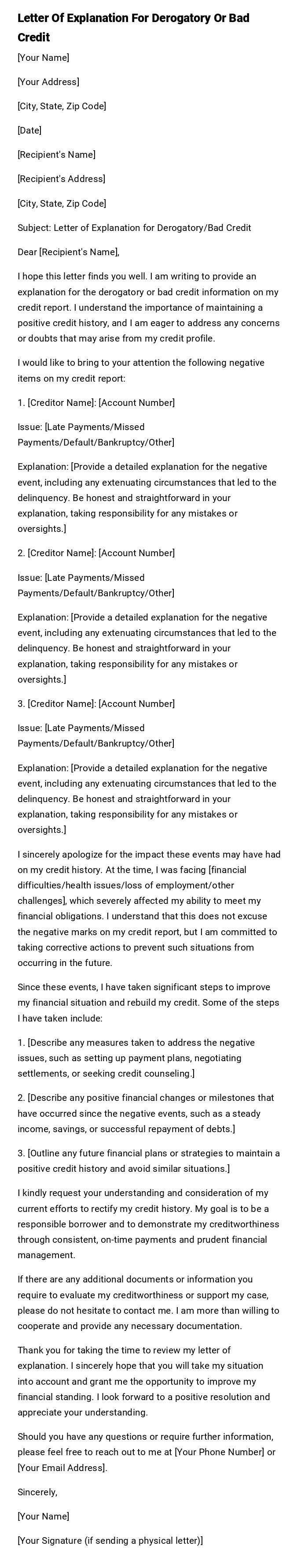

Letter Of Explanation For Derogatory Or Bad Credit

[Your Name]

[Your Address]

[City, State, Zip Code]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, Zip Code]

Subject: Letter of Explanation for Derogatory/Bad Credit

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to provide an explanation for the derogatory or bad credit information on my credit report. I understand the importance of maintaining a positive credit history, and I am eager to address any concerns or doubts that may arise from my credit profile.

I would like to bring to your attention the following negative items on my credit report:

1. [Creditor Name]: [Account Number]

Issue: [Late Payments/Missed Payments/Default/Bankruptcy/Other]

Explanation: [Provide a detailed explanation for the negative event, including any extenuating circumstances that led to the delinquency. Be honest and straightforward in your explanation, taking responsibility for any mistakes or oversights.]

2. [Creditor Name]: [Account Number]

Issue: [Late Payments/Missed Payments/Default/Bankruptcy/Other]

Explanation: [Provide a detailed explanation for the negative event, including any extenuating circumstances that led to the delinquency. Be honest and straightforward in your explanation, taking responsibility for any mistakes or oversights.]

3. [Creditor Name]: [Account Number]

Issue: [Late Payments/Missed Payments/Default/Bankruptcy/Other]

Explanation: [Provide a detailed explanation for the negative event, including any extenuating circumstances that led to the delinquency. Be honest and straightforward in your explanation, taking responsibility for any mistakes or oversights.]

I sincerely apologize for the impact these events may have had on my credit history. At the time, I was facing [financial difficulties/health issues/loss of employment/other challenges], which severely affected my ability to meet my financial obligations. I understand that this does not excuse the negative marks on my credit report, but I am committed to taking corrective actions to prevent such situations from occurring in the future.

Since these events, I have taken significant steps to improve my financial situation and rebuild my credit. Some of the steps I have taken include:

1. [Describe any measures taken to address the negative issues, such as setting up payment plans, negotiating settlements, or seeking credit counseling.]

2. [Describe any positive financial changes or milestones that have occurred since the negative events, such as a steady income, savings, or successful repayment of debts.]

3. [Outline any future financial plans or strategies to maintain a positive credit history and avoid similar situations.]

I kindly request your understanding and consideration of my current efforts to rectify my credit history. My goal is to be a responsible borrower and to demonstrate my creditworthiness through consistent, on-time payments and prudent financial management.

If there are any additional documents or information you require to evaluate my creditworthiness or support my case, please do not hesitate to contact me. I am more than willing to cooperate and provide any necessary documentation.

Thank you for taking the time to review my letter of explanation. I sincerely hope that you will take my situation into account and grant me the opportunity to improve my financial standing. I look forward to a positive resolution and appreciate your understanding.

Should you have any questions or require further information, please feel free to reach out to me at [Your Phone Number] or [Your Email Address].

Sincerely,

[Your Name]

[Your Signature (if sending a physical letter)]

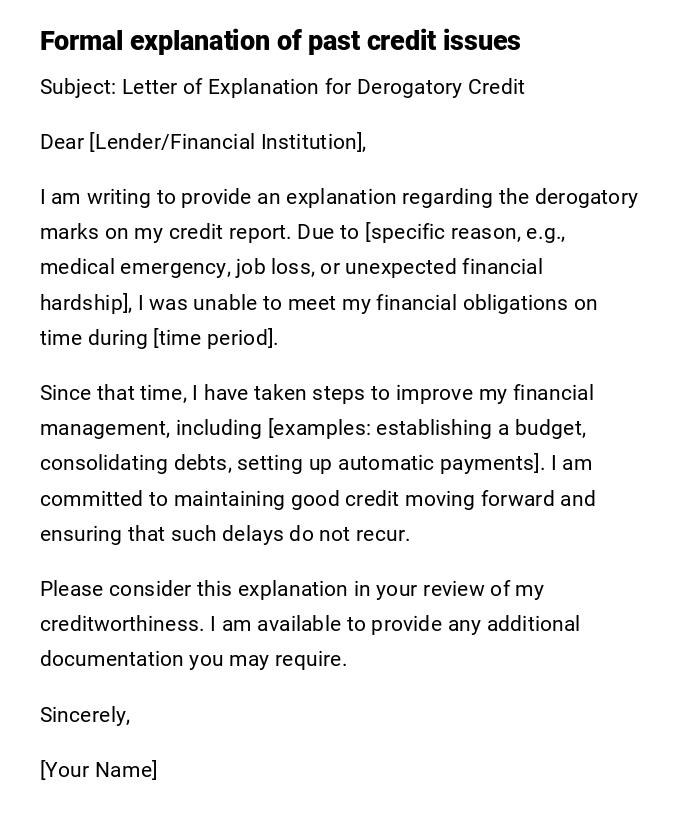

Professional Letter of Explanation for Derogatory Credit

Subject: Letter of Explanation for Derogatory Credit

Dear [Lender/Financial Institution],

I am writing to provide an explanation regarding the derogatory marks on my credit report. Due to [specific reason, e.g., medical emergency, job loss, or unexpected financial hardship], I was unable to meet my financial obligations on time during [time period].

Since that time, I have taken steps to improve my financial management, including [examples: establishing a budget, consolidating debts, setting up automatic payments]. I am committed to maintaining good credit moving forward and ensuring that such delays do not recur.

Please consider this explanation in your review of my creditworthiness. I am available to provide any additional documentation you may require.

Sincerely,

[Your Name]

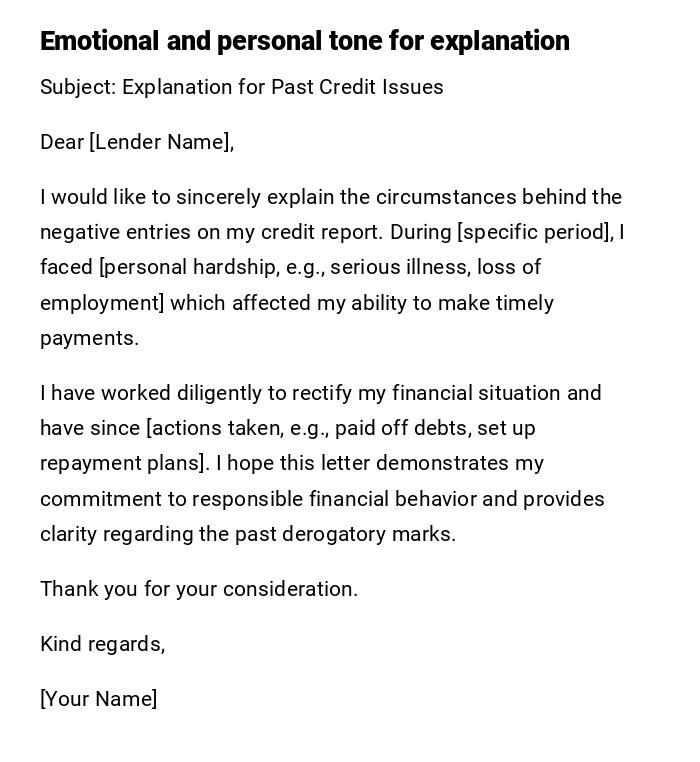

Heartfelt and Honest Explanation Letter for Bad Credit

Subject: Explanation for Past Credit Issues

Dear [Lender Name],

I would like to sincerely explain the circumstances behind the negative entries on my credit report. During [specific period], I faced [personal hardship, e.g., serious illness, loss of employment] which affected my ability to make timely payments.

I have worked diligently to rectify my financial situation and have since [actions taken, e.g., paid off debts, set up repayment plans]. I hope this letter demonstrates my commitment to responsible financial behavior and provides clarity regarding the past derogatory marks.

Thank you for your consideration.

Kind regards,

[Your Name]

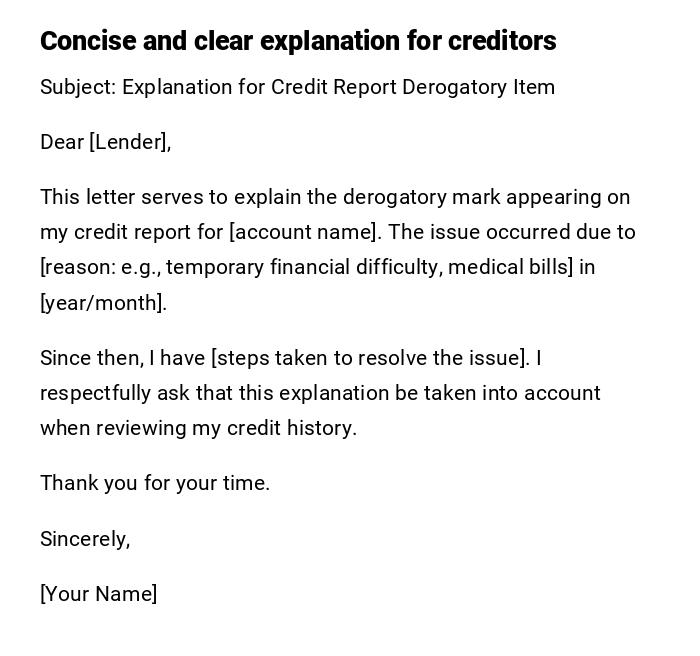

Simple and Direct Letter of Explanation

Subject: Explanation for Credit Report Derogatory Item

Dear [Lender],

This letter serves to explain the derogatory mark appearing on my credit report for [account name]. The issue occurred due to [reason: e.g., temporary financial difficulty, medical bills] in [year/month].

Since then, I have [steps taken to resolve the issue]. I respectfully ask that this explanation be taken into account when reviewing my credit history.

Thank you for your time.

Sincerely,

[Your Name]

Formal and Detailed Letter for Bad Credit Explanation

Subject: Detailed Letter of Explanation for Derogatory Credit

To Whom It May Concern,

I am providing this detailed explanation for the derogatory entries listed under my credit history. The primary reason for these entries was [specific financial hardship, e.g., unexpected medical expenses, job loss, or business failure].

I have since implemented corrective actions:

- Settled outstanding balances.

- Established automatic payments for all bills.

- Monitored credit reports regularly for accuracy.

Enclosed are supporting documents that verify the circumstances mentioned above. I trust this information provides context and demonstrates my commitment to financial responsibility.

Sincerely,

[Your Name]

Casual and Friendly Email Explanation for Bad Credit

Subject: Clarification Regarding Credit Report

Hi [Lender Name],

I wanted to explain the derogatory entry on my credit report related to [account or loan]. It happened because [reason, e.g., temporary financial hardship or unexpected medical bills] during [time period].

I’ve since taken steps to resolve all issues and improve my financial habits. Please let me know if you need any supporting documents or further clarification.

Thanks,

[Your Name]

Provisional Letter of Explanation for Pending Bad Credit Issues

Subject: Provisional Explanation for Credit Challenges

Dear [Financial Institution],

This letter serves as a provisional explanation for the derogatory mark on my credit report for [specific account]. While the matter is still being fully resolved, the main cause was [reason, e.g., temporary financial setback, unpaid bills].

I am actively working to settle this account and will provide updated documentation once resolved. Your understanding and consideration of this provisional explanation are greatly appreciated.

Sincerely,

[Your Name]

Elements and Structure of a Letter of Explanation for Bad Credit

- Subject line: Clearly state the purpose of the letter.

- Greeting: Address the lender, creditor, or financial institution directly.

- Introduction: Briefly state the purpose of the letter.

- Explanation of issue: Describe the circumstances that led to the derogatory mark.

- Actions taken: Detail the steps taken to correct or mitigate the situation.

- Supporting documentation: Attach proof if applicable (e.g., medical bills, termination letters).

- Closing: Express commitment to responsible financial behavior and willingness to provide more information.

- Signature: Include full name and contact information.

When and Why You Should Send a Letter of Explanation for Bad Credit

- Applying for loans, mortgages, or credit cards.

- Seeking to improve the evaluation of your creditworthiness.

- Explaining discrepancies in credit reports to potential landlords or employers.

- Providing context to financial institutions regarding temporary financial hardships.

Who Should Send This Letter

- Individuals with derogatory marks, late payments, or bad credit history.

- Applicants applying for credit, housing, or employment where credit history is assessed.

- Borrowers seeking clarification for past financial difficulties.

Whom to Address a Letter of Explanation for Bad Credit

- Banks or credit unions.

- Credit card issuers or lenders.

- Mortgage companies.

- Landlords or property management companies.

- Employers or background check agencies (if requested).

Formatting Guidelines for Bad Credit Explanation Letters

- Keep the letter concise: 1–2 pages.

- Tone: Professional, respectful, and honest.

- Clarity: Use simple language to explain the issue.

- Attach relevant documents as proof where necessary.

- For email submissions, use a clear subject line and attach documents in PDF format.

Common Mistakes to Avoid

- Being vague or omitting key details about the financial hardship.

- Making excuses without showing corrective actions.

- Using an aggressive or defensive tone.

- Sending letters without proofreading for clarity and grammar.

- Failing to attach necessary supporting documents.

Tricks, Tips, and Best Practices

- Be honest and transparent about the situation.

- Keep explanations short but comprehensive.

- Include dates, amounts, and specific actions taken to correct the issue.

- Attach supporting documentation to strengthen credibility.

- Maintain a polite and professional tone, even in informal emails.

After Sending the Letter: Follow-Up Actions

- Confirm receipt of the letter via email or phone.

- Keep a copy of the letter and attachments for records.

- Respond promptly to any requests for additional documentation.

- Monitor credit reports to ensure updates are reflected correctly.

Pros and Cons of Sending a Letter of Explanation

Pros:

- Provides context to lenders or institutions about credit issues.

- Demonstrates responsibility and commitment to financial improvement.

- Can positively influence lending or approval decisions.

Cons:

- May not always change the decision if the derogatory marks are severe.

- Requires honesty and documentation, which may expose sensitive information.

Frequently Asked Questions (FAQ)

Q: Can a letter of explanation remove derogatory marks?

A: No, but it provides context and may improve the lender’s perception.

Q: How long should the letter be?

A: Typically 1–2 pages, concise but detailed enough to explain circumstances.

Q: Should supporting documents be attached?

A: Yes, any documents that validate the explanation can strengthen the letter.

Q: Can this letter be sent via email?

A: Yes, email is acceptable if accompanied by clear attachments in PDF or other readable formats.

Download Word Doc

Download Word Doc

Download PDF

Download PDF