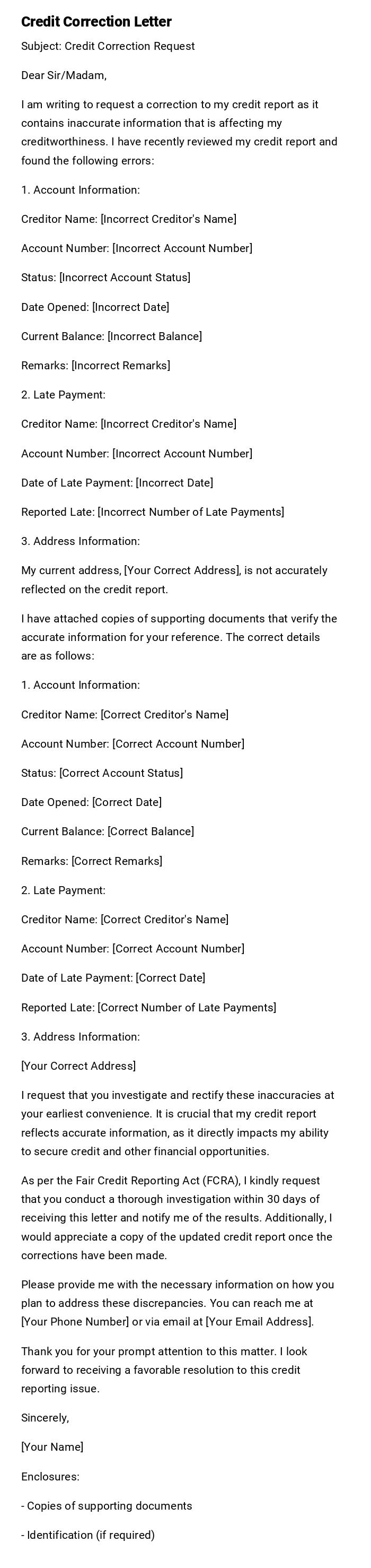

Credit Correction Letter

Subject: Credit Correction Request

Dear Sir/Madam,

I am writing to request a correction to my credit report as it contains inaccurate information that is affecting my creditworthiness. I have recently reviewed my credit report and found the following errors:

1. Account Information:

Creditor Name: [Incorrect Creditor's Name]

Account Number: [Incorrect Account Number]

Status: [Incorrect Account Status]

Date Opened: [Incorrect Date]

Current Balance: [Incorrect Balance]

Remarks: [Incorrect Remarks]

2. Late Payment:

Creditor Name: [Incorrect Creditor's Name]

Account Number: [Incorrect Account Number]

Date of Late Payment: [Incorrect Date]

Reported Late: [Incorrect Number of Late Payments]

3. Address Information:

My current address, [Your Correct Address], is not accurately reflected on the credit report.

I have attached copies of supporting documents that verify the accurate information for your reference. The correct details are as follows:

1. Account Information:

Creditor Name: [Correct Creditor's Name]

Account Number: [Correct Account Number]

Status: [Correct Account Status]

Date Opened: [Correct Date]

Current Balance: [Correct Balance]

Remarks: [Correct Remarks]

2. Late Payment:

Creditor Name: [Correct Creditor's Name]

Account Number: [Correct Account Number]

Date of Late Payment: [Correct Date]

Reported Late: [Correct Number of Late Payments]

3. Address Information:

[Your Correct Address]

I request that you investigate and rectify these inaccuracies at your earliest convenience. It is crucial that my credit report reflects accurate information, as it directly impacts my ability to secure credit and other financial opportunities.

As per the Fair Credit Reporting Act (FCRA), I kindly request that you conduct a thorough investigation within 30 days of receiving this letter and notify me of the results. Additionally, I would appreciate a copy of the updated credit report once the corrections have been made.

Please provide me with the necessary information on how you plan to address these discrepancies. You can reach me at [Your Phone Number] or via email at [Your Email Address].

Thank you for your prompt attention to this matter. I look forward to receiving a favorable resolution to this credit reporting issue.

Sincerely,

[Your Name]

Enclosures:

- Copies of supporting documents

- Identification (if required)

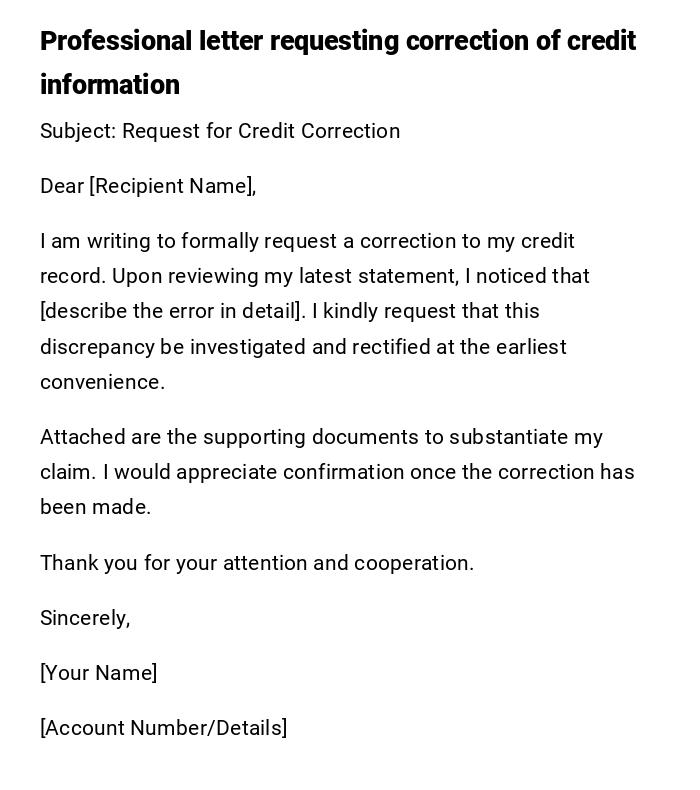

Formal Credit Correction Request Letter

Subject: Request for Credit Correction

Dear [Recipient Name],

I am writing to formally request a correction to my credit record. Upon reviewing my latest statement, I noticed that [describe the error in detail]. I kindly request that this discrepancy be investigated and rectified at the earliest convenience.

Attached are the supporting documents to substantiate my claim. I would appreciate confirmation once the correction has been made.

Thank you for your attention and cooperation.

Sincerely,

[Your Name]

[Account Number/Details]

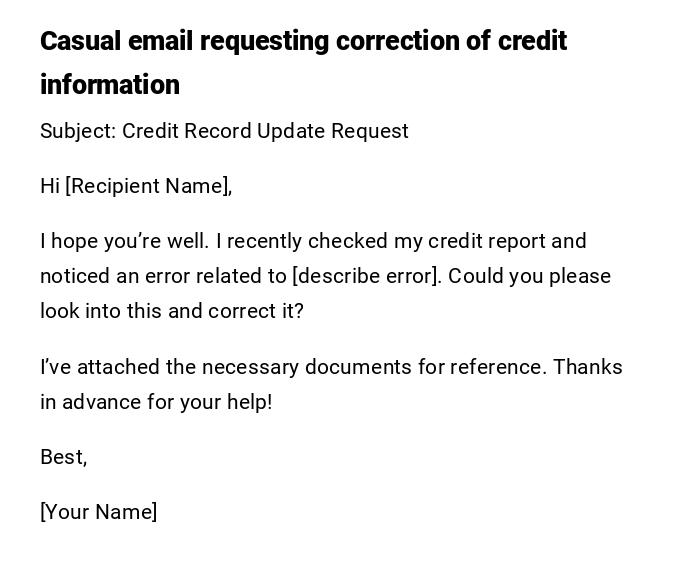

Informal Credit Correction Email

Subject: Credit Record Update Request

Hi [Recipient Name],

I hope you’re well. I recently checked my credit report and noticed an error related to [describe error]. Could you please look into this and correct it?

I’ve attached the necessary documents for reference. Thanks in advance for your help!

Best,

[Your Name]

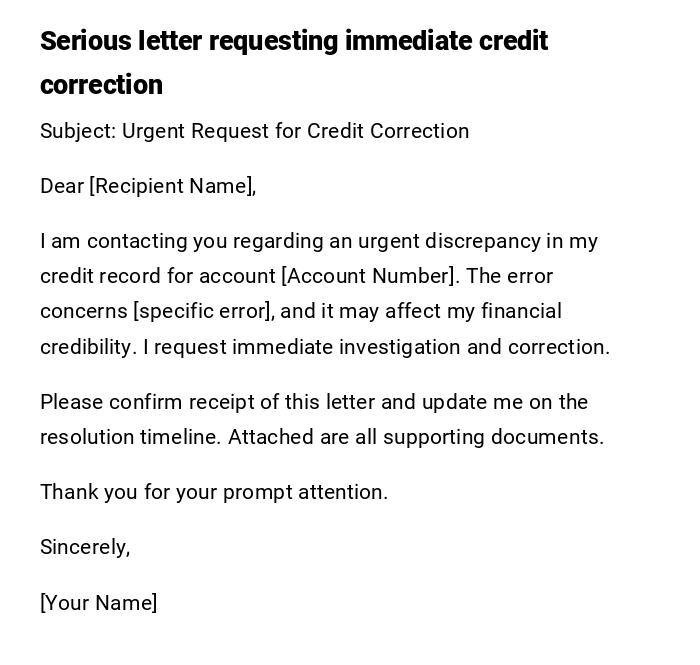

Urgent Credit Correction Letter

Subject: Urgent Request for Credit Correction

Dear [Recipient Name],

I am contacting you regarding an urgent discrepancy in my credit record for account [Account Number]. The error concerns [specific error], and it may affect my financial credibility. I request immediate investigation and correction.

Please confirm receipt of this letter and update me on the resolution timeline. Attached are all supporting documents.

Thank you for your prompt attention.

Sincerely,

[Your Name]

Heartfelt Credit Correction Request

Subject: Credit Correction Request

Dear [Recipient Name],

I recently discovered an error in my credit record for [Account Number]. This has caused me considerable concern as it affects my financial plans. I kindly request your assistance in rectifying this matter as soon as possible.

I have attached all relevant documents for your reference. Your support in resolving this issue is greatly appreciated.

Thank you for your understanding and assistance.

Warm regards,

[Your Name]

Quick Credit Correction Email

Subject: Credit Correction Needed

Hi [Recipient Name],

I noticed an error in my credit record regarding [specific error]. Please correct it at your earliest convenience. Attached are the supporting documents.

Thank you,

[Your Name]

What is a Credit Correction Letter and Why It Is Important

A Credit Correction Letter is a formal request sent to financial institutions, banks, or credit bureaus to correct inaccurate information on a credit report.

Purpose:

- Ensure accurate credit reporting.

- Protect financial credibility.

- Rectify mistakes that could impact loans, credit approval, or interest rates.

Who Should Send a Credit Correction Letter

- Individuals noticing inaccuracies in their credit reports.

- Business owners detecting errors in corporate credit information.

- Financial representatives or legal proxies acting on behalf of clients.

Whom the Credit Correction Letter Should Be Addressed To

- Banks, lending institutions, or credit bureaus.

- Customer service or credit dispute departments.

- Any official entity maintaining the credit records in question.

When to Send a Credit Correction Letter

- After discovering errors during regular credit report review.

- Following identification of incorrect payments, balances, or personal details.

- Immediately after receiving notices that credit status affects financial decisions.

How to Write and Send a Credit Correction Letter

- Start with a clear subject indicating the correction request.

- Detail the specific errors with relevant dates and account numbers.

- Attach supporting documents as proof.

- Maintain a professional tone and clear language.

- Send via official channels: email for quick action or certified mail for formal records.

Requirements and Prerequisites Before Sending

- Obtain a recent copy of your credit report.

- Identify and document all errors accurately.

- Collect supporting evidence like receipts, statements, or legal documents.

- Know the correct contact person or department for disputes.

Formatting Guidelines for Credit Correction Letters

- Length: 1–2 pages maximum.

- Tone: Formal and professional.

- Structure: Subject, salutation, description of error, request for correction, closing.

- Attachments: Include all necessary proof documents.

- Mode: Certified mail or official email preferred.

After Sending a Credit Correction Letter

- Track confirmation of receipt.

- Follow up if no response within the stipulated timeframe (usually 30 days).

- Keep copies of all correspondence and responses for records.

- Confirm that corrections are reflected in the updated credit report.

Tricks and Tips for Effective Credit Correction Letters

- Be concise but detailed with the error description.

- Include all supporting evidence in one packet.

- Send via trackable methods to ensure confirmation.

- Maintain polite and professional language even if errors caused frustration.

Common Mistakes to Avoid

- Providing vague or incomplete information.

- Sending without supporting documents.

- Ignoring deadlines or statutory timelines for disputes.

- Using informal or unprofessional language.

- Failing to follow up or verify correction completion.

Elements and Structure of a Credit Correction Letter

- Subject line clearly stating "Credit Correction Request".

- Salutation addressing the correct department or individual.

- Introduction explaining reason for writing.

- Body detailing errors, account information, and impact.

- Request for correction and timeline expectations.

- Closing with polite acknowledgment and signature.

- Attachments: proof documents, statements, or receipts.

Does a Credit Correction Letter Require Attestation or Authorization

- Generally, attestation is not required for personal credit corrections.

- Authorization may be needed if a third-party representative is submitting the letter.

- Certified mail or notarization may enhance legitimacy in formal or disputed cases.

Download Word Doc

Download Word Doc

Download PDF

Download PDF