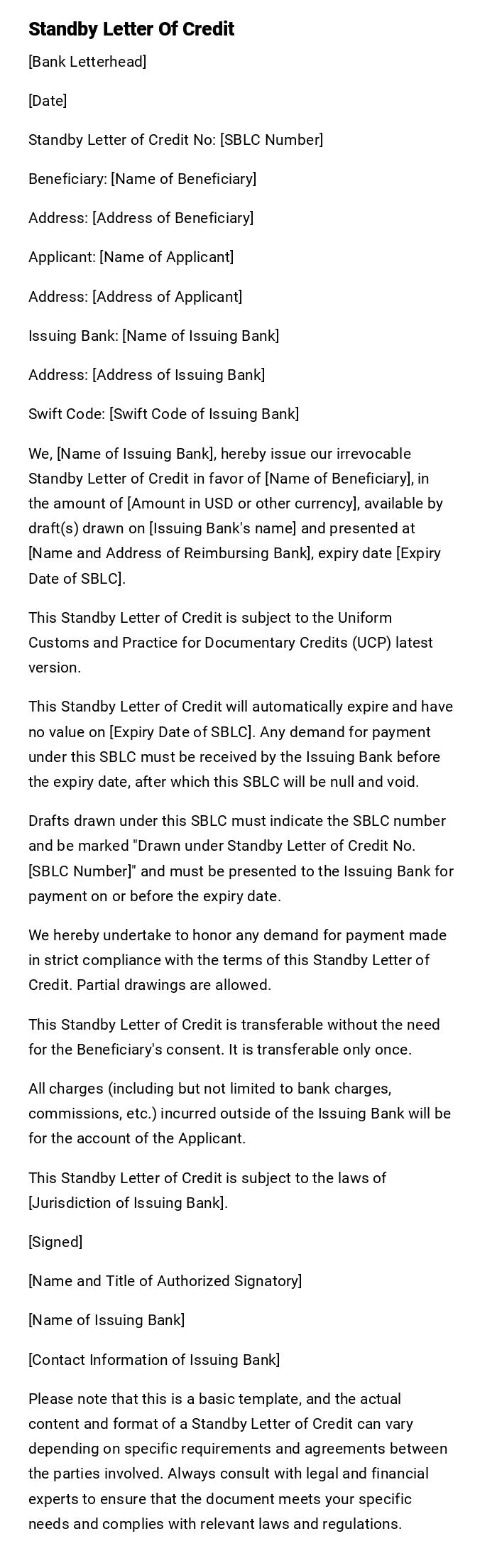

Standby Letter Of Credit

[Bank Letterhead]

[Date]

Standby Letter of Credit No: [SBLC Number]

Beneficiary: [Name of Beneficiary]

Address: [Address of Beneficiary]

Applicant: [Name of Applicant]

Address: [Address of Applicant]

Issuing Bank: [Name of Issuing Bank]

Address: [Address of Issuing Bank]

Swift Code: [Swift Code of Issuing Bank]

We, [Name of Issuing Bank], hereby issue our irrevocable Standby Letter of Credit in favor of [Name of Beneficiary], in the amount of [Amount in USD or other currency], available by draft(s) drawn on [Issuing Bank's name] and presented at [Name and Address of Reimbursing Bank], expiry date [Expiry Date of SBLC].

This Standby Letter of Credit is subject to the Uniform Customs and Practice for Documentary Credits (UCP) latest version.

This Standby Letter of Credit will automatically expire and have no value on [Expiry Date of SBLC]. Any demand for payment under this SBLC must be received by the Issuing Bank before the expiry date, after which this SBLC will be null and void.

Drafts drawn under this SBLC must indicate the SBLC number and be marked "Drawn under Standby Letter of Credit No. [SBLC Number]" and must be presented to the Issuing Bank for payment on or before the expiry date.

We hereby undertake to honor any demand for payment made in strict compliance with the terms of this Standby Letter of Credit. Partial drawings are allowed.

This Standby Letter of Credit is transferable without the need for the Beneficiary's consent. It is transferable only once.

All charges (including but not limited to bank charges, commissions, etc.) incurred outside of the Issuing Bank will be for the account of the Applicant.

This Standby Letter of Credit is subject to the laws of [Jurisdiction of Issuing Bank].

[Signed]

[Name and Title of Authorized Signatory]

[Name of Issuing Bank]

[Contact Information of Issuing Bank]

Please note that this is a basic template, and the actual content and format of a Standby Letter of Credit can vary depending on specific requirements and agreements between the parties involved. Always consult with legal and financial experts to ensure that the document meets your specific needs and complies with relevant laws and regulations.

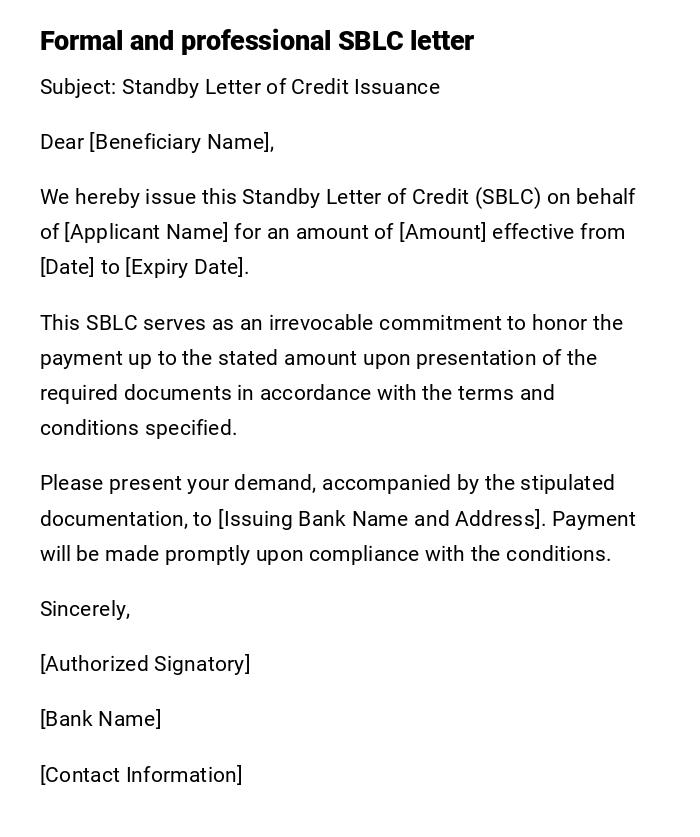

Standard Standby Letter of Credit Template

Subject: Standby Letter of Credit Issuance

Dear [Beneficiary Name],

We hereby issue this Standby Letter of Credit (SBLC) on behalf of [Applicant Name] for an amount of [Amount] effective from [Date] to [Expiry Date].

This SBLC serves as an irrevocable commitment to honor the payment up to the stated amount upon presentation of the required documents in accordance with the terms and conditions specified.

Please present your demand, accompanied by the stipulated documentation, to [Issuing Bank Name and Address]. Payment will be made promptly upon compliance with the conditions.

Sincerely,

[Authorized Signatory]

[Bank Name]

[Contact Information]

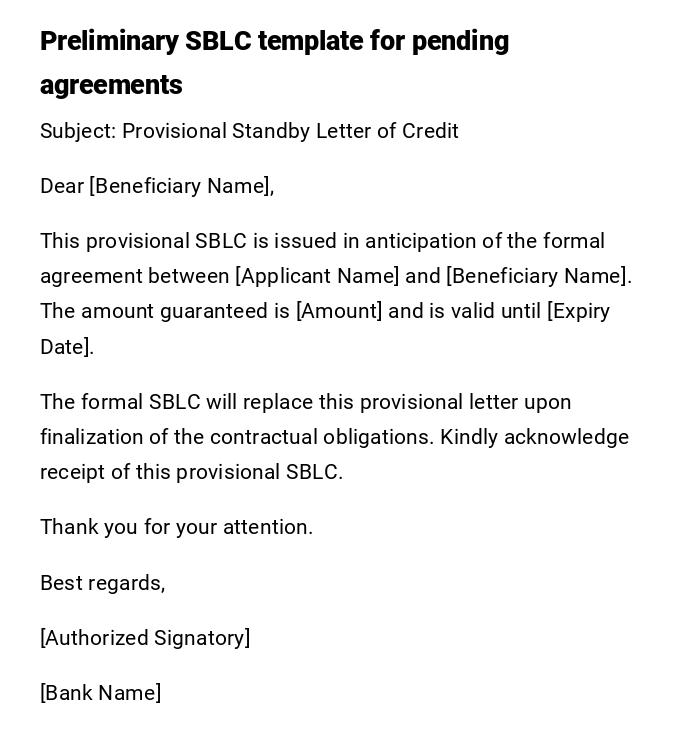

Provisional Standby Letter of Credit

Subject: Provisional Standby Letter of Credit

Dear [Beneficiary Name],

This provisional SBLC is issued in anticipation of the formal agreement between [Applicant Name] and [Beneficiary Name]. The amount guaranteed is [Amount] and is valid until [Expiry Date].

The formal SBLC will replace this provisional letter upon finalization of the contractual obligations. Kindly acknowledge receipt of this provisional SBLC.

Thank you for your attention.

Best regards,

[Authorized Signatory]

[Bank Name]

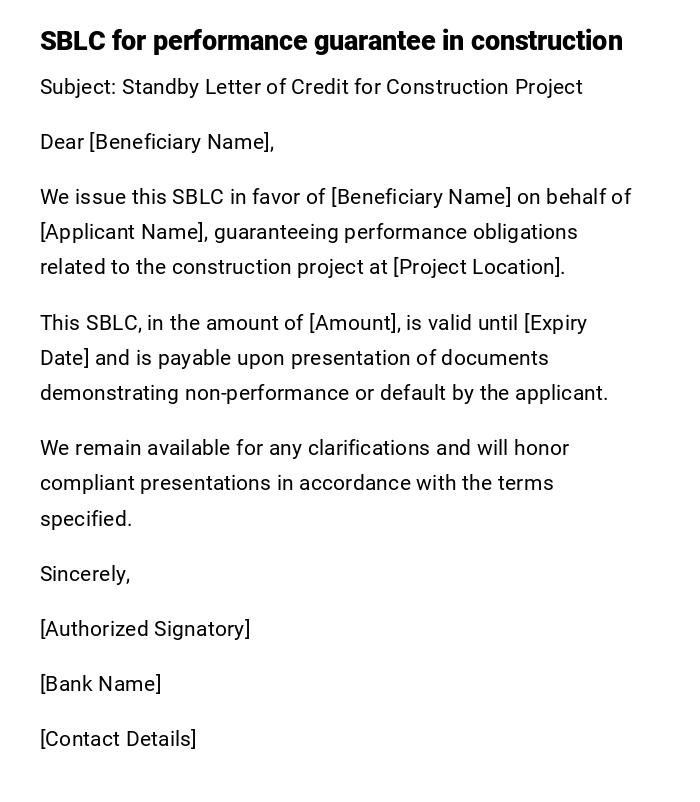

SBLC for Construction Project

Subject: Standby Letter of Credit for Construction Project

Dear [Beneficiary Name],

We issue this SBLC in favor of [Beneficiary Name] on behalf of [Applicant Name], guaranteeing performance obligations related to the construction project at [Project Location].

This SBLC, in the amount of [Amount], is valid until [Expiry Date] and is payable upon presentation of documents demonstrating non-performance or default by the applicant.

We remain available for any clarifications and will honor compliant presentations in accordance with the terms specified.

Sincerely,

[Authorized Signatory]

[Bank Name]

[Contact Details]

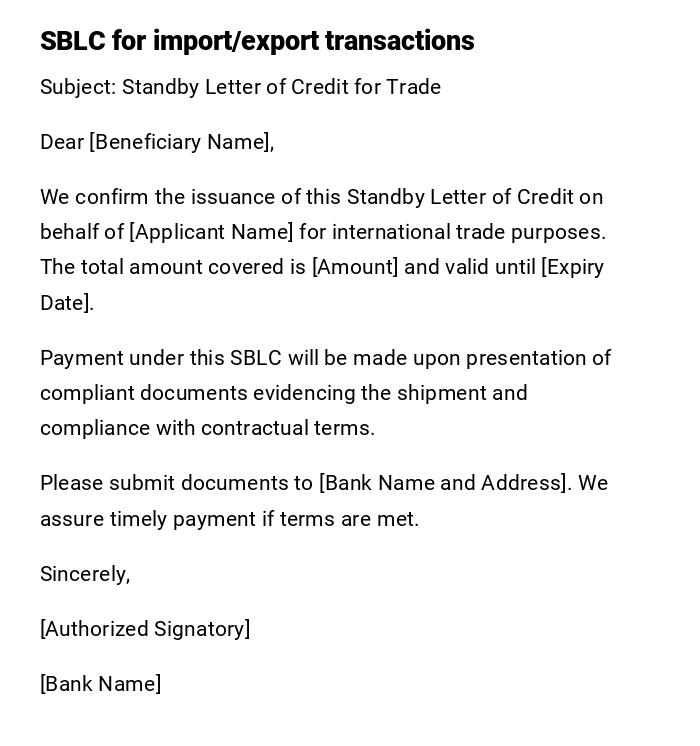

SBLC for International Trade

Subject: Standby Letter of Credit for Trade

Dear [Beneficiary Name],

We confirm the issuance of this Standby Letter of Credit on behalf of [Applicant Name] for international trade purposes. The total amount covered is [Amount] and valid until [Expiry Date].

Payment under this SBLC will be made upon presentation of compliant documents evidencing the shipment and compliance with contractual terms.

Please submit documents to [Bank Name and Address]. We assure timely payment if terms are met.

Sincerely,

[Authorized Signatory]

[Bank Name]

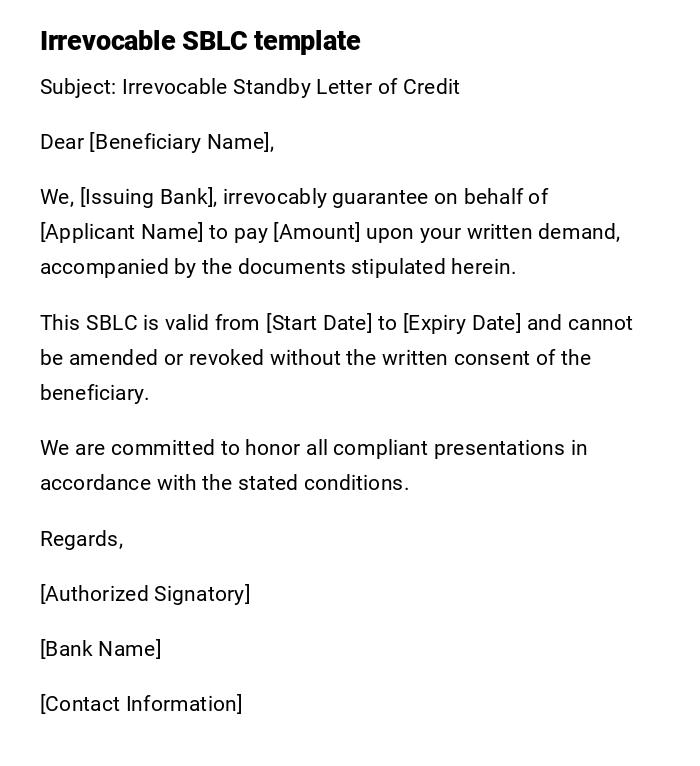

Irrevocable Standby Letter of Credit

Subject: Irrevocable Standby Letter of Credit

Dear [Beneficiary Name],

We, [Issuing Bank], irrevocably guarantee on behalf of [Applicant Name] to pay [Amount] upon your written demand, accompanied by the documents stipulated herein.

This SBLC is valid from [Start Date] to [Expiry Date] and cannot be amended or revoked without the written consent of the beneficiary.

We are committed to honor all compliant presentations in accordance with the stated conditions.

Regards,

[Authorized Signatory]

[Bank Name]

[Contact Information]

What is a Standby Letter of Credit and Why It Is Used

A Standby Letter of Credit (SBLC) is a financial instrument issued by a bank guaranteeing payment on behalf of a client to a beneficiary if certain obligations are not met.

Purpose:

- Provides assurance to the beneficiary that payment will be made.

- Acts as a backup for contractual or financial obligations.

- Common in trade, construction, and international business transactions.

Who Issues a Standby Letter of Credit

- Typically issued by a bank or financial institution.

- Can be requested by individuals or companies requiring assurance for contracts.

- Authorized signatories from the bank handle the issuance and compliance.

Whom a Standby Letter of Credit Is Addressed To

- Beneficiary or the party receiving the guarantee.

- May include intermediary banks if used in international transactions.

- Clearly state the beneficiary’s name and contact details for clarity.

When a Standby Letter of Credit Is Required

- When payment or performance guarantees are needed.

- For international trade to assure exporters or importers.

- For large construction or infrastructure projects requiring performance guarantees.

- During provisional agreements pending full contract execution.

How to Prepare and Send a Standby Letter of Credit

- Determine the beneficiary, amount, and validity period.

- Draft clear terms and conditions for document presentation.

- Ensure compliance with international banking regulations.

- Issue the SBLC via bank channels (email, SWIFT, or physical letter).

- Confirm receipt with the beneficiary and maintain records.

Requirements and Prerequisites Before Issuance

- Verified creditworthiness of the applicant.

- Completed contractual agreements requiring the guarantee.

- Clear identification of beneficiary and payment conditions.

- Regulatory approvals if required for international transactions.

- Bank forms and documents for internal processing.

Formatting, Tone, and Key Elements

- Tone: Professional, formal, and unambiguous.

- Length: Typically 1–2 pages depending on details.

- Include:

- Beneficiary details

- Applicant details

- Amount and currency

- Validity dates

- Conditions for document presentation

- Signature and bank seal

- Mode: Email, SWIFT message, or physical letter.

After Sending or Issuing an SBLC

- Confirm receipt with the beneficiary.

- Monitor for compliance documents and demands.

- Keep copies for auditing and legal purposes.

- Advise the applicant of any payment or claim under the SBLC.

Common Mistakes in Standby Letters of Credit

- Ambiguous or incomplete terms.

- Incorrect beneficiary or applicant details.

- Misalignment with contractual obligations.

- Missing expiry or validity dates.

- Not adhering to regulatory or SWIFT formats.

Tips and Best Practices for SBLC

- Double-check all names, amounts, and dates.

- Use clear language to avoid disputes.

- Ensure compliance with ICC rules (UCP 600 or ISP98 as applicable).

- Maintain proper communication with both applicant and beneficiary.

- Attach supporting documents or instructions if necessary.

FAQ About Standby Letters of Credit

-

Q: Is an SBLC the same as a regular letter of credit?

A: No, SBLC acts as a backup guarantee rather than primary payment for trade. -

Q: Can an SBLC be revoked?

A: Typically no, unless explicitly allowed and agreed by the beneficiary. -

Q: Who pays for the SBLC?

A: The applicant requesting the SBLC usually bears the bank fees. -

Q: What documents are required for payment?

A: As per the terms, often including demand letter, invoices, or proof of non-performance. -

Q: Is an SBLC internationally recognized?

A: Yes, especially if issued through reputable banks and compliant with international rules.

Download Word Doc

Download Word Doc

Download PDF

Download PDF