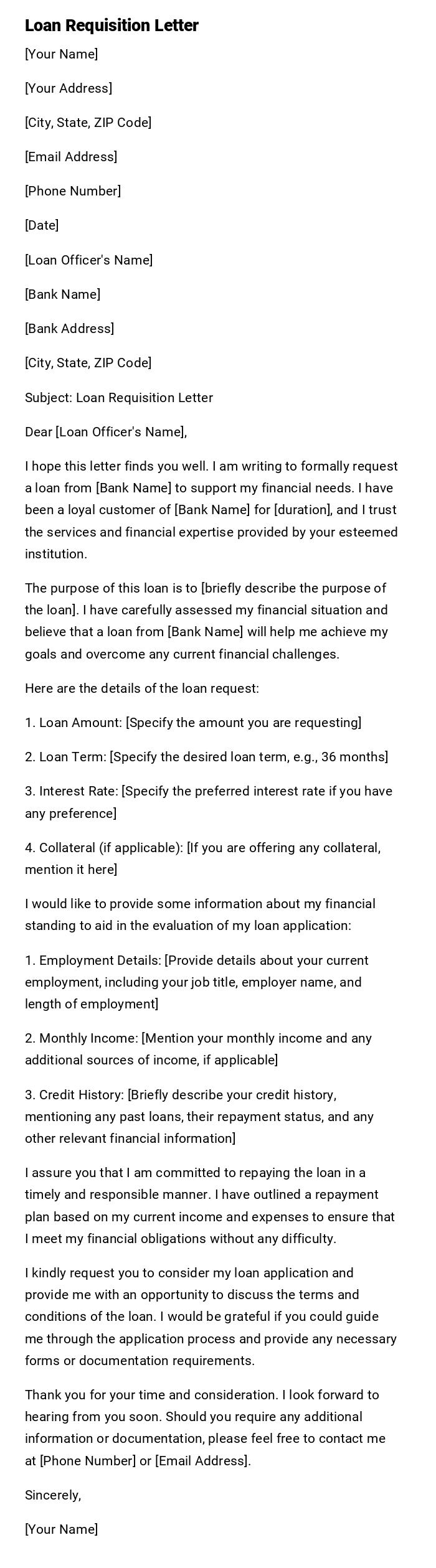

Loan Requisition Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Loan Officer's Name]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Subject: Loan Requisition Letter

Dear [Loan Officer's Name],

I hope this letter finds you well. I am writing to formally request a loan from [Bank Name] to support my financial needs. I have been a loyal customer of [Bank Name] for [duration], and I trust the services and financial expertise provided by your esteemed institution.

The purpose of this loan is to [briefly describe the purpose of the loan]. I have carefully assessed my financial situation and believe that a loan from [Bank Name] will help me achieve my goals and overcome any current financial challenges.

Here are the details of the loan request:

1. Loan Amount: [Specify the amount you are requesting]

2. Loan Term: [Specify the desired loan term, e.g., 36 months]

3. Interest Rate: [Specify the preferred interest rate if you have any preference]

4. Collateral (if applicable): [If you are offering any collateral, mention it here]

I would like to provide some information about my financial standing to aid in the evaluation of my loan application:

1. Employment Details: [Provide details about your current employment, including your job title, employer name, and length of employment]

2. Monthly Income: [Mention your monthly income and any additional sources of income, if applicable]

3. Credit History: [Briefly describe your credit history, mentioning any past loans, their repayment status, and any other relevant financial information]

I assure you that I am committed to repaying the loan in a timely and responsible manner. I have outlined a repayment plan based on my current income and expenses to ensure that I meet my financial obligations without any difficulty.

I kindly request you to consider my loan application and provide me with an opportunity to discuss the terms and conditions of the loan. I would be grateful if you could guide me through the application process and provide any necessary forms or documentation requirements.

Thank you for your time and consideration. I look forward to hearing from you soon. Should you require any additional information or documentation, please feel free to contact me at [Phone Number] or [Email Address].

Sincerely,

[Your Name]

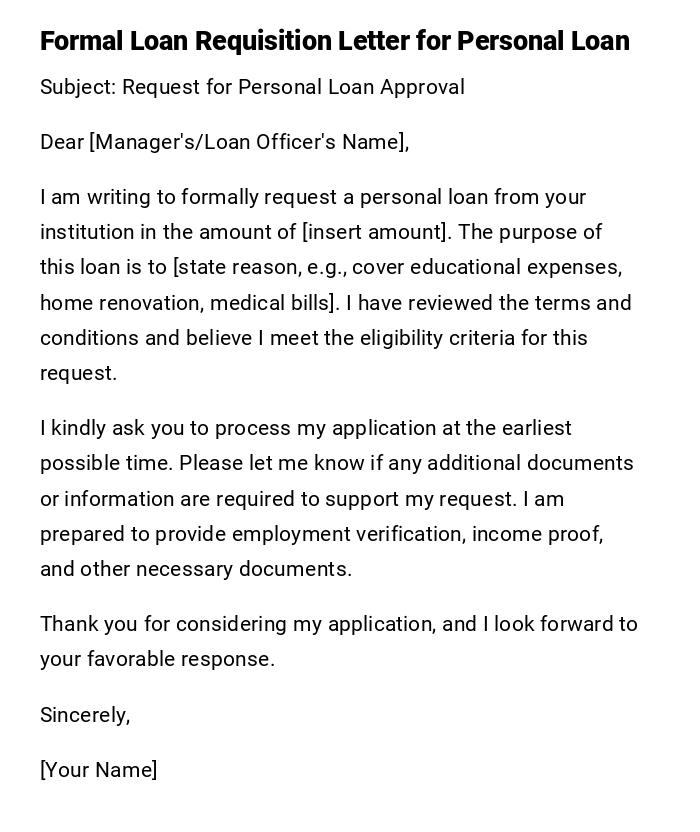

Formal Loan Requisition Letter for Personal Loan

Subject: Request for Personal Loan Approval

Dear [Manager's/Loan Officer's Name],

I am writing to formally request a personal loan from your institution in the amount of [insert amount]. The purpose of this loan is to [state reason, e.g., cover educational expenses, home renovation, medical bills]. I have reviewed the terms and conditions and believe I meet the eligibility criteria for this request.

I kindly ask you to process my application at the earliest possible time. Please let me know if any additional documents or information are required to support my request. I am prepared to provide employment verification, income proof, and other necessary documents.

Thank you for considering my application, and I look forward to your favorable response.

Sincerely,

[Your Name]

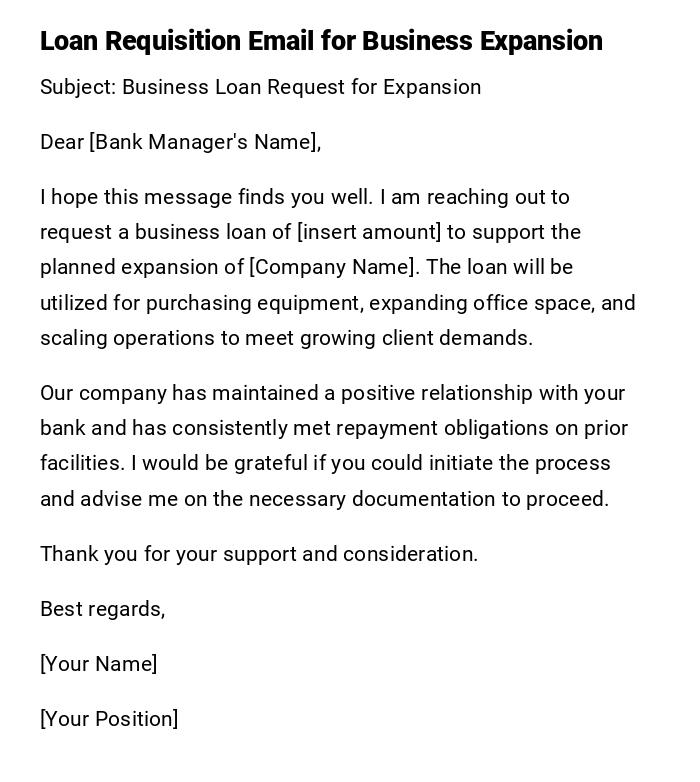

Loan Requisition Email for Business Expansion

Subject: Business Loan Request for Expansion

Dear [Bank Manager's Name],

I hope this message finds you well. I am reaching out to request a business loan of [insert amount] to support the planned expansion of [Company Name]. The loan will be utilized for purchasing equipment, expanding office space, and scaling operations to meet growing client demands.

Our company has maintained a positive relationship with your bank and has consistently met repayment obligations on prior facilities. I would be grateful if you could initiate the process and advise me on the necessary documentation to proceed.

Thank you for your support and consideration.

Best regards,

[Your Name]

[Your Position]

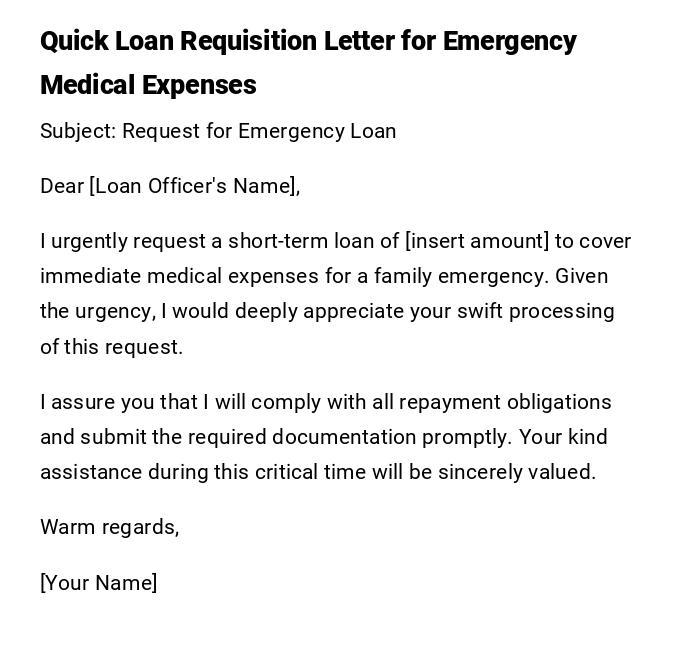

Quick Loan Requisition Letter for Emergency Medical Expenses

Subject: Request for Emergency Loan

Dear [Loan Officer's Name],

I urgently request a short-term loan of [insert amount] to cover immediate medical expenses for a family emergency. Given the urgency, I would deeply appreciate your swift processing of this request.

I assure you that I will comply with all repayment obligations and submit the required documentation promptly. Your kind assistance during this critical time will be sincerely valued.

Warm regards,

[Your Name]

Creative Loan Requisition Email for Education Loan

Subject: Education Loan Request to Support My Academic Journey

Dear [Loan Officer's Name],

I am reaching out with excitement and determination to request an education loan of [insert amount] to pursue my higher studies at [University/Institution Name]. This opportunity is a dream come true, and with your support, I will be able to finance tuition, accommodation, and study materials.

Education is an investment that yields lifelong returns, and I am committed to repaying this loan responsibly. Please let me know the steps I must take to complete this application.

Thank you in advance for helping me turn this dream into reality.

Sincerely,

[Your Name]

Professional Loan Requisition Letter for Vehicle Purchase

Subject: Vehicle Loan Request

Dear [Bank Manager's Name],

I am submitting this request for a loan of [insert amount] to purchase a vehicle. This vehicle is necessary for my daily commute and professional obligations. I have researched the repayment terms and am confident in my ability to meet them.

Attached are my salary slips, bank statements, and other documents for your review. I kindly request you to process my application at your earliest convenience.

Thank you for your assistance.

Respectfully,

[Your Name]

Casual Loan Requisition Message to Employer

Subject: Request for Salary Advance/Loan

Hi [Manager's Name],

I hope you’re doing well. I wanted to ask if I could request a loan/advance of [insert amount] from my salary due to some unexpected personal expenses. I will be able to repay this in installments as per company policy.

Please let me know if this is possible and what documents I need to provide.

Thanks so much for your understanding.

[Your Name]

Official Loan Requisition Letter for Government Housing Scheme

Subject: Housing Loan Request under Government Housing Scheme

Dear Sir/Madam,

I am writing to request a housing loan of [insert amount] under the [Name of Scheme] for the purchase of a residential property. I have reviewed the eligibility requirements and believe I qualify based on my income and employment status.

Enclosed with this letter are the necessary documents, including proof of identity, income certificate, and property details. Kindly review my application and let me know the next steps.

Thank you for your attention and cooperation.

Sincerely,

[Your Name]

Heartfelt Loan Requisition Email for Family Support

Subject: Personal Loan Request to Support Family Needs

Dear [Loan Officer's Name],

I am writing with humility to request a personal loan of [insert amount] to support my family’s immediate financial needs. This assistance would help us manage essential living expenses and maintain stability during a challenging time.

I assure you of my commitment to honor the repayment terms faithfully. I kindly request your understanding and expedited support in this matter.

With gratitude,

[Your Name]

What is a Loan Requisition Letter and why do you need it?

A loan requisition letter is a formal or informal request made to a bank, financial institution, or employer to borrow money for personal or business use. Its purpose is to explain the reason for borrowing, the amount needed, and the assurance of repayment. Without such a letter, loan requests may appear unstructured and less credible.

Who should send a loan requisition letter?

- Employees requesting salary advances or loans from employers.

- Business owners seeking expansion or equipment loans.

- Individuals applying for personal, housing, or education loans from banks.

- Families in need of financial support during emergencies.

Whom should the loan requisition letter be addressed to?

- Bank managers or loan officers in financial institutions.

- Employers or HR departments in workplaces.

- Government housing or education loan authorities.

- Family members or close contacts (in informal cases).

When should you send a loan requisition letter?

- When planning major purchases such as housing, vehicles, or equipment.

- During emergencies requiring urgent financial support.

- Before educational terms begin to cover tuition fees.

- When seeking salary advances due to personal needs.

- When participating in government-backed loan schemes.

How to write and send a loan requisition letter

- Begin with a clear subject line mentioning the loan request.

- State the amount you need and the purpose for which it will be used.

- Provide reassurance of repayment capability.

- Attach necessary documents like salary slips, bank statements, or identity proof.

- Keep the tone professional unless writing to an employer in an informal context.

- Submit via email, physical letter, or company system as appropriate.

Requirements and prerequisites before writing the letter

- Proof of income or salary slips.

- Bank account statements.

- Employment verification letters.

- Identity proof and address proof.

- Collateral information (for secured loans).

- Knowledge of loan terms and repayment ability.

Formatting guidelines for loan requisition letters

- Keep the length between one to two pages.

- Maintain a polite, professional, and respectful tone.

- Use formal language unless addressing a familiar manager casually.

- Ensure clarity in stating amount, purpose, and repayment plan.

- Use "Letter" for printed applications and "Email/Message" for digital communication.

After sending a loan requisition letter: follow-up actions

- Confirm with the recipient that the letter has been received.

- Provide additional documents if requested.

- Track the progress of your application.

- Send reminders if there is no response within a reasonable time.

- Be prepared for an interview or discussion regarding repayment terms.

Pros and cons of sending a loan requisition letter

Pros:

- Creates a formal record of the request.

- Demonstrates seriousness and professionalism.

- Improves chances of loan approval by being detailed.

Cons:

- May delay approval if incomplete.

- Requires preparation of documents.

- Might be rejected if not well-structured.

Common mistakes to avoid in loan requisition letters

- Failing to specify the exact loan amount.

- Not stating a clear purpose for the loan.

- Using an overly casual tone for formal institutions.

- Submitting without required supporting documents.

- Forgetting to sign or include contact details.

Elements and structure of a loan requisition letter

- Subject line mentioning the loan type.

- Opening greeting.

- Loan amount and reason for borrowing.

- Repayment assurance statement.

- List of attached documents.

- Closing remarks and signature.

Tricks and tips for effective loan requisition writing

- Keep sentences clear and concise.

- Always highlight your repayment ability.

- Personalize the letter to the recipient’s role.

- Submit applications well before deadlines.

- Double-check for errors before sending.

Download Word Doc

Download Word Doc

Download PDF

Download PDF