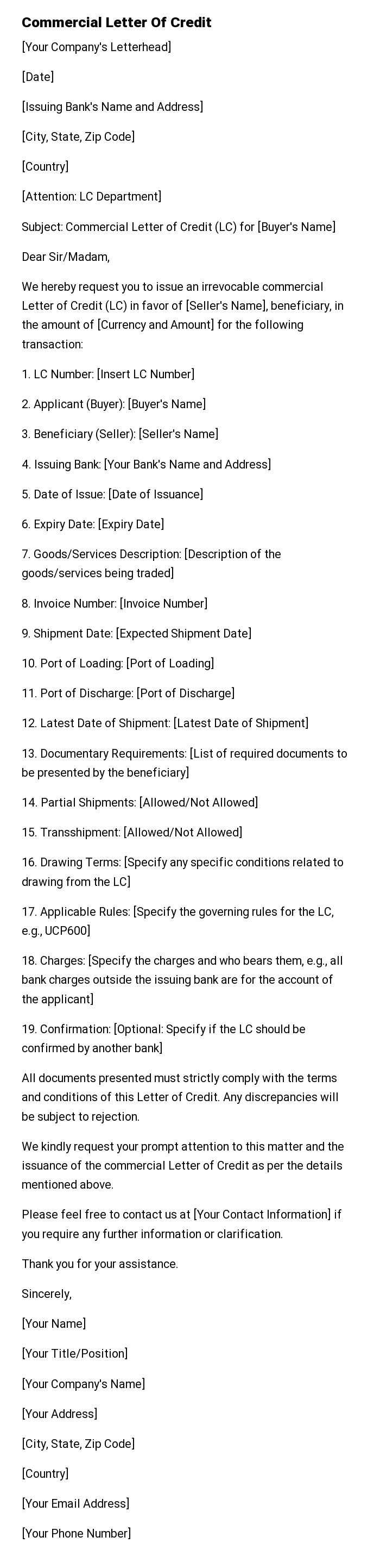

Commercial Letter Of Credit

[Your Company's Letterhead]

[Date]

[Issuing Bank's Name and Address]

[City, State, Zip Code]

[Country]

[Attention: LC Department]

Subject: Commercial Letter of Credit (LC) for [Buyer's Name]

Dear Sir/Madam,

We hereby request you to issue an irrevocable commercial Letter of Credit (LC) in favor of [Seller's Name], beneficiary, in the amount of [Currency and Amount] for the following transaction:

1. LC Number: [Insert LC Number]

2. Applicant (Buyer): [Buyer's Name]

3. Beneficiary (Seller): [Seller's Name]

4. Issuing Bank: [Your Bank's Name and Address]

5. Date of Issue: [Date of Issuance]

6. Expiry Date: [Expiry Date]

7. Goods/Services Description: [Description of the goods/services being traded]

8. Invoice Number: [Invoice Number]

9. Shipment Date: [Expected Shipment Date]

10. Port of Loading: [Port of Loading]

11. Port of Discharge: [Port of Discharge]

12. Latest Date of Shipment: [Latest Date of Shipment]

13. Documentary Requirements: [List of required documents to be presented by the beneficiary]

14. Partial Shipments: [Allowed/Not Allowed]

15. Transshipment: [Allowed/Not Allowed]

16. Drawing Terms: [Specify any specific conditions related to drawing from the LC]

17. Applicable Rules: [Specify the governing rules for the LC, e.g., UCP600]

18. Charges: [Specify the charges and who bears them, e.g., all bank charges outside the issuing bank are for the account of the applicant]

19. Confirmation: [Optional: Specify if the LC should be confirmed by another bank]

All documents presented must strictly comply with the terms and conditions of this Letter of Credit. Any discrepancies will be subject to rejection.

We kindly request your prompt attention to this matter and the issuance of the commercial Letter of Credit as per the details mentioned above.

Please feel free to contact us at [Your Contact Information] if you require any further information or clarification.

Thank you for your assistance.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Company's Name]

[Your Address]

[City, State, Zip Code]

[Country]

[Your Email Address]

[Your Phone Number]

Commercial Letter Of Credit

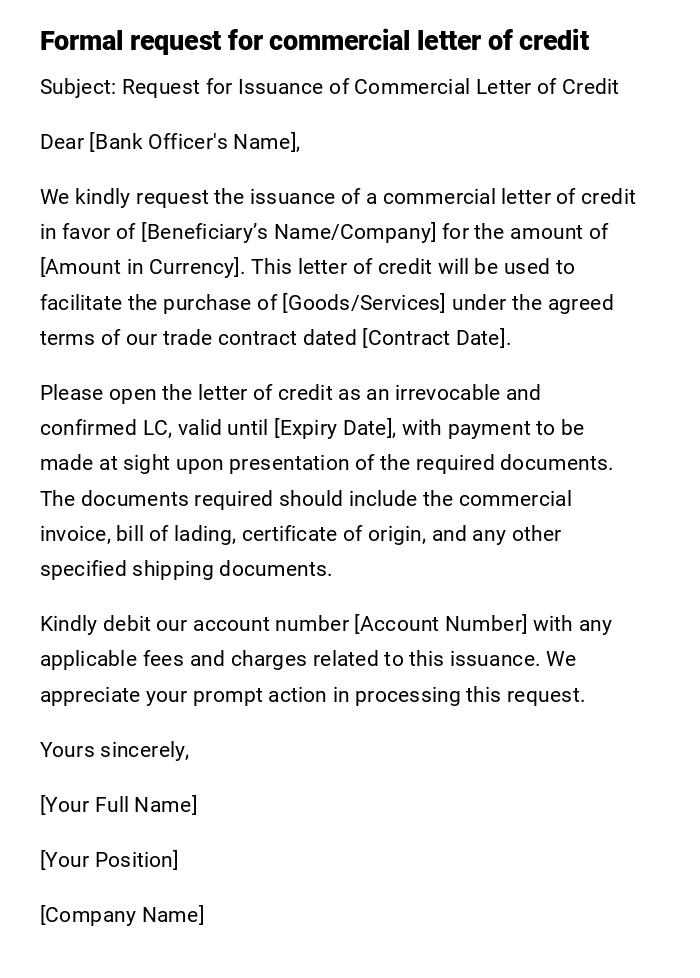

Formal Commercial Letter of Credit Request Letter

Subject: Request for Issuance of Commercial Letter of Credit

Dear [Bank Officer's Name],

We kindly request the issuance of a commercial letter of credit in favor of [Beneficiary’s Name/Company] for the amount of [Amount in Currency]. This letter of credit will be used to facilitate the purchase of [Goods/Services] under the agreed terms of our trade contract dated [Contract Date].

Please open the letter of credit as an irrevocable and confirmed LC, valid until [Expiry Date], with payment to be made at sight upon presentation of the required documents. The documents required should include the commercial invoice, bill of lading, certificate of origin, and any other specified shipping documents.

Kindly debit our account number [Account Number] with any applicable fees and charges related to this issuance. We appreciate your prompt action in processing this request.

Yours sincerely,

[Your Full Name]

[Your Position]

[Company Name]

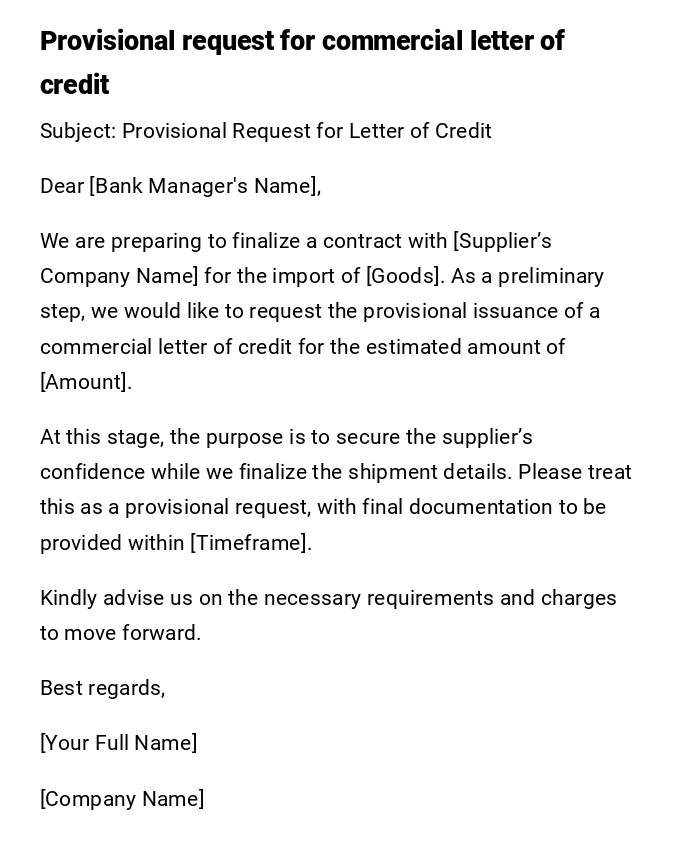

Provisional Commercial Letter of Credit Request Email

Subject: Provisional Request for Letter of Credit

Dear [Bank Manager's Name],

We are preparing to finalize a contract with [Supplier’s Company Name] for the import of [Goods]. As a preliminary step, we would like to request the provisional issuance of a commercial letter of credit for the estimated amount of [Amount].

At this stage, the purpose is to secure the supplier’s confidence while we finalize the shipment details. Please treat this as a provisional request, with final documentation to be provided within [Timeframe].

Kindly advise us on the necessary requirements and charges to move forward.

Best regards,

[Your Full Name]

[Company Name]

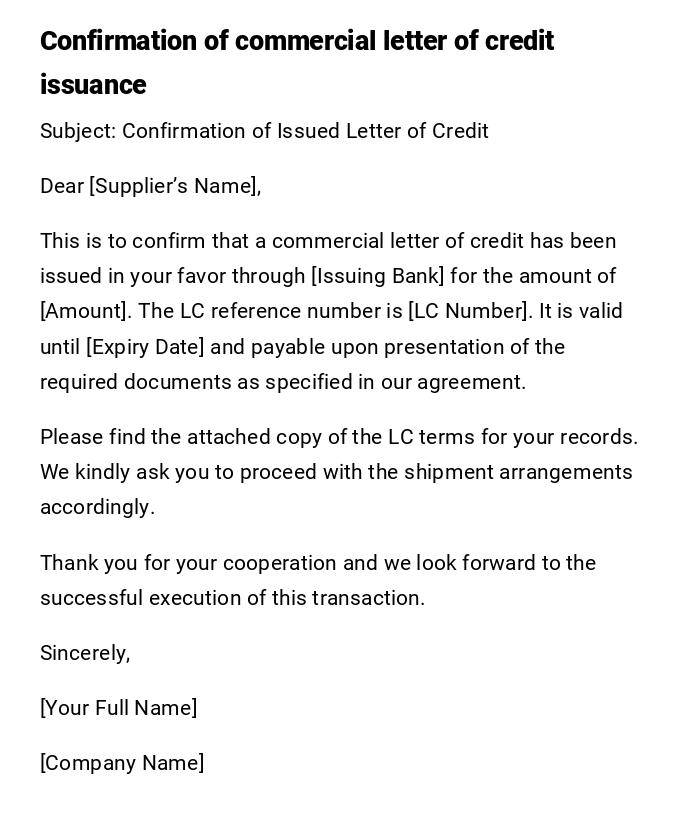

Commercial Letter of Credit Confirmation Letter

Subject: Confirmation of Issued Letter of Credit

Dear [Supplier’s Name],

This is to confirm that a commercial letter of credit has been issued in your favor through [Issuing Bank] for the amount of [Amount]. The LC reference number is [LC Number]. It is valid until [Expiry Date] and payable upon presentation of the required documents as specified in our agreement.

Please find the attached copy of the LC terms for your records. We kindly ask you to proceed with the shipment arrangements accordingly.

Thank you for your cooperation and we look forward to the successful execution of this transaction.

Sincerely,

[Your Full Name]

[Company Name]

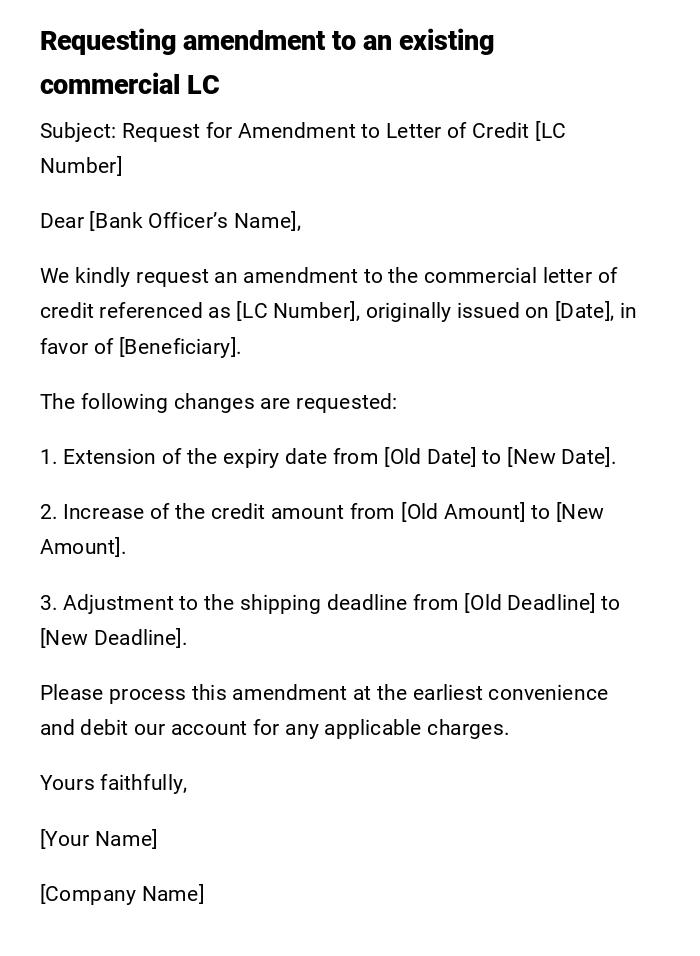

Commercial Letter of Credit Amendment Request Letter

Subject: Request for Amendment to Letter of Credit [LC Number]

Dear [Bank Officer’s Name],

We kindly request an amendment to the commercial letter of credit referenced as [LC Number], originally issued on [Date], in favor of [Beneficiary].

The following changes are requested:

1. Extension of the expiry date from [Old Date] to [New Date].

2. Increase of the credit amount from [Old Amount] to [New Amount].

3. Adjustment to the shipping deadline from [Old Deadline] to [New Deadline].

Please process this amendment at the earliest convenience and debit our account for any applicable charges.

Yours faithfully,

[Your Name]

[Company Name]

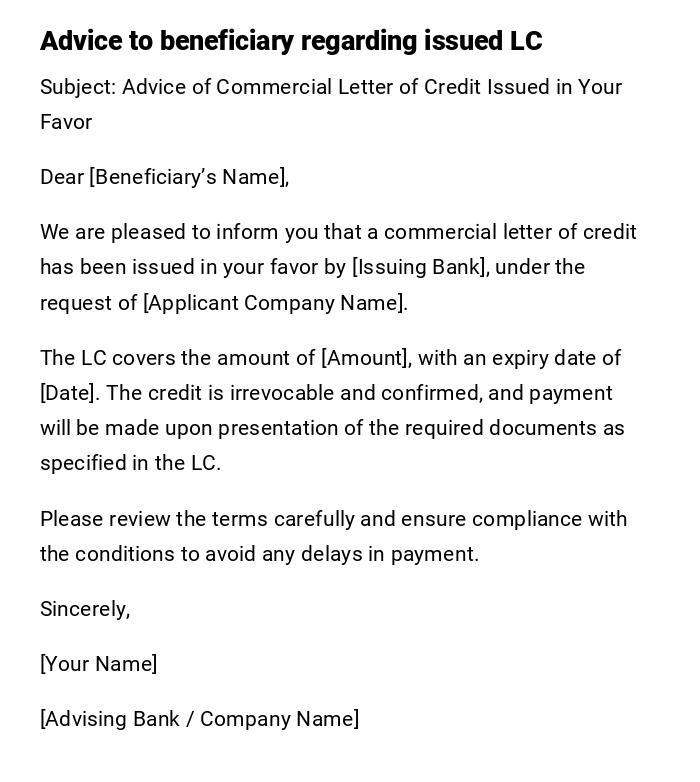

Commercial Letter of Credit Advice Letter

Subject: Advice of Commercial Letter of Credit Issued in Your Favor

Dear [Beneficiary’s Name],

We are pleased to inform you that a commercial letter of credit has been issued in your favor by [Issuing Bank], under the request of [Applicant Company Name].

The LC covers the amount of [Amount], with an expiry date of [Date]. The credit is irrevocable and confirmed, and payment will be made upon presentation of the required documents as specified in the LC.

Please review the terms carefully and ensure compliance with the conditions to avoid any delays in payment.

Sincerely,

[Your Name]

[Advising Bank / Company Name]

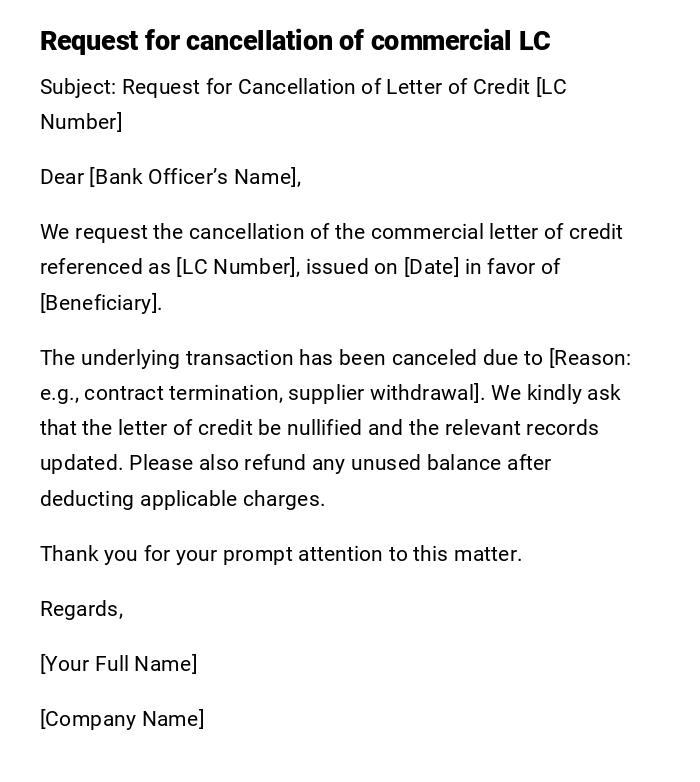

Commercial Letter of Credit Cancellation Request Letter

Subject: Request for Cancellation of Letter of Credit [LC Number]

Dear [Bank Officer’s Name],

We request the cancellation of the commercial letter of credit referenced as [LC Number], issued on [Date] in favor of [Beneficiary].

The underlying transaction has been canceled due to [Reason: e.g., contract termination, supplier withdrawal]. We kindly ask that the letter of credit be nullified and the relevant records updated. Please also refund any unused balance after deducting applicable charges.

Thank you for your prompt attention to this matter.

Regards,

[Your Full Name]

[Company Name]

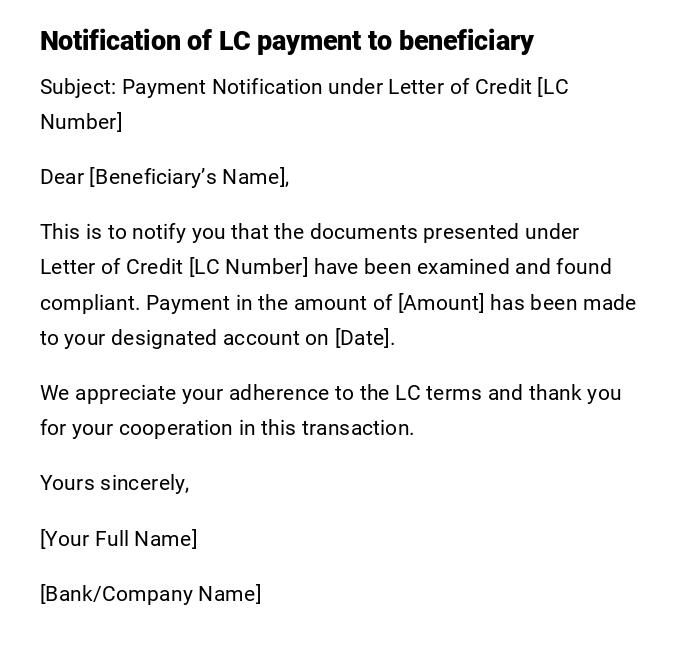

Commercial Letter of Credit Payment Notification Letter

Subject: Payment Notification under Letter of Credit [LC Number]

Dear [Beneficiary’s Name],

This is to notify you that the documents presented under Letter of Credit [LC Number] have been examined and found compliant. Payment in the amount of [Amount] has been made to your designated account on [Date].

We appreciate your adherence to the LC terms and thank you for your cooperation in this transaction.

Yours sincerely,

[Your Full Name]

[Bank/Company Name]

Why do you need a commercial letter of credit?

A commercial letter of credit serves as a financial guarantee in international trade.

- It ensures the seller receives payment once shipping and documentation requirements are fulfilled.

- It provides buyers with assurance that payment will only be made when agreed conditions are met.

- It reduces risk in cross-border trade where trust or legal frameworks may differ.

Who issues and manages a commercial letter of credit?

- Typically, the applicant (buyer) requests their bank to issue the LC.

- The issuing bank guarantees payment to the seller.

- The advising bank informs the beneficiary about the LC.

- Sometimes, a confirming bank is involved to add an extra guarantee.

When is a commercial letter of credit used?

- When a buyer and seller do not have an established trust relationship.

- For large international trade deals where risks are high.

- When governments, customs, or regulations require payment guarantees.

- When sellers demand security before shipping goods overseas.

What are the requirements before requesting a commercial letter of credit?

- Signed sales contract between buyer and seller.

- Agreed payment and delivery terms.

- Buyer’s bank account with sufficient funds or credit.

- List of required documents such as invoices, bills of lading, certificates of origin.

How do you write and process a commercial letter of credit?

- Begin with a formal request to the issuing bank.

- Clearly state the amount, beneficiary, and purpose.

- Define expiry dates, shipping deadlines, and required documentation.

- Submit supporting documents such as the trade contract.

- Monitor issuance and share LC details with the supplier.

What are the common mistakes when dealing with letters of credit?

- Incorrect or incomplete documentation.

- Not checking expiry or shipping dates carefully.

- Using vague language in the LC request.

- Failure to align LC terms with the sales contract.

- Forgetting to budget for bank fees and commissions.

What elements and structure must a commercial LC-related letter include?

- Clear subject line referencing the LC number.

- Identification of buyer, seller, and banks involved.

- Statement of request, advice, or notification.

- Detailed conditions, amounts, and dates.

- Polite closing with signature and company details.

Pros and cons of using commercial letters of credit

Pros:

- Provides payment security for sellers.

- Reduces risk of fraud in international trade.

- Encourages smoother global transactions.

Cons:

- Can be expensive due to fees.

- Documentation requirements are complex.

- Delays may occur if terms are not strictly followed.

Tricks and tips for handling commercial letters of credit

- Always double-check document requirements.

- Work closely with your bank to avoid errors.

- Keep timelines realistic for shipment and documentation.

- Use clear contract terms that match LC requirements.

- Consider professional advice for large transactions.

After sending: what follow-up is required?

- Confirm with the supplier that they have received LC details.

- Track expiry and shipping deadlines to avoid invalidation.

- Communicate with the bank if amendments are needed.

- Keep copies of all related documentation for legal and audit purposes.

Download Word Doc

Download Word Doc

Download PDF

Download PDF