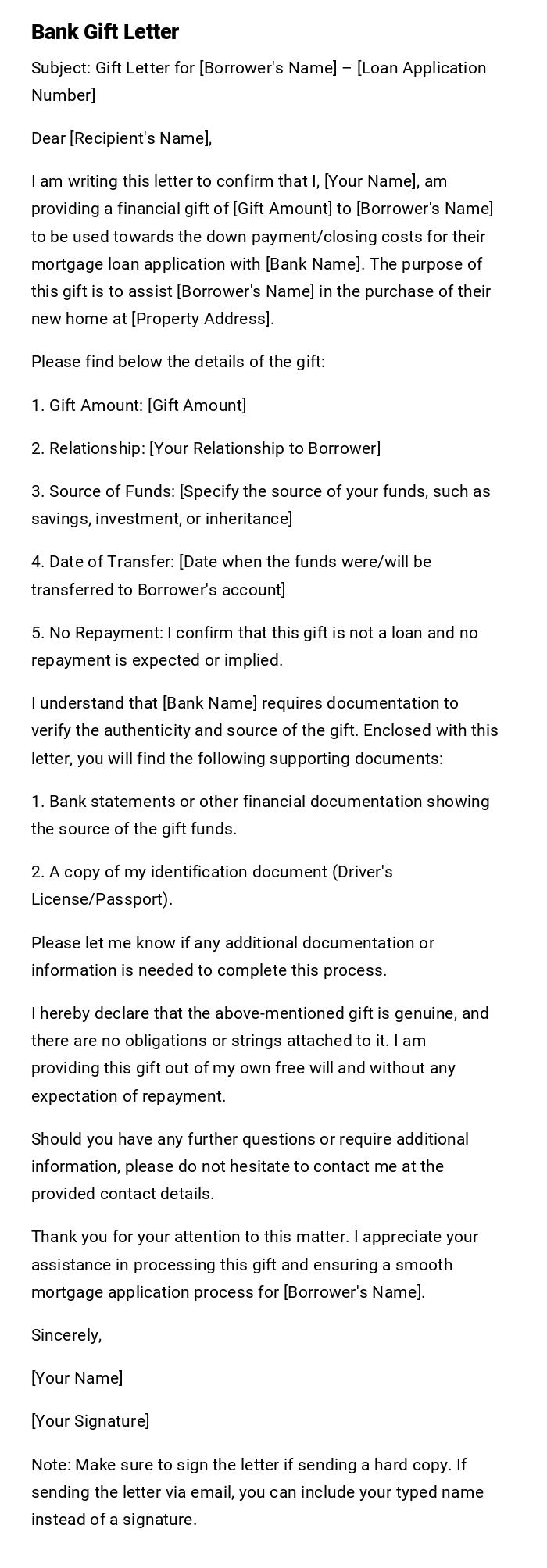

Bank Gift Letter

Subject: Gift Letter for [Borrower's Name] – [Loan Application Number]

Dear [Recipient's Name],

I am writing this letter to confirm that I, [Your Name], am providing a financial gift of [Gift Amount] to [Borrower's Name] to be used towards the down payment/closing costs for their mortgage loan application with [Bank Name]. The purpose of this gift is to assist [Borrower's Name] in the purchase of their new home at [Property Address].

Please find below the details of the gift:

1. Gift Amount: [Gift Amount]

2. Relationship: [Your Relationship to Borrower]

3. Source of Funds: [Specify the source of your funds, such as savings, investment, or inheritance]

4. Date of Transfer: [Date when the funds were/will be transferred to Borrower's account]

5. No Repayment: I confirm that this gift is not a loan and no repayment is expected or implied.

I understand that [Bank Name] requires documentation to verify the authenticity and source of the gift. Enclosed with this letter, you will find the following supporting documents:

1. Bank statements or other financial documentation showing the source of the gift funds.

2. A copy of my identification document (Driver's License/Passport).

Please let me know if any additional documentation or information is needed to complete this process.

I hereby declare that the above-mentioned gift is genuine, and there are no obligations or strings attached to it. I am providing this gift out of my own free will and without any expectation of repayment.

Should you have any further questions or require additional information, please do not hesitate to contact me at the provided contact details.

Thank you for your attention to this matter. I appreciate your assistance in processing this gift and ensuring a smooth mortgage application process for [Borrower's Name].

Sincerely,

[Your Name]

[Your Signature]

Note: Make sure to sign the letter if sending a hard copy. If sending the letter via email, you can include your typed name instead of a signature.

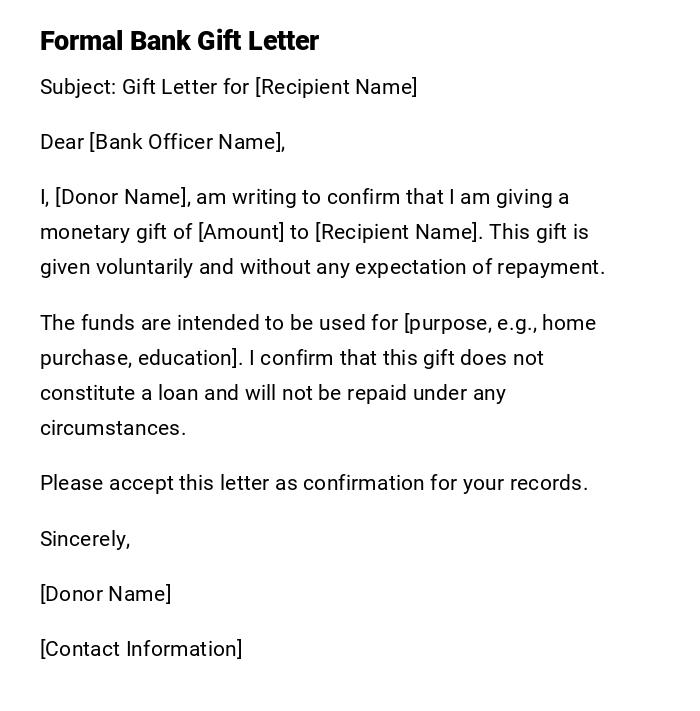

Formal Bank Gift Letter

Subject: Gift Letter for [Recipient Name]

Dear [Bank Officer Name],

I, [Donor Name], am writing to confirm that I am giving a monetary gift of [Amount] to [Recipient Name]. This gift is given voluntarily and without any expectation of repayment.

The funds are intended to be used for [purpose, e.g., home purchase, education]. I confirm that this gift does not constitute a loan and will not be repaid under any circumstances.

Please accept this letter as confirmation for your records.

Sincerely,

[Donor Name]

[Contact Information]

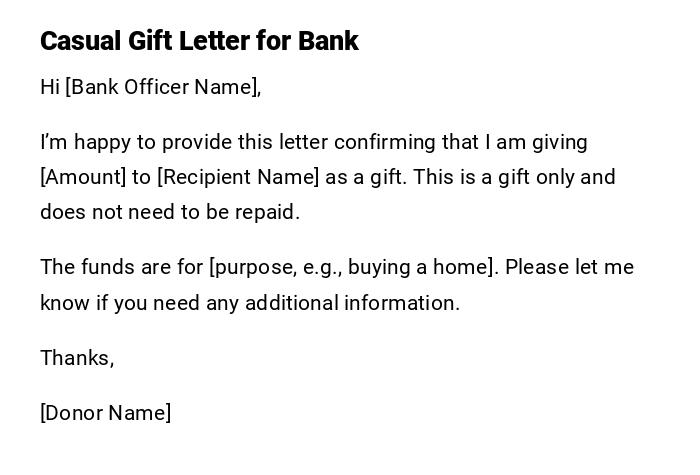

Casual Gift Letter for Bank

Hi [Bank Officer Name],

I’m happy to provide this letter confirming that I am giving [Amount] to [Recipient Name] as a gift. This is a gift only and does not need to be repaid.

The funds are for [purpose, e.g., buying a home]. Please let me know if you need any additional information.

Thanks,

[Donor Name]

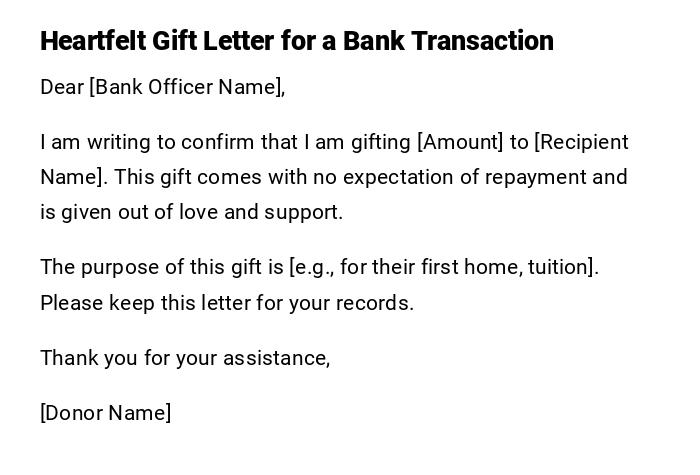

Heartfelt Gift Letter for a Bank Transaction

Dear [Bank Officer Name],

I am writing to confirm that I am gifting [Amount] to [Recipient Name]. This gift comes with no expectation of repayment and is given out of love and support.

The purpose of this gift is [e.g., for their first home, tuition]. Please keep this letter for your records.

Thank you for your assistance,

[Donor Name]

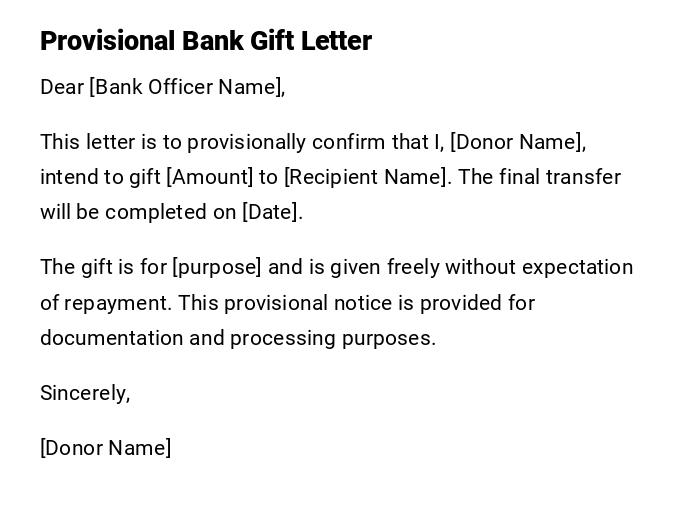

Provisional Bank Gift Letter

Dear [Bank Officer Name],

This letter is to provisionally confirm that I, [Donor Name], intend to gift [Amount] to [Recipient Name]. The final transfer will be completed on [Date].

The gift is for [purpose] and is given freely without expectation of repayment. This provisional notice is provided for documentation and processing purposes.

Sincerely,

[Donor Name]

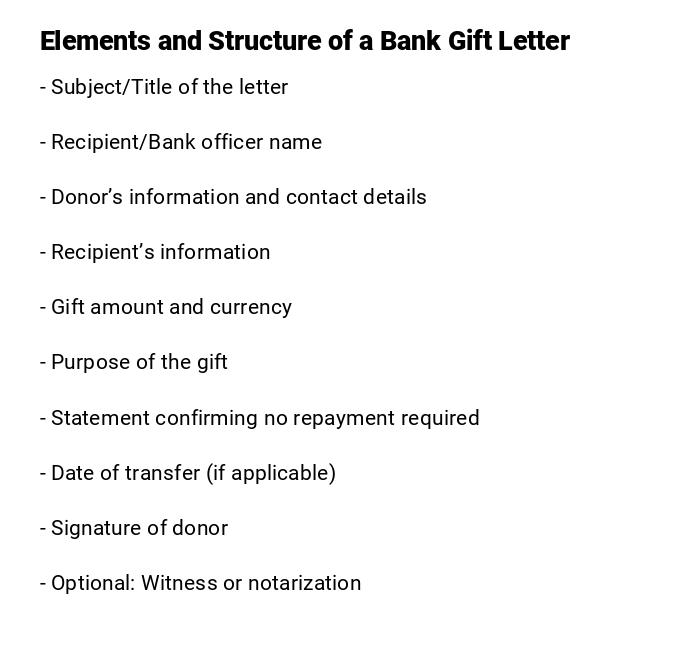

Elements and Structure of a Bank Gift Letter

- Subject/Title of the letter

- Recipient/Bank officer name

- Donor’s information and contact details

- Recipient’s information

- Gift amount and currency

- Purpose of the gift

- Statement confirming no repayment required

- Date of transfer (if applicable)

- Signature of donor

- Optional: Witness or notarization

What is a Bank Gift Letter and Why It Is Important

A Bank Gift Letter is a formal document provided by a donor confirming the transfer of funds to a recipient as a gift.

Purpose:

- Confirms the voluntary nature of the gift

- Provides proof for banks or lenders during financial transactions

- Ensures compliance with loan and mortgage regulations

- Prevents future misunderstandings regarding repayment

Who Should Send a Bank Gift Letter

- Individuals giving monetary gifts

- Parents or relatives gifting funds for education or property

- Sponsors providing financial assistance

- Legal representatives acting on behalf of donors

Whom the Bank Gift Letter Should Be Addressed To

- Bank officers processing loans or mortgages

- Lenders requiring documentation of gift funds

- Financial institutions overseeing fund transfer

- Relevant regulatory authorities (if required)

When a Bank Gift Letter Is Required

- During home purchase or mortgage application

- When receiving educational grants from a family member

- For financial sponsorships or large fund transfers

- Whenever banks require confirmation that funds are gifts and not loans

How to Write and Send a Bank Gift Letter

- Clearly state donor and recipient information

- Specify the gift amount and purpose

- Include a statement confirming no repayment is expected

- Sign the letter and date it

- Send via secure delivery method: email, physical mail, or directly to the bank

- Keep a copy for personal records

Requirements and Prerequisites Before Writing the Letter

- Full names and contact information of donor and recipient

- Exact gift amount

- Purpose of the gift

- Bank account details or transfer information

- Knowledge of lender or bank requirements

Formatting Guidelines for a Bank Gift Letter

- Use a formal, professional tone

- Keep the letter concise (150–250 words)

- Use clear, unambiguous language

- Include all critical elements: donor info, recipient info, amount, purpose, repayment disclaimer

- Optional: notarization if required by the bank

Common Mistakes to Avoid

- Failing to mention that the gift does not require repayment

- Omitting purpose of the gift

- Providing inaccurate recipient or donor information

- Not including date or signature

- Sending without following bank-specific requirements

After Sending / Follow-up

- Confirm the bank received the letter

- Provide any additional documentation requested

- Keep copies for your records

- Monitor the gift transfer process to ensure completion

Tricks and Tips for Writing an Effective Bank Gift Letter

- Use precise language and numbers

- Personalize with full names

- Include clear statements about the non-repayable nature

- Attach supporting documents if needed (bank statements, transfer slips)

- Double-check bank requirements before sending

Compare and Contrast: Bank Gift Letter vs. Personal Gift Letter

- Bank Gift Letter: formal, used for financial institutions, may require notarization

- Personal Gift Letter: informal, often not needed for banks, used for casual or internal documentation

- Both confirm the voluntary nature of a gift, but bank versions must meet regulatory standards

Pros and Cons of Using a Bank Gift Letter

Pros:

- Provides legal and financial clarity

- Prevents misunderstandings with banks or lenders

- Strengthens transparency in financial transactions

Cons:

- Requires precise information and formal structure

- May need notarization or additional verification

- Mistakes can delay processing of loans or transfers

Download Word Doc

Download Word Doc

Download PDF

Download PDF