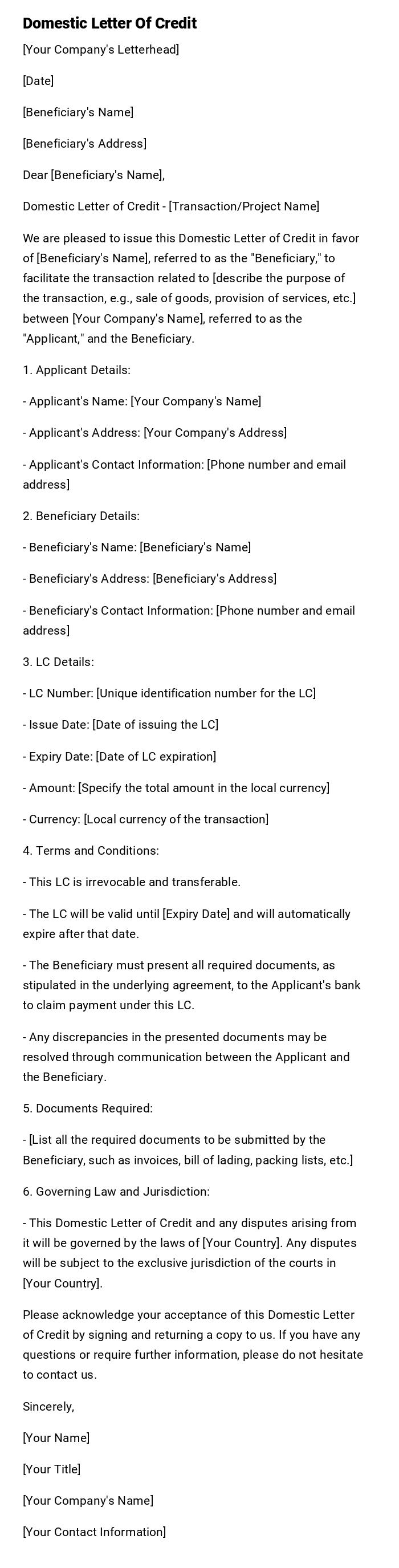

Domestic Letter Of Credit

[Your Company's Letterhead]

[Date]

[Beneficiary's Name]

[Beneficiary's Address]

Dear [Beneficiary's Name],

Domestic Letter of Credit - [Transaction/Project Name]

We are pleased to issue this Domestic Letter of Credit in favor of [Beneficiary's Name], referred to as the "Beneficiary," to facilitate the transaction related to [describe the purpose of the transaction, e.g., sale of goods, provision of services, etc.] between [Your Company's Name], referred to as the "Applicant," and the Beneficiary.

1. Applicant Details:

- Applicant's Name: [Your Company's Name]

- Applicant's Address: [Your Company's Address]

- Applicant's Contact Information: [Phone number and email address]

2. Beneficiary Details:

- Beneficiary's Name: [Beneficiary's Name]

- Beneficiary's Address: [Beneficiary's Address]

- Beneficiary's Contact Information: [Phone number and email address]

3. LC Details:

- LC Number: [Unique identification number for the LC]

- Issue Date: [Date of issuing the LC]

- Expiry Date: [Date of LC expiration]

- Amount: [Specify the total amount in the local currency]

- Currency: [Local currency of the transaction]

4. Terms and Conditions:

- This LC is irrevocable and transferable.

- The LC will be valid until [Expiry Date] and will automatically expire after that date.

- The Beneficiary must present all required documents, as stipulated in the underlying agreement, to the Applicant's bank to claim payment under this LC.

- Any discrepancies in the presented documents may be resolved through communication between the Applicant and the Beneficiary.

5. Documents Required:

- [List all the required documents to be submitted by the Beneficiary, such as invoices, bill of lading, packing lists, etc.]

6. Governing Law and Jurisdiction:

- This Domestic Letter of Credit and any disputes arising from it will be governed by the laws of [Your Country]. Any disputes will be subject to the exclusive jurisdiction of the courts in [Your Country].

Please acknowledge your acceptance of this Domestic Letter of Credit by signing and returning a copy to us. If you have any questions or require further information, please do not hesitate to contact us.

Sincerely,

[Your Name]

[Your Title]

[Your Company's Name]

[Your Contact Information]

What is a Domestic Letter of Credit and Why is it Essential

A Domestic Letter of Credit (DLC) is a financial instrument issued by a bank on behalf of a buyer (applicant) to guarantee payment to a seller (beneficiary) within the same country. It serves as a risk mitigation tool that ensures the seller receives payment upon meeting specified conditions, while protecting the buyer from non-delivery or non-conforming goods. DLCs are crucial for establishing trust in business transactions where parties may not have established relationships or when large amounts are involved.

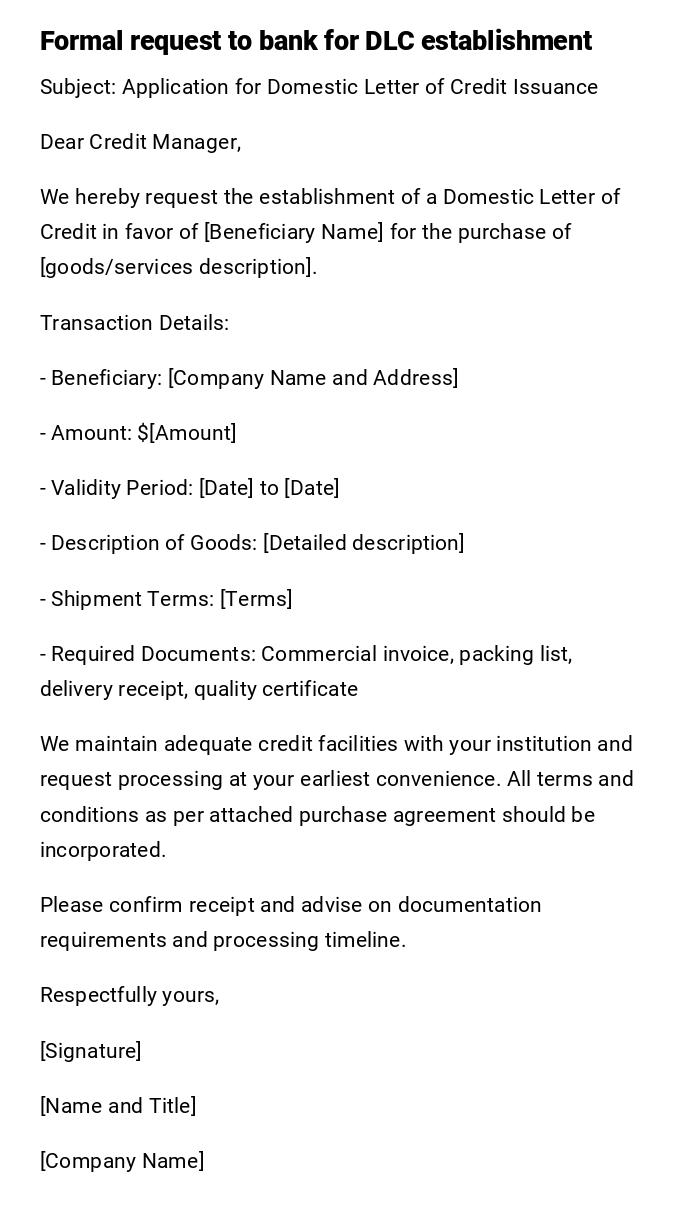

Application for Domestic Letter of Credit Issuance

Subject: Application for Domestic Letter of Credit Issuance

Dear Credit Manager,

We hereby request the establishment of a Domestic Letter of Credit in favor of [Beneficiary Name] for the purchase of [goods/services description].

Transaction Details:

- Beneficiary: [Company Name and Address]

- Amount: $[Amount]

- Validity Period: [Date] to [Date]

- Description of Goods: [Detailed description]

- Shipment Terms: [Terms]

- Required Documents: Commercial invoice, packing list, delivery receipt, quality certificate

We maintain adequate credit facilities with your institution and request processing at your earliest convenience. All terms and conditions as per attached purchase agreement should be incorporated.

Please confirm receipt and advise on documentation requirements and processing timeline.

Respectfully yours,

[Signature]

[Name and Title]

[Company Name]

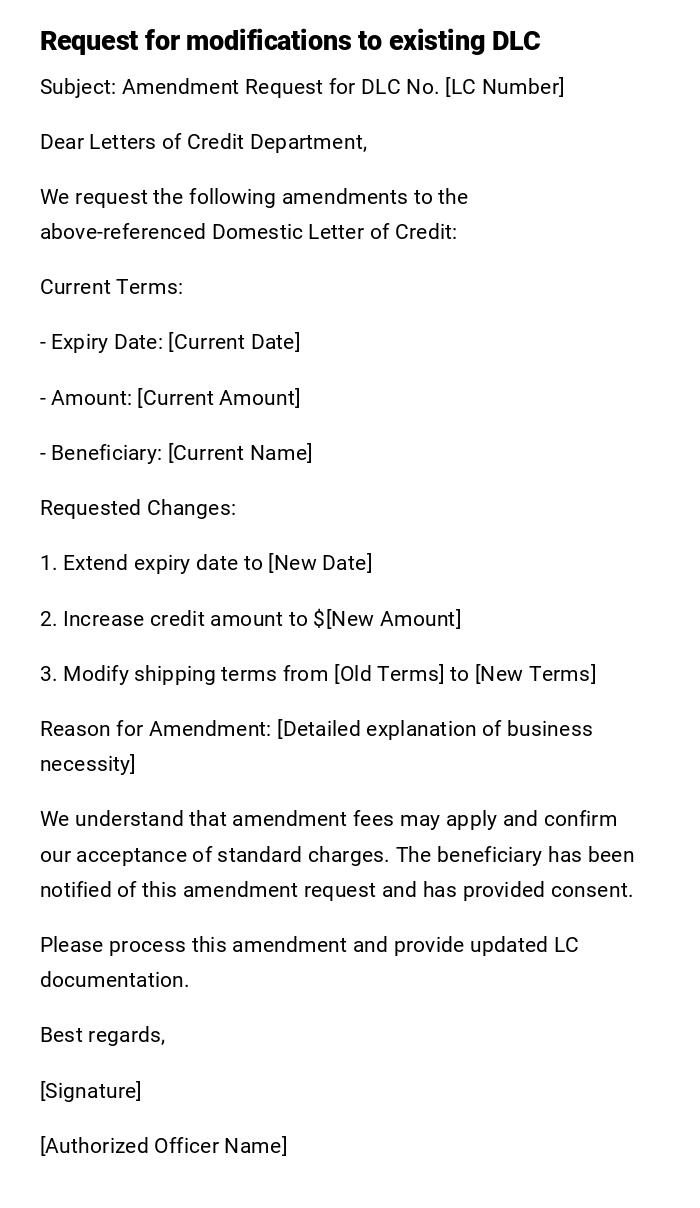

Letter of Credit Amendment Request

Subject: Amendment Request for DLC No. [LC Number]

Dear Letters of Credit Department,

We request the following amendments to the above-referenced Domestic Letter of Credit:

Current Terms:

- Expiry Date: [Current Date]

- Amount: [Current Amount]

- Beneficiary: [Current Name]

Requested Changes:

1. Extend expiry date to [New Date]

2. Increase credit amount to $[New Amount]

3. Modify shipping terms from [Old Terms] to [New Terms]

Reason for Amendment: [Detailed explanation of business necessity]

We understand that amendment fees may apply and confirm our acceptance of standard charges. The beneficiary has been notified of this amendment request and has provided consent.

Please process this amendment and provide updated LC documentation.

Best regards,

[Signature]

[Authorized Officer Name]

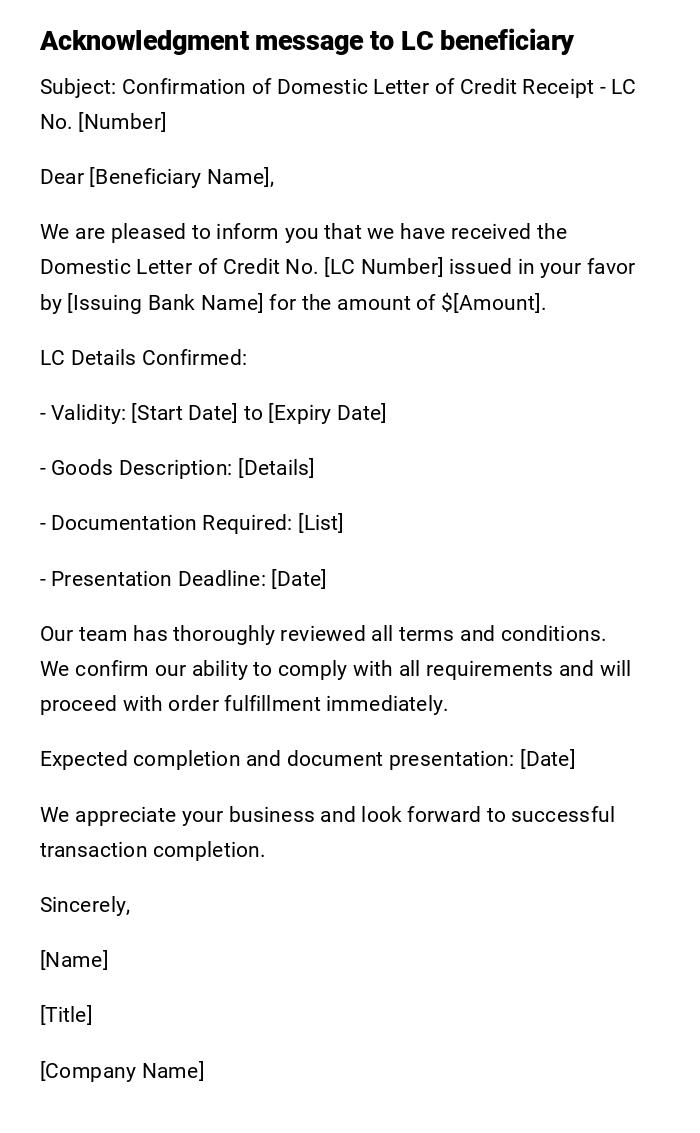

Beneficiary Notification of Letter of Credit Receipt

Subject: Confirmation of Domestic Letter of Credit Receipt - LC No. [Number]

Dear [Beneficiary Name],

We are pleased to inform you that we have received the Domestic Letter of Credit No. [LC Number] issued in your favor by [Issuing Bank Name] for the amount of $[Amount].

LC Details Confirmed:

- Validity: [Start Date] to [Expiry Date]

- Goods Description: [Details]

- Documentation Required: [List]

- Presentation Deadline: [Date]

Our team has thoroughly reviewed all terms and conditions. We confirm our ability to comply with all requirements and will proceed with order fulfillment immediately.

Expected completion and document presentation: [Date]

We appreciate your business and look forward to successful transaction completion.

Sincerely,

[Name]

[Title]

[Company Name]

Document Presentation Notice

Subject: Document Presentation Under DLC No. [LC Number]

To the Documentary Credit Department,

We hereby present the following documents for payment under the above-referenced Domestic Letter of Credit:

1. Original Commercial Invoice No. [Number] - $[Amount]

2. Signed Delivery Receipt dated [Date]

3. Packing List showing [Details]

4. Quality Certificate issued by [Authority]

5. Insurance Certificate (if required)

6. Transport Documents

All documents are presented within the validity period and comply with LC terms and conditions. We have verified that goods delivered match LC specifications exactly.

We request immediate processing and credit to our account No. [Account Number] at [Bank Name].

Should you require any clarification regarding presented documents, please contact us immediately.

Yours faithfully,

[Authorized Signature]

[Company Representative]

Discrepancy Notification Letter

Subject: Document Discrepancies - DLC No. [LC Number]

Dear [Beneficiary Name],

Upon examination of documents presented under the above Letter of Credit, we have identified the following discrepancies:

1. Invoice amount shows $[Amount] while LC specifies $[Different Amount]

2. Goods description reads "[Description]" instead of required "[Correct Description]"

3. Delivery date shown as [Date] exceeds LC expiry date of [Date]

4. Missing required quality inspection certificate

Current Status: Documents held pending correction or applicant's waiver

Options Available:

- Correct discrepancies and re-present documents

- Request applicant's acceptance of discrepancies

- Return documents if corrections cannot be made

Please advise your preferred course of action within 5 banking days. Additional charges may apply for document handling and re-examination.

We remain at your disposal for clarification.

Best regards,

[Bank Officer Name]

Documentary Credits Department

Payment Confirmation Notice

Subject: Payment Processed Under DLC No. [LC Number]

Dear [Beneficiary Name],

We are pleased to confirm that payment under the above-referenced Domestic Letter of Credit has been processed successfully.

Payment Details:

- Amount Paid: $[Amount]

- Payment Date: [Date]

- Account Credited: [Account Number]

- Reference Number: [Transaction Reference]

All presented documents were found in compliance with LC terms and conditions. Documents have been forwarded to the applicant as per standard procedure.

This completes our obligations under the Letter of Credit. We thank you for choosing our documentary credit services and look forward to serving you in future transactions.

Should you require a payment confirmation certificate, please contact our customer service department.

Sincerely,

[Bank Representative]

Letters of Credit Department

Letter of Credit Cancellation Request

Subject: Cancellation Request for DLC No. [LC Number]

Dear Credit Operations,

We hereby request cancellation of the above-referenced Domestic Letter of Credit due to [reason - contract termination/mutual agreement/business circumstances].

LC Details:

- Original Amount: $[Amount]

- Beneficiary: [Name]

- Expiry Date: [Date]

- Current Status: Unused/Partially utilized

We confirm that:

- The beneficiary has agreed to this cancellation

- No documents are pending presentation

- All parties release claims under this LC

Please process the cancellation and release any collateral or margins held against this credit facility. Kindly confirm cancellation in writing and advise of any applicable charges.

We appreciate your prompt attention to this matter.

Yours truly,

[Signature]

[Applicant Representative]

Who Should Issue or Request a Domestic Letter of Credit

- Buyers/Importers within the country who need assurance of delivery before payment

- Corporate procurement departments handling large-value purchases from new suppliers

- Government agencies conducting transparent bidding processes

- Manufacturing companies securing critical raw materials or components

- Construction companies purchasing expensive equipment or materials

- Small and medium enterprises establishing credibility with major suppliers

- Trading companies facilitating transactions between domestic parties

When to Use a Domestic Letter of Credit

- First-time transactions between unknown parties

- High-value purchases exceeding company payment thresholds

- Critical supplies where delivery timing is essential

- Transactions requiring quality or specification guarantees

- Government contracts mandating secured payment methods

- Seasonal purchases where advance payment is required

- Equipment purchases requiring installation and testing

- Bulk commodity purchases with specific grade requirements

- Construction material supplies tied to project milestones

- Emergency procurement situations requiring immediate supplier confidence

Requirements and Prerequisites Before Issuing a DLC

- Credit Assessment: Bank evaluation of applicant's creditworthiness and financial standing

- Collateral or Margin: Security deposit typically 10-25% of LC value

- Purchase Agreement: Detailed contract between buyer and seller specifying terms

- KYC Documentation: Know Your Customer compliance for all parties

- Trade License Verification: Valid business registration and trade permits

- Bank Account: Active relationship with issuing bank

- Insurance Coverage: Adequate coverage for goods in transit if applicable

- Authorization Letters: Board resolution or power of attorney for LC application

- Financial Statements: Recent audited accounts demonstrating financial capacity

How to Structure and Process a Domestic Letter of Credit

- Initial Negotiation: Buyer and seller agree on LC terms as payment method

- LC Application: Buyer submits formal application to their bank with required documents

- Credit Evaluation: Bank assesses applicant's creditworthiness and approves facility

- LC Issuance: Bank issues LC and forwards to beneficiary directly or through their bank

- Goods Shipment: Seller ships goods according to LC specifications

- Document Preparation: Seller prepares all required documents per LC terms

- Document Presentation: Seller presents documents to bank within validity period

- Document Examination: Bank verifies document compliance with LC terms

- Payment Processing: Bank pays seller if documents comply or holds pending correction

- Document Delivery: Bank forwards documents to buyer for goods clearance

Elements and Structure Required in DLC Documentation

- LC Number and Issue Date: Unique identification and timestamp

- Applicant Details: Complete buyer information including address and account

- Beneficiary Information: Seller's complete corporate details and banking information

- Credit Amount: Maximum payable amount in specific currency

- Validity Period: Clear expiry date and place of document presentation

- Goods Description: Detailed specification matching purchase agreement

- Required Documents: Comprehensive list of mandatory documentation

- Shipment Terms: Delivery conditions, timeline, and transportation requirements

- Payment Terms: At sight, deferred payment, or acceptance conditions

- Special Conditions: Any unique requirements specific to the transaction

- Presentation Rules: Document submission deadlines and procedures

Formatting Guidelines and Communication Standards

- Length: LC applications should be comprehensive, typically 2-3 pages with attachments

- Tone: Professional, formal, and precise language avoiding ambiguity

- Format: Standard business letter format with clear section headers

- Documentation: All supporting documents must be originals or certified copies

- Signatures: Authorized signatory stamps and signatures on all documents

- Delivery Method: Secure transmission through banking channels or registered mail

- Language: English or local language as agreed between parties

- Currency: Clearly specified with exact amount in words and figures

- Amendments: Any changes must be formally documented and agreed by all parties

Follow-up Actions After DLC Issuance

- Confirmation Receipt: Verify beneficiary has received LC and accepts terms

- Progress Monitoring: Track goods preparation and shipment status

- Document Tracking: Monitor document presentation deadlines

- Payment Authorization: Be ready to approve discrepant documents if acceptable

- Goods Inspection: Arrange quality control upon delivery

- Account Reconciliation: Verify payment debiting and document charges

- Record Keeping: Maintain complete transaction file for audit purposes

- Performance Evaluation: Assess supplier performance for future business

- Facility Review: Update credit limits based on transaction success

Common Mistakes to Avoid in DLC Transactions

- Incomplete Documentation: Missing required documents or information

- Ambiguous Terms: Vague goods descriptions leading to compliance issues

- Unrealistic Deadlines: Insufficient time for goods preparation or document processing

- Currency Mismatches: Inconsistent currency specifications across documents

- Address Errors: Incorrect beneficiary or applicant information

- Late Amendments: Requesting changes too close to expiry dates

- Inadequate Insurance: Insufficient coverage for high-value goods

- Poor Communication: Lack of coordination between all transaction parties

- Expiry Oversight: Allowing LC to expire before document presentation

- Non-compliance: Presenting documents that don't match LC requirements exactly

Advantages and Disadvantages of Using Domestic Letters of Credit

Advantages:

- Risk mitigation for both buyers and sellers in domestic transactions

- Payment guarantee reduces supplier hesitation with new customers

- Standardized documentation process improves transaction efficiency

- Bank involvement provides professional oversight and dispute resolution

- Credit enhancement allows smaller companies to access better suppliers

- Flexible terms accommodate various business requirements

Disadvantages:

- Additional costs including bank fees, margins, and processing charges

- Complex documentation requirements may delay transactions

- Rigid compliance standards can cause payment delays for minor discrepancies

- Reduced cash flow due to margin requirements

- Administrative burden of managing LC documentation and deadlines

- Limited flexibility once LC terms are established and communicated

Tips and Best Practices for Successful DLC Management

- Early Planning: Begin LC process well in advance of required delivery dates

- Clear Communication: Ensure all parties understand terms before LC issuance

- Document Templates: Maintain standard formats for faster processing

- Relationship Building: Develop strong banking relationships for better service

- Regular Training: Keep staff updated on LC procedures and requirements

- Technology Usage: Utilize electronic LC systems where available

- Backup Planning: Have alternative payment methods ready if LC fails

- Cost Analysis: Compare LC costs with other payment security methods

- Performance Tracking: Monitor LC success rates and identify improvement areas

- Legal Review: Have complex LC terms reviewed by trade finance specialists

Download Word Doc

Download Word Doc

Download PDF

Download PDF