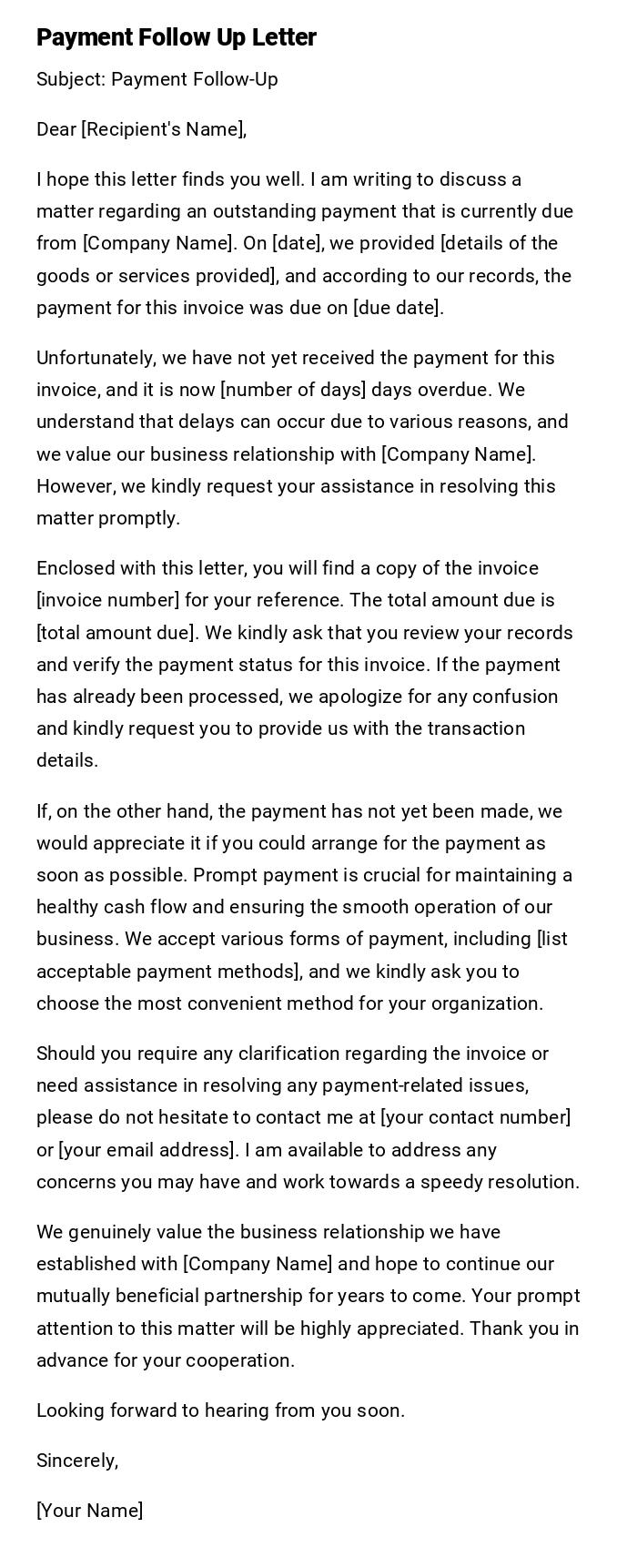

Payment Follow Up Letter

Subject: Payment Follow-Up

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to discuss a matter regarding an outstanding payment that is currently due from [Company Name]. On [date], we provided [details of the goods or services provided], and according to our records, the payment for this invoice was due on [due date].

Unfortunately, we have not yet received the payment for this invoice, and it is now [number of days] days overdue. We understand that delays can occur due to various reasons, and we value our business relationship with [Company Name]. However, we kindly request your assistance in resolving this matter promptly.

Enclosed with this letter, you will find a copy of the invoice [invoice number] for your reference. The total amount due is [total amount due]. We kindly ask that you review your records and verify the payment status for this invoice. If the payment has already been processed, we apologize for any confusion and kindly request you to provide us with the transaction details.

If, on the other hand, the payment has not yet been made, we would appreciate it if you could arrange for the payment as soon as possible. Prompt payment is crucial for maintaining a healthy cash flow and ensuring the smooth operation of our business. We accept various forms of payment, including [list acceptable payment methods], and we kindly ask you to choose the most convenient method for your organization.

Should you require any clarification regarding the invoice or need assistance in resolving any payment-related issues, please do not hesitate to contact me at [your contact number] or [your email address]. I am available to address any concerns you may have and work towards a speedy resolution.

We genuinely value the business relationship we have established with [Company Name] and hope to continue our mutually beneficial partnership for years to come. Your prompt attention to this matter will be highly appreciated. Thank you in advance for your cooperation.

Looking forward to hearing from you soon.

Sincerely,

[Your Name]

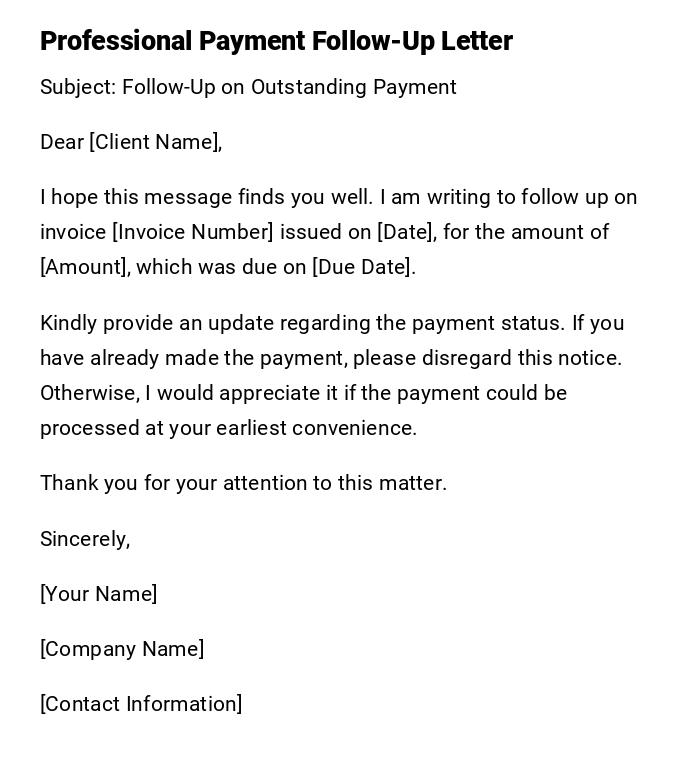

Professional Payment Follow-Up Letter

Subject: Follow-Up on Outstanding Payment

Dear [Client Name],

I hope this message finds you well. I am writing to follow up on invoice [Invoice Number] issued on [Date], for the amount of [Amount], which was due on [Due Date].

Kindly provide an update regarding the payment status. If you have already made the payment, please disregard this notice. Otherwise, I would appreciate it if the payment could be processed at your earliest convenience.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Company Name]

[Contact Information]

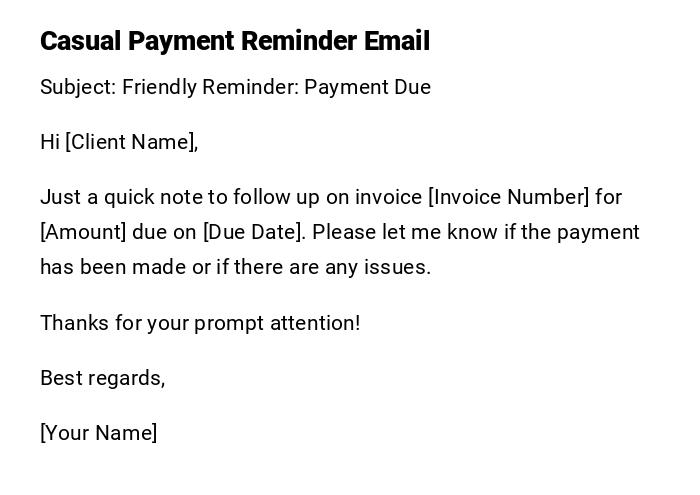

Casual Payment Reminder Email

Subject: Friendly Reminder: Payment Due

Hi [Client Name],

Just a quick note to follow up on invoice [Invoice Number] for [Amount] due on [Due Date]. Please let me know if the payment has been made or if there are any issues.

Thanks for your prompt attention!

Best regards,

[Your Name]

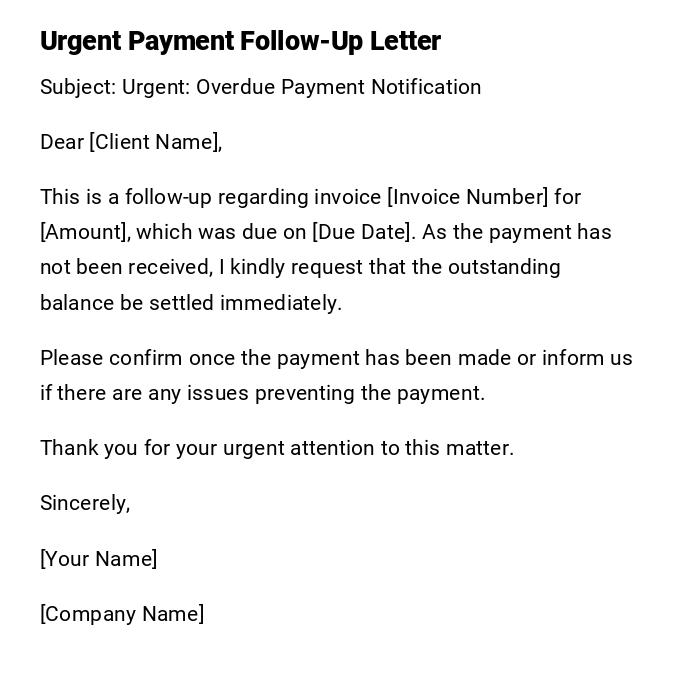

Urgent Payment Follow-Up Letter

Subject: Urgent: Overdue Payment Notification

Dear [Client Name],

This is a follow-up regarding invoice [Invoice Number] for [Amount], which was due on [Due Date]. As the payment has not been received, I kindly request that the outstanding balance be settled immediately.

Please confirm once the payment has been made or inform us if there are any issues preventing the payment.

Thank you for your urgent attention to this matter.

Sincerely,

[Your Name]

[Company Name]

Heartfelt Payment Follow-Up Email

Subject: Follow-Up on Payment Status

Dear [Client Name],

I hope all is well. I wanted to follow up on the payment for invoice [Invoice Number] totaling [Amount] due on [Due Date]. I understand unforeseen circumstances may arise, so please let me know if you require any assistance.

Your prompt attention to this matter would be greatly appreciated.

Warm regards,

[Your Name]

Polite Reminder Payment Follow-Up Letter

Subject: Payment Reminder for Invoice [Invoice Number]

Dear [Client Name],

This letter serves as a polite reminder regarding the pending payment of [Amount] for invoice [Invoice Number], originally due on [Due Date]. We would greatly appreciate your prompt action in settling this outstanding balance.

Please contact us if you have already processed the payment or require any clarification regarding this invoice.

Thank you for your cooperation.

Sincerely,

[Your Name]

[Contact Information]

What is a Payment Follow-Up Letter and Why It Is Important

A payment follow-up letter is a formal or informal communication sent to clients or customers to remind them of an overdue payment.

It is used to:

- Ensure timely payment and maintain cash flow

- Document communication for accounting and legal purposes

- Maintain professional relations while addressing outstanding debts

Who Should Send a Payment Follow-Up Letter

- Business owners or managers requesting overdue payments

- Accountants or finance officers handling receivables

- Freelancers or service providers following up with clients

Whom Should the Payment Follow-Up Letter Be Addressed To

- Clients who have received products or services

- Companies or organizations with outstanding invoices

- Individuals who have agreed to payment terms but have delayed payment

When to Send a Payment Follow-Up Letter

- Immediately after the payment due date passes

- Before escalating to collections or legal action

- As part of a scheduled payment reminder strategy (e.g., 3, 7, 14 days after due date)

How to Write and Send a Payment Follow-Up Letter

- Start with a clear subject line indicating the purpose

- Greet the recipient politely

- Specify the invoice number, amount, and due date

- Politely request payment and provide payment options

- Include contact information for any queries

- Send via email, postal mail, or company portal for documentation

Formatting Guidelines for Payment Follow-Up Letters

- Keep the letter concise and clear

- Tone: Polite, professional, or firm depending on context

- Style: Formal for corporate clients, casual for small businesses or known clients

- Mode: Email for speed, printed letter for official records

- Include: Invoice number, payment amount, due date, and contact details

Requirements and Prerequisites Before Sending a Payment Follow-Up

- Confirm the outstanding amount and invoice details

- Verify that payment has not been received

- Keep records of previous communications regarding the invoice

- Prepare a clear, polite, and professional message

Tricks and Tips for Effective Payment Follow-Up

- Use automated reminders for recurring invoices

- Include multiple payment options to make it easy for the client

- Maintain a polite but firm tone to encourage prompt payment

- Keep a record of follow-ups for legal or accounting purposes

- Send reminders promptly but spaced appropriately to avoid annoyance

Common Mistakes to Avoid in Payment Follow-Up Letters

- Being aggressive or accusatory

- Failing to include key invoice details

- Forgetting to provide contact information for inquiries

- Delaying follow-ups too long after the due date

- Using vague language that does not specify the payment required

Elements and Structure of a Payment Follow-Up Letter

- Subject line indicating follow-up or overdue payment

- Polite greeting to the recipient

- Statement of invoice details (number, amount, due date)

- Clear request for payment with preferred method

- Closing remarks thanking the recipient

- Sender’s name, title, and contact information

FAQ About Payment Follow-Up Letters

Q: How many follow-ups should I send before taking further action?

A: Typically 2–3 reminders are sufficient before escalation.

Q: Can I send a follow-up for partial payments?

A: Yes, indicate the remaining balance and encourage completion.

Q: Should I send follow-ups via email or post?

A: Email is faster and efficient; postal mail is useful for official documentation.

Q: Is it appropriate to offer a payment plan?

A: Yes, suggesting a structured payment plan can encourage timely payment.

Download Word Doc

Download Word Doc

Download PDF

Download PDF