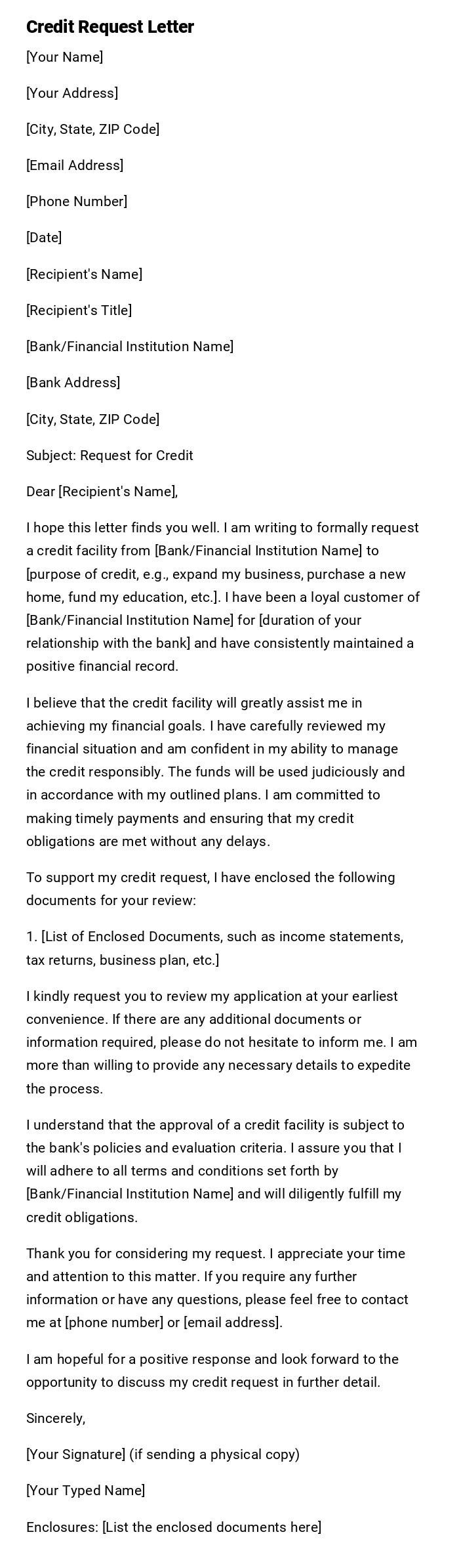

Credit Request Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Recipient's Name]

[Recipient's Title]

[Bank/Financial Institution Name]

[Bank Address]

[City, State, ZIP Code]

Subject: Request for Credit

Dear [Recipient's Name],

I hope this letter finds you well. I am writing to formally request a credit facility from [Bank/Financial Institution Name] to [purpose of credit, e.g., expand my business, purchase a new home, fund my education, etc.]. I have been a loyal customer of [Bank/Financial Institution Name] for [duration of your relationship with the bank] and have consistently maintained a positive financial record.

I believe that the credit facility will greatly assist me in achieving my financial goals. I have carefully reviewed my financial situation and am confident in my ability to manage the credit responsibly. The funds will be used judiciously and in accordance with my outlined plans. I am committed to making timely payments and ensuring that my credit obligations are met without any delays.

To support my credit request, I have enclosed the following documents for your review:

1. [List of Enclosed Documents, such as income statements, tax returns, business plan, etc.]

I kindly request you to review my application at your earliest convenience. If there are any additional documents or information required, please do not hesitate to inform me. I am more than willing to provide any necessary details to expedite the process.

I understand that the approval of a credit facility is subject to the bank's policies and evaluation criteria. I assure you that I will adhere to all terms and conditions set forth by [Bank/Financial Institution Name] and will diligently fulfill my credit obligations.

Thank you for considering my request. I appreciate your time and attention to this matter. If you require any further information or have any questions, please feel free to contact me at [phone number] or [email address].

I am hopeful for a positive response and look forward to the opportunity to discuss my credit request in further detail.

Sincerely,

[Your Signature] (if sending a physical copy)

[Your Typed Name]

Enclosures: [List the enclosed documents here]

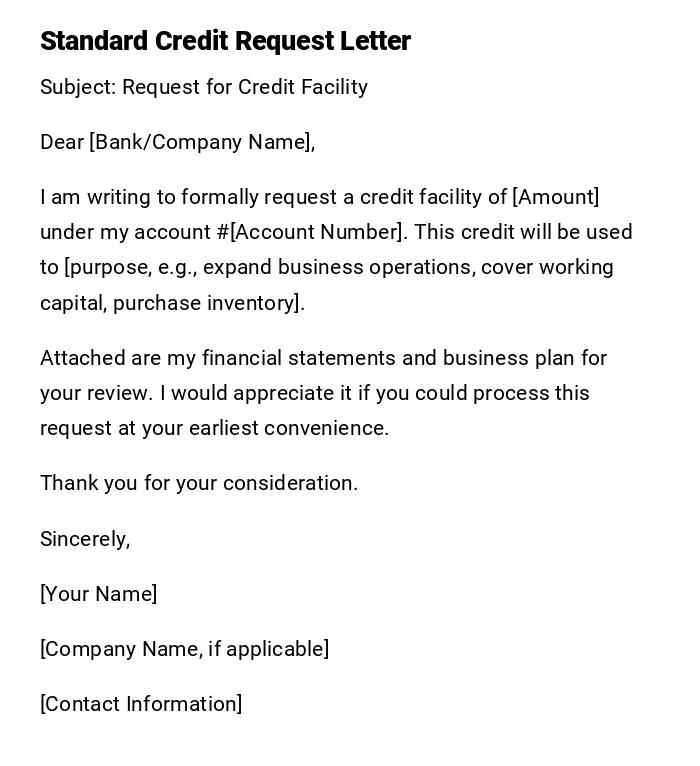

Credit Request Letter – Standard Formal Request

Subject: Request for Credit Facility

Dear [Bank/Company Name],

I am writing to formally request a credit facility of [Amount] under my account #[Account Number]. This credit will be used to [purpose, e.g., expand business operations, cover working capital, purchase inventory].

Attached are my financial statements and business plan for your review. I would appreciate it if you could process this request at your earliest convenience.

Thank you for your consideration.

Sincerely,

[Your Name]

[Company Name, if applicable]

[Contact Information]

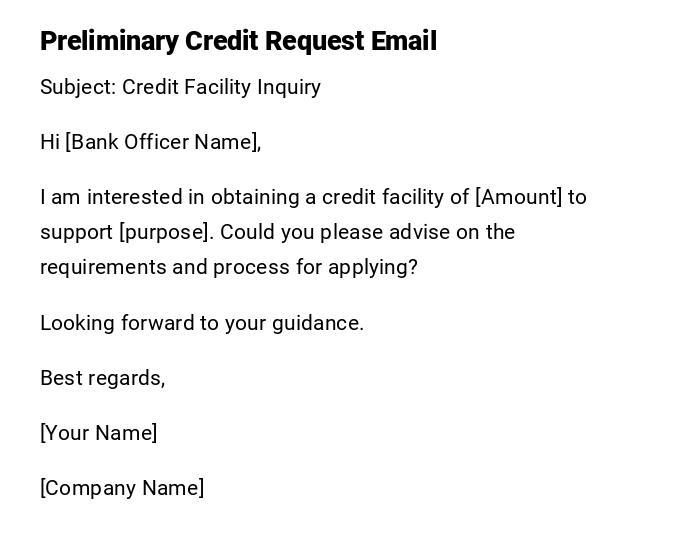

Credit Request Letter – Preliminary / Informal Email

Subject: Credit Facility Inquiry

Hi [Bank Officer Name],

I am interested in obtaining a credit facility of [Amount] to support [purpose]. Could you please advise on the requirements and process for applying?

Looking forward to your guidance.

Best regards,

[Your Name]

[Company Name]

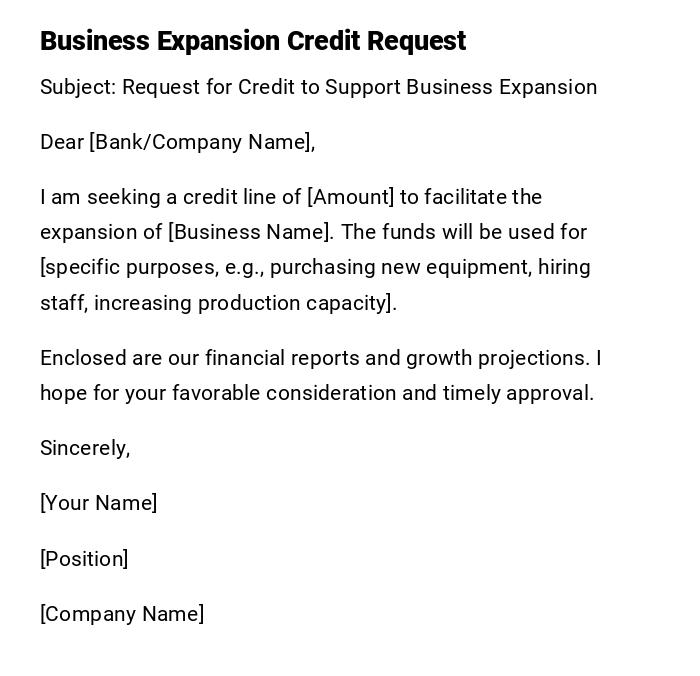

Credit Request Letter – Business Expansion Focus

Subject: Request for Credit to Support Business Expansion

Dear [Bank/Company Name],

I am seeking a credit line of [Amount] to facilitate the expansion of [Business Name]. The funds will be used for [specific purposes, e.g., purchasing new equipment, hiring staff, increasing production capacity].

Enclosed are our financial reports and growth projections. I hope for your favorable consideration and timely approval.

Sincerely,

[Your Name]

[Position]

[Company Name]

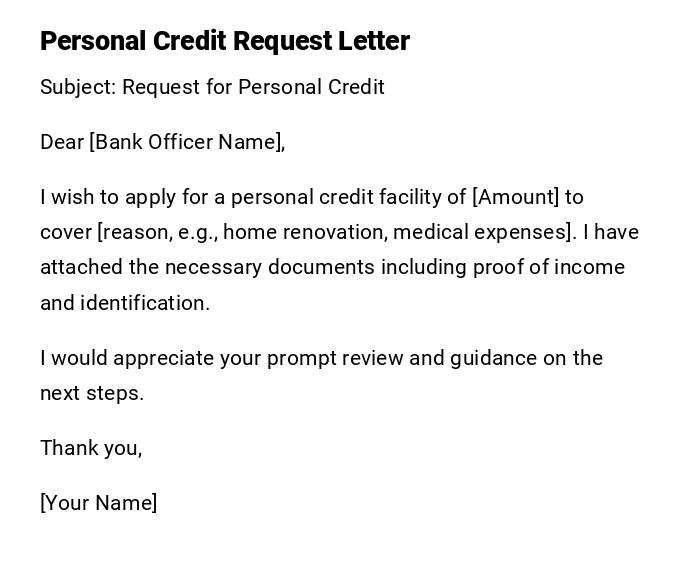

Credit Request Letter – Personal Loan / Credit Request

Subject: Request for Personal Credit

Dear [Bank Officer Name],

I wish to apply for a personal credit facility of [Amount] to cover [reason, e.g., home renovation, medical expenses]. I have attached the necessary documents including proof of income and identification.

I would appreciate your prompt review and guidance on the next steps.

Thank you,

[Your Name]

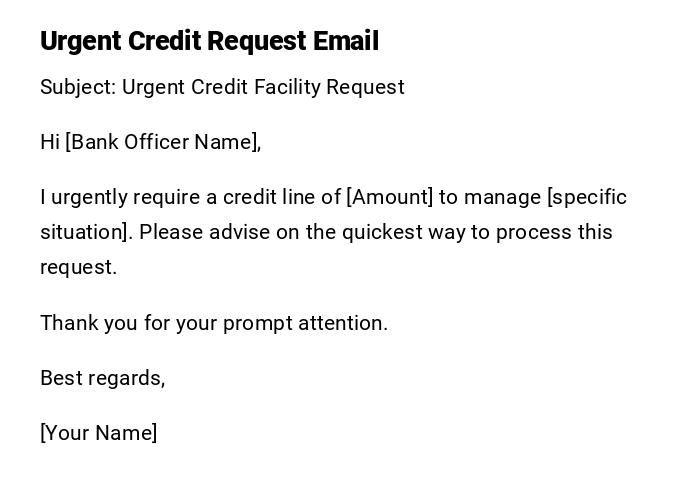

Credit Request Letter – Urgent / Quick Approval Email

Subject: Urgent Credit Facility Request

Hi [Bank Officer Name],

I urgently require a credit line of [Amount] to manage [specific situation]. Please advise on the quickest way to process this request.

Thank you for your prompt attention.

Best regards,

[Your Name]

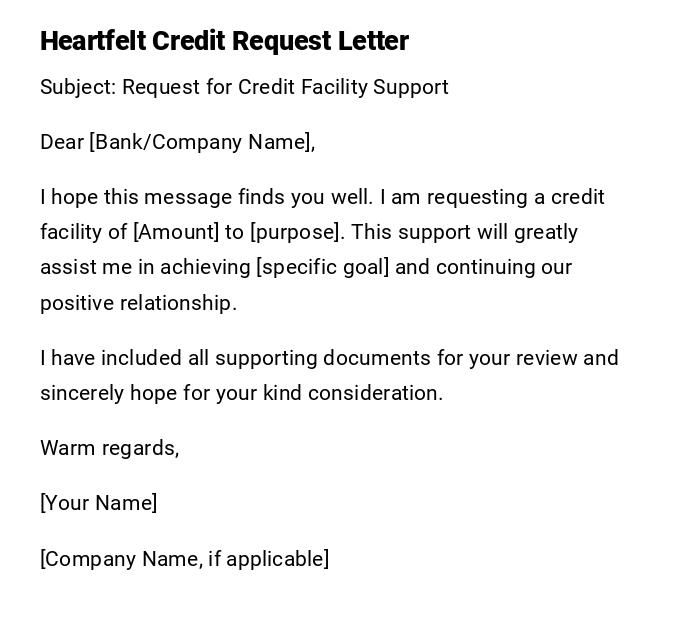

Credit Request Letter – Heartfelt / Persuasive Tone

Subject: Request for Credit Facility Support

Dear [Bank/Company Name],

I hope this message finds you well. I am requesting a credit facility of [Amount] to [purpose]. This support will greatly assist me in achieving [specific goal] and continuing our positive relationship.

I have included all supporting documents for your review and sincerely hope for your kind consideration.

Warm regards,

[Your Name]

[Company Name, if applicable]

What / Why a Credit Request Letter is Needed

- Formally requests a line of credit or loan from a bank or financial institution.

- Serves as an official record of the request and proposed use of funds.

- Helps the institution assess the borrower's eligibility and financial standing.

- Establishes a professional communication channel between borrower and lender.

Who Should Send a Credit Request Letter

- Individuals seeking personal loans or credit facilities.

- Business owners requesting corporate or business credit lines.

- Representatives authorized to act on behalf of a company or organization.

Whom Should the Letter Be Addressed To

- Bank managers or officers responsible for loan approvals.

- Financial institutions or credit companies.

- Authorized decision-makers within lending organizations.

When to Send a Credit Request Letter

- When seeking a new credit facility or loan.

- Prior to major business expansions or investments.

- To manage urgent financial needs or personal emergencies.

- As part of formal application processes requested by the lender.

How to Write and Send a Credit Request Letter

- Clearly state the purpose and amount of the requested credit.

- Include relevant financial documentation and supporting information.

- Use a professional or persuasive tone depending on urgency and context.

- Send via email for preliminary inquiries or letter for formal requests.

- Ensure all attachments are properly labeled and complete.

Requirements and Prerequisites Before Sending

- Accurate financial statements, income proof, or business reports.

- Clear purpose of the credit or loan.

- Understanding of lender’s application requirements.

- Internal approval from company management if representing a business.

Formatting Guidelines for Credit Request Letters

- Length: Typically one to two pages.

- Tone: Professional, formal, or persuasive depending on recipient.

- Structure: Subject, greeting, body, closing, signature.

- Attachments: Financial documents, business plans, identification.

- Mode: Printed letter for formal submission, email for preliminary requests.

After Sending / Follow-up Actions

- Confirm receipt with the bank or financial institution.

- Respond promptly to additional requests for documents or clarification.

- Track the approval process and maintain communication.

- Keep a copy of the letter and attachments for records.

Tricks and Tips for Effective Credit Request Letters

- Be clear and concise about the amount and purpose.

- Personalize the letter to the specific bank officer or institution.

- Include all required financial documents upfront to avoid delays.

- Use a polite and professional tone, even in urgent requests.

- Highlight any strong financial indicators to strengthen your case.

Common Mistakes to Avoid

- Omitting the purpose or amount of the credit requested.

- Sending incomplete or unverified financial documents.

- Using an overly casual or informal tone for formal requests.

- Failing to follow the lender’s application procedure.

- Neglecting to include contact information for follow-up.

Elements and Structure of a Credit Request Letter

- Subject line indicating credit request.

- Salutation addressing the lender.

- Body: Amount requested, purpose, supporting information, and justification.

- Closing: Professional sign-off with contact information.

- Attachments: Financial statements, identification, business plans (if applicable).

FAQ About Credit Request Letters

-

Q: Can a credit request be sent via email?

A: Yes, preliminary inquiries can be sent via email, but formal requests may require printed letters. -

Q: What supporting documents are typically needed?

A: Financial statements, income proof, business plans, and identification. -

Q: How long does it take for a response?

A: Depends on the institution, typically a few days to a few weeks. -

Q: Can I request a specific repayment period?

A: Yes, include your proposed repayment schedule in the letter.

Compare and Contrast With Other Financial Requests

- Unlike general loan inquiries, a credit request letter provides formal justification and documentation.

- Different from invoice or payment request letters, which demand existing payments.

- Similar to loan applications but often used to establish a line of credit for future use.

- Alternative: online application forms; however, letters provide a personalized and professional touch.

Download Word Doc

Download Word Doc

Download PDF

Download PDF