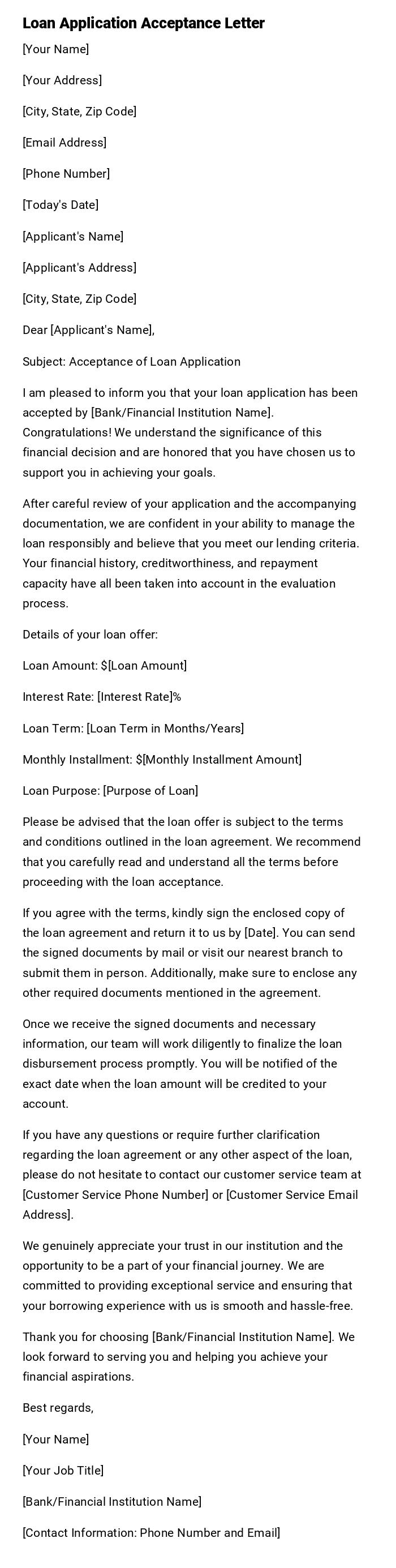

Loan Application Acceptance Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Today's Date]

[Applicant's Name]

[Applicant's Address]

[City, State, Zip Code]

Dear [Applicant's Name],

Subject: Acceptance of Loan Application

I am pleased to inform you that your loan application has been accepted by [Bank/Financial Institution Name]. Congratulations! We understand the significance of this financial decision and are honored that you have chosen us to support you in achieving your goals.

After careful review of your application and the accompanying documentation, we are confident in your ability to manage the loan responsibly and believe that you meet our lending criteria. Your financial history, creditworthiness, and repayment capacity have all been taken into account in the evaluation process.

Details of your loan offer:

Loan Amount: $[Loan Amount]

Interest Rate: [Interest Rate]%

Loan Term: [Loan Term in Months/Years]

Monthly Installment: $[Monthly Installment Amount]

Loan Purpose: [Purpose of Loan]

Please be advised that the loan offer is subject to the terms and conditions outlined in the loan agreement. We recommend that you carefully read and understand all the terms before proceeding with the loan acceptance.

If you agree with the terms, kindly sign the enclosed copy of the loan agreement and return it to us by [Date]. You can send the signed documents by mail or visit our nearest branch to submit them in person. Additionally, make sure to enclose any other required documents mentioned in the agreement.

Once we receive the signed documents and necessary information, our team will work diligently to finalize the loan disbursement process promptly. You will be notified of the exact date when the loan amount will be credited to your account.

If you have any questions or require further clarification regarding the loan agreement or any other aspect of the loan, please do not hesitate to contact our customer service team at [Customer Service Phone Number] or [Customer Service Email Address].

We genuinely appreciate your trust in our institution and the opportunity to be a part of your financial journey. We are committed to providing exceptional service and ensuring that your borrowing experience with us is smooth and hassle-free.

Thank you for choosing [Bank/Financial Institution Name]. We look forward to serving you and helping you achieve your financial aspirations.

Best regards,

[Your Name]

[Your Job Title]

[Bank/Financial Institution Name]

[Contact Information: Phone Number and Email]

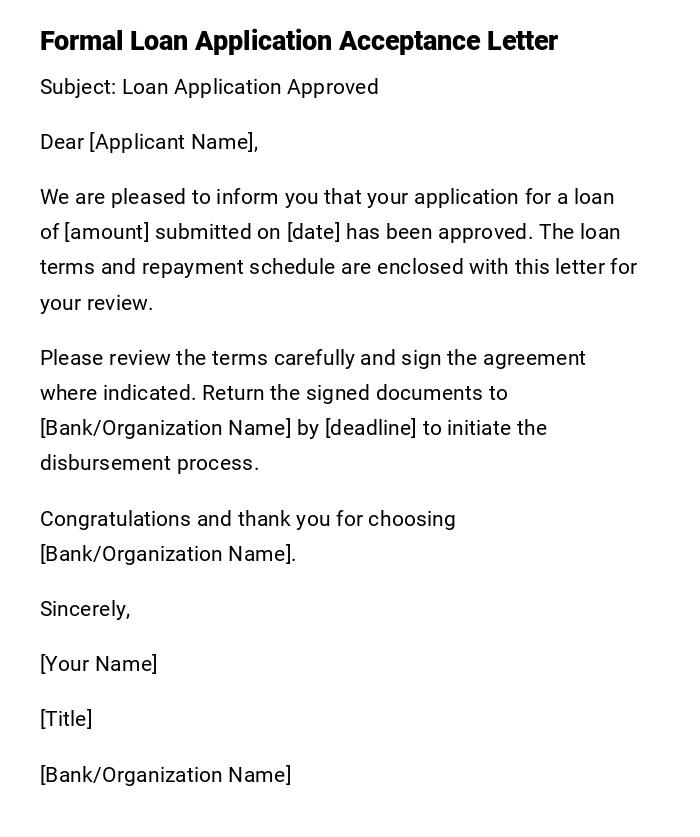

Formal Loan Application Acceptance Letter

Subject: Loan Application Approved

Dear [Applicant Name],

We are pleased to inform you that your application for a loan of [amount] submitted on [date] has been approved. The loan terms and repayment schedule are enclosed with this letter for your review.

Please review the terms carefully and sign the agreement where indicated. Return the signed documents to [Bank/Organization Name] by [deadline] to initiate the disbursement process.

Congratulations and thank you for choosing [Bank/Organization Name].

Sincerely,

[Your Name]

[Title]

[Bank/Organization Name]

Informal Quick Loan Approval Email

Subject: Your Loan Has Been Approved!

Hi [Applicant Name],

Good news! Your loan application for [amount] has been approved. Check the attached document for the repayment details and next steps.

Please sign and return the agreement at your earliest convenience so we can process your funds.

Thanks,

[Your Name]

[Bank/Organization Name]

Conditional Loan Acceptance Letter

Subject: Conditional Loan Approval

Dear [Applicant Name],

Your loan application for [amount] has been provisionally approved pending submission of the following documents: [list required documents].

Once we receive these documents and verify them, we will proceed with final approval and disbursement. Please submit the documents by [deadline] to avoid delays.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Title]

[Bank/Organization Name]

Heartfelt Loan Approval Letter for Special Circumstances

Subject: Loan Application Approval

Dear [Applicant Name],

We are happy to inform you that your loan request for [amount] has been approved. We understand the importance of this loan for your [specific purpose, e.g., home, education, business] and hope it brings you closer to your goals.

Enclosed are the terms and repayment schedule. Please review and sign the documents to proceed with the disbursement.

Warm regards,

[Your Name]

[Title]

[Bank/Organization Name]

Official Loan Acceptance Letter with Terms

Subject: Official Notification of Loan Approval

Dear [Applicant Name],

This letter confirms the approval of your loan application for [amount] dated [application date]. The approved interest rate is [interest rate] with a repayment term of [term].

Please find the loan agreement attached, outlining all terms and conditions. Sign and return the agreement by [deadline] to enable disbursement.

Thank you for choosing [Bank/Organization Name].

Sincerely,

[Your Name]

[Title]

[Bank/Organization Name]

What is a Loan Application Acceptance Letter and why it is important

A Loan Application Acceptance Letter is an official notification issued to inform a borrower that their loan request has been approved.

Purpose:

- Formally communicate approval of the loan

- Provide loan terms, interest rate, and repayment schedule

- Serve as a legal record of approval and conditions

- Guide the borrower on next steps to receive the funds

Who should send a Loan Application Acceptance Letter

- Banks, credit unions, or financial institutions

- Lending companies or microfinance organizations

- Mortgage brokers or loan officers acting on behalf of institutions

Whom should a Loan Application Acceptance Letter be addressed to

- Individual borrowers who applied for personal, business, or educational loans

- Joint applicants or co-borrowers if applicable

- Organizations or companies if the loan is business-related

When to send a Loan Application Acceptance Letter

- After the loan application has been fully reviewed and approved

- Once all conditions and eligibility criteria have been verified

- Prior to disbursement of funds to the borrower

Elements and Structure of a Loan Application Acceptance Letter

- Subject line indicating loan approval

- Greeting addressing the applicant

- Loan amount and type approved

- Terms and interest rate (if applicable)

- Conditions or requirements (if conditional approval)

- Next steps and deadlines for signing documents

- Closing and signature of authorized official

Requirements and Prerequisites before sending a Loan Application Acceptance Letter

- Verification of borrower eligibility

- Review of submitted documents and application forms

- Approval from authorized personnel or management

- Preparing loan agreement and schedule of repayment

Formatting and Tone of Loan Application Acceptance Letter

- Length: 1–2 pages maximum

- Tone: Professional, clear, and courteous

- Style: Formal for legal record, informal for email notification if appropriate

- Include: Signature, date, and official letterhead when possible

Common mistakes to avoid in a Loan Application Acceptance Letter

- Leaving out loan terms or repayment schedule

- Failing to specify any conditions for conditional approvals

- Using ambiguous language that can confuse the borrower

- Sending without authorized signatures or letterhead

After sending a Loan Application Acceptance Letter: follow-up

- Confirm receipt with the borrower via phone or email

- Monitor submission of signed agreements and required documents

- Schedule disbursement of funds upon completion of all prerequisites

- Keep a copy of the letter and signed documents for records

Tips for writing an effective Loan Application Acceptance Letter

- Be concise and direct about the approval and terms

- Highlight important deadlines and actions required by the borrower

- Use professional and courteous language

- Attach supporting documents such as loan agreements and repayment schedules

- Maintain a formal record for both the institution and borrower

Download Word Doc

Download Word Doc

Download PDF

Download PDF