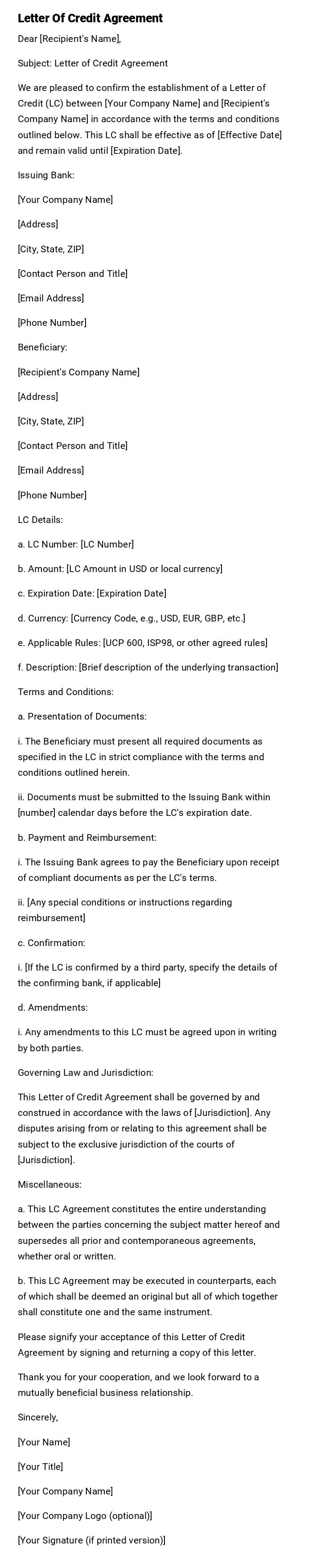

Letter Of Credit Agreement

Dear [Recipient's Name],

Subject: Letter of Credit Agreement

We are pleased to confirm the establishment of a Letter of Credit (LC) between [Your Company Name] and [Recipient's Company Name] in accordance with the terms and conditions outlined below. This LC shall be effective as of [Effective Date] and remain valid until [Expiration Date].

Issuing Bank:

[Your Company Name]

[Address]

[City, State, ZIP]

[Contact Person and Title]

[Email Address]

[Phone Number]

Beneficiary:

[Recipient's Company Name]

[Address]

[City, State, ZIP]

[Contact Person and Title]

[Email Address]

[Phone Number]

LC Details:

a. LC Number: [LC Number]

b. Amount: [LC Amount in USD or local currency]

c. Expiration Date: [Expiration Date]

d. Currency: [Currency Code, e.g., USD, EUR, GBP, etc.]

e. Applicable Rules: [UCP 600, ISP98, or other agreed rules]

f. Description: [Brief description of the underlying transaction]

Terms and Conditions:

a. Presentation of Documents:

i. The Beneficiary must present all required documents as specified in the LC in strict compliance with the terms and conditions outlined herein.

ii. Documents must be submitted to the Issuing Bank within [number] calendar days before the LC's expiration date.

b. Payment and Reimbursement:

i. The Issuing Bank agrees to pay the Beneficiary upon receipt of compliant documents as per the LC's terms.

ii. [Any special conditions or instructions regarding reimbursement]

c. Confirmation:

i. [If the LC is confirmed by a third party, specify the details of the confirming bank, if applicable]

d. Amendments:

i. Any amendments to this LC must be agreed upon in writing by both parties.

Governing Law and Jurisdiction:

This Letter of Credit Agreement shall be governed by and construed in accordance with the laws of [Jurisdiction]. Any disputes arising from or relating to this agreement shall be subject to the exclusive jurisdiction of the courts of [Jurisdiction].

Miscellaneous:

a. This LC Agreement constitutes the entire understanding between the parties concerning the subject matter hereof and supersedes all prior and contemporaneous agreements, whether oral or written.

b. This LC Agreement may be executed in counterparts, each of which shall be deemed an original but all of which together shall constitute one and the same instrument.

Please signify your acceptance of this Letter of Credit Agreement by signing and returning a copy of this letter.

Thank you for your cooperation, and we look forward to a mutually beneficial business relationship.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

[Your Company Logo (optional)]

[Your Signature (if printed version)]

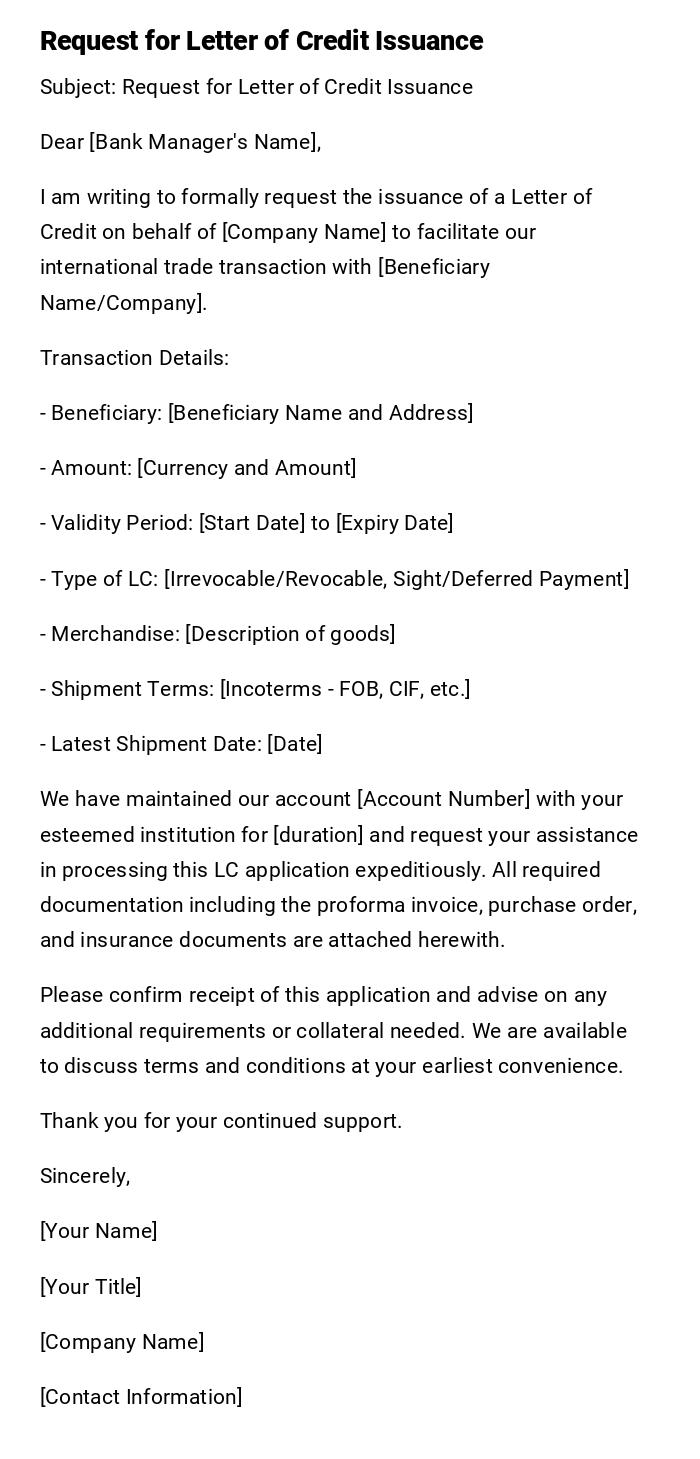

Letter of Credit Issuance Request Letter

Subject: Request for Letter of Credit Issuance

Dear [Bank Manager's Name],

I am writing to formally request the issuance of a Letter of Credit on behalf of [Company Name] to facilitate our international trade transaction with [Beneficiary Name/Company].

Transaction Details:

- Beneficiary: [Beneficiary Name and Address]

- Amount: [Currency and Amount]

- Validity Period: [Start Date] to [Expiry Date]

- Type of LC: [Irrevocable/Revocable, Sight/Deferred Payment]

- Merchandise: [Description of goods]

- Shipment Terms: [Incoterms - FOB, CIF, etc.]

- Latest Shipment Date: [Date]

We have maintained our account [Account Number] with your esteemed institution for [duration] and request your assistance in processing this LC application expeditiously. All required documentation including the proforma invoice, purchase order, and insurance documents are attached herewith.

Please confirm receipt of this application and advise on any additional requirements or collateral needed. We are available to discuss terms and conditions at your earliest convenience.

Thank you for your continued support.

Sincerely,

[Your Name]

[Your Title]

[Company Name]

[Contact Information]

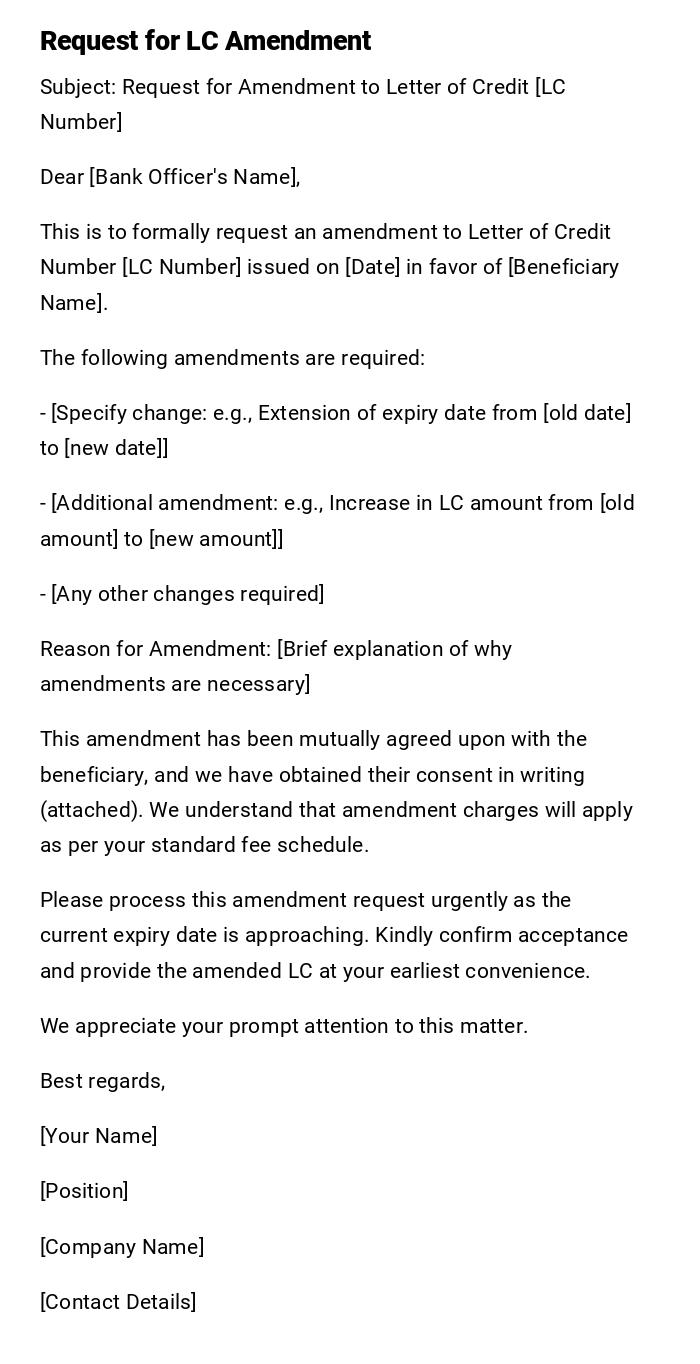

Letter of Credit Amendment Request Letter

Subject: Request for Amendment to Letter of Credit [LC Number]

Dear [Bank Officer's Name],

This is to formally request an amendment to Letter of Credit Number [LC Number] issued on [Date] in favor of [Beneficiary Name].

The following amendments are required:

- [Specify change: e.g., Extension of expiry date from [old date] to [new date]]

- [Additional amendment: e.g., Increase in LC amount from [old amount] to [new amount]]

- [Any other changes required]

Reason for Amendment: [Brief explanation of why amendments are necessary]

This amendment has been mutually agreed upon with the beneficiary, and we have obtained their consent in writing (attached). We understand that amendment charges will apply as per your standard fee schedule.

Please process this amendment request urgently as the current expiry date is approaching. Kindly confirm acceptance and provide the amended LC at your earliest convenience.

We appreciate your prompt attention to this matter.

Best regards,

[Your Name]

[Position]

[Company Name]

[Contact Details]

Letter of Credit Discrepancy Response Letter

Subject: Response to Discrepancy Notice - LC [Number]

Dear [Bank Representative],

We acknowledge receipt of your discrepancy notice dated [Date] regarding Letter of Credit [LC Number] and the documents presented by [Beneficiary Name].

After careful review of the discrepancies noted, we wish to respond as follows:

[Discrepancy 1]: [Your response/explanation]

[Discrepancy 2]: [Your response/explanation]

[Discrepancy 3]: [Your response/explanation]

We hereby authorize you to: [Choose one]

- Accept the documents despite the noted discrepancies and proceed with payment

- Reject the documents and request corrected documentation from the beneficiary

- Hold the documents pending further instructions

Please note that our decision is based on [brief justification]. We request confirmation of the action taken and any implications for future transactions.

Thank you for bringing these matters to our attention.

Respectfully,

[Your Name]

[Title]

[Company Name]

[Contact Information]

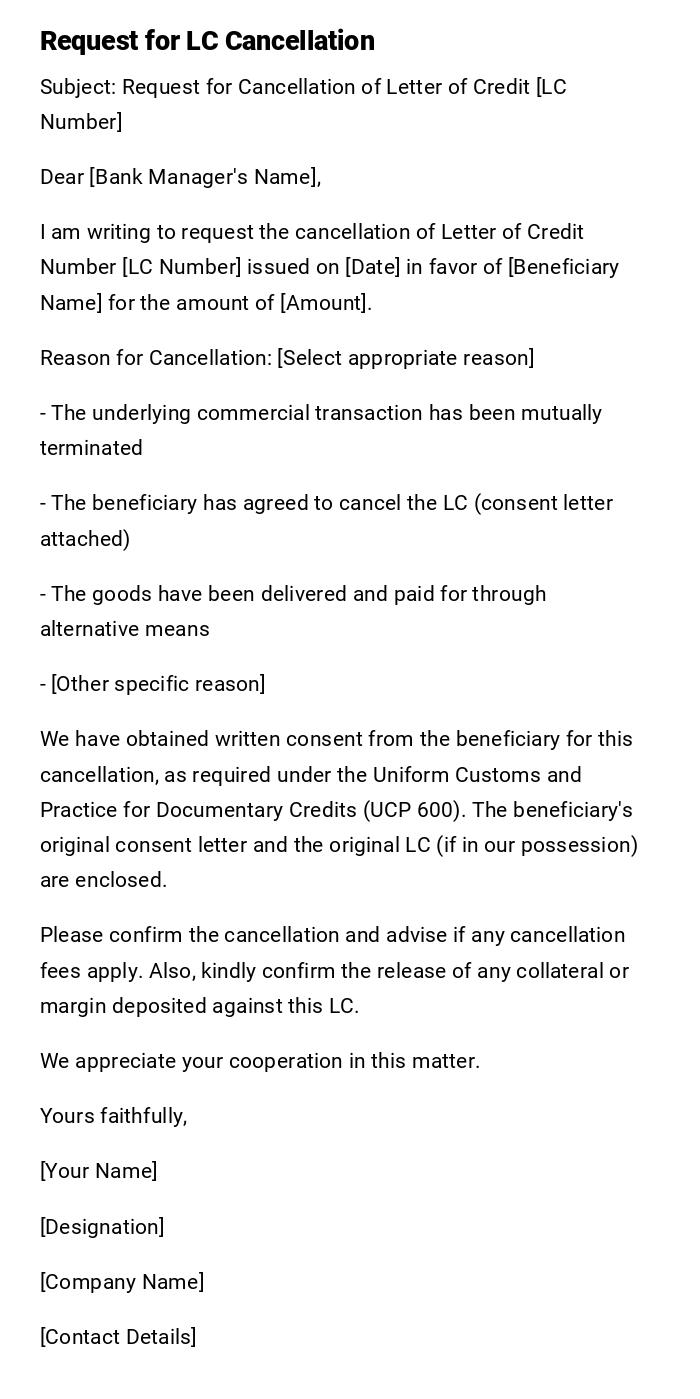

Letter of Credit Cancellation Request Letter

Subject: Request for Cancellation of Letter of Credit [LC Number]

Dear [Bank Manager's Name],

I am writing to request the cancellation of Letter of Credit Number [LC Number] issued on [Date] in favor of [Beneficiary Name] for the amount of [Amount].

Reason for Cancellation: [Select appropriate reason]

- The underlying commercial transaction has been mutually terminated

- The beneficiary has agreed to cancel the LC (consent letter attached)

- The goods have been delivered and paid for through alternative means

- [Other specific reason]

We have obtained written consent from the beneficiary for this cancellation, as required under the Uniform Customs and Practice for Documentary Credits (UCP 600). The beneficiary's original consent letter and the original LC (if in our possession) are enclosed.

Please confirm the cancellation and advise if any cancellation fees apply. Also, kindly confirm the release of any collateral or margin deposited against this LC.

We appreciate your cooperation in this matter.

Yours faithfully,

[Your Name]

[Designation]

[Company Name]

[Contact Details]

Letter of Credit Confirmation Request Email

Subject: Request for Confirmation of Letter of Credit [LC Number]

Dear [Confirming Bank Officer],

We are writing to request your bank's confirmation of Letter of Credit Number [LC Number] issued by [Issuing Bank Name] on [Date] in our favor.

LC Details:

- Issuing Bank: [Bank Name and Address]

- Applicant: [Buyer's Name]

- Beneficiary: [Our Company Name]

- Amount: [Currency and Amount]

- Expiry Date: [Date]

As the beneficiary, we seek your confirmation to add an additional layer of payment security to this transaction. We understand that your confirmation will constitute a definite undertaking in addition to that of the issuing bank.

Please review the attached LC and advise:

1. Your confirmation fees and charges

2. Any additional requirements or documentation needed

3. Expected timeline for confirmation

We would appreciate your prompt response as we need to proceed with shipment arrangements.

Thank you for considering our request.

Best regards,

[Your Name]

[Position]

[Company Name]

[Email and Phone]

Letter of Credit Acceptance Notification Letter

Subject: Acknowledgment and Acceptance of Letter of Credit [LC Number]

Dear [Applicant/Buyer Name],

We are pleased to acknowledge receipt of Letter of Credit Number [LC Number] issued by [Issuing Bank Name] on [Date] in our favor for the amount of [Amount].

We have carefully reviewed all terms and conditions stipulated in the LC and are pleased to confirm that they are acceptable and in accordance with our commercial agreement dated [Date].

We shall proceed with the following:

- Manufacturing/procurement of the goods as specified

- Shipment by [Latest Shipment Date]

- Presentation of compliant documents to the bank within [number] days of shipment

We will ensure strict compliance with all documentary requirements including: [list key documents - invoice, packing list, bill of lading, certificate of origin, etc.]

Should you require any clarification or wish to discuss any aspect of this transaction, please feel free to contact us.

We look forward to a successful transaction and continued business relationship.

Warm regards,

[Your Name]

[Title]

[Company Name]

[Contact Information]

Letter of Credit Expiry Extension Request Letter

Subject: Urgent Request for Extension of LC Expiry Date - [LC Number]

Dear [Bank Manager's Name],

We are writing to request an urgent extension of the expiry date for Letter of Credit Number [LC Number] currently set to expire on [Current Expiry Date].

We propose extending the expiry date to [New Proposed Date], representing an extension of [number] days.

Reason for Extension Request: [Choose applicable reason]

- Unexpected delays in manufacturing due to [specific reason]

- Shipping delays caused by [port congestion/weather/logistics issues]

- Documentation processing has taken longer than anticipated

- [Other legitimate business reason]

The transaction remains valid, and both parties are committed to completing it. We have been in communication with the beneficiary/applicant who has agreed to this extension (confirmation attached).

All other terms and conditions of the LC shall remain unchanged. We understand that extension charges will apply and are willing to fulfill all fee obligations.

Your immediate attention to this matter would be greatly appreciated as time is of the essence.

Sincerely,

[Your Name]

[Your Position]

[Company Name]

[Contact Details]

Letter of Credit Document Discrepancy Waiver Letter

Subject: Waiver of Discrepancies for LC [Number]

Dear [Bank Name/Officer],

Reference: Letter of Credit Number [LC Number]

Further to your discrepancy notice dated [Date] regarding documents presented under the above-referenced LC, we hereby authorize and instruct you to waive the following discrepancies and proceed with payment to the beneficiary:

Discrepancies Being Waived:

1. [Specific discrepancy description]

2. [Specific discrepancy description]

3. [Specific discrepancy description]

We have carefully reviewed the discrepancies and have determined that they are minor and do not materially affect the underlying transaction. We have also verified with our inspection reports and shipping documents that the goods have been shipped as per our requirements.

This waiver is granted voluntarily and without prejudice to our rights under the sales contract. Please process the payment immediately upon receipt of this authorization.

Please confirm receipt of this waiver and the date on which payment will be effected.

Thank you for your assistance.

Yours truly,

[Your Name]

[Title]

[Company Name]

[Authorization Signature]

What is a Letter of Credit Agreement and Why is it Needed

A Letter of Credit (LC) Agreement is a formal banking document that guarantees payment from a buyer to a seller, with the bank acting as an intermediary that ensures both parties fulfill their obligations. The primary purpose is to mitigate risk in international and domestic trade transactions where parties may not have established trust or where geographical distance creates uncertainty.

Key purposes include:

- Providing payment security to exporters/sellers who ship goods to unknown buyers

- Offering buyers assurance that payment will only be made upon presentation of compliant documents proving shipment

- Facilitating international trade by bridging trust gaps between parties in different countries

- Reducing credit risk through bank guarantee mechanisms

- Enabling businesses to trade with new partners without extensive credit history

- Serving as a financing tool in trade transactions

- Protecting both parties' interests through strict documentary compliance requirements

When Should You Use a Letter of Credit

Letters of Credit are triggered by or applicable in the following scenarios:

- International trade transactions between parties who have not previously conducted business

- High-value transactions where payment security is paramount

- Transactions with buyers in countries with political or economic instability

- When the seller requires guaranteed payment before manufacturing or shipping goods

- Government contracts that mandate LC as the payment method

- Situations where buyer needs proof of shipment before releasing payment

- Cross-border transactions involving different legal systems and jurisdictions

- When traditional payment methods like wire transfer or open account carry too much risk

- Manufacturing contracts requiring advance payment protection

- Commodity trading where market price fluctuations create additional risk

- Situations where buyer's creditworthiness is uncertain or unverified

- Long-distance transactions where inspection before payment is impractical

- When export credit insurance is unavailable or too expensive

Who Should Issue Letter of Credit Communications

From the Buyer/Applicant Side:

- Company's financial controller or CFO requesting LC issuance

- Procurement manager handling international purchases

- Import manager responsible for inbound shipments

- Trade finance specialist within the organization

- Authorized signatories with banking authority

- Legal representatives when complex terms are involved

From the Seller/Beneficiary Side:

- Export manager acknowledging LC receipt

- Sales director confirming LC acceptance

- Trade finance department handling document presentation

- Operations manager coordinating shipment against LC terms

- Compliance officer ensuring regulatory adherence

From Banking Institutions:

- Trade finance officers processing LC applications

- LC issuing bank representatives

- Advising bank officials notifying beneficiaries

- Confirming bank officers adding confirmation

- Document examiners identifying discrepancies

Requirements and Prerequisites Before Initiating a Letter of Credit

Documentation Required:

- Valid commercial contract or purchase order between parties

- Proforma invoice detailing goods, quantities, and values

- Company registration documents and trade licenses

- Bank account statements demonstrating financial capability

- Tax identification numbers and business licenses

- Import/export licenses if required for specific goods

- Insurance documents or arrangements for the shipment

Financial Prerequisites:

- Sufficient collateral or margin deposit with the issuing bank (typically 10-100% of LC value)

- Established banking relationship with creditworthy institution

- Available credit line or approved LC facility

- Clear understanding of all fees and charges involved

- Funds to cover LC issuance fees, amendment charges, and other bank expenses

Operational Prerequisites:

- Clear agreement on Incoterms (FOB, CIF, DDP, etc.)

- Defined shipment and expiry dates that are realistic

- Agreed-upon documents required for payment

- Specified port of loading and discharge

- Description of goods that matches customs and shipping requirements

- Agreement on partial shipments and transshipment allowances

How to Write and Process Letter of Credit Communications

Initial Request Process:

- Begin by reviewing the underlying sales contract thoroughly

- Identify all key terms including amount, goods description, shipping terms, and timeline

- Approach your bank with a formal LC application

- Provide all supporting documents as requested by the bank

- Discuss and negotiate LC terms, fees, and collateral requirements

- Review the draft LC carefully before issuance to ensure alignment with contract terms

Document Preparation Standards:

- Use formal business language throughout all communications

- Reference LC numbers, dates, and parties clearly in every correspondence

- Maintain a professional tone regardless of urgency

- Keep communications concise while including all necessary details

- Ensure all amendments or changes are documented in writing

- Maintain complete records of all LC-related correspondence

Processing Steps:

- Submit LC request with complete documentation package

- Bank reviews application and conducts credit assessment

- Upon approval, bank issues LC to beneficiary through advising bank

- Beneficiary reviews and either accepts or requests amendments

- Goods are shipped and documents prepared per LC requirements

- Documents presented to bank for examination

- Bank reviews for compliance with LC terms

- Payment is released upon satisfactory document review

Formatting Guidelines for Letter of Credit Letters

Length and Structure:

- Keep letters concise, typically one to two pages maximum

- Use single-spaced text with double spacing between paragraphs

- Begin with clear subject line referencing LC number

- Include all relevant LC details in tabular or bullet format for clarity

- End with clear call-to-action or next steps

Tone and Style Preferences:

- Maintain formal and professional tone throughout

- Use clear, unambiguous language avoiding jargon where possible

- Be direct and specific about requests or actions needed

- Avoid emotional language even when addressing problems

- Use active voice for clarity and accountability

Mode of Delivery:

- Formal LC requests should be submitted on company letterhead

- Amendment requests and discrepancy responses can be email

- Include electronic signature or authorization where applicable

- Follow up important emails with hard copies when appropriate

- Maintain read receipts for time-sensitive communications

Etiquette Considerations:

- Address bank officers by proper titles

- Reference previous communications and meetings

- Express appreciation for assistance and cooperation

- Respond to discrepancy notices within prescribed timeframes (typically 5 banking days)

- Maintain professional courtesy even during disputes

Common Mistakes to Avoid with Letters of Credit

Documentary Errors:

- Requesting LC terms that don't match the underlying sales contract

- Providing vague or ambiguous descriptions of goods

- Setting unrealistic shipment or expiry dates

- Failing to specify all required documents clearly

- Omitting important details like Incoterms or inspection requirements

- Including conflicting terms or conditions in the LC

Communication Mistakes:

- Delaying response to discrepancy notices beyond allowed timeframes

- Failing to obtain beneficiary consent before requesting amendments

- Not confirming receipt of LC or amendments promptly

- Submitting incomplete documentation with requests

- Using informal language in formal banking correspondence

- Forgetting to reference LC numbers in all communications

Procedural Errors:

- Not reading UCP 600 rules that govern LC transactions

- Assuming verbal agreements modify LC terms

- Failing to verify bank details and addresses accurately

- Missing amendment deadlines or expiry dates

- Not maintaining complete records of all LC-related documents

- Overlooking currency or amount discrepancies in documents

- Presenting documents after LC expiry date

What to Do After Sending LC-Related Communications

Immediate Follow-up Actions:

- Obtain and retain confirmation of receipt from recipient

- Diarize key dates including response deadlines and expiry dates

- Update internal tracking systems with LC status

- Brief relevant team members on LC terms and requirements

- Set calendar reminders for critical milestones

Ongoing Monitoring:

- Track amendment requests through to completion

- Monitor shipment progress against LC timeline

- Prepare documents well in advance of presentation deadline

- Maintain regular communication with banks and trading partners

- Review all received documents for accuracy before submission

Documentation Management:

- File all LC-related correspondence systematically

- Maintain both digital and physical copies as appropriate

- Create audit trail for compliance purposes

- Update financial records with LC obligations

- Prepare summary reports for management review

Confirmation Requirements:

- LC issuance typically requires beneficiary acknowledgment within 7 days

- Amendment requests need confirmation from all parties

- Discrepancy waivers should be acknowledged by banks

- Document presentations require formal receipt acknowledgment

- Cancellations need written confirmation from all stakeholders

Advantages and Disadvantages of Using Letters of Credit

Advantages:

- Provides strong payment security for sellers through bank guarantee

- Reduces credit risk for buyers by ensuring documents are verified before payment

- Facilitates trade between parties without established relationships

- Enables access to financing options like LC-backed loans

- Creates clear documentary requirements reducing disputes

- Internationally recognized instrument governed by UCP 600 rules

- Protects against non-payment or non-shipment scenarios

- Can be used as collateral for working capital financing

Disadvantages:

- Expensive compared to other payment methods (fees range 0.75-2% of LC value)

- Complex and time-consuming process requiring expertise

- Strict compliance requirements can lead to unnecessary discrepancies

- Requires significant collateral or margin deposits

- Ties up credit lines and working capital

- Amendment process can be costly and time-consuming

- Does not protect against quality issues with goods

- May delay payment due to document examination process

- Banks examine documents not goods, creating potential disputes

Comparison with Alternative Payment and Security Methods

LC vs. Cash in Advance:

- LCs provide more security for buyers than paying upfront

- Cash advances are faster but riskier for buyers

- LCs tie up less buyer capital compared to full advance payment

- Cash advance gives seller immediate funds; LC provides payment assurance

LC vs. Open Account:

- Open account requires high trust; LC doesn't

- LCs are more expensive than open account terms

- Open account is faster and simpler administratively

- LC provides sellers with guaranteed payment unlike open accounts

LC vs. Documentary Collection:

- LCs offer stronger payment guarantee than collections

- Documentary collections are less expensive than LCs

- LCs involve bank payment undertaking; collections don't

- Collections are simpler but riskier for exporters

LC vs. Bank Guarantee:

- Bank guarantees are for performance; LCs are for payment

- LCs are transaction-specific; guarantees can be general

- Both provide bank security but serve different purposes

- Guarantees are typically called only if obligations aren't met

LC vs. Escrow Services:

- Both provide third-party security mechanisms

- Escrow is more common for services; LC for goods

- LCs are standardized internationally; escrow terms vary

- Banks have more expertise with LCs than escrow

Essential Elements and Structure of LC Communications

Opening Elements:

- Subject line with clear reference to LC number and purpose

- Formal salutation addressing appropriate bank officer or party

- Reference to previous correspondence or LC documents

- Clear statement of purpose in opening paragraph

Body Components:

- Detailed LC specifications (number, date, amount, parties)

- Specific request or response being communicated

- Supporting rationale or explanation for the request

- Relevant dates, deadlines, and timelines

- Reference to attached supporting documents

- Clear indication of actions required from recipient

Required Attachments:

- Commercial invoices and packing lists

- Bills of lading or airway bills

- Certificates of origin

- Inspection certificates if required

- Insurance documents

- Beneficiary certificates as specified

- Consent letters for amendments or cancellations

- Supporting evidence for discrepancy waivers

Closing Elements:

- Summary of action requested or next steps

- Contact information for questions or clarification

- Expression of appreciation or professional courtesy

- Formal closing and signature

- Designation and company information

- Date and reference numbers

Tips, Best Practices, and Expert Advice for LC Management

Strategic Tips:

- Negotiate LC terms during contract stage, not after

- Build relationships with experienced trade finance bankers

- Use standardized ICC Incoterms to avoid confusion

- Consider LC confirmation for high-risk countries

- Start with smaller LCs when beginning relationships with new banks

- Maintain template libraries for common LC correspondence

Operational Best Practices:

- Allow extra time in LC validity period as buffer

- Use electronic presentation systems (e-UCP) where available

- Conduct pre-shipment document reviews to catch discrepancies

- Train staff on UCP 600 rules and compliance requirements

- Create internal checklists for document preparation

- Maintain direct communication channels with all banks involved

Cost Management:

- Negotiate annual LC facility terms for better rates

- Minimize amendments which trigger additional fees

- Use transferable LCs when acting as intermediary to reduce costs

- Consider LC alternatives for low-risk transactions

- Shop around banks for competitive LC fees

- Bundle LC services for volume discounts

Risk Mitigation:

- Always verify beneficiary bank details independently

- Use confirmed LCs for transactions in politically unstable regions

- Include grace periods for document presentation

- Specify clear quality standards in LC terms

- Maintain comprehensive insurance coverage

- Keep communication documented for dispute resolution

Frequently Asked Questions About Letters of Credit

How long does LC issuance take? Typically 3-7 banking days from application to issuance, depending on bank procedures and complexity of terms.

Can an LC be canceled unilaterally? No, all parties including issuing bank, beneficiary, and applicant must consent to cancellation.

What happens if documents contain discrepancies? The bank will issue a discrepancy notice, and the applicant can choose to waive discrepancies, reject documents, or wait for corrected documents.

Are LCs only for international trade? No, domestic LCs are also used within countries, though less common than international LCs.

What is the difference between revocable and irrevocable LC? Revocable LCs can be canceled without beneficiary consent; irrevocable LCs cannot. Most modern LCs are irrevocable.

How much collateral is required? Typically ranges from 10% to 100% of LC value depending on relationship with bank and creditworthiness.

Can LC terms be changed after issuance? Yes, through the amendment process, but requires consent from all parties and incurs additional fees.

What is a transferable LC? An LC that allows the beneficiary to transfer rights to one or more subsequent beneficiaries, useful in trading operations.

How quickly is payment made after document presentation? For sight LCs, payment is typically made within 5-7 banking days after compliant document presentation.

Does Letter of Credit Correspondence Require Attestation or Authorization

Authorization Requirements:

- All LC applications must be signed by authorized signatories registered with the bank

- Amendment requests require signatures from parties with banking authority

- Discrepancy waivers must be authorized by senior management or designated officers

- Cancellation requests need dual authorization in many organizations

- Large LC amounts may require board resolution or multiple approvals

Attestation Needs:

- Supporting documents like certificates of origin may require government attestation

- Commercial invoices might need chamber of commerce certification

- Consent letters for amendments should be notarized in some jurisdictions

- Corporate resolutions authorizing LC transactions may need legal attestation

- Beneficiary certificates within LCs often require company seal and authorized signature

When Attestation is Critical:

- Cross-border transactions between countries with strict documentary requirements

- High-value LCs exceeding certain thresholds set by banks

- Government or public sector contracts mandating additional verification

- Transactions involving restricted or regulated goods

- First-time LC issuance with a new banking relationship

- When specifically required by the LC terms or beneficiary country regulations

Documentation Standards:

- Maintain original authorized signatures on file with banks

- Update signature cards promptly when personnel changes occur

- Use company seals consistently across all LC documents

- Ensure attestations are current and within validity periods

- Keep certified copies of all attestation documents for audit purposes

Download Word Doc

Download Word Doc

Download PDF

Download PDF