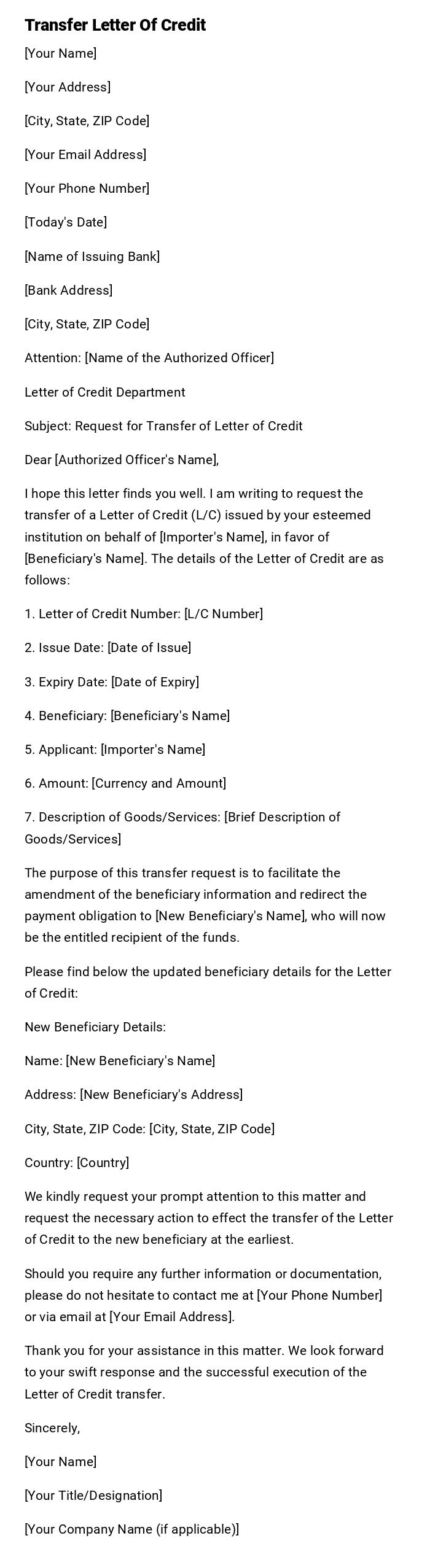

Transfer Letter Of Credit

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Your Email Address]

[Your Phone Number]

[Today's Date]

[Name of Issuing Bank]

[Bank Address]

[City, State, ZIP Code]

Attention: [Name of the Authorized Officer]

Letter of Credit Department

Subject: Request for Transfer of Letter of Credit

Dear [Authorized Officer's Name],

I hope this letter finds you well. I am writing to request the transfer of a Letter of Credit (L/C) issued by your esteemed institution on behalf of [Importer's Name], in favor of [Beneficiary's Name]. The details of the Letter of Credit are as follows:

1. Letter of Credit Number: [L/C Number]

2. Issue Date: [Date of Issue]

3. Expiry Date: [Date of Expiry]

4. Beneficiary: [Beneficiary's Name]

5. Applicant: [Importer's Name]

6. Amount: [Currency and Amount]

7. Description of Goods/Services: [Brief Description of Goods/Services]

The purpose of this transfer request is to facilitate the amendment of the beneficiary information and redirect the payment obligation to [New Beneficiary's Name], who will now be the entitled recipient of the funds.

Please find below the updated beneficiary details for the Letter of Credit:

New Beneficiary Details:

Name: [New Beneficiary's Name]

Address: [New Beneficiary's Address]

City, State, ZIP Code: [City, State, ZIP Code]

Country: [Country]

We kindly request your prompt attention to this matter and request the necessary action to effect the transfer of the Letter of Credit to the new beneficiary at the earliest.

Should you require any further information or documentation, please do not hesitate to contact me at [Your Phone Number] or via email at [Your Email Address].

Thank you for your assistance in this matter. We look forward to your swift response and the successful execution of the Letter of Credit transfer.

Sincerely,

[Your Name]

[Your Title/Designation]

[Your Company Name (if applicable)]

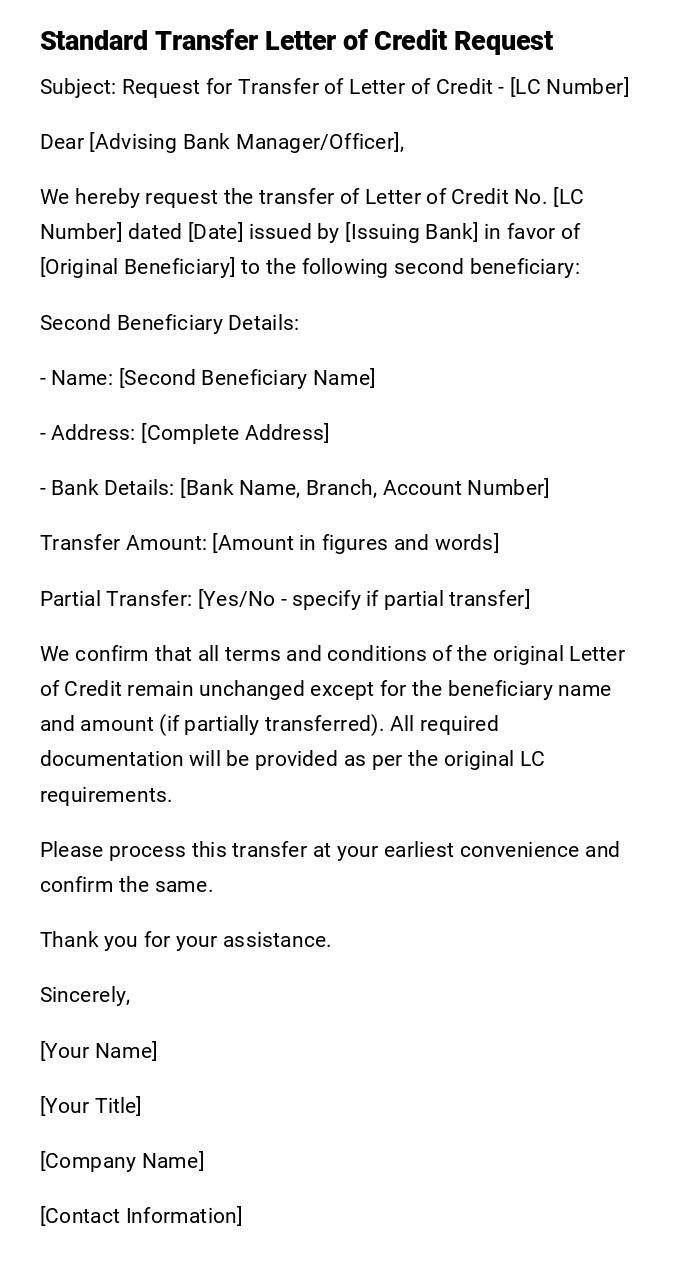

Standard Transfer Letter of Credit Request - Professional

Subject: Request for Transfer of Letter of Credit - [LC Number]

Dear [Advising Bank Manager/Officer],

We hereby request the transfer of Letter of Credit No. [LC Number] dated [Date] issued by [Issuing Bank] in favor of [Original Beneficiary] to the following second beneficiary:

Second Beneficiary Details:

- Name: [Second Beneficiary Name]

- Address: [Complete Address]

- Bank Details: [Bank Name, Branch, Account Number]

Transfer Amount: [Amount in figures and words]

Partial Transfer: [Yes/No - specify if partial transfer]

We confirm that all terms and conditions of the original Letter of Credit remain unchanged except for the beneficiary name and amount (if partially transferred). All required documentation will be provided as per the original LC requirements.

Please process this transfer at your earliest convenience and confirm the same.

Thank you for your assistance.

Sincerely,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

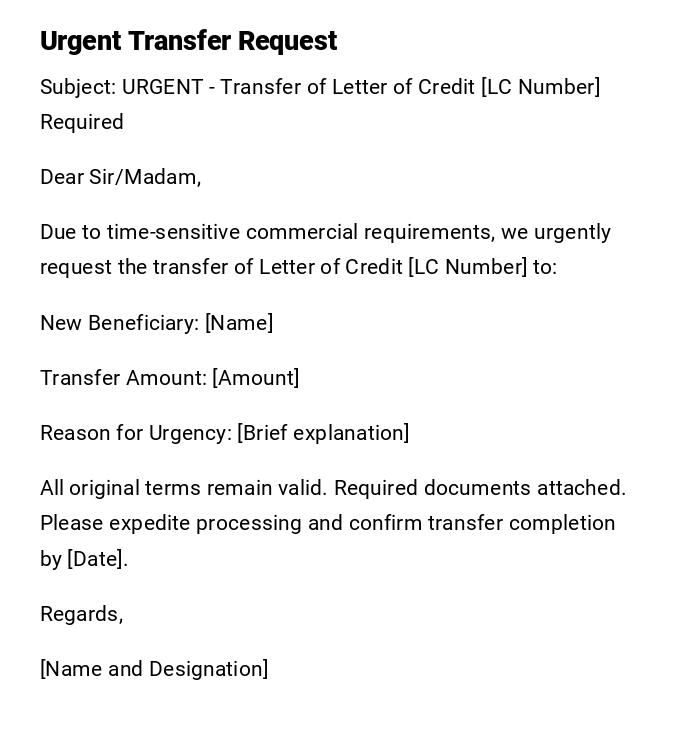

Urgent Transfer Letter of Credit - Quick Processing

Subject: URGENT - Transfer of Letter of Credit [LC Number] Required

Dear Sir/Madam,

Due to time-sensitive commercial requirements, we urgently request the transfer of Letter of Credit [LC Number] to:

New Beneficiary: [Name]

Transfer Amount: [Amount]

Reason for Urgency: [Brief explanation]

All original terms remain valid. Required documents attached. Please expedite processing and confirm transfer completion by [Date].

Regards,

[Name and Designation]

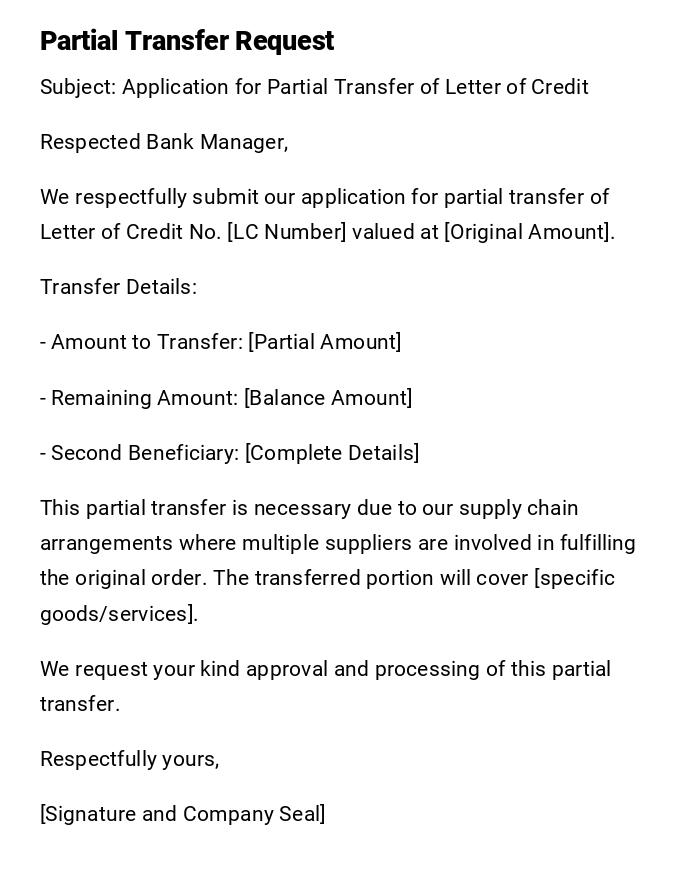

Partial Transfer Letter of Credit - Formal

Subject: Application for Partial Transfer of Letter of Credit

Respected Bank Manager,

We respectfully submit our application for partial transfer of Letter of Credit No. [LC Number] valued at [Original Amount].

Transfer Details:

- Amount to Transfer: [Partial Amount]

- Remaining Amount: [Balance Amount]

- Second Beneficiary: [Complete Details]

This partial transfer is necessary due to our supply chain arrangements where multiple suppliers are involved in fulfilling the original order. The transferred portion will cover [specific goods/services].

We request your kind approval and processing of this partial transfer.

Respectfully yours,

[Signature and Company Seal]

Back-to-Back Letter of Credit Transfer - Official

Subject: Request for Back-to-Back Letter of Credit Transfer

Dear Trade Finance Department,

We are writing to formally request a back-to-back Letter of Credit transfer arrangement based on the master Letter of Credit [LC Number] received from [Master LC Issuing Bank].

Master LC Details:

- Amount: [Amount]

- Expiry Date: [Date]

- Applicant: [End Buyer Name]

Requested Transfer LC Details:

- Beneficiary: [Supplier Name]

- Amount: [Transfer Amount]

- Modified Terms: [Any changes in shipment dates, descriptions]

We maintain adequate security margins and confirm our capability to handle both transactions simultaneously.

Please advise on documentation requirements and processing timeline.

Best regards,

[Authorized Signatory]

Transfer Cancellation Letter - Formal

Subject: Cancellation of Letter of Credit Transfer Request

Dear Banking Officer,

We hereby request the immediate cancellation of our previous transfer request for Letter of Credit [LC Number] submitted on [Date].

Reason for Cancellation: [Change in business arrangements/supplier issues/other reasons]

Please confirm that:

1. The transfer process has been halted

2. Original LC remains active and unchanged

3. Any fees incurred will be advised

We apologize for any inconvenience and appreciate your prompt action on this matter.

Yours faithfully,

[Name and Position]

International Transfer Letter of Credit - Detailed

Subject: Cross-Border Transfer of Letter of Credit - [LC Number]

Dear International Trade Team,

We request the international transfer of Letter of Credit [LC Number] to a beneficiary located in [Country Name].

Transfer Specifications:

- Original Beneficiary: [Current Beneficiary Details]

- New Beneficiary: [International Beneficiary with full address]

- Transfer Currency: [Currency]

- Exchange Rate Instructions: [Fixed/Floating]

- Compliance Requirements: [Country-specific regulations]

Documentation Enclosed:

- Original LC copy

- Transfer application form

- Beneficiary verification documents

- Regulatory compliance certificates

Please ensure all international banking regulations and correspondent bank requirements are met during this transfer process.

Thank you for your expertise in handling this international transaction.

Cordially,

[Senior Executive Name and Title]

Amendment with Transfer Letter of Credit - Professional

Subject: Amendment and Subsequent Transfer of Letter of Credit

Dear Trade Finance Manager,

We request simultaneous amendment and transfer of Letter of Credit [LC Number].

Amendments Required:

- [Specific changes needed]

- [Additional amendments]

Transfer Details:

- New Beneficiary: [Details]

- Reason: [Business justification]

Please process the amendment first, followed by the transfer to ensure all terms are correctly reflected in the transferred LC.

Estimated processing time and fees would be appreciated.

Professional regards,

[Executive Name]

What is a Transfer Letter of Credit and Why is it Needed

A Transfer Letter of Credit is a formal request to transfer the rights and obligations of an existing Letter of Credit from the original beneficiary to a second beneficiary. This mechanism is essential in international trade when:

- The original beneficiary cannot fulfill the LC terms directly

- Multiple suppliers are involved in completing an order

- Business arrangements require reassignment of payment rights

- Supply chain restructuring necessitates beneficiary changes

- Risk mitigation strategies require spreading obligations across different entities

The transfer maintains the security and payment assurance of the original LC while allowing business flexibility in execution.

Who Should Send Transfer Letter of Credit Requests

Transfer requests should be initiated by:

- Original Beneficiaries who hold the LC rights and need to transfer them

- Authorized Representatives with proper legal authority to act on behalf of the beneficiary

- Corporate Trade Finance Departments handling company LC operations

- Legal Representatives in cases involving corporate restructuring

- Export/Import Managers managing international trade operations

- Financial Controllers overseeing payment instrument transfers

The sender must have legal standing and authorization to request the transfer of LC rights.

To Whom Should Transfer Letters be Addressed

Transfer letters should be directed to:

- Advising Bank that originally advised the LC to the beneficiary

- Confirming Bank if the LC was confirmed by a local bank

- Negotiating Bank designated in the LC terms

- Trade Finance Department of the relevant banking institution

- LC Operations Team specializing in documentary credit operations

- Relationship Manager if you have an assigned banking relationship officer

- Branch Manager for smaller banks or specific branch operations

Always verify the correct department and contact person before sending the transfer request.

When to Send Transfer Letter of Credit Requests

Transfer requests are appropriate in these scenarios:

- Supply Chain Changes when original suppliers cannot deliver

- Business Restructuring during corporate reorganization

- Partial Fulfillment when multiple vendors complete different order portions

- Risk Management to distribute exposure across different beneficiaries

- Subcontracting Arrangements when work is delegated to third parties

- Financial Optimization to improve cash flow management

- Regulatory Compliance when local regulations require local beneficiaries

- Emergency Situations when original beneficiary faces operational issues

Timing is crucial as transfers must occur before LC expiry and document presentation deadlines.

Requirements and Prerequisites for LC Transfer

Before requesting a transfer, ensure:

- Original LC allows transfers (must contain transfer clause)

- Transfer amount doesn't exceed original LC value

- Second beneficiary meets creditworthiness requirements

- All original LC terms remain substantially unchanged

- Proper documentation is available (LC copy, transfer application)

- Legal authority exists to request the transfer

- Bank relationship is established with advising/confirming bank

- Compliance requirements are met for international transfers

- Sufficient time remains before LC expiry

- Fee arrangements are confirmed with the bank

Missing any prerequisite may result in transfer rejection or delays.

How to Process Letter of Credit Transfers

The transfer process involves:

- Review Original LC Terms to confirm transferability

- Identify Second Beneficiary and verify their credentials

- Calculate Transfer Amount (partial or full)

- Prepare Documentation including transfer request letter

- Submit to Advising Bank with all required documents

- Pay Transfer Fees as advised by the bank

- Receive Transfer Confirmation from the bank

- Notify Second Beneficiary of the transfer completion

- Update Internal Records to reflect the new arrangement

- Monitor Compliance with transferred LC terms

Each step requires careful attention to detail and timing.

Formatting Guidelines for Transfer Letters

Effective transfer letters should include:

- Professional tone and formal language

- Clear subject line with LC number reference

- Complete beneficiary details (original and new)

- Specific transfer amount in figures and words

- Reason for transfer briefly explained

- Request for confirmation of transfer completion

- Contact information for follow-up questions

- Appropriate closing with signature and company seal

- Attachments list if supporting documents are included

Length should be concise but comprehensive, typically 1-2 pages maximum.

Common Mistakes to Avoid in LC Transfers

Frequent errors include:

- Requesting transfer of non-transferable LCs

- Exceeding original LC amount in transfer requests

- Incomplete second beneficiary information

- Missing legal authorization to request transfers

- Inadequate reason justification for the transfer

- Wrong bank contact or department addressing

- Insufficient documentation supporting the request

- Ignoring transfer fees and cost implications

- Poor timing close to LC expiry dates

- Failure to notify all relevant parties

These mistakes can cause delays, rejections, or additional costs.

Follow-up Actions After Sending Transfer Requests

After submitting transfer letters:

- Confirm receipt with the bank within 2-3 business days

- Track processing status regularly until completion

- Provide additional documentation if requested by the bank

- Pay transfer fees promptly to avoid delays

- Notify second beneficiary once transfer is confirmed

- Update internal systems with new LC arrangements

- Monitor compliance with transferred LC terms

- Maintain communication with all parties involved

- Document the process for future reference

- Review transferred LC for any discrepancies

Proactive follow-up ensures smooth transfer completion and prevents operational issues.

Download Word Doc

Download Word Doc

Download PDF

Download PDF