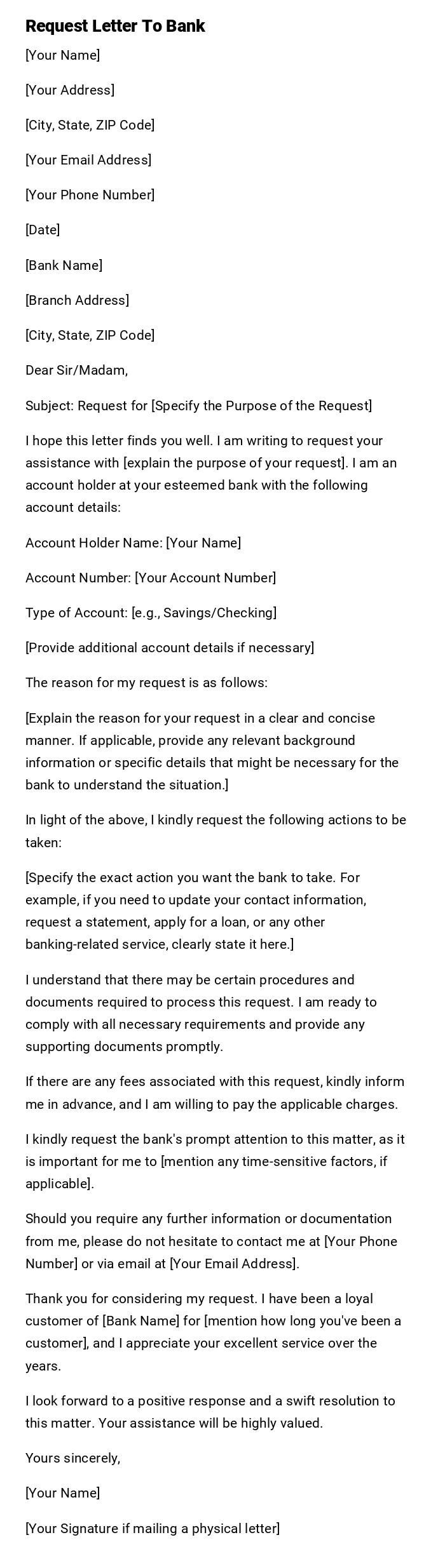

Request Letter To Bank

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Your Email Address]

[Your Phone Number]

[Date]

[Bank Name]

[Branch Address]

[City, State, ZIP Code]

Dear Sir/Madam,

Subject: Request for [Specify the Purpose of the Request]

I hope this letter finds you well. I am writing to request your assistance with [explain the purpose of your request]. I am an account holder at your esteemed bank with the following account details:

Account Holder Name: [Your Name]

Account Number: [Your Account Number]

Type of Account: [e.g., Savings/Checking]

[Provide additional account details if necessary]

The reason for my request is as follows:

[Explain the reason for your request in a clear and concise manner. If applicable, provide any relevant background information or specific details that might be necessary for the bank to understand the situation.]

In light of the above, I kindly request the following actions to be taken:

[Specify the exact action you want the bank to take. For example, if you need to update your contact information, request a statement, apply for a loan, or any other banking-related service, clearly state it here.]

I understand that there may be certain procedures and documents required to process this request. I am ready to comply with all necessary requirements and provide any supporting documents promptly.

If there are any fees associated with this request, kindly inform me in advance, and I am willing to pay the applicable charges.

I kindly request the bank's prompt attention to this matter, as it is important for me to [mention any time-sensitive factors, if applicable].

Should you require any further information or documentation from me, please do not hesitate to contact me at [Your Phone Number] or via email at [Your Email Address].

Thank you for considering my request. I have been a loyal customer of [Bank Name] for [mention how long you've been a customer], and I appreciate your excellent service over the years.

I look forward to a positive response and a swift resolution to this matter. Your assistance will be highly valued.

Yours sincerely,

[Your Name]

[Your Signature if mailing a physical letter]

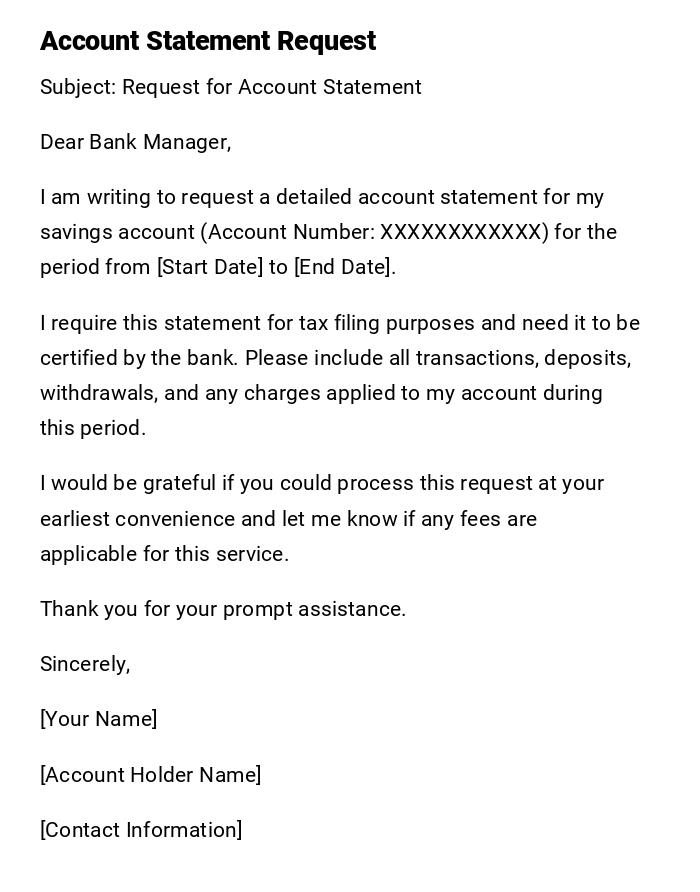

Account Statement Request Letter

Subject: Request for Account Statement

Dear Bank Manager,

I am writing to request a detailed account statement for my savings account (Account Number: XXXXXXXXXXXX) for the period from [Start Date] to [End Date].

I require this statement for tax filing purposes and need it to be certified by the bank. Please include all transactions, deposits, withdrawals, and any charges applied to my account during this period.

I would be grateful if you could process this request at your earliest convenience and let me know if any fees are applicable for this service.

Thank you for your prompt assistance.

Sincerely,

[Your Name]

[Account Holder Name]

[Contact Information]

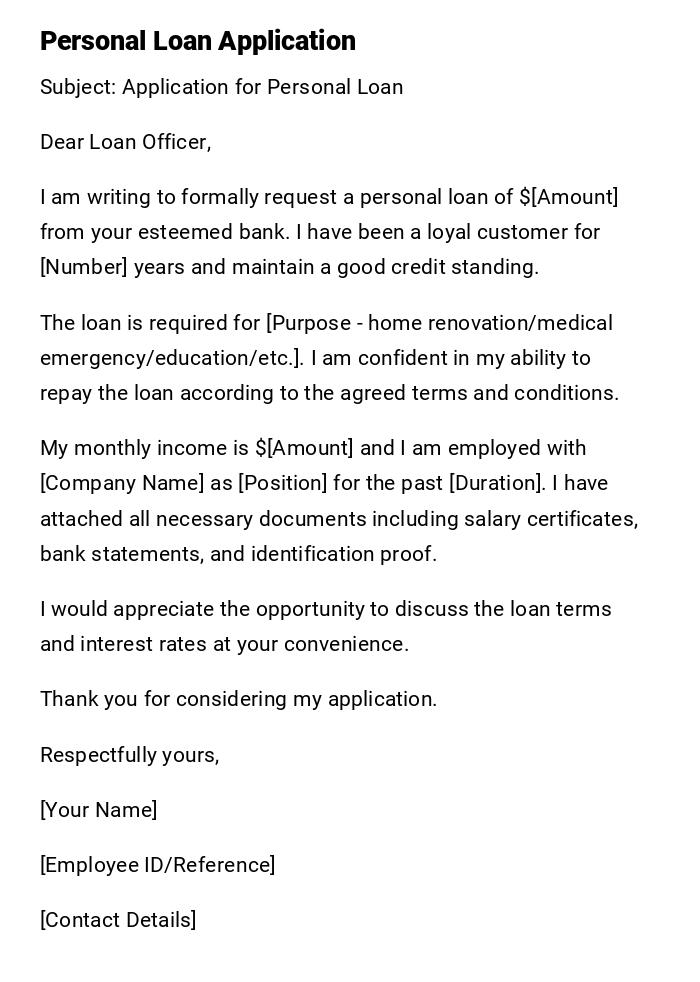

Loan Application Request Letter

Subject: Application for Personal Loan

Dear Loan Officer,

I am writing to formally request a personal loan of $[Amount] from your esteemed bank. I have been a loyal customer for [Number] years and maintain a good credit standing.

The loan is required for [Purpose - home renovation/medical emergency/education/etc.]. I am confident in my ability to repay the loan according to the agreed terms and conditions.

My monthly income is $[Amount] and I am employed with [Company Name] as [Position] for the past [Duration]. I have attached all necessary documents including salary certificates, bank statements, and identification proof.

I would appreciate the opportunity to discuss the loan terms and interest rates at your convenience.

Thank you for considering my application.

Respectfully yours,

[Your Name]

[Employee ID/Reference]

[Contact Details]

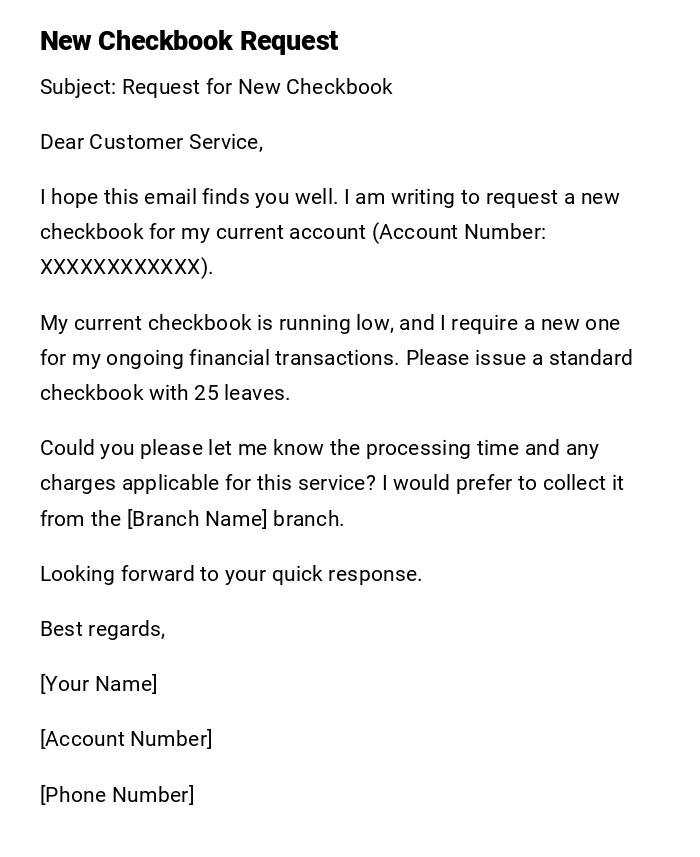

Check Book Request Email

Subject: Request for New Checkbook

Dear Customer Service,

I hope this email finds you well. I am writing to request a new checkbook for my current account (Account Number: XXXXXXXXXXXX).

My current checkbook is running low, and I require a new one for my ongoing financial transactions. Please issue a standard checkbook with 25 leaves.

Could you please let me know the processing time and any charges applicable for this service? I would prefer to collect it from the [Branch Name] branch.

Looking forward to your quick response.

Best regards,

[Your Name]

[Account Number]

[Phone Number]

Credit Card Request Message

Subject: Application for Credit Card

Dear Credit Card Department,

Greetings! I am interested in applying for a credit card with your bank. As a long-standing customer with excellent account history, I believe I would be eligible for your premium credit card services.

I am particularly interested in the [Card Type] due to its rewards program and benefits that align with my spending patterns. My annual income is $[Amount] and I have a stable employment history.

Please guide me through the application process and let me know what documents are required. I would also appreciate information about annual fees, interest rates, and credit limits.

Thank you for your time and assistance.

Warm regards,

[Your Name]

[Customer ID]

[Email Address]

Account Closure Request Letter

Subject: Request for Account Closure

Dear Branch Manager,

I am writing to formally request the closure of my savings account (Account Number: XXXXXXXXXXXX) due to my relocation to another city.

Please transfer the remaining balance of $[Amount] to my new account at [Bank Name], Account Number: [New Account Number], or issue a cashier's check payable to my name.

I have returned all unused checks and debit cards. Please confirm that all pending transactions have been cleared before processing the closure.

I have been satisfied with your services during my association with the bank and appreciate your prompt attention to this matter.

Sincerely,

[Your Name]

[Account Holder Signature]

[Date]

ATM Card Replacement Request

Subject: Urgent - ATM Card Replacement Request

Dear Sir/Madam,

I am writing to report the loss of my ATM card and request an immediate replacement. My card number ends with XXXX and is linked to account number XXXXXXXXXXXX.

I discovered the card was missing on [Date] and immediately called your customer service to block the card. Reference number for the blocking request is [Reference Number].

This situation is causing significant inconvenience as I rely heavily on the ATM card for daily transactions. I would greatly appreciate if you could expedite the replacement process.

Please let me know when the new card will be ready for collection and if there are any charges involved.

Thank you for your understanding and swift action.

Desperately yours,

[Your Name]

[Account Number]

[Contact Information]

Mortgage Pre-approval Request

Subject: Request for Mortgage Pre-approval

Dear Mortgage Department,

I am writing to request pre-approval for a home mortgage loan. I am planning to purchase a property valued at approximately $[Amount] and would like to secure financing through your bank.

As a responsible borrower with a stable income of $[Amount] annually, I believe I meet your lending criteria. I have maintained excellent credit history and have been banking with you for [Duration].

I am seeking a loan amount of $[Amount] for a [Duration]-year term. Please provide information about current interest rates, down payment requirements, and the pre-approval process.

I have attached preliminary financial documents and am prepared to provide additional documentation as needed.

I look forward to beginning this important financial journey with your institution.

Optimistically yours,

[Your Name]

[Employment Details]

[Assets Information]

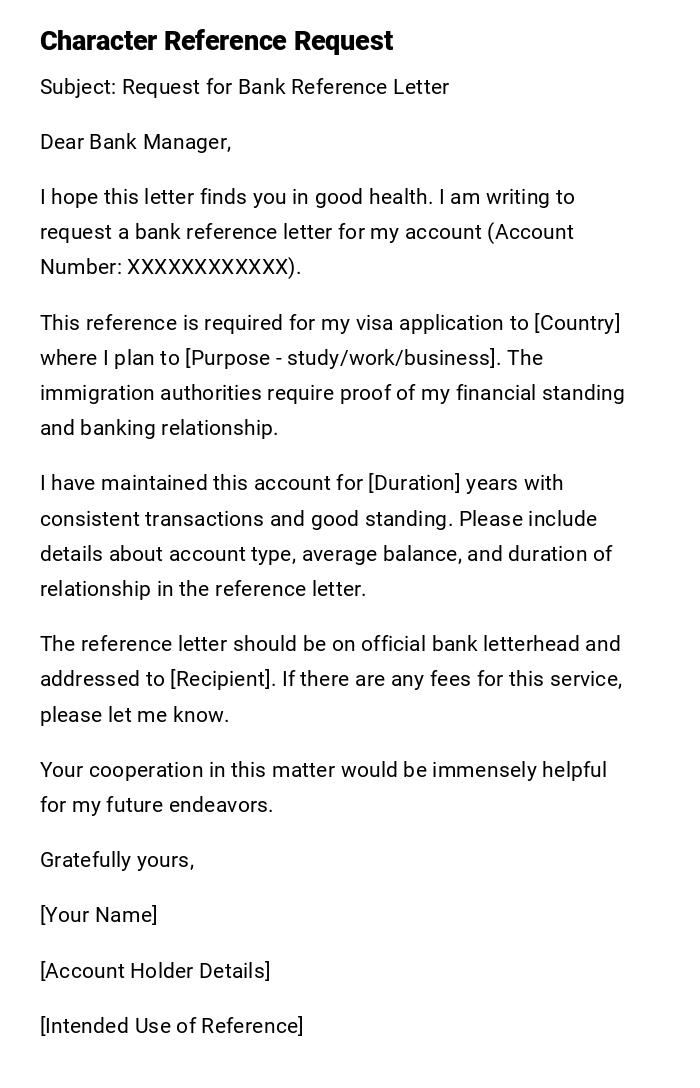

Bank Reference Letter Request

Subject: Request for Bank Reference Letter

Dear Bank Manager,

I hope this letter finds you in good health. I am writing to request a bank reference letter for my account (Account Number: XXXXXXXXXXXX).

This reference is required for my visa application to [Country] where I plan to [Purpose - study/work/business]. The immigration authorities require proof of my financial standing and banking relationship.

I have maintained this account for [Duration] years with consistent transactions and good standing. Please include details about account type, average balance, and duration of relationship in the reference letter.

The reference letter should be on official bank letterhead and addressed to [Recipient]. If there are any fees for this service, please let me know.

Your cooperation in this matter would be immensely helpful for my future endeavors.

Gratefully yours,

[Your Name]

[Account Holder Details]

[Intended Use of Reference]

What is a Request Letter to Bank and Why Do You Need It

A request letter to bank is a formal written communication from a customer to their banking institution seeking specific services, information, or assistance. These letters serve as official documentation of customer requests and create a paper trail for banking transactions and services. Banks require formal requests for various services to ensure proper authorization, maintain security protocols, and provide legal protection for both parties. Whether requesting account statements, loan applications, card replacements, or account closures, these letters demonstrate your identity verification and serious intent regarding financial matters.

When Do You Need to Send a Request Letter to Bank

Request letters to banks are typically required during several key scenarios:

- Opening or closing bank accounts

- Applying for loans, credit cards, or mortgages

- Requesting account statements or transaction history

- Reporting lost or stolen cards and requesting replacements

- Changing account details or personal information

- Requesting bank references for visa applications or employment

- Disputing unauthorized transactions or charges

- Requesting stop payment on checks

- Applying for overdraft facilities or credit line increases

- Seeking loan restructuring or payment deferrals during financial hardship

- Requesting foreign currency exchange or international transfer services

Who Should Send Bank Request Letters

Bank request letters should be sent by:

- Primary account holders for personal accounts

- Authorized signatories for business accounts

- Power of attorney holders with proper legal documentation

- Legal guardians for minor account holders

- Executors or administrators of estate accounts

- Company representatives with board authorization for corporate accounts

- Joint account holders (though some banks require all holders' signatures)

- Loan guarantors when requesting information about guaranteed loans

How to Write and Send Bank Request Letters

The process involves several systematic steps:

- Planning: Clearly identify your request and gather necessary information

- Documentation: Collect required supporting documents and identification

- Drafting: Write a clear, concise letter using professional language

- Review: Check for accuracy, completeness, and proper formatting

- Submission: Deliver through appropriate channels (in-person, mail, or email)

- Follow-up: Track your request and maintain communication with bank representatives

- Record-keeping: Maintain copies of all correspondence and responses

Always include account numbers, specific dates, amounts, and reference numbers when applicable. Use formal business letter format and maintain a respectful, professional tone throughout.

Requirements and Prerequisites Before Sending

Before submitting your request letter, ensure you have:

- Valid identification documents (passport, driver's license, national ID)

- Account information and numbers

- Recent bank statements or transaction records

- Proper authorization documents if acting on behalf of others

- Supporting financial documents for loan applications

- Contact information including current address and phone number

- Specific details about your request including dates, amounts, and purposes

- Knowledge of applicable fees and charges

- Understanding of bank's policies and procedures for your specific request

Formatting Guidelines and Best Practices

Effective bank request letters should follow these formatting principles:

- Length: Keep letters concise, typically one to two pages maximum

- Tone: Use formal, professional, and respectful language

- Structure: Include clear subject line, proper greeting, body paragraphs, and professional closing

- Font: Use standard fonts like Arial or Times New Roman, size 11-12

- Spacing: Single-spaced with double spacing between paragraphs

- Headers: Include date, recipient's address, and your contact information

- Signatures: Always include handwritten signature for printed letters

- Attachments: Clearly list any supporting documents included

- Copies: Maintain copies for your records

Common Mistakes to Avoid

Avoid these frequent errors when writing bank request letters:

- Providing incomplete or incorrect account information

- Using informal language or inappropriate tone

- Failing to include necessary supporting documents

- Not specifying exact requirements or deadlines

- Sending letters to wrong departments or branches

- Forgetting to include contact information for follow-up

- Making requests without understanding associated fees

- Not keeping copies of submitted letters

- Using outdated account information or personal details

- Submitting unclear or ambiguous requests that require clarification

Follow-up Actions After Sending

Once you've submitted your request letter:

- Confirmation: Verify receipt with bank representatives

- Timeline: Inquire about processing timeframes and expected completion dates

- Documentation: Obtain reference numbers or tracking information

- Communication: Stay accessible for any clarification requests

- Payment: Process any applicable fees or charges promptly

- Collection: Arrange pickup or delivery of requested documents/services

- Verification: Review completed services for accuracy

- Records: File all correspondence and responses properly

- Feedback: Provide feedback on service quality if requested

Advantages and Disadvantages of Formal Bank Requests

Advantages:

- Creates official documentation and paper trail

- Ensures proper authorization and security protocols

- Provides legal protection for both parties

- Facilitates complex requests requiring detailed explanation

- Demonstrates serious intent and professionalism

Disadvantages:

- Time-consuming compared to digital alternatives

- May require physical presence or postal services

- Processing delays compared to instant online services

- Risk of miscommunication or lost correspondence

- Additional fees may apply for certain services

Essential Elements and Structure Components

Every effective bank request letter must include:

- Header: Your contact information and date

- Recipient: Bank's address and appropriate department

- Subject Line: Clear, specific description of request

- Salutation: Professional greeting addressing proper authority

- Introduction: Brief identification and relationship with bank

- Body: Detailed explanation of request with supporting information

- Conclusion: Appreciation and call to action

- Closing: Professional sign-off with handwritten signature

- Attachments: List of supporting documents included

- Account References: Relevant account numbers and customer identification

Download Word Doc

Download Word Doc

Download PDF

Download PDF