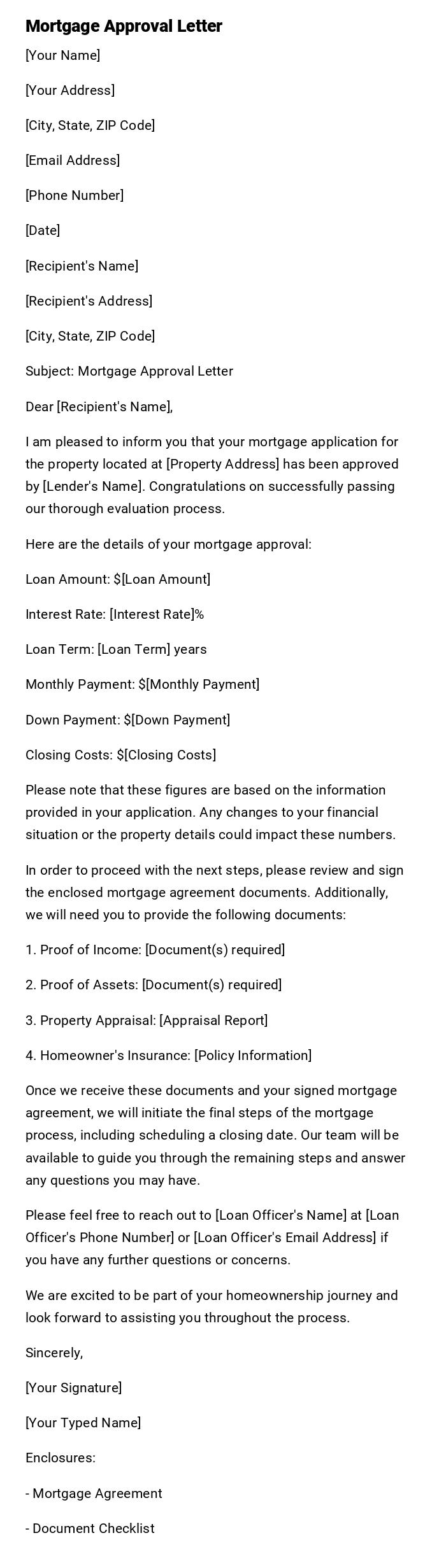

Mortgage Approval Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State, ZIP Code]

Subject: Mortgage Approval Letter

Dear [Recipient's Name],

I am pleased to inform you that your mortgage application for the property located at [Property Address] has been approved by [Lender's Name]. Congratulations on successfully passing our thorough evaluation process.

Here are the details of your mortgage approval:

Loan Amount: $[Loan Amount]

Interest Rate: [Interest Rate]%

Loan Term: [Loan Term] years

Monthly Payment: $[Monthly Payment]

Down Payment: $[Down Payment]

Closing Costs: $[Closing Costs]

Please note that these figures are based on the information provided in your application. Any changes to your financial situation or the property details could impact these numbers.

In order to proceed with the next steps, please review and sign the enclosed mortgage agreement documents. Additionally, we will need you to provide the following documents:

1. Proof of Income: [Document(s) required]

2. Proof of Assets: [Document(s) required]

3. Property Appraisal: [Appraisal Report]

4. Homeowner's Insurance: [Policy Information]

Once we receive these documents and your signed mortgage agreement, we will initiate the final steps of the mortgage process, including scheduling a closing date. Our team will be available to guide you through the remaining steps and answer any questions you may have.

Please feel free to reach out to [Loan Officer's Name] at [Loan Officer's Phone Number] or [Loan Officer's Email Address] if you have any further questions or concerns.

We are excited to be part of your homeownership journey and look forward to assisting you throughout the process.

Sincerely,

[Your Signature]

[Your Typed Name]

Enclosures:

- Mortgage Agreement

- Document Checklist

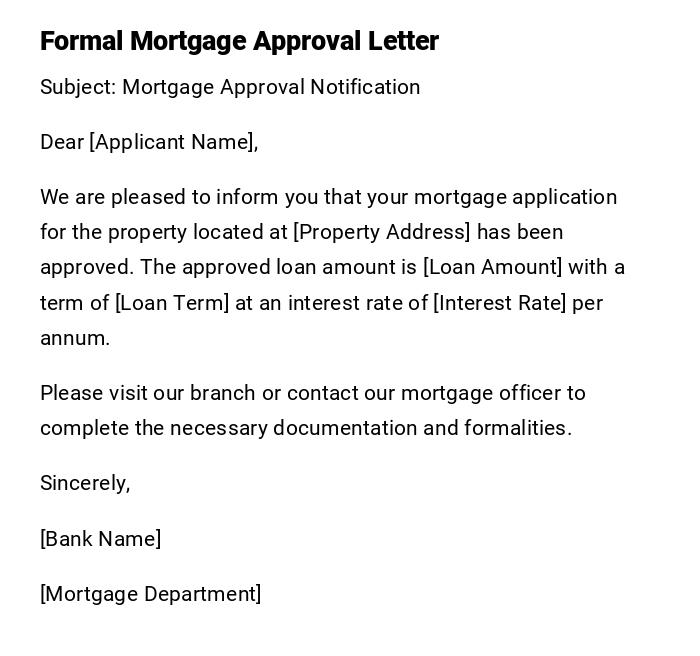

Formal Mortgage Approval Letter

Subject: Mortgage Approval Notification

Dear [Applicant Name],

We are pleased to inform you that your mortgage application for the property located at [Property Address] has been approved. The approved loan amount is [Loan Amount] with a term of [Loan Term] at an interest rate of [Interest Rate] per annum.

Please visit our branch or contact our mortgage officer to complete the necessary documentation and formalities.

Sincerely,

[Bank Name]

[Mortgage Department]

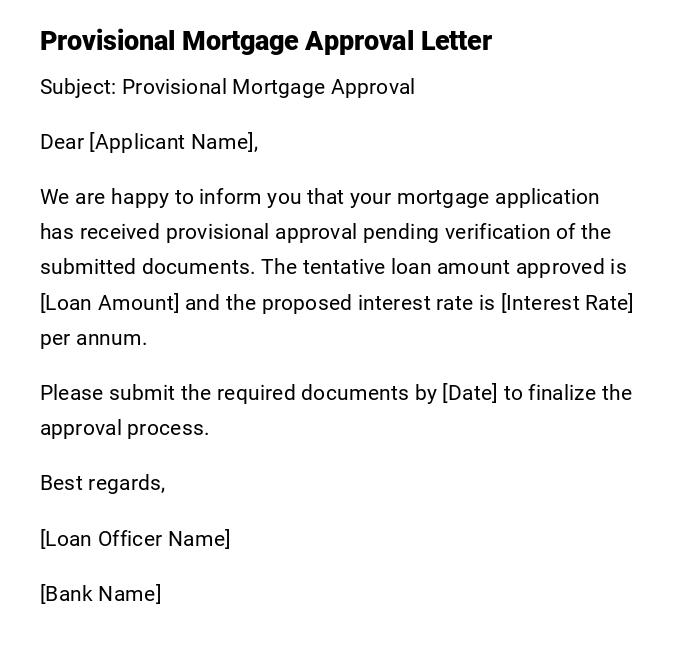

Provisional Mortgage Approval Letter

Subject: Provisional Mortgage Approval

Dear [Applicant Name],

We are happy to inform you that your mortgage application has received provisional approval pending verification of the submitted documents. The tentative loan amount approved is [Loan Amount] and the proposed interest rate is [Interest Rate] per annum.

Please submit the required documents by [Date] to finalize the approval process.

Best regards,

[Loan Officer Name]

[Bank Name]

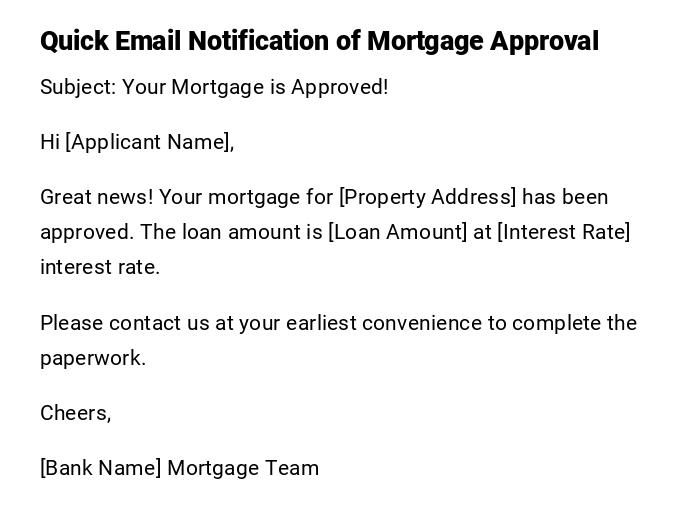

Quick Email Notification of Mortgage Approval

Subject: Your Mortgage is Approved!

Hi [Applicant Name],

Great news! Your mortgage for [Property Address] has been approved. The loan amount is [Loan Amount] at [Interest Rate] interest rate.

Please contact us at your earliest convenience to complete the paperwork.

Cheers,

[Bank Name] Mortgage Team

Heartfelt Mortgage Approval Letter

Subject: Congratulations on Your Mortgage Approval

Dear [Applicant Name],

It is our pleasure to inform you that your mortgage application has been successfully approved. We understand that purchasing a home is a major milestone, and we are honored to be part of this exciting journey with you.

Please contact our office to schedule the next steps for documentation and disbursement.

Warm regards,

[Bank Manager Name]

[Bank Name]

Official Mortgage Approval Letter for Documentation

Subject: Official Mortgage Approval

Dear [Applicant Name],

This letter serves as official confirmation that your mortgage application for [Property Address] has been approved. The sanctioned amount is [Loan Amount], with terms and conditions as outlined in the mortgage agreement.

Please proceed to submit all required documentation for the release of funds.

Sincerely,

[Authorized Signatory]

[Bank Name]

[Mortgage Department]

What is a Mortgage Approval Letter and Why It Is Important

A Mortgage Approval Letter is an official document issued by a financial institution confirming that a mortgage loan application has been approved.

Its purposes include:

- Providing legal confirmation for the applicant to proceed with the property purchase.

- Outlining approved loan amount, interest rate, and repayment terms.

- Serving as proof of financial capability for sellers or real estate agents.

Who Should Send a Mortgage Approval Letter

- Mortgage officers or loan officers.

- Branch managers or authorized bank officials.

- Financial institution’s credit department.

- Authorized representatives responsible for loan communications.

Whom to Address a Mortgage Approval Letter

- The individual or entity who applied for the mortgage.

- Co-applicants if applicable.

- Legal representatives or real estate agents in certain scenarios.

When to Send a Mortgage Approval Letter

- Upon final approval of the mortgage application.

- After preliminary approval if the letter specifies conditions.

- Before the disbursement of funds to the property seller.

- After verification of all required documentation is complete.

How to Write and Send a Mortgage Approval Letter

- Begin with a clear subject line indicating mortgage approval.

- Address the applicant by name and include property details.

- Specify loan amount, interest rate, and loan term.

- Mention any conditions or requirements if applicable.

- Provide instructions for completing documentation.

- Sign the letter with an authorized bank official and include contact details.

Formatting Guidelines for Mortgage Approval Letters

- Length: 150–300 words for clarity and completeness.

- Tone: Formal, professional, and clear.

- Style: Structured, precise, and legally compliant.

- Mode: Printed letter for official purposes; email acceptable for initial notification.

- Include: Subject, applicant details, loan details, terms, instructions, and authorized signature.

Requirements and Prerequisites Before Sending a Mortgage Approval Letter

- Full verification of the applicant’s financial and personal information.

- Approval of loan amount, interest rate, and terms by the credit department.

- Confirmation of property details and legal ownership documents.

- Authorization from the bank’s lending authority.

After Sending a Mortgage Approval Letter

- Follow up with the applicant to ensure documentation is completed.

- Confirm receipt of the letter and resolve any queries.

- Schedule fund disbursement or loan account setup.

- Keep a record of the letter for legal and administrative purposes.

Common Mistakes in Mortgage Approval Letters

- Omitting important loan details such as interest rate or term.

- Using informal or unclear language in a formal context.

- Sending approval before verifying documents or authorization.

- Failing to mention conditions of approval or next steps.

- Not including contact information for follow-up questions.

Elements and Structure of a Mortgage Approval Letter

- Opening: Greeting and subject line indicating approval.

- Applicant Information: Name, property address, and application details.

- Approval Statement: Confirmation of mortgage approval with loan amount.

- Terms & Conditions: Interest rate, loan term, and any special conditions.

- Instructions: Steps for submitting documentation and fund disbursement.

- Closing: Authorized signature and contact details.

- Optional Attachments: Mortgage agreement, documentation checklist, or payment schedule.

Tips and Best Practices for Mortgage Approval Letters

- Ensure accuracy in all financial figures and property details.

- Use professional formatting to convey credibility.

- Clarify all terms and conditions to avoid misunderstandings.

- Send promptly once approval is granted.

- Maintain a copy for both bank records and applicant reference.

FAQ About Mortgage Approval Letters

-

Q: Can a mortgage approval letter be provisional?

A: Yes, provisional letters indicate pending verification of documents or conditions. -

Q: Does the letter serve as a legal guarantee?

A: It confirms approval, but final disbursement depends on fulfilling all conditions. -

Q: Can it be sent via email?

A: Initial notifications can be emailed, but formal letters are usually printed. -

Q: Who can sign the approval letter?

A: An authorized representative of the bank or financial institution.

Download Word Doc

Download Word Doc

Download PDF

Download PDF