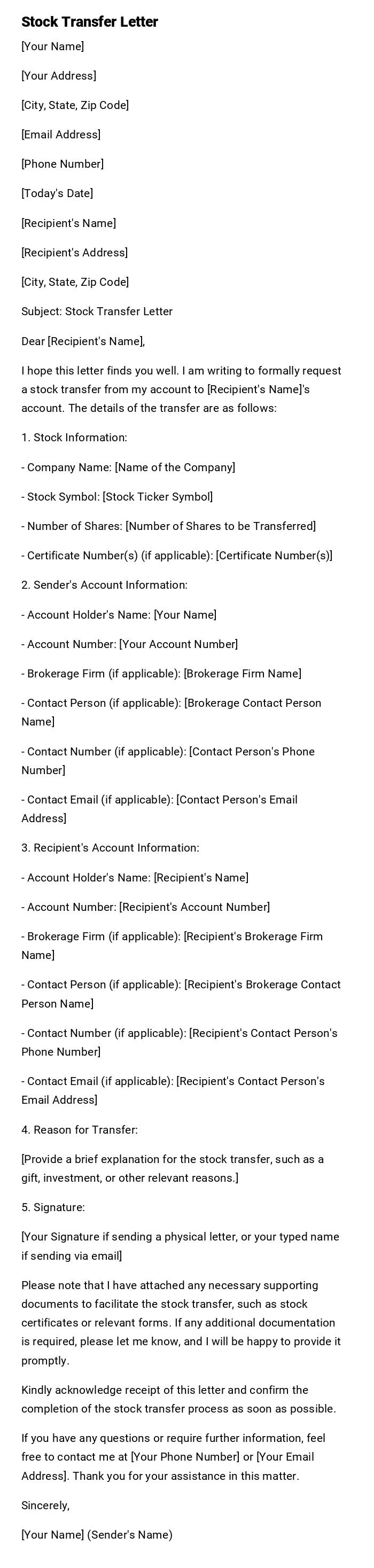

Stock Transfer Letter

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Today's Date]

[Recipient's Name]

[Recipient's Address]

[City, State, Zip Code]

Subject: Stock Transfer Letter

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to formally request a stock transfer from my account to [Recipient's Name]'s account. The details of the transfer are as follows:

1. Stock Information:

- Company Name: [Name of the Company]

- Stock Symbol: [Stock Ticker Symbol]

- Number of Shares: [Number of Shares to be Transferred]

- Certificate Number(s) (if applicable): [Certificate Number(s)]

2. Sender's Account Information:

- Account Holder's Name: [Your Name]

- Account Number: [Your Account Number]

- Brokerage Firm (if applicable): [Brokerage Firm Name]

- Contact Person (if applicable): [Brokerage Contact Person Name]

- Contact Number (if applicable): [Contact Person's Phone Number]

- Contact Email (if applicable): [Contact Person's Email Address]

3. Recipient's Account Information:

- Account Holder's Name: [Recipient's Name]

- Account Number: [Recipient's Account Number]

- Brokerage Firm (if applicable): [Recipient's Brokerage Firm Name]

- Contact Person (if applicable): [Recipient's Brokerage Contact Person Name]

- Contact Number (if applicable): [Recipient's Contact Person's Phone Number]

- Contact Email (if applicable): [Recipient's Contact Person's Email Address]

4. Reason for Transfer:

[Provide a brief explanation for the stock transfer, such as a gift, investment, or other relevant reasons.]

5. Signature:

[Your Signature if sending a physical letter, or your typed name if sending via email]

Please note that I have attached any necessary supporting documents to facilitate the stock transfer, such as stock certificates or relevant forms. If any additional documentation is required, please let me know, and I will be happy to provide it promptly.

Kindly acknowledge receipt of this letter and confirm the completion of the stock transfer process as soon as possible.

If you have any questions or require further information, feel free to contact me at [Your Phone Number] or [Your Email Address]. Thank you for your assistance in this matter.

Sincerely,

[Your Name] (Sender's Name)

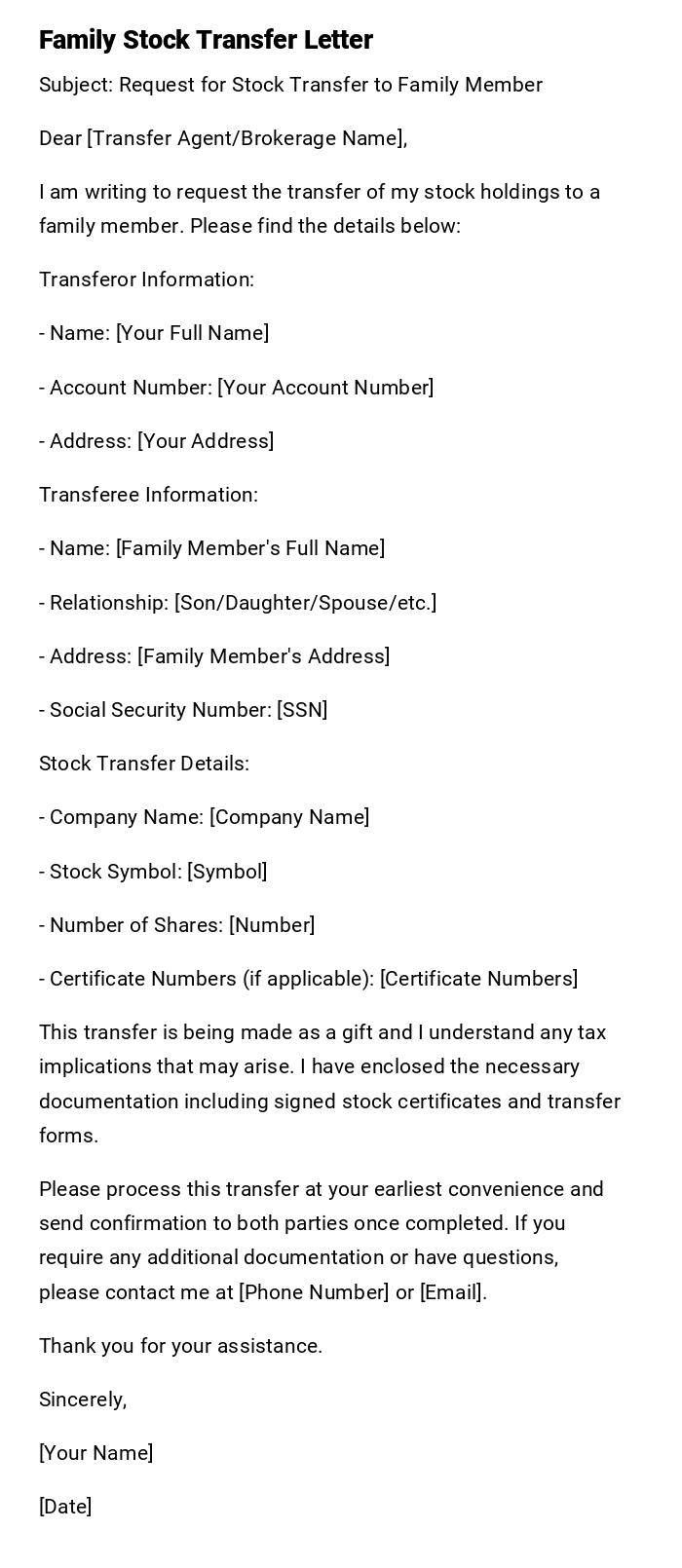

Stock Transfer to Family Member

Subject: Request for Stock Transfer to Family Member

Dear [Transfer Agent/Brokerage Name],

I am writing to request the transfer of my stock holdings to a family member. Please find the details below:

Transferor Information:

- Name: [Your Full Name]

- Account Number: [Your Account Number]

- Address: [Your Address]

Transferee Information:

- Name: [Family Member's Full Name]

- Relationship: [Son/Daughter/Spouse/etc.]

- Address: [Family Member's Address]

- Social Security Number: [SSN]

Stock Transfer Details:

- Company Name: [Company Name]

- Stock Symbol: [Symbol]

- Number of Shares: [Number]

- Certificate Numbers (if applicable): [Certificate Numbers]

This transfer is being made as a gift and I understand any tax implications that may arise. I have enclosed the necessary documentation including signed stock certificates and transfer forms.

Please process this transfer at your earliest convenience and send confirmation to both parties once completed. If you require any additional documentation or have questions, please contact me at [Phone Number] or [Email].

Thank you for your assistance.

Sincerely,

[Your Name]

[Date]

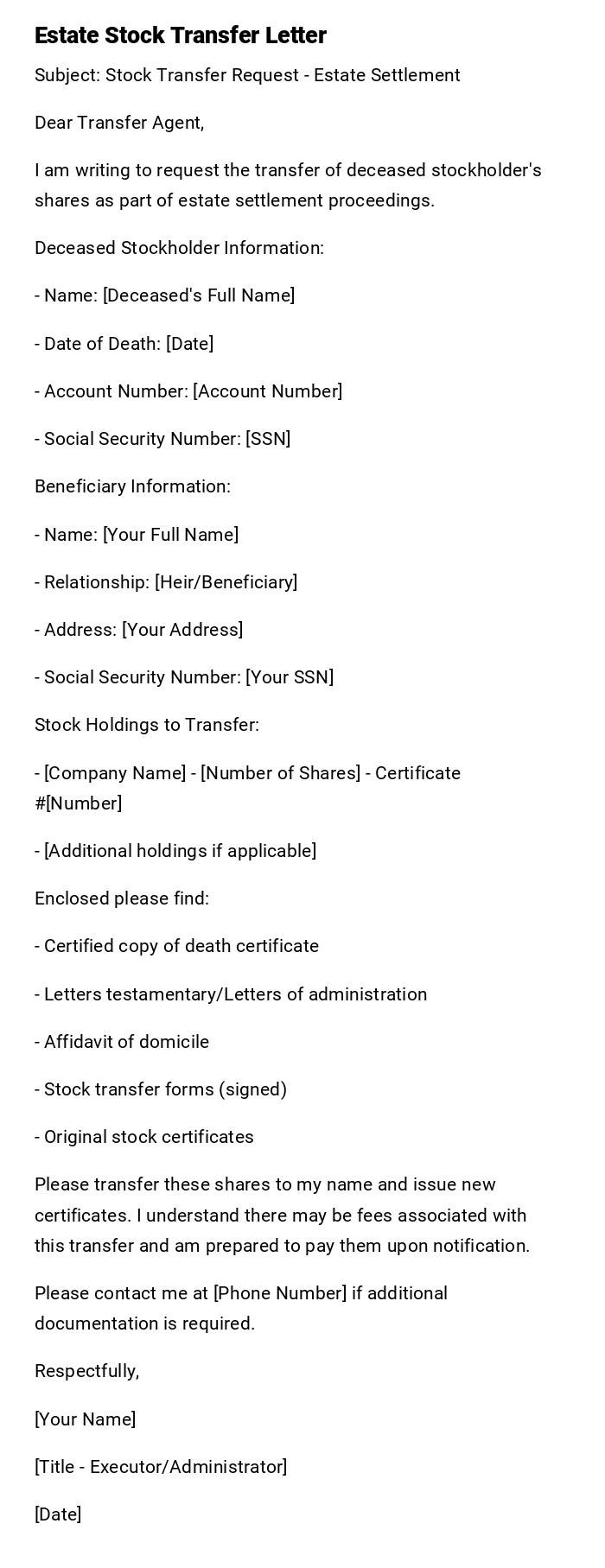

Stock Transfer Due to Inheritance

Subject: Stock Transfer Request - Estate Settlement

Dear Transfer Agent,

I am writing to request the transfer of deceased stockholder's shares as part of estate settlement proceedings.

Deceased Stockholder Information:

- Name: [Deceased's Full Name]

- Date of Death: [Date]

- Account Number: [Account Number]

- Social Security Number: [SSN]

Beneficiary Information:

- Name: [Your Full Name]

- Relationship: [Heir/Beneficiary]

- Address: [Your Address]

- Social Security Number: [Your SSN]

Stock Holdings to Transfer:

- [Company Name] - [Number of Shares] - Certificate #[Number]

- [Additional holdings if applicable]

Enclosed please find:

- Certified copy of death certificate

- Letters testamentary/Letters of administration

- Affidavit of domicile

- Stock transfer forms (signed)

- Original stock certificates

Please transfer these shares to my name and issue new certificates. I understand there may be fees associated with this transfer and am prepared to pay them upon notification.

Please contact me at [Phone Number] if additional documentation is required.

Respectfully,

[Your Name]

[Title - Executor/Administrator]

[Date]

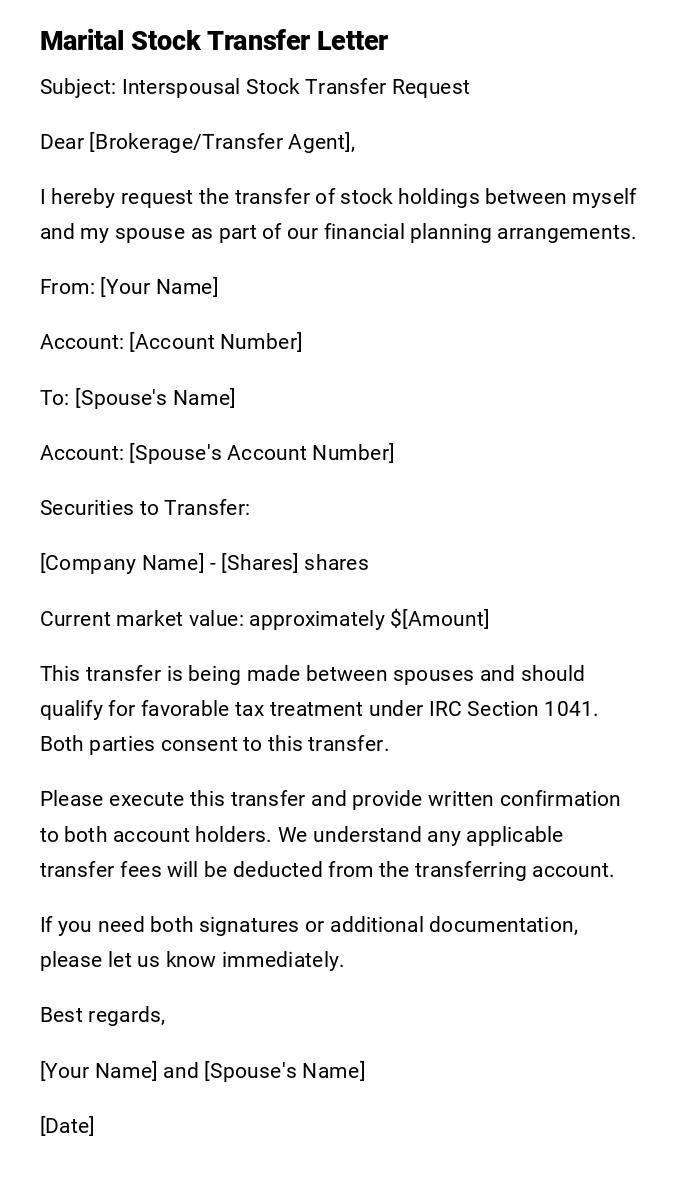

Stock Transfer Between Spouses

Subject: Interspousal Stock Transfer Request

Dear [Brokerage/Transfer Agent],

I hereby request the transfer of stock holdings between myself and my spouse as part of our financial planning arrangements.

From: [Your Name]

Account: [Account Number]

To: [Spouse's Name]

Account: [Spouse's Account Number]

Securities to Transfer:

[Company Name] - [Shares] shares

Current market value: approximately $[Amount]

This transfer is being made between spouses and should qualify for favorable tax treatment under IRC Section 1041. Both parties consent to this transfer.

Please execute this transfer and provide written confirmation to both account holders. We understand any applicable transfer fees will be deducted from the transferring account.

If you need both signatures or additional documentation, please let us know immediately.

Best regards,

[Your Name] and [Spouse's Name]

[Date]

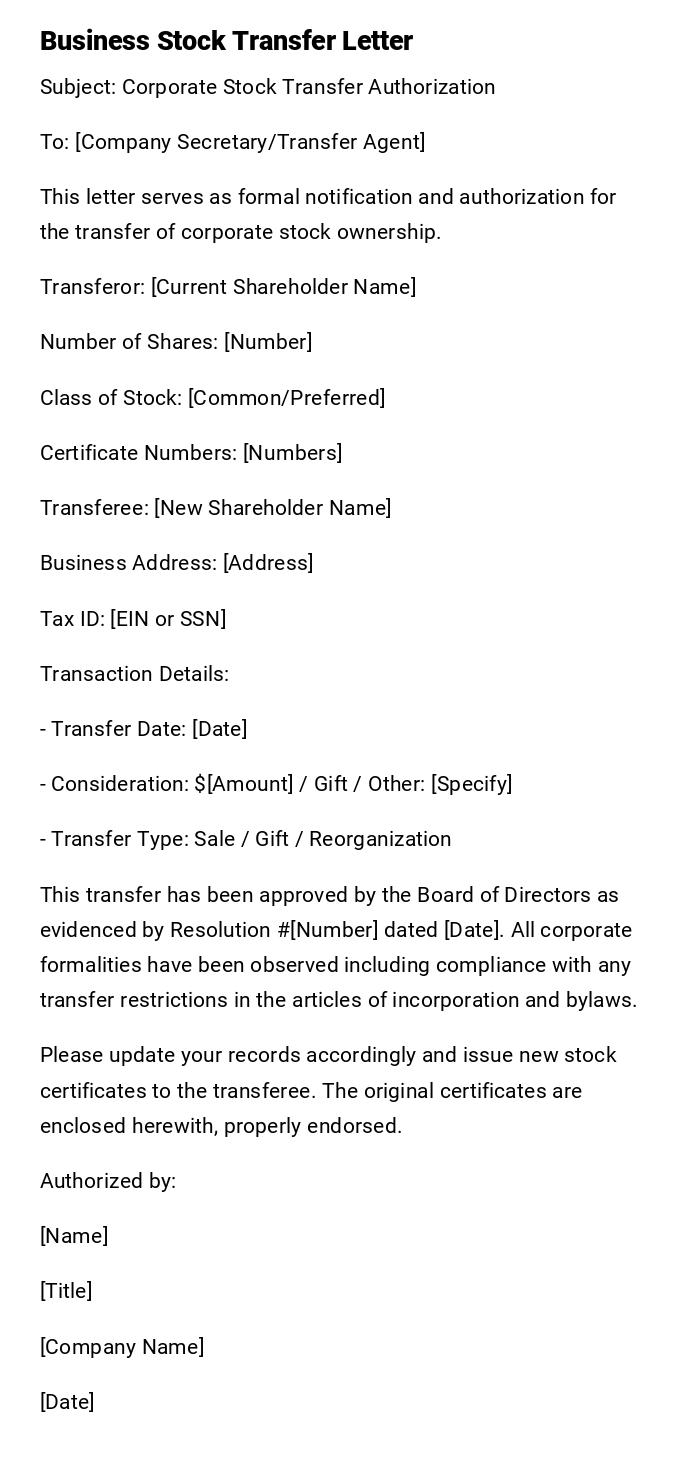

Corporate Stock Transfer

Subject: Corporate Stock Transfer Authorization

To: [Company Secretary/Transfer Agent]

This letter serves as formal notification and authorization for the transfer of corporate stock ownership.

Transferor: [Current Shareholder Name]

Number of Shares: [Number]

Class of Stock: [Common/Preferred]

Certificate Numbers: [Numbers]

Transferee: [New Shareholder Name]

Business Address: [Address]

Tax ID: [EIN or SSN]

Transaction Details:

- Transfer Date: [Date]

- Consideration: $[Amount] / Gift / Other: [Specify]

- Transfer Type: Sale / Gift / Reorganization

This transfer has been approved by the Board of Directors as evidenced by Resolution #[Number] dated [Date]. All corporate formalities have been observed including compliance with any transfer restrictions in the articles of incorporation and bylaws.

Please update your records accordingly and issue new stock certificates to the transferee. The original certificates are enclosed herewith, properly endorsed.

Authorized by:

[Name]

[Title]

[Company Name]

[Date]

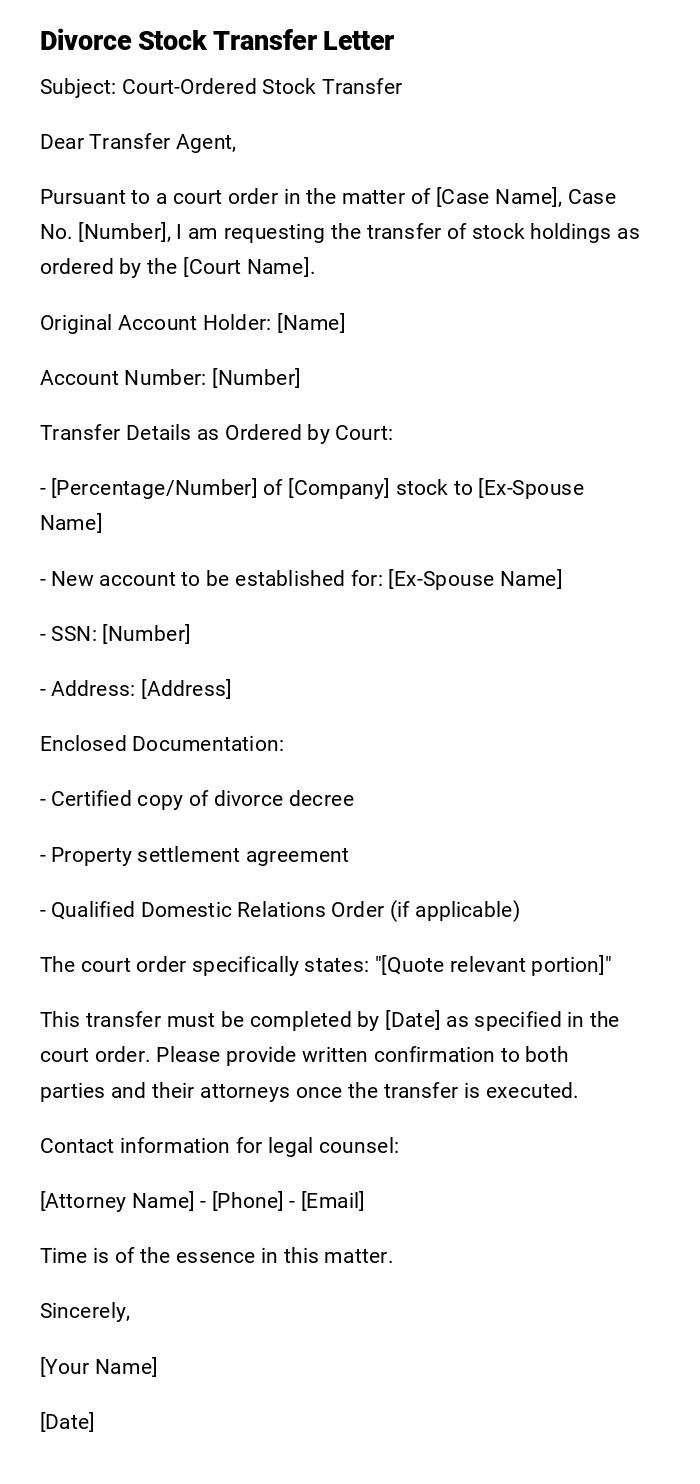

Stock Transfer Due to Divorce

Subject: Court-Ordered Stock Transfer

Dear Transfer Agent,

Pursuant to a court order in the matter of [Case Name], Case No. [Number], I am requesting the transfer of stock holdings as ordered by the [Court Name].

Original Account Holder: [Name]

Account Number: [Number]

Transfer Details as Ordered by Court:

- [Percentage/Number] of [Company] stock to [Ex-Spouse Name]

- New account to be established for: [Ex-Spouse Name]

- SSN: [Number]

- Address: [Address]

Enclosed Documentation:

- Certified copy of divorce decree

- Property settlement agreement

- Qualified Domestic Relations Order (if applicable)

The court order specifically states: "[Quote relevant portion]"

This transfer must be completed by [Date] as specified in the court order. Please provide written confirmation to both parties and their attorneys once the transfer is executed.

Contact information for legal counsel:

[Attorney Name] - [Phone] - [Email]

Time is of the essence in this matter.

Sincerely,

[Your Name]

[Date]

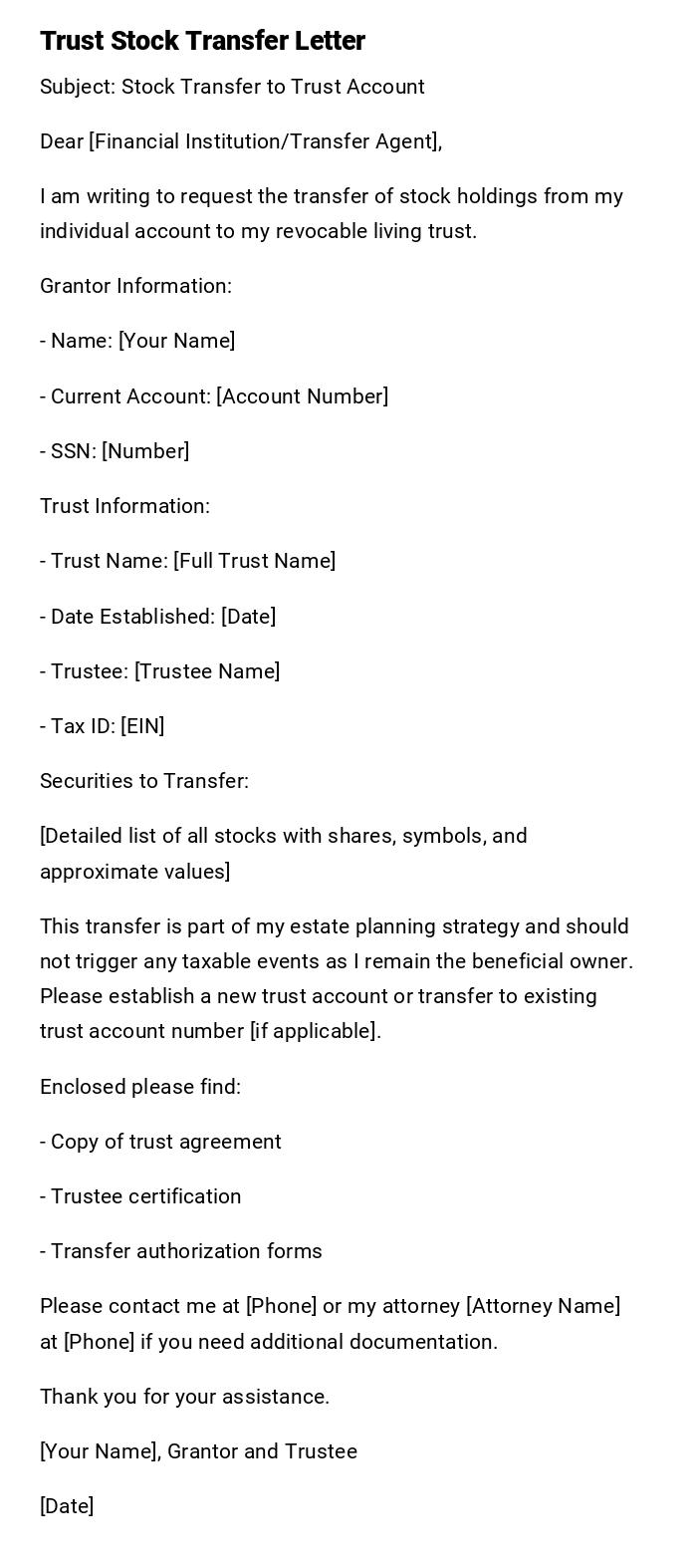

Stock Transfer for Trust

Subject: Stock Transfer to Trust Account

Dear [Financial Institution/Transfer Agent],

I am writing to request the transfer of stock holdings from my individual account to my revocable living trust.

Grantor Information:

- Name: [Your Name]

- Current Account: [Account Number]

- SSN: [Number]

Trust Information:

- Trust Name: [Full Trust Name]

- Date Established: [Date]

- Trustee: [Trustee Name]

- Tax ID: [EIN]

Securities to Transfer:

[Detailed list of all stocks with shares, symbols, and approximate values]

This transfer is part of my estate planning strategy and should not trigger any taxable events as I remain the beneficial owner. Please establish a new trust account or transfer to existing trust account number [if applicable].

Enclosed please find:

- Copy of trust agreement

- Trustee certification

- Transfer authorization forms

Please contact me at [Phone] or my attorney [Attorney Name] at [Phone] if you need additional documentation.

Thank you for your assistance.

[Your Name], Grantor and Trustee

[Date]

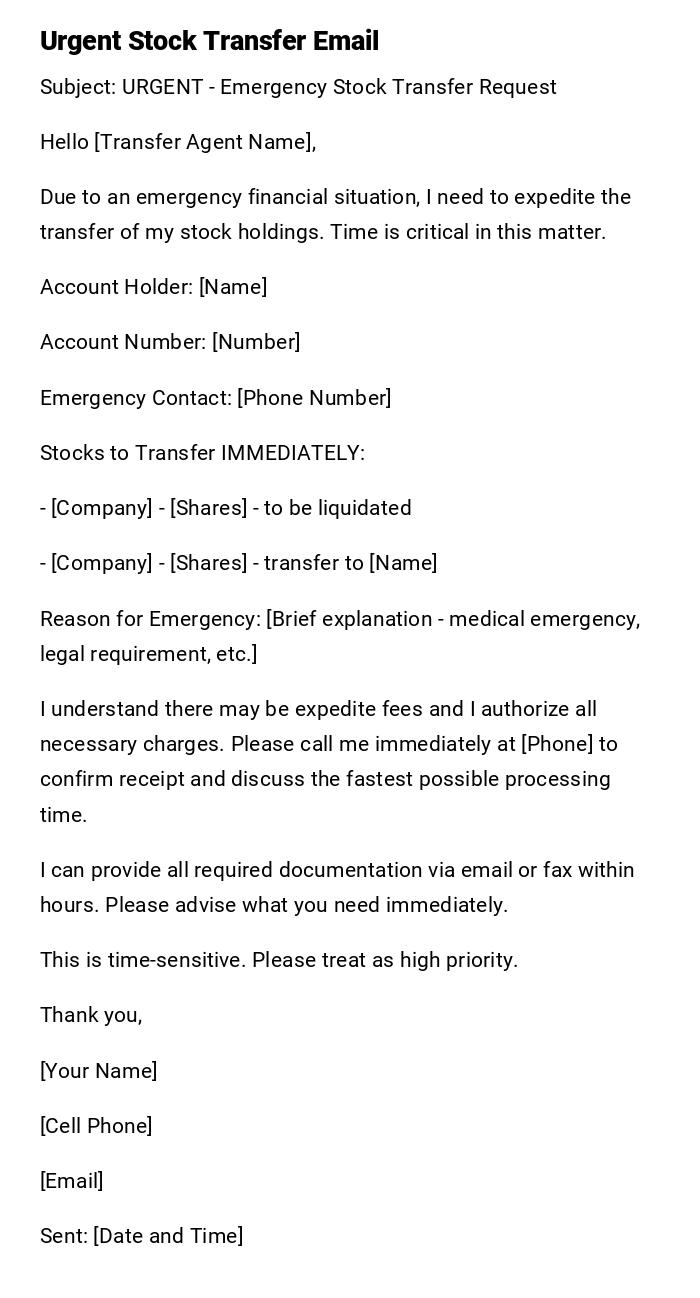

Emergency Stock Transfer

Subject: URGENT - Emergency Stock Transfer Request

Hello [Transfer Agent Name],

Due to an emergency financial situation, I need to expedite the transfer of my stock holdings. Time is critical in this matter.

Account Holder: [Name]

Account Number: [Number]

Emergency Contact: [Phone Number]

Stocks to Transfer IMMEDIATELY:

- [Company] - [Shares] - to be liquidated

- [Company] - [Shares] - transfer to [Name]

Reason for Emergency: [Brief explanation - medical emergency, legal requirement, etc.]

I understand there may be expedite fees and I authorize all necessary charges. Please call me immediately at [Phone] to confirm receipt and discuss the fastest possible processing time.

I can provide all required documentation via email or fax within hours. Please advise what you need immediately.

This is time-sensitive. Please treat as high priority.

Thank you,

[Your Name]

[Cell Phone]

[Email]

Sent: [Date and Time]

What is a Stock Transfer Letter and Why Do You Need One

A stock transfer letter is a formal document that authorizes the transfer of ownership of stock shares from one party to another. This letter serves as official notification to transfer agents, brokerages, or companies that a change in stock ownership is taking place. The letter ensures proper documentation of the transaction and helps maintain accurate ownership records.

Key purposes include:

- Legal documentation of ownership change

- Compliance with securities regulations

- Tax record maintenance

- Prevention of fraud and unauthorized transfers

- Clear communication of transfer terms and conditions

Who Should Send Stock Transfer Letters

Stock transfer letters should be sent by:

- Current stockholders transferring shares

- Estate executors or administrators handling deceased shareholders' assets

- Corporate officers authorized to transfer company shares

- Trustees managing trust assets

- Court-appointed representatives in legal proceedings

- Financial advisors acting with power of attorney

- Legal guardians managing minor beneficiaries' assets

The sender must have legal authority to authorize the transfer and should be clearly identified in company records.

Who Should Receive Stock Transfer Letters

Recipients of stock transfer letters typically include:

- Transfer agents designated by the issuing company

- Brokerage firms holding the securities

- Company registrars and secretaries

- Corporate stock transfer departments

- Custodial institutions managing accounts

- Legal representatives of receiving parties

- Tax advisors for both parties

- Insurance companies (for certain transfers)

Always verify the correct recipient before sending to ensure proper processing.

When Stock Transfer Letters Are Required

Stock transfer letters become necessary in various situations:

- Gifting shares to family members or charities

- Estate settlement following death of shareholder

- Divorce proceedings requiring asset division

- Corporate reorganizations and mergers

- Trust establishment or modification

- Sale of privately held company shares

- Employee stock option exercises

- Court-ordered asset transfers

- International relocations requiring account changes

- Name changes due to marriage or legal reasons

- Financial emergencies requiring immediate liquidity

Requirements and Prerequisites Before Sending

Essential preparations include:

- Verify current stock ownership and certificate numbers

- Obtain proper legal documentation (death certificates, court orders, etc.)

- Confirm transfer agent or brokerage contact information

- Review any transfer restrictions in corporate bylaws

- Calculate potential tax implications

- Secure required signatures and notarizations

- Gather Social Security numbers or tax IDs for all parties

- Obtain current market valuations

- Check for any liens or encumbrances on shares

- Ensure compliance with state and federal securities laws

- Review company transfer policies and fees

How to Write and Process Stock Transfer Letters

The writing and sending process involves:

- Draft letter with complete transferor and transferee information

- Include specific stock details (company, shares, certificates)

- State the reason and legal basis for transfer

- Attach all required supporting documentation

- Have letter reviewed by legal counsel if complex

- Send via certified mail or secure delivery method

- Follow up within 5-10 business days

- Maintain copies of all correspondence

- Track processing status through completion

- Obtain written confirmation of completed transfer

Professional assistance may be advisable for complex transfers involving significant value or legal complications.

Formatting Guidelines and Best Practices

Proper formatting requirements:

- Use formal business letter format on letterhead when possible

- Include date, addresses, and reference numbers

- Maintain professional, clear, and concise tone

- Organize information logically with clear sections

- Use specific language avoiding ambiguity

- Length should be 1-2 pages maximum

- Include contact information for follow-up questions

- Sign in blue ink for original documents

- Use certified mail for mailing original documents

- Keep digital copies with secure backup storage

- Format supporting documents consistently

- Use standard fonts and business formatting

Common Mistakes to Avoid

Critical errors that delay or invalidate transfers:

- Incomplete or inaccurate shareholder information

- Missing required signatures or notarizations

- Failing to include certificate numbers or account details

- Not obtaining proper legal documentation

- Ignoring transfer restrictions or waiting periods

- Sending to wrong transfer agent or department

- Inadequate explanation of transfer authority

- Missing tax identification numbers

- Failing to calculate and report tax implications

- Not keeping adequate records for audit purposes

- Using informal language or unclear instructions

- Forgetting to follow up on processing status

After Sending - Follow-up Requirements

Post-submission actions include:

- Confirm receipt within 3-5 business days

- Track processing timeline and milestones

- Respond promptly to requests for additional documentation

- Verify accuracy of new certificates or account statements

- Update personal records and tax documentation

- Notify relevant parties (accountants, attorneys, family)

- File copies with important documents

- Review monthly statements for proper recording

- Address any discrepancies immediately

- Obtain final confirmation letters for permanent records

- Update estate planning documents if necessary

- Coordinate with tax professionals for reporting requirements

Advantages and Disadvantages of Stock Transfers

Advantages:

- Facilitates estate planning and wealth transfer

- Enables tax-efficient gifting strategies

- Allows for quick liquidity in emergencies

- Supports family financial planning goals

- Enables charitable giving with tax benefits

- Facilitates business succession planning

Disadvantages:

- May trigger immediate tax consequences

- Involves complex paperwork and processing delays

- Requires professional fees and transfer costs

- Loss of control over transferred assets

- Potential for family disputes or complications

- Market timing risks during transfer periods

Download Word Doc

Download Word Doc

Download PDF

Download PDF