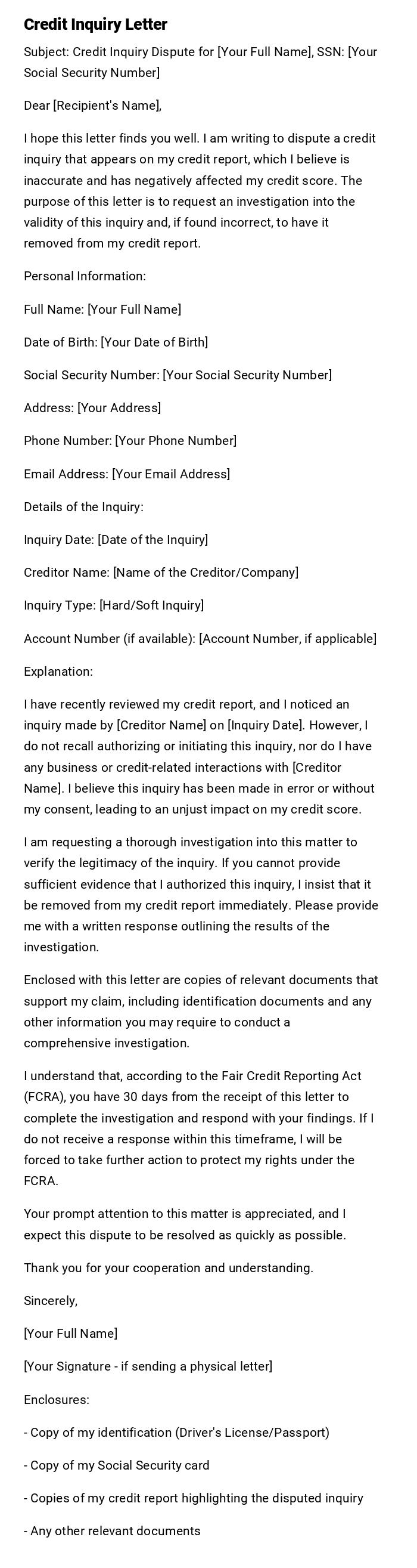

Credit Inquiry Letter

Subject: Credit Inquiry Dispute for [Your Full Name], SSN: [Your Social Security Number]

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to dispute a credit inquiry that appears on my credit report, which I believe is inaccurate and has negatively affected my credit score. The purpose of this letter is to request an investigation into the validity of this inquiry and, if found incorrect, to have it removed from my credit report.

Personal Information:

Full Name: [Your Full Name]

Date of Birth: [Your Date of Birth]

Social Security Number: [Your Social Security Number]

Address: [Your Address]

Phone Number: [Your Phone Number]

Email Address: [Your Email Address]

Details of the Inquiry:

Inquiry Date: [Date of the Inquiry]

Creditor Name: [Name of the Creditor/Company]

Inquiry Type: [Hard/Soft Inquiry]

Account Number (if available): [Account Number, if applicable]

Explanation:

I have recently reviewed my credit report, and I noticed an inquiry made by [Creditor Name] on [Inquiry Date]. However, I do not recall authorizing or initiating this inquiry, nor do I have any business or credit-related interactions with [Creditor Name]. I believe this inquiry has been made in error or without my consent, leading to an unjust impact on my credit score.

I am requesting a thorough investigation into this matter to verify the legitimacy of the inquiry. If you cannot provide sufficient evidence that I authorized this inquiry, I insist that it be removed from my credit report immediately. Please provide me with a written response outlining the results of the investigation.

Enclosed with this letter are copies of relevant documents that support my claim, including identification documents and any other information you may require to conduct a comprehensive investigation.

I understand that, according to the Fair Credit Reporting Act (FCRA), you have 30 days from the receipt of this letter to complete the investigation and respond with your findings. If I do not receive a response within this timeframe, I will be forced to take further action to protect my rights under the FCRA.

Your prompt attention to this matter is appreciated, and I expect this dispute to be resolved as quickly as possible.

Thank you for your cooperation and understanding.

Sincerely,

[Your Full Name]

[Your Signature - if sending a physical letter]

Enclosures:

- Copy of my identification (Driver's License/Passport)

- Copy of my Social Security card

- Copies of my credit report highlighting the disputed inquiry

- Any other relevant documents

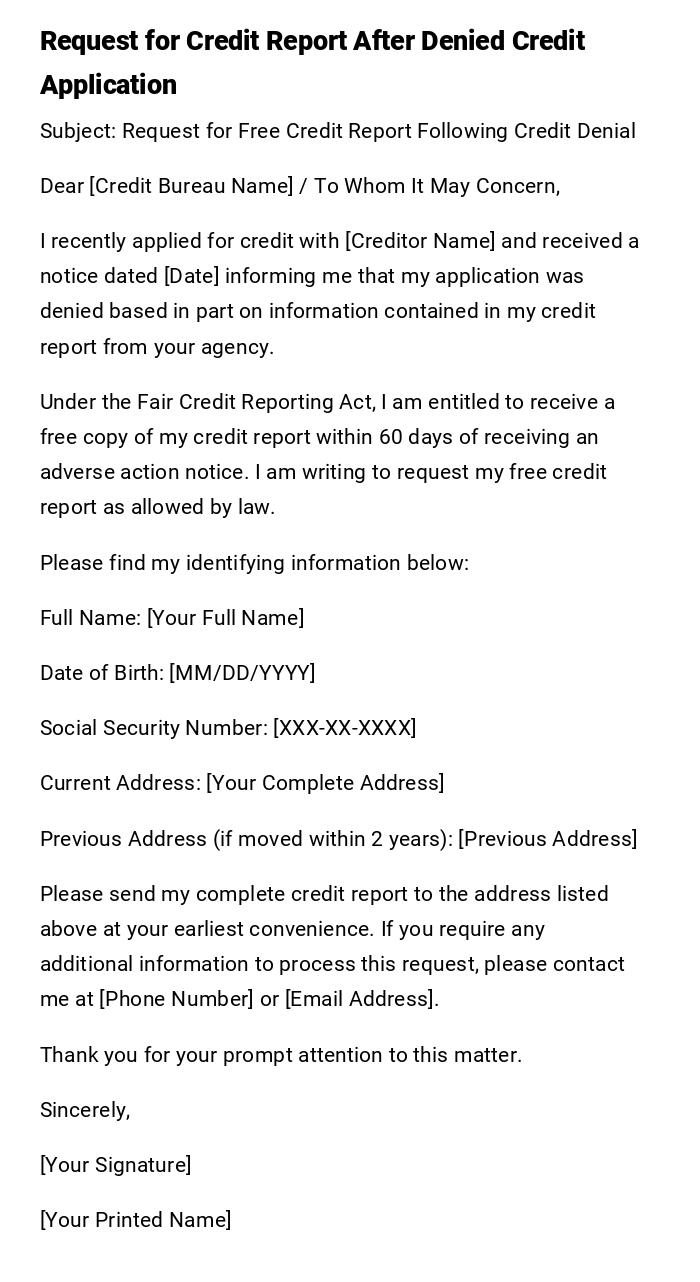

Request for Credit Report After Denied Credit Application

Subject: Request for Free Credit Report Following Credit Denial

Dear [Credit Bureau Name] / To Whom It May Concern,

I recently applied for credit with [Creditor Name] and received a notice dated [Date] informing me that my application was denied based in part on information contained in my credit report from your agency.

Under the Fair Credit Reporting Act, I am entitled to receive a free copy of my credit report within 60 days of receiving an adverse action notice. I am writing to request my free credit report as allowed by law.

Please find my identifying information below:

Full Name: [Your Full Name]

Date of Birth: [MM/DD/YYYY]

Social Security Number: [XXX-XX-XXXX]

Current Address: [Your Complete Address]

Previous Address (if moved within 2 years): [Previous Address]

Please send my complete credit report to the address listed above at your earliest convenience. If you require any additional information to process this request, please contact me at [Phone Number] or [Email Address].

Thank you for your prompt attention to this matter.

Sincerely,

[Your Signature]

[Your Printed Name]

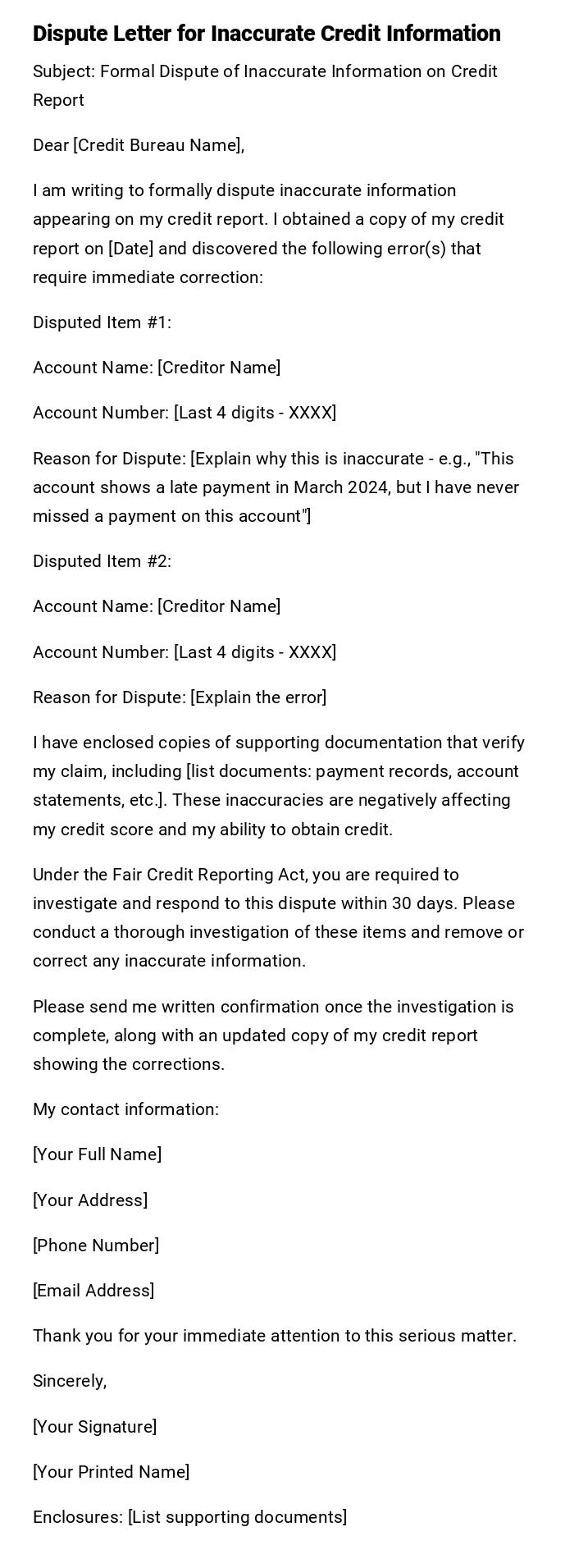

Dispute Letter for Inaccurate Credit Information

Subject: Formal Dispute of Inaccurate Information on Credit Report

Dear [Credit Bureau Name],

I am writing to formally dispute inaccurate information appearing on my credit report. I obtained a copy of my credit report on [Date] and discovered the following error(s) that require immediate correction:

Disputed Item #1:

Account Name: [Creditor Name]

Account Number: [Last 4 digits - XXXX]

Reason for Dispute: [Explain why this is inaccurate - e.g., "This account shows a late payment in March 2024, but I have never missed a payment on this account"]

Disputed Item #2:

Account Name: [Creditor Name]

Account Number: [Last 4 digits - XXXX]

Reason for Dispute: [Explain the error]

I have enclosed copies of supporting documentation that verify my claim, including [list documents: payment records, account statements, etc.]. These inaccuracies are negatively affecting my credit score and my ability to obtain credit.

Under the Fair Credit Reporting Act, you are required to investigate and respond to this dispute within 30 days. Please conduct a thorough investigation of these items and remove or correct any inaccurate information.

Please send me written confirmation once the investigation is complete, along with an updated copy of my credit report showing the corrections.

My contact information:

[Your Full Name]

[Your Address]

[Phone Number]

[Email Address]

Thank you for your immediate attention to this serious matter.

Sincerely,

[Your Signature]

[Your Printed Name]

Enclosures: [List supporting documents]

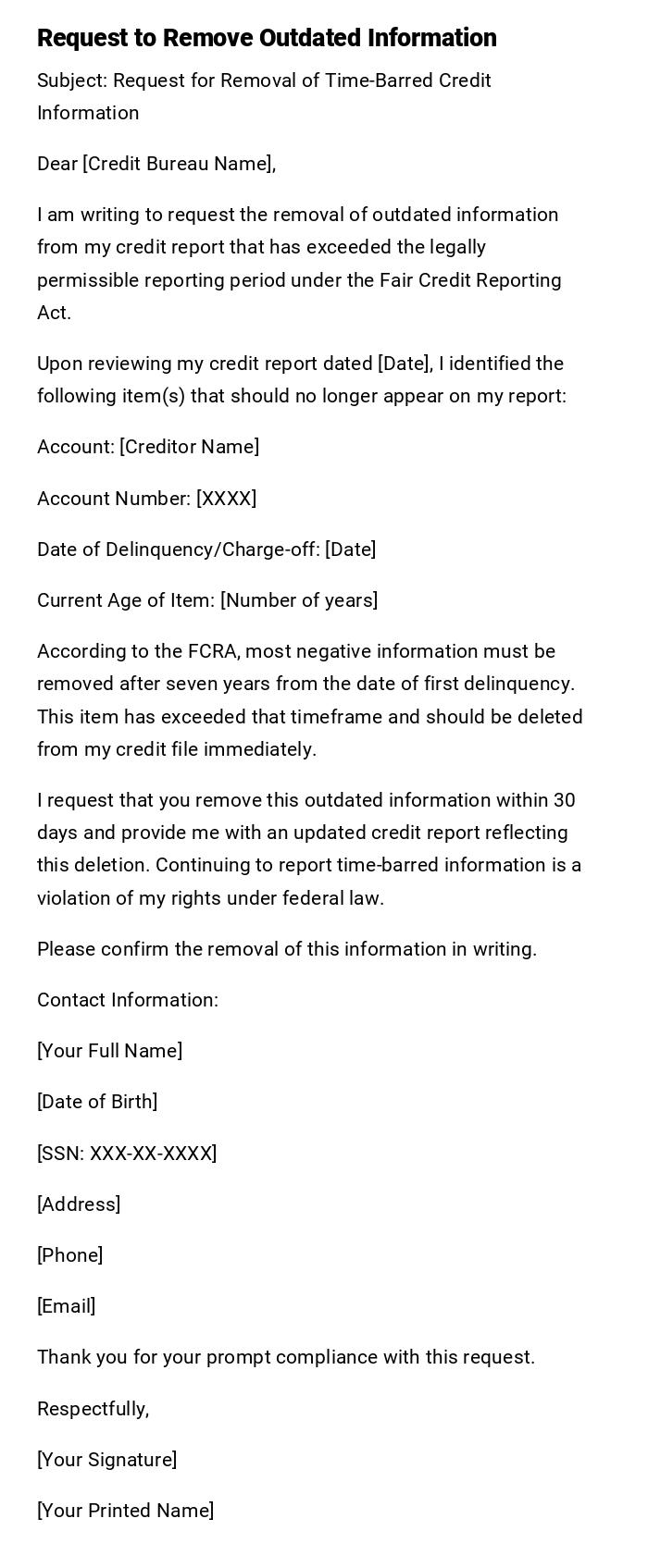

Request to Remove Outdated Information

Subject: Request for Removal of Time-Barred Credit Information

Dear [Credit Bureau Name],

I am writing to request the removal of outdated information from my credit report that has exceeded the legally permissible reporting period under the Fair Credit Reporting Act.

Upon reviewing my credit report dated [Date], I identified the following item(s) that should no longer appear on my report:

Account: [Creditor Name]

Account Number: [XXXX]

Date of Delinquency/Charge-off: [Date]

Current Age of Item: [Number of years]

According to the FCRA, most negative information must be removed after seven years from the date of first delinquency. This item has exceeded that timeframe and should be deleted from my credit file immediately.

I request that you remove this outdated information within 30 days and provide me with an updated credit report reflecting this deletion. Continuing to report time-barred information is a violation of my rights under federal law.

Please confirm the removal of this information in writing.

Contact Information:

[Your Full Name]

[Date of Birth]

[SSN: XXX-XX-XXXX]

[Address]

[Phone]

[Email]

Thank you for your prompt compliance with this request.

Respectfully,

[Your Signature]

[Your Printed Name]

Identity Theft Fraud Alert Request

Subject: URGENT - Request for Fraud Alert Due to Identity Theft

Dear [Credit Bureau Name],

I am a victim of identity theft and am writing to request that you place a fraud alert on my credit file immediately to protect me from further fraudulent activity.

I discovered this identity theft on [Date] when [briefly explain how you discovered it - e.g., "I received a credit card statement for an account I never opened" or "I was denied credit for accounts I never applied for"].

Under the Fair Credit Reporting Act, I am requesting an initial fraud alert for one year. I may extend this to an extended fraud alert upon providing additional documentation.

Fraudulent accounts/activity identified:

1. [Account name/description]

2. [Account name/description]

3. [Additional items as needed]

I have filed a report with [local police department/Federal Trade Commission] and have attached a copy of the identity theft report for your records.

Please place the fraud alert on my file immediately and send written confirmation to the address below. I also request a free copy of my credit report as I am entitled to under these circumstances.

Contact Information:

Full Name: [Your Name]

Date of Birth: [MM/DD/YYYY]

SSN: [XXX-XX-XXXX]

Address: [Your Address]

Phone: [Your Phone Number]

Email: [Your Email]

This is an urgent matter affecting my financial security. Please process this request immediately.

Sincerely,

[Your Signature]

[Your Printed Name]

Enclosures: Identity Theft Report, Police Report

Credit Freeze Request

Subject: Request to Place Security Freeze on Credit File

Dear [Credit Bureau Name],

I am writing to request that you place a security freeze on my credit file effective immediately. A security freeze will prevent potential creditors from accessing my credit report without my express authorization.

I am requesting this freeze as a proactive measure to protect myself from [choose: identity theft/unauthorized credit inquiries/fraud/personal security reasons].

My identifying information is as follows:

Full Name: [Your Full Name]

Date of Birth: [MM/DD/YYYY]

Social Security Number: [XXX-XX-XXXX]

Current Address: [Complete Address]

Previous Address (if within 2 years): [Previous Address if applicable]

Please process this security freeze immediately and send me written confirmation along with my PIN or password that I will need to temporarily lift or permanently remove the freeze in the future.

I understand that with a security freeze in place, I will need to lift the freeze temporarily if I wish to apply for credit, and I accept this requirement as part of protecting my credit information.

Please confirm receipt of this request and provide an estimated timeframe for implementation.

Contact Information:

Phone: [Your Phone Number]

Email: [Your Email Address]

Thank you for your prompt attention to this security matter.

Sincerely,

[Your Signature]

[Your Printed Name]

[If applicable: Enclosed: Copy of ID, Proof of Address]

Annual Free Credit Report Request

Subject: Request for Annual Free Credit Report

Dear [Credit Bureau Name],

Under the Fair Credit Reporting Act, I am entitled to receive one free copy of my credit report from your agency every 12 months. I am writing to request my free annual credit report.

Please send my complete credit report to the address listed below:

Full Name: [Your Full Legal Name]

Date of Birth: [MM/DD/YYYY]

Social Security Number: [XXX-XX-XXXX]

Current Address: [Your Complete Mailing Address]

Previous Address (if moved recently): [Previous Address]

I prefer to receive my report by [mail/online access]. If mailing, please send it to the address above. If there are any questions or if you need additional information to verify my identity, please contact me at:

Phone: [Your Phone Number]

Email: [Your Email Address]

Please process this request within the timeframe required by law (15 days) and confirm receipt of this letter.

Thank you for your assistance.

Sincerely,

[Your Signature]

[Your Printed Name]

Request to Add 100-Word Statement to Credit Report

Subject: Request to Add Consumer Statement to Credit File

Dear [Credit Bureau Name],

I recently disputed an item on my credit report, and while your investigation concluded that the information is accurate, I believe there are extenuating circumstances that should be noted in my credit file.

Under the Fair Credit Reporting Act, I have the right to add a 100-word consumer statement to my credit report explaining my side of the situation. I am requesting that you add the following statement to my credit file:

[Your 100-word statement explaining the circumstances - e.g., "The late payments on my mortgage account from January-April 2024 occurred due to a medical emergency that resulted in my hospitalization and temporary inability to work. I have since resumed regular payments and have remained current for the past 12 months. These circumstances were beyond my control and do not reflect my typical payment behavior or creditworthiness."]

This statement relates to:

Account: [Creditor Name]

Account Number: [Last 4 digits - XXXX]

Please add this statement to my credit file and include it with any future credit reports provided to potential creditors. Please send me written confirmation once the statement has been added.

My information:

Full Name: [Your Name]

Address: [Your Address]

SSN: [XXX-XX-XXXX]

Phone: [Your Phone]

Email: [Your Email]

Thank you for processing this request.

Sincerely,

[Your Signature]

[Your Printed Name]

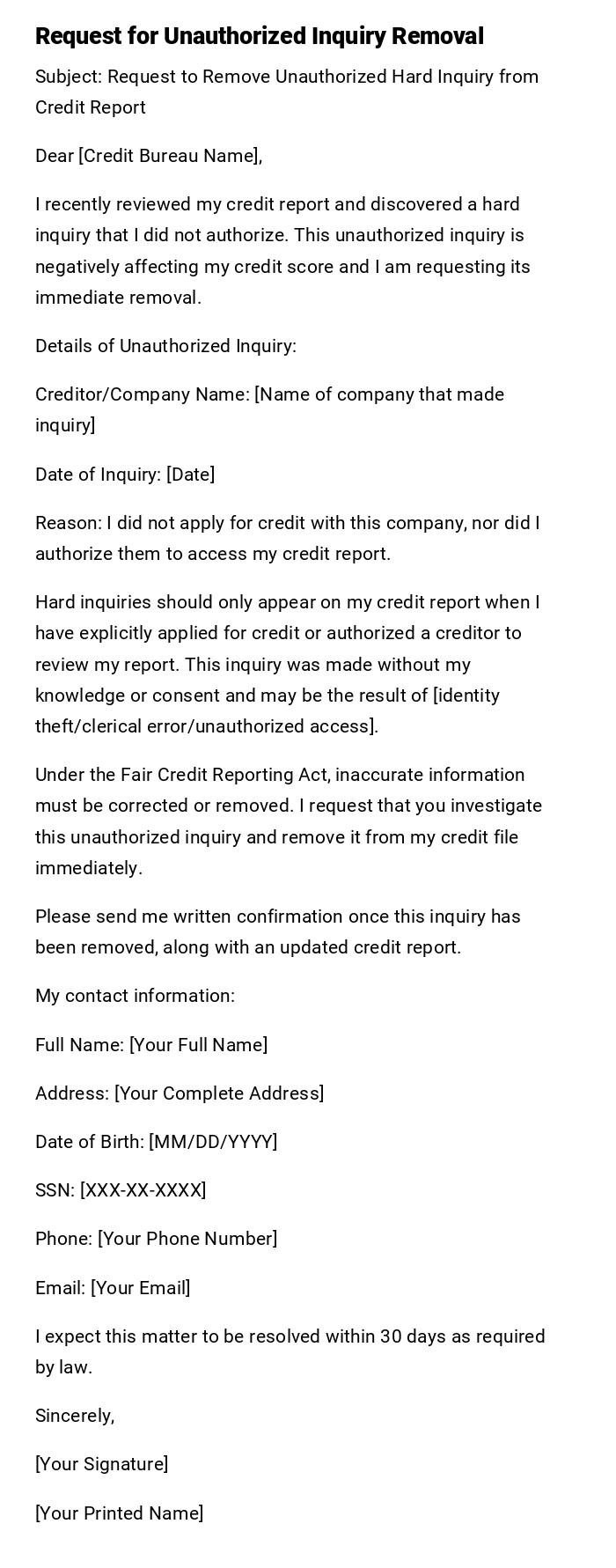

Request for Credit Inquiry Removal (Unauthorized Hard Inquiry)

Subject: Request to Remove Unauthorized Hard Inquiry from Credit Report

Dear [Credit Bureau Name],

I recently reviewed my credit report and discovered a hard inquiry that I did not authorize. This unauthorized inquiry is negatively affecting my credit score and I am requesting its immediate removal.

Details of Unauthorized Inquiry:

Creditor/Company Name: [Name of company that made inquiry]

Date of Inquiry: [Date]

Reason: I did not apply for credit with this company, nor did I authorize them to access my credit report.

Hard inquiries should only appear on my credit report when I have explicitly applied for credit or authorized a creditor to review my report. This inquiry was made without my knowledge or consent and may be the result of [identity theft/clerical error/unauthorized access].

Under the Fair Credit Reporting Act, inaccurate information must be corrected or removed. I request that you investigate this unauthorized inquiry and remove it from my credit file immediately.

Please send me written confirmation once this inquiry has been removed, along with an updated credit report.

My contact information:

Full Name: [Your Full Name]

Address: [Your Complete Address]

Date of Birth: [MM/DD/YYYY]

SSN: [XXX-XX-XXXX]

Phone: [Your Phone Number]

Email: [Your Email]

I expect this matter to be resolved within 30 days as required by law.

Sincerely,

[Your Signature]

[Your Printed Name]

What is a Credit Inquiry Letter and Why Do You Need One

A credit inquiry letter is a formal written communication sent to credit reporting agencies (Equifax, Experian, TransUnion) or creditors to request information about your credit report, dispute inaccuracies, remove unauthorized inquiries, or exercise your rights under the Fair Credit Reporting Act (FCRA). These letters serve as official documentation of your request and create a paper trail for legal protection.

You need credit inquiry letters to:

- Obtain your free annual credit report or post-denial report

- Dispute inaccurate, incomplete, or outdated information affecting your credit score

- Remove unauthorized hard inquiries that you didn't approve

- Request fraud alerts or security freezes to protect against identity theft

- Add explanatory statements to provide context for negative items

- Exercise your consumer rights under federal credit reporting laws

- Document all communications with credit bureaus for potential legal action

When Should You Send a Credit Inquiry Letter

- After Credit Denial: Within 60 days of receiving an adverse action notice to request your free credit report

- Annual Review: Once every 12 months to obtain your free credit report from each bureau

- Discovered Errors: Immediately upon finding inaccurate information, wrong account details, or incorrect payment history

- Identity Theft: As soon as you suspect or confirm fraudulent accounts or unauthorized activity

- Unauthorized Inquiries: When you notice hard inquiries you didn't authorize appearing on your report

- Before Major Financial Decisions: 3-6 months before applying for a mortgage, car loan, or other significant credit

- Account Closure: When an old account should have been removed after the 7-10 year reporting period

- Extenuating Circumstances: After resolving financial hardships to add explanatory statements

- Pre-emptive Protection: When you want to freeze your credit before suspected fraud occurs

- Post-Dispute Follow-up: 30-45 days after filing a dispute if you haven't received a response

Who Should Send a Credit Inquiry Letter

- Consumers: Any individual monitoring their credit health or exercising FCRA rights

- Identity Theft Victims: People who have discovered fraudulent accounts or unauthorized activity

- Credit Denial Recipients: Applicants who were denied credit, employment, or housing based on credit reports

- Mortgage Applicants: Homebuyers preparing for major loan applications who need clean credit reports

- Divorce Parties: Individuals separating finances and ensuring only their accounts appear on their reports

- Fraud Prevention Advocates: Proactive consumers implementing security freezes before problems occur

- Recent Immigrants: New residents establishing credit history and ensuring accurate reporting

- Legal Representatives: Attorneys, guardians, or executors acting on behalf of clients or deceased persons (with proper authorization)

- Financial Recovery Individuals: People who have completed bankruptcy, settled debts, or are rebuilding credit

- Anyone with Credit Concerns: Consumers who notice score drops, suspicious activity, or want annual monitoring

To Whom Should Credit Inquiry Letters Be Addressed

Credit Reporting Agencies (Primary Recipients)

- Equifax, Experian, and TransUnion (send separate letters to each bureau as they maintain independent files)

- Address letters to their dispute or inquiry departments specifically

- Use certified mail addresses provided on their official websites

Original Creditors

- Banks, credit card companies, or lenders who reported the information

- Send when you want to address the issue at the source before involving bureaus

- Required when disputing with "furnishers" of information

Collection Agencies

- When disputing debts in collection or requesting validation

- Must be addressed within 30 days of first contact for debt validation rights

AnnualCreditReport.com

- For requesting free annual credit reports from all three bureaus simultaneously

- Official site authorized by federal law

Federal Trade Commission

- When filing identity theft reports that accompany fraud alerts

- For complaints about credit bureau non-compliance

Specialty Credit Bureaus

- ChexSystems (for banking history), LexisNexis (for insurance), or Innovis (fourth credit bureau)

- When issues involve non-traditional credit reporting

Requirements and Prerequisites Before Sending Your Letter

Identity Verification Documents

- Government-issued photo ID (driver's license, passport, or state ID)

- Social Security card or document showing your full SSN

- Proof of current address (utility bill, bank statement, or lease agreement dated within 90 days)

- Previous address documentation if you moved within the past two years

Credit Report Copy

- Obtain your current credit report before disputing to identify specific errors

- Note the report date and specific item numbers you're disputing

- Highlight or mark the inaccurate information clearly

Supporting Evidence

- Payment records, bank statements, or canceled checks proving your claims

- Account statements showing correct information

- Court documents for bankruptcies, judgments, or divorces

- Police reports or FTC Identity Theft Reports for fraud cases

- Correspondence from creditors acknowledging errors or account status

Detailed Information Gathering

- Exact account numbers, creditor names, and dates of alleged delinquencies

- Timeline of events leading to the dispute or inquiry

- Your complete payment history if disputing late payment reports

- Documentation of any previous disputes on the same issue

Legal Prerequisites

- Adverse action notice (if requesting post-denial free report) received within 60 days

- Identity theft report filed with FTC and local police (for fraud alerts)

- Understanding of your rights under FCRA before making requests

How to Write and Send an Effective Credit Inquiry Letter

Planning Phase

- Review your credit report thoroughly and identify all issues needing attention

- Gather all supporting documentation before writing

- Determine which type of letter matches your situation

- Decide whether to dispute with the bureau, creditor, or both

Writing Process

- Use a clear, professional business letter format

- State your request explicitly in the subject line and first paragraph

- Include all required identifying information (name, address, DOB, SSN)

- Be specific about disputed items with account names, numbers, and dates

- Explain why information is inaccurate without emotional language

- Reference your rights under FCRA when appropriate

- Keep your letter concise and focused on facts

- Request specific actions (removal, correction, investigation)

- Provide your contact information for follow-up

Documentation

- Make copies of all supporting documents (never send originals)

- Create a cover sheet listing all enclosures

- Keep copies of the letter and all supporting materials for your records

Sending Method

- Use certified mail with return receipt requested for proof of delivery

- Consider sending via the credit bureau's online dispute portal for faster processing

- Keep tracking numbers and delivery confirmations

- Send separate letters to each credit bureau if disputing with multiple agencies

- Allow 3-5 business days for mail delivery before the 30-day investigation clock starts

Letter Formatting Guidelines and Best Practices

Length and Structure

- Keep letters to one page when possible, maximum two pages for complex disputes

- Use single-spaced paragraphs with double spacing between paragraphs

- Standard business letter format with your address, date, and recipient address

Tone and Language

- Professional and formal tone required (credit bureaus are businesses, not friends)

- Assertive but respectful language when citing your rights

- Avoid emotional, angry, or threatening language even if frustrated

- State facts clearly without excessive explanation or storytelling

- Use legal terminology correctly when referencing FCRA rights

Wording Specifics

- Be precise: "Account #1234 shows late payment on March 2024" not "there's something wrong"

- Use phrases like "I am requesting," "I dispute," "I am entitled to"

- Reference specific laws: "Under 15 U.S.C. § 1681" or "pursuant to FCRA"

- Avoid admitting debt or liability when disputing collection accounts

Style Elements

- Use bullet points or numbered lists for multiple disputed items

- Bold or underline key information like account numbers and dates

- Include clear headers for sections if letter is lengthy

- Professional font (Times New Roman, Arial) in 11-12pt size

Delivery Mode

- Certified mail with return receipt for legal documentation is strongly preferred

- Online dispute portals acceptable for routine requests (though may limit documentation)

- Email generally not recommended as primary method (no proof of receipt)

- Fax acceptable if followed up with mailed copy

Essential Etiquette

- Always include your full legal name and signature

- Date the letter with the actual sending date

- Use "Dear Sir or Madam" or "To Whom It May Concern" if no specific contact

- Close with "Sincerely" or "Respectfully"

- Number pages if multiple pages (e.g., "Page 1 of 2")

What to Do After Sending Your Credit Inquiry Letter

Immediate Follow-up Actions

- File your mailed letter copy with delivery confirmation in a dedicated credit folder

- Calendar the 30-day deadline for bureau response (45 days if they request additional information)

- Monitor your email and mailbox daily for responses during investigation period

- Save all tracking numbers and receipt confirmations

During Investigation Period

- Do not send duplicate letters for the same issue (appears as harassment)

- Respond promptly if credit bureau requests additional documentation

- Continue checking your credit report for any changes or updates

- Keep detailed notes of all phone calls including date, time, representative names, and conversation summaries

Upon Receiving Response

- Review the investigation results letter carefully

- Verify changes were made correctly on your credit report by requesting updated copy

- If dispute was denied, review the explanation and evidence provided

- Document the resolution date and outcome in your records

If Satisfied with Results

- Request updated credit reports from all three bureaus to confirm changes

- Monitor your credit score for expected improvements (may take 1-2 billing cycles)

- Keep all documentation for at least 7 years in case items reappear

- Send thank you note if appropriate (optional but professional)

If Unsatisfied with Results

- Request the method of verification and specific documents reviewed during investigation

- File a complaint with Consumer Financial Protection Bureau (CFPB) if bureau violated FCRA

- Consider requesting a consumer statement (100 words) be added to your report

- Send a second dispute letter with additional evidence

- Dispute directly with the creditor/furnisher of information

- Consult with a consumer rights attorney specializing in FCRA violations

- File complaints with Federal Trade Commission and state attorney general if necessary

Ongoing Monitoring

- Set up credit monitoring alerts to catch if disputed items reappear

- Review credit reports quarterly for next year after dispute resolution

- Keep disputes open in your tracking system until confirmation of permanent removal

Common Mistakes to Avoid When Writing Credit Inquiry Letters

Documentation Errors

- Sending original documents instead of copies (you may never get them back)

- Failing to keep copies of letters and supporting materials for your records

- Not using certified mail, losing proof that you sent the dispute

- Forgetting to include essential identification information

- Providing incomplete account details that prevent proper investigation

Content Mistakes

- Writing angry, emotional, or threatening letters that damage your credibility

- Including irrelevant personal stories that distract from the core issue

- Disputing too many items at once (appears frivolous; focus on legitimate errors)

- Being vague about what you're disputing ("my score is wrong" vs. specific account errors)

- Admitting debt or liability when disputing collection accounts

- Claiming items are inaccurate when they're actually correct but unfavorable

- Using templates without customizing to your specific situation

Procedural Errors

- Missing the 60-day window for free credit reports after adverse action

- Sending disputes to wrong addresses or using outdated bureau contact information

- Filing disputes online without keeping adequate documentation

- Not following up within 30-35 days if you receive no response

- Sending identical letters to multiple bureaus (personalize for each)

- Disputing items that are beyond the statute of limitations and will fall off soon anyway

Strategic Mistakes

- Focusing on credit score instead of specific inaccurate items (bureaus don't control scores)

- Waiting until you need credit to dispute rather than handling proactively

- Not disputing with both credit bureaus AND creditors when appropriate

- Giving up after first dispute denial without escalating properly

- Failing to verify that corrections were made across all three bureaus

- Not monitoring reports after dispute to ensure errors don't reappear

Legal Missteps

- Misrepresenting facts or providing false information (federal offense)

- Claiming identity theft falsely to remove legitimate negative items

- Harassing credit bureaus with repeated frivolous disputes

- Threatening legal action without legitimate grounds

- Not understanding the difference between inaccurate items (must be removed) and accurate negative items (generally cannot be removed)

Pros and Cons of Sending Credit Inquiry Letters

Advantages

- Creates official documentation of your dispute protected by federal law

- Triggers mandatory 30-day investigation requirement under FCRA

- Can result in removal of inaccurate information that damages your credit score

- Costs nothing except postage and time (free to dispute under FCRA)

- Empowers you to take control of your credit health without hiring costly services

- Provides legal paper trail if you need to sue for FCRA violations later

- Often more effective than phone disputes which lack documentation

- Can prevent identity theft from worsening by catching it early

- May improve credit score significantly if negative errors are removed

- Protects your consumer rights and holds credit bureaus accountable

Disadvantages

- Time-consuming process requiring documentation gathering and careful writing

- Takes 30-45 days for investigation completion (not immediate results)

- No guarantee that dispute will be resolved in your favor

- May require multiple rounds of disputes for stubborn errors

- Accurate negative information cannot be removed (only inaccurate items)

- Can be frustrating if credit bureaus request additional verification documents

- Requires follow-up and persistence to achieve results

- May need to dispute with multiple bureaus separately (triplicates effort)

- Some consumers find legal language and format intimidating

- Errors can reappear if furnisher continues reporting incorrect information

- Could potentially draw attention to accounts you'd prefer remain unexamined

Credit Inquiry Letters vs. Alternative Actions

Credit Inquiry Letter vs. Phone Disputes

- Letters provide documented proof; phone calls often have no record

- Written disputes trigger formal FCRA investigation requirements; phone calls may be noted but not formally processed

- Letters create legal paper trail for potential lawsuits; phone conversations don't

- Phone disputes faster initially but less effective for serious issues

- Use letters for important disputes; phone for simple questions or clarifications

DIY Letters vs. Credit Repair Companies

- Writing your own letters costs only postage; credit repair companies charge $50-150 monthly

- You can dispute anything a credit repair company can (they have no special powers)

- Credit repair companies often just submit letters on your behalf using templates

- DIY approach gives you complete control and understanding of the process

- Credit repair companies may provide convenience if you lack time or confidence

- Many credit repair companies are scams promising unrealistic results

- Legitimate concerns can be handled equally well through self-advocacy

Credit Bureau Dispute vs. Creditor Dispute

- Bureau disputes work for reporting errors; creditor disputes address issues at the source

- Disputing with creditor first may prevent bureau dispute necessity

- Bureau must investigate within 30 days; creditors have similar obligations under FCRA

- Best practice: dispute with both simultaneously for comprehensive resolution

- If bureau verifies error but doesn't fix it, creditor dispute becomes essential

Formal Letter vs. Online Dispute Portal

- Online portals faster (submit immediately) but limit documentation you can provide

- Letters allow comprehensive explanation and extensive supporting documents

- Online disputes may be seen as less serious by credit bureaus

- Letters with certified mail create stronger legal standing for lawsuits

- Use online for simple disputes; use letters for complex issues or if you anticipate legal action

Fraud Alert vs. Credit Freeze

- Fraud alerts free, last 1 year (or 7 years for identity theft), warn creditors to verify identity

- Credit freezes free, last until you lift them, completely block credit report access

- Fraud alerts less restrictive but also less protective than freezes

- Freezes require you to lift them before applying for credit (fraud alerts don't)

- Both require letters or online requests to credit bureaus

- Use fraud alerts for suspected fraud; use freezes for maximum protection

Essential Tips and Best Practices for Credit Inquiry Letters

Strategy Tips

- Dispute most important/impactful errors first rather than overwhelming bureaus with everything at once

- Time your disputes strategically (3-6 months before major credit applications)

- Always dispute the same error with all three credit bureaus separately

- Keep a spreadsheet tracking all disputes, dates sent, deadlines, and outcomes

- Research credit bureau addresses regularly as they change periodically

Writing Shortcuts

- Use templates as starting points but always customize with your specific details

- Keep a master document with your identifying information to copy-paste into letters

- Create a reusable checklist of required documents for each dispute type

- Save effective phrase examples: "pursuant to FCRA," "I am entitled to," "I request immediate investigation"

- Maintain a file folder with photocopies of commonly needed documents (ID, address proof, SSN)

Documentation Best Practices

- Photograph or scan everything before sending (letters and all enclosures)

- Create a digital backup folder organized by date and dispute type

- Use highlighters on credit report copies to mark specific disputed items

- Write reference numbers on all documents matching them to specific disputes

- File delivery confirmations immediately with their corresponding letter copies

Investigation Period Advice

- Don't call asking for updates before 30 days (may reset investigation clock)

- If day 30 passes with no response, send follow-up letter immediately citing FCRA violation

- Request "method of verification" in writing if dispute is denied to understand their investigation

- Be prepared to provide additional evidence if bureaus request it (respond within their timeframe)

Professional Secrets

- Credit bureaus are more responsive when you cite specific FCRA sections violated

- Threatening legal action rarely helps; stating facts and rights is more effective

- Small inaccuracies matter: wrong account numbers, incorrect dates can support dispute claims

- If an account is reporting differently across three bureaus, that inconsistency itself proves inaccuracy

- Furnishers (original creditors) often remove items more readily than credit bureaus

- Consider adding "please investigate this matter pursuant to 15 U.S.C. § 1681i" for formal weight

Time-Saving Guidelines

- Batch your disputes: if you have multiple errors, address them systematically rather than scattershot

- Use certified mail receipt as your calendar reminder for the 30-day deadline

- Set up free credit monitoring to alert you automatically when changes occur

- Pre-print address labels for all three credit bureaus to speed up mailing process

Essential Elements Your Credit Inquiry Letter Must Include

Opening Section

- Clear subject line stating the purpose (Request, Dispute, Freeze, etc.)

- Date of the letter

- Your full legal name exactly as it appears on credit report

- Current complete mailing address including apartment number if applicable

- Appropriate greeting to recipient

Identification Information Block

- Full legal name (including Jr., Sr., III if applicable)

- Complete Social Security Number or clear statement you'll provide it upon verification

- Date of birth (MM/DD/YYYY format)

- Current address with ZIP code

- Previous address if you moved within past 2 years

- Phone number and email address for contact

Body Content Requirements

- Specific statement of your request or dispute

- Reference to applicable rights under Fair Credit Reporting Act

- Detailed information about each disputed item (account name, number, dates, amounts)

- Clear explanation of why information is inaccurate or reason for your request

- Specific action you want taken (remove, correct, investigate, freeze, etc.)

- Reference to enclosed supporting documentation

- Timeline expectations based on FCRA (typically 30 days)

Supporting Elements

- List of enclosures at the end (e.g., "Enclosures: Copy of ID, Utility Bill, Payment Records")

- Professional closing ("Sincerely," or "Respectfully,")

- Your handwritten signature (even if printing letter)

- Your typed/printed name below signature

- Page numbers if multi-page letter

Attachments to Include

- Copy of government-issued photo ID

- Copy of document proving your address (utility bill, bank statement under 90 days old)

- Copy of Social Security card or tax document showing SSN

- Copy of credit report with disputed items clearly marked/highlighted

- Supporting evidence specific to your dispute (statements, payment records, court documents, police reports)

- Copy of adverse action notice if requesting post-denial free report

- Identity theft report if requesting fraud alert or disputing fraudulent accounts

Structure Best Practices

- Paragraph 1: State your request clearly and directly

- Paragraph 2-3: Provide necessary identifying information and specific details

- Paragraph 4: Explain your rights and what you expect

- Paragraph 5: Close with contact information and professional sign-off

- Keep each paragraph focused on one main idea for clarity

How Many Credit Inquiry Letters Should You Send

Number of Bureaus to Contact

- Always send to all three major credit bureaus (Equifax, Experian, TransUnion) as they maintain independent files

- Errors on one bureau's report may not appear on others, so check all three

- Each bureau requires a separate, individualized letter (don't send identical copies)

- Consider specialty bureaus (ChexSystems, Innovis) if your issue involves banking or insurance

Frequency Guidelines

- One annual credit report request per bureau per year is your legal

right

- Space out dispute letters reasonably (don't send weekly letters about the same issue)

- Wait 30-45 days for investigation completion before sending follow-up on same dispute

- If denied, you can send one re-dispute letter with additional evidence

- Avoid excessive disputes (more than 10-15 items at once may be flagged as frivolous)

Items Per Letter

- Focus on 3-5 disputed items per letter for best results

- Bureaus may ignore or deprioritize letters disputing too many items simultaneously

- If you have many errors, send multiple letters spaced 1-2 months apart

- Prioritize items having the biggest negative impact on your credit score

- Group related disputes together (e.g., all late payments from one creditor)

Follow-up Letters Needed

- One confirmation request if you receive no response after 35 days

- One escalation letter if initial dispute is denied without proper investigation

- Method of verification request if you disagree with denial explanation

- Consumer statement addition letter if you cannot get item removed

- CFPB complaint concurrent with final letter if bureau violates FCRA rights

Timeline Considerations

- Send initial dispute immediately upon discovering errors

- Allow full 30 days before follow-up communication

- If urgent (applying for mortgage soon), note this in letter but don't expect faster processing

- Budget 60-90 days total for complete dispute resolution including any appeals

- Plan for 2-3 rounds of correspondence for stubborn disputes

Cost Considerations

- Certified mail costs approximately $8-10 per letter

- Budget $25-30 to dispute with all three bureaus using certified mail

- Return receipt adds $3-4 more per letter but provides delivery proof

- Consider online portals for routine requests to save postage (though less documentation)

- Multiple disputes over time can cost $50-100+ annually in postage alone

Comparing Credit Inquiry Letters to Similar Actions

Verification vs. Validation Letters

- Verification letters go to credit bureaus requesting they verify information accuracy

- Validation letters go to collection agencies demanding proof they own the debt

- Verification focuses on reporting accuracy; validation focuses on debt legitimacy

- Both must be sent within specific timeframes (60 days for adverse action; 30 days for collections)

- Use verification for credit report errors; use validation for questionable collection accounts

Goodwill Letters vs. Dispute Letters

- Goodwill letters request creditors voluntarily remove accurate negative information out of kindness

- Dispute letters demand removal of inaccurate information under FCRA law

- Goodwill letters appeal to creditor's compassion; dispute letters cite legal rights

- Goodwill letters have no legal backing; dispute letters trigger mandatory investigations

- Use goodwill for accurate late payments you want removed; use disputes only for actual errors

Cease and Desist vs. Dispute Letters

- Cease and desist letters tell debt collectors to stop contacting you

- Dispute letters challenge accuracy of reported credit information

- Cease and desist stops communication but doesn't resolve the debt or credit reporting

- Dispute letters address the credit report itself, not collection calls

- Cease and desist can be used alongside dispute letters for comprehensive debt strategy

Pay for Delete vs. Dispute Letters

- Pay for delete is an agreement to pay debt in exchange for removal from credit report

- Dispute letters challenge whether the information should be there at all

- Pay for delete requires payment; dispute letters cost only postage

- Pay for delete works for legitimate debts you'll pay anyway; disputes work for errors

- Credit bureaus discourage pay for delete; dispute letters are your legal right

Credit Counseling vs. Self-Advocacy Letters

- Credit counseling agencies negotiate payment plans and provide financial education

- Self-written letters exercise your FCRA rights directly with bureaus

- Counseling addresses underlying financial issues; letters address reporting errors

- Counseling may cost fees; letters are free except postage

- Both can be used together: counseling for debt management, letters for report accuracy

Understanding Authorization and Attestation Requirements

When Attestation is Required

- Identity theft affidavits must be notarized or signed under penalty of perjury

- Requests to place extended fraud alerts (7 years) require official identity theft reports

- Estate representatives must provide letters of testamentary or administration

- Powers of attorney must be included when representative acts on another's behalf

- Military personnel requesting active duty alerts should include copy of orders

Authorization Documents Needed

- Third-party authorization form if someone else (attorney, spouse, family member) is writing on your behalf

- Court documents granting guardianship if acting for minor children or incapacitated adults

- Death certificate and executor documentation when handling deceased person's credit

- Signed authorization from all parties when disputing joint accounts

- Military ID or deployment orders when requesting active duty fraud alerts

Self-Authentication Methods

- Photo ID copy serves as visual identity verification

- SSN verification proves you are the person whose credit is being disputed

- Address verification through utility bills proves current residence

- Signature on letter serves as attestation that information provided is truthful

- Some bureaus may require additional verification questions answered by phone or online

Legal Attestation Language

- Include statement like: "I certify under penalty of perjury that the information provided is true and correct"

- For identity theft: "I hereby declare that the information I have provided is true and correct to the best of my knowledge"

- Sign and date the attestation statement

- Notarization not typically required for routine disputes but strengthens serious fraud claims

What Does NOT Require Attestation

- Routine credit report requests

- Standard dispute letters for inaccurate information

- Annual free credit report requests

- Most freeze/unfreeze requests (though ID verification still needed)

- Consumer statement additions

Consequences of False Attestation

- Providing false information on credit disputes is a federal crime

- Falsely claiming identity theft can result in prosecution

- Credit bureaus may permanently flag your file for fraudulent disputes

- Loss of credibility for future legitimate disputes

- Potential civil liability to creditors harmed by false claims

Download Word Doc

Download Word Doc

Download PDF

Download PDF