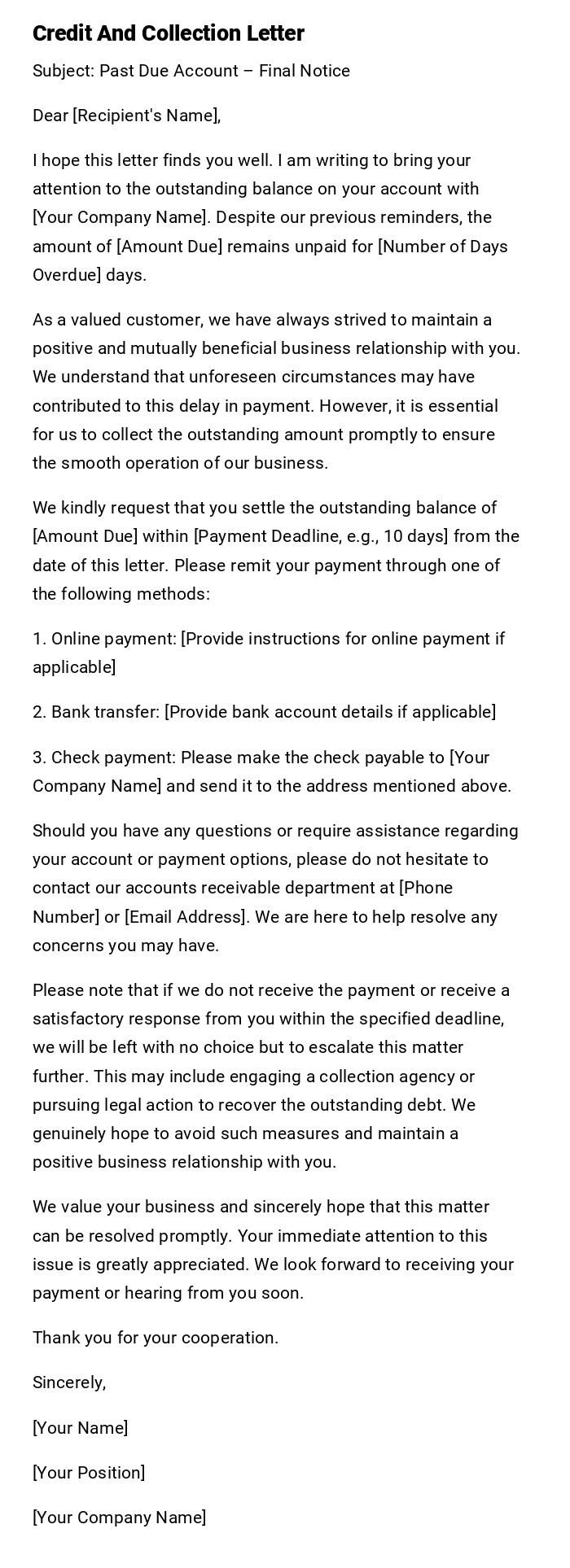

Credit And Collection Letter

Subject: Past Due Account – Final Notice

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to bring your attention to the outstanding balance on your account with [Your Company Name]. Despite our previous reminders, the amount of [Amount Due] remains unpaid for [Number of Days Overdue] days.

As a valued customer, we have always strived to maintain a positive and mutually beneficial business relationship with you. We understand that unforeseen circumstances may have contributed to this delay in payment. However, it is essential for us to collect the outstanding amount promptly to ensure the smooth operation of our business.

We kindly request that you settle the outstanding balance of [Amount Due] within [Payment Deadline, e.g., 10 days] from the date of this letter. Please remit your payment through one of the following methods:

1. Online payment: [Provide instructions for online payment if applicable]

2. Bank transfer: [Provide bank account details if applicable]

3. Check payment: Please make the check payable to [Your Company Name] and send it to the address mentioned above.

Should you have any questions or require assistance regarding your account or payment options, please do not hesitate to contact our accounts receivable department at [Phone Number] or [Email Address]. We are here to help resolve any concerns you may have.

Please note that if we do not receive the payment or receive a satisfactory response from you within the specified deadline, we will be left with no choice but to escalate this matter further. This may include engaging a collection agency or pursuing legal action to recover the outstanding debt. We genuinely hope to avoid such measures and maintain a positive business relationship with you.

We value your business and sincerely hope that this matter can be resolved promptly. Your immediate attention to this issue is greatly appreciated. We look forward to receiving your payment or hearing from you soon.

Thank you for your cooperation.

Sincerely,

[Your Name]

[Your Position]

[Your Company Name]

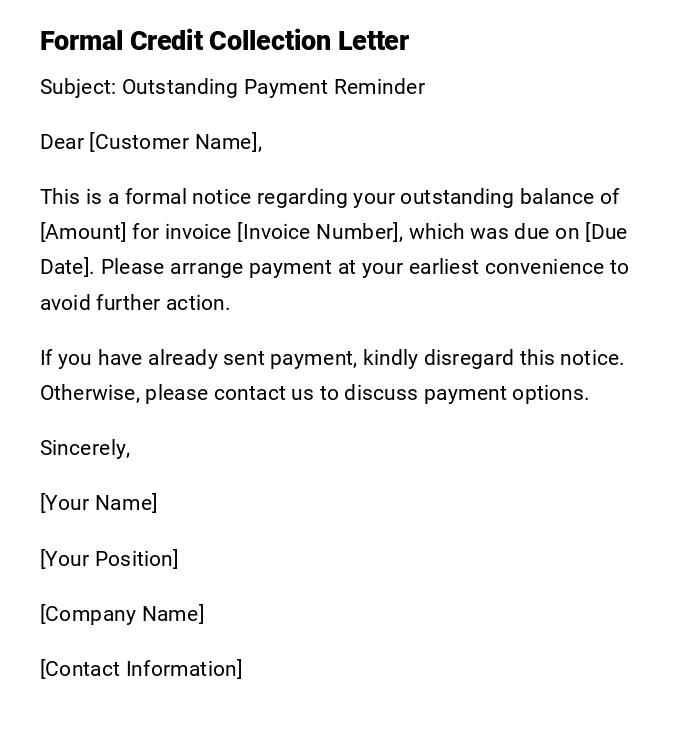

Professional Credit Collection Letter

Subject: Outstanding Payment Reminder

Dear [Customer Name],

This is a formal notice regarding your outstanding balance of [Amount] for invoice [Invoice Number], which was due on [Due Date]. Please arrange payment at your earliest convenience to avoid further action.

If you have already sent payment, kindly disregard this notice. Otherwise, please contact us to discuss payment options.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

[Contact Information]

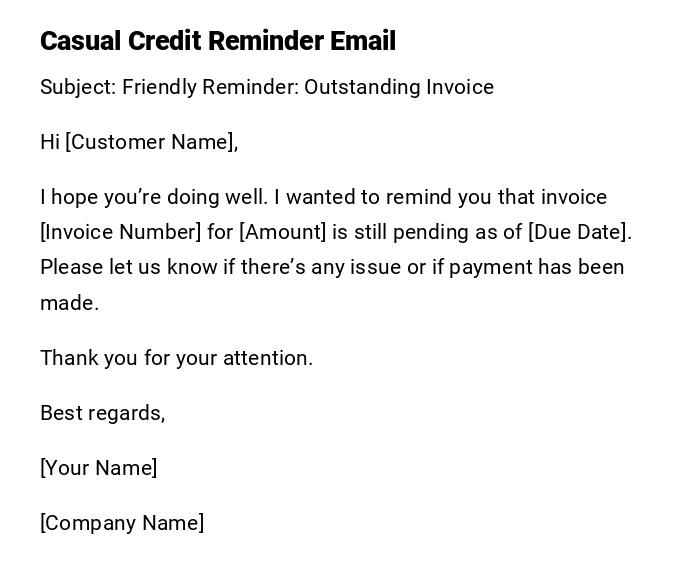

Friendly Reminder Email for Credit Collection

Subject: Friendly Reminder: Outstanding Invoice

Hi [Customer Name],

I hope you’re doing well. I wanted to remind you that invoice [Invoice Number] for [Amount] is still pending as of [Due Date]. Please let us know if there’s any issue or if payment has been made.

Thank you for your attention.

Best regards,

[Your Name]

[Company Name]

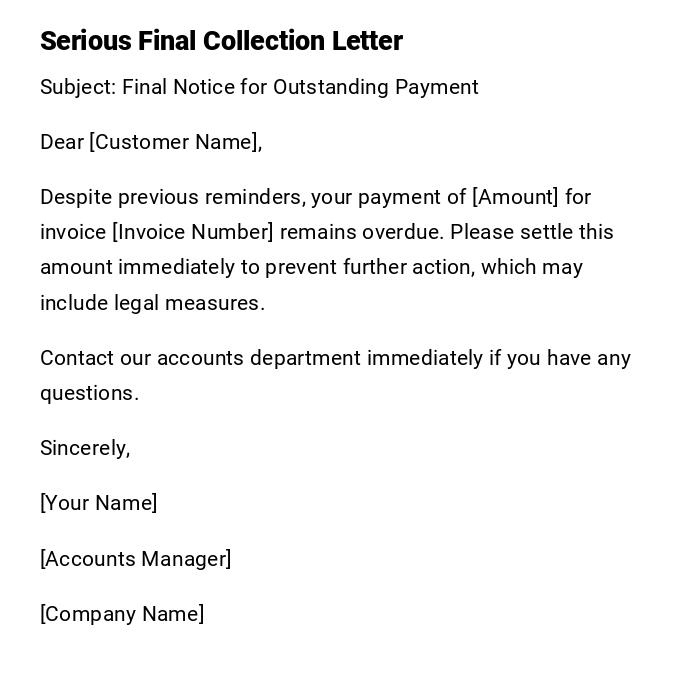

Final Notice Credit Collection Letter

Subject: Final Notice for Outstanding Payment

Dear [Customer Name],

Despite previous reminders, your payment of [Amount] for invoice [Invoice Number] remains overdue. Please settle this amount immediately to prevent further action, which may include legal measures.

Contact our accounts department immediately if you have any questions.

Sincerely,

[Your Name]

[Accounts Manager]

[Company Name]

Payment Arrangement Proposal Letter

Subject: Proposal for Payment Arrangement

Dear [Customer Name],

We understand that unexpected circumstances can cause delays in payment. We are willing to offer a payment arrangement for the outstanding balance of [Amount] on invoice [Invoice Number]. Please contact us to discuss a suitable repayment plan.

We appreciate your prompt attention to this matter.

Best regards,

[Your Name]

[Company Name]

Urgent Collection Email for Overdue Account

Subject: Urgent Action Required: Overdue Payment

Dear [Customer Name],

This email serves as an urgent reminder that your account balance of [Amount] for invoice [Invoice Number] is overdue. Immediate payment is required to avoid interruption of services or further actions.

Please confirm the status of your payment.

Sincerely,

[Your Name]

[Company Name]

[Contact Details]

What / Why You Need a Credit and Collection Letter

Purpose and Importance

- Serves as a formal communication to request payment for goods or services rendered.

- Helps maintain a professional relationship while addressing financial obligations.

- Provides documented evidence of attempts to collect overdue payments.

- Protects the company legally in case escalation is needed.

Who Should Send a Credit and Collection Letter

Authorized Senders

- Accounts receivable department of the company.

- Company managers or financial officers.

- Authorized representatives with collection responsibility.

Whom Should Receive a Credit and Collection Letter

Recipients

- Customers or clients with outstanding balances.

- Corporate accounts or billing departments for B2B transactions.

- Legal representatives if formal escalation is required.

When to Send a Credit and Collection Letter

Timing Scenarios

- Immediately after a payment becomes overdue.

- After sending previous reminders without response.

- Before initiating legal or further collection action.

How to Write and Send a Credit and Collection Letter

Steps

- Start with a clear subject line identifying the purpose (e.g., "Overdue Payment Notice").

- Include details: invoice number, amount due, and due date.

- Maintain a professional tone, escalating seriousness with repeated letters.

- Include contact information and available payment methods.

- Send via email or printed letter depending on client preference and legal requirements.

Formatting Guidelines for Credit and Collection Letters

Style and Structure

- Length: Concise but complete, one page preferred.

- Tone: Professional, firm, escalating to serious if repeated.

- Sections: Subject, salutation, statement of overdue payment, instructions or request, closing, signature.

- Attachments: Invoice copies or account statements if necessary.

- Mode: Email or printed letter depending on official procedure.

Requirements and Prerequisites Before Sending

Checklist

- Confirm accurate invoice details and payment history.

- Review previous reminders or communication sent.

- Prepare legal or escalation plan if non-payment continues.

- Ensure correct recipient contact information.

Tricks and Tips for Credit and Collection Letters

Best Practices

- Keep records of all communications for reference.

- Start with polite reminders, escalating to firm language gradually.

- Use clear deadlines to prompt payment.

- Provide multiple payment options to facilitate resolution.

- Tailor tone to client relationship and past payment behavior.

Common Mistakes in Credit and Collection Letters

Pitfalls to Avoid

- Sending letters without verifying the overdue amount.

- Using vague language that does not specify payment requirements.

- Ignoring escalation protocols or sending overly aggressive letters prematurely.

- Failing to provide contact information or payment instructions.

- Missing documentation or invoice attachments.

Elements and Structure of a Credit and Collection Letter

Key Components

- Subject line clearly stating the purpose.

- Salutation addressing the customer or client.

- Clear statement of the overdue amount and invoice reference.

- Instructions for payment or contact information for disputes.

- Optional escalation statements or legal disclaimers.

- Closing with signature and company details.

- Attachments: invoices, statements, or previous notices.

After Sending a Credit and Collection Letter

Follow-Up Steps

- Confirm receipt of letter via email, phone, or acknowledgment.

- Monitor payment status against deadlines.

- Escalate to higher management or legal action if payment is not received.

- Maintain accurate records of all correspondence and responses.

Pros and Cons of Sending a Credit and Collection Letter

Advantages

- Provides formal documentation and record of payment requests.

- Maintains professional communication while asserting rights.

- Can prompt timely payment without requiring immediate legal action.

Disadvantages

- May strain client relationships if repeated or aggressive.

- Requires careful tracking and follow-up to be effective.

- Possible cost and time involved in drafting and sending multiple letters.

Download Word Doc

Download Word Doc

Download PDF

Download PDF