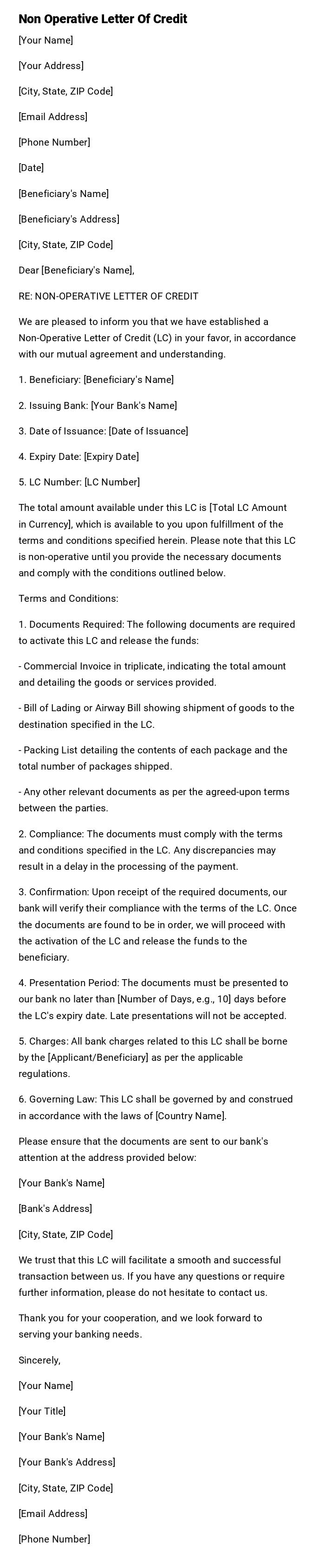

Non Operative Letter Of Credit

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Beneficiary's Name]

[Beneficiary's Address]

[City, State, ZIP Code]

Dear [Beneficiary's Name],

RE: NON-OPERATIVE LETTER OF CREDIT

We are pleased to inform you that we have established a Non-Operative Letter of Credit (LC) in your favor, in accordance with our mutual agreement and understanding.

1. Beneficiary: [Beneficiary's Name]

2. Issuing Bank: [Your Bank's Name]

3. Date of Issuance: [Date of Issuance]

4. Expiry Date: [Expiry Date]

5. LC Number: [LC Number]

The total amount available under this LC is [Total LC Amount in Currency], which is available to you upon fulfillment of the terms and conditions specified herein. Please note that this LC is non-operative until you provide the necessary documents and comply with the conditions outlined below.

Terms and Conditions:

1. Documents Required: The following documents are required to activate this LC and release the funds:

- Commercial Invoice in triplicate, indicating the total amount and detailing the goods or services provided.

- Bill of Lading or Airway Bill showing shipment of goods to the destination specified in the LC.

- Packing List detailing the contents of each package and the total number of packages shipped.

- Any other relevant documents as per the agreed-upon terms between the parties.

2. Compliance: The documents must comply with the terms and conditions specified in the LC. Any discrepancies may result in a delay in the processing of the payment.

3. Confirmation: Upon receipt of the required documents, our bank will verify their compliance with the terms of the LC. Once the documents are found to be in order, we will proceed with the activation of the LC and release the funds to the beneficiary.

4. Presentation Period: The documents must be presented to our bank no later than [Number of Days, e.g., 10] days before the LC's expiry date. Late presentations will not be accepted.

5. Charges: All bank charges related to this LC shall be borne by the [Applicant/Beneficiary] as per the applicable regulations.

6. Governing Law: This LC shall be governed by and construed in accordance with the laws of [Country Name].

Please ensure that the documents are sent to our bank's attention at the address provided below:

[Your Bank's Name]

[Bank's Address]

[City, State, ZIP Code]

We trust that this LC will facilitate a smooth and successful transaction between us. If you have any questions or require further information, please do not hesitate to contact us.

Thank you for your cooperation, and we look forward to serving your banking needs.

Sincerely,

[Your Name]

[Your Title]

[Your Bank's Name]

[Your Bank's Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

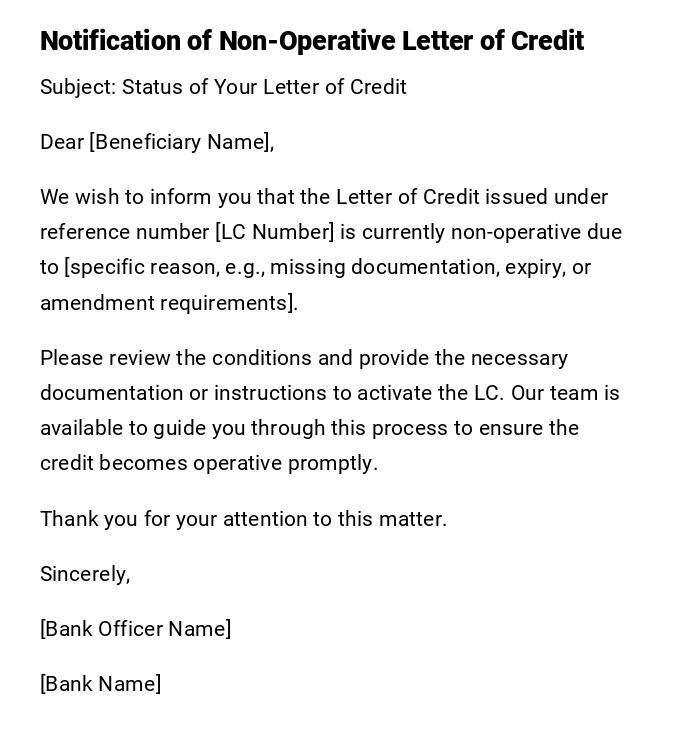

Notification of Non-Operative Letter of Credit

Subject: Status of Your Letter of Credit

Dear [Beneficiary Name],

We wish to inform you that the Letter of Credit issued under reference number [LC Number] is currently non-operative due to [specific reason, e.g., missing documentation, expiry, or amendment requirements].

Please review the conditions and provide the necessary documentation or instructions to activate the LC. Our team is available to guide you through this process to ensure the credit becomes operative promptly.

Thank you for your attention to this matter.

Sincerely,

[Bank Officer Name]

[Bank Name]

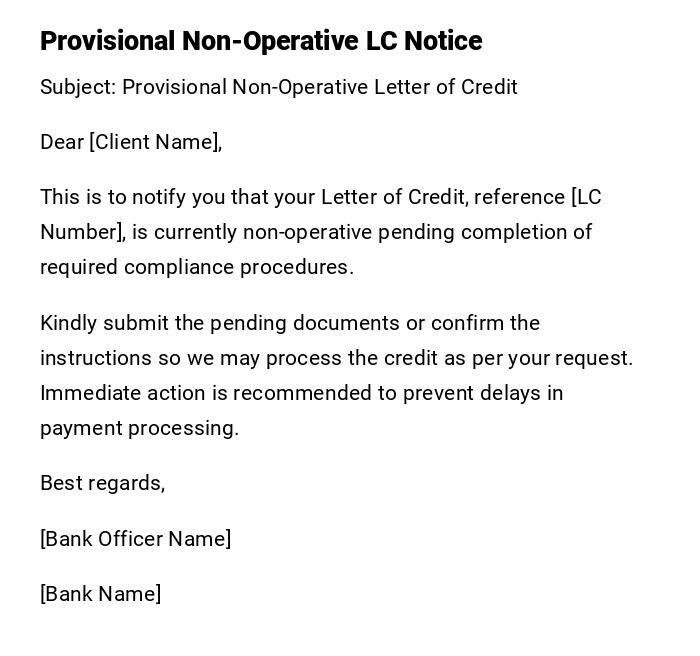

Provisional Non-Operative LC Notice

Subject: Provisional Non-Operative Letter of Credit

Dear [Client Name],

This is to notify you that your Letter of Credit, reference [LC Number], is currently non-operative pending completion of required compliance procedures.

Kindly submit the pending documents or confirm the instructions so we may process the credit as per your request. Immediate action is recommended to prevent delays in payment processing.

Best regards,

[Bank Officer Name]

[Bank Name]

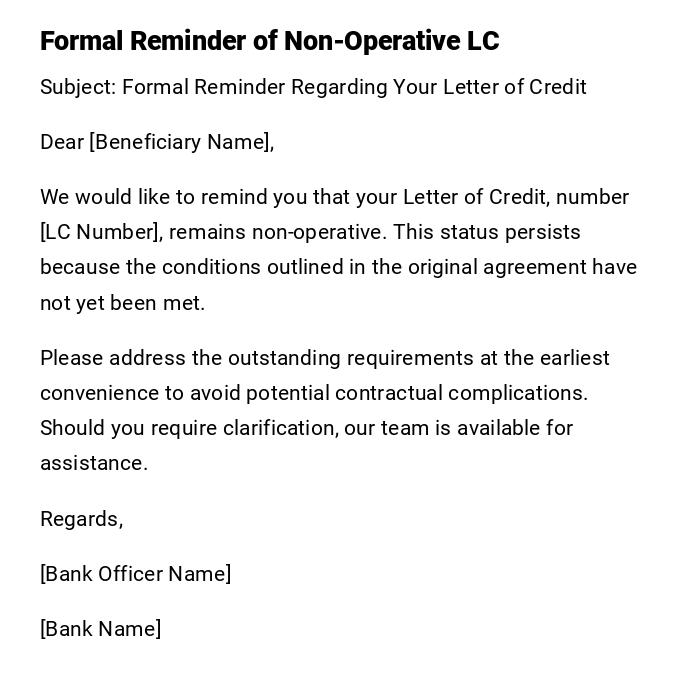

Formal Reminder of Non-Operative LC

Subject: Formal Reminder Regarding Your Letter of Credit

Dear [Beneficiary Name],

We would like to remind you that your Letter of Credit, number [LC Number], remains non-operative. This status persists because the conditions outlined in the original agreement have not yet been met.

Please address the outstanding requirements at the earliest convenience to avoid potential contractual complications. Should you require clarification, our team is available for assistance.

Regards,

[Bank Officer Name]

[Bank Name]

Informal Email About Non-Operative LC

Subject: Quick Update on Your LC Status

Hi [Client Name],

Just a quick note to let you know that your Letter of Credit [LC Number] is currently non-operative. We need a few documents to get it up and running.

Let us know if you need any help or guidance, and we’ll make sure this gets sorted quickly.

Thanks,

[Bank Officer Name]

Serious Notification of LC Deactivation

Subject: Immediate Attention Required – Non-Operative LC

Dear [Client Name],

This is a serious notification that your Letter of Credit, reference [LC Number], is non-operative and will remain so until compliance conditions are fulfilled. Non-action may result in forfeiture of LC benefits.

Please act immediately to provide the necessary documentation or clarify instructions. Your prompt attention will help avoid any financial or contractual inconvenience.

Sincerely,

[Bank Officer Name]

[Bank Name]

Non-Operative LC Follow-Up Message

Subject: Follow-Up on Non-Operative Letter of Credit

Dear [Beneficiary Name],

Following our previous communication, we remind you that your Letter of Credit [LC Number] is still non-operative. Timely submission of the required documents or instructions is essential for activation.

Please provide an update on your end to ensure seamless processing. We remain available for any assistance you may need.

Kind regards,

[Bank Officer Name]

[Bank Name]

What is a Non-Operative Letter of Credit and Why It Matters

- A Non-Operative Letter of Credit (LC) is an LC that has been issued but is not active for payment due to missing documentation, unmet conditions, or pending approvals.

- Purpose:

- Ensures clarity for beneficiaries about the status of payments.

- Protects banks and clients from premature transactions.

- Helps manage financial risk and contractual obligations.

Who Should Issue a Non-Operative LC Notification

- Typically issued by the bank or financial institution that opened the LC.

- Can also be initiated by an intermediary or compliance officer responsible for monitoring LC activation.

Whom the Non-Operative LC Letter Should Be Addressed To

- Beneficiaries of the LC who are expecting payment.

- Clients or importers who requested the LC.

- Occasionally, corporate compliance teams involved in LC transactions.

When to Send a Non-Operative LC Notification

- When an LC has been issued but conditions are not yet satisfied.

- Upon expiry or near-expiry of the LC without activation.

- If amendments or corrections are required to documents.

- When compliance or regulatory issues prevent activation.

How to Write a Non-Operative LC Letter

- Begin with a clear subject line indicating the non-operative status.

- Address the recipient politely but firmly.

- Explain the reason for non-operation in concise terms.

- List any actions required to activate the LC.

- Include contact information for follow-up or assistance.

- Close with a formal or professional tone appropriate to the relationship.

Requirements and Prerequisites Before Sending the Letter

- Accurate LC reference number and issuance details.

- Identification of missing documents or unmet conditions.

- Bank authorization to communicate the non-operative status.

- Understanding of regulatory or contractual requirements affecting LC activation.

Elements and Structure of a Non-Operative LC Letter

- Subject line stating non-operative status.

- Salutation addressing the beneficiary or client.

- Explanation of why the LC is non-operative.

- List of actions or documents needed for activation.

- Contact details for further assistance.

- Formal closing and sign-off.

Formatting and Tone Guidelines

- Length: 1–2 paragraphs for email, 1 page for formal letter.

- Tone: professional, formal, or serious depending on context.

- Mode: email for quick notifications, printed letter for formal records.

- Wording: concise, clear, and devoid of ambiguity.

Tricks and Tips for Effective Communication

- Use clear subject lines like "Non-Operative LC – Action Required".

- Include deadlines or timelines if applicable.

- Maintain a polite but firm tone to ensure compliance.

- Attach any reference documents to avoid confusion.

- Keep a record of communications for audit purposes.

Common Mistakes to Avoid

- Failing to specify the reason for non-operation.

- Using vague language that confuses the recipient.

- Omitting LC reference numbers or essential dates.

- Delaying notification, which may affect payment schedules.

- Not providing guidance for corrective action.

After Sending the Letter: Follow-Up Steps

- Monitor response from the beneficiary or client.

- Verify submission of required documents.

- Coordinate with the compliance or operations team for activation.

- Send reminders if deadlines are approaching.

- Keep detailed records of all follow-up communications.

Pros and Cons of Sending Non-Operative LC Letters

Pros:

- Clarifies the status and prevents misunderstandings.

- Helps manage risk for banks and clients.

- Encourages timely submission of required documentation.

Cons:

- May cause temporary concern or confusion for beneficiaries.

- Requires careful wording to maintain professional relationships.

Does Sending a Non-Operative LC Letter Require Authorization?

- Yes, it generally requires authorization from the issuing bank or LC officer.

- Internal approval ensures that the communication is consistent with legal and contractual obligations.

- Some cases may require additional attestation for regulatory compliance or international trade standards.

FAQ About Non-Operative Letters of Credit

-

Q: Can a non-operative LC be activated later?

A: Yes, once all conditions are met and required documents are submitted. -

Q: Who is responsible for providing missing documents?

A: Typically, the beneficiary or applicant, depending on the LC terms. -

Q: What happens if a non-operative LC is ignored?

A: Payment may be delayed or forfeited, depending on LC expiration and terms. -

Q: Can banks modify a non-operative LC?

A: Yes, amendments can be requested to correct or complete conditions for activation.

Download Word Doc

Download Word Doc

Download PDF

Download PDF