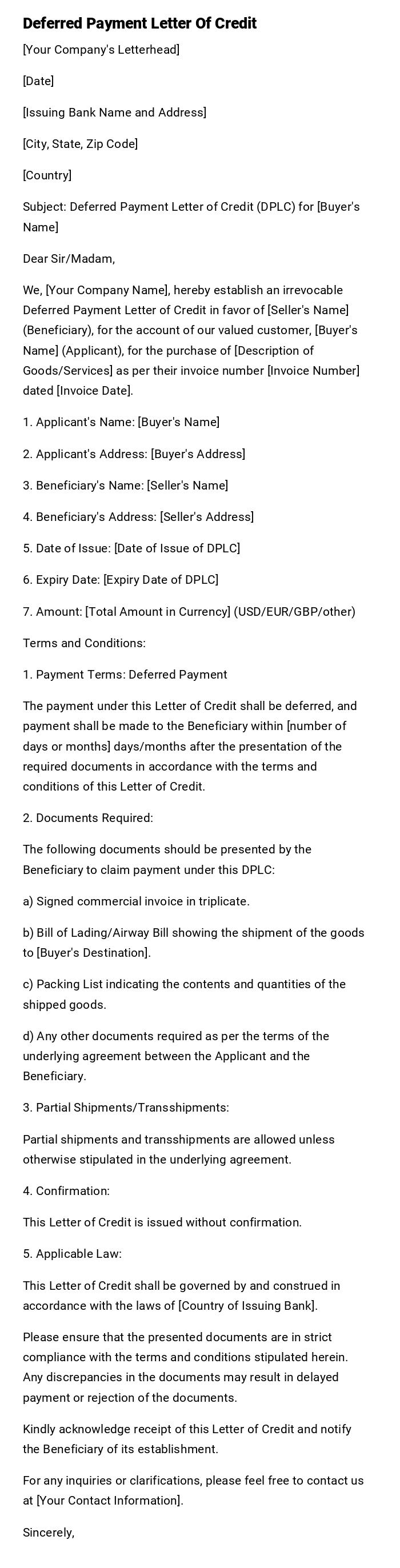

Deferred Payment Letter Of Credit

[Your Company's Letterhead]

[Date]

[Issuing Bank Name and Address]

[City, State, Zip Code]

[Country]

Subject: Deferred Payment Letter of Credit (DPLC) for [Buyer's Name]

Dear Sir/Madam,

We, [Your Company Name], hereby establish an irrevocable Deferred Payment Letter of Credit in favor of [Seller's Name] (Beneficiary), for the account of our valued customer, [Buyer's Name] (Applicant), for the purchase of [Description of Goods/Services] as per their invoice number [Invoice Number] dated [Invoice Date].

1. Applicant's Name: [Buyer's Name]

2. Applicant's Address: [Buyer's Address]

3. Beneficiary's Name: [Seller's Name]

4. Beneficiary's Address: [Seller's Address]

5. Date of Issue: [Date of Issue of DPLC]

6. Expiry Date: [Expiry Date of DPLC]

7. Amount: [Total Amount in Currency] (USD/EUR/GBP/other)

Terms and Conditions:

1. Payment Terms: Deferred Payment

The payment under this Letter of Credit shall be deferred, and payment shall be made to the Beneficiary within [number of days or months] days/months after the presentation of the required documents in accordance with the terms and conditions of this Letter of Credit.

2. Documents Required:

The following documents should be presented by the Beneficiary to claim payment under this DPLC:

a) Signed commercial invoice in triplicate.

b) Bill of Lading/Airway Bill showing the shipment of the goods to [Buyer's Destination].

c) Packing List indicating the contents and quantities of the shipped goods.

d) Any other documents required as per the terms of the underlying agreement between the Applicant and the Beneficiary.

3. Partial Shipments/Transshipments:

Partial shipments and transshipments are allowed unless otherwise stipulated in the underlying agreement.

4. Confirmation:

This Letter of Credit is issued without confirmation.

5. Applicable Law:

This Letter of Credit shall be governed by and construed in accordance with the laws of [Country of Issuing Bank].

Please ensure that the presented documents are in strict compliance with the terms and conditions stipulated herein. Any discrepancies in the documents may result in delayed payment or rejection of the documents.

Kindly acknowledge receipt of this Letter of Credit and notify the Beneficiary of its establishment.

For any inquiries or clarifications, please feel free to contact us at [Your Contact Information].

Sincerely,

Request for Deferred Payment Letter of Credit - Import Transaction

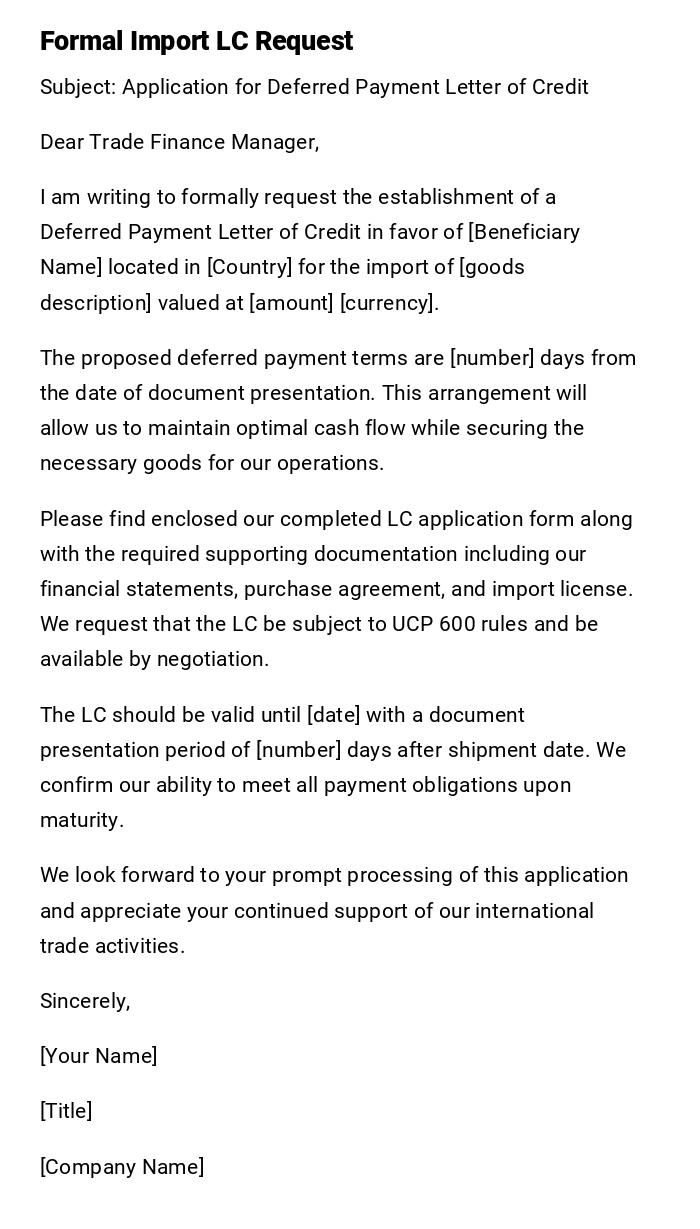

Subject: Application for Deferred Payment Letter of Credit

Dear Trade Finance Manager,

I am writing to formally request the establishment of a Deferred Payment Letter of Credit in favor of [Beneficiary Name] located in [Country] for the import of [goods description] valued at [amount] [currency].

The proposed deferred payment terms are [number] days from the date of document presentation. This arrangement will allow us to maintain optimal cash flow while securing the necessary goods for our operations.

Please find enclosed our completed LC application form along with the required supporting documentation including our financial statements, purchase agreement, and import license. We request that the LC be subject to UCP 600 rules and be available by negotiation.

The LC should be valid until [date] with a document presentation period of [number] days after shipment date. We confirm our ability to meet all payment obligations upon maturity.

We look forward to your prompt processing of this application and appreciate your continued support of our international trade activities.

Sincerely,

[Your Name]

[Title]

[Company Name]

Confirmation of Deferred Payment LC Terms - Export Transaction

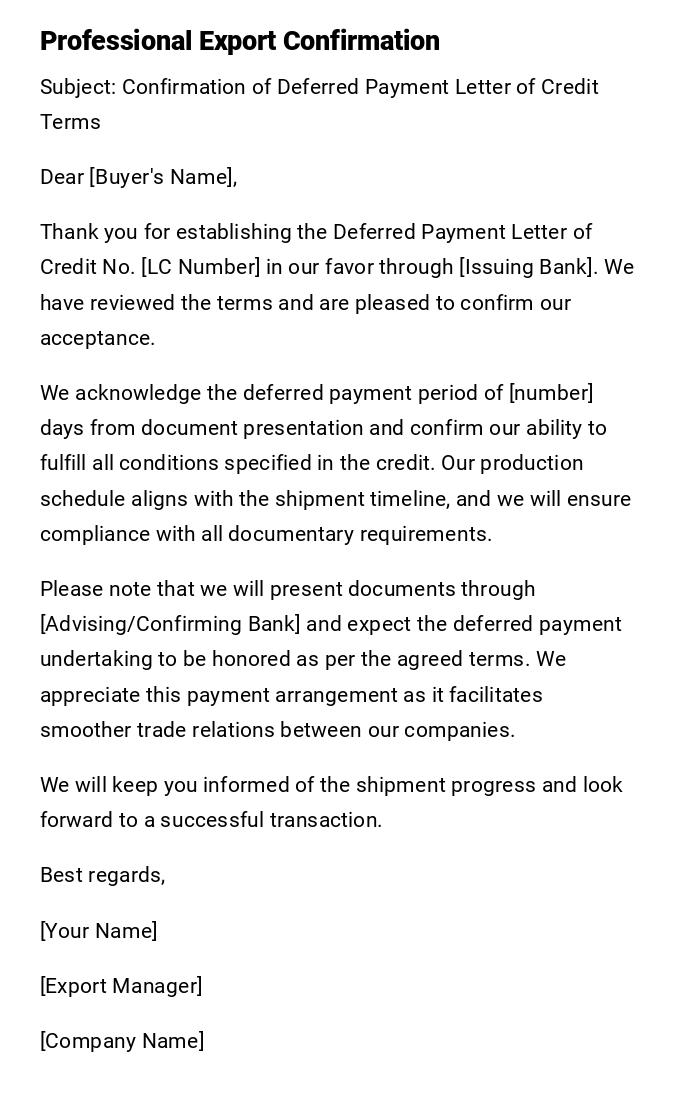

Subject: Confirmation of Deferred Payment Letter of Credit Terms

Dear [Buyer's Name],

Thank you for establishing the Deferred Payment Letter of Credit No. [LC Number] in our favor through [Issuing Bank]. We have reviewed the terms and are pleased to confirm our acceptance.

We acknowledge the deferred payment period of [number] days from document presentation and confirm our ability to fulfill all conditions specified in the credit. Our production schedule aligns with the shipment timeline, and we will ensure compliance with all documentary requirements.

Please note that we will present documents through [Advising/Confirming Bank] and expect the deferred payment undertaking to be honored as per the agreed terms. We appreciate this payment arrangement as it facilitates smoother trade relations between our companies.

We will keep you informed of the shipment progress and look forward to a successful transaction.

Best regards,

[Your Name]

[Export Manager]

[Company Name]

Amendment Request for Deferred Payment LC

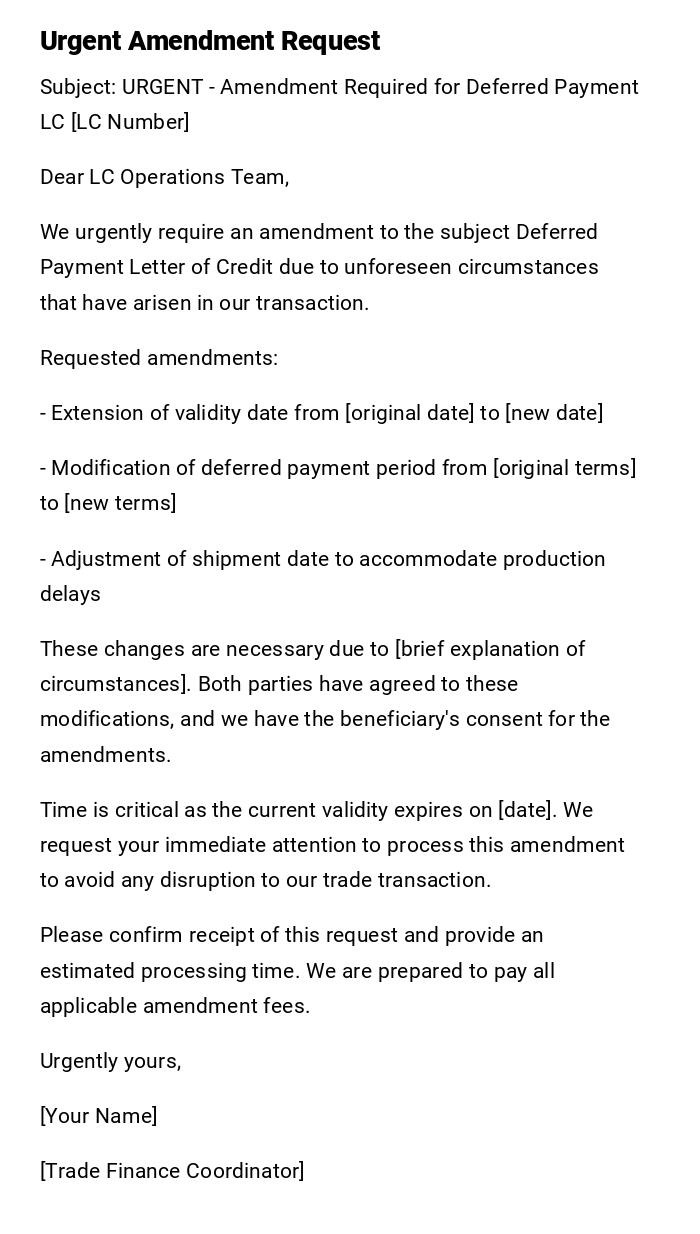

Subject: URGENT - Amendment Required for Deferred Payment LC [LC Number]

Dear LC Operations Team,

We urgently require an amendment to the subject Deferred Payment Letter of Credit due to unforeseen circumstances that have arisen in our transaction.

Requested amendments:

- Extension of validity date from [original date] to [new date]

- Modification of deferred payment period from [original terms] to [new terms]

- Adjustment of shipment date to accommodate production delays

These changes are necessary due to [brief explanation of circumstances]. Both parties have agreed to these modifications, and we have the beneficiary's consent for the amendments.

Time is critical as the current validity expires on [date]. We request your immediate attention to process this amendment to avoid any disruption to our trade transaction.

Please confirm receipt of this request and provide an estimated processing time. We are prepared to pay all applicable amendment fees.

Urgently yours,

[Your Name]

[Trade Finance Coordinator]

Deferred Payment LC Maturity Notification

Subject: Maturity Notice - Deferred Payment LC [LC Number]

Dear [Applicant/Buyer],

This letter serves as formal notification that the above-referenced Deferred Payment Letter of Credit will mature on [maturity date]. The deferred amount of [currency] [amount] becomes due and payable on this date.

Documents were presented and accepted on [presentation date], initiating the [number]-day deferred payment period as specified in the original credit terms. All conditions have been satisfactorily met by the beneficiary.

Please ensure that adequate funds are available in your account [account number] by the maturity date to honor this payment obligation. Failure to pay on maturity may result in default charges and potential damage to your credit standing.

If you require any clarification regarding this payment or need to discuss alternative arrangements, please contact our Trade Finance Department immediately.

We appreciate your prompt attention to this matter.

Professionally yours,

[Bank Name]

Trade Finance Department

Discrepancy Notice for Deferred Payment LC

Subject: Document Discrepancies - Deferred Payment LC [LC Number]

Dear [Beneficiary/Exporter],

We have examined the documents presented under the referenced Deferred Payment Letter of Credit and regret to inform you of the following discrepancies:

1. [Specific discrepancy description]

2. [Specific discrepancy description]

3. [Specific discrepancy description]

As per UCP 600 Article 16, we are holding these documents at your risk and disposition. The deferred payment undertaking cannot be established until these discrepancies are resolved.

You have the following options:

- Authorize us to approach the applicant for acceptance of discrepancies

- Provide corrected documents within the remaining validity period

- Request return of documents if corrections cannot be made

Please provide your written instructions within [number] banking days. Note that any charges related to discrepancy handling will be for your account.

We remain available to assist you in resolving these matters promptly.

Regards,

[Bank Name]

Documentary Credits Department

Request for Early Payment of Deferred LC

Subject: Request for Early Payment - Deferred Payment LC [LC Number]

Hi [Bank Contact],

Hope you're doing well! I'm reaching out regarding our deferred payment LC that's due to mature on [maturity date]. Due to some cash flow opportunities that have come up, we'd like to explore the possibility of making early payment.

We understand there might be a discount available for early payment, and we're definitely interested in discussing the terms. Our finance team has reviewed our position and we're ready to settle the obligation ahead of schedule if the numbers work out.

Could you please let me know:

- What discount rate would apply for payment today

- The net amount we'd need to pay

- The process for arranging early settlement

This could be a win-win situation - you get your money early, and we save on interest costs. Let me know when you have a few minutes to discuss this.

Thanks for your help!

Cheers,

[Your Name]

[Finance Manager]

Confirmation of Deferred Payment LC Receipt

Subject: Received - Deferred Payment LC [LC Number]

Dear [Issuing Bank],

Just a quick email to confirm that we've received the Deferred Payment Letter of Credit [LC Number] issued in our favor.

Our team is currently reviewing all the terms and conditions. We'll get back to you within 48 hours if we notice any issues or if amendments are needed. Otherwise, please consider this our acceptance of the credit as presented.

We're planning to ship the goods by [expected date] and will present documents through our usual banking channel. Everything looks good to proceed!

Thanks for the smooth processing.

Best,

[Your Name]

[Export Sales Team]

Deferred Payment LC Expiry Warning

Subject: CRITICAL - Deferred Payment LC Expiring Soon [LC Number]

Dear [Beneficiary],

This is a critical notice regarding the above-referenced Deferred Payment Letter of Credit which is set to expire on [expiry date] - only [number] days remaining.

We have not yet received any documents for presentation under this credit. If you intend to utilize this LC, immediate action is required to avoid expiry and potential loss of payment security.

Required immediate actions:

- Prepare all required documents per LC terms

- Arrange shipment if not already completed

- Present documents through authorized banking channels

- Ensure all conditions are met before expiry

Please note that no documents can be accepted after the expiry date, and we cannot guarantee extension without applicant consent. This could result in significant financial loss for your company.

Contact us immediately if you need assistance or clarification on any requirements.

Time is of the essence.

Seriously yours,

[Bank Name]

LC Operations Manager

What is a Deferred Payment Letter of Credit and Why is it Used

A Deferred Payment Letter of Credit is a financial instrument that allows the buyer (applicant) to defer payment for goods or services for a specified period after the seller (beneficiary) presents compliant documents. Unlike sight LCs where payment is immediate, deferred payment LCs provide extended payment terms typically ranging from 30 to 180 days.

- Provides cash flow flexibility for importers

- Allows exporters to secure payment guarantee while offering credit terms

- Facilitates international trade by bridging payment timing gaps

- Reduces credit risk compared to open account transactions

- Enables competitive pricing through extended payment terms

Who Should Send Deferred Payment LC Letters

Letters related to deferred payment LCs should be sent by various parties depending on the stage and purpose:

- Importers/Buyers: Request LC establishment, amendments, early payment

- Exporters/Beneficiaries: Confirm terms, acknowledge receipt, request clarifications

- Issuing Banks: Send maturity notices, discrepancy notices, expiry warnings

- Advising/Confirming Banks: Communicate LC details, document examination results

- Trade Finance Officers: Handle operational communications and instructions

- Company Finance Teams: Coordinate payment arrangements and cash flow planning

When Deferred Payment LC Letters Are Needed

Several scenarios trigger the need for deferred payment LC correspondence:

- LC Application Process: Initial request for credit establishment

- Term Confirmation: When LC is received and terms need acknowledgment

- Amendment Requirements: Changes to dates, amounts, or conditions

- Document Presentation: After shipping and document submission

- Discrepancy Handling: When documents don't comply with LC terms

- Maturity Approaching: Payment due date notifications

- Early Payment Options: When cash flow allows prepayment

- Expiry Situations: Last-minute warnings before LC expires

- Settlement Issues: Problems with payment processing

Requirements and Prerequisites for Deferred Payment LCs

Before engaging with deferred payment LCs, several requirements must be met:

- Credit Assessment: Buyer's creditworthiness evaluation by issuing bank

- Financial Documentation: Recent financial statements, bank references

- Trade Documents: Purchase agreements, import/export licenses

- Banking Relationships: Established relationship with trade finance bank

- Insurance Coverage: Credit insurance may be required for extended terms

- Legal Framework: Understanding of UCP 600 rules and local regulations

- Cash Flow Planning: Ability to meet deferred payment obligations

- Documentation Skills: Knowledge of required trade documents

How to Write and Process Deferred Payment LC Letters

The process involves careful attention to detail and proper documentation:

- Clear Identification: Always reference LC number and parties involved

- Specific Details: Include exact amounts, dates, and terms

- Professional Tone: Maintain formal business communication standards

- Timely Response: Adhere to banking deadlines and validity periods

- Accurate Information: Verify all details before sending

- Proper Channels: Use established banking communication routes

- Follow-up System: Track responses and maintain communication records

- Legal Compliance: Ensure adherence to international trade regulations

Formatting Guidelines for Deferred Payment LC Letters

Proper formatting ensures effective communication and professional presentation:

- Length: Keep letters concise, typically 1-2 pages maximum

- Structure: Use clear subject lines, proper greetings, and logical paragraphs

- Tone: Professional and formal for bank communications, can be casual for internal team messages

- Technical Terms: Use standard LC terminology and banking language

- Urgency Indicators: Highlight time-sensitive matters clearly

- Contact Information: Include complete sender details and contact methods

- Document References: Clearly cite LC numbers, dates, and related documents

- Digital Format: Most communications are via email or secure banking portals

After Sending Deferred Payment LC Letters - Follow-up Actions

Post-communication activities are crucial for successful LC transactions:

- Confirmation Receipt: Verify that recipients received your communication

- Response Tracking: Monitor deadlines for replies and actions

- Document Filing: Maintain organized records of all LC correspondence

- Status Updates: Keep internal teams informed of developments

- Payment Monitoring: Track maturity dates and payment schedules

- Relationship Management: Follow up with banking partners regularly

- Problem Resolution: Address issues promptly when they arise

- Performance Review: Evaluate transaction success and areas for improvement

Common Mistakes to Avoid with Deferred Payment LC Letters

Avoiding these pitfalls can prevent costly delays and complications:

- Late Communication: Missing critical deadlines for responses or actions

- Incomplete Information: Omitting essential details like LC numbers or dates

- Wrong Recipients: Sending letters to incorrect parties or departments

- Unclear Instructions: Ambiguous requests that cause confusion

- Inadequate Documentation: Failing to maintain proper communication records

- Ignored Discrepancies: Not addressing document problems promptly

- Missed Expiry Dates: Allowing LCs to expire without action

- Poor Cash Flow Planning: Inadequate preparation for maturity payments

- Informal Tone: Using casual language in formal banking communications

Pros and Cons of Deferred Payment Letters of Credit

Understanding the advantages and disadvantages helps in decision-making:

Advantages:

- Enhanced cash flow management for buyers

- Competitive advantage through extended payment terms

- Reduced credit risk compared to open account trading

- Bank guarantee provides payment security for sellers

- Facilitates larger transaction volumes

Disadvantages:

- Higher costs compared to sight LCs due to extended terms

- Increased complexity in documentation and processing

- Potential for disputes over deferred payment terms

- Credit risk assessment requirements can delay approval

- Limited flexibility once terms are established

Essential Elements and Structure of Deferred Payment LC Letters

Every deferred payment LC letter should include these key components:

- Header Information: Date, sender details, recipient information

- Subject Line: Clear identification of purpose and LC reference

- Opening: Professional greeting and immediate context

- Body Content: Specific details, requests, or information

- Action Items: Clear instructions or expected responses

- Closing: Professional sign-off and contact information

- Attachments: Supporting documents when applicable

- Reference Numbers: LC numbers, transaction IDs, file references

- Deadlines: Specific dates for responses or actions required

- Legal Language: Appropriate banking and trade finance terminology

Download Word Doc

Download Word Doc

Download PDF

Download PDF