (VIN, make, model, year, mileage), both parties' complete information, and the agreed-upon transfer terms. Verify everything for accuracy.

Choose the appropriate template: Select a template that matches your specific situation (sale, gift, estate, business, etc.). Different scenarios require different language and legal considerations.

Be specific and detailed: Use precise language and include all relevant details. Vague statements can lead to disputes or complications with DMV processing.

Use clear, formal language: Write in a professional business tone even for informal transfers to family. This is a legal document that may be reviewed by authorities or courts.

Include all required certifications: Explicitly state that you are the legal owner, have authority to transfer, and disclose any liens or known issues with the vehicle.

Date everything accurately: Use the actual transfer date, not when you write the letter. This date determines liability transfer and is crucial for legal purposes.

Consider notarization: While not always required, having the letter notarized adds legal weight and credibility, especially for high-value vehicles or complex situations like estates.

Delivery method: For most transfers, hand the letter directly to the recipient along with other documents. For estate or business transfers, send via certified mail with return receipt to create proof of delivery.

Keep copies: Make multiple copies of the signed letter. Keep one for your records, give one to the recipient, and consider filing one with the DMV or relevant authority.

Coordinate with other documents: The transfer letter should accompany, not replace, the title transfer process. Submit all required forms to the DMV together to avoid processing delays.

Formatting Guidelines for Your Vehicle Transfer Letter

Length: Keep the letter concise but comprehensive, typically one to two pages. Include all essential information without unnecessary elaboration.

Tone: Use a formal, professional tone for all transfers, even those between family members. This demonstrates the seriousness of the legal transaction.

Structure: Use clear sections or paragraphs for different categories of information (vehicle details, transfer terms, certifications). This makes the document easy to read and reference.

Font and presentation: Use a standard business font (Times New Roman, Arial) in 11-12 point size. If printing, use quality white paper. Ensure adequate margins for readability.

Headers: Include a clear subject line that immediately identifies the document's purpose (e.g., "Vehicle Transfer Letter - Sale" or "Transfer of Ownership Notification").

Numbered or bulleted lists: Use lists for vehicle specifications and included items to improve clarity and ensure nothing is overlooked.

Legal language: While being professional, avoid overly complex legal jargon. The document should be understandable to all parties without a law degree.

Signature block: Leave adequate space for handwritten signatures with printed names underneath. Include a date line for each signature.

Mode of sending: For routine sales or gifts, hand delivery with the vehicle is appropriate. For estate, divorce, or business transfers, use certified mail or registered delivery services.

Digital vs. printed: While email copies are useful for records, most DMVs require original signatures on printed documents. Always maintain a physical signed copy.

Letterhead: If transferring from a business, use company letterhead. For estate transfers, consider using executor letterhead if available.

What to Do After Sending Your Vehicle Transfer Letter

Confirm receipt: If mailed, verify that the recipient received the letter. For important transfers like estate or divorce situations, request signed acknowledgment of receipt.

Complete DMV title transfer: Don't rely on the recipient to handle this. Verify with your local DMV within a few days that the title transfer has been initiated to protect yourself from liability.

File notification of sale: Many states allow or require sellers to file a "Notice of Transfer and Release of Liability" with the DMV. Complete this immediately after transfer to protect yourself from tickets or accidents.

Cancel insurance: Contact your insurance company on the transfer date to remove the vehicle from your policy. Don't wait, as you're paying for unnecessary coverage.

Remove license plates if required: Some states require you to keep your license plates when selling. Check local regulations and remove plates if necessary.

Update related accounts: Cancel toll transponders, parking permits, or subscription services (like satellite radio) associated with the vehicle.

Keep permanent records: File your copy of the transfer letter with other important documents. You may need it for tax purposes or if disputes arise years later.

Monitor for issues: For 30-60 days after transfer, watch for any tickets or notices related to the vehicle. Contact DMV immediately if you receive anything.

Follow up on estate transfers: If you're an executor, confirm with the beneficiary that they successfully transferred registration and title. This closes out your responsibility for that estate asset.

Tax documentation: For donations, ensure you receive the required tax receipt from the charity. For sales, keep records for potential capital gains tax reporting.

Payment completion: If accepting payment in installments, document each payment and don't release the title until fully paid. Consider keeping the title and providing a copy until final payment clears.

Pros and Cons of Using a Vehicle Transfer Letter

Advantages:

- Legal protection: Creates documented evidence of when ownership transferred, protecting you from liability for incidents after the transfer date

- Clarity for all parties: Eliminates confusion about transfer terms, what's included, vehicle condition, and each party's responsibilities

- DMV facilitation: Makes the title transfer process smoother by providing officials with clear documentation of the transaction

- Tax benefits documentation: Supports claims for charitable deductions, gift tax exemptions, or proper business expense accounting

- Dispute prevention: Having everything in writing prevents "he said, she said" situations if disagreements arise later

- Professional appearance: Demonstrates seriousness and professionalism, which can increase trust in the transaction

- Record keeping: Provides a permanent record for both parties that can be referenced years later if needed

Disadvantages:

- Time investment: Writing a comprehensive letter takes time and thought, especially for complex situations like estates or business transfers

- Potential for errors: If written carelessly, mistakes in VIN, names, or terms can cause DMV processing problems or legal complications

- Not always required: For simple transactions with immediate DMV processing, a letter might seem like extra paperwork

- False sense of security: A transfer letter doesn't replace proper title transfer with the DMV; some people mistakenly think the letter alone transfers ownership

- Can highlight problems: Documenting vehicle defects or liens in writing might discourage some buyers, though disclosure is legally and ethically appropriate

- Complexity in some situations: Estate and business transfers may require legal review of the letter, adding cost and delay

Common Mistakes to Avoid When Writing Transfer Letters

Incorrect or incomplete VIN: Transposing numbers in the Vehicle Identification Number is extremely common and can cause major DMV processing problems. Always verify the VIN multiple times against the title.

Vague transfer dates: Using "today" or "current date" without specifying the actual date creates ambiguity. Always include the specific month, day, and year.

Omitting lien information: Failing to disclose outstanding loans or liens can make the transfer invalid and expose you to legal liability. Always address lien status explicitly.

Missing odometer reading: Federal law requires odometer disclosure for most transfers. Forgetting this can delay or invalidate the transfer.

Incomplete party information: Using nicknames instead of legal names, or missing addresses can cause DMV rejection. Use exactly the names as they appear on legal documents.

Unclear payment terms: For sales, vague language about payment (like "to be paid") without specifics creates opportunities for disputes. Detail the exact amount, method, and timing.

No signature or date: An unsigned letter has no legal value. Both parties should sign and date the document, with witness signatures if required.

Conflicting information: When the letter contradicts other documents (like title or bill of sale) regarding price, date, or terms, it creates red flags for fraud.

Forgetting "as-is" statements: For private sales, not including "as-is" condition language can expose you to liability claims about vehicle defects discovered later.

Using only email: While email copies are convenient, most legal transfers require original signatures on physical documents. Don't rely solely on digital versions.

Not keeping copies: Handing over the only copy of the letter leaves you without proof of the transaction. Always retain copies for your records.

Overpromising or overcommitting: Making guarantees about vehicle condition or future performance that you can't back up can create legal liability.

Tips and Best Practices for Effective Vehicle Transfer Letters

Use templates strategically: Start with a template that matches your situation, then customize it with your specific details rather than creating from scratch.

Get everything in writing: Even if you have a verbal agreement, document everything in the letter. Memories fade and circumstances change.

Be honest about condition: Disclosing known problems protects you legally and ethically. "As-is" sales still require disclosure of major known defects.

Include a VIN check invitation: For private sales, invite the buyer to run a vehicle history report (Carfax, AutoCheck). This demonstrates transparency and builds trust.

Reference supporting documents: Mention what else you're providing (title, service records, owner's manual) to create a complete record of what was transferred.

Use certified mail for important transfers: For estate, divorce, or high-value transactions, send via certified mail with return receipt to prove delivery and create a paper trail.

Consider having witnesses: For large transactions or sensitive situations, have a witness sign the letter. This adds credibility if disputes arise.

Take photos: Photograph the vehicle's condition, odometer, and VIN on the transfer date. These images can support the written documentation if needed.

State law supersedes everything: Research your specific state's requirements because vehicle transfer laws vary significantly. What works in California might not be sufficient in New York.

Keep it simple but complete: Use straightforward language that anyone can understand while still covering all necessary legal points.

Time it with payment: For sales, coordinate the letter signing with final payment transfer and title handover. Everything should happen simultaneously.

Address tax implications: For gifts and donations, explicitly state there's no monetary consideration to support gift tax exemptions or charitable deductions.

Include contact information: Make it easy for the other party or authorities to reach you if questions arise about the transfer.

Comparing Vehicle Transfer Letters with Alternative Documentation Methods

Transfer letter vs. Bill of sale: A bill of sale is a simpler document focused primarily on the financial transaction (price paid, date, parties). A transfer letter is more comprehensive, including certifications, condition disclosures, and detailed vehicle information. Both are often used together for complete documentation.

Transfer letter vs. Title transfer alone: Simply signing over the title is the minimum legal requirement but provides no written record of the transfer terms, condition, or circumstances. A transfer letter supplements the title with important details and protections.

Transfer letter vs. Purchase agreement: A purchase agreement is typically used before the transfer occurs, outlining the terms under negotiation. A transfer letter documents the completed transaction and confirms the agreement was executed.

Transfer letter vs. Affidavit of ownership: An affidavit is a sworn statement under oath, often notarized, used primarily for estate transfers when the title is lost or court documentation is needed. It's more formal and legally binding than a standard transfer letter.

Transfer letter vs. Verbal agreement: Verbal agreements are legally binding in many situations but nearly impossible to prove if disputes arise. Written transfer letters provide concrete evidence and eliminate "he said, she said" problems.

Formal letter vs. Email confirmation: Email exchanges can document discussions but lack the formality and legal weight of a signed physical letter. For legal purposes, original signatures on paper remain the gold standard.

DIY letter vs. Attorney-drafted document: Self-written letters work well for straightforward transactions. Complex situations like business asset transfers, estate settlements, or high-value vehicles may benefit from attorney review despite the added cost.

Does a Vehicle Transfer Letter Require Attestation or Authorization

Notarization requirements: Whether notarization is required depends on your state and the type of transfer. Many states do not require notarization for standard sales between private parties, but some do. Estate transfers almost always benefit from notarization. Check your specific state's DMV requirements.

When notarization is highly recommended:

- Estate transfers where the executor is distributing assets

- High-value vehicles to prevent future disputes about authenticity

- Divorce-related transfers to ensure compliance with court orders

- Business-to-employee transfers for tax and accounting purposes

- Cross-state transfers where requirements differ between states

- Situations where the parties don't know each other well

Witness signatures: Even when notarization isn't required, having one or two witnesses sign the letter adds credibility. This is particularly useful for family transfers or situations where the parties' relationship might invite scrutiny.

Corporate authorization: For business transfers, the letter often needs approval from corporate officers (CEO, CFO) or the board of directors, depending on company bylaws and vehicle value. Include documentation of this authorization.

Court approval: Estate transfers may require court approval before the executor can distribute assets. Reference the court order and include certified copies of relevant probate documents with your transfer letter.

Power of attorney considerations: If someone is signing on behalf of another party (elderly parent, incapacitated owner), a valid power of attorney document must be attached to the transfer letter, and the attorney-in-fact's authority must be clearly stated.

Lender authorization: If transferring a vehicle with an outstanding loan (with lender permission), include written authorization from the lender approving the transfer or assumption of the loan.

Download Word Doc

Download Word Doc

Download PDF

Download PDF