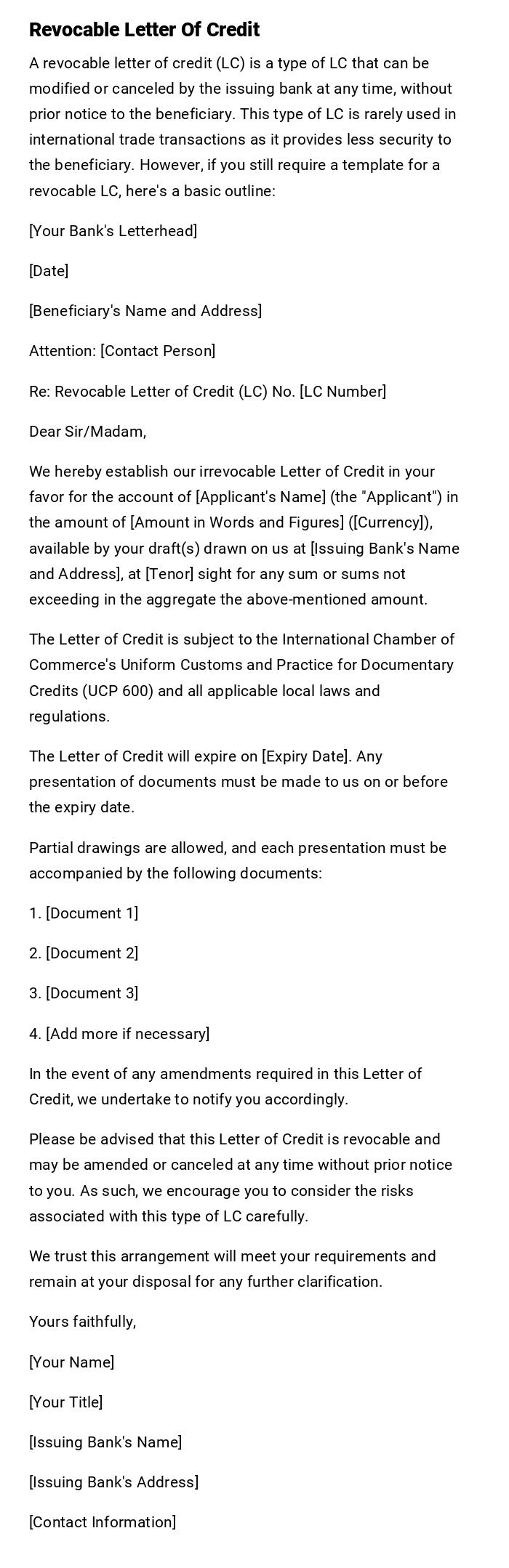

Revocable Letter Of Credit

A revocable letter of credit (LC) is a type of LC that can be modified or canceled by the issuing bank at any time, without prior notice to the beneficiary. This type of LC is rarely used in international trade transactions as it provides less security to the beneficiary. However, if you still require a template for a revocable LC, here's a basic outline:

[Your Bank's Letterhead]

[Date]

[Beneficiary's Name and Address]

Attention: [Contact Person]

Re: Revocable Letter of Credit (LC) No. [LC Number]

Dear Sir/Madam,

We hereby establish our irrevocable Letter of Credit in your favor for the account of [Applicant's Name] (the "Applicant") in the amount of [Amount in Words and Figures] ([Currency]), available by your draft(s) drawn on us at [Issuing Bank's Name and Address], at [Tenor] sight for any sum or sums not exceeding in the aggregate the above-mentioned amount.

The Letter of Credit is subject to the International Chamber of Commerce's Uniform Customs and Practice for Documentary Credits (UCP 600) and all applicable local laws and regulations.

The Letter of Credit will expire on [Expiry Date]. Any presentation of documents must be made to us on or before the expiry date.

Partial drawings are allowed, and each presentation must be accompanied by the following documents:

1. [Document 1]

2. [Document 2]

3. [Document 3]

4. [Add more if necessary]

In the event of any amendments required in this Letter of Credit, we undertake to notify you accordingly.

Please be advised that this Letter of Credit is revocable and may be amended or canceled at any time without prior notice to you. As such, we encourage you to consider the risks associated with this type of LC carefully.

We trust this arrangement will meet your requirements and remain at your disposal for any further clarification.

Yours faithfully,

[Your Name]

[Your Title]

[Issuing Bank's Name]

[Issuing Bank's Address]

[Contact Information]

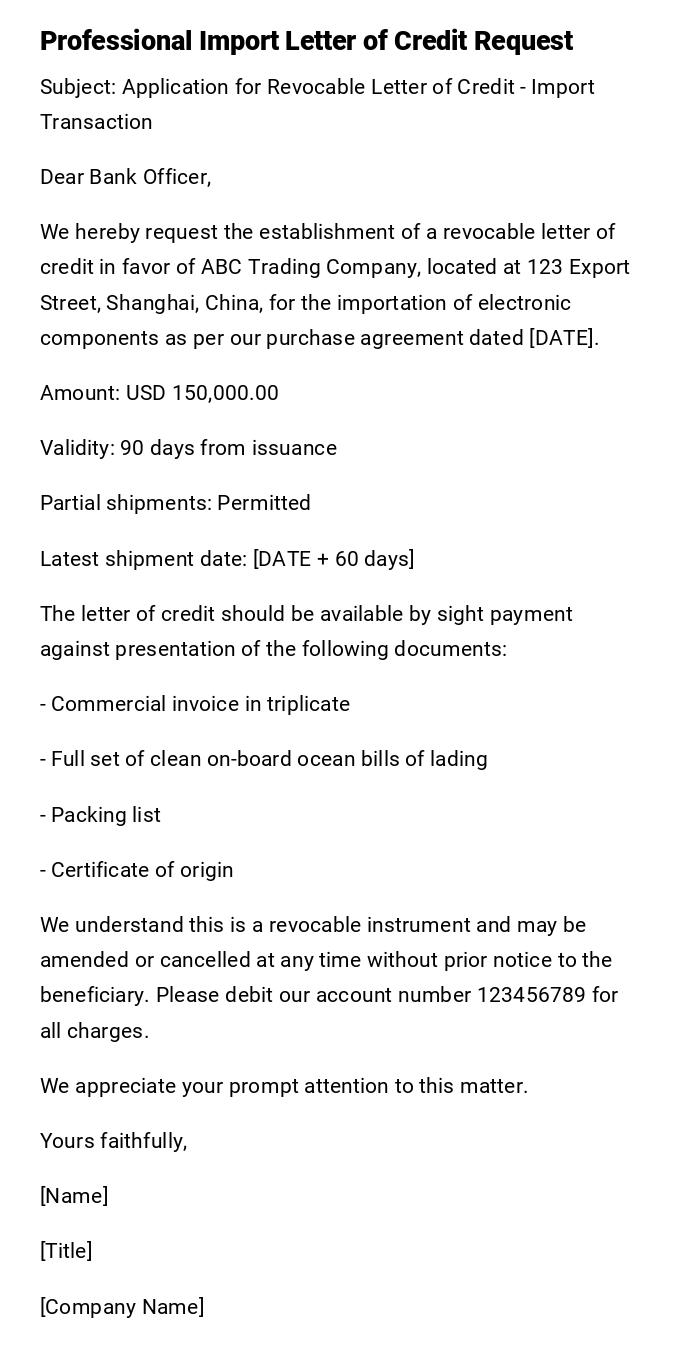

Standard Commercial Import Transaction

Subject: Application for Revocable Letter of Credit - Import Transaction

Dear Bank Officer,

We hereby request the establishment of a revocable letter of credit in favor of ABC Trading Company, located at 123 Export Street, Shanghai, China, for the importation of electronic components as per our purchase agreement dated [DATE].

Amount: USD 150,000.00

Validity: 90 days from issuance

Partial shipments: Permitted

Latest shipment date: [DATE + 60 days]

The letter of credit should be available by sight payment against presentation of the following documents:

- Commercial invoice in triplicate

- Full set of clean on-board ocean bills of lading

- Packing list

- Certificate of origin

We understand this is a revocable instrument and may be amended or cancelled at any time without prior notice to the beneficiary. Please debit our account number 123456789 for all charges.

We appreciate your prompt attention to this matter.

Yours faithfully,

[Name]

[Title]

[Company Name]

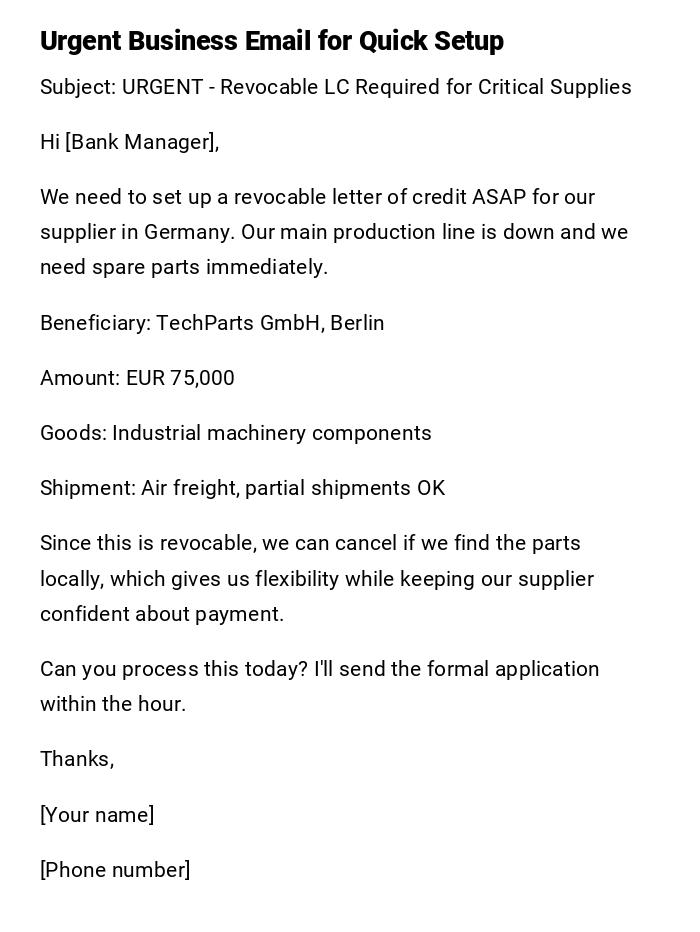

Emergency Supplier Payment Authorization

Subject: URGENT - Revocable LC Required for Critical Supplies

Hi [Bank Manager],

We need to set up a revocable letter of credit ASAP for our supplier in Germany. Our main production line is down and we need spare parts immediately.

Beneficiary: TechParts GmbH, Berlin

Amount: EUR 75,000

Goods: Industrial machinery components

Shipment: Air freight, partial shipments OK

Since this is revocable, we can cancel if we find the parts locally, which gives us flexibility while keeping our supplier confident about payment.

Can you process this today? I'll send the formal application within the hour.

Thanks,

[Your name]

[Phone number]

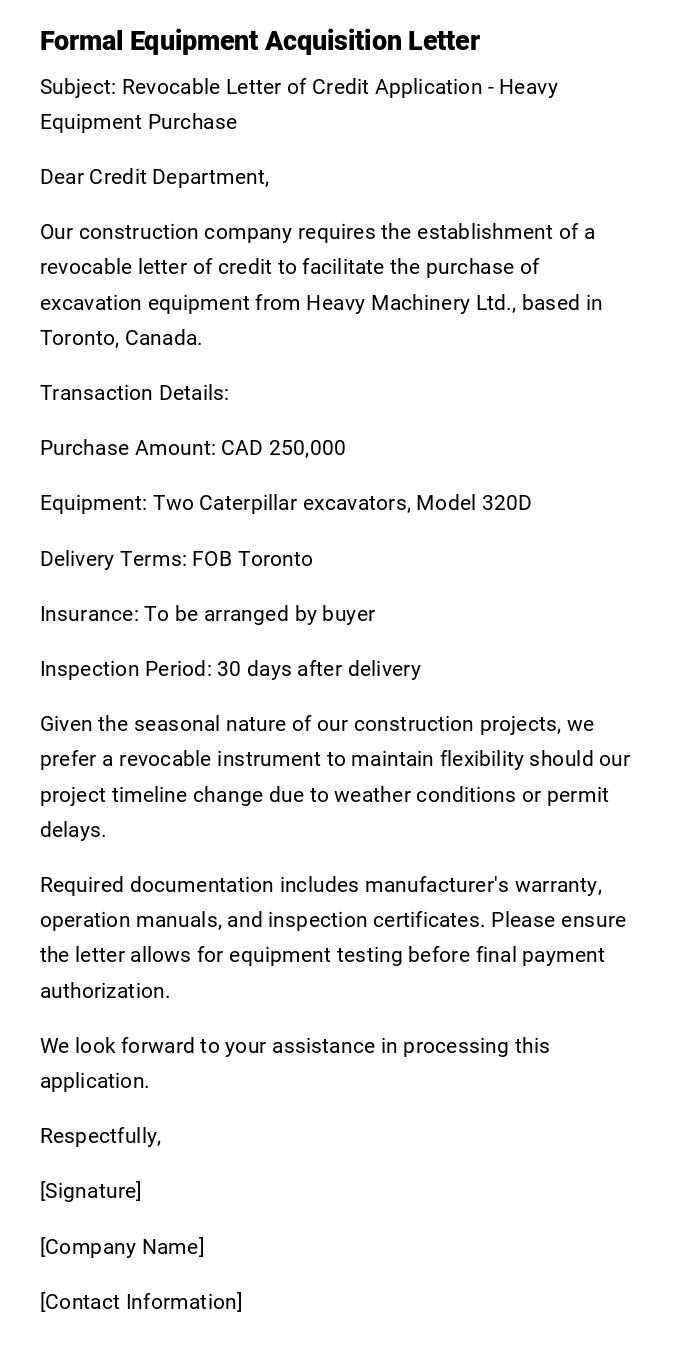

Construction Equipment Purchase

Subject: Revocable Letter of Credit Application - Heavy Equipment Purchase

Dear Credit Department,

Our construction company requires the establishment of a revocable letter of credit to facilitate the purchase of excavation equipment from Heavy Machinery Ltd., based in Toronto, Canada.

Transaction Details:

Purchase Amount: CAD 250,000

Equipment: Two Caterpillar excavators, Model 320D

Delivery Terms: FOB Toronto

Insurance: To be arranged by buyer

Inspection Period: 30 days after delivery

Given the seasonal nature of our construction projects, we prefer a revocable instrument to maintain flexibility should our project timeline change due to weather conditions or permit delays.

Required documentation includes manufacturer's warranty, operation manuals, and inspection certificates. Please ensure the letter allows for equipment testing before final payment authorization.

We look forward to your assistance in processing this application.

Respectfully,

[Signature]

[Company Name]

[Contact Information]

Agricultural Product Import

Subject: Revocable LC Setup - Seasonal Coffee Bean Import

Dear Trade Finance Team,

We wish to establish a revocable letter of credit for importing premium coffee beans from our supplier in Colombia. Given the volatile nature of commodity prices and seasonal availability, the revocable feature provides necessary flexibility.

Supplier: Colombian Coffee Estates SA

Product: Arabica coffee beans, Grade A

Quantity: 500 bags (60kg each)

Unit Price: USD 4.50 per kg

Total Value: USD 135,000

Quality specifications must include moisture content below 12%, defect rate under 5%, and organic certification. Shipment should occur during the dry season (December-March) for optimal quality.

The revocable nature allows us to adjust quantities based on market demand and cancel if quality standards aren't met during pre-shipment inspection.

Please include standard agricultural product documentation requirements.

Best regards,

[Name]

[Import Manager]

[Contact Details]

Technology License Agreement

Subject: Revocable Letter of Credit - Software License Payment

Hello [Bank Representative],

We need to establish a revocable letter of credit to secure payment for a software license agreement with TechInnovate Solutions in Singapore.

License Details:

Software: Advanced Manufacturing Control System

License Type: Multi-user enterprise license

Amount: USD 85,000

Implementation Period: 6 months

Support Period: 2 years

The revocable structure is essential because software implementation success depends on our team's ability to integrate the system effectively. If integration proves impossible within 30 days, we need the option to cancel the remaining payment obligations.

Documentation should include software delivery confirmation, source code escrow agreement, and implementation milestone reports.

This arrangement protects both parties while ensuring our supplier receives secure payment commitment.

Regards,

[IT Director Name]

[Company]

Textile Manufacturing Order

Subject: Revocable LC for Fabric Order - Spring Collection

Hey [Bank Team],

We're launching our spring collection and need a revocable letter of credit set up for our fabric supplier in India. Fashion is all about timing and flexibility!

Details:

Supplier: Mumbai Textiles Pvt Ltd

Products: Organic cotton fabrics, various patterns

Order Value: USD 95,000

Quantities: Subject to final design approval

Delivery: March 2025

Since fashion trends can shift quickly, the revocable feature lets us adjust order quantities or cancel if consumer preferences change. We might need to modify colors or patterns based on market feedback.

The supplier trusts our payment commitment, and we keep the flexibility to adapt to market demands. Win-win!

Can you get this started this week?

Cheers,

[Fashion Buyer]

[Brand Name]

Medical Equipment Emergency Purchase

Subject: CRITICAL - Revocable Letter of Credit for Medical Equipment

Dear Banking Officer,

Our hospital urgently requires a revocable letter of credit to procure essential medical equipment following recent facility expansion.

Supplier: MedEquip International, Frankfurt

Equipment: Patient monitoring systems, ventilators

Total Amount: EUR 180,000

Delivery Required: Within 45 days

Compliance: CE marking, FDA approval required

The revocable nature is crucial because medical equipment purchases often require regulatory approval modifications. If equipment doesn't receive final certification from health authorities, we must retain cancellation rights.

Documentation must include compliance certificates, installation guides, training materials, and warranty provisions. Patient safety regulations may require last-minute specifications changes.

Time is critical for patient care delivery. Please expedite processing.

Urgently yours,

[Chief Medical Officer]

[Hospital Name]

[Emergency Contact]

What is a Revocable Letter of Credit and Why Use It

A revocable letter of credit is a financial instrument issued by a bank on behalf of a buyer (applicant) that guarantees payment to a seller (beneficiary) upon presentation of specified documents. Unlike irrevocable letters of credit, revocable instruments can be modified, amended, or cancelled by the issuing bank at any time without prior notice to the beneficiary.

Key purposes include:

- Providing payment security for international trade transactions

- Maintaining buyer flexibility in volatile market conditions

- Enabling risk management for seasonal or commodity-based purchases

- Facilitating business relationships where terms may need adjustment

- Supporting transactions where delivery or quality standards are uncertain

Who Should Issue Revocable Letters of Credit

The applicant (buyer) should be established businesses or individuals with:

- Sufficient creditworthiness and banking relationships

- Experience in international trade transactions

- Clear understanding of trade finance instruments

- Adequate financial resources to cover the credit amount

- Business need for flexible payment arrangements

Typical applicants include:

- Import/export companies handling seasonal goods

- Manufacturers requiring raw materials or components

- Retailers purchasing inventory from overseas suppliers

- Construction companies buying equipment or materials

- Agricultural businesses dealing in commodities

When to Use Revocable Letters of Credit

Primary scenarios triggering revocable letter usage:

- Commodity trading with price volatility concerns

- Seasonal businesses requiring inventory flexibility

- New supplier relationships requiring risk management

- Market uncertainty affecting demand projections

- Quality control issues in manufacturing processes

- Regulatory approval requirements for specialized products

- Construction projects with timeline uncertainties

- Fashion or trend-dependent product purchases

- Technology implementations with integration risks

- Emergency procurement situations requiring speed

Who Receives Revocable Letters of Credit

Recipients (beneficiaries) typically include:

- International suppliers and manufacturers

- Export companies in developing markets

- Agricultural producers and commodity traders

- Technology companies licensing software or equipment

- Construction equipment suppliers

- Medical device manufacturers

- Textile and garment manufacturers

- Raw material suppliers

- Industrial equipment providers

- Service providers requiring advance payment security

Beneficiaries should understand the revocable nature and associated risks before accepting such arrangements.

Requirements and Prerequisites Before Application

Essential preparations include:

- Establish banking relationship with trade finance capabilities

- Maintain adequate credit line or cash collateral

- Prepare detailed purchase agreements or contracts

- Verify supplier credentials and business registration

- Obtain necessary import licenses or permits

- Arrange cargo insurance and shipping arrangements

- Review compliance with international trade regulations

- Prepare required documentation lists

- Understand local banking laws and procedures

- Assess foreign exchange implications

- Evaluate political and commercial risks

- Secure management approvals for financial commitments

How to Process and Send Applications

Application process steps:

- Contact bank's trade finance department

- Complete letter of credit application form

- Provide detailed transaction information

- Submit supporting documents (contracts, invoices, permits)

- Specify exact documentation requirements

- Define shipment and delivery terms

- Set validity periods and payment terms

- Review and sign bank agreements

- Pay required fees and establish collateral

- Coordinate with suppliers regarding LC terms

- Monitor document compliance and presentation

- Arrange payment authorization upon document review

Formatting and Documentation Standards

Critical formatting elements:

- Clear identification of all parties involved

- Precise description of goods or services

- Exact monetary amounts in specified currencies

- Detailed shipping and delivery instructions

- Complete list of required documents

- Specific quality standards or specifications

- Clear payment terms and conditions

- Validity periods and expiration dates

- Amendment and cancellation procedures

- Bank contact information and references

Professional tone recommended for formal applications, while email communications may be less formal but should remain businesslike and complete.

Common Mistakes to Avoid

Frequent errors include:

- Insufficient detail in goods descriptions

- Ambiguous documentation requirements

- Unrealistic delivery timeframes

- Inadequate quality specifications

- Missing regulatory compliance requirements

- Unclear amendment procedures

- Insufficient collateral or credit arrangements

- Poor communication with suppliers about LC terms

- Failure to monitor document presentation deadlines

- Inadequate understanding of revocable nature risks

- Overlooking foreign exchange fluctuation impacts

- Incomplete insurance arrangements

Follow-up Actions After Issuance

Post-issuance responsibilities:

- Monitor supplier compliance with LC terms

- Track shipment progress and documentation

- Maintain communication with issuing bank

- Review presented documents for compliance

- Authorize payment upon satisfactory presentation

- Handle any discrepancies or amendments

- Coordinate with freight forwarders and insurers

- Maintain records for accounting and tax purposes

- Evaluate supplier performance for future transactions

- Process goods receipt and quality inspection

- Resolve any disputes or claims promptly

- Update internal systems and procedures

Advantages and Disadvantages Analysis

Benefits:

- Maximum flexibility for buyers in changing market conditions

- Ability to cancel or modify terms without beneficiary consent

- Lower costs compared to irrevocable instruments

- Faster processing and setup times

- Reduced commitment in uncertain transactions

- Better cash flow management options

Drawbacks:

- Limited supplier acceptance due to uncertainty

- Potential relationship damage if cancelled

- Higher risk perception from beneficiaries

- Possible premium pricing from suppliers

- Reduced negotiating power in competitive markets

- Limited availability from some banks

Comparison with Alternative Payment Methods

Revocable LC vs. Irrevocable LC:

- Flexibility vs. security trade-off

- Cost differences and processing times

- Supplier acceptance levels

- Risk allocation between parties

Revocable LC vs. Wire Transfer:

- Payment timing and security

- Documentation requirements

- Risk management capabilities

Revocable LC vs. Documentary Collection:

- Control level and payment guarantees

- Cost implications and processing complexity

- Suitable transaction types and amounts

Professional Tips and Best Practices

Effective strategies:

- Negotiate revocable terms upfront with suppliers

- Use for trial transactions with new suppliers

- Combine with other risk mitigation tools

- Maintain clear internal approval processes

- Establish strong banking relationships

- Monitor political and economic conditions

- Keep detailed transaction records

- Train staff on proper procedures

- Regular review of terms and conditions

- Build supplier relationships gradually

- Use for seasonal or cyclical businesses

- Consider market timing in applications

Download Word Doc

Download Word Doc

Download PDF

Download PDF