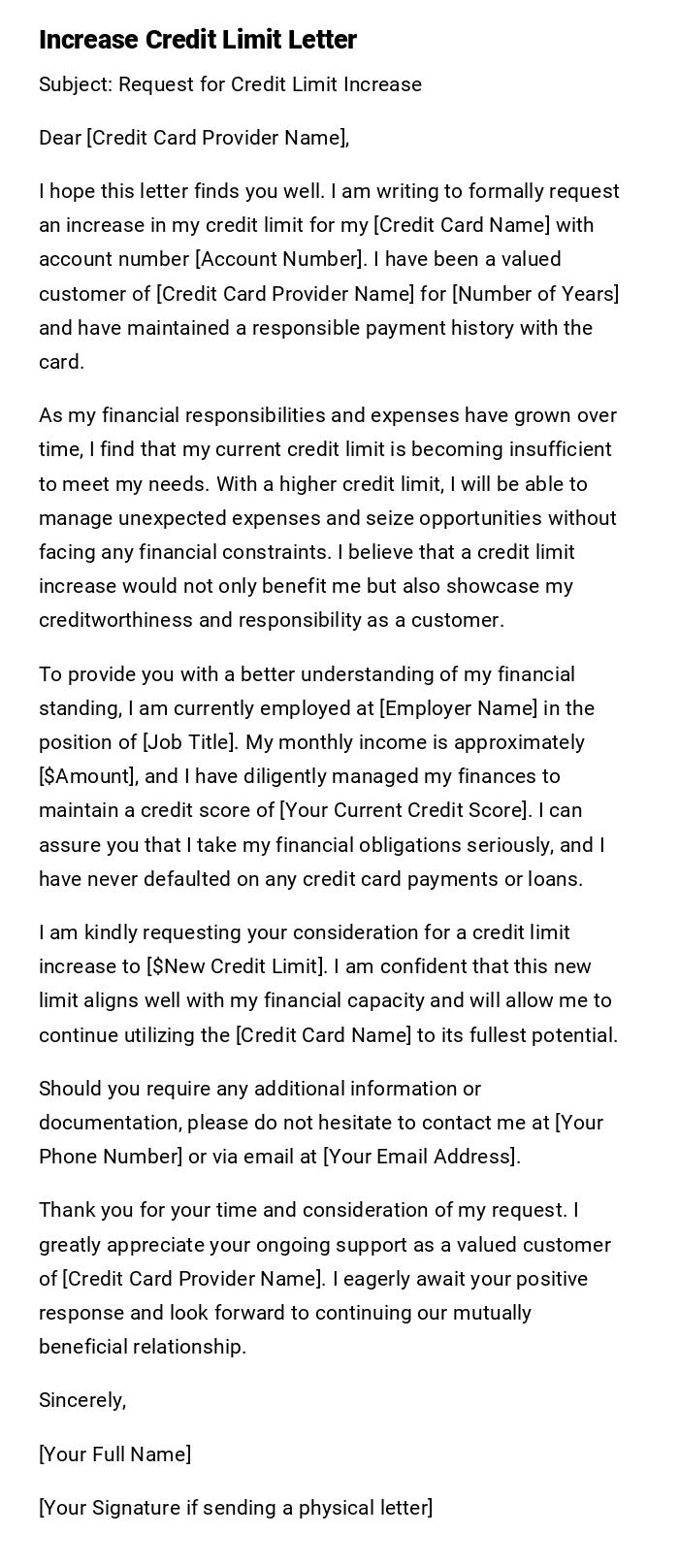

Increase Credit Limit Letter

Subject: Request for Credit Limit Increase

Dear [Credit Card Provider Name],

I hope this letter finds you well. I am writing to formally request an increase in my credit limit for my [Credit Card Name] with account number [Account Number]. I have been a valued customer of [Credit Card Provider Name] for [Number of Years] and have maintained a responsible payment history with the card.

As my financial responsibilities and expenses have grown over time, I find that my current credit limit is becoming insufficient to meet my needs. With a higher credit limit, I will be able to manage unexpected expenses and seize opportunities without facing any financial constraints. I believe that a credit limit increase would not only benefit me but also showcase my creditworthiness and responsibility as a customer.

To provide you with a better understanding of my financial standing, I am currently employed at [Employer Name] in the position of [Job Title]. My monthly income is approximately [$Amount], and I have diligently managed my finances to maintain a credit score of [Your Current Credit Score]. I can assure you that I take my financial obligations seriously, and I have never defaulted on any credit card payments or loans.

I am kindly requesting your consideration for a credit limit increase to [$New Credit Limit]. I am confident that this new limit aligns well with my financial capacity and will allow me to continue utilizing the [Credit Card Name] to its fullest potential.

Should you require any additional information or documentation, please do not hesitate to contact me at [Your Phone Number] or via email at [Your Email Address].

Thank you for your time and consideration of my request. I greatly appreciate your ongoing support as a valued customer of [Credit Card Provider Name]. I eagerly await your positive response and look forward to continuing our mutually beneficial relationship.

Sincerely,

[Your Full Name]

[Your Signature if sending a physical letter]

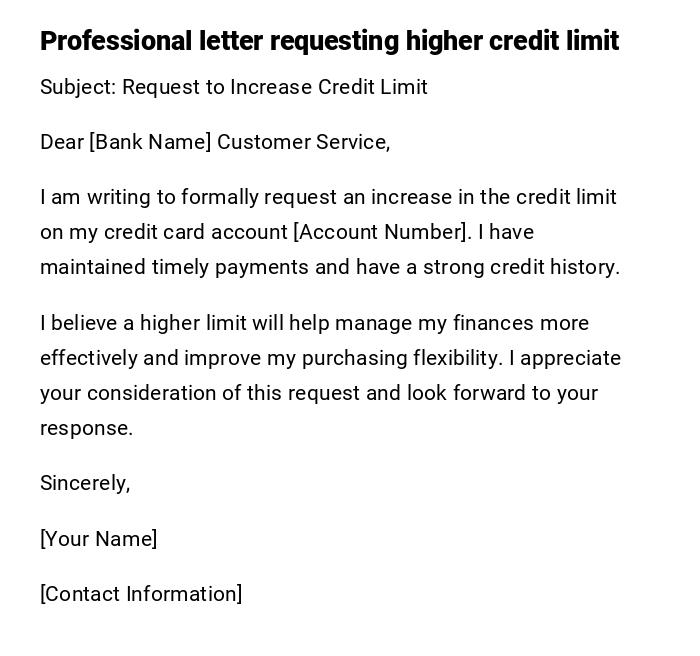

Formal Increase Credit Limit Request Letter

Subject: Request to Increase Credit Limit

Dear [Bank Name] Customer Service,

I am writing to formally request an increase in the credit limit on my credit card account [Account Number]. I have maintained timely payments and have a strong credit history.

I believe a higher limit will help manage my finances more effectively and improve my purchasing flexibility. I appreciate your consideration of this request and look forward to your response.

Sincerely,

[Your Name]

[Contact Information]

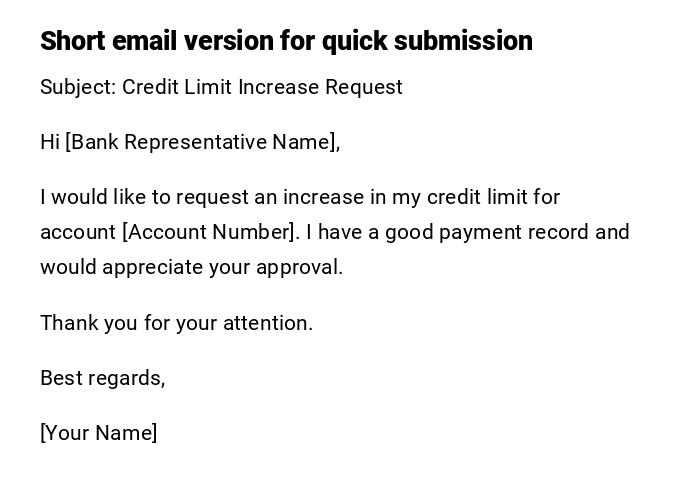

Quick Email to Request Credit Limit Increase

Subject: Credit Limit Increase Request

Hi [Bank Representative Name],

I would like to request an increase in my credit limit for account [Account Number]. I have a good payment record and would appreciate your approval.

Thank you for your attention.

Best regards,

[Your Name]

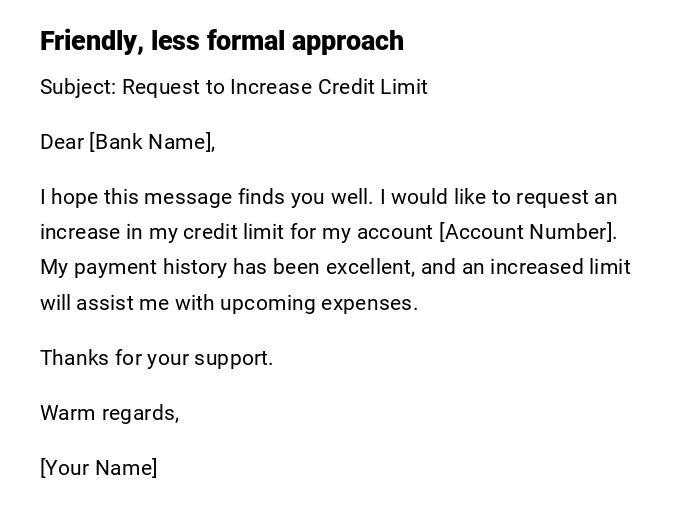

Casual Increase Credit Limit Letter

Subject: Request to Increase Credit Limit

Dear [Bank Name],

I hope this message finds you well. I would like to request an increase in my credit limit for my account [Account Number]. My payment history has been excellent, and an increased limit will assist me with upcoming expenses.

Thanks for your support.

Warm regards,

[Your Name]

Professional Increase Credit Limit Letter with Justification

Subject: Request for Credit Limit Increase

Dear [Bank Name] Credit Department,

I am requesting a credit limit increase on my credit card [Account Number]. Over the past [number] years, I have maintained an impeccable payment history, and my current income has increased, allowing me to manage higher credit responsibly.

This increase will assist with higher monthly expenses and planned purchases. I appreciate your consideration and look forward to your response.

Sincerely,

[Your Name]

[Contact Information]

Heartfelt Credit Limit Increase Letter

Subject: Request for Credit Limit Enhancement

Dear [Bank Representative Name],

I am sincerely grateful for the excellent service and support provided by [Bank Name]. I am requesting an increase in my credit limit on account [Account Number] to better manage personal expenses and emergency needs.

Your approval would greatly help me and further strengthen our relationship. Thank you for considering my request.

Warm regards,

[Your Name]

Formal Email for High-Value Credit Limit Increase

Subject: Request for High-Value Credit Limit Increase

Dear [Bank Name] Credit Department,

I am requesting a significant increase in my credit limit for account [Account Number]. My account is in good standing with a strong payment record, and my current financial capacity supports this request.

Kindly advise if any further documentation is required. I appreciate your prompt consideration.

Sincerely,

[Your Name]

Creative Credit Limit Increase Letter

Subject: Request to Boost My Credit Limit

Dear [Bank Name] Team,

I am writing to request a credit limit increase on my account [Account Number]. With consistent timely payments and increasing financial responsibility, I believe a higher limit will be mutually beneficial.

Thank you for your attention, and I look forward to your favorable response.

Best regards,

[Your Name]

What is an Increase Credit Limit Letter and Why It Is Important

- A letter requesting an increase in credit limit is a formal communication to a financial institution.

- Purpose: allows the customer to obtain higher credit for managing expenses, emergencies, or large purchases.

- Provides official documentation of request and justification, ensuring transparency and proper evaluation by the bank.

Who Should Send a Credit Limit Increase Letter

- Current account holders in good standing with the bank.

- Customers who have demonstrated consistent payment history and responsible credit usage.

- Individuals seeking additional credit for personal or professional financial management.

Whom Should the Credit Limit Increase Letter Be Addressed To

- Customer service department or credit department of the bank.

- Designated bank representative or relationship manager.

- Any official contact provided by the bank for credit limit requests.

When to Submit a Credit Limit Increase Letter

- After demonstrating responsible usage of current credit limit.

- When planning significant expenses or purchases.

- Upon salary increase, improved credit score, or demonstrated financial stability.

How to Write and Submit a Credit Limit Increase Letter

- Include account number and current credit limit.

- Mention reason for increase: higher expenses, improved financial standing, emergencies, or large purchases.

- Attach supporting documents if needed (income proof, credit score, employment details).

- Choose appropriate mode: email for faster response, printed letter for formal submission.

- Maintain polite and professional tone throughout.

Formatting Guidelines for Credit Limit Increase Letters

- Length: one page maximum, concise but detailed.

- Tone: formal, professional, or polite casual depending on relationship with bank.

- Subject line: clear and specific (e.g., "Request for Credit Limit Increase").

- Signature: include full name, contact details, and account information.

Requirements and Prerequisites Before Sending

- Review current credit card/account standing.

- Ensure timely repayment history.

- Prepare any documentation requested by the bank: income proof, employment verification, credit report.

- Check bank policies for credit limit increases.

Elements and Structure of a Credit Limit Increase Letter

- Subject Line: Clearly state the purpose.

- Greeting: Address bank representative appropriately.

- Introduction: Mention account number and current status.

- Reason for Request: Justification for increase, financial stability, and responsible usage.

- Supporting Details: Attach documents if necessary.

- Closing: Polite request for approval and appreciation.

- Signature: Full name, contact information, account details.

Common Mistakes to Avoid

- Vague reasons for requesting an increase.

- Ignoring bank guidelines or prerequisites.

- Submitting with past due payments or poor credit history.

- Using informal language in professional communication.

- Failing to provide contact information or supporting documents.

After Sending a Credit Limit Increase Letter: Follow-Up

- Confirm receipt with bank if sent via email or mail.

- Follow up after a reasonable period (usually 7–14 days) for response.

- Provide additional documentation if requested.

- Keep a copy of the letter for personal records.

Tips and Best Practices for Credit Limit Increase Letters

- Be concise and clear with justification.

- Maintain polite, professional tone.

- Submit supporting documents upfront to expedite processing.

- Highlight positive payment history and financial stability.

- Avoid frequent or unnecessary requests; time your request strategically.

FAQ About Credit Limit Increase Letters

- Q: Can anyone request a credit limit increase?

A: Only account holders in good standing with sufficient credit history. - Q: Is supporting documentation always required?

A: Depends on bank policy and the amount of increase requested. - Q: How long does approval take?

A: Typically 5–14 business days; may vary by bank. - Q: Can I request an increase via email?

A: Yes, email is commonly accepted, but follow-up may be necessary.

Download Word Doc

Download Word Doc

Download PDF

Download PDF